Economic Way of Thinking - 5. Supply and demand, a process of coordination

- Specialization is what distinguishes every wealthy society in the world.

- People have some skills but they also remain ignorant of countless other skills.

- People cooperate to produce goods.

- The government encourages this by enforcing property rights.

- Market prices convey useful information.

The market is a process of plan coordination

- Some people think of the market as a place.

- Journalists refer to it as a person metaphorically.

- Economists refer to it as a mechanical thing.

- The market is a process of plan coordination among sellers and buyers.

- When economists use the terms supply and demand, they are talking about continual negotiations among individuals.

The basic process and market clearing

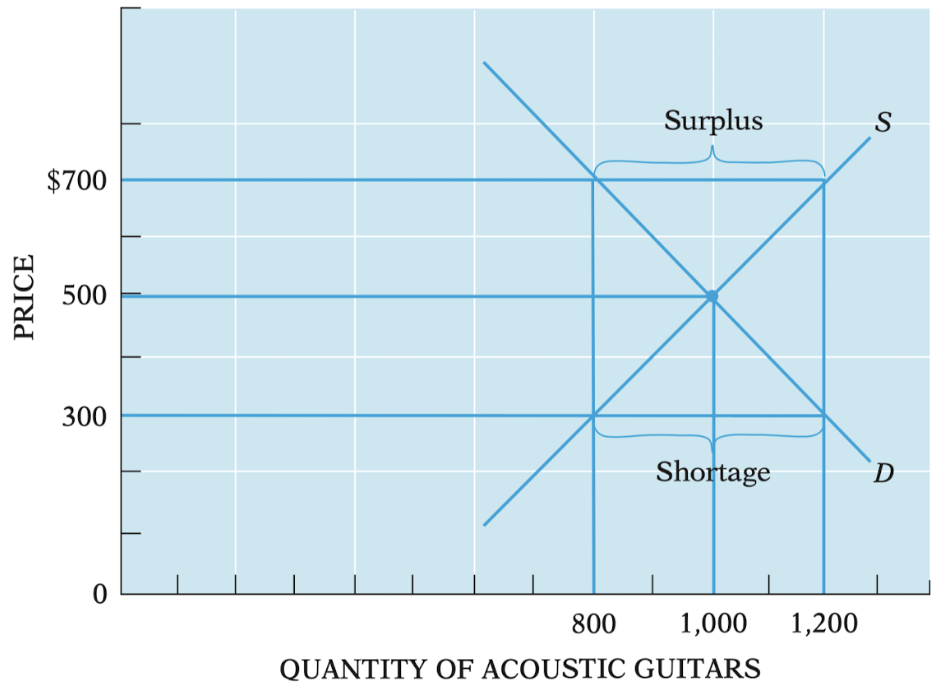

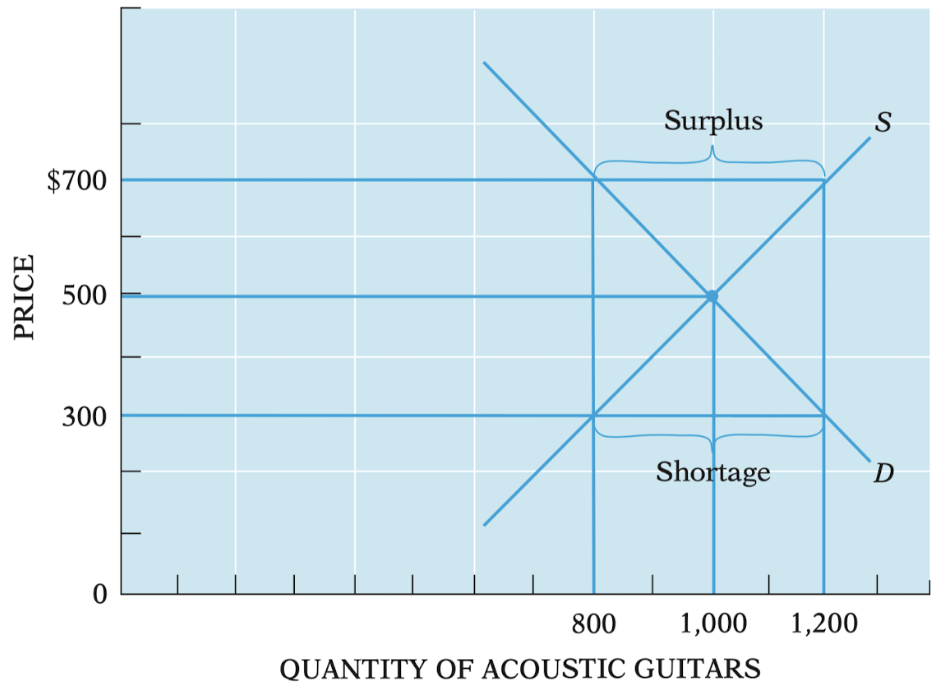

- Where the supply and demand curves intersect, the buyers and producers are fully coordinated.

- This is the equilibrium price: the forces of supply and demand have worked themselves out.

- Also referred to as the market-clearing price.

- Free markets for any good or service show a tendency to clear.

- A surplus occurs when the quantity supplied is greater than the quantity demanded.

- Frustrated sellers because they have inventory that didn't sell.

- They will cut prices to sell more.

- A shortage occurs when the quantity demanded is greater than the quantity supplied.

- Frustrated buyers because it ran out before they could buy.

- They will offer a higher price, to which producers will respond by producing more.

- Prices tend to rise during shortages and fall during surplus.

- Buyers compete with buyers and sellers with sellers

- This is because sellers and buyers mutually benefit each other through exchange.

