B4002 - Chapter 11

Translation and Consolidation of Foreign Operations

November 20, 2023

Introduction

Consolidated FS are required when one entity has control over another entity

With the global economy, it is now very common for a subsidiary to be in a foreign country

Most Canadian public companies have subsidiaries in foreign countries

Foreign currency denominated FS must be translated to the presentation currency of the reporting entity

Major issues related to the translation process:

(1) What the function currency of the foreign operation is

(2) What the presentation currency of the parent company is

(3) Where the resulting translation adjustment should be reported in the consolidated FS

Accounting Exposure vs Economic Exposure

Foreign currency exposure is the risk that a loss (or gain) could occur as a result of changes in foreign exchange rates

Foreign currency risk can be viewed from different perspectives:

(1) Translation exposure (accounting exposure)

This is what we translated last time vs what we translated today

(2) Transaction exposure

(3) Economic exposure

You would think in theory that our gain/loss is the difference, but these values change

Translation Exposure

Translation exposure results from the translation of foreign-currency-denominated FS into Canadian dollars, giving rise to exchange gains and losses

Only those FS items translated at the closing rate or forward rate create an accounting exposure since the Canadian dollar value of those items changes every time the exchange rate changes

The value of items translated using the historical rate is fixed and does not fluctuate with rate changes

Positive translation adjustments increase shareholders’ equity, whereas negative translation adjustments decrease shareholders’ equity

Accounting exposure exists when FS items are translated at the c losing rate or the forward rate

A foreign operation has a net asset exposure when assets translated at the closing or forward exchange rate are larger in amount than liabilities translated at the closing or forward exchange rate

A net liability exposure exists when liabilities translated at the closing or forward exchange rate at larger than assets translated at the closing or forward exchange rate

Transaction Exposure

Transaction exposure represents the foreign exchange loss/gain that can occur between the time of entering a transaction (ex: sale or purchase) involving a foreign currency denominated receivable or payable, and the time of settling it in cash with the customer or vendor

Note: refer to discussion and examples in chapter 10

The resulting cash gains/losses are realized and affect the enterprise’s working capital and earnings

Economic Exposure

Economic exposure is the risk that the economic value of the entity could decrease due to the occurrence of a future event (ex: change in foreign exchange rates)

Economic value, theoretically speaking, is the PV of the future cash flows

Practically speaking, it is difficult to measure the impact on economic value because it is affected by so many variables

When exchange rates change, it could affect the cost of purchases, the selling price of sales, the volume of sales, interest rates, inflation rates, and so on

Economic exposure exists when the PV of future cash flows would change as a result of changes in exchange rates; it is not easy to measure

There is an inverse relationship between inflation rates and exchange rates

When inflation goes up, the value of currency goes down

When inflation goes down, the value of currency goes up

FV may be a good proxy for economic values

The FCT and PCT methods use the GAAP based BS where some items are measured at CV and some items are measured at historical cost (HC)

Neither translation method captures the true economic value of the reporting entity

Translation of Foreign Operations

IAS 21 defines a foreign operation as an entity that is a subsidiary, associate, joint arrangement or branch of a reporting entity, the activities of which are based or conducted in a country or currency other than those of the reporting entity

There are two methods used under IAS 21 to translate the FS of a foreign operation:

(1) The functional currency translation method (FCT) is used to translate the FS of a foreign operation from its recording currency to tis functional currency

(2) The presentation currency translation method (PCT) is used when the functional currency of the subsidiary is different from the parent’s presentation currency

