5.1-5.2 Financial Ratio Analysis

Understanding the Business

Financial statements help people make better economic decisions

Published financial statements are designed primarily to the needs of external decision-makers such as present and potential owners, investment analysts, creditors

3 Investment Decision-Making Factors

Economy-Wide Factors: Often the overall health of the economy has a direct impact on the performance of an individual company. Investors should consider data such as the unemployment rate, general inflation rate, and changes interest rates

Industry Factors: certain events can have a major impact on each company within an industry but only a minor impact on other companies outside the library

Individual Company Factors: to proper analyze a company, good analysts do not rely solely on the information reported in a company’s financial statements and other reports. They visit the company, buy its products, and read about it in the business press

Potential investors should evaluate the company’s future income and growth potential on the basis of industry factors, economic factors, and individual company factors

2 Fundamental Business Strategies

Product differentiation: under this strategy, companies offer products with unique benefits, such as high quality or unusual styles or features. These unique benefits allow a company to charge higher prices. In general, a product differentiation strategy results in higher profit margins but lower inventory turnover

Cost differentiation: under this strategy, companies attempt to operate more efficiently than their competitors, which permits them to offer lower prices to attract customers. In general, a cost differentiation strategy results in lower profits margins but higher inventory turnover

2 General Method for Financial Statement Comparison

Time-Series Analysis: information on a single company is compared over time. For example, a key measure of performance for most retail companies is the change in sales at existing stores, which often is referred to as “comparable store sales“

Cross-Sectional Analysis: information for multiple companies is compared at a point in time. By comparing a company with other companies in the same line of business, an analyst can gain better insight into its performance

Ratio Analysis

Ratio Analysis helps decision-makers identify significant relationships and make meaningful comparisons

Component Percentages

express each item on a particular financial statement as a percentage of a single base amount

Income Statement Base Value: Net Sales

Balance Sheet Base Value: Total Assets

Component percentage ratios are computed using amounts from the same financial statement, either the income statement or the balance sheet. Other ratios compare amounts from different financial statements, such as net income to total assets

Classifications of Financial Ratios

Profitability Ratios

Profitability ratios focus on net income and how it compares to other amounts reported on the financial statements. Measures the company’s ability to generate profits from its resources (assets)

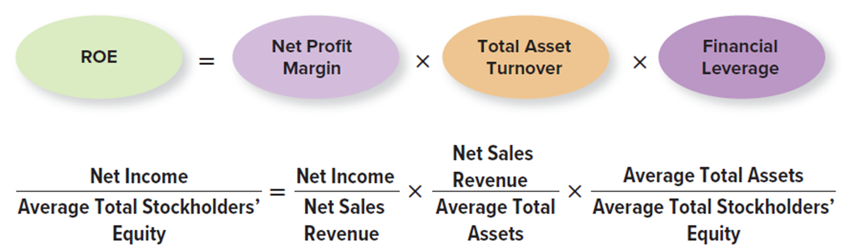

Return on Equity Ratio (ROE)

relates income earned to the investment made by the owners. Investors expect to earn a return on the money they invest

it measures how much profit a company generates using owner’s capital (equity), that is how much profit a firm can make for its shareholders

Equation: Net Income ÷ Average Total Stockholders’ Equity

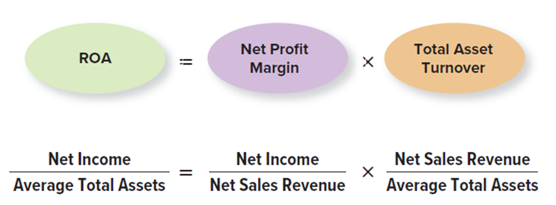

Return on Assets (ROA)

compares income to the total assets used to generate the income

it measures how much profit a company generates using its total assets, essentially measuring allocative efficiency

Equation: Net Income Average ÷ Total Assets

Gross Profit Margin Ratio

this ratio reflects gross profits as a percent of sales

it measures the profitability purely in buying and selling goods before any other expenses are taken into account

Equation: Gross Profit ÷ Net Sales Revenue

Higher gross profit margin indicate either high pricing power or lower product cost

Operating Profit Margin

measures how well the business has converted sales revenue into operating profit

can vary considerably between types of business, but a higher margin shows good ability to control operating costs

when analyzing the margin one should consider different pricing & marketing strategies, whether the the products are premium and what the external environment looks like

Equation: Operating Profit Margin = (Operating Profit ÷ Sales Revenue) x 100%

Net Profit Margin Ratio

this ratio reflects net income as a percentage of sales and is used as a measure of operating efficiency

Equation: Net Income ÷ Net Sales Revenue

Earnings per Share Ratio (EPS)

a measure of return on investment that is based on the number of common shares understanding

Equation: Net Income ÷ Weighted Average Number of Common Shares Outstanding

Quality of Income Ratio

compares net income to cash flows from operating activities

a ratio higher than 1 indicates high-quality income because each dollar of income is supported by one or more dollars of cash flows

Equation: Cash Flows from Operating Activities ÷ Net Income

Efficiency Ratios (Assets Turnover Ratios)

measures how efficiently a company performs day-to-day tasks, such as the collection of receivables and management of inventory. It focuses on capturing how efficiently a company uses its assets.

