[5: Sept. 27, 2025] Corporate Income Tax

Deductions from gross income

Exception - taxpayers earning compensation income arising from personal services rendered under an employer-employee relationship

A. Expenses

1. Necessary expenses

reasonable allowance for salaries, wages

travel expenses

rentals

entertainment expenses connected to development of the trade

Substantiation requirements - need evidence

Bribes (lol as if)

2. Expenses allowable under private educational institutions

deduct expenditures considered as outlays

deduct allowance for depreciation

B. Interest

interest is deductible but reduced by amt equal to 38%

exceptions:

indebtedness on which interest is paid in advance through discount or otherwise

General Deferral: The interest is not allowed as a deduction in the year it's paid in advance.

Deduction Trigger: It's allowed as a deduction in the year the indebtedness is paid.

If both the taxpayer and the person to whom the payment has been made or is to be

made are persons specified under Section 36 (B);

Optional Treatment of Interest Expense. - At the option of the taxpayer, interest incurred to acquire property used in trade business or exercise of a profession may be allowed as a deduction or treated as a capital expenditure.

optional choice - interest incurred to acquire property used in trade business can be a deduction or capital expenditure

C. Taxes

(1) In General. - Taxes paid or incurred within the taxable year in connection with the taxpayer's profession, trade or business, shall be allowed as deduction except:

income tax under this title etc

(3) Credit Against Tax for Taxes of Foreign Countries.

D. Losses

1. In General.- Losses actually sustained during the taxable year and not compensated for by insurance or other forms of indemnity

No loss shall be allowed as a deduction under this Subsection if at the time of the filing of the return, such loss has been claimed as a deduction for estate tax purposes in the estate tax return. (only once lang)

2. Proof of Loss

the losses deductible shall be those actually sustained during the year incurred in busines

3. Net Operating Loss Carry-Over

carried over as a deduction from gross income for the next three (3) consecutive taxable years

BUT, any net loss incurred in a taxable year during which the taxpayer was exempt from income tax shall not be allowed as a deduction under this Subsection

for mines other than oil and gas wells, a net operating loss without the benefit of incentives provided for under Executive Order No. 226, as amended, otherwise known as the Omnibus Investments Code of 1987, incurred in any of the first ten (10) years of operation may be carried over as a deduction from taxable income for the next five (5) years immediately following the year of such loss.

The entire amount of the loss shall be carried over to the first of the five (5) taxable years following the loss, and any portion of such loss which exceeds, the taxable income of such first year shall be deducted in like manner form the taxable income of the next remaining four (4) years.

4. Capital Losses

5. Losses from Wash Sales of stocks or securities

6. Wagering Losses

7. Abandonment losses

E. Bad Debts

Debts due to the taxpayer actually ascertained to be worthless and charged off within the taxable year except those not connected with profession, trade or business and those sustained in a transaction entered into between parties mentioned under Section 36

recovery of bad debts previously allowed as deduction in the preceding years shall be included as part of the gross income in the year of recovery

Securities Becoming Worthless

F. Depreciation

reasonable allowance for obsolescense

in accordance w rules by secretry of finance

straight line method

declining balance method

sum of the years digit method

agreement as to useful life on which depreciation rate is baded

H. Charitable and other contributions

Contributions or gifts actually paid or made within the taxable year to, or for the use of the Government of the Philippines or to any corporations for religious charitable purposes

Contributions deducted in full

donations to the government

certain foreign institutions

accredited non government organizations

utilization - Any amount in cash or in kind (including administrative expenses) paid or utilized to accomplish one or more purposes for which the accredited nongovernment organization was created or organized

to acquire an asser

pwede any amt set aside for the pupose of it can can as utilization but within 5 yrs and satisfied commissioner

valuation - based on acquisiton cost of said property

proof of deductions -needs to be verified

I. Research and Development

not chargeable to capital account

amortization of certain research and development expenditures

Chargeable to capital account but not chargeable to property of a character which is subject to depreciation or depletion.

LIMITATIONS

Any expenditure for the acquisition or improvement of land, or for the improvement of property to be used in connection with research and development of a character

Any expenditure paid or incurred for the purpose of ascertaining the existence, location, extent, or quality of any deposit of ore or other mineral, including oil or gas.

