Chapter 30.3a: Interest Rates and Monetary Policy

Tools of Monetary Policy

- The Fed has four main tools of monetary policy it can use to alter the reserves of commercial banks:

- open market operations

- reserve ratio

- discount rate

- interest on reserves

1. Open-Market Operations

- Bond markets are “open” to all buyers and sellers of corporate and government bonds (securities)

- The Federal Reserve is the largest single holder of U.S. government securities

- open-market operations::

- The purchases and sales of U.S. government securities that the Federal Reserve System undertakes in order to influence interest rates and the money supply

- consist of bond market transactions in which the Fed either buys or sells government bonds (U.S. securities) outright or uses them as collateral on loans of money

- collateral::

- The pledge of specific assets by a borrower to a lender with the understanding that the lender will get to keep the assets if the borrower fails to repay the loan with cash.

- Fed’s open-market operations occur at the trading desk of the New York Federal Reserve bank.

- When the Fed buys or sells government bonds

- the New York Fed interacts exclusively with a group of about 23 large financial firms called “primary dealers.”

- When the Fed borrows or lends money via collateralized transactions called repos and reverse repos, the New York Fed interacts with a larger group:

- 20 commercial banks (ex. Bank of America and Goldman Sachs)

- 41 nonbank financial institutions

- 28 investment management companies (ex. Fidelity and Vanguard)

- 13 government-sponsored financial entities (ex. Federal Home Loan Bank of Boston, Federal National Mortgage Association, Fannie Mae)

Open Market Operations: Buying Securities

suppose the Fed decides to have the Federal Reserve Banks buy government bonds from commercial banks or from the public

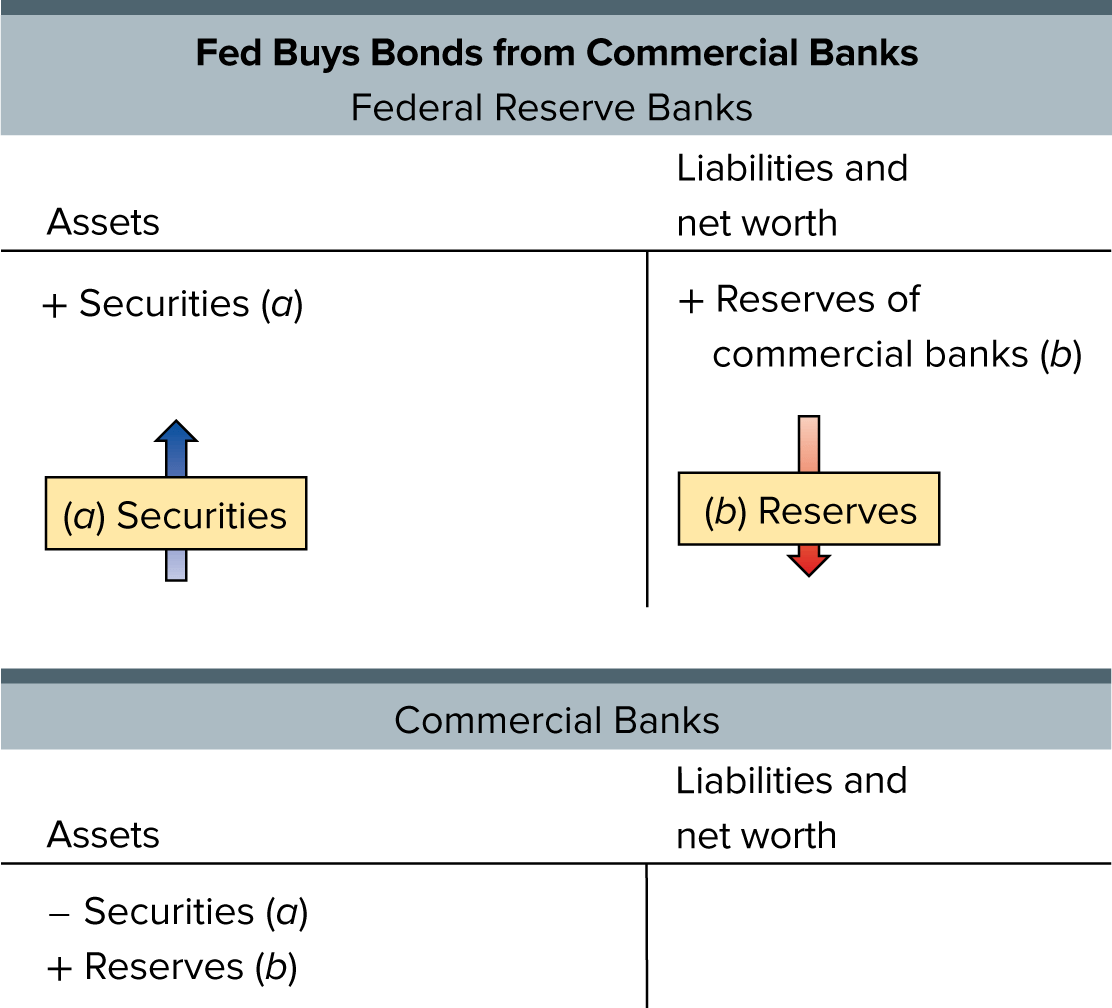

When Federal Reserve Banks buy securities from ==commercial banks==

a) commercial banks give up part of their holdings of securities (the government bonds) to the Federal Reserve Banks.

b) The Federal Reserve Banks place new reserves in the accounts of the commercial banks at the Fed when paying for these securities.

The reserves of the commercial banks go up by the amount of the purchase of the securities.

the 3 labels marked (a) show that securities have moved from the commercial banks to the Federal Reserve Banks

the 3 labels marked (b) show that the Federal Reserve Banks have provided reserves to the commercial banks

although commercial bank reserves have increased, they are a liability to the Federal Reserve Banks because the reserves are owned by the commercial banks.

when Federal Reserve Banks purchase securities from commercial banks, they increase the reserves in the banking system, ^^which increases the lending ability of the commercial banks.^^

When Federal Reserve Banks buy securities from @@the public@@

- Suppose the “Gristly” company sells government bonds in the open market to the Federal Reserve Banks.

- Gristly gives securities to the Federal Reserve Banks and gets paid a check drawn by the Federal Reserve Banks on themselves.

- Gristly deposits the check in its account at the Wahoo bank.

- The Wahoo bank sends this check against the Federal Reserve Banks to a Federal Reserve Bank for collection.

- the Wahoo bank enjoys an increase in its reserves.

