Economics HL Unit 3

Equality and Equity

Equity → income inequalities are needed to create incentive

Equality → equal distribution of income (minimizing income gap)

Market is unable to achieve equity

Equity → concept/idea of fairness; normative, means different things to different people

inequity is not inequality → distribution of wealth, income, or human opportunity

National Income Accounting

used to measure amount of economic activity in a country

money value of all goods and services produced in a year

can be measured through things like GDP

output method

actual value of all finished goods and services produced each year

prevents double counting

measures level of economic activity

income method

calculates the value of all factor incomes earned in the economy

sum of wages and salaries (labour), rent (land), interest (capital), profits (enterprise) → factors of production

national income (Y) → households receive factor incomes for output produced

expenditure method

total value of all spending

total spending on all newly produced goods and services

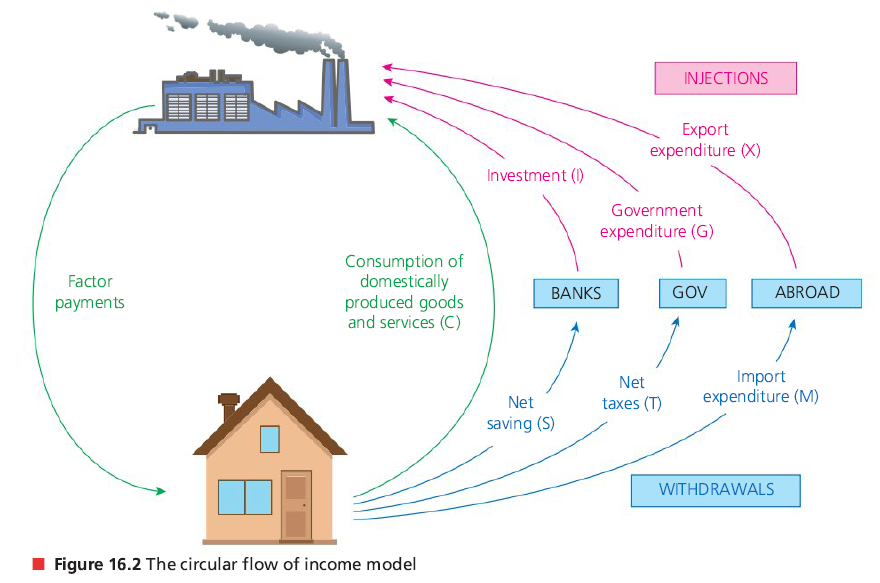

comprising C, I, G, and (X-M)

C → spending by individuals and households (largest component)

I → spending by all firms (gross fixed capital formation)

G → spending of the public sector

(X-M) → import expenditure

Circular flow of income

injections → add money to increase size (inc. in G, I, X)

leakages → remove money to reduce size (inc. in savings, tax, import)

Gross National Income (GNI)

GNI = GDP + (income earned abroad) - (income sent abroad)

Aggregate Demand (AD)

AD is the total demand for all goods and services in an economy at any given average price level

value often calculated using expenditure approach

AD = C+I+G+(X-M)

if AD has increased, economic growth has occured (and vice versa)

a 1% increase in C or G is much more significant than a 1% increase in (X-M)

AD curve is downward sloping

whenever there is a change in average price level, there is movement along the AD curve

if there is a change in any non-price determinants of AD, the AD curve shifts

increase in the non-price determinants results in a rightward shift

at every price level, real GDP has increased

Factors of Aggregate Demand

consumption (C)

consumer confidence →

interest rates ←

wealth →

income taxes ←

level of household debt ←

expectations of future price levels →

investment (I)

interest rates ←

business confidence →

technology →

business taxes ←

level of corporate debt ←

government spending (G)

political priorities

economic priorities

net exports (X-M)

income of trading partners →

exchange rates ←

trade policies

Real GDP and GNI

adjusted for inflation

calculated using a price deflator (GDP deflator)

converts current prices to constant prices

Real GDP = (nominal GDP / GDP deflator) * 100

Real GNI = Real GDP + net income earned abroad

Real GDP per capita = Real GDP / population

Real GNI per capita = Real GNI / population

purchasing power parity (ppp)

used to calculate relative purchasing power of different currencies

shows number of units of a country’s currency that are required to buy a product in the local economy, as $1 would buy the same product in the USA

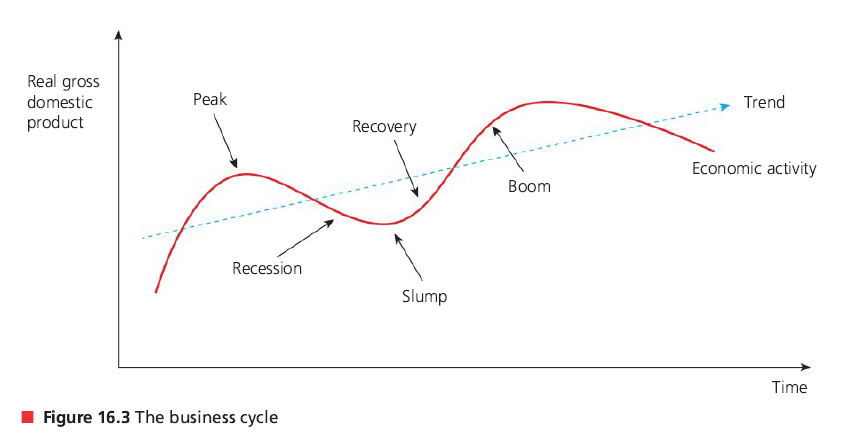

Business Cycle

Recession

two or more consecutive quarters (6 months) of negative economic growth

increasing/high unemployment

increasing negative output gap and spare production capacity

low confidence for firms and households

low inflation

increase in government expenditure (great budget deficit)

Boom

increasing/high rates of economic growth

decreasing unemployment, increasing job vacancies

reduction of negative output gap or creation of positive output gap

spare capacity reduced/eliminated

high confidence = riskier decisions

increasing rates of inflation → usually demand-pull

Alternative Measures of Well-being

OECD Better Life Index → 11 factors

Housing

Jobs

Income

community

education

environment

civil engagement

health

life satisfaction

safety

work-life balance

The Happiness Index → 14 factors (scale from 0-10)

business and economic

citizen engagement

communications and technology

diversity (social issues)

education and families

emotional well-being

environment and energy

food and shelter

government and politics

law and order (safety)

health

religion and ethics

transportation

work (employment)