J. Pension Trusts

K. Additional Requirements for Deductibility of Certain Payments. - Any amount paid or payable which is otherwise deductible from, or taken into account in computing gross income or for which depreciation or amortization may be allowed under this Section, shall be allowed as a deduction only if it is shown that the tax required to be deducted and withheld therefrom has been paid to the Bureau of Internal Revenue in accordance with this Section 58 and 81 of this Code.

l. Optional Standard Deduction - an individual subject to tax under Section 24, other than a nonresident alien, may elect a standard deduction in an amount not exceeding forty percent (40%) of his gross sales or gross receipts, as the case maybe

M. Premium Payments on Health and/or Hospitalization Insurance of an Individual Taxpayer

Net operating loss - excess of allowable deduction over gross income of the business in a taxable year.

INCOME TAX RATES FOR CORPORATIONS

an income tax of thirty-five percent (35%) is hereby imposed upon the taxable income derived during each taxable year from all sources within and without the Philippines by every corporation (foreign? confirm w sir)

income tax on domestic corps:

Except as otherwise provided in this Code, an income tax rate of twenty-five percent (25%) effective July 1, 2020, is hereby imposed upon the taxable income derived during each taxable year from all sources within and without the Philippines by every corporation

corporations with net taxable income not exceeding five million pesos (P5,000,000.00) and with total assets not exceeding One hundred million pesos (P100,000,000.00), excluding land on which the particular business entity's office, plant, and equipment are situated during the taxable year for which the tax is imposed, shall be taxed at twenty percent (20%)

B. Proprietary Educational Institutions and Hospitals. -

Proprietary educational institutions and hospitals which are nonprofit shall pay a tax of ten percent (10%) on their taxable income except those covered by Subsection (D) hereof

But if exceeding 50% income nya due to unrelated trade, business, or other activity, a. (rule above) takes place: 25% na

unrelated trade, business, or other activity - means any trade, business or other activity, the conduct of which is not substantially related to the exercise or performance by such educational institution or hospital of its primary purpose or function

proprietary educational institution' is any private school maintained and administered by private individuals or groups with an issued permit to operate from the Department of Education, Culture and Sports (DECS) [17] , or the Commission on Higher Education (CHED), or the Technical Education and Skills Development Authority (TESDA)

Q: does this mean 10% tax ng DLSU?

C. Government-owned or -Controlled Corporations, Agencies or Instrumentalities

except the Government Service Insurance System (GSIS), the Social Security System (SSS), the Philippine Health Insurance Corporation (PHIC), the local water districts (LWDs), [19] and the Philippine Charity Sweepstakes Office (PCSO) and the Philippine Amusement and Gaming Corporation (PAGCOR), they will pay rate of tax in line w this section engaged in similar indutsry

REVENUE REGULATION

these Regulations are hereby promulgated to provide a ceiling on the amount of entertainment, amusement and recreation expense claimed by individual taxpayers engaged in business

DEFINITION OF TERMS

“Entertainment, Amusement and Recreation Expenses” - representation expenses, depreciation, rental, related to entertainment facilities

Representation expenses - incurred by a taxpayer in connection with the conduct of his trade, business or exercise of profession, in entertaining, providing amusement and recreation to, or meeting with, a guest or guests at a dining place

SHALL NOT refer to fixed representation allowances that are subject to withholding tax on wages

In the case of country, gold, sports club, etc. where the employee of taxpayer is the registered member and the expenses are paid for by the taxpayer, it is assumed expenses are fringe benefits tax unless proven otherwise

a. amount og expense

date and place of expense

purpose of expense

professional or business relationship of expense

name of person and company entertained with contact details

Entertainment facilities - yacht, vacation home, etc.; for entertainment of guests or employees

Condition to be considered an entertainment facility:

property must be owned or form part of taxpayer’s trade, or rented (With depreciation)

use ust not be restricted to specified officers or employees, or it will be fringe benefits

Guests - entities the taxpayer has direct business relations.

