AI notes - property law final

CIVIL LAW. PROPERTY (MIGUEL ANGEL MALO VALENZUELA) – NOTES

S3-4: DYNAMICS OF PROPERTY RIGHTS AND CONVEYANCE SYSTEMS (M15/01)

MIDTERM doc

S16-17: SECONDARY PROPERTY RIGHTS (04/03)

SERVITUDES - USUFRUCT, USE, HABITATION

Intro: principles and classification

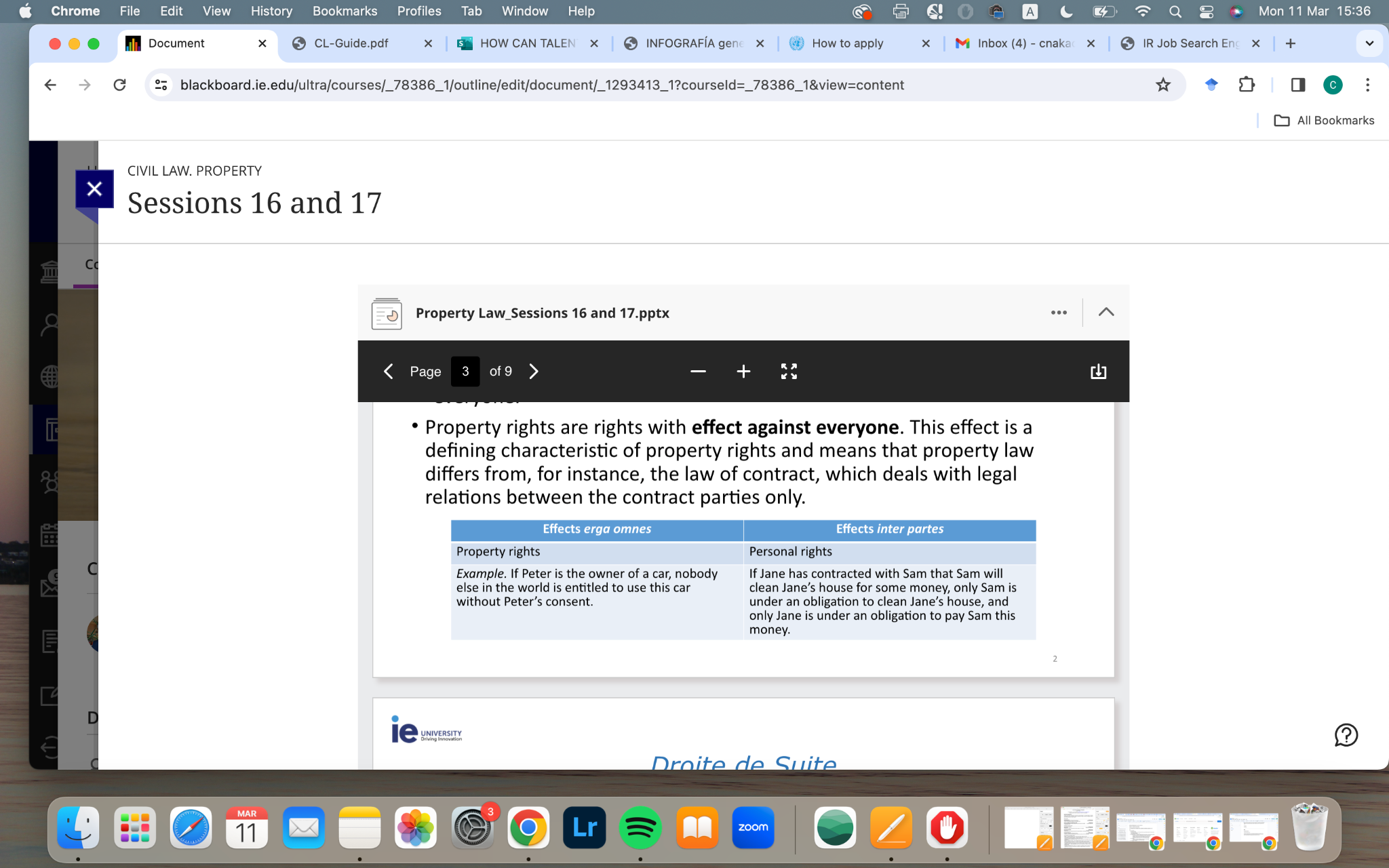

- Effects Erga Omnes

- The expression erga omnes is Latin and refers to an effect against “everyone”

- Property rights are rights with effect against everyone

- This effect is a defining characteristic of property rights and means that property law differs from, for instance, the law of contract, which deals with legal relations between the contract parties only

- Droite de Suite

- Droite de suite (“right to follow”) is a distinctive feature of property rights, according to which the right follows the object, regardless of the subjects

- Principle in property law that emphasizes the inherent connection between certain rights and the property itself, rather than the individuals or parties involved

- EX: Elisa has the property right of usufruct in a house which belonged to her former husband James.

- This right involves that Elisa is entitled to use the house as long as she lives. Suppose the house is sold to Joan, who becomes the new owner of the house.

- Because Elisa’s right pertains to the house, and is not a right specifically against anyone, Elisa is still entitled to use the house.

- Joan must respect the usufruct which Elisa has on the house.

- And if Joan were to sell the house again, the new owner must also respect the usufruct.

- The right which Elisa has on the house so to speak “follows” the house, regardless of whoever is the owner.

- Droite de suite (“right to follow”) is a distinctive feature of property rights, according to which the right follows the object, regardless of the subjects

- General classification of property right

- Which specific rights exist differs from one legal system to another, and for that reason it makes little sense to provide a list of “all” property rights

- However, it is possible to divide property rights into subcategories:

- 1. Primary property right (e.g. right of ownership)

- 2. Secondary property rights

- All property rights that are not primary rights are secondary (or lesser) rights

- They comprise powers that would normally belong to the holder of the primary right but that can be exercised by the holder of the secondary right instead of, or next to, the holder of the primary right

- (2) Secondary property rights are traditionally divided into:

- A. Secondary rights to use: usufruct and servitude

- B. Secondary security rights: pledge (personal) and mortgage (property)

- These two categories of rights stem from Roman law

SPR - to use

- Usufruct

- Sometimes called “personal servitudes” because when the holder of the right ceases to exist, the right also ceases to exist

- A right of usufruct is the right to use and enjoy an object owned by someone else, as well as the right to take the fruits this produces

- Therefore, the secondary right to usufruct comprises the permission to use and enjoy the object of the owner, who no longer holds this permission himself

- Right to use and enjoy - legal idea with different consequences

- Can be very profitable - shares, leading to dividends

- The owner now retains “bare ownership”, signaling that he has given away permission to use and enjoy the object

- Bare ownership, also known as naked ownership or naked title, is a concept in property law that refers to ownership rights without the accompanying rights to use, enjoy, or derive income from the property.

- In essence, it represents the right to ownership of a property without the right to possess or use it.

- Ex: it can be the right to have a painting owned by someone else in your house for the remainder of your life

- This situation is usually created upon the death of one spouse in a family to allow the longest-living spouse to enjoy the painting without any heir, children, or step children interfering

- The holder of a right of usufruct can continue to use the object of his right even if the owner of the good sells it

- Because the usufruct rests on the object and is not a personal right against the person who granted it, the right “follows” the object (droite de suite)

- Although the holder of a usufruct may use things for the duration of his property right, she is under the obligation to take care of them and maintain their economic purpose

- The standard imposed is that of a good usufructuary

- When the usufruct is created, an inventory is drafted to establish which assets fall under the right of usufruct

- The right of usufruct is connected to the life of a person

- Traditionally, it cannot be assigned to another person

- Normally, one cannot transfer the right of usufruct itself - connection/burden to right of ownership (?)