The Happy Planet Index → 4 factors

well-being → how citizens feel about their life overall (0-10)

life-expectancy → number of years a person is expected to live

inequality of outcomes → inequalities of people in a country (well-being, etc.)

ecological footprint → impact a person has on an environment

Aggregate Demand (AD) Curve

negative relationship between price levels and real GDP

wealth effect

when price levels increase, real value of wealth decreases, decreasing consumer confidence thus reducing demand/output

interest rate effect

increase in price levels leads to a fall in output demanded due to interest rates increasing because of an increased need for money

international trade effect

rising price level causes a fall in exports and a rise in imports due to domestic price increasing but others stay the same

Short Run (SR) and Long Run (LR)

SR in macroeconomics in the period of time when prices of resources are rougly constant/inflexible, in spite of changes in the price level

LR in macroeconomics is the period of time where prices of all resources (labour/wages) are flexible and change with changes in the price level

wages account for the largest part of the firm’s costs of production

SRAS - short run aggregate supply

profitability causes positive relationship between price levels and real GDP (increase in price = increase in output) and with unchanging resource prices, profits increase

Determinants of SRAS:

costs of factors of production

indirect taxes/potential subsidies/supply shocks

LRAS - long run aggregate supply

Monetarist/Neoclassical model

price mechanism

competitive market equilibrium

economy as a harmonious system (automatically tends to full employment)

LRAS is vertical due to changing resource prices

located at Yp (potential GDP) at the full employment level of real GDP

in the LR, economy produces potential GDP, which is independant of the price level

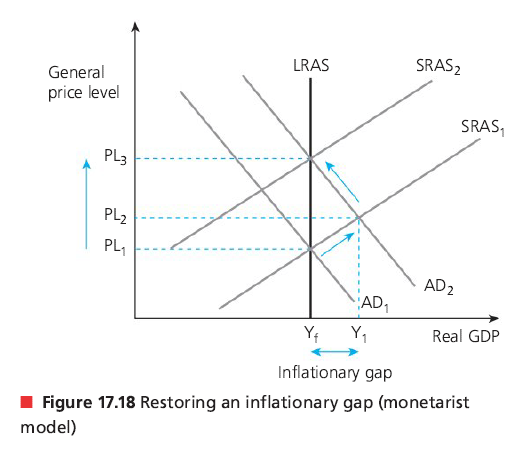

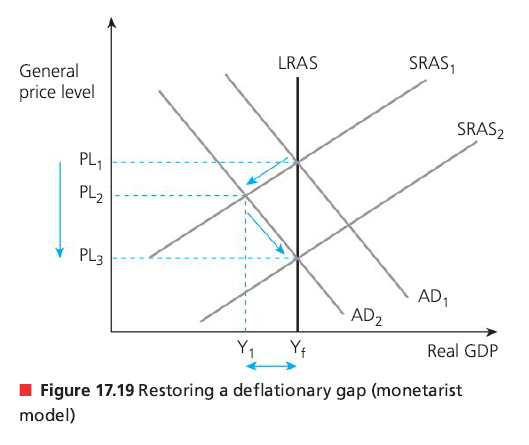

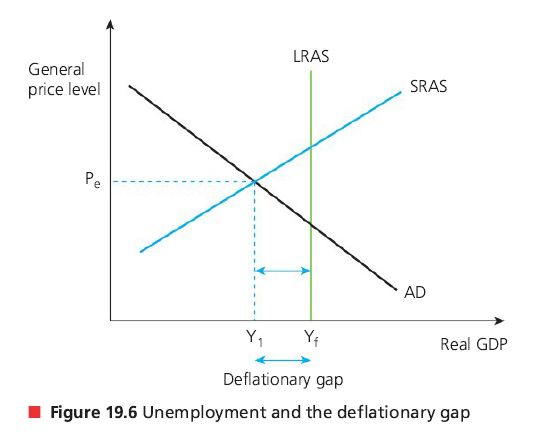

inflationary/deflationary gap - difference between SR and LR equilibrium

inflationary → SR>LR

deflationary → SR<LR

market corrections → either SRAS or AD curve shifts (different price levels, same GDP)

inflationary gap:

deflationary gap:

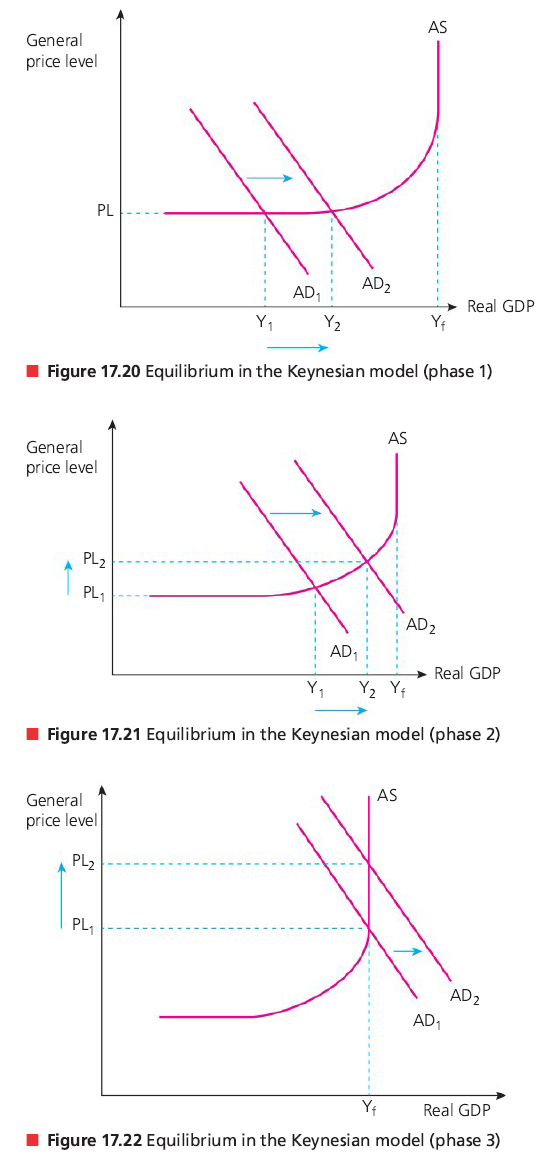

Keynesian model

equilibrium at different sections means different things (where AD=AS)

