Chapters 28.3-28.4: Money, banking, financial institutions

What “Backs” the Money Supply?

- The money supply in the United States essentially is “backed” (guaranteed) by the government’s ability to keep the value of money relatively stable.

Money as Debt

- The major components of the money supply—paper money and checkable deposits—are debts, or promises to pay.

- In the US, paper money is the debt of the Federal Reserve Banks.

- Checkable deposits are the debts of commercial banks and thrift institutions

- Paper currency and checkable deposits have no intrinsic value

- coins have less intrinsic value than their face value

- government will not redeem the paper money you hold for anything tangible

- If the government backed the currency with something tangible like gold, then the supply of money would vary with how much gold was available.

- By not backing the currency, the government avoids this and has the ability to control the money supply to best suit the economic needs of the country

- if we used gold to back the money supply so that gold was redeemable for money and vice versa

- a large increase in the nation’s gold stock as the result of a new gold discovery might increase the money supply too rapidly and trigger rapid inflation.

- a long-lasting decline in gold production might reduce the money supply enough to cause recession and unemployment

- Money and checkable deposits are exchangeable only for paper money

Value of Money comes from:

1. Acceptability

- currency and checkable deposits perform the basic function of money: They are acceptable as a medium of exchange

- We accept paper money in exchange because we are confident it will be exchangeable for real goods, services, and resources when we spend it.

2. Legal Tender

- Our confidence in the acceptability of paper money is strengthened because the government has designated currency as legal tender

- each bill contains the statement “This note is legal tender for all debts, public and private.”

- paper money is a valid and legal means of payment of any debt that was contracted in dollars

- private firms and government are not mandated to accept cash

- The government has never decreed checks to be legal tender but they serve as such in many of the economy’s exchanges of goods, services, and resources

3. Relative Scarcity

- The value of money, like the economic value of anything else, depends on its supply and demand.

- Money derives its value from its scarcity relative to its utility (its want-satisfying power)

- The utility of money lies in its capacity to be exchanged for goods and services, now or in the future.

- The economy’s demand for money depends on the total dollar volume of transactions in any period plus the amount of money individuals and businesses want to hold for future transactions.

- With a reasonably constant demand for money, the supply of money provided by the monetary authorities will determine the domestic value or “purchasing power” of the monetary unit

Money and Prices

The Purchasing Power of the Dollar

- The amount a dollar will buy varies inversely with the price level

- Higher prices (and a higher CPI) lower the value of the dollar because more dollars are needed to buy a particular amount of goods, services, or resources.

- lower prices increase the purchasing power of the dollar because fewer dollars are needed to obtain a specific quantity of goods and services

- ^^$V = 1/P^^

- $V = value of the dollar

- P = price level P expressed as an index number (in hundredths)

- ex.

- If the price level rises to 1.20, $V falls to 0.833

- a 20 percent increase in the price level reduces the value of the dollar by 16.67 percent

Inflation and Acceptability

- instances of runaway inflation (hyperinflation) happened when the government issued so many pieces of paper currency that the purchasing power of each of those units of money almost completely fell

- ex. post–World War I hyperinflation in Germany

- Runaway inflation may significantly depreciate the value of money between the time it is received and the time it is spent.

- Businesses and households may refuse to accept paper money

- Without an acceptable domestic medium of exchange, the economy may revert to barter

- or, a country may adopt a foreign currency as its own official currency

- people will use money as a store of value and an economy can employ money as a unit of account only when its purchasing power is relatively stable

- When the value of the dollar is declining rapidly, sellers do not know what to charge and buyers do not know what to pay.

Stabilizing Money’s Purchasing Power

- Since the purchasing power of money and the price level vary inversely, stabilization of the purchasing power of a nation’s money requires stabilization of the nation’s price level.

- price-level stability (2 to 3 percent annual inflation) mainly requires regulation of the nation’s money supply and interest rates (monetary policy).

- It also requires appropriate fiscal policy that supports the monetary authorities’ efforts

- U.S. monetary authorities (the Federal Reserve) make available a particular quantity of money and can change that amount through their policy tools.

The Federal Reserve and the Banking System

- In the United States, the “monetary authorities” are the members of the Board of Governors of the Federal Reserve System (the “Fed”)

- the Board directs the 12 Federal Reserve Banks, which in turn control the lending activity of the nation’s banks and thrift institutions

- The Fed’s goal is to control the money supply and assure the stability of the banking system

Historical Background

- Congress decided that the banking system had to be centralized

- because of decentralized banking,

- numerous private banknotes were used as currency

- sometimes money supply was inappropriate to the needs of the economy

- No single entity was charged with creating and implementing nationally consistent banking policies.

- sometimes banks either closed down or insisted on immediate repayment of loans to prevent their own failure

- people would try to withdraw all their money at once

- A banking crisis in 1907 made Congress appoint the National Monetary Commission to reform the banking system

- The result was the Federal Reserve Act of 1913.

Board of Governors

- They are the central authority of the U.S. money and banking system

- The U.S. president, with the confirmation of the Senate, appoints the seven Board members.

- Terms are 14 years and staggered so that one member is replaced every 2 years.

- The president selects the chairperson and vice chairperson of the Board

- they serve 4-year terms and can be reappointed to new 4-year terms by the president.

