AP Macroeconomics

History of Economics

Adam Smith (Father of modern of Economics)

Wrote The Wealth of Nations published in 1776

Strongly opposed mercantilism

Moral philosopher—foundation of good society is good morals

Classical economics

“Propensity to truck, barter and exchange one thing for another is common to all men, not found in any other races of animals”

"Virtue is more to be feared than vice, because its excesses are not subject to the regulation of conscience”

“It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest”

Good society results from self-interest not adhering to moral values—in market economy business stimulated by demand no need for government to tell them/control what to do

“The real and effectual discipline which is exercised over a workman is that of his customers. It is the fear of losing their employment which restrains his frauds and correct his negligence”

No need to be told to act morally; too many civil servants come up with too many unnecessary regulations

“No human wisdom or knowledge could ever be sufficient for the duty of superintending the industry of private people”

Forces of the market supply and demand should decide prices

Key Ideas of Classical Economics

Invisible Hand of the Market (forces of demand and supply) vs visible hand of the government

Division of labor- greater efficiency

Free trade/exchange

Market/market system (exchange products of their labor with each other)

Pursuit of self-interest (not egoism)- no contradiction between self interest and common good vs doing things at the expense of others/society

3 laws of economics: Law of Supply and Demand, Law of Self-Interest, Law of Competition (lack of competition does not incentivize businesses to produce high quality goods/services)

Classical economists: Adam Smith, David Ricardo, John Stuart Mill, Jean-Baptiste Say

John Maynard Keynes

Demand side economics/Keynesian economics government intervention

Helped solve great depression—government create public works jobs

Intellectual, civil servant, director of the Bank of England, Cambridge

Wrote the General Theory of Employment, Interest and Money which was published in 1936

Made the transition from statics to dynamics, converted economics into a study of the flow of income; concern with the economic health of the community a measured by the national income and symbolized by state of employment

Milton Friedman (Chicago School of Economics)

Supply-side economics—monetarism

Tax cuts, support companies to create supply

Wrote Monetary History of the US which was published in 1976

Due to US unable to compete with Japanese companies

Strongly opposed demand side economics

“When government in pursuit of good intentions tries to rearrange the economy, legislate morality, or help special interests, the cost come in inefficiency, lack of motivation, and loss of freedom”

Karl Marx

Founder of scientific socialism/communism/Marxist economics

Wrote Das Kapital which was published in 1867

Strongly opposed capitalist system—against private property (means of production—factory, machines, etc.) believed it was the root of evil

Quote: “like slave labor, like serf labor, hired labor is but a transitory and inferior form, destined to disappear before associated labor plying its toil with a willing hand, a ready mind and a joyous heart”

Independent scholar, philosopher, economist, free-lance journalist (wrote articles supported by Abraham Lincoln)

Austrian School of Economics

Ludwig von Mises

Wrote The Theory of Money and Credit 1912

Fredrich von Hayek*

Wrote The Road to Serfdom 1943

Ideas adapted to Ronald Reagan—criticized communist/socialist economic policies

Peter Drucker

Laid foundation of modern business corporation

Joseph Schumpeter

Theory of innovation (“creative destruction”)

Whenever new industries created old industries are replaced

Carl Menger

Marginal theory of value/marginalism—all value is subjective society/government no place to impose objective concepts on society (no intervention in economy)

Eugen von Bohm-Bawerk

Theory of interest—savings as investments

Level of Government Control

Government Control: Marxism—ownership, wages, level of production, prices

Government Intervention: Keynesian Economics—involvement when economy is failing in times of crisis

Limited Government: Chicago School

Laissez Faire: Austrian School

Level of Government Involvement

Adam Smith: Border protection, enforce civil law (policing), public works (infrastructure)

Chicago School: Subsidies and tax cuts (to stimulate business—supply side economics), low interest rate (encourage investments)

Austrian School: No government intervention—society perspective is wrong as values are subjective

Keynesian (British): Government spending when economy is not doing well

Laissez Faire

“Let us make” coined by Finance minister Jean-Batiste Colbert at end of 17th century

Economics is a dismal (miserable) science - Thomas Caryl because it’s very technical vs. Poetry was considered a “joyful science”

Thomas Malthus famously predicted that short-term gains in living standards would inevitably be undermined as human population growth outstripped food production thereby driving living standards back toward subsistence causing societal collapse; believed human population increases geometrically while food production only increases arithmetically; however food production and yields also increased exponentially

