accounting

Ch. 2

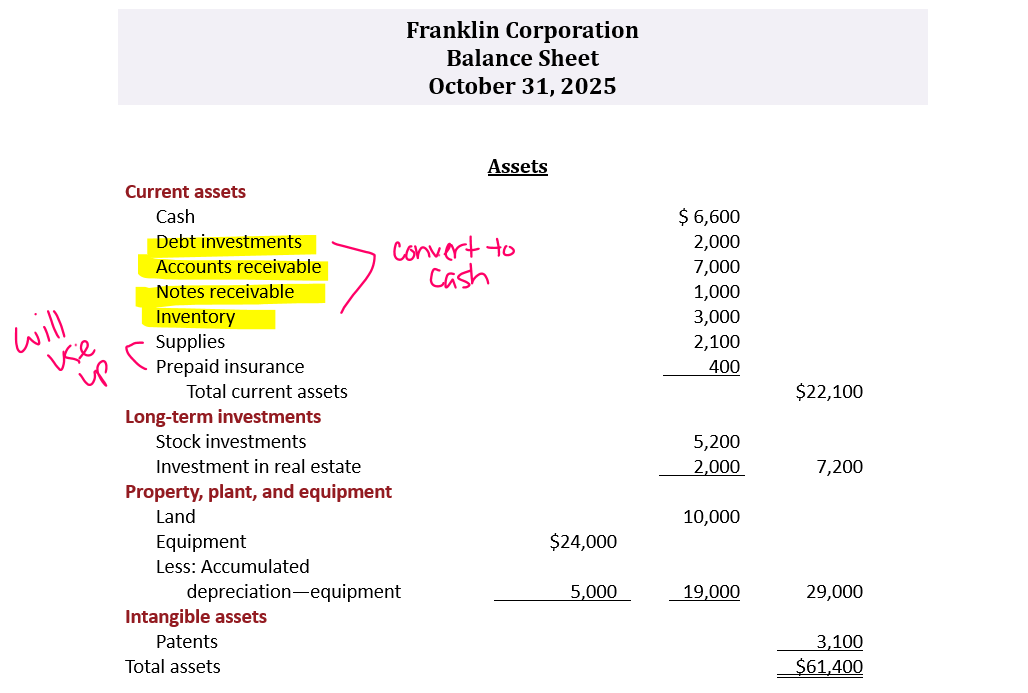

Classified balance sheet- groups together similar assets and similar liabilities, using standard classifications and sections

Classifications of Classified Balance Sheet

Assests

Current Assets

company-owned assets that can be converted to cash within one year or the operating cycle, whichever is longer.

basically, using cash to gain more cash

Operating cycle is the average time it takes to go from cash to cash. This is the time to purchase inventory, sell it on account and then collect cash from customers.

For most businesses, the cycle is less than a year so a one-year cutoff is used.

Current assets are listed in the order in which convert to cash.

Long term investments

Investments in stocks and bonds of other companies that are held for more than one year.

Long-term notes receivable

Investments in long-term assets such as land not currently being used in operating activities.

debt investment- Debt investment is when you lend money to someone, like a company or a government, and in return, they promise to pay you back with interest.

It’s like giving a loan and earning money from the interest they pay you.

Common types of debt investments include bonds and loans

stock investment- Stock investment is when you buy a small piece of ownership in a company, called a "share" or "stock." By owning stock, you become a part-owner of the company

Property, plant and equipment (PPE)

Assets with long useful lives that are currently used in operating the business

Examples: Land, buildings, equipment, vehicles, and furniture

A process known as depreciation is used to allocate the cost of these assets to a number of years

depreciation- a way of spreading out the cost of a big purchase over time.

When a business buys something like equipment, machinery, or a vehicle, that item loses value as it gets older and wears out. Instead of taking the whole cost as an expense right away, businesses use depreciation to gradually reduce the value of the item on their books each year

The accumulated depreciation account shows the total of depreciation that a company has taken so far on its assets

Intangible assets

Assets that do not have a physical substance yet are often valuable

assets that give you rights

Examples: goodwill, copyrights, patents, franchises, trademarks

List 5 common current assets in order of liquidity

Cash

Investment (short term)

Receivables- notes receivable, accounts receivable

Inventories

Prepaid Expenses- prepaid insurance, prepaid rent, supplies

Liabilities & Stockholders’ Equity

Current liabilities

Current liabilities are obligations that the company is to pay within the coming year or operating cycle, whichever is longer. For most companies, this is one year.

