AOS2

Accounting assumption (4) PAGE

Indicate how accounting information is generated and reported.

Period assumptions

Financial activities are recorded and reported for a particular period of time.

Supports Accrual Basis assumption which allows revenues for the period to be compared against the expenses for the period

Profit can be calculated, and compared period-to-period if same time period is used

Allows for the distinction between Assets consumed in future periods and Expenses consumed in current period

Accrual Basis

Revenues recognised when earned and expenses when incurred, focuses on the economic benefit to the business.

Revenues recognised when earned: when goods have been delivered or service provided and there is a source document to verify.

Expenses recognised when consumed: either an Asset decreases (eg Bank, Inventory) or Liability increases (Accrued Expense, Accounts Payable)

Liabilities are recognised when there is an obligation such as receiving an Invoice or signing a Loan contract

Going Concern

Record and report transactions under the assumption that the business will continue to operate in the future.

Allows for the recognition of credit transactions, providing assurance to fulfill its obligations and repay its debts.

Allows the recognition of non-current Assets & Liabilities (as we can assume future benefits with the Assets and future transfers with the Liabilities)

Assets can be valued at what they represent in terms of their future contribution to the business rather than their current market value as if they were going to be sold

Accounting Entity

Record all transactions related to the business. The business has its own financial status and is separate from the owner and other businesses.

Separate records are maintained for each entity and reports are generated for each entity

Transactions with the owner should be recorded

Eg. Capital contributions and Drawings

Supports qualitative characteristic of Relevance as the owner’s personal Assets & Liabilities do not belong in the Reports of the business and should not be used in decision-making.

Qualitative characteristics (6)

Faithful Representation

Information in a report should accurately reflect real-world economic events and should be complete, unbiased, free from error and neutral.

Trust the information in reports.

Reporting assets in the Balance Sheet at their original purchase price is required under the Standards as it can be verified by the source document and so will be without error and neutral.

Reducing the value of Inventory when demand falls away or new models come onto the market, or perhaps there is minor damage.

Making an allowance for doubtful debts when it is believed with some certainty that Accounts Receivable will not pay, therefore reporting the figure in the Balance Sheet for Accounts Receivable that is a more faithful representation

Verifiability

Financial information should be faithfully represented and supported through evidence on source documents

Source Documents

Supports Faithful Representation

Not using estimates in reports

Comparability

Information should allow us to see similarities and differences in Reports when comparing over time or with other businesses.

Knowing that consistent methods have been used, results that vary in different periods can be linked to changes in performance not changes in accounting methods

Using consistent methods in each period:

Using the same depreciation methods for a particular non-current Asset

Using the same cost valuation method for Inventory when determining the cost price of inventory sold

Understandability

Information should be presented clearly and concisely so that users with a reasonable knowledge of business and economic activities can understand it.

Using clear setting out so information in the reports is easy to follow

Using classification in reports will help users understand the information in the reports

Using graphs and charts may also enhance understanding

Avoiding too much technical language in reports and giving explanations where needed

Timeliness

Financial information should be available to decision makers in time to be capable of influencing their decisions.

So better decision-making can be made

Preparing reports as soon as possible after the end of the reporting period

Preparing budgets frequently and in a timely manner so they can be useful for decision making

Relevance

Information capable of making a difference to decisions made by users. Helps users form predictions about the outcomes of past, present or future events. It may also provide suitable feedback about previous evaluations or decisions.

Ensures that the correct information is included in reports.

The personal assets/liabilities of the owner (Entity) should not be included in reports.

Transactions between the owner and the business should be recorded

If the information relates to the current reporting period, then is should be included. If it relates to another reporting period, then it should be excluded

Information that is significant is more likely to impact decision making, so insignificant items may not satisfy Relevance.

Accounting process

What are the stages of the accounting process?

Stage 1 - Business/ Source documents

What is the function of source documents of a single-entry accounting system?

Collect source documents during a specific reporting period to verify cash transactions. Documents must be reported for ATO purposes (audits)

Types of documents:

Cash receipts

Invoices

Cheque

Memos

Purpose of Statement account

Have a neat summary of all transactions between two businesses.

