CHAPTER 5

Chapter 5: Accounting for Merchandising Operations

1. Introduction to Merchandising Operations

Merchandising Companies: Businesses that buy and sell goods, primarily generating revenue through the sales of those goods. They typically handle tangible products rather than intangible services.

Types of Merchandising Companies:

Retailers: Sell directly to consumers (e.g., Amazon, eBay, Walmart). They operate stores or online platforms offering a wide variety of products.

Wholesalers: Sell in bulk to retailers or other merchants rather than directly to consumers. They often provide supply to retailers at lower prices.

Sales Revenue: The total amount received from sales is the primary source of revenue and is crucial in evaluating business performance.

2. Income Measurement in Merchandising Operations

Components of Income Measurement:

Sales Revenue: Total amount derived from selling products, reflecting business activity.

Cost of Goods Sold (COGS) (giá vốn hàng bán): Represents the direct costs attributable to the production of the goods sold by the company. This figure is crucial for calculating gross profit.

Gross Profit ( lợi nhuận gộp ): Calculated as Sales Revenue - COGS; it indicates the efficiency of production and selling.

Net Income: Calculated as Gross Profit - Operating Expenses; it shows the total profit after all expenses are taken into account.

Unique to Merchandising: Unlike service businesses, merchandising firms must account for the cost of goods sold, which affects their profit margins significantly.

3. Operating Cycle

Definition: The total length of time it takes for a company to purchase inventory, sell that inventory, and collect cash from the sale.

Comparison with Service Companies: Merchandising companies generally experience a longer operating cycle than service businesses due to the additional step of inventory management.

Operating Cycle Steps:

Cash - Initial cash available for purchasing inventory

Buy Inventory - Acquiring goods for sale

Sell Inventory - Completing the sale to customers

Receive Cash - Collecting payment from buyers

4. Inventory Systems

4.1 Perpetual Inventory System

Characteristics:

Maintains detailed records of each inventory purchase and sale in real-time, which helps in tracking stock levels accurately.

Continuous tracking allows businesses to know how much inventory is on hand at any time.

COGS is calculated and updated immediately upon each sale, enabling prompt financial reporting.

4.2 Periodic Inventory System

Characteristics:

Does not keep daily records of goods on hand; results are found through periodic physical counts.

COGS is calculated at the end of an accounting period as follows:

Calculation: COGS = Beginning Inventory + Purchases - Ending Inventory. This approach can lead to discrepancies if sales fluctuate significantly.