Marxism | Keynesian Economics | Classical Economics | Chicago School of Economics | Austrian School of Economics |

Karl Marx- Founder of scientific socialism/communism/Marxist economics -Wrote Das Kapital which was published in 1867 opposed Capitalism | John Maynard Keynes- Wrote the General Theory of Employment, Interest and Money which was published in 1936 | Adam Smith -Wrote The Wealth of Nations published in 1776 (opposed mercantilism) David Ricardo, John Stuart Mill, Jean-Baptiste Say, John Maynard Keynes | Milton Friedman -Wrote Monetary History of the US in 1976 (opposed demand-side economics) | Ludwig von Mises- Wrote The Theory of Money and Credit 1912 Fredrich von Hayek- Wrote The Road to Serfdom 1943 (criticized communist/socialist policies) Joseph Schumpeter- Theory of Innovation- whenever new industries created old industries replaced Peter Drucker- Foundation of modern business corporation Carl Menger- Marginal theory of value/marginalism Eugen von Bohm-Bawerk- Theory of interest—savings as investments |

-Collective ownership of the means of production (factories, machines, etc.) - Government control over economy (setting prices, production quotas) -Redistribution of wealth | -Demand-side economics-total demand (consumer + government spending) drivers the economy -Encourages government intervention especially during economic recessions -Concern with the economic health of the community as measured by the national income and symbolized by the state of employment | -Invisible hand of the market (forces of supply/demand) not government intervention Free market + free trade -3 Laws of Economics: -Law of Supply/Demand- Forces supply/ demand should decide prices -Law of Self-interest- No need for moral governing people acting in self-interests will promote common good (NOT egoism--at the expense of others/society) Law of Competition- competition incentivizes higher quality goods at lower prices -Division of labor increases efficiency | -Supply-side economics (support corporations to create supply) -Limited government intervention—government is inefficient | -Marginal Theory of Value: All values are subjective—government/society cannot impose values -Laissez-faire free market economy |

Complete government control over the economy + ownership of the means of production | -Government spending during economic crisis (creating public works, jobs) to create jobs + encourage spending | -Government enforce civil laws (policing) -Create infrastructure -Border protection | -Government subsidies to stimulate businesses -Tax cuts (corporate) -Low interest rates-encourage investments | -NO government intervention |

Unit 1 Basic Economics Concepts

Economics is the science of scarcity- we have unlimited wants but limited resources and since we have everything we desire, we must make choices on how we will use our resources—study the choices of individuals, firms, and governments

Economics- Social science concerned with the efficient use of scarce resources to achieve maximum satisfaction of economic wants—how individuals/societies deal with scarcity

*Shortage- Artificially created (often caused by inefficient management) occurs when producers will not or cannot offer goods/services at current prices; temporary

Scarcity (natural limitations) occurs at all times for all resources

Types of Scarcity

Absolute (time—24 hours in a day)

Relative (water scarcity in certain regions)

Supply-induced- insufficient supplies/resources to make products (i.e. supply chains broke)

Demand-induced- too high demand

Structural- different social groups have different access to resources like housing

Created scarcity (panics)

Needs and wants

Mentality of scarcity

Utility → satisfaction (satisfaction increases or drops)

Marginal → additional

Allocate → distribute

Price, cost, investment

Price = amount the BUYER pays

Cost = amount SELLER pays for production of a good

Investment = money spent by BUSINESSES to improve their production

Goods vs Services

Goods- physical objects satisfying needs/wants

Consumer goods- created for direct consumption

Capital goods- indirect consumption help make consumer goods (knives, ovens, blenders)

Services- actions or activities one person performs for another

Accountants vs Economists

Accountants look only at EXPLICIT costs (out-of-pocket costs)

Economists look at EXPLICIT and IMPLICIT costs (opportunity costs like forgone time and income)

Classical vs Behavioral Economics

Classical economics- assumes people are completely rational—most efficient and optimal way

Behavior economics- combines elements of economics and psychology to understand how and why people behave the way they do in the real world (i.e. if you prefer to A to B and B to C you must also prefer A to C but that is not always the case)

Biases, risk aversion, sensitivity to fairness-

Psychological concept of loss aversion: Losses loom larger than gains—people experience/react to losses on average 2-2.5x more strongly than gains

Consider famous Samuelson bet where people are offered 50% chance of winning $200 or losing $100 most people decline the bet because they experience losses stronger even though statistically it is worth it—from an economists POV it can be vie

Microeconomics vs Macroeconomics

Microeconomics studies SMALL economic units such as individuals, firms, and industries (ex. supply, and demand in specific markets, production costs, labor markets, etc.)