- Right of usufruct is usually given to someone for a certain period of time, but owner of right of usufruct cannot be transferred

- Otherwise, right of ownership would be burdened forever (connection to bare ownership)

- At the end of the usufruct, the right of ownership will become full and complete again

- Traditionally, it cannot be assigned to another person

- Quasi-usufruct

- When a right of usufruct is established on assets that are perishable or intended to be consumed, the usufruct holder cannot fulfill her obligation as a good usufructuary to preserve the assets

- In those situations, a right of usufruct cannot be created

- Instead, French and German law recognize quasi-usufruct

- Ex: when a right of usufruct is established on object that cannot be used without being consumed, such as money, grain and liquors, the usufructuary has a right to use them, but with the obligation to, at the end of the usufruct, return either objects of the same quantity and quality or their value estimated at the date of return

- It is not a right of usufruct, but a transfer of ownership of a thing

- iow: Quasi usufruct is a type of usufruct that applies to consumable items—goods that are exhausted or lose their identity when used

- This differs from traditional usufruct, where the usufructuary has the right to use and enjoy the non-consumable property of another person, with the obligation to preserve its substance

- When a right of usufruct is established on assets that are perishable or intended to be consumed, the usufruct holder cannot fulfill her obligation as a good usufructuary to preserve the assets

- Use and habitation

- These rights are similar to the right of usufruct, but more restricted in content

- The right of use is used for immovable objects more than movable objects, mainly because it only awards the rights to use, which is used to give another the right to use land rather than use an object

- It includes the same right of use as a usufructuary but does not include the right to take the fruits, except when needed for private use

- The right of habitation can only be created on an immovable object

- It is a right to use a building to live in and, therefore, should be seen as a restricted property right of use

- The rights of use and habitation are strictly connected to the person whom the right was granted and cannot be assigned

- This prohibition of assignment means that the right-holder cannot allow another access to the exercise of the right

- Additionally, the right-holders of a right to use or habitation are under the same obligations as a usufructuary

- These include the duty to take care of the land and preserve its value

- Servitude

- In property law, a servitude is a legal right granted by one property owner to another to use the land in a specific way that is less than full ownership.

- Servitudes are a type of easement and are primarily used to allow the non-owning party certain predefined uses of the owner's land.

- They are a means to address needs or conveniences that transcend property boundaries, such as access to roads, utilities, or light and air.

- Where an owner of a piece of land wants to grant a neighbor access to her land she can do so by agreement, which would create a right personal to that neighbor

- However, the owner may also establish a property right on behalf of the neighbor which would connect the property right (servitude) to the ownership of the land

- Once established, the property right would burden the right of ownership and therefore bind the right of ownership

- The servitudes can also come into existence by operation of the law

- For example, under French law:

- Lower pieces of land are subjected to those that are situated higher, to receive waters which naturally flow from them without the hand of man having contributed thereto. The owner of the lower piece of land may not rise dams that prevent that flow, and the owner of the higher piece of land may not do anything to the detriment of the servitude of the wonder of the lower piece of land

- The right to use water for irrigation to the owner’s land → the public waterway functions as the servient land from which the owner of the dominant land may take water

- For example, under French law:

- The right of servitude is a property right which comes into existence between two owners of a piece of land

- The right of servitude limits the ownership of the land on which the servitude runs

- The owner is normally allowed to exclude everyone else from his land, but now agrees to no longer exclude the right holder of the servitude when he or she is exercising his/her right

- However, the owner cannot be compelled to do something

- A positive duty cannot be the subject of a real servitude

- The right of servitude is created on the land

- The effect of this is that when the right of ownership of land is sold and transferred to someone else, the new owner is still bound by the right of servitude

- A right of servitude requires 2 pieces of land

- These pieces of land are known as the dominant and servient land

- The owner of the servient land must tolerated a specific act of the owner of the dominant land over his land

- It is the dominant land which should benefit from the existence of the servitude and not just the owner itself

- A typical example is the right of way, which allows the owner of the one piece of land to walk (or drive) over the other piece of land, usually the of the neighbor

- Such a right is, for example, useful to reach a nearby road, or to ensure an escape route in case of fire

- A typical example is the right of way, which allows the owner of the one piece of land to walk (or drive) over the other piece of land, usually the of the neighbor

- Although the right of servitude may restrict the owner from doing something on the land itself, it cannot restrict the owner’s exercise of his right to dispose of the land

- Right of ownership is split in 2:

- Bare ownership - no right to use, enjoy and take fruits of the thing; but with the expectation that will recover that at some point

- Right to use

- Relation between 2 plots of land

- Dominant and servient land

- Servient - obligation to tolerate the right (of the dominant land) (?)

- In property law, a servitude is a legal right granted by one property owner to another to use the land in a specific way that is less than full ownership.

S18-19: SECURITY RIGHTS. CONCEPT, ELEMENTS AND CATEGORIES & PLEDGE. FLOATING CHARGE (M11/03) (M18/03)

Security rights/interests (1)

- Security rights/interests → secure/guarantee the performance of an obligation

- iow: security that an obligation will be performed

- Important, and based on contracts - aimed at securing the performance of another obligation

- No transfer of property security rights.. Only intended to guarantee that a principal obligation is going to be performed!

- Only purpose of guarantee/pledge → guarantee performance of obligation

- Hold possession as a guarantee → not intended for use, etc.

- Ex: if you lend 1K if the other gives laptop (as a pledge) → laptop is the owner’s, but it is in the debtor’s possession

- Implies not transfer of ownership and a sale in the case of no performance (?)

- In all European legal systems, the basic rule is that the value of the available assets in the insolvency proceedings must be distributed to all creditors on the basis of the pari passu rule. This is generally called the paritas creditorum rule

- Fundamental principles in bankruptcy law

- "Pari passu" → (Latin for “on equal footing” / “equally”) specifically refers to creditors being treated on an equal footing in terms of payment distribution

- "Paritas creditorum" (also known as the equality of creditors) → broadens this concept to the general principle of equal treatment of creditors within the same class, underscores the equitable treatment of creditors

- Particularly in the context of bankruptcy, the rules refer to the principle that creditors in the same class and rank should be treated equally and paid proportionally out of the available assets of the debtor

- All the creditors have to be paid equally - depending on the amount of their credits

- If I have 10 creditors (at the same rank), and I owe €1M to each one, but I have €1. How much will each creditor be receiving? → €1 amongst the 10 creditors

- However, creditors aim to protect their claims through security interests

- In general terms, a security interest aims at securing a personal obligation, in other words to protect the creditor against the insolvency of his debtor

- If you have a secured credit, you can get paid first (as the first creditor) !!

- Property security - you will skill that pari passu rule - because you can request that something is sold and get paid directly

- If credit is guaranteed with a right of hypothec - can request that object of the hypothec is sold to be paid whatever you are owed

- Obs: What if there are many security rights? What was registered first…

- Important from the perspective of contact law in general

A. Personal security interest (guarantor)

- Consists of the “object of execution”, this is the extension of the assets on which a creditor can exercise the claim:

- according to a personal security interest, a creditor can exercise his claim not only on the assets belonging to his debtor, but also on the assets belonging to his debtor, but also on assets which belong to the provider of the personal security (e.g. a guarantor)

- E.g. asking money from the bank and bank agreeing to loan if the amount of the loan is given back in a certain period; bank asks for a guarantee by a third party in the case you don't perform the obligation to give back the loan, the bank can claim against that third party. Creditor agrees and gets the right to claim against the debtor and guarantor

- iow: Bringing a guarantor to perform my obligation - If I do not perform

- Someone/bank who will respond if you do not pay → guarantee that value will be paid

- Transfer of possession

Always a triangular relation:

A - debtor‘Borrows’ €100 from the creditor (B)iow: debtor (A) → receives from B, needs to give back to B

Is under the obligation to give back the €100 to the creditoriow: Assumes an obligation vis a vis the creditor

B - creditorLends/gives €100 to debtor (A)Has the right to claim the €100 from the debtor (A)If the debtor does not pay, the creditor can claim against the guarantor (C)

C - guarantorGuarantees the debtor’s (A) obligation to payAssumes the obligation to pay €100 to the creditor (B), if debtor (A) is unable to do soLegal person?