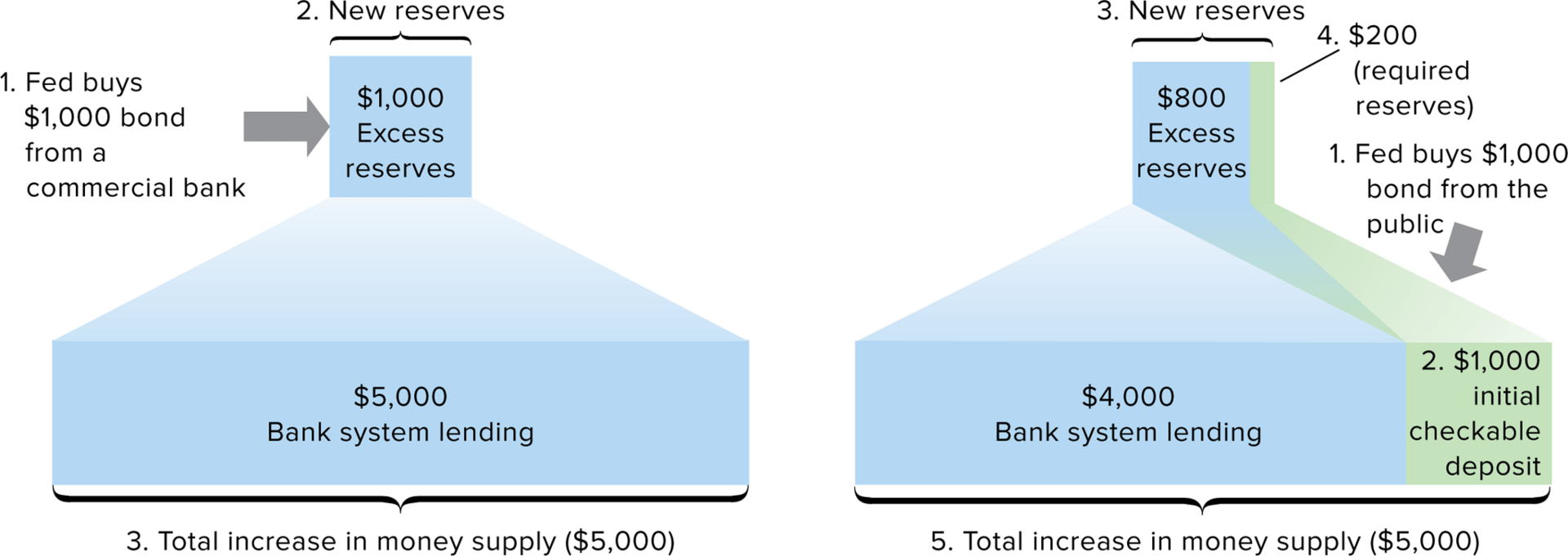

similarities between the Fed purchasing securities from commercial banks vs the public

- ^^the purchases of securities from either increase the reserves and lending ability of the commercial banking system.^^

differences between the Fed purchasing securities from commercial banks vs the public

- bond purchases from commercial banks increase the actual reserves and excess reserves of commercial banks ^^by the entire amount of the bond purchases.^^

- bond purchases from the public increase actual reserves but also increase checkable deposits when the sellers place the Fed’s check into their checking accounts

- in the right figure, a $1,000 bond purchase from the public would increase checkable deposits and actual reserves of the banking system by $1,000

- with a 20% reserve ratio applied to the $1,000 checkable deposit, the excess reserves of the would be only $800 since $200 would be held as required reserves.

in both cases, ^^the potential increase in money supply is the same^^

- in the figure, a $1,000 purchase of bonds by the Federal Reserve results in a potential $5,000 increase regardless of who the purchase was made from

- on the left, this $5000 is from:

- $1000 excess reserves* (1/20% reserve ratio) = $5000

- on the right, this $5000 is from:

- $800 excess reserves * (1/20% reserve ratio) = $4000

- the $1000 checkable deposit paid from the Fed to the Gristly company

- when securities are purchased from the public, part of the increase in money supply is due to the increase in checkable deposits