Ymax is where there is full employment

economy can be below full employment level, even in the long run

section 1 → AS is perfectly elastic as there is spare capacity (any increase in demand has no direct impact on general price levels)

section 2 → AS is relatively price elastic (upward sloping) as there is pressure of scarce resources as the economy grows

section 3 → AS is perfectly inelastic as there is no longer any spare capacity (all factor resources are fully employed)

any increase in AD beyond full employment level is inflationary

Shifts of the AS curve

Short run

costs of factors of production / indirect taxes

labour costs - wages/salaries account for a significant portion

raw material costs - increase means increase in costs of production

exchange rate - rise means domestic firms can buy imports at a lower price

interest rates - borrowing

bureaucracy and administration - legal procedures and policies

Long run

changes in economy’s quantity of factors of production

improvements in technology

increases in efficiency

changes in institutions

reductions in natural rate of employment

Long Run Equilibria

full employment is not zero unemployment (unemployment always exists)

frictional → certain number of people are in between jobs

seasonal → redundancies are caused by cyclical factors in the year

structural → skills mismatch in certain industries

Monetarist/Neoclassical model

occurs at full employment level of output (potential output)

Keynesian model

increase in AD increases national output without changing the general price level

increased demand for scarce resources and labour shortages cause general price levels to rise as national output increases

full employment level of output

firms compete for highly limited resources

general price increases but GDP is at its max

Macroeconomic objectives

economic growth

low unemployment

inflation

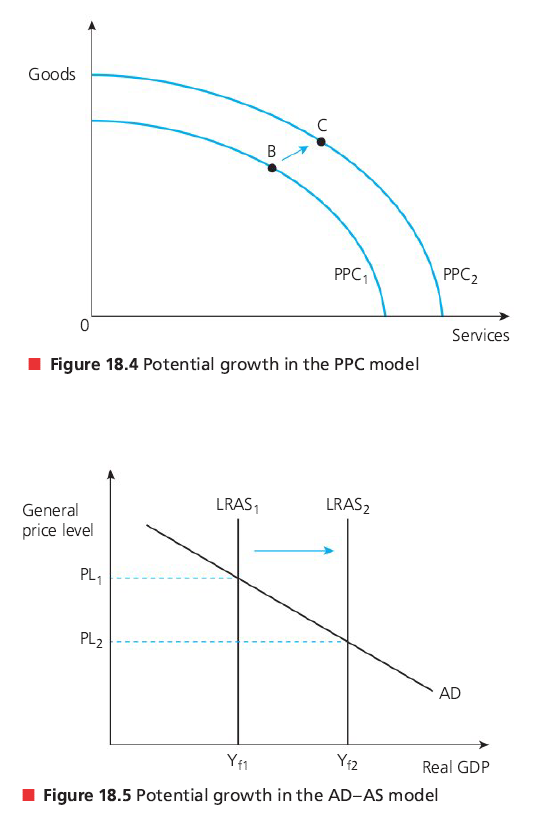

Economic Growth

maximization of the factors of production → quality + quantity

long-term economic growth

above potential level → something is wrong

short-term economic growth

actual output → current level fo real GDP

represented by any point on PPF diagram

actual growth → rate at which actual moves towards potential

short-term → below full level of unemployment

annual percentage change of a country’s output

short-run economic growth

increase in AD (rightrward shift) → Keynesian + Monetarist

increase in SRAS (rightward shift) → Monetarist

long-run economic growth

increase in potential output

achieves both economic growth and full employment

shift of the AS → monetarist + Keynesian

measurements of economic growth

nominal: rate of change in monetary value of GDP

real: accounts for inflation

Consequences of economic growth

living standards

generally leads to higher living standards

higher real income per capita

reduction/elimination of absolute poverty (not able to purchase essential goods)

raises consumption → encourages investment in capital → sustains growth

increased tax revenues (for taxes on expenditure/income) enable government to fund more merit goods

increased consumer spending → higher sales revenue (firms) → greater profits

spending on demerit goods increase → in long run, causes social welfare loss

risk of inflation increases → excessive aggregate demand → negative consequences

environment

creates negative externalities that cause problems to the environment

creates market failures caused by resource depletion

damages social and economic well-being in the long run

resource depletion not always sustainable → intergenerational equities

green GDP → adjustment of a country’s GDP to take into account environment degradation

income distribution

often generates greater disparities in distribution of income/wealth

not everyone benefits from economic growth

example: rich get richer, poor get relatively poorer

greater tax revenues = government redistribution of income/wealth in the economy

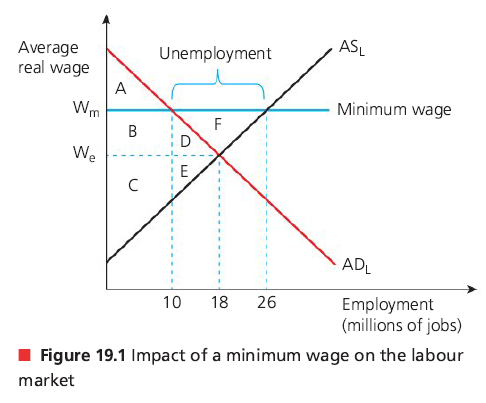

Low Unemployment

employment - use of factors of production in the production process

use of labour resources

governments want all available and willing to be employed

formal sector employment → officially recorded employment → workers paying income taxes and contributing to the country’s official GDP

unemployment → exists when forces of demand and supply are in disequilibrium

people are available and willing, seeking work but cannot find a job

inefficiency, non-use of scarce resources in the production process

ADL → aggregate demand for labour

ASL → aggregate supply for labour

those who are able and willing to work at the prevailing market equilibrium wage rate (Wc)

A = employer surplus, B+C = employee surplus, D+E = welfare loss, F = welfare supply

complements economic growth → higher employment = greater national expenditure

raises economic well-being and living standards

increases tax revenues for government expenditure on education/healthcare/infrastructure

prevents workers from leaving the country to find better opportunities (brain drain)