Liability / obligation - 3 types!

If the liability from debtor to creditor is joint and several → can claim directly against guarantor1.Joint→ creditor can only claim the whole amount against all (in a single claim)All parties are collectively responsible for fulfilling the entirety of an obligation or debtIf a claim is brought against them, it must be brought against all joint obligors together, not separatelyEach party under joint liability is responsible for the entire obligation, but the creditor can only recover the total amount of the debt once

EX1: If A, B and C assume the obligation to pay €30 to D jointly…3 of them jointly agreed to pay €30D does not get paid. Need to claim €30 against the 3!Can only file the claim against the three parties for the €30

EX2: If A, B and C had assumed the obligation to pay 3K jointly…Then D would need to claim 3K jointly from A, B and CIf obligation is joint D cannot claim from one or two, has to claim from all three

2.Several(separate) → if the creditor assumes the obligation separately, it needs to claim separately (individually)!Each party is only responsible for their own specified share of the debt or obligation, and not for the shares of othersEach obligor can be sued individually for their part of the obligation

Creditors must claim only the designated portion from each obligor without holding any one individual responsible for the entire debtEX1: : If A, B and C assume the obligation to pay €30 to D severally…If assume the obligation separate, need to claim separatelyD can only claim 10 from A, 10 from B, 10 from CLiability only for the money that the specific party gave

3.Joint and several/ solidary → creditor can claim from any partyEach party is individually responsible for the entire debt, as well as being collectively responsibleThis means a creditor can demand the full amount from any one of the parties (or some in any proportion), regardless of their individual shareOnce the creditor is paid in full, they cannot claim the debt from the other parties

After one party pays more than their share of the liability (because the claimant chose to collect the entire amount from them), then that party (that pays the creditor in full) may seek contribution from the other liable partiesThis means they can go to court to compel the other parties to pay their fair share of the debt or damages

Who is in a comfortable position? The creditorIt simplifies the process of obtaining a remedy, especially if one of the liable parties is significantly more solvent or accessible than the othersThe creditor does whatever it wants. It can claim against the richestIf a guarantor assumed obligation to debtor, joint and severally → creditor can claim directly against guarantor, and guarantor can claim against the debtor

Why would the debtors accept joint and several liability? XXOnly works in external relations - between the debtors (?)EX1: If A, B and C assume the obligation to pay €30 to D jointly and severally…If A, B and C assumed the obligation to pay 10E joint and severallyD can claim 30 against C. C can claim 20 against other creditors (10 against A and 10 against B)C is only under an obligation to pay 10, but if it agrees joint and severally, must pay full amount - but with the right to pay the “additional” amount from A and BIn the case that A and B are insolvent, C would have to pay and would not be able to claim against them (?)If A is in default, C can only claim 10 against B (not 20). C would pay 30 and get 10 back, in the end paying 20.

EX2: If A, B and C had assumed the obligation to pay 3K jointly…D can claim 3K from anyone, or D can decide to claim 3K against each, or other amountsNormally, would like to file a single claim → faster, cheaper

Benefits - include the increased likelihood that the plaintiff will be fully compensated for losses or damages, particularly in cases where some liable parties are insolvent or cannot be located.Criticisms - revolve around perceived unfairness, especially if one party ends up paying more than their share simply because they have deeper pockets or are more easily targeted legally.

GuaranteePrincipal + interest → Pay exactly the amount you oweThere cannot be an unfair enrichment by the debtor or the creditorCannot be “extra” enriched because of not paintingGuarantee the principle of ligation, nothing more

Once in default, the amount you owe will be debt…During Enforcement proceedings - may increase!!Sometimes: Creditor may not claim until relevant default (not simply one installment, but some/many)Creditor normally holds the right to claim the whole amount with interest!The interest will be running always, until you pay!!Creditor holds the right to that interest

B. Property security interest (assets, goods, immovables)

- Does not extend the amount of assets on which a claim can be realized, but grants a priority right in favor of one or more secured creditors allowing them to be paid out of the proceeds of that asset before other creditors

- Security can be executed over a thing

- Agreement on property security → security on specific goods

i. MOVABLES → (contract of) PLEDGE

- Over a movable good (e.g. a painting, a watch) ! → Can be a pledge

- Not for use, but for the other party to keep → once money is paid, the owner gets it back; if not, may request for the painting to be sold

- Transfer of possession → something is given to the creditor so it gets the right to sell in case of non-performance

- Over a movable good (e.g. a painting, a watch) ! → Can be a pledge

ii. IMMOVABLES → (contract of) HYPOTHEC, does not require a possession

- In the case of immovables → the same, but no possession (?)

- Request money from the bank; loan to buy the house → bank lends with the agreement of an hypothec over the house being bought with that money → if amount lent is not paid, can request that house be sold so that the bank (credtor) gets paid with the proceeds of the sale

- Right of hypothec: If guarantee is a thing → property security right

- In the case of immovables → the same, but no possession (?)

- In this session we only deal with property security interests, as the personal security interests fall outside the scope of property law

Security rights/interest (2)

- Categories: pledge, hypothec, right of retention (Civil Law) or lien (Common Law), and security ownership (e.g. retention of title)

- Common features:

- Principles of property security rights

- Recap: Security right - guarantee of performance of obligation

- If personal - extension of the assets that will be subject to giving back the amount of money (of debtor or guarantor)

- Security over something - if unable to pay, creditor can claim thing is sold target paid with the proceeds of the sale

- Overview

- One of the main features of property security rights is “accessority”

- Specificity - You need to know what is beijing guaranteed - what amount, what obligation

- Prohibition of unjustified enrichment - is a consequence/implication of accessories

- 1) Accessory nature of the security interests: property security rights are said to be accessory with regard to the claim they guarantee. This has a double meaning:

- (i) they do not grant any power to make use of the economic value of the asset except for the priority right they confer when exercising the right to fulfill the obligation; and

- (ii) the existence, transfer and extinction of the property security right is dependent upon the existence, transfer and extinction of the claim of which they guarantee the payment

- Accessory - follows the principal obligation

- Accessory

- If principal obligation is performed, property security right ceases to exist

- → it has to be canceled: has no reason to exist

- The purpose of its existence is to guarantee the accomplishment of a different obligation

- If I give back amount of loan, property security right, should be canceled immediately

- Only reason for security right is to guarantee performance of a different obligation (e.g. giving back amount of the loan)

- 2) Specificity of the secured claim: the debt secured must be actual or future; in the latter case, they must be determinable

- We need to know the economic value of the obligation that is being guaranteed

- If it an obligation to give an amount of money - easy

- If it is a different obligation - should convert that into an amount of money

- 3) Prohibition of unjustified enrichment: a security right exists for the sole purpose of the payment of the secured claim

- The powers of the secured creditor to realize his right are limited to the value of his claim

- The realization of the security right cannot put the holder of the security right in a more favorable position than the one in which he would have been if the secured claim had been paid in due course

- Obs: In civil law - there's family, inheritance, the law of obligations, property law; in the law of obligation, can include contract, torts – within this, there is the “unfair enrichment doctrine”

- What happens if you make a bank transfer - you are paying something, and by mistake you make that bank transfer to someone else

- Need to undo the unjust enrichment!

- First person has the right to claim against the second, so the second gives back the amount of money

- No wrongdoing on the second person’s part. Loss of money, but not the second person’s fault → cannot resort to torts

- Tort action - requires wrongdoing, with negligence, wilful misconduct, etc.

