Unit 2: Government's role in economy

Lesson 1: Public vs. Private Sectors

Providing a safety net for citizens, businesses, and companies

Market failure- When the market cannot distribute resources efficiently, the government (Public Sector) steps in

dust bowl

standard oil

American system

Market crash

Public Goods- a shared good or service that would be inefficient or impractical to make consumers pay for

Law enforcement

National parks

Libraries

Education

Traffic control

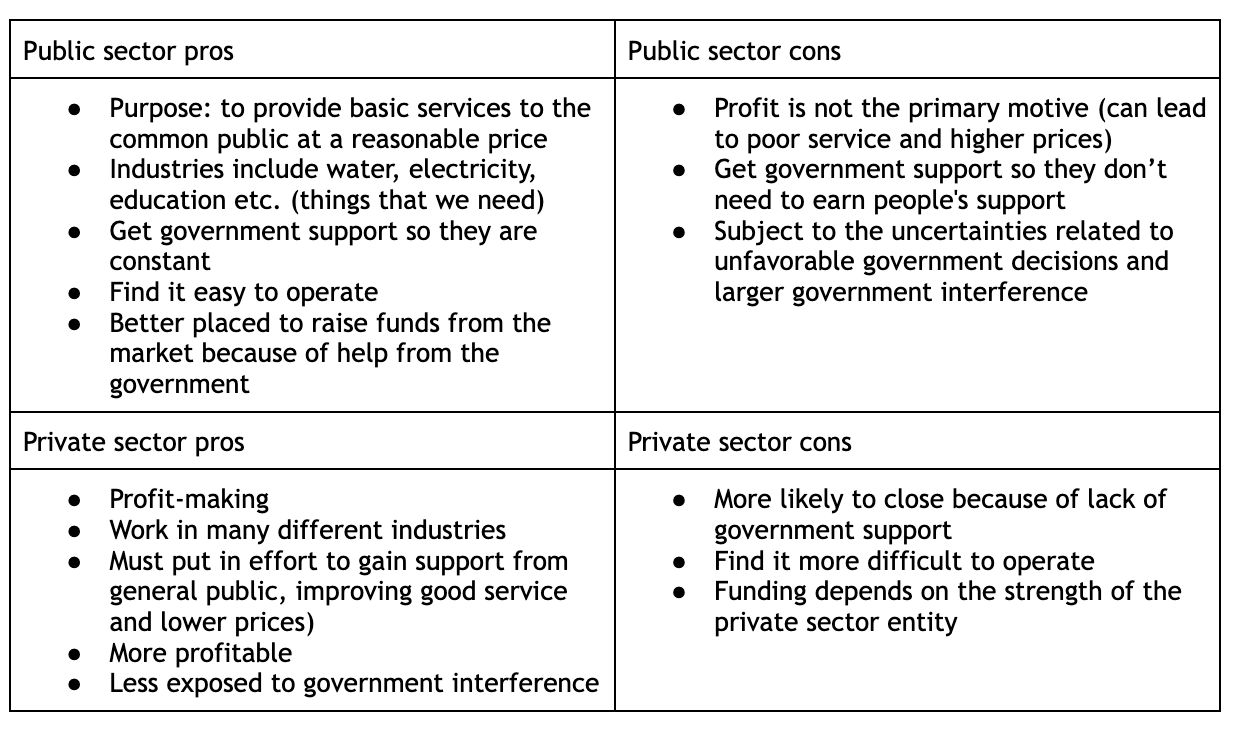

Public Sector- part of the economy that is funded by the government

teacher, politicians, police/fire departments

Private Sector- part of the economy that is funded by individual businesses

Lesson 2: Government Agencies

The Federal Reserve Bank is the US central bank. It sets “monetary policy”

What tools does the Fed use to influence the economy?

Reserve requirement, the amount of actual cash a bank is required to have in its vault at any one time

Discount rate/fed funds rate:- The interest rate the Fed charges banks to borrow money on a short-term basis

Open market operations, the Fed constantly buys back and sells government debt (US Treasuries)

SEC- Securities and Exchange Commission- Federal Government agency that regulates the purchase and sale of securities (any financial investment)

Administers Security Broker’s licensing exams (series 7 etc)

Requires risk horizon analysis for investors to ensure their safety in the marketplace

Files federal corruption charges for fraud etc.