EXCLUDES employees, officers, partners, directors

EXCLUSIONS

1. Expenses which are treated as compensation or fringe benefits for services rendered under an employer-employee relationship, pursuant to Revenue Regulations 2-98, 3-98 and amendments thereto;

2. Expenses for charitable or fund raising events;

3. Expenses for bonafide business meeting of stockholders, partners or directors

4. Expenses for attending or sponsoring an employee to a business league or professional organization meeting;

5. Expenses for events organized for promotion, marketing and advertising including concerts, conferences, seminars, workshops, conventions, and other similar events;

6. Other expenses of a similar nature.

REQUISITES

a. It must be paid or incurred during the taxable year;

b. It must be: (i) directly connected to the development, management and

operation of the trade, business or profession of the taxpayer; or

a. directly related to or in furtherance of the conduct of his or its trade,

business or exercise of a profession;

c. It must not be contrary to law, morals, good customs, public policy or

public order;

d. It must not have been paid, directly or indirectly, to an official or

employee of the national government, or any local government unit,

or of any government owned or controlled corporation (GOCC), or of

a foreign government, or to a private individual, or corporation, or

general professional partnership (GPP), or a similar entity, if it

constitutes a bribe, kickback or other similar payment;

e. It must be duly substantiated by adequate proof. The official receipts, or

invoices, or bills or statements of accounts should be in the name of

the taxpayer claiming the deduction; and

f. The appropriate amount of withholding tax, if applicable, should have

been withheld therefrom and paid to the Bureau of Internal Revenue

CEILING

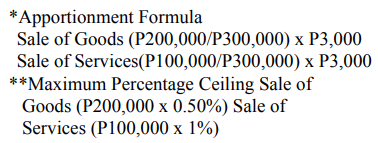

in no case shall such deduction exceed 0.50 percent (%) of net sales (i.e., gross sales less sales returns/allowances and sales discounts)

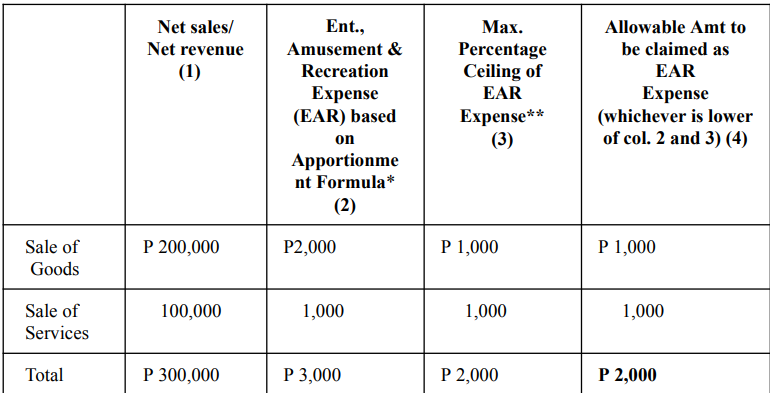

However, if the taxpayer is deriving income from both sale of goods/properties and services:

the allowable entertainment, amusement and recreation expense shall in all cases be determined based on an apportionment formula taking into consideration the percentage of the net sales/net revenue to the total net sales/net revenue, but which in no case shall exceed the maximum percentage ceiling provided in these Regulations.

Apportionment formula:

EXAMPLE

Constant formula ^

0.50% of Net Sales for taxpayers engaged in the sale of goods or properties.

1% of Net Revenue for taxpayers engaged in the sale of services.

ERA Corporation can only claim a total of P2,000

if after verification a taxpayer is found to have shifted the amount of the entertainment, amusement and recreation expense to any other expense in order to avoid being subjected to the ceiling herein prescribed, the amount shifted shall be disallowed in its totality

REPORTING

Taxpayer uses title “entertainment, amusement and recreation expense”, or disclose in the notes to the financial statements

REPEALING CLAUSE

MINIMUM CORPORATE INCOME TAX

DOMESTIC CORPORATIONS

A minimum corporate income tax of two percent (2%) of the gross income as of the end of the taxable year

Any excess of the minimum corporate income tax over the normal income tax will be carried forward for the three immediately succeeding taxable years

