Public Goods and Common Resources - chapter 19

19.1. Characteristics Of Goods

- The important characteristics concerning the consumption of good and whether they're allocated efficiently are if the good is rival and/or/nor excludable

- Excludability matters because it allows owners to set an enforceable price on a good

- if you cannot prevent people from consuming something, then they have little motivation to pay to use it

- Rivalry has to do with whether or not a good is used up when someone consumes it

- often rivalry is a matter of degree (decreases other's utility by also using its

- knowledge and technology are typically non-rival, as once something has been thought up or invented, anyone can use it

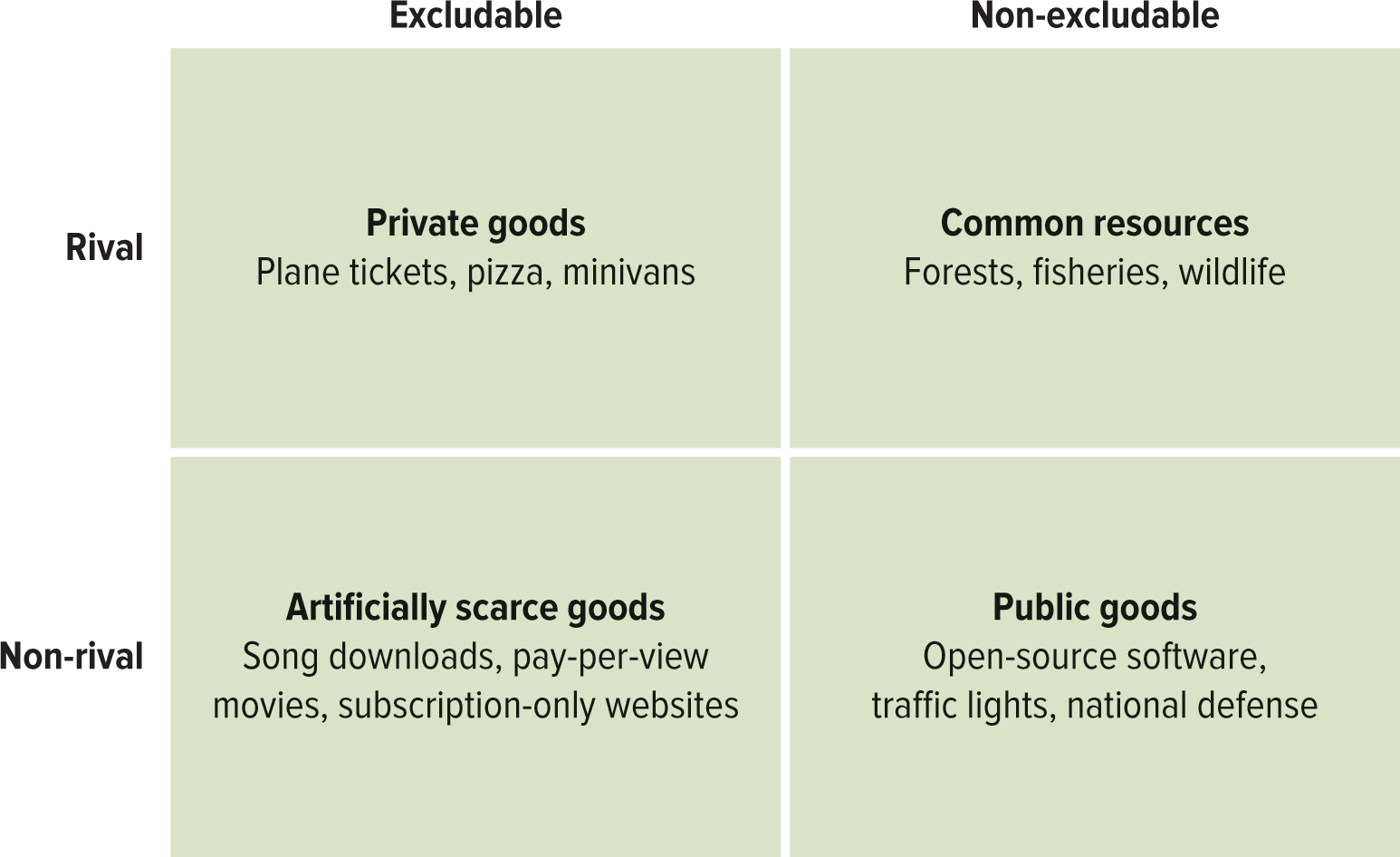

- There are 4 categories of goods (private goods, common resources, artificially scarce goods, and public goods)

