Economics HL

Green = new unit, Yellow = new topic, Underline = new section

Real world examples at the end → demand + supply side policies (WIP)

Unit 1: What is economics?

Factors of Production

Land

natural resources

Labour

human resources

Capital

production of goods

Entrepreneurship

management, ideas

Scarcity - limited availability of economic resources relative to society’s unlimited demand for goods and services

Efficiency - maximized production using supply and based off of individual choices (demand) or making the best possible use of scarce resources

Choice - not all needs and wants can be satisfied, so choices have to be made → opp. cost

Oppurtunity cost - what you give up to have something else

Economic cost - accounting/financial cost + oppurtunity cost

Sustainability - ability of the present generation to meet its needs without compromising the ability of the future generation(s) to meet their own needs

Margin - theory of how prices are derived, derived from consuming something, not total utility but extra utility of consuming

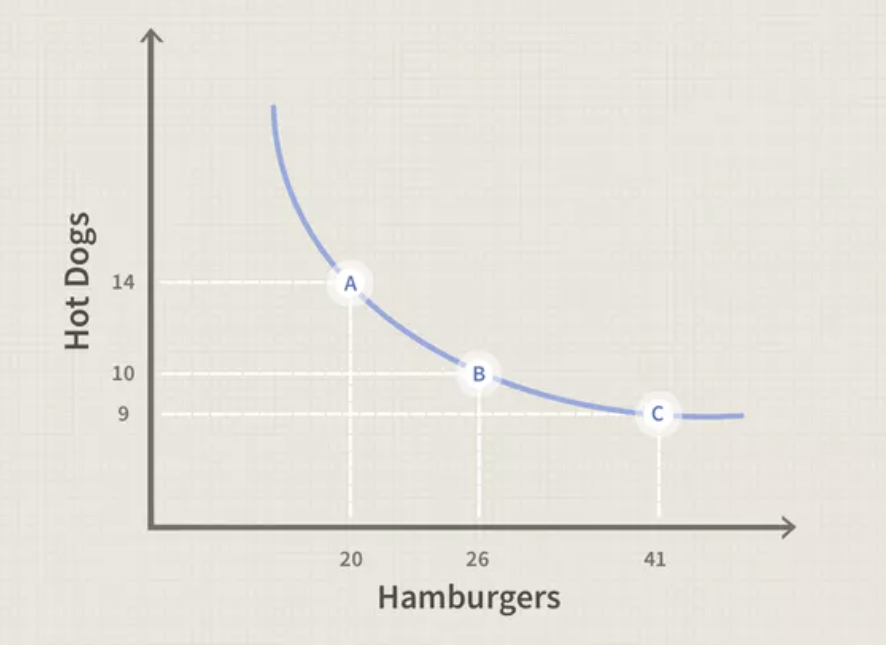

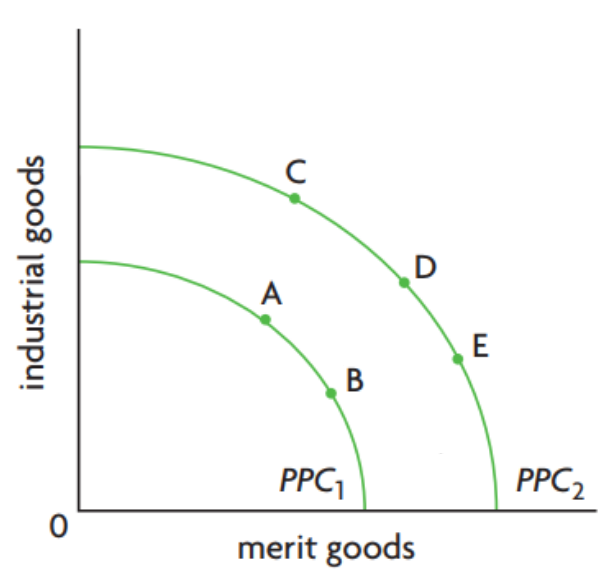

Production Possibilities Curve (PPC)

a graph which indicates the different possible choices a firm can make to maximize profit while maintaining maximum efficiency

difference between Price 1 and Price 2 is not the same as the difference between Price 2 and Price 3 (opp. cost is not equal in all scenarios)

curve is named PPF (production possibility frontier)

assumptions

technology, time and FOP are constant

only two goods are produced in this market

all of society’s income goes toward these two goods

Circular Flow Diagram

GDP = C + I + G + (X-M)

Consumption, Investment, Government, eXports, iMports

simplification of reality that takes out certain factors and makes them constant

Methodology

Positive

scientific perspective on economics (hypothesis + data/evidence)

verifiable in principle

all other things remain equal (ceteris paribus)

Normative

subjective value judgement

cannot be objectively verified/measured

nonquantifiable adjectives (important, ought to, must, etc.)