Measuring unemployment and unemployment rate

using number of people officialy unemployed as a percentage of the workforce per time period

unemployment rate = (number of employed / labour force) * 100

labour force - employed + self-employed + unemployed

difficulties of measuring unemployment

hidden unemployment / disguised unemployment → not included in the calculation

discouraged workers → unwilling to work but able to

voluntarily unemployed → not actively searching for work

Underemployment

people are inadequately employed → underutilization of labour force

although technically employed, the underemployed are not at their most efficient

cannot fully use their skills/abilities

Disparities

measure of unemployment ignores disparities such as:

regional → different regions have different rates of unemployment

ethnic → ethnic minority groups struggle more to find a job (higher unemployment)

age → unemployment rates are higher for the young/old

gender → females face a higher rate of unemployment

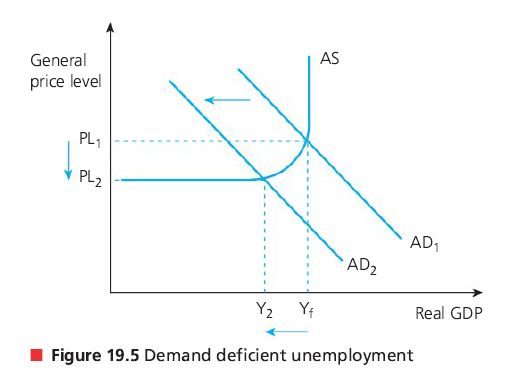

Cyclical Unemployment

unemployment derived from a downturn in the business cycle (recession)

lack of aggregate demand → fall in national real output → job losses

also referred to as demand deficient unemployment

most severe type of unemployment

results in mass job losses

firms try to control costs, protect profitability, and prevent business failure

represented through a deflationary gap / recessionary gap / negative output gap

difference between full employment and actual level of output (short-run)

closing the gap reduces cyclical unemployment

Natural Rate of Unemployment

equilibrium rate of unemployment

calculating level of unemployment when labour market is in equilibrium

NRU: no involuntary unemployment

some voluntary → some poeple remain out of a job

NRU = structural + seasonal + frictional

Costs of unemployment

personal costs

stress (depression, suicide)

low self-esteem

poverty

family breakdowns

social costs

crime / anti-social behaviour

indebtedness

social deprivation

economic costs

loss of GDP → negative economic growth

loss of tax revenues

increased cost of unemployment benefits

loss of income for individuals

greater disparities in distribution of income and wealth

Low and Stable rate of Inflation

inflation → sustained rise in general price level over time

people spend more to get the same amount

reduces purchasing power and country’s international competitiveness

price stability → general price levels remain broadly constant

net zero inflation, but a low and stable rate

Measuring rate of inflation

consumer price index (CPI) - change in average consumer prices over time

measured on a monthly basis but reported for a twelve month period

collects price data from a range of retail locations

assigns statistical weights (volume + value of quantities purchased)

Limitations of the CPI

atypical households → CPI measures the ‘average’ household

regional/international disparities → prices vary between countries + average household

different income earners → CPI measures average; high income less affected by inflation

changes in product quality → CPI ignores quality

different patterns of consumption → difficult to apply statistical weights in historical data

time lags → due to huge amount of data needed to construct the CPI

volume / value of quantities purchased → uses quantities purchased instead of percentage of income

Causes of inflation

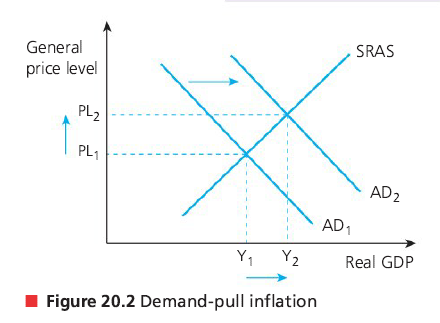

Keynesian - increase in aggregate demand

Monetarist - money supply

demand-pull → AD must be controlled

example: deflationary fiscal policy → prevents rise in consumption and investment

higher levels of AD

drives up general price levels

excessive aggregate demand (AD increases faster than AS)

might be due to higher GDP per capita, lower unemployment, increase in exports, lower interest rates, cuts in income tax

shown by AD1 → AD2

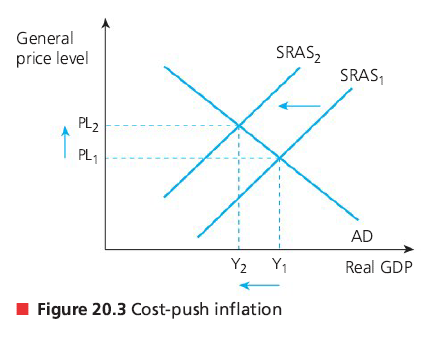

cost-push → rise in general price level

higher costs of production

shift from SRAS1 → SRAS2

increase in general price levels

reduces national output

higher production costs = raised prices

Costs of a high inflation rate

diminishes ability of money to function as a medium of exchange

uncertainty → reducing consumer and business confidence levels (lowers long run economic growth)

redistributive effects → costs are not equally distributed (ex: people with fixed income)

savings → real value of savings decrease over time (borrowers, lenders)

export competitiveness → exports become more expensive

economic growth → lowers expected real rates of return on capital investments

inefficient resource allocation → higher costs of production

shoe leather costs → customers spend more time looking for the best deals

REUSER → redistributive effects, export competitiveness, uncertainty, savings, economic growth, resource allocation

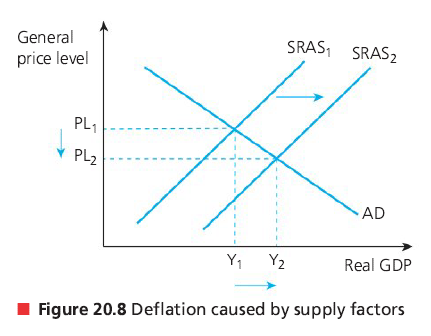

Causes of deflation

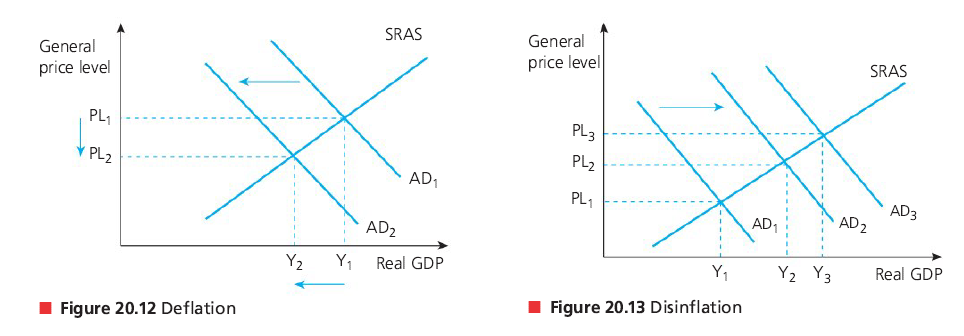

deflation → persistent fall in general price levels over time (inflation rate is negative)

either continual decline in AD or increase in SRAS

Benign deflation → positive effect as economy can produce more (rightwards shift of the SRAS curve) → boosts rational output + employment without raising general price level

deflation can be caused by lower production costs, higher productivity, or higher efficiency

Benign deflation - SRAS1 → SRAS2

also called non-threatening deflation

greater number and variety of goods and services

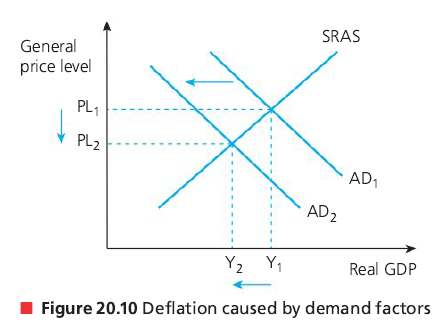

malign deflation → negative effect (leftwards shift of AD)

AD1 → AD2

associated with recessions and unemployment

harmful to the economy as there is a fall in real GDP

Disinflation

fall in the rate of inflation but prices are still rising

occurs when inflation rate is negative

leads to deflation if not controlled

shown by smaller proportional increase in average prices

Costs of deflation (malign)

uncertainty → increase in value of debts reduces confidence levels

redistributive effects → fall in value of assets and wealth

deferred consumption → postpones consumption (deflationary spiral)

cyclical unemployment / bankruptedness → falling prices/wages = falling AD/confidence

increase in real value of debt

inefficient resource allocation

policy ineffectiveness

Sustainable level of government (national) debt

budget deficit → value of government spending exceeds its revenue (G>T) per time period

government debt = accumulated budget deficits over the years

sustainable level - debt is affordable → paid in the long term

Measurement of government debt

uses percentage of GDP (debt to GDP ratio)

different from nominal/absolute value of debt

Costs of government debt

debt servicing costs - loan repayment plus interest rates incurred in the debt

credit ratings - measure of borrower’s ability to repay a loan

future taxation / government spending - austerity measures

budget deficits are not sustainable in the long run, there must be budget surpluses (G<T) to balance it out

Potential conflict between macroeconomic objectives

low unemployment and low inflatioon

high economic growth and low inflation

high economic growth and environmental sustainability

high economic growth and equity in income distribution

Low unemployment and low inflation

more employment = inflationary pressures

low unemployment creates demand-pull inflation due to increase in AD

full employment creates cost-push inflation due to wage inflation

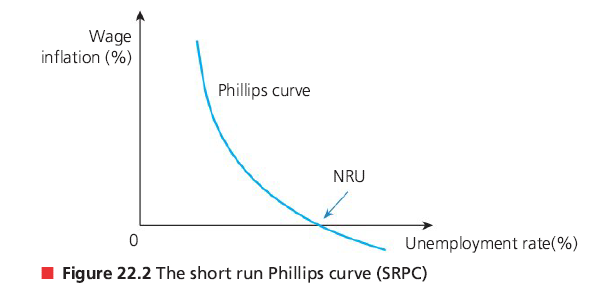

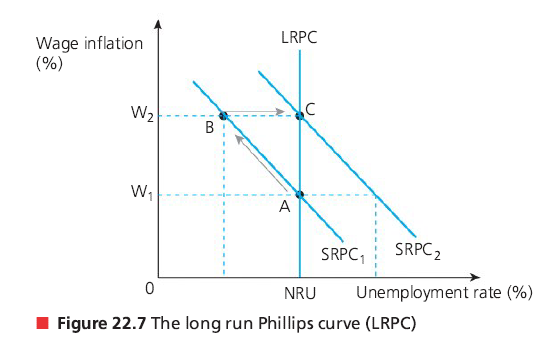

short run Philips curve (SRPC) shows relationship between inflation and unemployment

demonstrates opportunity cost, either low unemployment or low inflation

trade-off only exists in the short run

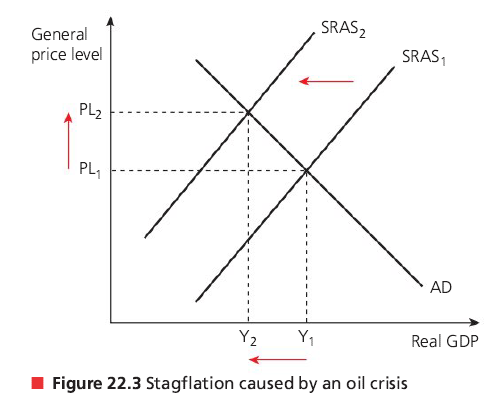

stagflation → employment / GDP falls as there is inflation

stagflation and short run Philips curve

increased natural rate of unemployment

stagflation creates a worse trade-off between low unemployment and low inflation

long-run Philips curve (LRPC) is vertical at the natural rate of unemployment (NRU) → no trade-off

attempts to reduce NRU will be inflationary in the long run ((A→B) will cause (B→C))

the increase in costs of production shifts SRPC reverting the unemployment rate back to NRU