Indicators for Evaluating a Foreign Operation

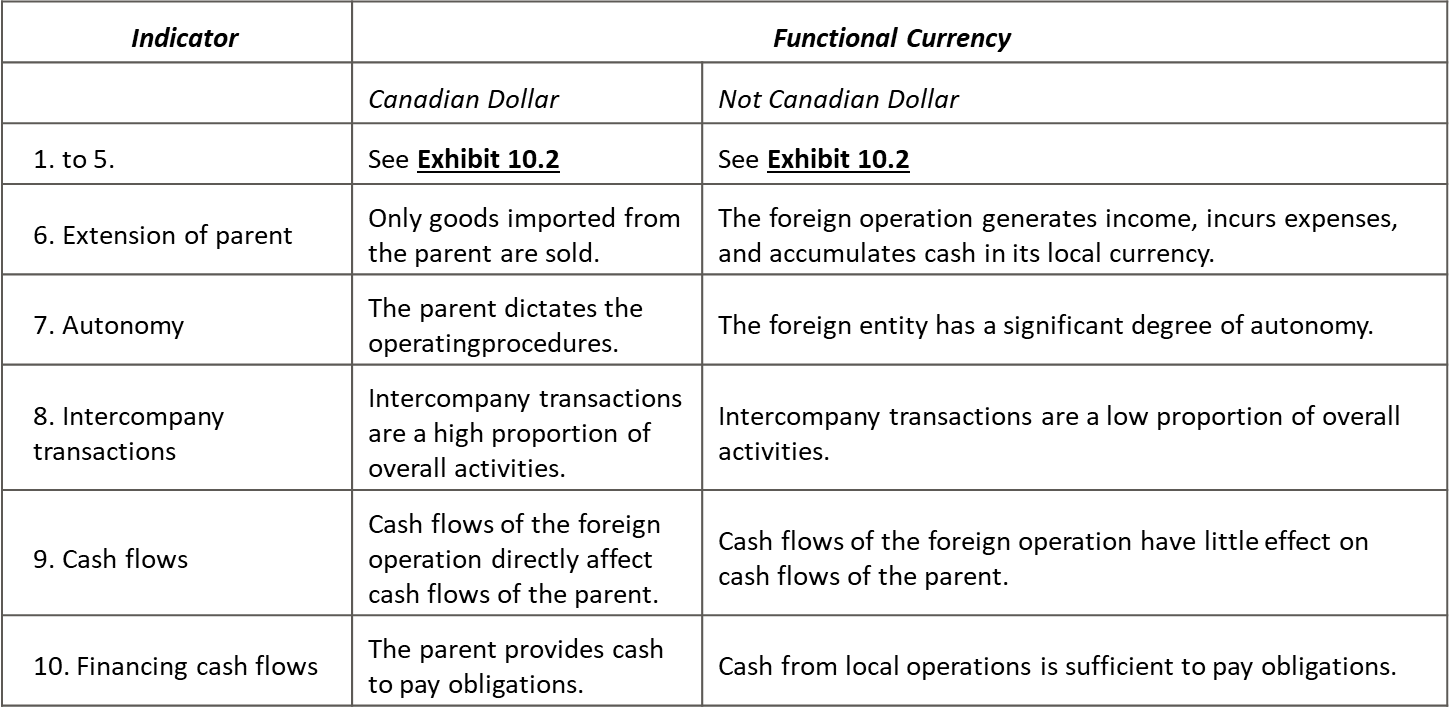

Exhibit 11.2 – the indicators determine whether the foreign operation is highly integrated with the Canadian operations

The Functional Currency Translation Method

We will assume that the foreign operation’s functional currency is the Canadian dollar

The FCT method give the same results as if the transactions had occurred in Canadian dollars in the first place

Use historical exchange rates to translate revenues and expenses

Use average rates to approximate historical exchange rates throughout the period

Use historical rates to measure expenses based on the historical cost of the related BS items

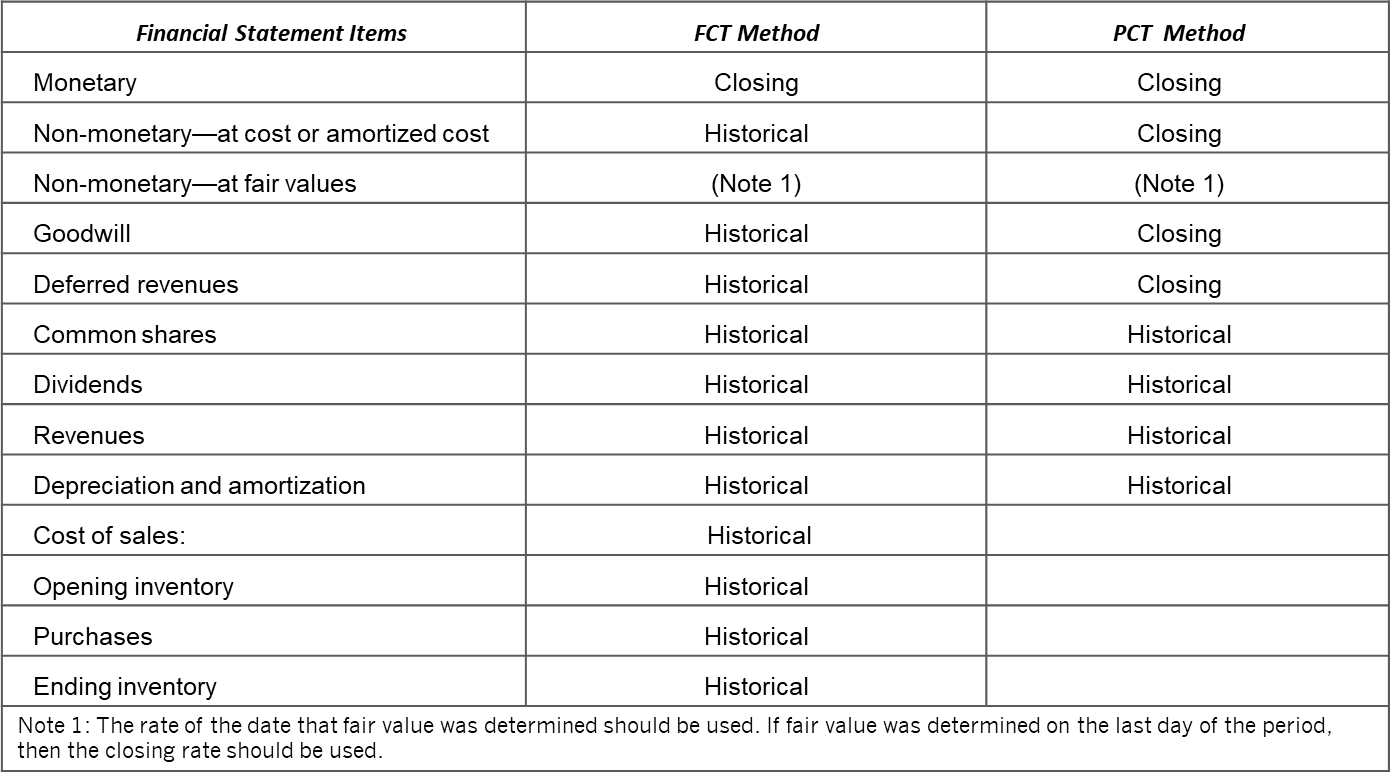

Exhibit 11.13 –

This specifies the rates to be used for various FS items under the FCT method and PCT method

For depreciation, historical rate for the FCT method is the rate when the asset was acquired, whereas for the PCT method it is the rate when expense was incurred

When the parent acquires the subsidiary, the parent indirectly buys all of the net assets of the subsidiary

For consolidation purposes, we never use an exchange rate older than the rate at the date of acquisition

Shareholders’ equity accounts are translated at historical rates

COGS and depreciation expense are translated using the historical rates of the related BS accounts

Assets to be reported at FV are translated at the closing rate and assets to be reported at cost are translated at the historical rates

Exchange gains or losses only occur on items translated at the closing rate

The exchange gain/loss is reported in net income under the FCT method

The Presentation Currency Translation Method

This method is used for translating a foreign operation from its function currency to a different presentation currency

All asset and liabilities should be translated at the closing rate

This method is much simpler than the FCT method because it uses the same rate for all assets and liabilities

This maintains the relationship between assets and liabilities when switching from the functional currency to the presentation currency

Share capital is translated at historical rates

All revenues and expenses are translated using the exchange rate in effect on the dates on which such items are recognized in income during the period

Exchange gains/losses occur only on those items translated at the closing rate and only if the rates change during the period

Comparative Observations of the Two Translation Methods

Under the PCT method, the net assets position of the foreign entity is at risk from currency fluctuations, while under the FCT method it is typically the net monetary position that is at risk

A company usually has more monetary liabilities than monetary assets but has more overall assets than overall liabilities

Consolidation of Foreign Operations

The textbook illustrates the preparation of consolidated FS for Stormont and its wholly owned subsidiary, Controlada

Exhibit 11.10 – the preparation of the acquisition date consolidated BS

Exhibit 11.11 – year 2 FS of Stormont, the translated statements of Controlada using the FCT method, and the consolidated FS

Exhibit 11.12 – preparation of the consolidated FS at the end of year 2 using Controlada’s statements translated under the PCT method

Exhibit 11.13 – the consolidated statement of changes in equity for the year ended December 31, Year 2

Exhibit 11.14 – calculation of acquisition differential

Exhibit 11.15 – preparation of consolidated BS

Exhibit 11.16 – acquisition differential amortization schedule

Exhibit 11.17 – preparation of the Year 2 consolidated FS

Exhibit 11.18 – acquisition differential amortization schedule is translated

Exhibit 11.18 and 11.19 – preparation of consolidated FS for Year 2

Other Considerations

Lower of cost and net realizable value (LCNRV):

Under the FCT method, the LCNRV principle must be applied using historical cost in Canadian dollars and net realizable value in Canadian dollars

Inventory is translated at the closing rate under the PCT method and the LCNRV principle need not be applied

Intercompany profits:

The historical rate should be used in determining the intercompany profit to be eliminated

This eliminates the sale profit that was recorded in the first place

When the profit is contained in the assets of the subsidiary and the PCT method is used, the asset has been translated at the closing rate

The historical exchange rate should be used to calculate the amount of the profit

This eliminates the same profit that was recorded in the first place

However, the translated assets will not be reported at historical cost to the consolidated entity

This is one of the anomalies of the PCT method

Cash flow statement:

A cash flow statement is prepared by analyzing the change in non-cash items on the BS after they have been translated into Canadian dollars

Tax effects of exchange adjustments:

Exchange differences arising from translating the FS of a foreign operation into Canadian dollars are usually not taxable or deductible until the gains or losses are realized

Since these differences were recognized for accounting purposes but not for tax purposes, a temporary difference occurs, and deferred income taxes should be recognized in the FS of the reporting entity

Disclosure requirements:

IAS 21 requires the following disclosures for the effects of changes in foreign exchange rates related to foreign operations:

(1) The amount of exchange differences recognized in profit or loss

(2) Net exchange differences recognized in OCI

(3) When presentation currency is different from functional currency, the fact must be stated with disclosure of the functional currency and the reason for use of a different presentation currency

(4) When there is a change in the functional currency, that fact and the reason for the change in functional currency must be disclosed

In addition, IFRS 7.40 requires an entity to disclose:

(1) A sensitivity analysis for each type of market risk to which the entity is exposed at the end of the reporting period

(2) The methods and assumptions used in preparing the sensitivity analysis

(3) Changes from the previous period in the methods and assumptions used, and the reasons for such changes

Analysis and Interpretation of Financial Statements

A company must use the FCT method when translating to its functional currency and the PCT method when translating from its functional currency to a different presentation currency

Note: refer to exhibit 11.21

Exchange gains and losses are reported in net income under the FCT method and in OCI under the PCT method

The FCT method reports an exchange gain, whereas the PCT method reports an exchange loss

Profitability ratios look better under the PCT method, whereas liquidity and solvency ratios look better under the FCT method