- What happens if you make a bank transfer - you are paying something, and by mistake you make that bank transfer to someone else

- Obs:

- Enrichment -

- Person 2

- Impoverishment -

- Person 1

- Lack of legal cause

- No legal cause/ground or specific provision/contract or legal title.. Allowing enrichment/impoverishment to happen

- No provision allowing it -

- Enrichment -

- In the case of the execution of s property security right → there can never be an unjust enrichment

- Ex: If I do not fulfill duty with the creditor, it can claim execution of the property security right (thing is sold to get paid)

- If it get sold 200, and I owed 100 – bank will get 100

- Cannot be put in a better position that it would be if I had performed my obligation

- Ex: If I do not fulfill duty with the creditor, it can claim execution of the property security right (thing is sold to get paid)

Right of pledge

- Pledge - a property security right over movables

- Ex: if you lend me 1k euros, I can give my laptop as a guarantee

- The laptop continues to be mine and you are not intended to use it

- You only keep it as a guarantee

- Debtor should make sure that movable is worth amount that is owed

- A pledge is a limited property right with regard to movable (corporeal or incorporeal) assets which grants the pledgee a right to be paid from the proceeds of the forced sale of the subject matter of the pledge, in discharge of the debt or obligation secured

- There is a transfer of possession!

- Never requires a transfer of ownership; only if the property security right is executed/enforced by the bank. If the creditor/bank is not paid and requested that the thing is sold to get paid the proceeds. Then, there will be a transfer of the ownership of the thing because a third party will acquire the ownership of the thing.

- Pledges are most frequently restricted to movable assets

- Property security rights over movables

- Normally requires a transfer of possession

- Usually, a pledge secures the payment of a monetary debt but, in principle, there is no reason why a pledge should not secure the performance by the pledgor of some other obligation

- 2 alternative methods of publicity are possible: the transfer of possession or the registration

- Way of guaranteeing the publicity of that property security right: Fulfilled through - transfer of possession or registration

- With movables → dispossession + pledge (?)

- With immovables → with registration + hypothec (?)

- No need of transfer of possession

- Publicity - not achieved with transfer of possession but through registration!!

- E.g. if the house is a guarantee, person owns and possesses the house (lives in it), but it is burdened by aa property security right - right of hypothec → if I don't perform and give back the loan, bank can request and house gets sold

- No transfer of the house from the person to the bank!

- In some cases, for instance security over an important object, the creditor wants to get paid. How will the debtor get the creditor paid? Via its assets.

- Transfer of possession does not make sense. Creditor wants to get paid. Does not want to have a plane, for instance.

- Depends on whether the goods can be registered or not

- Ships and aircrafts - special registries for special types of goods

- Property security rights over those (certain) specific movables - no transfer of possession is needed

- In the tradition of the Roman law, the right of pledge of corporeal assets requires the transfer of possession of the object of the pledge

- The pledgee, or a third party about whom the parties have agreed, has to receive the exclusive control of the pledged objects, but the delivery could be actual or symbolic (handing over the keys of the immovable in which the objects are kept)

- Pledge requires dispossession? Yes! → But, the requirement of dispossession is in decline

- Dutch law generalized the registered pledge without dispossession in 1992

- French law followed this development in 2006

- English law makes a general distinction between a:

- (i) possessory pledge - transaction in which the debtor (pledgor) transfer possession of a thing to the creditor (pledgee) to hold a security; and

- Pledge with a transfer of possession

- (ii) non-possessory pledge or charge - a security right which does not require that the creditor (chargee) take possession of the charged asset

- Change is like the hypothec but can affect movables and immovables

- Does not require possession

- Obs: Same as hypothec (in civil law)

- Mortgage sometimes used interchangeably with “hypothec”

- Common law mortgage - transfer of property for security purposes (?) → different from property security right

- The effectiveness of a charge is subject to the requirements of writing and registration

- A charge can have both movable and immovable assets as object

- (i) possessory pledge - transaction in which the debtor (pledgor) transfer possession of a thing to the creditor (pledgee) to hold a security; and

- 2 issues arise with regard to the realization of the right of pledge:

- First, whether the pledgee is entitled to sell the object of the pledge and to be reimbursed of the proceeds

- Can the creditor sell the pledge/thing directly? Or must it request that it is sold judicially? → Most, the latter

- Issue of selling things yourself: there could be no clarity over there has been an unfair enrichment, same with hypothec

- Immediate payment of the thing - could be sold for the valued of what is owed (which could be higher or lower) than the actual object is worth

- Sold to the best offer - guarantee the highest amount of the good - not harming the debtor by selling for a low/lower price

- Issue of selling things yourself: there could be no clarity over there has been an unfair enrichment, same with hypothec

- French and Belgian law: the pledgee is not entitled to sell the object of a pledge without prior judicial authorization

- Dutch, German and English law: the creditor can sell the object of the pledge without judicial authorization, except if the agreement requires his previous authorization

- Can the creditor sell the pledge/thing directly? Or must it request that it is sold judicially? → Most, the latter

- Second, whether the parties can agree that the creditor will become owner of the pledged objects on the default of the debtor, without judicial authorization

- "Pacta comissoria" refers to an agreement between the creditor and the debtor that upon the debtor's default in payment, the creditor automatically becomes the owner of the pledged property without the need for judicial authorization or intervention. In essence, it's an agreement that allows the creditor to acquire ownership of the pledged assets if the debtor fails to fulfill their obligations.

- Prohibition: Most civil law systems, following principles derived from Roman law, prohibit the use of pacta comissoria. This means that parties cannot agree in advance, before the debtor's failure to pay, that the secured creditor will automatically obtain full ownership of the pledged movable assets upon default.

- According to most of the civil systems, in line with Roman law, it is not allowed that parties agree prior to the debtor’s failure to pay the obligation that the secured creditor should obtain full ownership of the pledged movable. This is the so-called prohibition of pacta comissoria

- French law allows it

- Creditor cannot acquire/keep object subject to the right of hypothec - would simply have a right as a creditor that the thing is sold judicially to get paid with the proceeds of the sale

- Rationale for prohibition: The prohibition of pacta comissoria is rooted in legal and policy considerations aimed at protecting debtors' rights and preventing abuses by creditors. Allowing creditors to automatically acquire ownership of pledged assets upon default without judicial oversight could lead to unfair outcomes and potential exploitation of debtors.

- Judicial authorization requirement: Instead of allowing automatic transfer of ownership to the creditor upon default, most civil law systems require judicial authorization or intervention to effectuate such transfers. This ensures that the process is fair, transparent, and subject to legal scrutiny. Judicial oversight helps safeguard debtors' interests and prevents creditors from unfairly benefiting from default situations.

- First, whether the pledgee is entitled to sell the object of the pledge and to be reimbursed of the proceeds

- Overview:

- Movables - pledge - transfer of possession

- Immovables - hypothec - no transfer of possession, but rather registration

Fixed charge - floating charge (Common law)

- Charge - (Common Law) property security right - over immovables or movables that doesn't require the transfer of possession !!

- In the case of immovables - like a hypothec

- Regarding movables - it would be like a pledge, but without dispossession

- The common law makes a further distinction between fixed and floating charges

- Fixed charge

- Over specific goods + Has priority: should always be paid in the first place !!

- Obligation subject

- A fixed charge is a type of security interest granted over specific, identifiable assets of a debtor (delineated at the time the charge is created) to secure a loan or other financial obligation.

- Floating charge

- A floating charge is a security right which covers all or most present and future assets of a debtor, but does not attach to these assets until a certain specified event happens, in which case the floating charge becomes a fixed charge

- In this way, a floating charge does not prevent the chargor from disposing of the assets free from the charge

- Floating charge: charge affecting all/most present and future goods of the company, and will be converted into a fixed charged once a defaulting event happen

- More than a property security right → threat of a charge that could exist in the future (?)

- Good of that party could be subject to a charge

- If a triggering event occurs…

- Then the floating charge is transformed into a fixed charge → which would be like a hypothec over the goods

- Default event makes it a fixed charge over the goods

- In the case that the company defaults on its obligation, incapable of paying debts → floating charge is converted into a fixed charge and would be behaving like a right of hypothec (?)

