Property, plant, and equipment (PP&E)

Understanding PP&E

Property, plant, and equipment (PP&E) are long-term assets: things that a business owns and uses for a long time, like buildings or machinery.

The method of depreciation calculation for long-term assets like PP&E has an impact on the way depreciation is reflected in the accounting records.

Why is PP&E important?

It tells us about a business’s financial health.

PP&E are a business’s long-term assets that are expected to generate economic benefits and contribute to revenue for many years.

Investment in PP&E is also called a capital investment.

When the business buys new PP&E, it’s a good sign that they are confident about the future of the business.

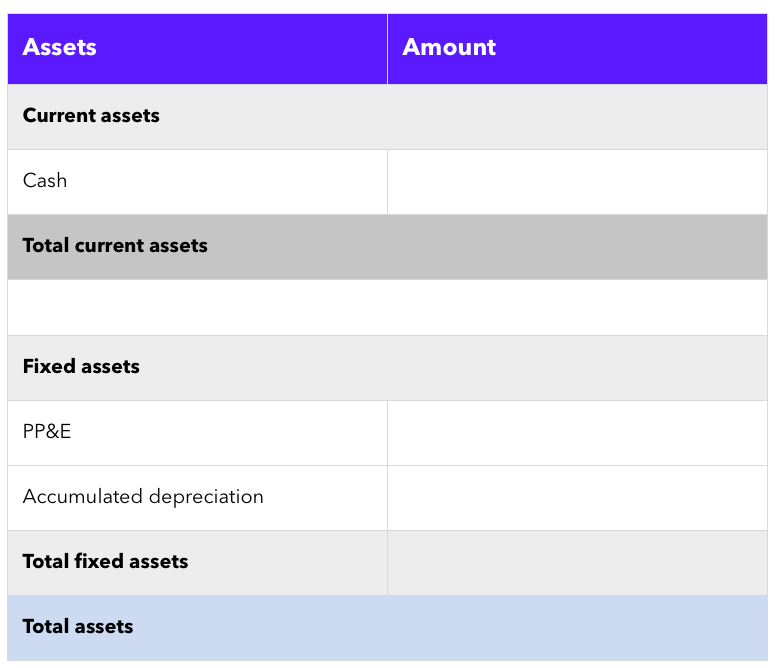

Financial statements

There are different accounts specifically for PP&E.

There are different accounts specifically for PP&E.

These accounts help track and organize the different types of PP&E the business owns.

There is a line for PP&E in the asset section on the balance sheet.

The chart of accounts has different accounts for each type of PP&E, so everything is nicely organized between the balance sheet and the chart of accounts.

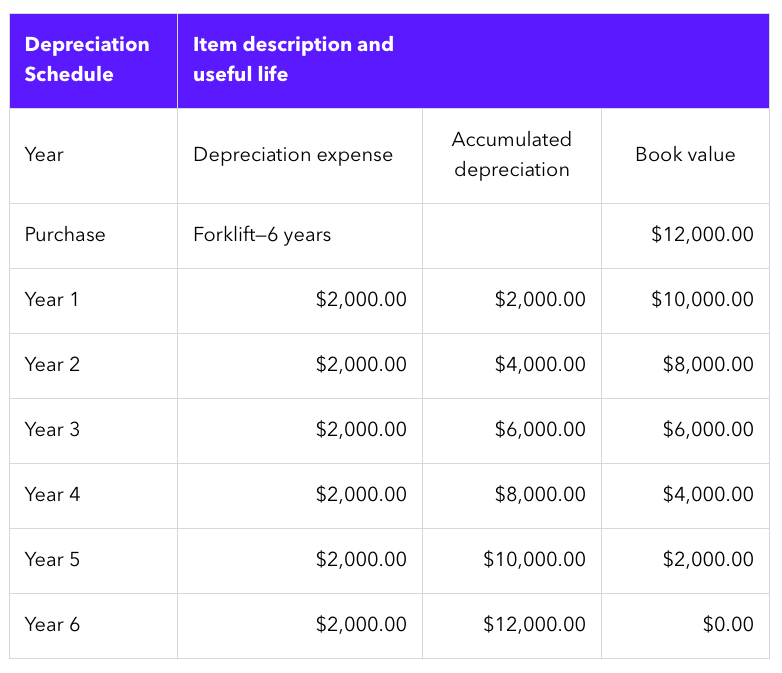

Example of a depreciation schedule:

Depreciation expense

Depreciation expense represents the amount an asset has been depreciated for a specific period, like a year.

It tells us how much of the asset’s value has been used up during that time, based on the asset’s useful life.

The depreciation expense is used to spread the expense of purchasing high-value assets over time.

This helps spread out tax obligations over time as well.

Depreciation methods

Different methods determine how much depreciation expense is recorded during each accounting period, taking into account factors such as time, usage, and production levels.

Straight-line depreciation

The same amount of depreciation expense is recorded each accounting period during an asset’s service life

Accelerated depreciation

The asset is depreciated at a higher rate at the beginning of its service life based on usage

Double-declining balance method is an accelerated depreciation method that allows for larger deductions in the early years of the asset’s life.

Example

Suppose a business purchases a machine for $10,000 with an estimated useful life of 5 years and no salvage value.

Year 1: (2/5) x $10,000 = $4,000

Year 2: (2/5) x $6,000 = $2,400

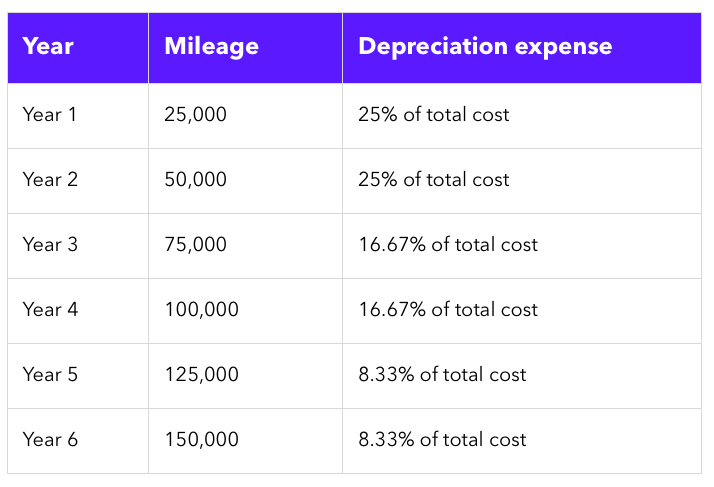

Units of production

How much the asset is used each year.

It is calculated by dividing the total units produced or the actual usage of the asset by the estimated service life

Example of units of production depreciation schedule