Purpose of Tax invoice

Verify how much GST has been received, paid and charged.

GST

Plus GST = selling price divide 100 times 10

Including GST = Total price divide by 11

Total Price = selling price + GST

Cheque Butts

Type of transaction - Cash payment

Recorded - Cash payments journal

Verifiability - Provides evidence that a cash payment had been made by the business.

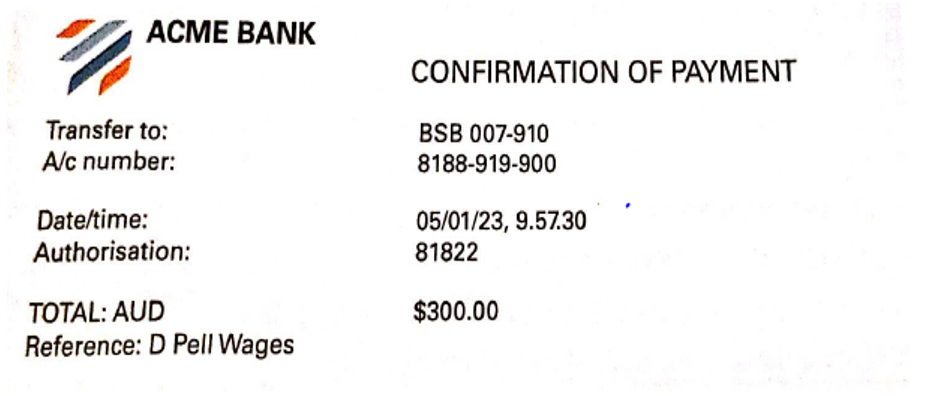

EFT payments

Type of transaction - Cash payment

Recorded - Cash payments journal

Verifiability - Provides evidence that a cash payment had been made by the business online.

Importance - Has replaced the need for a business to write cheques

How does it work?

Cash is transfer from one business bank account to another.

Receipts

Type of transaction - Cash receipt

Recorded - Cash receipt journal

Verifiability - Provides evidence that a cash payment had been made by the business.

The customer receives the original receipt and the business receives a copy.

EFTPOS Receipts

Type of transaction - Cash receipt

Recorded - Cash receipt journal

Verifiability - Provides evidence that cash has been received.

Importance - has allowed a business to accept credit cards, gift cards, debit cards

How does it work?

A business rents an EFTPOS machine from its bank. Works the same as receiving cash as the money is coming out of the customers bank account and going into the business’ bank account.

Sales invoices

Type of transaction - Credit Transaction

Recorded - Cash Sales journal

Verifiability - Provides evidence that a credit transaction has occurred between the customer (accounts receivable) and the business. The business document that verifies a credit transaction

How does a credit sale work?

The customer purchases goods or a service

No money is exchanged hands but a sale is made

The customer will be issued an invoice which will state when the payment of cash is due e.g within 30 days the customer must pay their account

Terms: 5/7 , n/30 - the 5 means a 5% discount if payment within 7 days, n/30 is payment due in 30 days

Purchase invoices

Type of transaction - Cash Transaction

Recorded - Cash purchases journal

Verifiability - Provides evidence that a credit transaction has occurred between the business and the supplier (accounts payable).

How does a credit sale work?

Our business purchases goods or services.

No money is exchanged but a sale is made

Our business will be issued with an invoice which will state when the payment of cash is due e.g 30 days

Within 30 days our business must pay their account owed to the supplier.

Credit Notes

Issued when an item is due to be returned back to the business.

Delivery docket

When goods are delivered by the supplier and it doesn’t usually include cost prices as the delivery is not recorded in the accounting system.

Stage 2 - Recording Accounting Information

Explain the function of journals in a single-entry accounting system.

A record book which classifies & summarises transactions during a reporting period. Journals are organised and structured for easy referencing and future audits.

Cash receipts and cash payment journal - summaries all cash received/paid by the business

The sales journal records credit sales, and the purchases journal records credit purchases

The general journey

Step 3 - Reporting Accounting Information

What is the function of statement of receipts and payments?