- More than a property security right → threat of a charge that could exist in the future (?)

- Company that is trading with certain goods - has property security right of charge - over all the goods of that company

- “Floating” because not a “real” charge yet

- Floating charges over all the goods can only be set over some goods, making them not fixed (?)

- When we have a floating charge - it has to be registered in a special registry - so those interacting with company know that assets/goods are over a floating charge

- Company cannot trade with those goods, as they will be used to pay the creditors

- There can be fixed charge from the beginning - in which case such goods cannot be traded

- Floating charge is not specific or specific goods - only expectation of real/fixed charge in the case of a default event

- Parties agree in the contract which goods would be converted and part of the fixed charge (?)

- Refer to goods within your ownership. Not applicable to goods already sold, etc.

- If everything goes right - floating charge will just be there..

- First problem:

- (Since the floating charge covers all/most of the debtor’s assets) It could totally exhaust the estate which must be liquidated by the insolvency administrator and would leave nothing more than an empty shell to the other creditors

- iow: draining assets

- Assets of companies subject to floating charge – benefiting other creditors (not you)

- In the event of default - other creditors, not protected by floating charge, will not get paid

- Because floating charge is converted into fixed

- To protect yourself, need to know whether the company you trading with has the assets affected over the floating charge – and weather it affects all or part of the assets / which assets

- In other words, if the debtor becomes insolvent and the floating charge crystallizes, all covered assets are then held as security for the debt associated with the charge…

- …This situation can result in a scenario where the assets available for liquidation by the insolvency administrator are insufficient to cover the debts owed to other creditors

- Therefore, nowadays, the preferential debts and fixed charges are payable out of the proceeds of a floating charge in priority to the debt secured by a floating charge

- In case of bankruptcy, insolvency law - would have to decide how to proceed…

- In other words: the law prioritizes certain debts and fixed charges over those secured by floating charges in the distribution of assets during insolvency proceedings

- This ensures that essential creditors receive payment before the assets are distributed to satisfy debts secured by floating charges

- (Since the floating charge covers all/most of the debtor’s assets) It could totally exhaust the estate which must be liquidated by the insolvency administrator and would leave nothing more than an empty shell to the other creditors

- Second problem:

- The company can continue to trade and incur credit despite the existence of the charge, putting the ordinary trade creditors of the company at risk, even they would not normally know of the existence of the charge

- This problem arises because the floating charge allows the company to continue operating and incurring debts, potentially putting ordinary trade creditors at risk.

- These creditors might extend credit to the company without knowledge of the floating charge, assuming that their claims will be satisfied from the company's assets in case of insolvency.

- This is the reason why the registration of the floating charges is compulsory

- Need to let creditors aware of the existence of a floating charge

- Compulsory registration ensures that creditors, especially ordinary trade creditors, are informed about the existence of the floating charge.

- By registering the floating charge, it becomes part of the public record, enabling creditors to make more informed decisions about extending credit to the company.

- This registration requirement helps protect the interests of creditors by promoting transparency and ensuring that all parties are aware of the security interests affecting the debtor's assets.

- The company can continue to trade and incur credit despite the existence of the charge, putting the ordinary trade creditors of the company at risk, even they would not normally know of the existence of the charge

RETENTION OF TITLE. TRANSFER OF OWNERSHIP FOR SECURITY PURPOSES. RIGHT OF RETENTION. LIEN.

Retention of title

- Simply: the seller retains ownership of the goods until the buyer pays the full price

- Usually, we do not acquire ownership until we pay the full price. We do not pay the full price unless acquiring the full ownership of the thing.

- It’s a contractual clause! Not a property security right

- The essence of a retention of title clause is to reserve ownership of the assets to the seller until the price is paid in full, notwithstanding that the assets are delivered to the buyer

- Therefore, the retention of title makes the transfer of ownership of the sold assets dependent upon the fulfillment of a condition precedent, usually one of full payment of the purchase price

- “Title retention clause”

- Refresh: property security rights

- When the seller agrees to keep (ownership) the item until it’s fully paid off

- Ex: I will continue to be the owner until you pay the full amount of the price – even though you have the possession

- If you are insolvent/bankrupt and cannot pay, I don’t have to queue up with other creditors, can claim vindication action against you

- The seller remains owner of the assets as long as the purchase price remains unpaid

- Upon fulfillment of the suspensive condition, the right of ownership will automatically pass to the buyer, who is already in possession of the assets

- “I will remain the owner while you hold possession of the thing”

- The ownership does not pass at the moment of consent of parties (consensual systems) or of the delivery (traditio systems) but is delayed

- Consensual system - does not happen upon agreement or transfer

- Transfer of ownership → only when the full price is paid!!

- Lack of payment of the price is not necessarily relevant from the pov of the transfer of ownership (?)

- Consensual system - does not happen upon agreement or transfer

- The essence of a retention of title clause is to reserve ownership of the assets to the seller until the price is paid in full, notwithstanding that the assets are delivered to the buyer

- Registration? Title retention clauses are not registered

- From a conceptual point of view, simple retention of title clauses are not considered as a charge or as a pledge which might require registration, but simply as an ordinary contractual provision deferring the passing of ownership until the payment has been effected

- For a title retention clause to be valid - legal system must recognize it

- Most legal systems do

- Liability? As the seller remains the owner of the assets, it continues to bear the risk of destruction or deterioration of the assets (res perit domino), unless otherwise agreed by the contract of sale

- General principle is that the owner bears the risk of the loss/destruction of the thing

- Was there fault or was it accidental destruction? Owner would lose it, but the possessor would still be under the obligation to pay (contractually)

- Normally, owner would include provision in the contract to protect its position

- If possessed by someone else - risk - clause/provision to cover for that possibility

- "Res perit domino" is a Latin legal maxim that translates to "the thing is lost to its owner."

- This principle signifies that if property or goods are destroyed or lost, the loss falls upon the owner of the property rather than on any other party involved.

- In essence, it emphasizes the principle of ownership and the associated risks that come with it. So, if something happens to the property, the owner bears the loss.

- General principle is that the owner bears the risk of the loss/destruction of the thing

- Purpose? The purpose of this clause is to transfer upon the seller some degree of security in the event of insolvency of the buyer

- The seller “functionally” retain a property security right, as the sold assets remain out of the insolvent patrimony if the buyer becomes insolvent before having paid the full purchase price

- Therefore, title retention clauses are only useful if they are not only valid but also proprietary effect in such a way that they can be invoked in case of insolvency of the debtor (French law and Belgian law require a written agreement, while Dutch and German law adhere to the simple consensual nature of the agreement with regard to the retention of title clause, also in relation to third parties)

- Absolute? However, a simple retention of title does not confer absolute security to the seller

- Although the buyer under title retention has not property rights on the purchased goods until he pays the purchase price, most legal systems accept that it is possible to grant to the buyer the right to resell the goods

- And even if the reservation of title clause does not impose (expressly or impliedly) restrictions on resale, they will most often not be of any effect against the purchaser (for value) without notice to the extent that the latter has acquired title through bona fide possession

- Transformation? …If the sales agreement relates to the manufacturing process, the buyer will transform the sold assets

- Problem: what if you give me certain goods. I do not acquire ownership. I acquire those goods and use it to make something else, create something new

- Issue: rights of ownership over those goods would be extinguished and new right of ownership would be created

- One of the parties would escape from its obligations

- Need to cover that possibility through contract

- Ex: “All goods are supplied XX”

- Using goods that I gave you to make another good

- End of previous right of goods, creation of a right over new good - specificatio

- Who is the new owner? Contract law

- If i'm selling those goods, would include title retention clause - not only goods that i gave you, but also goods that you make using the good that i gave you → until you pay me back ini full

- Ex: using a tool for Ferrari - if it is going to be the other person’s - stupid decision (??)

- Any consequences of the non-performance are to be dealt with by the debtor (?)