Total Asset Turnover Ratio

captures how well a company uses its assets to generate revenue

Equation: Net Sales Revenue ÷ Average Total Assets

Accounts Payable Turnover Ratio

measures how fast a company needs to make payments to suppliers

Equation: Cost of Goods Sold ÷ Average Accounts Payable

Ratio Converted to Days: Average days to pay = 365/Accounts Payable Ratio

Receivables Turnover Ratio

measures a company’s ability to generate sales given an investment in fixed assets

a high receivable turnover ratio suggest that a company collects its accounts receivable many times during a year

Equation: Net Credit Sales ÷ Average Net Receivables

Ratio Converted to Days: Average Days to Collect Receivables = 365/Receivables Turnover Ratio

Inventory Turnover Ratio

measures how quickly the company sells its inventory

Equation: Cost of Goods Sold ÷ Average Inventory

Ratio Converted to Days: Inventory Turnover Ratio = 365/Inventory Turnover Ratio

Liquidity Ratios

Liquidity Ratios measures a company’s ability to meet its short-term obligations

Current Ratio

measures the ability of the company to pay current debts as they become due

a high ratio (close to 2) usually indicates higher liquidity. But too high may signify less efficient use of current assets

Equation: Current Assets ÷ Current Liabilities

Quick Ratio

a more stringent test of short-term liquidity than the current ratio. It measures whether the highly liquid assets of a company, those that can be converted to cash quickly, are sufficient to cover current liabilities

Equation: (Cash & Cash Equivalents + Net Accounts Receivable + Marketable Securities) ÷ Current Liabilities

Cash Ratio

measures the adequacy of available cash

however, holding too much cash also means the company is not investing the cash into productive assets that will grow the business

Equation: Cash & Cash Equivalents ÷ Current Liabilities

Solvency Ratios (Financial Gearing Ratios)

Solvency ratios measure a company’s ability to meet its long-term obligations

Financial Gearing: the extent to which the firm is funded by lenders’ capital (debt) versus owners’ capital (equity)

A higher level of debt may increase the default risk (financial risk) and results in higher borrowing costs, which is also associated with higher credit risk

Times Interest Earned Ratio

compares the income available to pay interest in a period to a company’s interest obligations for the same period

indicates a margin of protection for creditors. A high ratio indicates a secure position for creditors

Equation: Net Income + Interest Expense + Income Tax Expense ÷ Interest Expense

Cash Coverage Ratio

compares the cash from operations to the cash needed to make required interest payments

Equation: Cash Flows from Operating Activities ÷ Interest Paid

Debt-to-Equity Ratio

expresses a company’s debt as a proportion of its stockholders’ equity

Equation: Total Liabilities ÷ Total Stockholders’ Equity

Return on Capital Employed (ROCE)

Capital Employed usually means long-term funds so it includes both equity and non-current liabilities

ROCE measures how efficiently a business uses its long-term capital to generate profits

it measures how much operating profit is earned per £1 invested

Equation: (Operating Profit ÷ Capital Employed) 100%

Capital Employed = Total Assets - Current Liabilities = Equity + Non-current liabilities

Operating Profit = EBIT = Profit before Investment & tax

Investment (Market) Ratios

Market ratios relate the current price per share of a company’s stock to the return that accrues to stockholders. Analysts find these ratios helpful because they are based on the current value of owner’s investment in a company

Price/Earnings (P/E) Ratio

measures the relationship between the current market price of a company’s stock and its earnings per share

A high ratio indicates that earnings are expected to grow rapidly

Equation: Market Price per Share ÷ Earnings per Share

Dividend Yield Ratio

reflects return on investment solely due to the dividends a company pays

investors are willing to accept low dividend yields if they expect that the price of a stock will increase while they own it

stocks with low growth potential tend to offer much higher dividend yields than do stocks with higher growth potential. Mature companies are more likely to pay higher dividend

Equation: Dividends per Share ÷ Market Price per Share

ROA Profit Driver Analysis

The DuPont Model

used by analysts to better asses how a company is implementing its business strategy. The model is broken down into three components