Usual order is notes payable, accounts payable, and then others in order of magnitude

Examples: accounts payable, short-term notes payable, salaries payable, interest payable, income taxes payable, unearned revenue

unearned revenue- Unearned revenue in business is money a company receives before it has provided the product or service. It's like getting paid in advance.

ex. giftcards

be careful with notes payable. they can be short term or long-term liability.

Usual order is notes payable, accounts payable, and then others in order of magnitude

Long term liabilities

Obligations that a company expects to pay after one year

Examples: long term notes payable, bonds payable, mortgages payable, lease liabilities, pension liabilities

Stockholders’ equity

Stockholders’ Equity consist of two parts:

1.Common stock- investments of assets into the business by stockholders

2. Retained Earnings- income retained for use in the business

Ratio Analysis

Ratio- expresses the mathematical relationship between one quantity and another

Types of Ratios

Profitability- Measure the income or operating success of a company for a given period of time

EPS (earns per share)- measures the income earned on each share of common stock

Eps= (Net Income – Preferred Dividends) / Weighted Average Common Shares Outstanding

increase in EPS is favorable

Liquidity- a measure that helps determine how easily a company can pay off its short-term debts using its available assets.

working capital ratio- a measure used in business to see if a company has enough short-term assets (like cash, inventory, and receivables) to cover its short-term liabilities (like bills and loans due soon).

Working Capital Ratio = Current Assets / Current Liabilities

Solvency- Measure the ability of the company to survive over a long period of time

debt to assets- it tells you what portion of the company’s assets are paid for with borrowed money.

Debt to Assets Ratio= Total Assets / Total Debt

Current ratio= current assets/ current liabilities

Government organizations?

(GAAP) Generally Accepted Accounting Principles - A set of rules and practices, having substantial authoritative support that the accounting profession recognizes as a general guide for financial reporting purposes.

(SEC) Securities and Exchange Commission- is an agency of the federal government that oversees the US financial markets and accounting standard setting bodies

(FASB) Financial Accounting Standards Board- is the primary accounting standard setting body in the US. A private organization.

Verifiability- Information that can be proved that it is free from error

Timeliness- Information that is available to decision makers before it loses capacity to influence decision makers

Comparability- Results when different companies use the same accounting principles

Consistency- Results when a company uses the same principles and methods from year to year

Understandability- Information has this quality if it is presented in a clear and concise fashion

(PCAOB) Public Company Accounting Oversight Board- determines the US auditing standards and reviews the performance of auditing firms.

(IASB) International Accounting Standards Board- issues standards called IFRS which have been adopted by countries overseas, mostly Europe.

Vocab

cost principle- an accounting rule that says assets should be recorded on the balance sheet at their original cost, not their current market value.

fair value principle- a way of estimating the value of an asset or liability based on what it would sell for in the market today

cost constraint- a company has a certain budget or limit on how much it can afford to spend on things like production, marketing, salaries, or other expenses

Full disclosure principle-

Periodicity assumption-

Going concern assumption-

Historical cost principle-

Monetary unit assumption

Economic entity assumption

Ch. 3

The accounting information system is a system of collecting processing transaction, data, and communicating financial information to decision makers

