WEEK 3b: REVENUE RECOGNITION

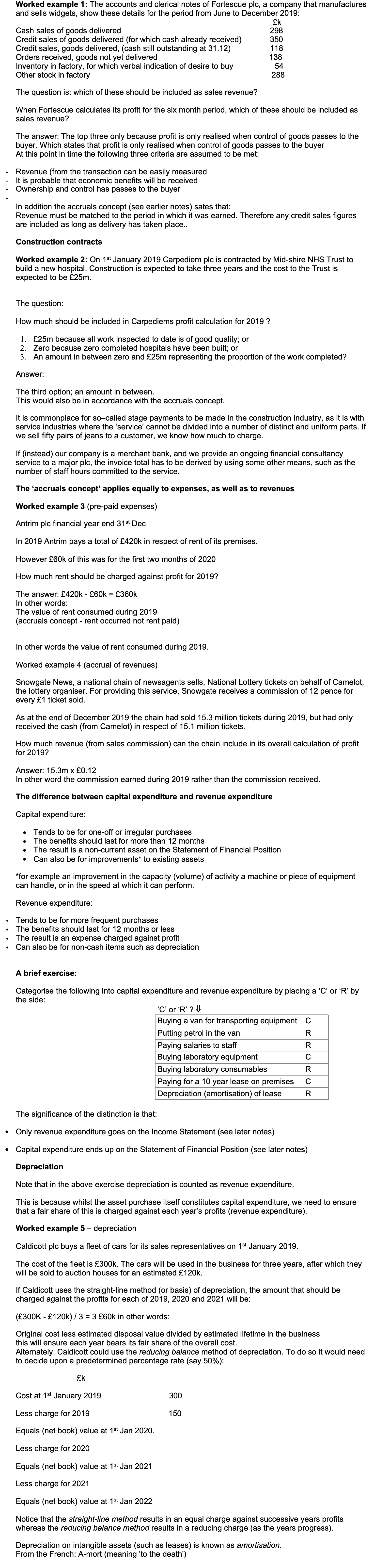

Worked example 1: The accounts and clerical notes of Fortescue plc, a company that manufactures and sells widgets, show these details for the period from June to December 2019:

£k

Cash sales of goods delivered 298

Credit sales of goods delivered (for which cash already received) 350

Credit sales, goods delivered, (cash still outstanding at 31.12) 118

Orders received, goods not yet delivered 138

Inventory in factory, for which verbal indication of desire to buy 54

Other stock in factory 288

The question is: which of these should be included as sales revenue?

When Fortescue calculates its profit for the six month period, which of these should be included as sales revenue?

The answer: The top three only because profit is only realised when control of goods passes to the buyer. Which states that profit is only realised when control of goods passes to the buyer

At this point in time the following three criteria are assumed to be met:

Revenue (from the transaction can be easily measured

It is probable that economic benefits will be received

Ownership and control has passes to the buyer

In addition the accruals concept (see earlier notes) sates that:

Revenue must be matched to the period in which it was earned. Therefore any credit sales figures are included as long as delivery has taken place..

Construction contracts

Worked example 2: On 1st January 2019 Carpediem plc is contracted by Mid-shire NHS Trust to build a new hospital. Construction is expected to take three years and the cost to the Trust is expected to be £25m.

The question:

How much should be included in Carpediems profit calculation for 2019 ?

£25m because all work inspected to date is of good quality; or

Zero because zero completed hospitals have been built; or

An amount in between zero and £25m representing the proportion of the work completed?

Answer:

The third option; an amount in between.

This would also be in accordance with the accruals concept.

It is commonplace for so–called stage payments to be made in the construction industry, as it is with service industries where the ‘service’ cannot be divided into a number of distinct and uniform parts. If we sell fifty pairs of jeans to a customer, we know how much to charge.

If (instead) our company is a merchant bank, and we provide an ongoing financial consultancy service to a major plc, the invoice total has to be derived by using some other means, such as the number of staff hours committed to the service.

The ‘accruals concept’ applies equally to expenses, as well as to revenues

Worked example 3 (pre-paid expenses)

Antrim plc financial year end 31st Dec

In 2019 Antrim pays a total of £420k in respect of rent of its premises.

However £60k of this was for the first two months of 2020

How much rent should be charged against profit for 2019?

The answer: £420k - £60k = £360k

In other words:

The value of rent consumed during 2019

(accruals concept - rent occurred not rent paid)

In other words the value of rent consumed during 2019.

Worked example 4 (accrual of revenues)

Snowgate News, a national chain of newsagents sells, National Lottery tickets on behalf of Camelot, the lottery organiser. For providing this service, Snowgate receives a commission of 12 pence for every £1 ticket sold.

As at the end of December 2019 the chain had sold 15.3 million tickets during 2019, but had only received the cash (from Camelot) in respect of 15.1 million tickets.

How much revenue (from sales commission) can the chain include in its overall calculation of profit for 2019?

Answer: 15.3m x £0.12

In other word the commission earned during 2019 rather than the commission received.

The difference between capital expenditure and revenue expenditure

Capital expenditure:

Tends to be for one-off or irregular purchases

The benefits should last for more than 12 months

The result is a non-current asset on the Statement of Financial Position

Can also be for improvements* to existing assets

*for example an improvement in the capacity (volume) of activity a machine or piece of equipment can handle, or in the speed at which it can perform.

Revenue expenditure:

Tends to be for more frequent purchases

The benefits should last for 12 months or less

The result is an expense charged against profit

Can also be for non-cash items such as depreciation

A brief exercise:

Categorise the following into capital expenditure and revenue expenditure by placing a ‘C’ or ‘R’ by the side:

‘C’ or ‘R’ ? ß

Buying a van for transporting equipment | C |

Putting petrol in the van | R |

Paying salaries to staff | R |

Buying laboratory equipment | C |

Buying laboratory consumables | R |

Paying for a 10 year lease on premises | C |

Depreciation (amortisation) of lease | R |

The significance of the distinction is that:

Only revenue expenditure goes on the Income Statement (see later notes)

Capital expenditure ends up on the Statement of Financial Position (see later notes)

Depreciation

Note that in the above exercise depreciation is counted as revenue expenditure.

This is because whilst the asset purchase itself constitutes capital expenditure, we need to ensure that a fair share of this is charged against each year’s profits (revenue expenditure).

Worked example 5 – depreciation

Caldicott plc buys a fleet of cars for its sales representatives on 1st January 2019.

The cost of the fleet is £300k. The cars will be used in the business for three years, after which they will be sold to auction houses for an estimated £120k.

If Caldicott uses the straight-line method (or basis) of depreciation, the amount that should be charged against the profits for each of 2019, 2020 and 2021 will be:

(£300K - £120k) / 3 = 3 £60k in other words:

Original cost less estimated disposal value divided by estimated lifetime in the business

this will ensure each year bears its fair share of the overall cost.

Alternately. Caldicott could use the reducing balance method of depreciation. To do so it would need to decide upon a predetermined percentage rate (say 50%):

£k

Cost at 1st January 2019 300

Less charge for 2019 150

Equals (net book) value at 1st Jan 2020.

Less charge for 2020

Equals (net book) value at 1st Jan 2021

Less charge for 2021

Equals (net book) value at 1st Jan 2022

Notice that the straight-line method results in an equal charge against successive years profits whereas the reducing balance method results in a reducing charge (as the years progress).

Depreciation on intangible assets (such as leases) is known as amortisation.

From the French: A-mort (meaning 'to the death')