L2, Regulation

Page 2: Introduction to Regulation

Key Topics

Designing optimal regulation under no information asymmetry

Setting the right price when costs and demand are known

Designing optimal regulation under information asymmetry

Challenge: Why imperfect information on costs makes regulation imperfect

Page 3: Stakeholders in Regulation

Objectives of Stakeholders

Regulated Firm: Focused on maximizing private profits

Government: Aims to foster efficiency and fair distribution of rents

Users/Consumers: Seek to maximize their net utility

Regulator: Acts as a benevolent referee but may have its own agenda

Taxpayers: Interested in minimizing the fiscal burden that distorts prices

Other Firms: Aim to maximize their private profits

Agencies: Each has its own private agenda (e.g., environmental agencies)

Page 4: Constraints on the Regulator

Types of Constraints

Technological and Economic Constraints: Include costs and preferences. cannot be changed , are constraints

Legal Constraints: Encompass laws such as privatization law, antitrust laws

Institutional Constraints: Involving decisions on price and wage controls

Informational Constraints: Covering asymmetric information including adverse selection and moral hazard

Page 5: Trade-offs between Regulator’s Objectives

Considerations

Efficiency: Ensure prices reflect costs, minimize production choices

Fiscal Viewpoints: Provide fiscal payoff to the government

Social Concerns/Equity: Aim for lowest price and highest quality

Voting Mechanism: Voters may express support or discontent

Governance: Ensures accountability among all actors

Page 6: Summary of Regulation Dimensions

Key Points

Importance of aggregating multiple perspectives to formulate policies

Quantifying main concerns reflected in policy trade-offs

Utilizing standard theory to measure profits, costs, and demand for risk assessment

Objective: Build rules of thumb to document trade-offs in regulation

Page 7: The Problem of Monopoly

Context

Natural Monopoly: Characterized by large fixed investments with low marginal costs

Regulator’s Dilemma: Balancing exploitation of scale economies against monopoly market power

EXAM QUESTION SUBJECT, often on this chapter

Page 8: Long-Run Investments and their Importance

Components

CAPEX (Capital Expenditure): Installation and reinvestment costs

OPEX (Operational Expenditure): Daily maintenance costs

Considerations

Relation between expenditures and scale of production

Need for forecasting demand to set appropriate scale

the scale of capex influences afterwards opex

in the long run: difficult to forecast demand to set up infrastructure at the right scale

short run problem: scale is given/ capacity is given in the short run , and to set quantity price

=> 2 types of mistakes: underestimate/overestimate demand => undercapacity/overcapacity

if undercapacity=>cost can rise (implies also possible rise in opex costs)

Page 9: Demand Forecasts and Capacity Issues

Capacity Management

Demand forecasts can be underestimated or overestimated

Underestimated demand leads to capacity shortages

Overestimated demand results in under-utilized capacity

Challenges

Adjusting capacity can be difficult, especially in infrastructure scenarios

Page 10: Capacity and Marginal Costs

Cost Dynamics

Assessing short-run marginal costs based on existing capacity levels

Marginal cost aligns when production equals installed capacity

golden rule=where the volume of operation will be, the moment where we approach short term capacity we have to invest

Page 11: Welfare Implications of Monopoly Regulation

Key Questions

What are the welfare consequences of unregulated monopolies?

Factors include market concentration and elasticity of demand

2 elements ffected by the monopolists

Page 12-15: Monopoly Profit Maximization

Profit Maximization Model

Demand Function: Formulated as p(q) where p is price and q is quantity

if price decreases, the monopolist sets q1, if lower price pushes volumes, monopolist is trading off both areas

Marginal Revenue and Cost: Relation established between revenue and cost functions

Optimization Condition: Usually stated as MR = MC (Marginal Revenue equals Marginal Cost)

Lerner Index: Measures market power, defined as price-cost margin relative to price elasticity

markup/by price = inverse of elasticity. of demand, you price product taking into account own price elasticity

=> if you want to gather info on firm you want to regulate, i need to know about the elements of this final equation (cost function,elasticity, price)

=>distortion of the monopoly is qp’(q) an d p(q)=c’(q) is actually the perfect competition condition, will produce int he elastic part of the demand function

Page 16-19: Assessing Market Power of Monopoly

Elasticity of Demand

Matter of market power: Low elasticity implies greater markup potential

Welfare Losses and Natural Monopoly Regulation

Monopoly Quantity (QM) vs. Regulated Quantity (QF) and Competitive Quantity (QC)

Welfare loss represented graphically in models (Harberger triangle)

≠have to be linear= a fixed part and a linear part

Page 20-22: Solutions for Regulating Monopolies

Marginal Cost Pricing

Balancing fixed costs with maintenance and ensuring consumer protection

Alternative Strategies

Setting up competition for the market via procurement procedures and auctions for efficiency

competition for the market: for telecommunication, there is a limited range of frequencies(property of the state), buy your license for certain number of years and range of frequencies where you become a monopoly, but a for the wole range of fr we have an oligopoly (also common for highways, if a section is run by a private company)

=> here want to select the best company that fits best all cst, quality criteria

=> pitifalls: need to esure frequencies of auctions is sufficiently high/ also needs ot asess the size of spectrum

competition in the market:

Page 23-26: Role of State-Owned Enterprises (SOEs)

Importance & Representation

SOEs prevalent in network industries (electricity, water)

Challenges include balancing user costs with provider profits

ports are one of the exceptions of public infrastructure which is mostly private

Page 27-30: Goals of the Regulator

Governance Objectives

Efficiency, equity, and financial viability considerations

Addressing profitability constraints and consumer/taxpayer interests

obv want to achieve efficiency + equity + also viability for taxpayers

the assumptions, want taxes to be efficient that’s why they are parametrized as opportunity costs

welfare of consumer is w-tilda, since it’s not the overall welfare only for consumers

might ask the exam the problem of a firm, so should know the mathematical models!!

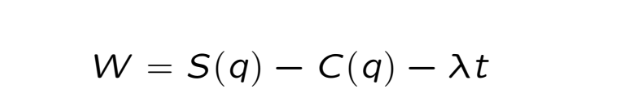

costs have 2 dimension, technical costs ( C(q) ° and then ther is the cost of taxation (lambda-t)

=> 2 implication sof the final welfare equation:

can get a bit of intuition on what impacts welfare

intuition: this partial derivative is actually a positive lambda, welfare goes up if the firm makes larger revenues, further comments in next slide taxation is distortionary, the more firm can finance through fees, the better it is from a efficiency pov, don’t want to finance too much through transfers, however that would mean that poorer people would have to pay more out of pocket than if more taxes were involved

intuition: less controversial, don’t want rents, bc they come for sure from high prices+low q or high subsidies

Page 31-34: Design of Regulation under Full Information

Cost Structure

Detailed examination of CAPEX and OPEX in relation to firm operations in the cost function now

Pricing Models

Introduction of Ramsey-Boiteux pricing to balance social welfare and financial viability

in blue; revenue side and lilac; costs side

the result, is adjusted by the term lambda, which is capturing the impact of taxation on economic efficiency, it is used to set prices

further explanation on 2 extreme cases

Page 35-39: Cost Efficiency in SOEs

Key Drivers

Problems stemming from inefficiencies in public operations and managerial decisions

Analysis of Pricing Margins

Influence of cost efficiencies on profitability and regulation of prices

p38, (22) is describing the optimum,

however, effort cannot be correctly measured, a lot of scope for moral hazar bc of information asymmetry, the company knows more about the effort than the regulator

this analysis started off from a welfare pov, not considering incentive or such

independence of regulators and political pressure has recently been questioned, (is it even possible?)

Page 40-46: Moral Hazard and Regulatory Challenges

Ex-Post Information Disadvantage

Evaluating management’s efforts to contain costs and implications for pricing

Contractual Implications

asymmetric information is especially interesting on the supply side (so related to the cost side),

Designing contracts to incentivize efficiency in both high and low-cost firms

p43, if regulator ‹ill not choose high type, so clients bring home more surplus

if don’t know the type though, and propose different contracts, firms have incentive to lie, low-cost will pretend to be high cost

p 40: always very probable on the EXAM!! now we have informational constraints

p 46, have to give up informational rent, so that efficient firm chooses its own contract, contract cannot be the one proposed by the naive player (its modified/adjusted contract now and is bit more profitable than the previous one)

the previous slides was the framework, from p.47 more detailed like in the book

p47 the formula, the t = transfer of the government for the firm’s contract

Page 47-60: Generalization of Asymmetric Information Models

Insights on Information Rents

Designing incentives under uncertainty, managing risk of rent-seeking behaviors

Applications and Practical Considerations

Addressing moral hazard through effective contract structures and regulatory frameworks

Recommendations for Effective Regulatory Practices

Estimation and monitoring strategies to reduce uncertainties and align incentives

p50, will put some formula seen on p50 and thenwhta can be found through them, and explain them,