Notes 9/8

Chapter 2: Financial Statements, Taxes, and Cash Flow

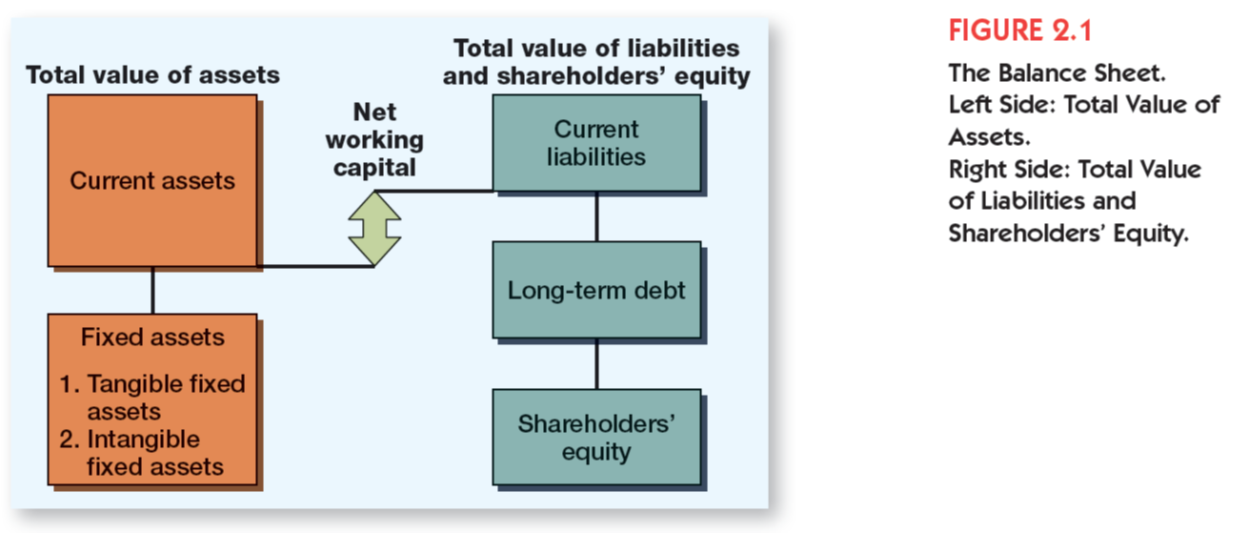

Balance Sheet

The balance sheet is a snapshot of the firm’s assets and liabilities at a given point in time

Assets are listed in order of decreasing liquidity

Ease of conversion to cash

Without significant loss of value

Balance Sheet Identity

Assets = Liabilities + Stockholders’ Equity

Net Working Capital and Liquidity

Net Working Capital

= Current Assets – Current Liabilities

Positive when the cash that will be received over the next 12 months exceeds the cash that will be paid out

Usually positive in a healthy firm

Liquidity

Ability to convert to cash quickly without a significant loss in value

Liquid firms are less likely to experience financial distress

But liquid assets typically earn a lower return

Trade-off to find balance between liquid and illiquid assets

Market Value vs. Book Value

The balance sheet provides the book value of the assets, liabilities, and equity.

Market value is the price at which the assets, liabilities, or equity can actually be bought or sold.

Income Statement

The income statement is more like a video of the firm’s operations for a specified period of time.

You generally report revenues first and then deduct any expenses for the period

Matching principle – GAAP says to show revenue when it accrues and match the expenses required to generate the revenue

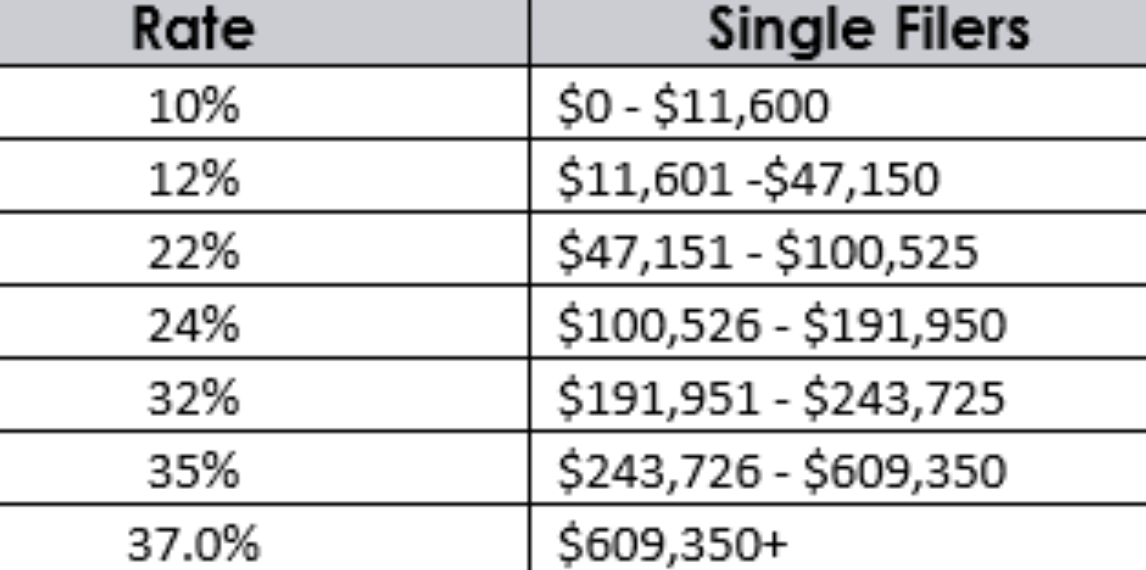

Taxes

The one thing we can rely on with taxes is that they are always changing

Marginal vs. average tax rates

Marginal tax rate – the percentage paid on the next dollar earned

Average tax rate – the tax bill / taxable income

Average tax rates vary widely across different companies and industries

Other taxes

Practice Taxable income

$100,000 in mass