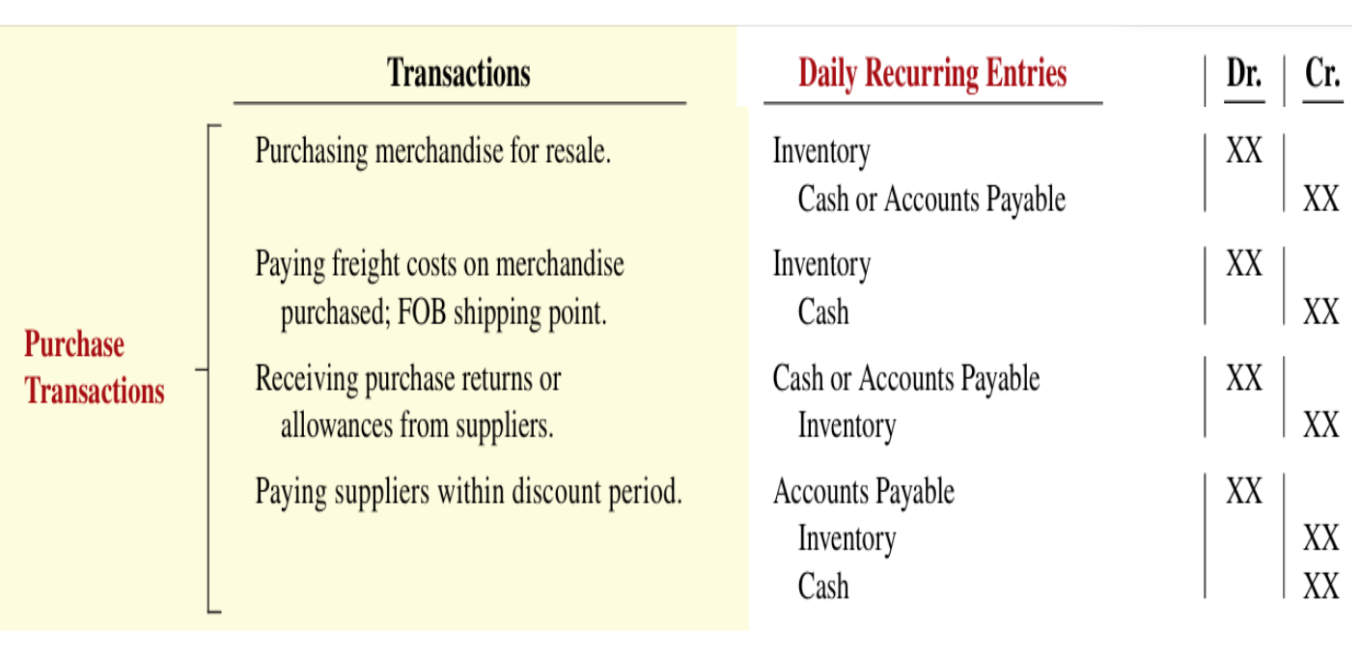

5. Recording Purchases Under a Perpetual Inventory System

Characteristics:

All purchases, made with cash or on credit, are recorded immediately upon receipt, impacting inventory levels directly.

Documentation Needed: A purchase invoice is essential for all credit purchases, serving as proof for accounting purposes.

FOB Shipping Point vs. FOB Destination:

Shipping Point: Ownership of goods passes to the buyer when the products are shipped, placing responsibility for freight costs on the buyer.

Destination: Ownership transfers once the goods are delivered, meaning the seller is responsible for all freight charges until delivery.

6. Purchase Returns and Allowances

Definition:

Purchase Returns: Goods returned for credit or cash refund, often due to defects or customer dissatisfaction.

Purchase Allowances: Sometimes, customers keep merchandise but receive a price reduction, often for quality issues.

Recording Example: For instance, if merchandise worth $300 is returned, the entry would be to debit Accounts Payable and credit Inventory to adjust the financial records accordingly.

7. Purchase Discounts

Definition: Discounts provided by suppliers for early payment of accounts payable, incentivizing prompt payment from buyers.

Example Discount Terms:

2/10, n/30: A 2% discount is available if payment is made within 10 days; the full amount is due within 30 days.

Recording: These discounts are vital to reflect reduced inventory costs correctly and to manage cash flow optimally, debit account payable, credit inventory and cash

8. Recording Sales Under a Perpetual Inventory System

Sales Revenue: Recognized when the performance obligation is fulfilled, which typically occurs when goods are transferred to the customer.

Journal Entry Components:

Debit to Cash or Accounts Receivable: Reflects the incoming cash or credit owed.

Credit to Sales Revenue: Increases sales revenue in financial records.

Debit to COGS and Credit to Inventory: Represents the cost of goods sold and reduces inventory accordingly.

9. Sales Returns and Allowances

Definition:

Contra-Revenue Account: Used to record returns and allowances that reduce total sales revenue reported.

Recording Example for Returns: A sales return valued at $300 with an associated cost of $140 would involve:

Debit Sales Returns and Allowances, increasing the contra-revenue

Credit Accounts Receivable, reflecting reduced amounts owed

Debit Inventory, to restock the returned item.

Credit Cost of Goods Sold, adjusting for the cost associated with that inventory.

10. Sales Discounts

Nature of Sales Discounts: Offered to encourage prompt payment from customers, these discounts are significant as they are recorded as contra-revenue accounts.

Example Calculation: For a sale amounting to $3,500 with a 2% discount:

Discount Calculation: $70 (2% of $3,500)

Net Sale: The recorded value after applying the discount would be $3,430.

11. Applying the Accounting Cycle to Merchandising Companies

Adjusting Entries: This process is quite similar to what is observed in service companies; however, merchandising firms often have to adjust their inventory levels periodically due to the nuances of physical inventory verification.

Sample Adjustment: If an inventory count reveals discrepancies when compared to recorded values, an adjustment must reflect this in the financial records.

12. Multiple-Step vs. Single-Step Income Statements

Multi-Step Income Statement

Features:

Clearly separates operating revenue from non-operating revenue, showcasing gross profit and detailing various expense categories.

Example Structure: Net Sales -> COGS -> Gross Profit -> Operating Expenses -> Net Income. Such a structure provides investors with precise information.

Single-Step Income Statement

Features:

Offers a more straightforward format by subtracting total expenses from total revenues, omitting the detailed separation of operating and non-operating activities.

13. Summary of Financial Statements for a Merchandising Company

Key Financial Statements Include:

Income Statement: A comprehensive summary that shows revenues, expenses, and profits over a specific period.

Balance Sheet: Displays a snapshot of the organization's assets, liabilities, and equity at a given point in time.

Statement of Cash Flows: Details cash inflows and outflows, providing insight into the company's liquidity position.

Conclusion

Understanding merchandising operations and the proper accounting for inventory is critical for effective financial reporting and analysis. By thoroughly grasping these concepts, businesses can strategically manage operational efficiency and make informed financial decisions.

Knowt

Knowt