- This is the reason why parties often aim to contractually extend the reservation of title using a different, extended, type of retention of title clauses

- Ex: “All goods are supplied under retention of title until full payment has been effected of all current and future claims by the principal, including the interest and expenses. Our ownership extends to the new goods which are manufactured out of the supplied goods. The principal manufactures the goods for us and holds them for us under exclusion of their ownership.”

Transfer of ownership for security purposes

- A debtor transfers to a creditor ownership of assets – without delivery – as security for whatever claim the transferee might have against the transferor, under the obligation for the former to make restitution of the ownership of the assets if the secured claim has been fully discharged

- The reason for this device is that the requirement of dispossession can be considered harmful for credit purposes, because of economic reasons

- The non-possessory pledge or the transfer of ownership for security purposes provide a solution

- 3 main positions for this fiduciary transfer for security purposes:

- 1. Legal systems according to which the fiduciary transfer for security purposes is invalid

- The purpose of creating a security right is not a valid or sufficient causa for the transfer of ownership

- 2. Legal systems according to which the fiduciary transfer for security purposes is valid but has not proprietary effects

- The result of this position towards the creditor is identical to the previous one: the security ownership cannot establish the security purpose it is created for an is thus useless

- 3. Legal systems according to which the fiduciary transfer for security purposes is valid and has proprietary effects

- 1. Legal systems according to which the fiduciary transfer for security purposes is invalid

- Not a property security right!

- AKA common law mortgage

- Not admitted in many civil law jurisdictions, but yes in common law

- In civil law - For fiduciary purposes

- Implies that in order to guarantee performance of an obligation - will transfer the ownership of something to you - although I will continue living in my house

- Transfer of ownership as a security - so that if I don’t perform my obligation - you will simply keep the ownership of the house

- Can file a vindication action if I am in possession and you want it

- If I perform obligation - duty to transfer back the ownership → accessory nature

- Transfer of ownership as a security - so that if I don’t perform my obligation - you will simply keep the ownership of the house

- iow: Means that in order to guarantee the performance of an obligation, I will transfer as guarantee the ownership of something

- You will keep as a guarantee

- Same as a mortgage (?)

Right of retention

- OBS: retention of title vs. right of retention → Not the same as title retention clause - title retention is not a property security right !!

- Contractual right

- It’s a self-help right (e.g. evicting squatters) (?)

- Different legal principles!

- Retention of Title: This refers to a contractual provision in a sale agreement where the seller retains ownership of the goods until certain conditions are met, usually until the buyer pays the full purchase price. Until the buyer fulfills their payment obligation, the seller retains legal ownership of the goods, even though they may be in the possession of the buyer. If the buyer fails to pay, the seller can reclaim the goods.

- Purely contractual - but has consequences on the possession of a thing

- Right of Retention: This is a legal right granted to a party to withhold possession or control of property until a debt or obligation owed by another party is satisfied. Unlike retention of title, which deals with ownership, right of retention deals with possession. For example, a landlord may have a right of retention over a tenant's possessions until the tenant pays overdue rent.

- A property security right - right intended to guarantee the performance of an obligation based on a thing

- Right of retention and title retention - clauses in a contract

- Title retention clause - i retain ownership until you pay (?)

- I retain/keep the title/ownership - while someone else has possession

- Retention of ownership

- Right retention -

- Right of retention of possession - until payment

- Contractual right

- A right of retention is a right awarded to the creditor to suspend his obligation to make restitution (return of object to owner) of a good until payment has been effected of a debt connected to that good

- It is the right deriving from the factual control of an asset to withhold that asset against the actual owner of the asset until the moment that the latter has complied with all his obligations relating to that asset

- When would someone be entitled to retain possession of something? (?) →

- When the other person acquires possession because one did not fulfill obligation..

- Ex: getting your car in a parking lot.

- Get the ticket. If you do not pay, you are not physically allowed to get out, not just because of the barrier, but also because parking has the right to keep your car if you do not pay. Parking lot can never become the owner of the car, nor is it burdened with property security rights.

- Can you take possession? Not until you pay. You are not entitled to hold/exercise your right to possess / right of retention - because you did not perform your obligation connected to the parking of your car. Once you pay, you can take back possession of the car.

- Contract by conduct - just by getting car into the parking lot - agreeing to the terms of the contract - which may not be certain, but can be more or less assumed

- Parking lot would not want to become owner anyways - nuisance. Costly.

- Normally, could be agreed

- The factual possessor of the asset must meet several conditions in order to be entitled to exercise a right of retention. These conditions are not identical in all legal systems but have large similarities:

- The person exercising the right of retention must have a claim which has become due by the owner or by a third person

- His possession must be lawful, e.g. not be obtained by the force or other tortuous means, or as a result of fraud or misrepresentation

- She must not have lost her factual possession in the meantime

- Most legal systems require the existence of a legal or (at least) material connection between the secured claim and the withheld asset

- Material connection XX

- There must be a connection between the secured claim and the withheld asset

- It is not enough.. To owe an amount of money…

- Right of retention has to be connected to the withheld asset!

- Material connection XX

- OBS: lease agreement, leading and option to purchase…

- Lease agreement - transfer of possession and rent

- Leaving - after a time period, one holds right to purchase - option to purchase - end the contract, continue leasing through contract of lease or acquire ownership by paying an amount

- The right of retention can be roughly considered as an application of the Roman law decide exceptio non adimpleti contractus, allowing a party to suspend execution of his obligation as long as the other contracting party has not executed his obligation

- The right of retention is not subject to any publicity requirements because it does not grant any property security right to the creditor

Lien (Common Law)

- Common law’s right of retention

- imw: right to retain possession if goods are not paid for

- Possessory Lien: This type of lien arises when a person (the creditor) has possession of another person's property and is owed money for work done on that property. The creditor can retain possession of the property until the debt is paid.

- Society looks hesitantly towards self-help, but there is room for it → different self-help remedies

- Termination - through a letter to the other party; if challenged, the court would have to determine whether it was correct or not (if correct, then would be considered as if issued by court, if not, that’s a problem, and the other party may be able to claim for breach of contract given absence of right of termination)

- Section 41 Sale of Goods Act 1979

- (1) Subject to this Act, the unpaid seller of goods who is in possession of them is entitled to retain possession of them until payment or tender of the price in the following cases:

- (a) Where the goods have been sold without any stipulation as to credit;

- (b) Where the goods have been sold on credit but the term of credit has expired;

- (c) Where the buyer becomes insolvent

- (2) The seller may exercise his lien or right of retention notwithstanding that he is in possession of the goods as agent or bailee or custodier for the buyer

- (1) Subject to this Act, the unpaid seller of goods who is in possession of them is entitled to retain possession of them until payment or tender of the price in the following cases:

- Section 42 Sale of Goods Act 1979

- Where an unpaid seller has had part delivery of the goods, he may exercise his lien or right of retention on the remainder, unless such part delivery has been made under such circumstances as to show an agreement to waive the lien or right of retention

- Tappenden v Artus and another (Court of Appeal, 11 July 1963):

- “The common law remedy of a possessory lien, like other primitive remedies such as abatement of nuisance, self-defence or ejection of trespass to land, is one of self-help. It is a remedy in rem exercisable upon the goods, and its exercise requires no intervention by the courts, for it is exercisable only by an artificer who has actual possession of the goods subject to the lien. Since, however, the remedy is the exercise of a right to continue an existing actual possession of the goods, it necessarily involves a right of possession adverse to the right of the person who, but for the lien, would be entitled to immediate possession of the goods. A common law lien, although not enforceable by action, thus affords a defence to an action for recovery of the goods by a person who, but for the lien would be entitled to immediate possession”.