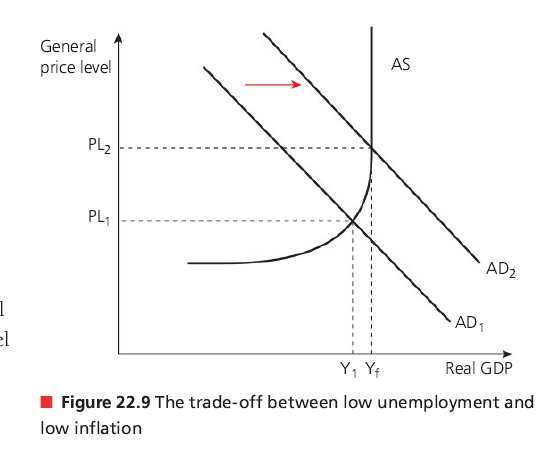

High economic growth and low inflation

economic growth → increase in AD in a country

if AD rises faster than AS, there is demand-pull inflation

increase in price levels caused by increase in AD

graph also represents trade-off between low unemployment and low inflation

cost-push inflation can also occur due to the full employment level being reached

firms try to attract the more scarce skilled labour, leading to wage inflation

monetary policy → reduces inflation by raising interest rates or increasing economic growth by cutting interest rates

conflict in use of interest rates, therefore conflict in objectives

sustainable economic growth can exist with low/stable rate of inflation

AS increases with AD

when inflation rises too quickly, it harms consumption and investment

controlled inflation can be helpful for economic growth (increases certainty)

high economic growth leads to an inflationary gap

High economic growth and environmental sustainability

as an economy grows, increased levels of production and consumption can create negative externalities that harm the environment

increased consumption of demerit goods (ex: cigarettes)

increased carbon footprint from increased income because of economic growth

environmentally sustainable economic growth is possible

use of green technologies and renewable energy sources

High economic growth and equity in income distribution

rapid economic growth leads to greater disparities in the distribution of the wealth/income in a country

widening the gap between the rich and the poor

although everyone in the country benefits from economic growth, not everyone benefits in the same way

minimum wage builds less wealth than billionaires

economic growth increases tax revenues, allowing the government to use the revenues to re-distribute income

so long as the tax system is progressive and equitable, there is not necessarily a conflict between economic growth and distribution of wealth

Unequal distribution of income/wealth

income

imbalances of income distributions → very few members of the society enjoying a high concentration of the nation’s income

to compare nations → GDP per capita or GDP in terms of purchasing power parity

wealth

imbalances in the spread of a country’s wealth → very few members account for a disproportionately large proportion of the wealth in a society

wealth → accumulation of assets with a monetary value

Factors that influence difference in wealth

economic factors → high national debt

natural resources → increases GDP per capita

environment → reduces wealth (ex: floods, droughts, etc.)

physical factors → reduces wealth (ex: hot/dry climates)

social factors → limits ability to produce wealth (ex: education)

political factors → determines economic prosperity (ex: war)

Measuring economic inequality

income inequality → relative share of national income earned by given percentages of a population (deciles / quintiles)

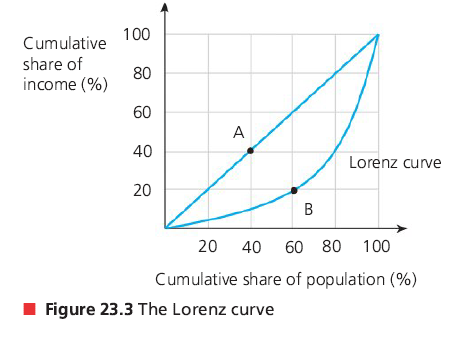

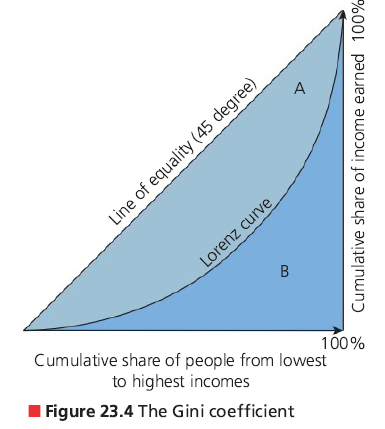

uses Lorenz curve and Gini coefficient

Lorenz curve

graphical representation of income/wealth distribution in a country

shows proportion of overall income/wealth accounted by each quintile or decile

this example shows that the bottom 60% of the population holds 20% of the wealth (B)

means the top 40% holds 80% of the wealth

data is cumulative → adds up to 1/100%

Gini coefficient

measures income/wealth inequality by calculating a numerical value of the Lorenz curve

G is between 0 and 1

the higher the value, the greater inequality

A = shaded area, B = area under Lorenz curve

Gini coefficient = A/(A+B)

line of equality has a 45° angle

Poverty

condition of an individual, household, or community/country being extremely poor

not having money to meet basic human needs

food, clothing, shelter, healthcare, education

absolute poverty → unable to afford basic needs for survival

relative poverty → income/consumption level below social norm within a country

differs from country to country

Measuring poverty

international poverty lines (poverty threshold) → minimum level of income to afford basic needs for human survival (below $1.90 a day)

does not take into account access to sanitation/water/electricity

a more accurate measure would be a national poverty line

line value depends on the country (higher national income = higher poverty line)

multidimensional poverty index (MPI)

uses health, education, and standards of living

considers multiple factors that reduce quality of life

ex: sanitation, child mortality rate, average years of school

Minimum Income Standards (MIS)

lowest amount of income needed for an acceptable standard of living

varies by a country’s people’s standards and economic state

helps people live in a socially acceptable way

in the UK, MIS is used for:

calculating the living wage (minimum wage)

quantitative benchmark for NGO/charities to determine who is in need

calculating costs of bearing/raising a child

helps governments determine level of social security and transfer payments

Difficulties in measuring poverty

how would the national poverty line of very poor countries translate to the IPL?

relative poverty is highly subjective

a permanently low income creates a poverty trap

PPP highly differs with location

Causes of economic inequality and poverty

inequality of opportunity

different levels of resource ownership

different levels of human capital

discrimination (gender, race, etc.)