The 12 Federal Reserve Banks

Central Bank

Most nations have a single central bank (ex. Britain and Japan)

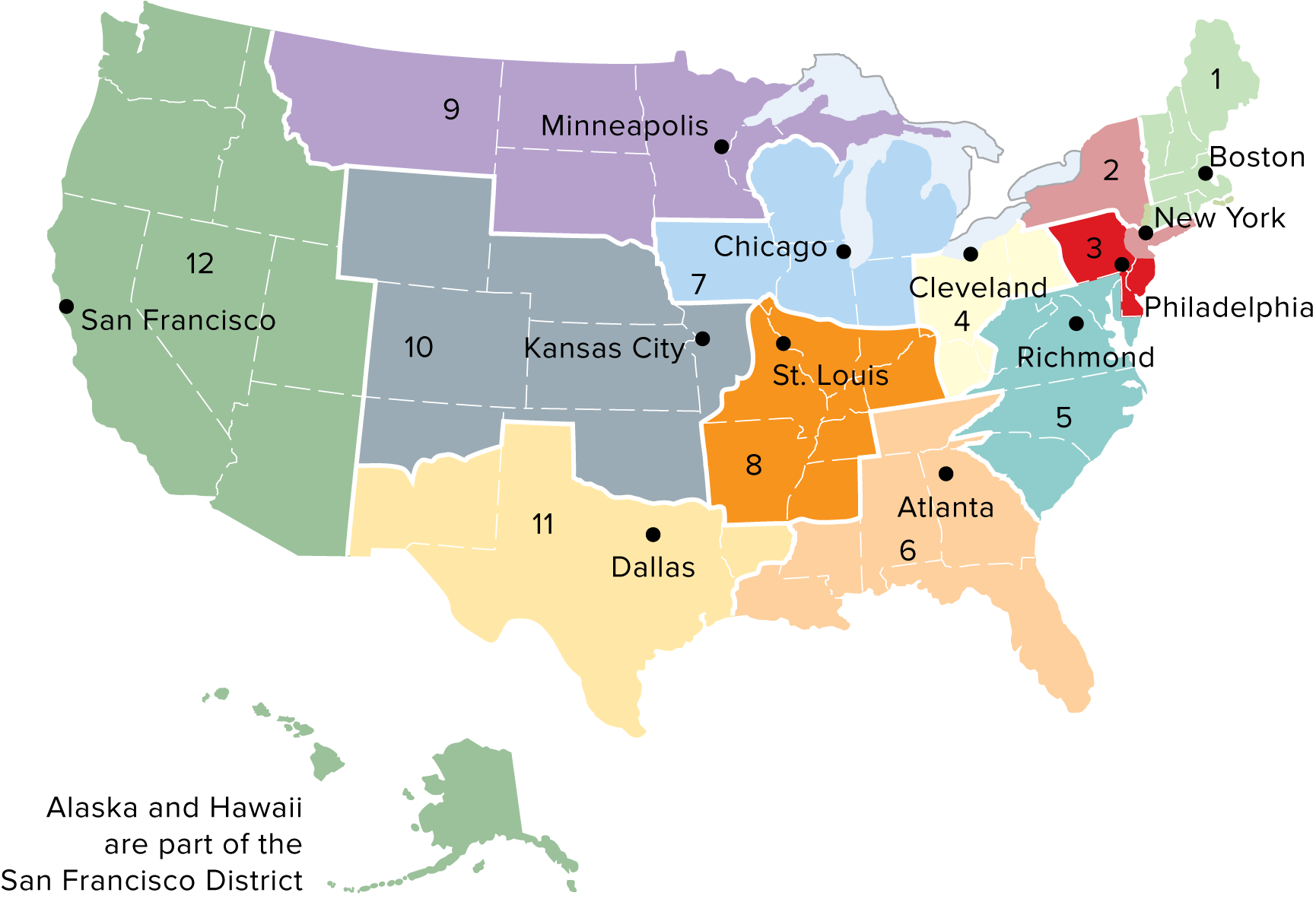

The US central bank consists of 12 banks whose policies are coordinated by the Fed’s Board of Governors

The 12 banks accommodate the geographic size and economic diversity of the United States and the its large number of commercial banks and thrifts

Quasi-Public Banks

- The 12 Federal Reserve Banks are quasi-public banks, which blend private ownership and public control.

- Each Federal Reserve Bank is owned by the private commercial banks in its district.

- Federally chartered banks are required to purchase shares of stock in the Federal Reserve Bank in their district

- the Board of Governors, a government body, sets the basic policies that the Federal Reserve Banks pursue.

- Federal Reserve Banks are in practice public institutions

- not motivated by profit

- designed to promote wellbeing of economy

- do not compete with commercial banks

- do not deal with public but interact with the gov’t and commercial banks and thrifts

Bankers’ Banks

- The Federal Reserve Banks perform essentially the same functions for banks and thrifts as those institutions perform for the public

- accept the deposits of and make loans to banks and thrifts

- these loans average only about $150 million a day

- But in emergency circumstances they become a “lender of last resort”

- lend out as much as needed to ensure that banks and thrifts can meet their cash obligations.

- On the day after September 11, 2001, the Fed lent $45 billion to U.S. banks and thrifts

- Unlike banks and thrifts, they issue currency

- namely Federal Reserve Notes which constitute the paper money supply

FOMC

- The Federal Open Market Committee (FOMC) aids the Board of Governors in conducting monetary policy. The FOMC is made up of 12 individuals:

- The seven members of the Board of Governors.

- The president of the New York Federal Reserve Bank.

- Four of the remaining presidents of Federal Reserve Banks on a 1-year rotating basis

- FOMC directs the purchase, sale, borrowing and lending of government securities (bills, notes, bonds) in the open market

- the purpose of these open-market operations is to control the nation’s money supply and influence interest rates

- The Federal Reserve Bank in New York City conducts most of the Fed’s open-market operations.

Commercial Banks and Thrifts

- There are about 6,000 commercial banks.

- Roughly three-fourths are state banks.

- private banks chartered (authorized) by the individual states to operate within those states

- One-fourth are national banks

- private banks chartered by the federal government to operate nationally

- some are among the world’s largest financial institutions