Cash receipts & payments journals summarised to generate a single report called Statement of receipts & payments.

Presents the accounting information in a way that communicates the business’ cash position during a reporting period.

The Balance Sheet

The Income Statement

The Cash Flow Statement

Evaluation of Business performance

Management makes decisions based on the financial information in the accounting report

Recording and Reporting Cash flows

Cash recording

Important to know the business’ cash position during a reporting period.

Cash receipts - where the cash had come from (cash received)

Cash payments - what the cash was spent on (cash paid)

Bank Balance - cash on hand, total amount of money in a bank account, including both cash and any other types of funds (e.g., deposits, investments, loans).

Cash at bank - amount of money held by a company in its bank accounts

Cash

Cash on hand and cash at bank, calculated by comparing cash inflows and outflows.

Profit

Calculated by comparing revenue earned with expenses incurred.

Why does profitable businesses still fail?

Because they haven’t paid sufficient attention to managing their cash and liquidity.

Should manage its cash as expenses that have to be paid, and the business owner may have their own demands for drawings

Steps to record cash flow

Identify all cash receipts and payments

Record this in a journal

Create a report of cash inflows and outflows which is called a statement of receipts and payments

Single-entry accounting

Simple form of book keeping, cash transactions are recorded as a single entry into a cash receipts/cash payment journal.

Source Documents → records → reports → advice

Recording cash payments

List three activities that would result in a cash payment.

Buying goods for cash

Paying expenses

Paying interest on loans

Repaying loans

Buying new assets

Cash withdrawals

Paying cash to accounts payable

Recording cash receipts

List three activities that would result in a cash receipt.

Cash from selling goods

Cash from providing services

Interest received

Loan taken out

Selling old assets

Receiving accounts receivable

Two-fold effect of Transactions

means that every transaction will affect at least two items in the accounting equation – a double entry After recording these changes, the accounting equation must still balance.

Sold Inventory with cost $500 for $1100 cash including GST

Inventory decrease 500

Cash at bank increase $1100

R- E

Cash sales 1, 000

Cost price - 500

GST: 100

Purchase Inventory $5000 from Singapore imports on credit

C price paid $300 on account

Sold two cars (cost $2, 500) for $7, 500 cash each

Sold three cars (cost $9, 000) for $15000 each on credit to Drennan’s computer

Paid $2, 000 to ZNA bank (payment of loan)

loan decrease

Sold car (cost $2, 000) for cash $4000

Received $1,400 cash from Accounts receivable.