FDIC- federal deposit insurance corporation

Federal government agency that insures deposits up to 250,000

Financial crisis of 2008

Glass-steagall regulations removed in 1999 by clinton and congress

Investment and commercial banks become combines (JPMorgan, chase, citigroup, bank of America)

Allowed banks to become “too big to fail” (their failure would have massive economic implications)

Many investment banks took on very risky investments including subprime (high risk) mortgages”

Lehman bros. And other big banks failed (went bankrupt), Citi, JPMorgan etc. and AIG accepted a $700 Billion Govt. bailout (Troubled asset relief program or TARP)

The treasury: Manages government revenue, prints currency, and oversees the IRS

CBO: provids economic data and budgetary analysis to congress

IRS: collects federal taxes and enforce tax laws

Fredie Mac/Fannie Mae- government sponsored enterprises that provide stability and affordability in the housing market by backing mortgages

Lesson 3: Government’s role combating poverty

our government play a limited but integral role in combating poverty

federal welfare programs are designed to redistribute money and services to those in need

TANF (Temporary Assistance for Needy Families)- federal government gives money to the states to design their own welfare programs

social security: collects payroll taxes from current workers and redistributes that money to retired people or people unable to work

Unemployment Insurance: Compensation checks are given to workers who have lost their jobs as long as they show proof they have made efforts to get work

Worker’s compensation: insurance program for workers injured or disabled on their job

In kind benefit- when the government provides goods and services for free or at greatly reduced prices

food stamps, subsidized housing, legal aid

Free Rides- when some individuals either consume more than their fair share for a common resource or pay less than their fair share of the cost of a common resource

communters/ubers

Free lunch- a situation in which a good or service is received at no cost

our definition of this term as it applies to economics means that a truly free lunch does not and cannot exist

externalities- economic side effects of the purchase or sale of any good/service

a positive or negative cost to someone the good/service was not intended to effect

Subsidy- The government makes a direct or indirect payment to an individual or institution to reduce the price of a good or a service because the government deems that good/service “in the national interest”

Child tax credit subsidy- incentivising people to have a family

student loans

subsidized- a loan for which a borrower is not responsible for the interest while in an in school, grace or deferment status

Unsubsidized- a loan for which the borrower is fully responsible for paying the interest regardless of the loan status. Interest on unsubsidized loans accrues from the data of disbursement

Lesson 4: Minimum vs. Living Wage

Poverty threshold

Some americans are considered too poor to support a family or household

Poverty threshold- income level below which one cannot support a family/household without govt assistance

Minivans at the Food Pantry

The coronavirus pandemic and ensuing quarantine led to an increase of the US unemployment rate from %3.8 to around %15 within weeks

Many middle class working families found themselves struggling to put food on the table

Welfare

General term that refers to all government aid for the poor

FDR’s new deal: the basis for many of the welfare programs we have today

Ie social security

All working americans pay this tax, the money is invested and given back to individuals in retirement

A combination approach

AFDC: Aid to families with dependent children 1935

First welfare system, relied heavily on the “give a fish” approach

TANF: Temporary Assistance for Needy Families 1997

From welfare to workfare. More accountability and incentives

Living Wage vs. Minimum Wage

Living wage- the minimum amount a person in a particular region must make in order to live without direct government assistance

Minimum wage- a price floor that prohibits employers from paying a rate lower than… $15.00/hour in NY

What is a living wage

A living wage is the minimum hourly wage income necessary for a worker to meet basic needs (for an extended period of time or for a lifetime)

Having enough money to pay for food, shelter, clothing, utilities, healthcare, transportation, child care, basic personal items

Poverty threshold/ poverty line

When an individual does not have the resources to meet their basic needs for healthy living

Their income is insufficient to provide the food, shelter and clothing needed to preserve health

Majority of countries facing high poverty levels were colonized throughout history

Lesson 5: Corporate Tax Rates

Purchasing power- The value of a currency expressed in terms of the number of goods or services that one unit of money can buy.

Corporate Tax Rates and Economic Performance (1950-1979)

Corporate tax rate: 52-71%

GDP growth 4.4% annually

Unemployment: below 5% for most of the period

middle class: strong wage growth increased home ownership

corporate profits: grow steadily despite high tax rates

Wages vs. Inflation: wages keep pace with inflation, maintaining purchasing power

Effect of Tax Cuts

Tax reform act of 1986: cut corporate tax rate to 34%

GDP growth- 3.2% annually

Unemployment:fluctuated reaching 7.5% in 1992

middle class: slower growth compared to the 1950s-70s

Wealth concentration: top 10% owned 65% of total US wealth by 2000

Wages vs. Inflation: wage growth falls behind inflation, reducing buying power

Corporate Tax cuts since 2017

Tax cuts and jobs act lowered rate to 21%

GDP growth: 2.5% annually (pre pandemic)

Unemployment rate hit a historic low of 3.5% in 2019

Who benefited the most

Stockholders and executives: corporate=e profits hit record highs

Workers: wage growth remained slow despite low unemployment

Federal revenue: corporate tax revenue fell from 2% to 1% of GDP of 20 billion

Wages vs. Inflation: real wages stagnated, inflation outpaced wage growth

Corporate Stock Buybacks and Impact

Definition: when corporates use profits to buy their own stock, rising share prices

Buybacks post 2017 tax cuts: reach $1 trillion in 2018

Investors and executives: stock prices surges

Workers: few saw wage increases or job investors

Government: less corporate tax revenue, less funding for public services

Wages vs. inflation: no significant impact on worker wages despite economic expansion

Economic Inequality and tax policy

Ceo to worker pay ratio

50s- 20:1

2020s-350:1

Millionaire wealth increase (2017-2023): up 50%

Corporate power: wealth concentrated among top earners, fewer tax contributions