Investment appraisal, NPV and Payback Period

Questions

Type 1 - 2023

a. Explain what is meant by the term investment appraisal (3 MARKS)

b. Explain what the term Net Present Value (NPV) means and discuss how it is used. (6 MARKS)

c. Explain what the term payback period means and discuss what are the advantages and disadvantages of using the payback period method. (6 MARKS)

Type 2 - 2024

a. Calculate Payback Period (6 MARKS)

b. Calculate the Net Present Value (8 MARKS)

c. Comment on results from a. and b. (8 MARKS)

d. Explain what the term Net Present Value (NPV) means and discuss how it is used. (8 MARKS)

Type 3 - 2024

a. Explain what is meant by the term investment appraisal

b. Explain what the term payback period means and discuss what are the advantages and disadvantages of using the payback period method.

What is Investment appraisal?

Investment appraisal is the process of evaluating the potential profitability and risk of an investment before committing capital.

It helps businesses and investors make informed decisions by assessing whether a project or investment will generate sufficient returns.

Common investment appraisal methods include Net Present Value (NPV), Payback Period, and Internal Rate of Return (IRR).

What is ‘Net Present Value’ (NPV)?

Net Present Value (NPV) is a financial metric used to assess the profitability of an investment by calculating the present value of expected future cash flows, discounted at a chosen rate (usually the cost of capital).

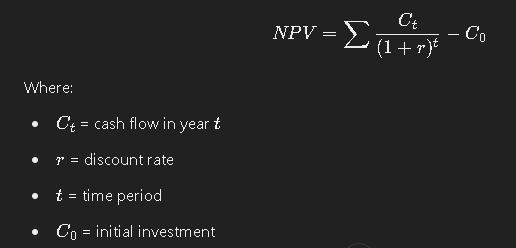

The formula for NPV

A positive NPV means the investment is expected to be profitable, while a negative NPV indicates a potential loss.

How is it used?

1. Assessing Investment Viability

If NPV > 0, the project is expected to generate more cash inflows than outflows, making it financially worthwhile.

If NPV < 0, the project is expected to lose money and is generally rejected.

If NPV = 0, the project is expected to break even, and the decision may depend on other strategic factors.

2. Comparing Investment Options

Companies often have multiple investment opportunities but limited resources. NPV helps compare projects by ranking them based on their profitability. The project with the highest NPV is usually preferred, as it offers the greatest financial return.

3. Incorporating the Cost of Capital

NPV considers the cost of capital (discount rate), ensuring that projects only go ahead if they generate returns higher than the company's required rate of return. This prevents businesses from investing in projects that do not add value.

4. Evaluating Long-Term Projects

Unlike simpler methods like the payback period, NPV accounts for all future cash flows over a project's lifetime, making it suitable for long-term investment decisions such as:

Capital expenditure (e.g., new machinery, factory expansion)

Mergers and acquisitions

Infrastructure projects

5. Adjusting for Risk and Uncertainty

By adjusting the discount rate, businesses can factor in different levels of risk. For instance, riskier projects may use a higher discount rate to reflect the uncertainty of cash flows. Sensitivity analysis can also be performed by varying key assumptions (e.g., future revenues, costs) to see how they impact NPV.

6. Strategic Decision-Making

While NPV provides a solid financial basis for decision-making, companies may also consider non-financial factors such as market conditions, competitive advantage, and strategic fit before finalizing an investment.

Limitations of NPV

Dependent on discount rate assumptions: Choosing an incorrect discount rate can lead to misleading results.

Ignores project size: A high NPV might not always mean a better investment if the project requires significantly more capital.

Difficult to estimate future cash flows: Uncertainty in forecasting revenues and costs can impact accuracy.

What is payback period?

The payback period is a simple investment appraisal method that calculates the time required for an investment to recover its initial cost. It is widely used for assessing short-term risk but has several limitations.

It is calculated as:

Payback Period = Initial Investment / Annual Cash Inflow

A shorter payback period is generally preferred as it means the investment risk is lower. However, this method ignores cash flows after the payback period and does not account for the time value of money.

Advantages of the Payback Period Method

1. Simple and Easy to Use

The payback period is straightforward to calculate and understand, making it a popular tool for businesses with limited financial expertise.

It requires only basic arithmetic, unlike more complex methods such as Net Present Value (NPV) or Internal Rate of Return (IRR).

2. Focuses on Liquidity and Risk Reduction

By prioritizing how quickly an investment is recovered, the method helps businesses manage cash flow effectively.

Shorter payback periods indicate lower investment risk, making this method useful for businesses with limited capital or high uncertainty.

3. Useful for Short-Term Decision-Making

Ideal for businesses that need quick returns or operate in fast-changing industries (e.g., technology, startups).

Helps in assessing projects where long-term profitability is uncertain due to market volatility.

4. Helps in Preliminary Investment Screening

The payback period is a quick tool to eliminate unviable projects before conducting a more detailed analysis using NPV or IRR.

Disadvantages of the Payback Period Method

1. Ignores the Time Value of Money (TVM)

The method does not discount future cash flows, meaning that a pound received today is treated the same as a pound received in the future.

This can lead to inaccurate assessments, especially for long-term projects.

2. Ignores Cash Flows After the Payback Period

The method only focuses on recovering the initial investment and does not consider any profits generated after the payback period.

A project with a short payback period but low long-term profitability might be chosen over a more profitable long-term project.

3. Does Not Measure Profitability

Payback period only considers when the investment is recovered but does not measure how much total return a project generates.

This can lead to poor decision-making when comparing projects of different scales.

4. Does Not Consider Project Lifespan

Two projects with the same payback period may have vastly different lifespans and profitability, but the method does not account for this.

For example, a machine with a 3-year payback period and a 5-year lifespan may be chosen over a machine with a 4-year payback period but a 20-year lifespan, which could be more beneficial in the long run.

5. Not Suitable for Large or Long-Term Investments

Payback period is often ineffective for large capital investments, such as infrastructure projects or research and development, where long-term profitability is key.