Macro Unit 3 Slides

Key Terms

Aggregate Demand (AD): The total quantity of goods and services (real GDP) that all buyers are willing and able to purchase at various price levels.

Real GDP: The total value of all goods and services produced in an economy, adjusted for inflation.

Wealth Effect: The change in consumer spending that results from a change in perceived wealth, particularly due to changes in price levels.

Interest Rate Effect: The impact of a change in interest rates on consumer spending and investment.

Foreign Trade Effect: The change in exports and imports that results from fluctuations in price levels, affecting international trade dynamics.

Multiplier Effect: The process by which an initial change in spending leads to a larger overall impact on the economy.

Marginal Propensity to Consume (MPC): The fraction of additional income that is spent on consumption rather than saved.

Marginal Propensity to Save (MPS): The fraction of additional income that is saved rather than consumed.

Short-Run Aggregate Supply (SRAS): The total quantity of goods and services supplied at different price levels in the short run, influenced by fixed wages and resource prices.

Long-Run Aggregate Supply (LRAS): The total quantity of goods and services supplied when the economy is at full employment, where wages and resource prices are flexible.

Fiscal Policy: Government actions regarding taxation and spending to influence the economy.

Discretionary Policy: Deliberate changes in government spending or taxes enacted in response to economic conditions.

Automatic Stabilizers: Policies such as taxes that automatically adjust based on economic cycles to stabilize the economy.

Unit 3: National Income and Price Determination

Topic 3.1 - Aggregate Demand (AD)

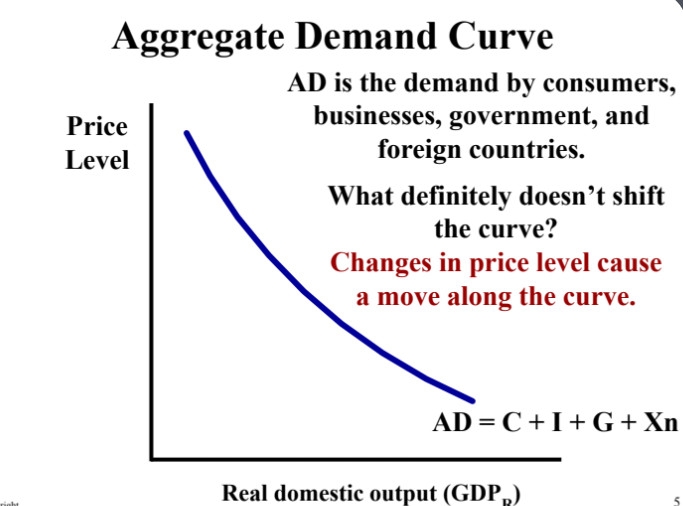

Definition of Aggregate Demand

Aggregate Demand reflects the total quantity of goods and services (real GDP) that all buyers are willing and able to purchase at various price levels. Representing demand for all goods and services in the economy.

Inverse Relationship:

Price Level Increases (Inflation): Real GDP demanded falls.

Price Level Decreases (Deflation): Real GDP demanded increases.

Aggregate Demand Components

Aggregate Demand (AD) is made up of the following components:

C: Consumer spending

I: Investment spending

G: Government spending

Xn: Net exports (exports - imports)

Changes in price level cause movements along the AD curve; do not shift it.

Reasons for Downward Sloping AD Curve

Wealth Effect (Real Balance Effect): Higher price levels reduce purchasing power; lower price levels increase purchasing power.

Interest Rate Effect: Higher price levels require lenders to charge higher interest rates, discouraging spending and investment.

Foreign Trade Effect: When U.S. prices increase, foreign buyers reduce purchases of U.S. goods while Americans buy more foreign goods.

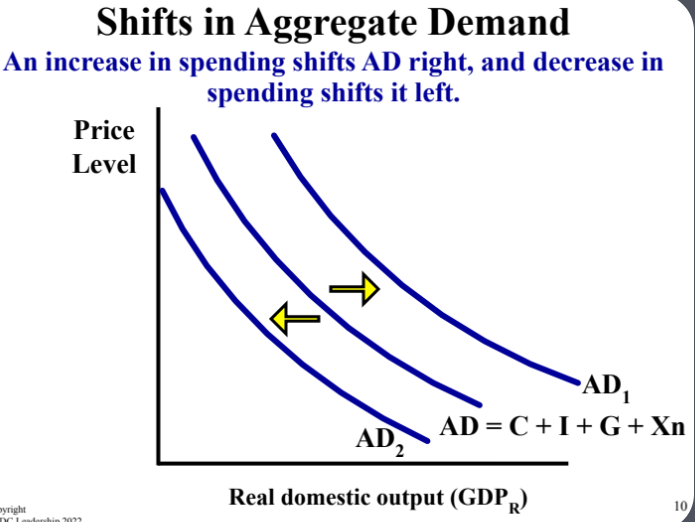

Shifters of Aggregate Demand

Key Factors Influencing AD Shifts:

Change in Consumer Spending: Factors include disposable income, consumer expectations, household indebtedness, and tax changes.

Change in Investment Spending: Factors include real interest rates, future business expectations, productivity, technology, and business taxes.

Change in Government Spending: Increases or decreases in defense spending or public projects.

Change in Net Exports: Influenced by exchange rates and national incomes compared to abroad.

Topic 3.2 - Multipliers

The Multiplier Effect

Definition: An initial change in spending leads to a larger overall impact on the economy. Example: Spending by one individual can lead to further spending by others, magnifying the initial economic impact.

Marginal Propensity to Consume (MPC)

Definition: The portion of additional income that is spent on consumption rather than saved. Expressed as a fraction. The formula is: MPC = Change in Consumption / Change in Disposable Income.

Marginal Propensity to Save (MPS)

Definition: The portion of additional income that is saved rather than consumed. Relationship: MPS = 1 - MPC.

Topic 3.3 - Short-Run Aggregate Supply (SRAS)

Short-Run vs Long-Run Aggregate Supply

Short-Run Aggregate Supply (SRAS): Influenced by fixed wages and resource prices; businesses produce more with rising price levels due to higher profit margins.

Long-Run Aggregate Supply (LRAS): Reflects full employment output, where the economy operates at its maximum sustainable capacity.

Topic 3.5 - Equilibrium in the Aggregate Demand - Aggregate Supply (AD - AS) Model

Equilibrium in the AD-AS Model

Price Level and Output: The AD-AS model illustrates equilibrium when AD intersects with AS at full employment. Output Gaps can emerge in the economy's real GDP, leading to either inflationary or recessionary gaps based on shifts in AD or AS.

Fiscal Policy: The Role

Government actions focusing on spending or taxes can influence AD, stabilizing the economy through discretionary changes or automatic stabilizers.

Discretionary Policy: Changes in government spending or taxes enacted by Congress in response to economic conditions.

Non-Discretionary Policy: Automatic stabilizers such as welfare and unemployment benefits adjust without direct legislative action.

Contractionary vs Expansionary Policies: Adjustments made to combat inflation (decrease spending and increase taxes) or reduce unemployment (increase spending and decrease taxes).

Automatic Stabilizers

Definition: Policies that automatically adjust to economic cycles. Examples include taxes that rise during expansion and fall during recession, helping stabilize the economy.

Relevant Equations for Aggregate Demand and Aggregate Supply Unit

Aggregate Demand (AD) Equation:

AD = C + I + G + XnWhere:

C = Consumer Spending

I = Investment Spending

G = Government Spending

Xn = Net Exports (Exports - Imports)

Multiplier Effect:

EQUATIONS:

Multiplier = 1 / (1 - MPC)orMultiplier = 1 / MPS

Where:

MPC = Marginal Propensity to Consume

MPS = Marginal Propensity to Save

Marginal Propensity to Consume (MPC):

MPC = Change in Consumption / Change in Disposable Income

Marginal Propensity to Save (MPS):

MPS = 1 - MPC

Aggregate Supply (AS):

The relationship between price level and aggregate output can be described in general terms as price levels rise, output increases in the short run, reflecting fixed wages and resource prices.

Equilibrium in AD-AS Model:

At equilibrium, AD = AS at the intersection of the AD and AS curves, determining the overall price level and output in the economy.

(UNFINISHED) Practice FRQ:

The economy of Country X is in equilibrium at full employment.

a. Draw a correctly labeled graph of the Long-run aggregate Supply, short-run aggregate supply, and aggregate demand curves, and show each of the following:

(i.) The current equilibrium price level, Labeled PL1

(ii.) The current equilibrium real output labeled Y1

which fiscal policy action, changing government spending or changing income taxes, is more effective in closing the

Knowt

Knowt