Macroeconomics studies the large economy as a whole or economic aggregates (all together) (ex. economic growth, government spending, inflation, unemployment, GDP, international trade)

How is economics used:

Economists use the scientific method to make generalizations and abstractions to develop theories—theoretical economics

Theories applied to fix problems or meet economic goals—policy economics

Positive vs Normative Economics/Statements

Positive statements- based on facts avoid value judgements (“what is”)—can be tested and validated; Scientific economics

Normative statements- includes value judgements (“what ought to be”)—often used by policy-makers, voters, philosophers

i.e. it is “too” hot, you “should” turn in your assignments on time—assumes a normative value

5 Key Economic Assumptions

Scarcity: society’s wants are unlimited ALL resources are limited

Trade-offs: due to scarcity choices must be made and each choice has a cost

Self-interests: Everyone’s goal is to make choices that maximize their satisfaction—everyone acts in their self-interests

Marginal costs/benefits: Everyone makes decisions by comparing the marginal costs and marginal benefits of every choice (cost/benefit from making one additional item)

Modeling: Real-life situations can be explained and analyzed through simplified models and graphs

5 Foundations of Economics

Incentives- incentives to work, produce; ex. patents and copyright

Positive incentives- encourage people to make choices (i.e. bonuses, increased wages, sales)

Negative incentives- discourage people to make choices (i.e. fines, punishments)

Trade-offs- the principle that each opportunity means the loss of other things/opportunities

Qualitative—ALL the alternatives we give up whenever we choose one course of action over others

Opportunity Cost- highest value/most desirable alternative (second best option)

Quantitative-Calculate best opportunity that you give up whenever making a choice

Ex. Going to college 4 years tuition -$108k + implicit cost of money that could have been earned working -$110k = $228k

Ex. Working $35 dollars/hour; cutting grass yourself (2 hours) vs paying someone ($45) = $70 - $45 = $25

Marginal Thinking

Principle that trade creates value

Key terms

Ceteris paribus- holding everything else constant

Endogenous (factors that we know about and can control)

Exogenous (factors beyond our control)

Marginal Analysis

Times watching the movie | Benefit (level of satisfaction) | Cost (ticket) |

1 | $50 | $10 |

2 | $15 | $10 |

2 | $5 | $10 |

Total | $50 | $30 |

Makes sense to only watch it 2 times because by the 3rd time the cost outweighs the benefit

Marginal analysis- involves making decisions based on the additional benefit vs additional cost (*Marginal = additional)

Decision-making process often is not an all or nothing question (should I or should I not do this)—marginal analysis is used more commonly than the all or nothing approach

Will continue to do so until marginal cost outweighs marginal benefit

4 Factors of Production

Land- All natural resources (i.e. water, sun, trees, stone, animals, oil)

Labor- Any effort a person devotes to a task for which the person is paid (manual labor, lawyers, doctors etc.)

Capital

Physical capital- any human-made resource used to create other goods/services (tools, machinery, buildings, factories)

Human capital- skills/knowledge gained by a worker through education and experience (college degree, vocational training, etc.)

Entrepreneurship- ambitious leaders that combine other factors of production to create goods and services to obtain profit (Inventors, store owners, etc.)

Entrepreneurs- 1. Take the initiative 2. Innovate 3. Act as risk bearers to obtain profit

Most important components are manegeral skills and creativity (ex. Architects run their own business is still an entrepreneur)

4 Factor Payments

Land- rent

Labor- wage

Capital- Interest

Entrepreneurship- profit (people take risks to receive profit)

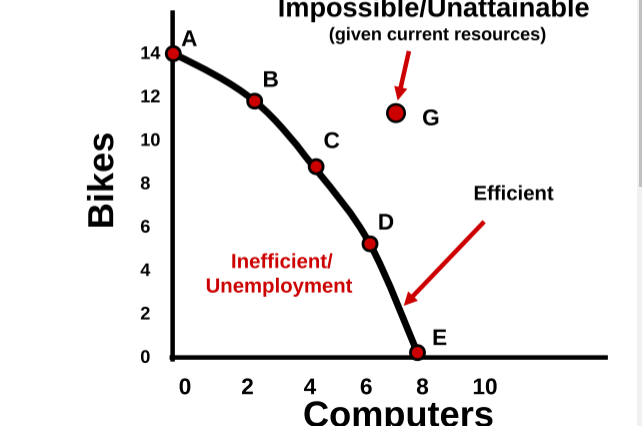

Production Possibility Curve (PPC)