Cash at bank increases

Accounts receivable decreases

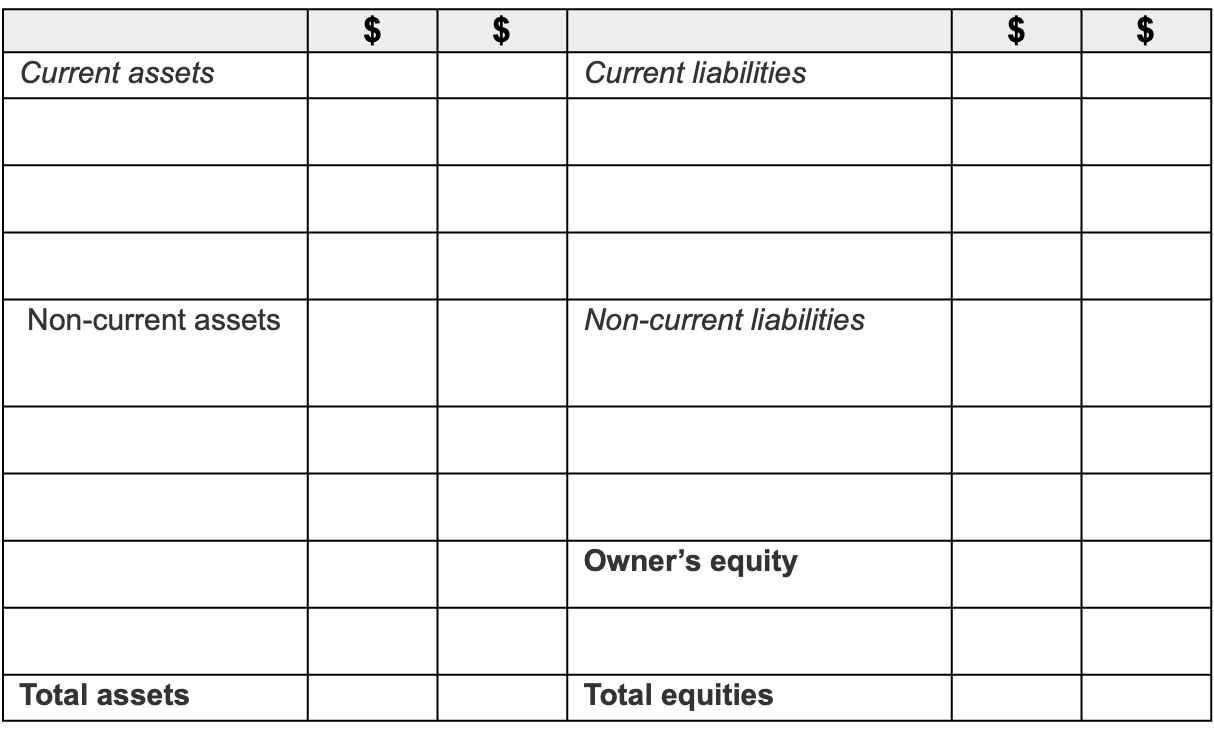

Balance sheets

Definition

An accounting report that shows the business’ Assets, Liabilities and Owner’s Equity at any point in time. Must always be balanced.

T-form

Definition

An accounting report that lists the business’ Assets on the left side and the Liabilities and Owner’s Equity on the right side.

Assets and Liabilities are separated into current and non-current.

Remember to calculate subtotals for each current and non-current items.

Classification of Loans

Current and Non-current Liability -

12 000 borrowed loan. Pays 2000 annually.

Put the amount paid for current (2000) and put the remaining amount for non-current (10 000).

Cash flow statement

Definition

An accounting report that details all cash inflows and outflows from operating, investing and financing activities, and the overall change in the firm’s cash

Purpose of cash flows

Decision- making

Performance evaluation

Whether business is generating enough cash from operating

Planning

Categories of outflow and inflow

Operating - cash flows related to day to day trading activities

Cash sales, GST received, Payments of Expenses, Materials

Investing - cash flows related to the purchase and sale of non- current asset

Furniture, purchased, sale of land

Financing - cash flows related to changes in the financial structure of the firm

Capital contribution, Repayments of loans, Taking out loans and drawings of cash.

Definitions

Accounts receivable

Customer who owe a business money because they obtained goods or services on credit

Accounts payable

Suppliers that a businness owes money to after obtaining goods or services on credit

Credit purchase

The business get goods or services from their suppliers immediately without paying

Credit sale

Business provides goods or services to customers immediately without them paying

Credit transaction

A credit transaction is where goods or services are supplied immediately, but payment follows at a later date (30-60 days)

GST transactions

GST payable

Current liability in the balance sheet

Net balance of GST received and GST paid in a period where the business has collected the more in GST on sales than GST paid on purchases

It reflects the amount that the business owes to the ATO

GST receivable

Current asset in the balance sheet

Net balance of GST received and GST paid in a period where the business has paid more GST on purchases than it collected on sales

It reflects the amount owned to the business by the ATO

GST received

Cash receipts journal

Increases the GST owned to ATO and increases GST Payable liability

GST received from customers for sales

GST paid

Cash payments journal

GST paid to suppliers when making cash payments

Decreases the amount of GST to ATO, decreases GST payable liabilty

GST settlement

Cash payment journal - Sundries column

Business pays ATO the GST payable balance

Decrease bank and GST payable liability, no longer owe this amount to ATO

cGST Refund

Cash Receipts journal - Sundries

ATO pays business the GST receivable balance that it owes

Increase bank and decrease the GST receivable asset as the ATO will no longer owe this amount to the business

Knowt

Knowt