An accounting information system relies on a process called the accounting

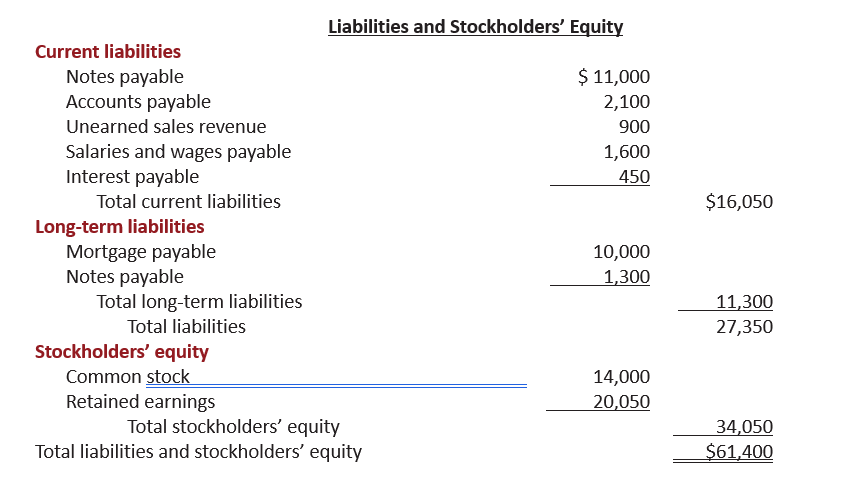

The Account & Debits and Credits

An account is a record of debits and credits in a specific asset, liability, equity, revenue, or expense item

An account has three parts:

1. the title of the account

2. a left side called the debits side

3. a right side called the credits side

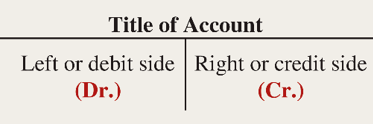

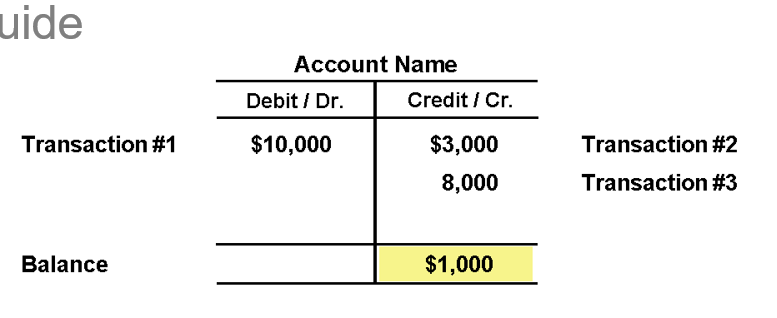

Debt balance

If debits are more than credits the account will have a debit balance such as in this example

Credit Balance

if credit is more than debits the account will have a credit balance such as in this example

credit- that the business owes money

after eating let’s read comics

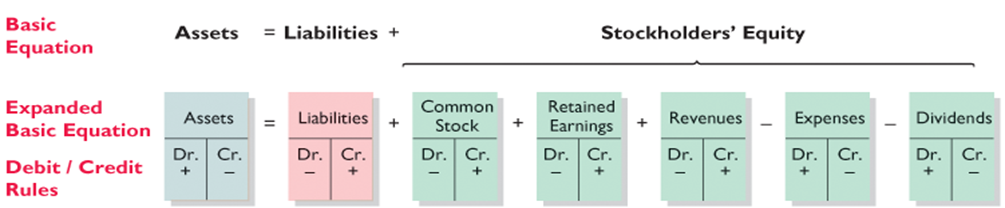

types of accounts that increase with a debit

assets

expenses

dividends

types of accounts that increase with credit

liabilities

revenues

retained earnings

common stock

After Eating Dinner Lets Read Comics (after eating dinner lets read comics)

Questions to ask:

What accounts are affected?

Is it increasing or decreasing?