- markets for artificially scarce goods function like those for private goods, and it's the lack of a close substitute for a good that makes its scarce

- scarcity of the good allows the sellers some power to charge a price above that in a perfectly competitive market

19.2. The Free-rider Problem

- Markets work well for allocating private goods efficiently, but not always so well for allocating public goods and common resources

- price charged by competitive firms doesn't capture the true costs and benefits of consumption

- public goods and common resources are closely tied to the problems of externalities

- Ex. there's a cost to run a public bus, so riders are charged a fare to support the cost

- if someone decides they don't want to pay, they can slip in the back, making them, a free-rider

- if there are enough paying riders, no harm is done, but if no one pays, bus services will be reduced to reflect reduced revenue

- reduced bus services don't reflect reduced demand or a lower value to riders, but no individual has an incentive to voluntarily pay the fare if they don't have to

- When a good isn't easily excludable, what people pay for it won't necessarily reflect the real value they place on it

- if given the opportunity, people will free-ride(they enjoy the positive externalities of others' actions)

19.3. Solutions To The Free-rider Problem

- The free-rider problem leads to market failure: markets typically undersupply public goods, this issue can be solved through:

- social norms, social disapproval, guilt, or conflict with those in your community can be costs

- doing the "nice" thing

- social disapproval carries a higher cost in places where you know the people around you, care about their opinions and expect to interact with them again in the future

- clear distinctions between who is and isn't allowed to access resources, the participation of resource users in setting the rules for use, and the ability of users to monitor one another, make informal solutions more effective

- government provision: when the government steps in to provide the good directly

- can be provided by public or private companies

- if the government is supplying a public good, the efficient quantity is the one at which the marginal benefit equals the cost

- each individual who uses the road network gains some marginal benefit from increased road maintenance

- the marginal social benefit is actually the sum of the marginal benefit gained by each individual user

- people have an incentive to overstate the marginal benefit they receive to encourage the government to increase funding

- this may be individually rational behaviour, but socially inefficient

- governments try to conduct a cost-benefit analysis when deciding how much of a public good to supply

- Economic research can help as they must make the “best” guess at what the marginal social benefit of an additional unit will be

- Can attempt to quantify the diffuse benefits that people get from better schools, reduced disease, or safer neighbourhoods

- Determining who will pay for the public goods depends on how easy it is to exclude people who don’t pay

- In some cases, it is possible to make the good excludable: the government can use its power to monitor the use and enforce payments among those who actually use them

- In other cases, it is difficult or undesirable to charge user fees

- For services that are used by almost all citizens (ex sewer systems, police and fire protection) it may be more costly to try to exclude non-users than it is worth so they are funded through general tax revenue

- Making a public good a private good by making it excludable

- Give individuals or firms the right to use or sell a public good, by assigning property rights

- A public good can be made excludable through patents and copyrights

- Without it, the profits from a new idea could be claimed by anyone, not just the inventor

- Such protection increases their incentives to undertake research that will create new knowledge

- Giving firms an incentive to conduct research solves the under-supply problem

19.4. The Tragedy of the Commons

- The problem with common resources is that they are over-consumed

- Due to individually rational but collectively inefficient overconsumption

- Common resources are goods that are not excludable but are rival

- Non-excludability causes people to demand a higher quantity than they would if they had to pay for what they consumed

- Because a common resource is also rival, it gets “used up” every time someone accesses it

- Demand for common resources is characterized by inefficiently high demand and dwindling quantity

- The ability to access the benefits of a common resource without paying any costs increases the demand

- Because the resource is rival in consumption, it imposes a negative externality on those whose ability to consume the resource is reduced

19.5. Solutions to the Tragedy of the Commons

- Strong societal norms can help rebalance the trade-offs involved in consuming common resources by imposing social costs on those who break the “rules” of good behaviour

- Imposing costs on overconsumption can help bring the quantity consumed closer to the efficient level

- Often, government bodies have the power to solve the non-excludability problem, while individuals don’t

- Banning or limiting use of common resources is a straightforward public-policy approach to solving the problem of overuse

- Often fail in situations where it’s difficult to monitor and punish rule breakers and is not necessarily efficient

- Sometimes the best way to solve the problem is to convert a common resource into a private good

- Privatization works when it is possible to divide up a resource and make it excludable by giving a private owner control over its use

- However has the right incentives to ensure an efficient level of use

- Bearing all of the costs and benefits of the resource

- Governments can institute private property rights is through the use of tradeable allowances or permits

- Tradeable allowances create a market for the rights to consume a common resource

- Ensures that it is allocated to those with the highest willingness to pay