Relief from the Minimum Corporate Income Tax Under Certain Conditions

prolonged labor dispute, force majeure, legitimate business reverses

Gross income - gross sales less sales returns, discounts and allowances and cost of goods sold

COGS - all business expenses directly incurred to produce the merchandise to bring them to their present location and use

For trading or merchandising - include invoice COGS + import duties + freight

Manufacturing concern - all costs of production of finished goods, such as raw materials used, direct labor and manufacturing overhead, freight cost, insurance premiums and other costs incurred

For taxpayers engaged in sale of service:

gross income - gross receipts less sales returns, allowances, discounts and cost of services

cost of services - all direct costs and expenses necessarily incurred to provide the services

a. salaries and employee benefits of personnel, consultants and specialists directly rendering the service

b. cost of facilities directly utilized in providing the service such as depreciation or rental of equipment used and cost of supplies

if bank, include interest expense

CHAMBER OF REAL ESTATE AND BUILDERS' ASSOCIATIONS, INC., Petitioner, vs. THE HON. EXECUTIVE SECRETARY ALBERTO ROMULO, THE HON. ACTING SECRETARY OF FINANCE JUANITA D. AMATONG, and THE HON. COMMISSIONER OF INTERNAL REVENUE GUILLERMO PARAYNO, JR., Respondents.

CONCEPT AND RATIONALE OF MCIT

perceived inadequacy in capturing the true income of corporations

to minimize tax evasion, tax avoidance, tax manipulation in the country and for administrative convenience.

tax shelters - over-deduction of expenses

many corporations have been paying no tax due to “losses”

SAFEGUARDS INCORPORATED INTO THE LAW

MCIT commences only on the fourth taxable year immediately following the year in which the corporation commenced its operations.

carrying forward of any excess of the MCIT paid over the normal income tax

credited against the normal income tax for the three immediately succeeding years

the law authorizes the Secretary of Finance to suspend the imposition of MCIT if a corporation suffers losses due to prolonged labor dispute, force majeure and legitimate business reverses.

CLAIMS ON VIOLATION OF DUE PROCESS

Petitioner: other major expenditures, such as administrative and interest expenses which are equally necessary to produce gross income, were not taken into account

SC Disagrees.

Taxation is an inherent attribute of sovereignty. It is a power that is purely legislative.

The legislature wields the power to define what tax shall be imposed, why it should be imposed, how much tax shall be imposed, against whom (or what) it shall be imposed and where it shall be imposed

General rule on taxation: the power to tax is plenary and unlimited in its range, acknowledging in its very nature no limits, so that the principal check against its abuse is to be found only in the responsibility of the legislature

The constitutional safeguard of due process is embodied in the fiat "[no] person shall be deprived of life, liberty or property without due process of law."

SUPPLEMENTAL EXPLANATION ON GENERAL RULE ON TAXATION

1. The Power to Tax is Vast (Plenary and Unlimited)

The Big Idea: The government's right to take your money (taxation) is one of its most fundamental and strongest powers.

Simple Translation: When the legislature (Congress or Parliament) decides to create a tax, there's practically nothing stopping them from a legal standpoint in terms of how much they tax or what they tax. They have the right to tax everything and everyone within their borders.

2. The Main Check on Abuse is Political, Not Legal

The Principal Check: The only real limit on a legislature making a ridiculously high or unfair tax is that they have to answer to the voters.

Simple Translation: If Congress taxes you too much, you don't call a lawyer; you vote them out. The public is the ultimate watchdog because they are the ones who pay the taxes. This is called the responsibility of the legislature to its constituency.

3. Limits are Still in Place (Constitutional Limitations)

Nevertheless, it is circumscribed by constitutional limitations: Even though the power to tax is vast, the Constitution still places guardrails on it.

Simple Translation: The legislature can't pass a tax law that violates your fundamental rights. For example, a tax law must be:

Equal (everyone in the same situation is taxed the same way).

Due Process (you must be given fair notice and a chance to contest the tax).

Public Purpose (the money must be for the benefit of the public, not for a private individual).

4. Tax Laws Are Presumed Good

Tax legislation carries a presumption of constitutionality: When a tax law is challenged in court, the court starts with the belief that the law is valid and legal.

Simple Translation: If you sue the government claiming a tax law is unfair or unconstitutional, the burden of proof is on you. You have to show very clearly that the law violates the Constitution; the court won't automatically assume the tax is wrong.

Petitioner is correct in saying that income is distinct from capital - Capital is a fund or property existing at one distinct point in time while income denotes a flow of wealth during a definite period of time.

Requisites for income to be taxable:

(1) there must be gain; (2) the gain must be realized or received and (3) the gain must not be excluded by law or treaty from taxation

Certainly, an income tax is arbitrary and confiscatory if it taxes capital because capital is not income. In other words, it is income, not capital, which is subject to income tax

IS MCIT AN ADDITIONAL TAX IMPOSITION?

It is imposed in lieu of the normal net income tax, and only if the normal income tax is suspiciously low.

The MCIT merely approximates the amount of net income tax due from a corporation, pegging the rate at a very much reduced 2% and uses as the base the corporation’s gross income.

US has a similar alternative minimum tax (AMT) system - lower tax rate but broader tax base.

American courts have also emphasized that Congress has the power to condition, limit or deny deductions from gross income in order to arrive at the net that it chooses to tax.56 This is because deductions are a matter of legislative grace

Absent any other valid objection, the assignment of gross income, instead of net income, as the tax base of the MCIT, taken with the reduction of the tax rate from 32% to 2%, is not constitutionally objectionable

Taxation is necessarily burdensome because, by its nature, it adversely affects property rights.

WHAT HAPPENS IF A CORPORATION HAS ZERO OR NEGATIVE TAXABLE INCOME?

(1) Imposition of the Tax. — xxx The MCIT shall be imposed whenever such corporation has zero or negative taxable income or whenever the amount of [MCIT] is greater than the normal income tax due from such corporation.

MCIT vs normal income tax due, which is greater applies.

SUPPLEMENTARY EXPLANATION

The Core Issue: Due Process and Gross Income

The petitioner's central argument against Revenue Regulation (RR) 9-98 is that the MCIT is a deprivation of property without due process because it is a tax on Gross Income (sales minus cost of goods sold/services) rather than on Net Income (gross income minus all deductible operating expenses).

Petitioner's View: A proper income tax should only be imposed when there is actual profit. Imposing the MCIT when a company has a loss (negative taxable income) or zero profit unfairly takes property when no wealth was actually gained, thus violating due process.

Government/RR 9-98's View (The Defense): RR 9-98 is simply implementing the law (Section 27(E) of the NIRC), which states that MCIT is calculated as 2% of Gross Income and is imposed whenever a corporation has zero or negative taxable income. This method is consistent with the law's intent to set a floor on corporate tax payments.

Understanding the Comparison (The Last Two Lines)

Your interpretation is correct. The MCIT is a floor tax that is compared to the normal tax. The rule is indeed: pay the higher of the two.

The last two confusing lines are attempting to reconcile the purpose of the MCIT (setting a minimum floor) with the petitioner's complaint (the calculation seems illogical for a loss company).

Formula | Description |

Normal Income Tax (NIT) | Taxable Net Income×Normal Tax Rate |

Minimum Corporate Income Tax (MCIT) | Gross Income×2% |

The law requires the corporation to pay: The higher of NIT or MCIT.

The Confusing Lines Explained:

"But the law also states that the MCIT is to be paid only if it is greater than the normal net income."

This line is slightly misphrased in the text. It should say: "...the MCIT is to be paid only if it is greater than the Normal Income Tax (NIT) due."

This is the standard comparison rule: If the calculated MCIT is a higher number than the calculated NIT for the year, the MCIT is the amount the taxpayer must pay.

"Obviously, it may well be the case that the MCIT would be less than the net income of the corporation which posts a zero or negative taxable income."

This line is trying to show how a company with a loss is still forced to pay MCIT.

If a company has a loss, its NIT is zero or negative.

The MCIT will be a positive number (because gross income is usually positive).

Since the MCIT>NIT (positive number is greater than zero/negative), the taxpayer pays the MCIT.

This highlights the petitioner's complaint: The company with a loss is still being forced to pay an income tax, which they argue is a violation of due process.