Economists

Adam Smith

the “invisible hand” is a metaphor for efficient allocation of resources by society

laissaz faire - policy of letting things run their own course

Karl Marx

labour theory of value

decreasing rates of profit and increasing concentration of wealth

more caring toward the masses

Keynes

counter-cyclical government and multiplier

argued that governments had an important management role in macroeconomics

provided a foundation for modern macroeconomics

full employment is a special case and is not frequently occuring

incentive to invest is too weak and the urge to hoard cash is too strong

without necessary investment, the economy maximizes the unfull employment which increases productivity

19th Century Classical Economic Ideas

Bentham

utilitarianism - most happiness among greatest number of people

utilty - property in any object tends to produce

benefits/advantages/pleasure/good/happiness or to prevent the opposite

Jevon

Jevon’s paradox - as technological advancements increase efficiency of labour, demand will increase thus not changing efficiency and waste

Say

Say’s Law - unemployment cannot exist for long periods because production would create its own demand

Carl Menger

subjective theory of value - in an exchange, both parties always profit as they trade something they think is less valuable for something they think is more valuable

Leon Walras

Walras’ Law - the existence of excess supply in one market must be matched by excess demand in another market so that both factors are balanced out

Milton Friedman

economic theory should be subject to empirical corroboration to test its relevance to the real world

prediction is a key factor

not the realism of the assumptions but the accuracy

Robert Lucas Jr.

individual’s rational expectations of inflation and government policies

Friedman + Lucas

the role of markets is bringing the economy back to a situation where there is full employment without any government intervention

Free Sector Diagram

Injections - investment (I), government spending (G), exports (X)

Leakages - savings (S), tax (T), imports (M)

If injections = leakages, the economy is in equilbrium/static

Behavioural Economics

Assumptions made in behavioural economic graphs

people are rational/consistent

utility is maximized

people have access to all information at all times

Thinking Fast/Slow

heurisitcs where people use rule of thumb to make quick decisions

Present Bias

people under-invest because the benefits come in the future, and people generally would want benefits in the present

Representative Individual

one person is recorded/measured and “cloned” to create a larger demographic

Nudging

preserving freedom but helping people make decisions when they cannot / don’t (default)

Hot-hand fallacy

belief that a winning streak leads to further success

Biases

overconfidence

a belief that one’s skill or judgement is better than they truly are, or that probability of success is higher than it actually is (ex: health club membership)

hyperbolic discounting

tendency of people to make the present much more important than even the near future while making economic decisions (ex: credit cards)

framing effects

endowment effect - possessing a good makes it more valuable

loss aversion - a framing bias in which consumers choose a reference point around which losses hurt more than gains feel good

anchoring - a framing bias in which a person’s decision is influenced by specific pieces of information given

sunk cost fallacy

the mistake of a sunk cost to affect decisions (ex: Robert Griffin III)

Degrowth communism

the economy is big enough already, when is the stopping point for growth?

focus growth on more important aspects such as healthcare and not consumption as it raises healthcare costs

example of Japan

Interdependence

a consideration of possible economic consequences of interdependences is essential when conducting economic anaylsis

nothing in the economy is self-sufficient, so they interact with one another (the greater the scale of interaction, the greater the interdependence)

Linear economy

take → make → waste

resource extraction → production → distribution → consumption → disposal

Circular economy

take → make/remake → distribute → use/repair/reuse → selectively dispose → enrich/recycle → take → …

aims to minimize waste and promote a sustainable use of natural resources

problems

no clear definition (too vague)

ignores scientific principles (matter/energy cannot be created or destroyed)

lack of scale (hard to scale up to global level)