unequal status and power

government tax and benefit policies

globalization and technological change

market-based supply-side policies

Impact of high income/wealth inequality

brings possibility of higher income for those who work hard which creates incentives for people to work harder → improving labour effort

prospect of earning higher incomes encourages people to invest in education and skill development → imporves labour productivity

entrepreneurial instincts are encouraged as a result of potential to earn higher profits

greater incentives and wealth creation can lead to a higher savings ratio

can be used to fund investments which creates an increase in the economy’s long-term growth and development

creates more social tensions in the form of demonstrations, protests, political unrest, and crime which leads to less investment and labour participation rates

more government spending on transfer payments to sustain the economy

adds to government debt, not directly to the national income

discourages workers from joining labour foce and entrepreneurs from investing

increases voluntary unemployment

affects standard of living

affects social stability

Taxation

progressive tax → higher incomes = higher percentage of tax paid

tax threshold → workers earn a certain amount of income per year before they can be taxed

proportional taxes → percentage of tax paid stays the same irrespective of taxpayer’s income

also called flat rate taxes

regressive taxes → those with a higher ability to pay are charged a lower rate of tax

used to combat inequality in wealth and income

Monetary policy

control and use of interest rates and money supply to influence level of AD and economic activity

overseen by the central bank or designated money authority

interest rates → price of money

Functions of a central bank

executor of monetary policy

government’s bank

banker’s bank

sole issue of legal tender (bank notes or coins)

lender of last resort

credit control

Goals of monetary policy

low and stable rate of inflation (inflation targeting)

inflation target rate → transparent goal to help control inflation

low unemployment

lower interest rates = economic activity increases = increase in AD

reduces borrowing costs so consumer confidence increases

reduce business cycle fluctuations

lower interest rates in a downturn and higher interest rates in booms

promote a stable economic environment for long-term growth

greater degree of certainty and confidence

external balance (imports = exports)

influence the exchange rate

lower interest rates = reducing exchange rate

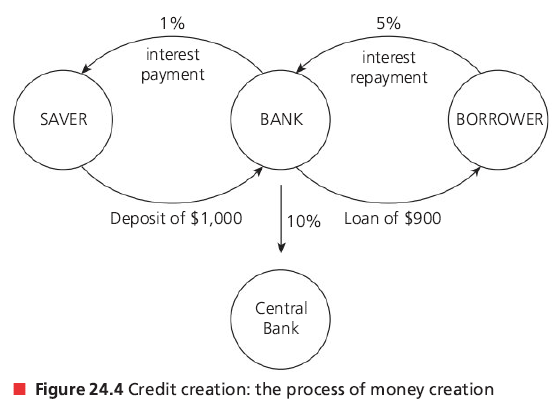

Money creation

credit creation → banks create money from deposits of savers and borrowers

minimum reserve ratio → limit on amount commercial banks can lend

to limit growth in money supply

money multiplier = 1/reserve ratio (how much deposit increases money supply)

if the central bank wants to limit economic activity and suppress inflationary pressures, the minimum reserve ratio is increased to limit growth in money supply

Tools of monetary policy

Open Market Operations (OMO)

buying/selling of government securities by a country’s central bank

government securities - type of public sector debt to finance government

sale of bonds with promise to repay borrowed money with fixed rate of interest

government securities sold when money supply needs to fall

increased interest (return) rate attracts buyers/investors

contractionary monetary policy → withdraws money from economy

opposite is true (not sold but purchased by central banks)

Minimum Reserve Requirements (MRR)

commerical banks generally want to lend more to profit more, but the central banks require them to keep a certain percentage of their deposits at the central bank

called the minimum reserve ratio or minimum reserve requirement (MRR)

ensures the commercial banks have enough cash for their daily transactions

bank run → most customers withdraw all their cash deposits on any given day

raising MRR limits growth → 1/MRR = money multiplier

Changes in central bank Minimum Lending Rate (MLR)

official rate of interest charged by central bank or loans to commercial banks

also known as base rate, discount rate, and refinancing rate

influences interest rates from commerical banks for lending

if MLR increases, the lending rates increase too → contractionary

Quantitative Easing (QE)

central banks purchase corporate bonds to directly inject money into the economy

the institutions have “new” money and see an increase in liquidity

boosts money supply and promotes lending (increase in AD)

central bank creates money

central bank buys bonds from financial institutions

interest rates reduced

businesses/people borrow more money

businesses/people spend more and create jobs

boosts the eocnomy

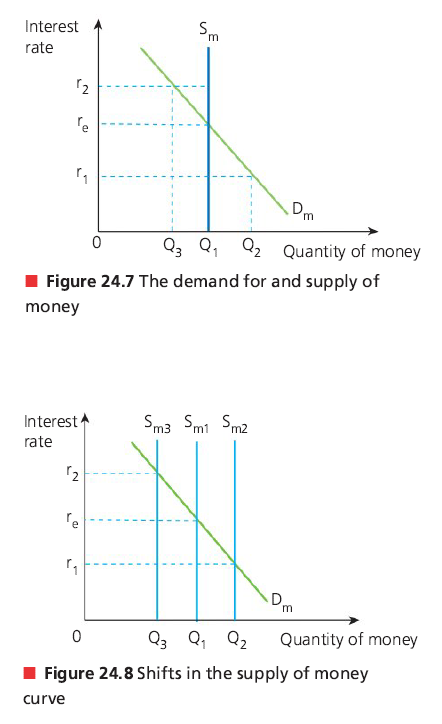

Demand and Supply of money

interest rate → return for lenders or price for borrowing (price of money)

Dm → desire to hold money rather than saving it

Sm → total amount of money in the economy

supply is vertical because supply of money is fixed at any given time by central banks

opportunity cost of holding money varies directly with interest rate → fall in interest rates = reduction in opportunity cost of holding money

central banks consider these when deciding supply of money:

state of economy (ex: deflationary gap = reduction in interest rates)

rate of growth of nominal wages (ex: higher labour cost = higher prices = inflation)

business confidence levels (lower interest rates = more incentive for investment)

house prices (most valuable asset)

exchange rate

Real VS Nominal interest rates

interest rate → price of money (cost of credit or return on savings)

nominal interest rate → actual rate agreed on between bank and customer

real interest rate → accounts for inflation

real IR = nominal IR - inflation rate

IR = interest rate

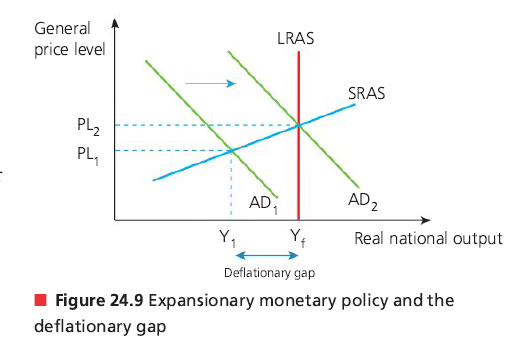

Expansionary monetary policy (loose/easy)

lower interest rates → shifts AD rightwards to close a deflationary gap

AD = C+I+G+(X-M)