Apply the AED=DEC rule

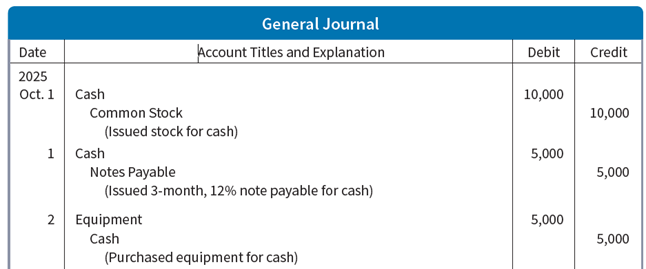

Journal Entries

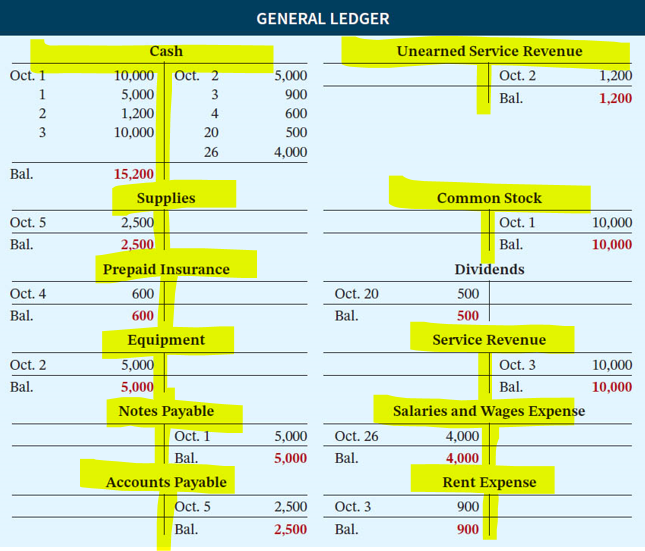

The ledger provides the balances of the accounts as weel keeps track of changes in these balances.

Prder of trail balance:

assets

liab

equity

revue

expenes

Ch. 4

Timing Issues

The periodicity assumption requires accountants to divide the economic life of business into artificial time periods.

Accounting time periods are usually a month, quarter or a year.

The Revenue Recognition Principle is an accounting rule that says businesses should only record revenue (money earned) when it is actually earned, not when they receive the cash.

If a company sells a product or service, they can count it as revenue only when they deliver the product or finish the service.

This principle ensures that financial reports show a more accurate picture of a company’s actual earnings during a specific time period.

Ex. October 15- Starr Company provided $500 services on account to a client.

assets- 500 debits

service revenue 500

The Expense Recognition Principle is an accounting rule that expenses should be recognized in the same period as the revenue they help to generate.

In other words, expenses are matched with related revenue. If an expense contributed to generating revenue in a particular period, it should be recorded in that period, even if the payment for the expense occurs earlier or later.

For example, if a company incus expenses in December to deliver services for which it will receive payment in january, the expenses should be recorded in December when the related revenue was earned.

Accrual vs. Cash Basis of Accounting

Accrual and Cash Basis are two common methods of accounting used to record income and expenses.

Accrual

Transaction recorded in the periods in which the events occur. (recording transactions)

To follow GAAP, companies have to do Accrual basis accounting

Revenues are recognized when the performance obligation is satisfied, even if cash was not received

accrued revenues- revenues for services performed but yet received in cash or recorded

