Fiscal Policy

What is it?

Is implemented by governments to intervene to manipulate the economy if it is over/underperforming.

Uses government spending to offset a recessionary gap, and uses taxes to offset an inflationary gap.

government spending has a direct positive impact on AD,

When taxes are decreased, it has an indirect impact on AD by increasing disposable income for consumers, which in turn boosts consumption and overall economic activity, but is a smaller magnitude of impact

Occurrences when in a recessionary gap

Unemployment rises

prices fall

productivity falls

Occurrences in an Inflationary gap

Unemployment is low

prices are rising

productivity is rising too fast for firms to keep up

Effects of gov spending

If gov spending increases on goods and services and taxation increases by the same amount, government spending will be greater, as it has a spillover effect, and will benefit everyone since people are paid more by the gov and they can spend more.

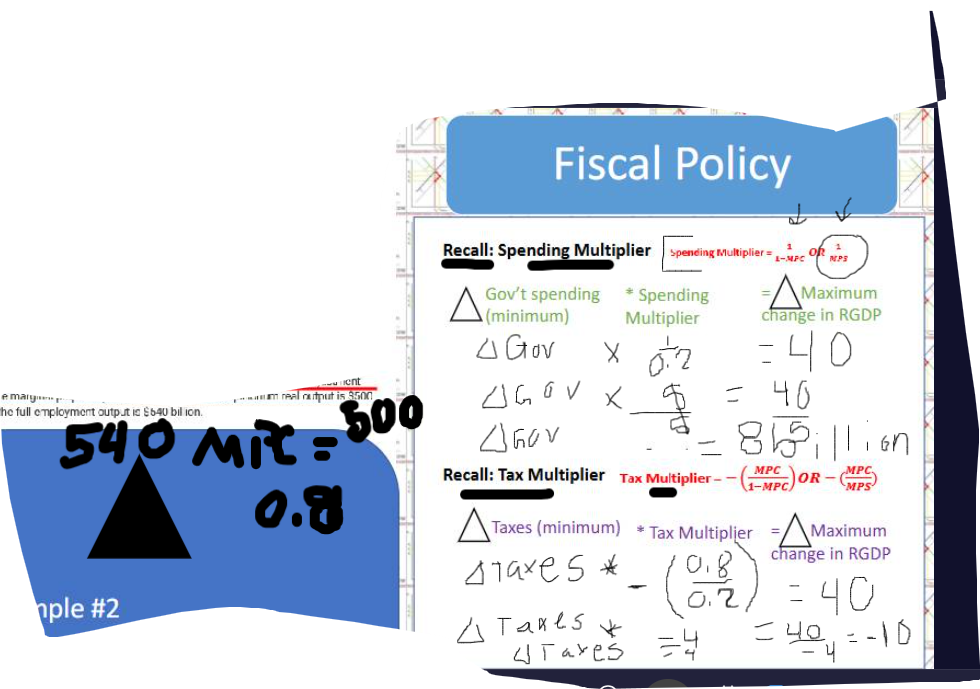

Multipliers

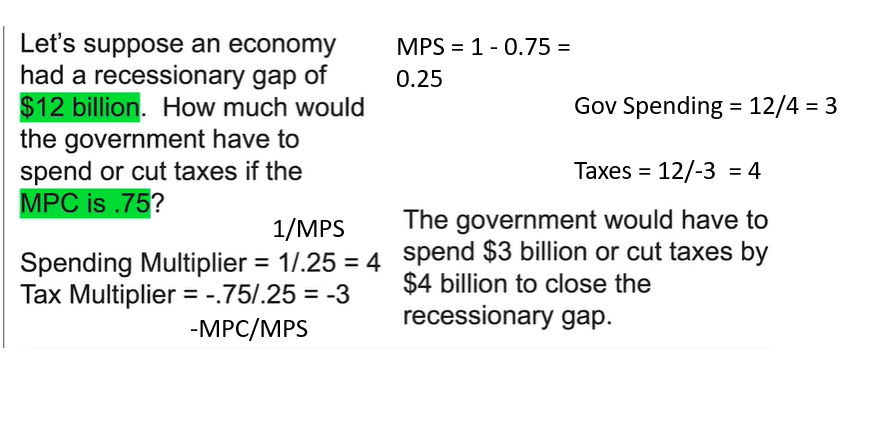

Tax and spending multipliers are both derived from MPC (Marginal propensity to consume) and MPS (Marginal propensity to save); MPC + MPS = 1.

Spending multiplier = 1/MPS

Tax multiplier = -MPC/MPS

Therefor, the tax multiplier is always 1 less than the spending multiplier

Suppose the marginal propensity to consume is 0.8. If government spending increases by $15 million and personal income taxes increase by $20 million, what will be the maximum possible change in aggregate demand in the short run?

Understand the Components:

The marginal propensity to consume (MPC) is 0.8. This means that for every additional dollar of income, consumers spend 80 cents and save 20 cents.

Government spending is increasing by $15 million.

Personal income taxes are increasing by $20 million.

Impact of Government Spending:

When government spending increases, it directly boosts aggregate demand. This is calculated using the spending multiplier, which is determined by the formula: Multiplier=1−MPC1

With an MPC of 0.8, the multiplier is 1−0.81=5.

Therefore, the increase in government spending of $15 million results in an increase in aggregate demand of:15×5=75 million dollars

Impact of Personal Income Taxes:

An increase in taxes generally reduces consumer spending because people have less disposable income. This decrease in spending also affects aggregate demand.

The effect of the increase in personal income taxes, taking into account the MPC, is:20×0.8×5=80 million dollars

Here, the tax increase reduces aggregate demand by $80 million.

Net Change in Aggregate Demand:

To find the maximum possible change in aggregate demand, we combine the effects of both government spending and tax changes.

The net change is calculated as follows:75−80=−5 million dollars

Thus, the maximum possible change in aggregate demand in the short run is a decrease of $5 million.