Trade-offs between possible production levels of TWO goods

PER unit Opportunity Cost

How much each marginal unit costs = Opportunity cost/units gained

Ex. Moving from A to B is loss of 2 bikes

Moving from C to D gain +2 computers lose from 9 → 5 bikes costs 4 bikes total; PER UNIT cost is 2 bikes (per computer)

Moving from D to E gain 2 computers lose 5 → 0 bikes 5 bikes total; PER unit cost is 5/2 bikes

Above line is unattainable

Distance between two points is the trade offs

Each point on PPC curve is productively efficient—maximizing use of resources

Two Types of Efficiency

Productive Efficiency- Products produced in the least costly way/maximizing use of resources

EVERY point along the curve is productively efficient

Allocative efficiency- Products produced are most DESIRED by society

FEW points are allocatively efficient

Ex. Producing primarily size 20 shoes vs size 10 shoes—allocatively inefficient for allocating resources to size 20 shoes that less people wear → better to allocate to making size 10 shoes that have higher demand

4 Key assumptions of the PPC (not based in real-life)

Only two goods can be produced

Full employment of resources

Fixed resources

Fixed technology/advancement

Bonus: (Demand does NOT affect production)

3 Shifters of the PPC (dynamic)

Change in resource quantity or quality

Increase resources/labor quality—curve shifts to the right; decrease resources/labor quality—curve shifts to left)

Ex. Increase in population = increase in labor → shifts to right

Change in technology (may increase production)

Ex. technology improvement in pizza ovens—increases pizza production but max amount of robots produced is the same but at every single point amount of robots produced increases because less resources needed to produce pizza even when no improvements are made in robot production

Change in trade

Restricted trade (tariffs, quotas)—shift to left; free trade—shift to right)

Capital Goods and Future Growth- countries producing more capital goods (technology, transportation, etc.) will have more future growth than producing consumer goods

Practice Questions

New robot making technology

Increase max for robot making technology—max number of pizzas stays the same but number of pizzas increases at every single point

Decrease in demand for pizza

Change in demand does NOT affect production

Mad Cow disease kills 85% of cows

Decrease in pizza production

Consumer and Capital goods PPC practice

Destruction of power plants leads to severe electricity shortage- decrease capital and consumer goods

Faster computer hardware- increase in capital and consumer goods

*Many workers unemployed- DOES NOT affect production

PPC curve represents the max POTENTIAL production not existing; unemployment would be an underutilization of potential resources but does not change the POTENTIAL production

Significant increases in education- increase in capital and consumer goods

Comparative Advantage

Calculating which producer has LOWER opportunity cost

Ex. Country A- 800 corn max 400 computers max (2:1); Country B- 200 corn max 600 computers max (1:3)

Country A- 1 corn costs ½ computer (400/800); 1 computer costs 2 corn (800/400)—comparative advantage in corn production

Country B- 1 corn costs 3 computers (600/200); 1 computer costs 1/3 corn (200/600)—comparative advantage in computer production

*To calculate opportunity cost of item x → divide item y by item x

Beneficial trade any number between ½ and 3 for computers beneficial; any number between 1/3 and 2 for corn is beneficial

Practice Problems

US 20 planes or 2 cruise ships; France 12 planes or 2 cruise ships

Plane - US 1/10 ship and France plane 1/6 ship; Ship- US 10 planes and France 6 planes

Comparative Advantage: Plane—US; Ship—France

Terms of Trade- 1 Plane for between 1/10-1/6 ships; 1 ship for between 10-6 planes

Korea 3 cars 9 motorcycles; Germany 4 cars 8 motorcycles

Cars- Korea 3 motorcycles Germany 2 motorcycles; Motorcycles Korea 1/3 car Germany ½ car

Comparative advantage: Cars—Germany; Motorcycles—Korea

Terms of Trade- 1 car for between 2-3 motorcycles; 1 motorcycle for between 1/3-1/2 cat

Japan 4 laptops 12 phones; Brazil 1 laptop 5 phones

Laptops- Japan 3 phones Brazil 5 phones; Phones- Japan 1/3 laptop Brazil 1/5 laptop

Comparative Advantage- Laptops—Japan; Phones—Brazil

Terms of trade- 1 laptop for between 3-5 phones; 1 phone for between 1/5-1/3 laptop

Cuba 4 hours TV 12 hours Salsa; Mexico 1 hour TV 5 hours Salsa →

Cuba ¼ TV per hour 1/12 Salsa per hour; Mexico 1 TV per hour 1/5 salsa per hour

TV: Cuba 1/3 Salsa, Mexico 1/5 Salsa; Salsa: Cuba 3 TVs Mexico 5 TVs

Comparative Advantage- TV—Mexico; Salsa—Cuba

Terms of Trade- 1 TV for between 1/5-1/3 salsa; 1 Salsa for between 3-5 TVs

Rachel 2 hours bread 1 hour pie; Joey 4 hours bread 4 hours pie

→ Rachel ½ bread per hour 1 pie per hour; Joey ¼ bread and ¼ pie per hour

Rachel- 1 Bread-2 pie and 1 Pie- 1/2 bread

Joey- 1 Bread 1 pie and 1 Pie- 1 Bread

Comparative Advantage: Bread—Joey; Advantage Pie—Rachel

Terms of Trade: 1 Bread for between 1-2 pies. 1 Pie for between 1/2-1 bread

How trade produces more value

Textbook Method:

Ex. Both have 24 hours- Rachel can produce max 24 pies, 12 bread, or split time evenly—12 pies (12 hours) + 6 bread (12 hours)

Joey produces either 6 bread, 6 pies, or split time evenly—3 pies (6 hours) + 3 bread (6 hours)

Combined total for even production without trade: 12 + 3 = 15 pies and 6 + 3 = 9 bread

HOWEVER if Rachel specializes in pie production- 24 pies and Joey specialized in Bread production- 6 bread

Combined total gain of 9 pies and loss of 3 bread—net gain of 6 products

Trade Joey trades 4 bread for 6 pies (choose 1 bread for 1.5 pies)

Joey- 2 bread, 6 pies; Rachel- 4 bread, 18 pies

With trade: Rachel gains 6 pies though gives up 2 bread net gain of 4 products; Joey gains 3 pies and gives up 1 bread net gain of 2 products—both receive more products trading than stand-alone

Without Trade (Even production) | Max Production | After Exchange |

Rachel 12 pies 6 bread 18 total | Rachel 24 pies 0 bread 24 total | Rachel 18 pies 4 bread |

Joey 3 pies 3 bread 6 total | Joey 0 pies 6 bread | Joey 6 pies 2 bread |

Rossman’s Method:

Ex. Each person has 12 hours to produce

Rachel specializes in production of pies makes 12 pies—if making bread max number of breads is 6

Exchange trade rate of 0.6 Bread for all her pies → 7.2 > 6 able to reach a point for bread production previously impossible

Joey specializes in production of bread makes 3 breads max—if making pies 3 pies max

Exchange rate of 1.5 for all his bread → 4.5 > 3 pies able to reach a point for pie production previously impossible

Output vs Input problems

Inputs often take into account hours

Outputs hh

Demand vs Supply

Demand

Consumer’s willingness and ABILITY to buy an item at a given price

Willingness means buyers want the item

Ability means that buyers must have financial resources to afford the item

Demand refers to BEHAVIOR not a quantity

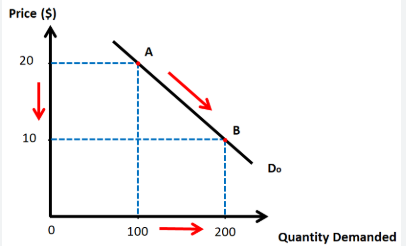

Law of Demand

Price of an item determines the quantity demanded

Lower the price the higher the quantity demanded— cheaper goods buy more

The higher the price the lower the quantity demanded—expensive goods buy less

*Therefore price of a good/service is INVERSELY related with quantity demanded

Reasons why the Law of Demand Exists

Income effect

When thing are expensive—money buys less

When things are cheap—money buys more

Substitution effect

When products are expensive and their substitutions are relatively cheap, buy less of the product and more of the substitute

Diminishing Marginal Unity

Each additional unit of an item purchased gives less marginal utility (satisfaction) than the previous unit therefore only will buy more if price is lower

Changes in Demand

Increase in Demand

More quantity demanded at all prices

Demand curve shifts to the RIGHT

Decrease in Demand

Less quantity demanded at all prices

Demand curve shifts to the LEFT

*Price DOES NOT CHANGE DEMAND it changes the quantity demanded

Changes in Demand

Knowt

Knowt