S22-23: MORTGAGE & HYPOTHEC (08/04)

English mortgage / hypothec

- English mortgage: A transaction in which the mortgagor transfers (to the secured creditor) his entire title, on condition or subject to an undertaking, that when the debt is repaid the title will be transferred (back). Therefore, in English law:

- (i) the mortgagee becomes the owner of the good which is subject to the mortgage, and

- (ii) the mortgagor merely retains a title for redemption, that is, the right to claim the asset upon the full payment of the secured claim even after the term for repayment has expired

- In that sense, a mortgage should be distinguished from a charge, which merely grants a limited property right to the chargee

- Transfer of ownership for security purposes !!

- iow: the English mortgage provides a straightforward and widely recognized mechanism for lenders to secure loans with real property as collateral, while allowing borrowers to retain ownership of their property during the term of the mortgage. It is a commonly used instrument in real estate financing in jurisdictions where English law principles apply.

Hypothec

- Hypothec: A limited property right with regard to immovables which grants the creditor a right to be paid from the proceeds of the forced sale of the subject matter of the hypothec, in discharge of the debt or obligation secured

- In common law terms, a hypothec is a charge

- The possibilities under English law, are very wide for the execution of the hypothec - different possibilities

- Execution of the hypothec under English law - normally parties can agree how it’s going to be

- Hypothecs are a form of security interest recognized under civil law systems, like those in Quebec, Canada, and several European countries, comparable to mortgages or liens under common law systems.

- Right of hypothec as a property security right - never implies a transfer of ownership!!

- A hypothec is not a common law mortgage:

- First, a mortgage creates a conditional ownership on behalf of the mortgage, which is different from the holder of a right of hypothec, who merely has a limited property security right

- Second, a mortgage normally refers to immovable things, but can also have as object movable things (shares, patents, etc.). A hypothec is traditionally restricted to immovables, or at least registered goods

- The functional equivalent of a civil law hypothec is not a common law mortgage, but rather a charge on land

- A hypothec is not a pledge!!

- First, a hypothec has an immovable object, while a pledge has a movable object as its subject matter

- Second, a hypothec does not require dispossession of the hypothecor. In contrast, a pledge normally requires dispossession of the pledgor

- However, in English law, the difference based on the way of publicity is not applied: non-possessory security rights are known as charges, independent of whether they involve movables or immovables

- Thus, a common law charge is like a hypothec

- Charge - Transfer of something for security purposes

- Can affect movable or immovables

- Maini consequence: no transfer of possession

- Hypothec - no transfer of ownership, just a security right

- Possessory pledge -

- Charge - Transfer of something for security purposes

- Thus, a common law charge is like a hypothec

Hypothec: main features

- 1. Immovable nature of a hypothec:

- The subject matter of the hypothec must be a specific immovable

- Although in most legal systems the subject matter of the hypothec must be an immovable, Dutch law has replaced the basic movable/immovable distinction by the distinction between registered things and non-registered things

- The basic principle is that registered aircrafts and ships can also be the object of a hypothec

- Special system of registration

- If I still need possession over the object - to make money, etc. → Dispossession doesn't make sense

- The basic principle is that registered aircrafts and ships can also be the object of a hypothec

- OBS:

- Right of hypothec over movables

- Right of pledge over special movables with a registration

- KP: What matters is that for special types of goods/movables → there is no need for a transfer of possession, and there is a special registration for that !!

- 2. Formal nature of a hypothec:

- An agreement to create a right of hypothec is a formal agreement; it requires a document in writing and, in those legal systems where the notarial office is known, even a notarial deed

- A private agreement to create a right of hypothec merely creates a promise to create a right of hypothec on a thing on behalf of the debtor

- If the latter does not comply with his promise, the creditor will not be entitled to enforce the person who made the promise to sign the notarial deed

- The only sanction for the non-compliance with a promise to create a right of hypothec is that the debtor has to pay damages, a sanction that does not give any protection in case of insolvency

- Additionally, German and Dutch law require the registration of this deed in a public registry

- 3. Accessory nature of a hypothec

- A right of hypothec has, as other security rights, an accessory nature. This means that it follows the status of the secured claim:

- If the secured claim is extinguished or destroyed, → the hypothec will also be extinguished or destroyed

- If the secured claim is transferred, the hypothec will automatically be assigned to the assignee of the claim

- A right of hypothec has, as other security rights, an accessory nature. This means that it follows the status of the secured claim:

- 3.1. Exception: Security land charge in German law (Grundschuld)

- The land is charged with a property security right which entitles the holder of the Grundschuld to a certain amount of money out of the value of the burdened land

- This land burden can be created and continue to exist independently from a debt between the right-holder and the owner of the land

- From a functional perspective, it is similar to a right of hypothec: it secures the payment of a claim through a property security right on an immovable object

- However, the distinctive feature is that, unlike a right of hypothec, the Grundschuld is not accessory to the secured obligation

- It can come into existence even if no secured obligation has come into existence, and it can exist independently from any secured obligation

- In German legal practice, the Grundschuld has to a large extent replaced the hypothec as security instrument, because it offers major advantages to the creditor

- She can exercise the security right in order to recover the money she has lent to the debtor, even if the secured claim is void

- Normally, when agreed - parties would have agreed (on a contract) on events that would trigger the occurrence of a guarantee

- Would be applicable for many different types of obligations

- Basic element: property security right that has no accessory nature

- So even if obligations are performed, grundschuld would continue to exist for future obligations that can be created between the parties

- Abstract guarantee, not accessory

- The land is charged with a property security right which entitles the holder of the Grundschuld to a certain amount of money out of the value of the burdened land

- Priority ranking: in all legal systems, the priority ranking of a hypothec is determined according to the date of the submission for its registration in the public register

- A priority ranking of a hypothec (often simply called a "hypothec") refers to the order in which creditors are paid from the proceeds of the sale of a debtor's secured property. Here’s how the priority ranking works:

- 1. Establishment of Hypothec: A hypothec is established by contract or by law as a security for the fulfillment of an obligation, typically the repayment of a loan.

- 2. Registration: The priority of most hypothecs depends largely on the order of their registration. In jurisdictions with a registry system for such security interests, a hypothec must be registered to establish priority over subsequent hypothecs registered against the same property. The principle here is "first in time, first in right," meaning the earlier a hypothec is registered, the higher its priority.

- 3. Priority Ranking: This ranking determines the order in which proceeds from the sale of the secured property are distributed among creditors. If a property is sold to satisfy debts, the proceeds are first used to pay off the creditor with the highest-ranking (earliest registered) hypothec. Any remaining proceeds are then distributed to the next creditors in order of their priority until all secured debts covered by hypothecs are paid.

- 4. Special Priority Rules: Some types of hypothecs can have special priority irrespective of the registration date. For example, legal or statutory hypothecs (such as those for taxes owed to the government or claims by workers for unpaid wages) may take precedence over earlier registered conventional hypothecs. Additionally, some jurisdictions may allow for a hypothec to obtain a super-priority status through credit arrangements, such as debtor-in-possession financing in insolvency cases.

- 5. Effects of Insolvency: In the event of the debtor's insolvency, the priority ranking of hypothecs can determine the extent to which creditors recover their investments. Secured creditors with higher-priority hypothecs are more likely to receive full repayment compared to those lower in the priority chain.

- Realization: if the debtor is in default, at law or as contractually agreed, the hypothecee can realize the hypothec. This realization can be termed “foreclosure”.

- Realization - refers to the enforcement of the security interest granted by a hypothec when a debtor defaults on their obligations.

- Default can occur under the terms specified by law or as outlined in a contractual agreement. When a debtor fails to meet their obligations—typically, failure to pay a debt—the creditor (hypothecary creditor) has the right to realize (enforce) the hypothec to recover the owed amounts.

- Foreclosure - is a common method of realizing a hypothec. It’s a form of realization.

- This process involves the creditor taking legal steps to terminate the debtor's right over the secured property (whether movable or immovable) so that the property can be sold. The proceeds from the sale are then used to pay off the debt owed to the creditor. The specific steps and legal procedures for foreclosure can vary significantly between jurisdictions but typically involve court intervention or a formal process to ensure fairness and legality.

