Untitled Flashcards Set

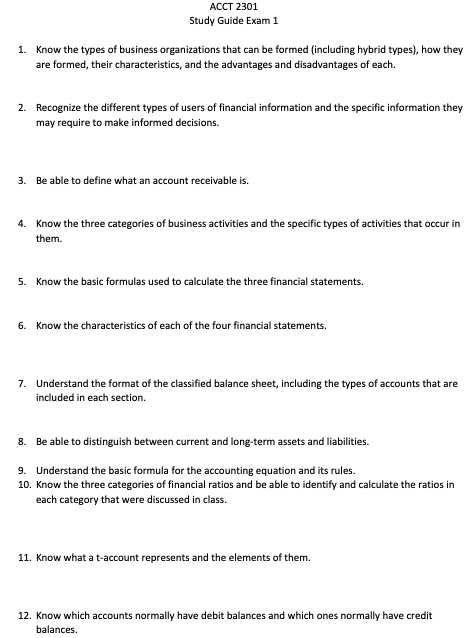

ACCT 2301

Study Guide Exam 1

1. Know the types of business organizations that can be formed (including hybrid types), how they are formed, their characteristics, and the advantages and disadvantages of each.

2. Recognize the different types of users of financial information and the specific information they may require to make informed decisions.

3. Be able to define what an account receivable is.

4. Know the three categories of business activities and the specific types of activities that occur in them.

5. Know the basic formulas used to calculate the three financial statements.

6. Know the characteristics of each of the four financial statements.

7. Understand the format of the classified balance sheet, including the types of accounts that are included in each section.

8. Be able to distinguish between current and long-term assets and liabilities.

9. Understand the basic formula for the accounting equation and its rules.

10. Know the three categories of financial ratios and be able to identify and calculate the ratios in each category that were discussed in class.

11. Know what a t-account represents and the elements of them.

12. Know which accounts normally have debit balances and which ones normally have credit balances.

13. Review the running example in Chapter 3 and the journal entries.

14. What happens when a corporation pays a dividend?

15. Know the effects of certain transactions’ effects on the cash account.

16. Know the first 3 steps in the accounting process, and the order in which they are performed.