Systems perspective

taking into account all of the behaviours of a system as a whole in the context of its environment

Economic efficiency

socially constructed concept with its politics and its political implications

public goal, competing with other public priorities

to improve the state of one party, you must hurt another

soceity gets maximum net benefits

Eco-efficiency

production of goods and services while using fewer resources and creating less waste/pollution

creating more value through an increase in resource productivity and a decrease in resource intensity

leads to less resource consumption

Economic Well-Being

refers to levels of prosperity, economics satisfaction and standards of living among the members of a society

Unit 2: Microeconomics

Marginal rate of substitution

MRSxy = oppurtunity cost, slope of indifference curve

A series of optimal consumer choices provides the theoretical basis for an individual demand curve

Diminishing marginal utility

as we consume more of a good, the satisfaction we derive from 1 additional unit decreases

rate of satisfaction diminishes with every 1 unit

examples: food, cars

Indifference curves

IC always has a negative slope if consumer likes both goods

IC cannot intersect

Every good can lie on one IC

ICs are not thick

Demand Theory

Substitute effect

Measures of consumer MRSxy, before and after the price change

Amount of additional food the consumer would buy to achieve the same level of utility (assuming a price decrease in one good)

Moving from one optimal curve to another

Steps:

Identify initial optimum basket of goods

Identify final optimum basket of goods, after the price change

Identify the decomposition optimum basket (DOB), attributed to the substitution effect

DOB must be on a BL that is parallel to BL2 following the price change

Assume that consumer retains same level of utility after the price change

Income effect

Accounts for price change by holding the consumer’s purchasing power (following price change) constant and finding an optimum bundle on a new (higher/lower) utility function

Purchasing power - number of goods/services that can be purchased with a unit of currency (falls when price increases)

Measured from the DOB (B and Xb) to the final optimum bundle, following price change (C and Xc)

Both effects move in the same direction

Law of Demand

At a higher price, consumers will demand a lower quantity of a good (vice versa)

Relates to diminishing marginal utility by compensating (off-set) DMU must be negatively related to quantity

Inverse relationship of price and quantity

Given the presence of diminishing marginal utility, in order to promote increased consumption, prices must fall

For a “normal good,” the increase in consumption results from a fall in price - this is driven by:

a lower MRSxy, while remaining on the same IC generates increased consumption of good X (substitute effect)

the theoretical increase in income necessary to lift the consumer to the higher IC, while keeping the ratio of prices at the new level (income effect)

Economic theory of demand always starts at the individual level. A horizontal summation of many individual demand curves provides a market demand curve. Market demand curves are always less steep than individual demand curves

Determinants of Demand

Income

Price of substitutes/complements

Number of consumers

Preference or tastes

These factors cause a market demand curve to shift (change in demand)

Individual Demand Curve

a series of optimal choice bundles across different price levels (shown on price-quantity graphs)

Inferior Good

whether the substitution effect or income effect dominates in an empirical not theoretical question

Opposite of a normal good, demand falls when income rises

Non-price determinants of demand

income (normal good)

income (inferior good)