C, I, G rise due to cheaper borrowing cost

(X-M) rise due to fall in exchange rate

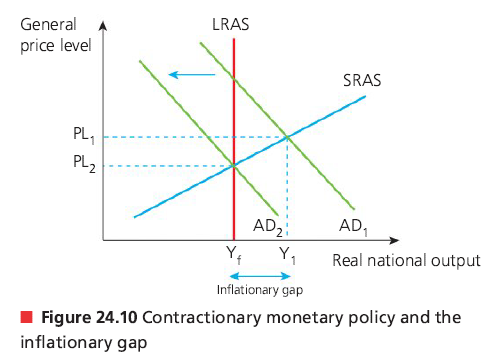

Contractionary monetary policy (tight)

closes an inflationary gap by increasing interest rates

opposite of expansionary

Effectiveness of monetary policy

limited scope of reducing interest rates when close to zero

low consumer and business confidence

incremental + flexible + easily revertible

short time lags

Fiscal policy

use of taxation and government expenditure strategies to influence level of economic activity

to achieve low unemployment, sustainable economic growth, and low inflation

promotes long-term economic growth and low unemployment through:

government spending on physical capital goods (ex: machinery, buildings, vehicles)

government spending on human capital formation (ex: education, training)

provision of incentives for firms to invest (ex: tax breaks, tax incentives)

Sources of government revenue

taxation → direct and indirect

sale of goods/services from state-owned enterprises

privitization proceeds from sale of government assets

Taxation

government levy on income or expenditure

direct → imposed on income, wealth, or pfoits of individuals/firms

ex: on wages/salaries, inheritance, and company profits

indirect → expenditure taxes on spending of goods/serivces in economy

ex: GST/VAT

Sale of goods and services from state-owned enterprises

state-owned enterprises/nationalized industries → postal, airports, broadcasting

government odes not aim to earn profits so revenue sources go toward paying the costs of providing the good or service

Sale of government assets

selling government-owned assets/enterprises to shareholders in the private sector

hence the alternate name privitization

short-lived policy → limited amount of assets to be sold

Government expenditures

current → spending on goods and services consumed within the current year

also called consumption expenditure

for immediate operations and benefits

ex: wages/salaries, healthcare/education, subsidies, interest repayments

capital → long-term items of spending (public sector investments) that boosts economy’s productivity

spending large amount of money to increase nation’s capital stock

also called fixed capital formation

intended to create future benefits for all members of society

ex: physical infrastructure: roads, tunnels, harbours, airports, schools, hospitals

ideally, the government would borrow money only to fund capital expenditure

fund investment expenditure in the economy

transfer payments → welfare expenses from government to redistribute income

done through funding essential public services

ex: state education, housing, healthcare, social housing, postal services

no corresponding exchange of goods and services (unlike current/capital)

ex: unemployment benefits, state pensions, housing benefits, disability allowances

Goals of fiscal policy

low and stable rate of inflation

using taxation policies to promote price stability

ex: higher tax rates + running a budget surplus = reduction in C+I+G

low unemployment

prevents cyclical unemployment during recessions

reduction in tax rates and/or increasing government expenditure (G)

promote a stable economic environment for long-term growth

promotes long-term economic growth by enabling low taxation

reduce business cycle fluctuations

to reduce impacts of a recession, a budget deficit can be run (expenditure > revenue)

opposite is true with a budget surplus and higher tax rates for a boom

equitable income distribution

done by using high marginal tax rates in a progressive tax system

also can use transfer payments

external balance

X=M

ex: indirect taxers imposed on imports and/or government subsidies for domestic exporters will generally increase external balance: (X-M) → positive, increases GDP

opposite is true creating less external balance

Expansionary/reflationary fiscal policy

used to stimulate economy during a recession

by increasing government expenditure and/or lowering taxes

boosts consumption and investment → rightward shift in AD

Keynesian → no LRAS, believes government intervention is effective and needed

Monetarist → LRAS shows no change in real GDP but increase in price levels (vertical)

Contractionary fiscal policy

reduces economic activity by decreasing government spending and/or raising taxes

limits consumption (C) and investment (I)

used to reduce inflationary pressures during a boom → closes inflationary gap

Keynesian multiplier

shows any increase in value of injections results in proportionally larger increase in AD

any increase in any of the injections will increase value of the Keynesian multiplier

injections → stimulates further rounds of spending (spending → income for another person)

ex: government spends money on social housing, leads to many other industries benefitting

the initial money generates a far greater value of final output

leakages → reduce value of Keynesian multiplier: takes money out of the economy

negative multiplier effect → initial leakage leads to greater than proportionate fall in GDP

determinants of Keynesian multiplier: MPC, MPM, MPS, MPT

marginal propensity to consume (MPC) → proportion of increase in household income that is spent on goods and services rather than saved (MPC = ∆C + ∆Y)

marginal propensity to import (MPM) → proportion of increase in household income that is spent on imports rather than on domestically produced goods/services (MPM = ∆M + ∆Y)

marginal propensity to save (MPS) → proportion of increase in household income saved rather than spent on consumption or imports (MPS = ∆S + ∆Y)

marginal propensity to tax (MPT) → proportion of each extra dollar of income earned that is taxed by the government (MPT = ∆T + ∆Y)

Keynesian multiplier = 1/(1-MPC)

Keynesian multiplier = 1/(MPS+MPT+MPM)

MPC + MPS + MPT + MPM = 1

Effectiveness of fiscal policy

constriants on fiscal policy

political pressures

time lags

sustainable debt

crowding out

when increased government borrowing increases interest rates and creates a reduction in the private sector investment expenditure

G increases but I decreases

strengths of fiscal policy

targeting of specific economic sectors

government spending effective in deep recession

automatic stabilizers

progressive taxes and unemployment benefits

Supply-side policies