Changing market conditions

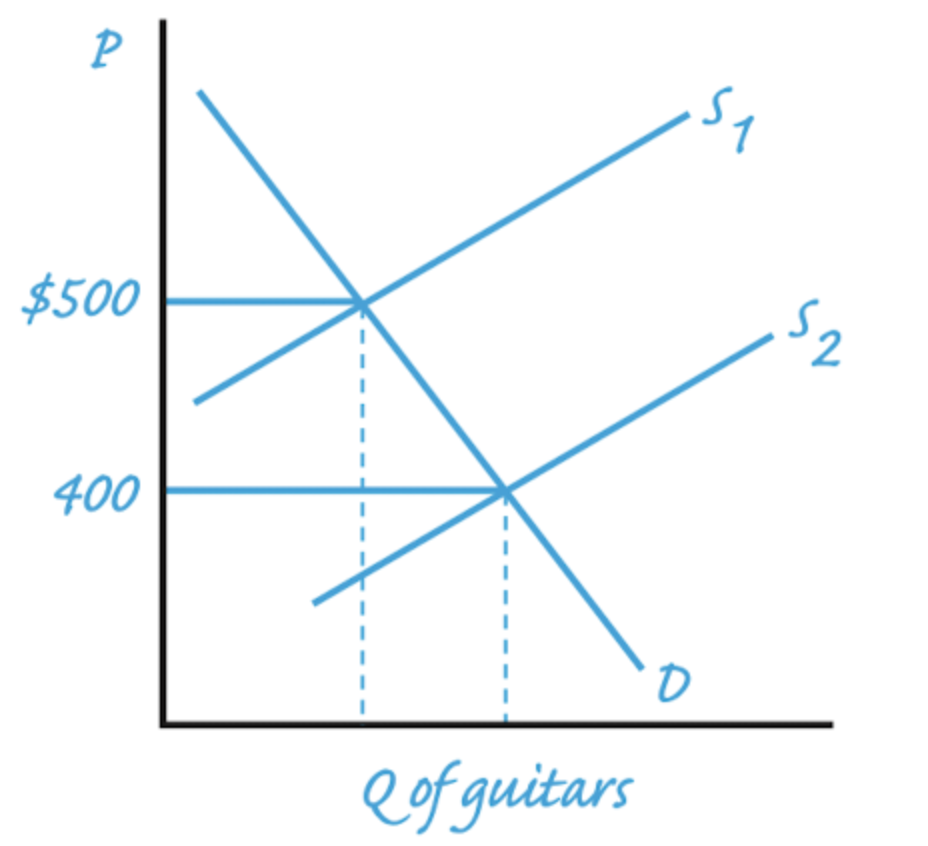

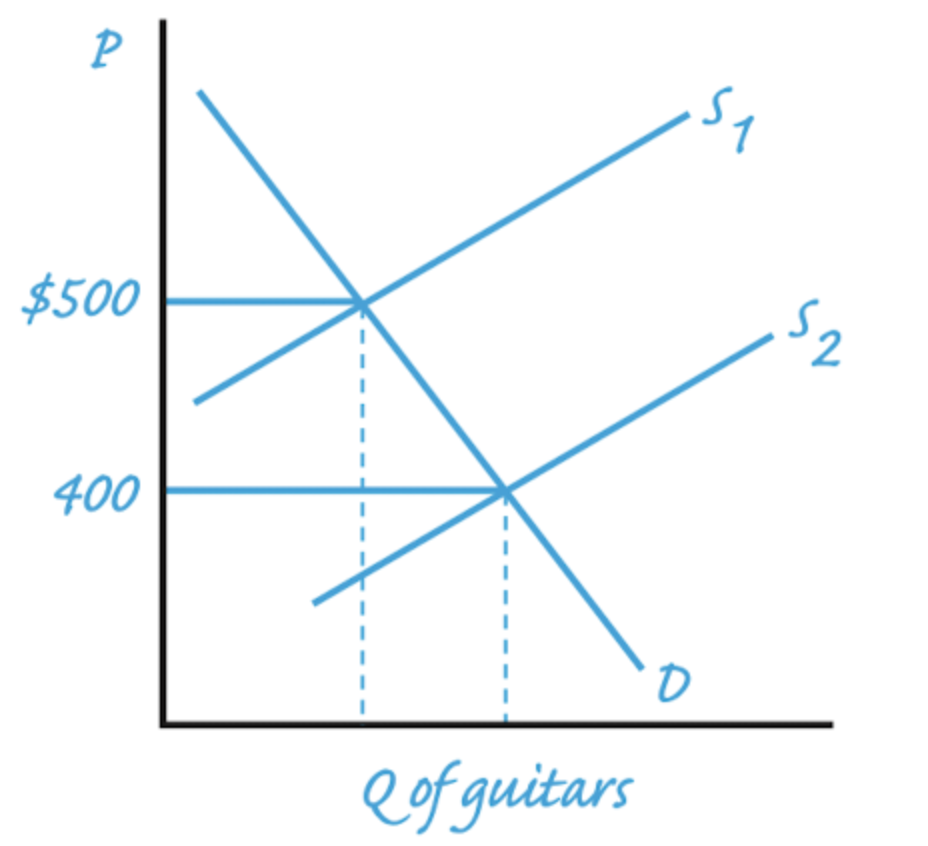

- When the curve of supply or demand shifts, the equilibrium price does too.

Learning from free market prices

- Scarcity is a relationship between desirability and availability, o between demand and supply.

- People mistakenly blame high prices for the scarcity of certain goods and act as if scarcity could be eliminated by enforcing price controls.

- A good is scarce when people cannot obtain as much of it as they would like without being required to sacrifice something else of value.

- Market prices inform of relative scarcities.

- Scarcity is not the same as rarity.

- Rarity means that it is available in a small quantity, while scarcity depends on desirability.

- Competition results from scarcity, and can be eliminated only with the elimination of scarcity

- The elimination of it occurs when people strive to meet the criteria that are being used to determine who gets what.

- The criteria used make a difference (using money vs grades).

Central planning and the knowledge problem

- The economic task for a society is to secure coordination among people in using what is available to obtain what is wanted.

- In a socialist economy, markets and the use of money would be abolished.

- If the government decides on the use of resources, prices can't give signals con the effective use of those resources.

- Economic calculation informs people of the relative scarcity of goods and services.

- A socialist economy abolishes this calculation because there are no money and market pricing.

- Lack of market pricing also creates significant transaction costs and failures of cooperation among suppliers and demanders.

- Example: unharvested food rotted while store shelves were empty in the URSS. There was no incentive to spend resources on harvesting, and there were no property rights to say who had the authority to harvest it.

The coordinating roles of money

- Money is a general medium of exchange.

- It lowers transaction costs.

- In an economic system limited to barter, people would have to spend a tremendous amount of time searching for others with whom they could make a trade.

- Aware of the high transaction costs attached to almost every exchange, people would increasingly try to produce for themselves most of whatever they wanted.

- Specialization would decline dramatically in a society confined to barter

- Another advantage is that the amount of money offered in exchange can be adjusted up or down by very small or very large amounts.

- Example: must someone trade a whole guitar for, say, 10 concert tickets, and then find ways to exchange the extra tickets for a six-pack, a burger, and so on?

- Reminder: the crucial importance of money prices to the working of our society implies nothing about the character or morality of our citizens.

Interest

- Interest is not the price of money.

- Interest is paid for borrowing money.

- Borrowing: obtaining purchasing power that we have not yet earned.

- Interest is the difference in value between present and future goods.

- Current resources are generally more valuable than future resources because having them usually expands one’s opportunities.

- We tend to place a higher value on present enjoyment than on enjoyment in the distant future.

- Except if we prefer to not use something right to exchange it for something bettwe in the future.

- Interest is paid to induce people to give up present enjoyment of goods.

- A promised return of interest on a loan compensates for the lender’s own opportunity cost.

- Highly credit-worthy customers generally pay lower interest rates compared to those with a weaker credit record.

- It is a kind of insurance premium that the bank collects from the borrower in anticipation of losses through costs of collection and defaults.

- Interest rates also incorporates an additional amount to compensate the lender for any expected decrease in the purchasing power of money (inflation).

- Nominal: the acutal, quoted rate spelled out in the loan.

- Real interest rate = nominal - rate of inflation.

Summary

- The coordination of decisions in a society characterized by extensive division of labor is a task of enormous complexity, requiring the continuous daily negotiation, renegotiation, and monitoring of millions of agreements to exchange.

- The market is best thought of as a process of plan coordination, rather than being depicted as a person, place, or thing. Supply and demand is the process of interaction through which relative prices are determined. It is a process of mutual adjustment and accommodation.

- Markets clear when the plans of buyers are coordinated with the plans of sellers, in other words, when quantity demanded equals quantity supplied. When a price is below its market-clearing level, a shortage occurs, defined as quantity demanded exceeding quantity supplied. The market price will tend to increase, thereby reducing the shortage. When a price is above its market-clearing level, a surplus occurs, defined as quantity supplied exceeding quantity demanded. The market price will tend to decrease, thereby reducing the surplus. Market clearing is an unintended outcome of buyers and sellers pursuing their own objectives. Economists are helpful in explaining how this process works; economists aren’t necessary, however, for free markets to work effectively.

- Exchange is a cooperative activity. Buyers and sellers cooperate with one another by agreeing to the terms of trade. Buyers compete with buyers by bidding up prices, or finding other nonmonetary ways to gain access to scarce goods, which is evident during a shortage. Sellers compete with sellers in their search for profit. During shortages they typically compete by reducing their prices.

- Rarity shouldn’t be confused with scarcity. Something is rare if it exists in relatively small quantities, such as a Prychitko autographed baseball or a Boettke autographed tennis racket.

- Scarcity is a relationship between availability and desirability, or between supply and demand. A good ceases to be scarce only when people can obtain all they want at a zero opportunity cost to themselves.

- In a world of scarcity, rules of the game, including discriminatory criteria, must evolve or be designed to determine who gets what. Competition is the attempt to satisfy whatever discriminatory criteria are being used.

- Prices established in an open market process transmit important information regarding the relative scarcities of goods and services. By attempting officially to abolish private ownership, money, and markets, centrally planned economies also destroyed precisely those market signals that allow people to discover their comparative advantage and effectively coordinate their production and consumption plans.

- An effective market economy features numerous institutions that have evolved to reduce transaction costs and thus facilitate voluntary exchange. Transaction costs are the costs of arranging contracts or transaction agreements between suppliers and demanders. Money is a general medium of exchange that reduces transaction costs. A corresponding system of money prices that change readily in response to changing conditions of supply and demand transmits the kind of information that allows for people to coordinate their plans efficiently in highly specialized economic systems.

- In its most general sense, interest represents the difference in value between present and future goods. Another way of stating this is that people display a positive rate of time preference: other things constant, an individual would prefer enjoyment of a good sooner rather than later in time. This is one reason why people are willing to pay interest to borrow money from others, to gain present command of goods. It’s also the reason why people will ask for an interest return—for they will be induced to give up some present command of goods if they can be compensated with more in the future.

- Market rates of interest are determined by the supply and demand for credit. The interest rate itself is not the price of money, but rather the terms of the loan. The specific terms will include a premium for the risk-factor of the loan, and a premium for the expected rate of inflation. The real rate of interest is calculated by subtracting that expected rate of inflation from the nominal rate of interest