- Prolonged proceedings of foreclosure make security rights often burdensome and diminish their economic value

- Time-Consuming: Foreclosure can be a lengthy process, often taking months or even years to complete. During this time, the property may not be properly maintained or might depreciate in value, affecting the potential recovery amount.

- Costly: The foreclosure process involves legal fees, court costs, and other expenses related to securing and selling the property. These costs can accumulate over the duration of the proceedings, reducing the net amount recovered by the creditor.

- French law: Article 2458 Code Civil:

- Unless one takes action to sell the thing burdened with a hypothec under the terms provided for by the laws which apply to enforcement proceedings, from which a contract of hypothec cannot derogate, an unpaid hypothecee may request the court that the immovable remains with him”. Therefore:

- (i) enforcement proceedings are needed, and there is no possibility of resorting to self-help

- (a clause in which parties agree that the creditor can sell the immovable asset if the debtor is in default to comply with the obligations is void because it could entail the risk that the creditor would sell the asset against a sales price which is sufficient to pay his claim, but which is below market value); and

- (ii) it may be agreed in an agreement of hypothec that the creditor shall become owner of the immovable burdened by the hypothec (the prohibition of pacta commissoria has been abolished in French law)

- German law: distinguishes two forms of forced execution of the hypothec, namely:

- (i) the compulsory action (immovable assets), and

- (ii) the forced administration (“fruits” such as the lease price)

- English law:

- Four-Maids Ltd v Dudley Marshall (Properties) Ltd: The proprietor of a legal charge has the choice between four means to enforce the security right:

- (a) taking possession,

- (b) enforced sale of the immovable,

- (c) foreclosure (the mortgagee becomes the absolute owner of the asset and may then sell it free of the mortgagor's rights), and

- (d) appointment of a receiver.

- In legal practice the hypothecee will almost always take possession before exercising the power to sell, because it will be impossible to get the best price unless vacant possession is offered.

- The taking of possession of the asset is therefore often the first stage in the sale of the property.

- Four-Maids Ltd v Dudley Marshall (Properties) Ltd: The proprietor of a legal charge has the choice between four means to enforce the security right:

- Realization - refers to the enforcement of the security interest granted by a hypothec when a debtor defaults on their obligations.

S24: MORTGAGE & HYPOTHEC FOR CONSUMERS. UNFAIR TERMS. DIRECTIVE 2014/17/EU.

Intro

- Reference to consumers and consumer law

- E.g. asking for a loan in a bank - consumer relation; signing an agreement

- Move from property law to contract law

- Main countries, especially in EU → protect the weaker party

- Consumer that is asking for a loan, or asking for a contract of hypothec

- Banks - draft the contract themselves and give it to ‘consumer’ → upper hand

- Purpose of consumer law → protect the weaker party

Unfair terms

- The Unfair Contract Terms Directive (93/13/EEC) protects consumers against unfair standard terms imposed by traders

- It applies to all kinds of contracts on the purchase of goods and services, for instance online or off-line purchases of consumers goods, gym subscriptions or contracts on financial services, such as loans

- The Directive has been amended by Directive (EU) 2019/2161 of 27 November 2019 on better enforcement and modernization of Union consumer protection rules, part of the “Review of EU consumer law - New Deal for Consumers”

- The amendment introduces an obligation for Member States to provide for effective penalties in case of infringements

- It gas to be transposed by 28 November 2021 and applied from 28 May 2022

- Standard contract terms: facilitate commercial transactions and can be useful in setting out the rights and obligations of the parties under a given contract.

- However, sellers and suppliers possess a considerable advantage over consumers by defining terms in advance without individual negotiation

- For the purpose of this directive, relevant to highlight standard terms → Terms applied by the seller/supplier to whatever consumers going there; terms not individually negotiated

- Standard contract terms (aka “boilerplate clauses”) are pre-drafted clauses that are commonly used in similar types of contracts

- These terms are designed to provide a clear framework for the agreement and reduce the need for extensive negotiations on routine matters

- Unfair contract terms:

- Standard contract terms have to be drafted in plain intelligible language and ambiguities are to be interpreted in favor of consumers

- Contract terms are unfair and, therefore, not binding on consumers if, contrary to the requirements of good faith, they cause significant imbalance in the parties’ rights and obligations to the detriment of the consumer (definition of unfair term!)

- Relevance: unfair contract terms are not binding !!

- In other situations, they would be binding as there is an agreement, etc.

- However, in regards to a consumer, if it is found to be unfair, it does not apply

- If one is paying, the other needs to give something that makes sense - not a waiver of one’s rights..

- E.g. bank will decide (unilaterally) rate of interest to be applied yearly → unfair

- E.g. if a father buys a toy for his son, and it says that the manufacturer will never be liable for damages → unfair

- Relevance: unfair contract terms are not binding !!

- iow: Unfair contract terms, on the other hand, are provisions that create a significant imbalance in the parties’ rights and obligations arising under the contract, to the detriment of the consumer or a party that is at a disadvantage in the contractual relationship

- A list of examples of terms that may be regarded as unfair illustrates this general requirement (see the Annex to the Directive)

- EU countries must make sure that effective means exist under national law to enforce these rights to prevent the continued use of unfair contract terms

- Article 2: “For the purposes of this Directive:

- (a) ‘unfair terms’ means the contractual terms defined in Article 3;

- (b) ‘consumer’ means any natural person who, in contracts covered by this Directive, is acting for purposes which are outside his trade, business or profession;

- E.g. Bank gives loans because that’s what it does, it’s its business

- E.g. lawyer buying a house - acting outside business/profession

- (c) ‘seller or supplier’ means any natural or legal person who, in contracts covered by this Directive, is acting for purposes relating to his trade, business or profession, whether publicly owned or privately owned”

- OBS: Lending money - not covered by directive - not a consumer relation

- Article 3: unfair terms

- “1. A contractual term which has not been individually negotiated shall be regarded as unfair if, contrary to the requirement of good faith, it causes a significant imbalance in the parties’ rights and obligations arising under the contract, to the detriment of the consumer.

- 2. A term shall always be regarded as not individually negotiated where it has been drafted in advance and the consumer has therefore not been able to influence the substance of the term, particularly in the context of a pre-formulated standard contract.

- The fact that certain aspects of a term or on specific terms have been individually negotiated shall not exclude the application of this Article to the rest of a contract if an overall assessment of the contract indicates it is nevertheless a pre-formulated standard contract.

- Where any seller or supplier claims that a standard term has been individually negotiated, the burden of proof in this respect shall be incumbent on him.

- 3. The Annex shall contain an indicative and non-exhaustive list of the terms which may be regarded as unfair.”

- Article 4:

- “1. Without prejudice to Article 7, the unfairness of a contractual term shall be assessed, taking into account the nature of the goods or services for which the contract was concluded and by referring, at the time of conclusion of the contract, to all the circumstances attending the conclusion of the contract and to all the other terms of another contract on which it is dependent.

- 2. Assessment of the unfair nature of the terms shall relate neither to the definition of the main subject matter of the contract nor to the adequacy of the price and remuneration, on the one hand, as against the services or goods supplies in exchange, on the other, in so far as these terms are in plain intelligible language”

- Article 5:

- “In the case of contracts where all or certain terms offered to the consumer are in writing, these terms must always be drafted in plain, intelligible language. Where there is doubt about the meaning of a term, the interpretation most favorable to the consumer shall prevail. This rule on interpretation shall not apply in the context of the procedures laid down in Article 7(2).”

Credit agreements directive

- Directive 2014/17/EU on credit agreements for consumers relating to residential immovable property

- Also intended for the protection of consumers

- Loan agreement - requesting money from the bank

- Bank conducts a credit-worthiness analysis - from whoever is asking money to understand if person is in a reasonable position to pay back and not put the bank in a reasonable position

- Whereas: