Chapter 19 - Saving, capital formation & financial markets

Saving and wealth

Saving: current income minus spending on current needs.

Saving rate: saving divided by income.

Wealth: value of assets minus liabilities.

Assets: anything of value that one owns.

Liabilities: debts one owes.

Balance sheet: list of an economic unit's assets and liabilities on a specific a date.

Flow: measure that is defined per unit of time.

Stock: measure that is defined at a point in time.

Capital gains: increases in the value of existing assets.

Capital losses: decreases in the value of existing assets.

National saving and its components

National saving: saving of the entire economy, equal to GDP less consumption expenditures and government purchases of goods and services, or Y - C - G.

Transfer payments: payments the government makes to the public for which it receives no current goods/services in return.

Private saving: saving of the private sector of the economy is equal to the after-tax income of the private sector minus consumption expenditures (Y - T - C)

- It can be further broken down into household saving and business saving.

Public saving: saving of the government sector is equal to net tax payments minus government purchases (T - G).

Government budget surplus: excess of government tax collections over government spending (T - G)

- It equals public saving.

Government budget deficit: excess of government spending over tax collections (G - T).

Why do people save?

Life-cycle saving: saving to meet long-term objectives such as retirement, college attendance, or the purchase of a home.

Precautionary saving: saving for protection against unexpected setbacks such as the loss of a job or a medical emergency.

Bequest saving: saving done for the purpose of leaving an inheritance.

Investment and capital formation

- Any of the following factors will increase the willingness of firms to invest in new capital:

- Decline in the price of new capital goods

- Decline in the real interest rate

- Technological improvement that raises the marginal product of capital

- Lower taxes on the revenues generated by capital

- Higher relative price for the firm's output

Bonds, stocks and the allocation of savings

Bond: legal promise to repay a debt, usually including both the principal amount and regular interest, or coupon, payments.

Principal amount: amount originally lent.

Maturation date: date at which the principal of a bond will be repaid.

Coupon payments: regular interest payments made to the bondholder.

Coupon rate: interest rate promised when a bond is issued; the annual coupon payments are equal to the coupon rate times the principal amount of the bond.

Stock (or equity): claim to partial ownership of a firm.

Dividend: regular payment received by stockholders for each share that they own.

Risk premium: rate of return that financial investors require to hold risky assets minus the rate of return on safe assets.

Diversification: practice of spreading one's wealth over a variety of different financial investments to reduce overall risk.

Mutual fund: financial intermediary that sells shares in itself to the public and then uses the funds raised to buy a wide variety of financial assets.

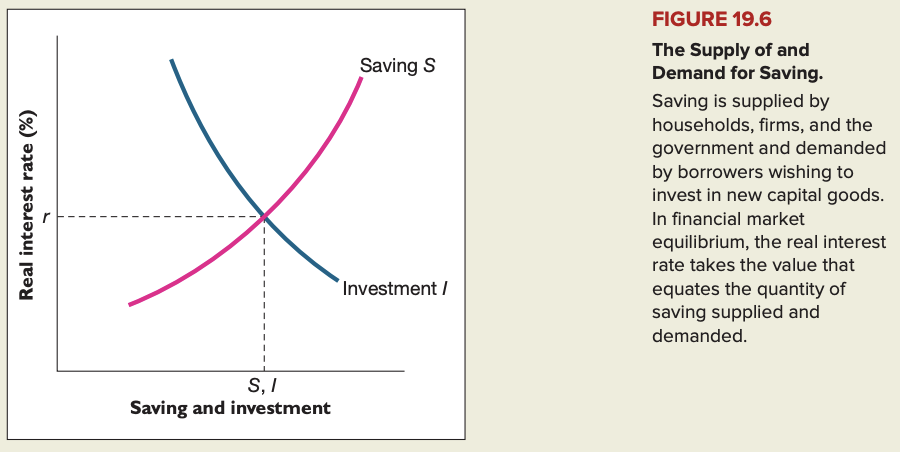

Saving, investment and financial markets

Any of the following factors will shift the demand for savings (I) to the right:

- Decline in the price of new capital goods

- Technological improvement that raises the marginal product of capital

- lower taxes on the revenues generated by capital

- Higher relative price for the firm's output

- Supply of savings will shift right if national saving, private and/or public saving, is increased.