Unit 4.7: Financial Sector

The Loanable Funds Market

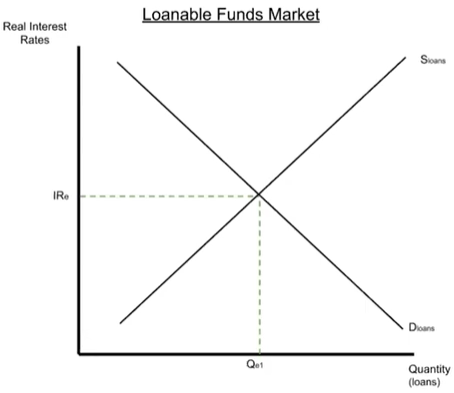

Loanable Funds market (loans)::

- How much money in the form of loans consumers, businesses, and government are requiring

- Determined by expectation of return on investment

Real interest rate::

- The “price of borrowing money”

- with loanable funds, use real instead of nominal b/c loans are usually taken over a longer period of time

- ^^Real interest rate = nominal interest rate - inflation rate^^

Demand for loans

- Follows the law of demand like any other good/service (downsloping)

- Represents the amount of loans being demanded by consumers, producers, and government

Supply of loans

- Follows the law of supply like any other good/service (upsloping)

- In a closed economy:

- ^^Supply in closed economy = national savings^^

- ^^national savings = public + private savings^^

- In an open economy

- ^^Supply in open economy = national savings + net capital inflow^^ (money coming in from foreign investors)

Equilibrium

- Occurs when the interest rate is set where quantity supplied = quantity demanded

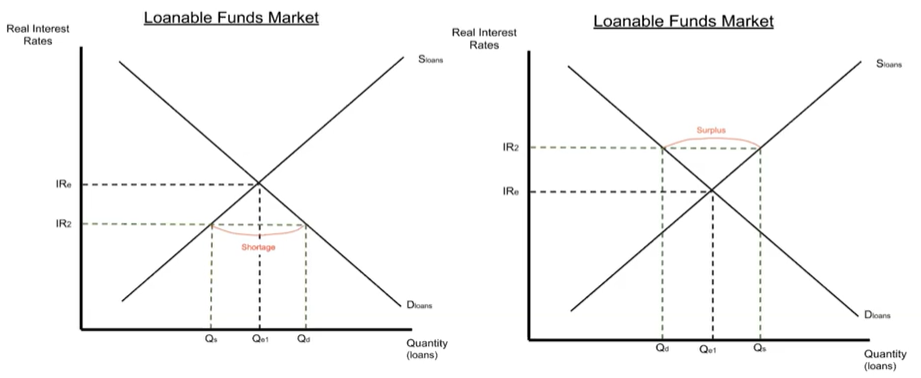

Disequilibrium in the loanable funds market

- Left graph:

- Real interest rate is below the equilibrium

- Shortage of loans

- demand will go up and supply will go down

- borrowing will be more cheap (high demand)

- less payoff for saving

- People won’t keep as much money in the bank so the amount available to loan out decreases (low supply)

- Must increase interest rate from IR2 to IRe

- Right graph:

- Real interest rate is above the equilibrium

- Surplus of loans

- demand will go down and supply will go up

- borrowing will be more expensive (low demand)

- more payoff for saving

- People will keep more money in the bank so the amount available to loan out increases (high supply)

- Must decrease interest rate from IR2 to IRe

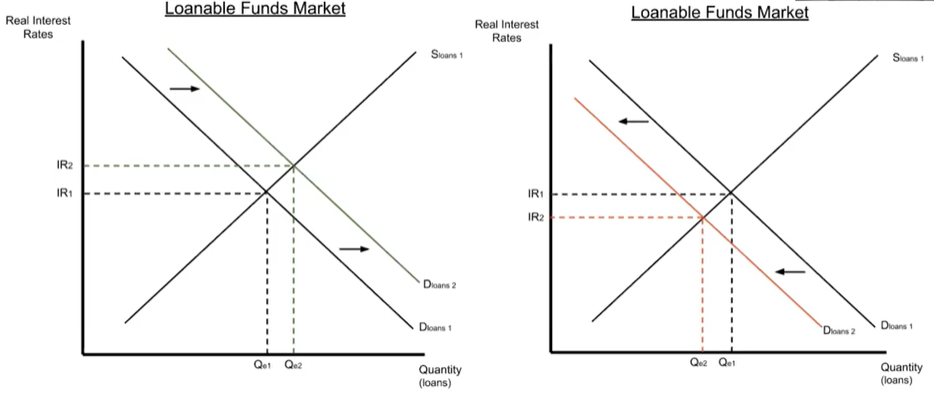

Changes in ^^demand^^ of loanable funds: shifted by changes in return on investment

- Left graph:

- Higher expected return on investment, economy doing well, higher income, etc

- Demand for loans increases (shifts right)

- Equilibrium interest rate increases

- Right graph:

- Lower expected return on investment, recession, people losing jobs, etc

- Demand for loans decreases (shifts left)

- Equilibrium interest rate decreases

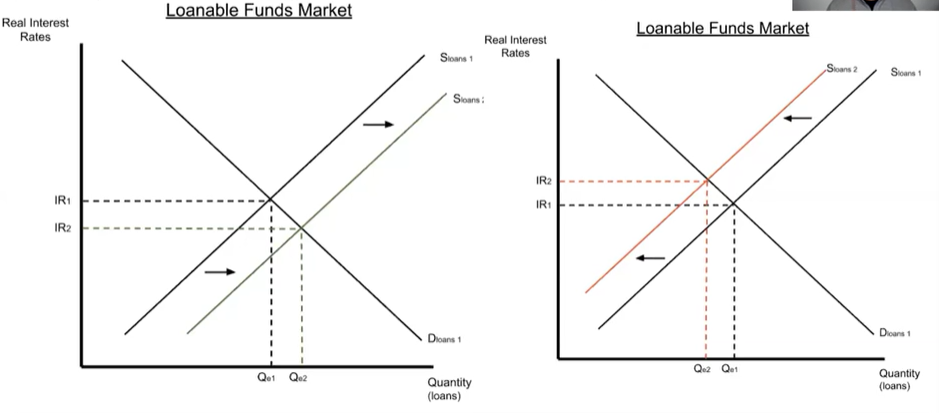

Changes in ^^supply^^ of loanable funds: shifted by changes in savers’ behavior

- Saving refers to people keeping their money in banks instead of spending it

- Left graph:

- Saving increases

- supply for loans increases (shifts right)

- Equilibrium interest rate decreases

- Right graph:

- Saving decreases

- supply for loans decreases (shifts left)

- Equilibrium interest rate increases