Expenses are recognized when incurred even if cash was not paid

accrued expenses- expenses incurred but not yet paid in cash or recorded

Cash

revenues are recognized only when cash is received

expenses are recognized only when cash is paid

not allowed under generally accepted accounting principles

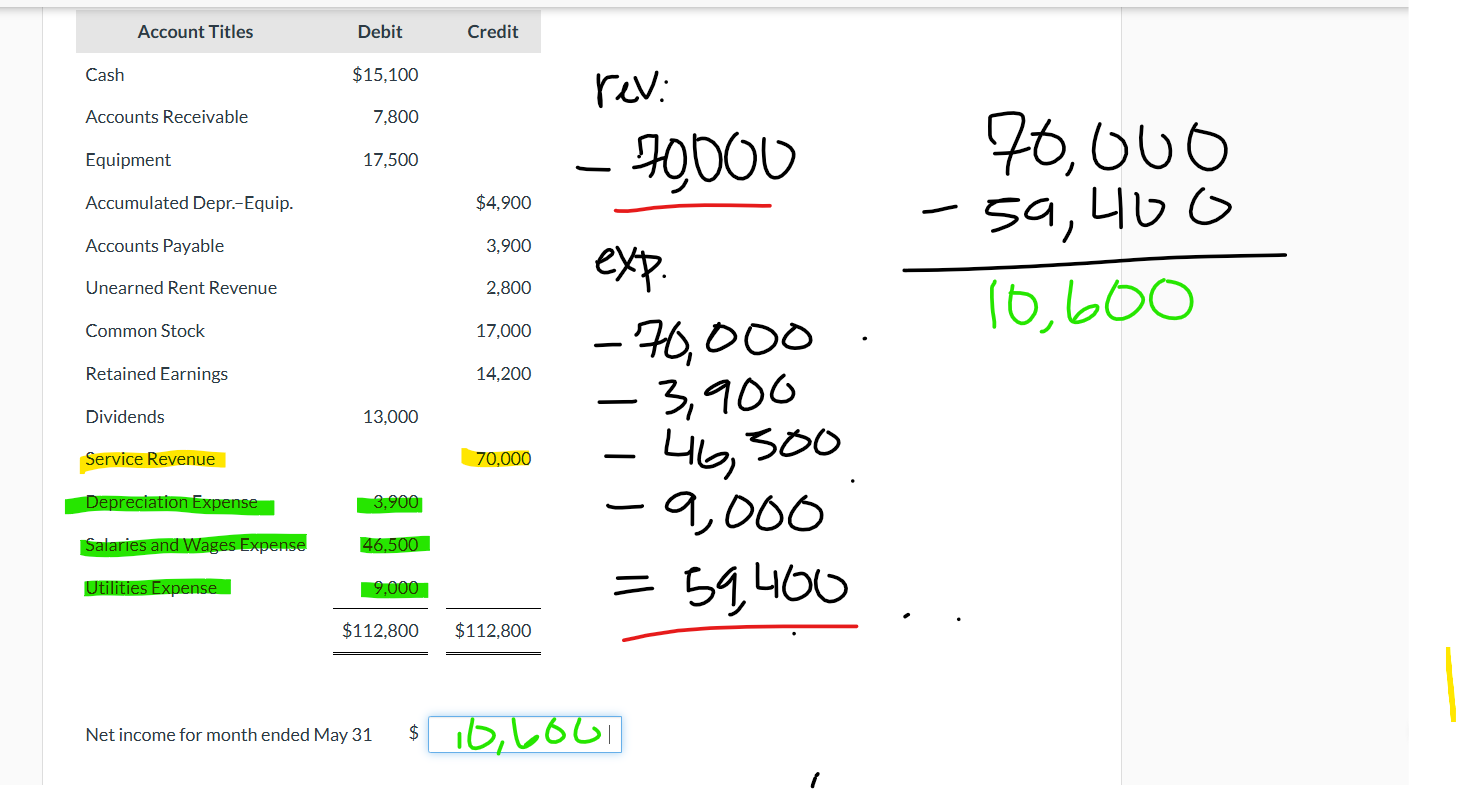

Adjusting Entries

Adjusting entries include one income statement account and one balance sheet

never cash?

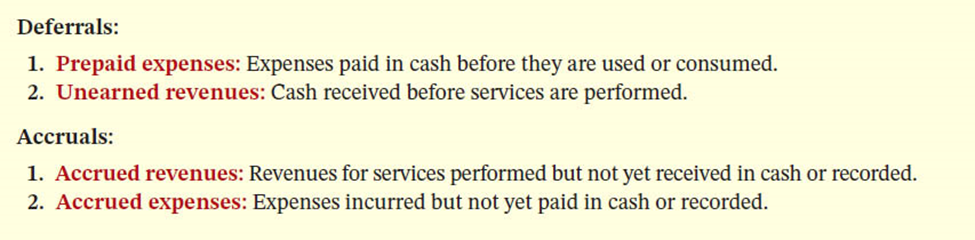

Types of Adjusting entries

Deferrals- means to postpone or delay. Deferrals are revenues or expenses that are recognized at a date ___later______ than the point when cash was originally exchanged.

Accruals- Revenues for services performed but not yet recorded at the statement date

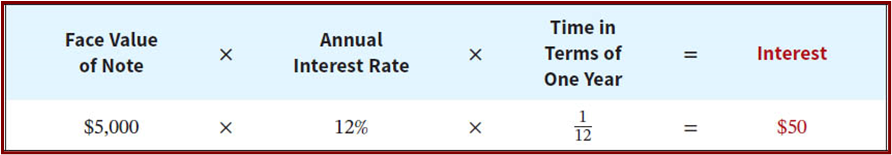

interest rate formula:

—— expense ——— payble

income summary

Knowt

Knowt