Open Market Operations: Selling Securities

The opposite from buying securities happens

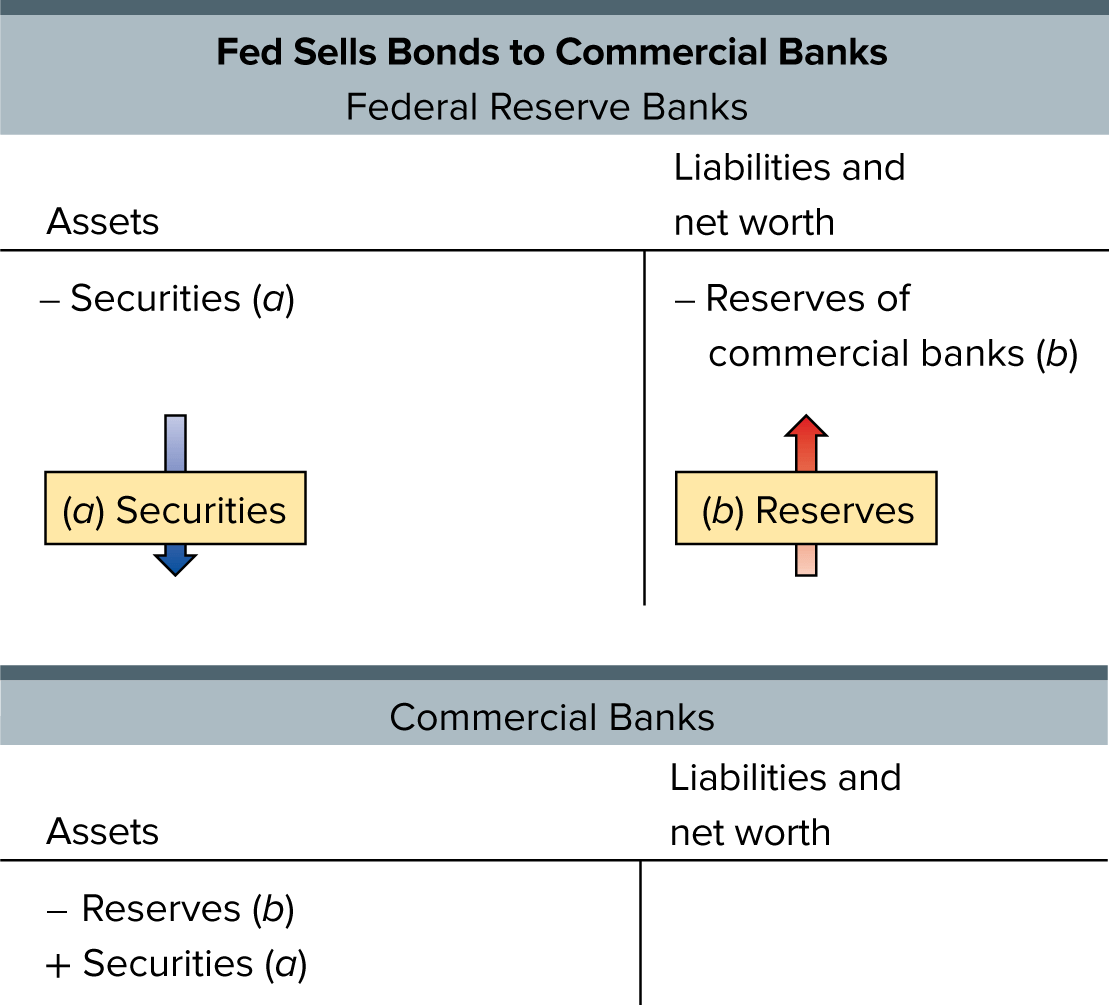

When Federal Reserve Banks sell securities to ==commercial banks==

- a) The Federal Reserve Banks give up securities to commercial banks

- b) The commercial banks pay for those securities by drawing checks against their deposits (against their reserves in Federal Reserve Banks)

- The Fed collects on those checks by reducing the commercial banks’ reserves accordingly

When Federal Reserve Banks sell securities to @@the public@@

- a) The Federal Reserve Banks sell government bonds to the Gristly company

- Gristly pays with a check drawn on the Wahoo bank.

- b) The Federal Reserve Banks clear this check by reducing Wahoo bank’s reserves.

- c) The Wahoo bank reduces Gristly’s checkable deposit accordingly

Differences

- a $1,000 bond sale to the commercial banking system

- reduces the system’s actual and excess reserves by $1,000 ^^(the exact amount of the sale)^^

- a $1,000 bond sale to the public

- the public’s checkable-deposit money is reduced by $1,000 (the amount of the sale)

- required reserves are reduced by $200 ^^(the amount of the sale * reserve ratio)^^

- excess reserves are reduced by $800 (the amount of the sale - change in required reserves)

Similarities

- When Federal Reserve Banks sell securities in the open market, commercial bank reserves are reduced and the money supply declines

- in the example, a $1,000 sale of government securities results in a $5,000 decline in the money supply whether the sale is made to commercial banks or to the general public

Why commercial banks and the public sell government securities to or buy them from Federal Reserve Banks

- When the Fed buys government bonds

- the demand for them increases.

- Government bond prices rise and their interest yields decline.

- banks, securities firms, and individual holders of government bonds sell them to the Federal Reserve Banks

- When the Fed sells government bonds

- the supply for them increases

- bond prices decrease and their interest yields increase

- government bonds become attractive purchases for banks and the public