preferences/tastes

price of substitute/complement goods

number of consumers

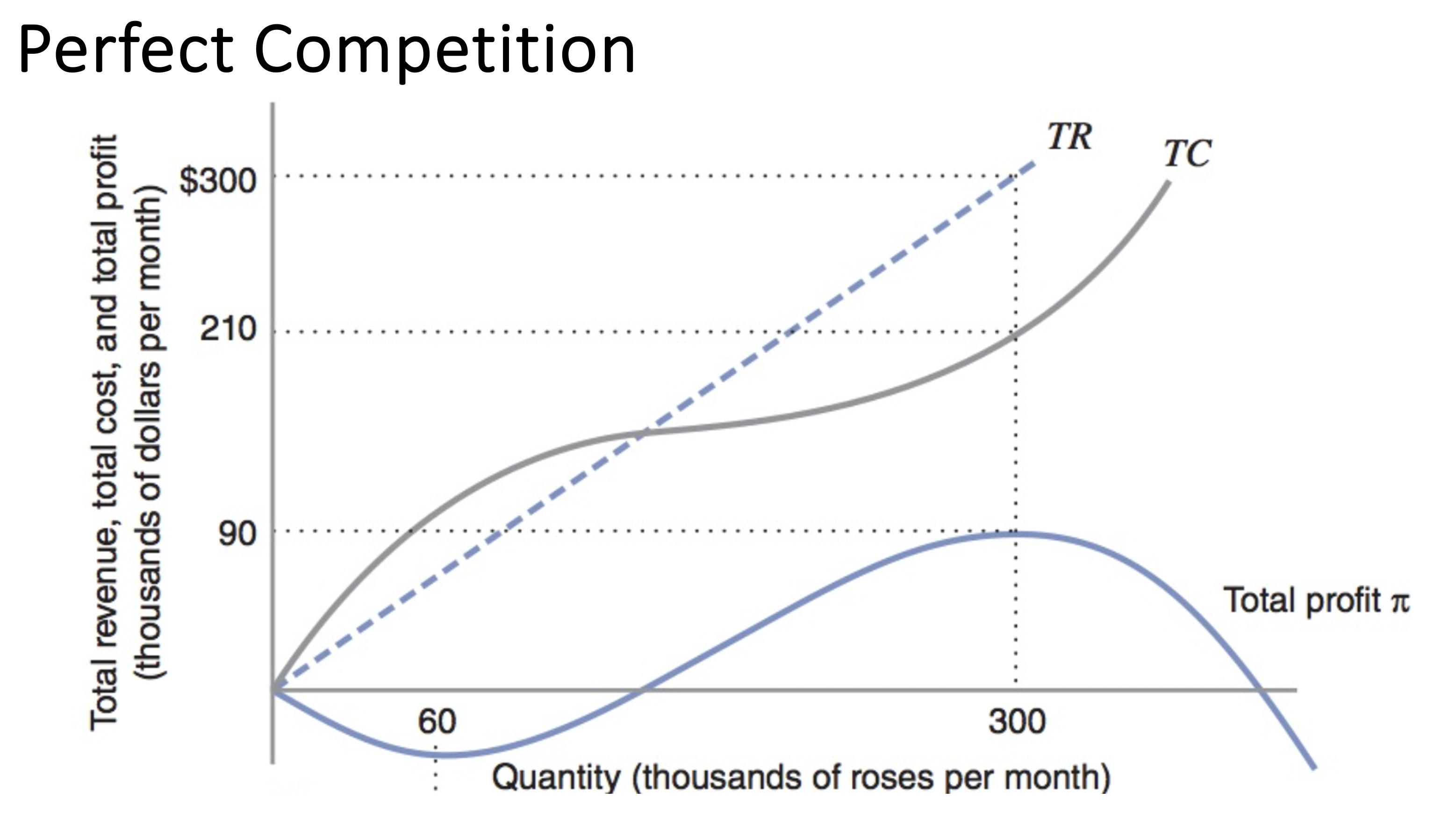

Perfect Competition

Economic profit maximization is the assumed goal of private firms

Total cost represents the most efficient combination of inputs for a given level of output

The rate at which total revenue (TR) changes with respect to change in output (Q) is marginal revenue (MR)

MR = TR/Q = (Q*P)/Q = P

Profits are maximized when marginal revenue = marginal cost

After the point where MR=MC, your profits will be negative

Supply = MC, total cost optimized

Market Equilibrium

the intersection of the demand and supply curves

total cost is important as it is the basis of an individual firm’s supply curve

upward sloping section of the marginal cost curve is the supply curve

Efficiency of demand/supply curves

Supply curves

Optimal combination of cost-minimizing inputs for each level of output

Demand curves

Optimal combination of utility-maximizing goods for a given level of income

Market supply curve

Horizontal summation of a series of individual supply curves

Supply Theory

Supply - total amount of goods and services that producers are willing and able to purchase at a given price in a given time period

Law of Supply

as the price of a product rises, the quantity supplied of the product will usually increase (ceteris paribus)

firms attempt to maximize product by increasing quantity supplied when the price is higher (and vice versa)

Non-price determinants of supply

Changes in costs of factors of production

Prices of related goods

Indirect taxes and subsidies

Future price expectations (producer)

Changes in technology

Number of firms

Shocks

Markets only work when there is strong competition

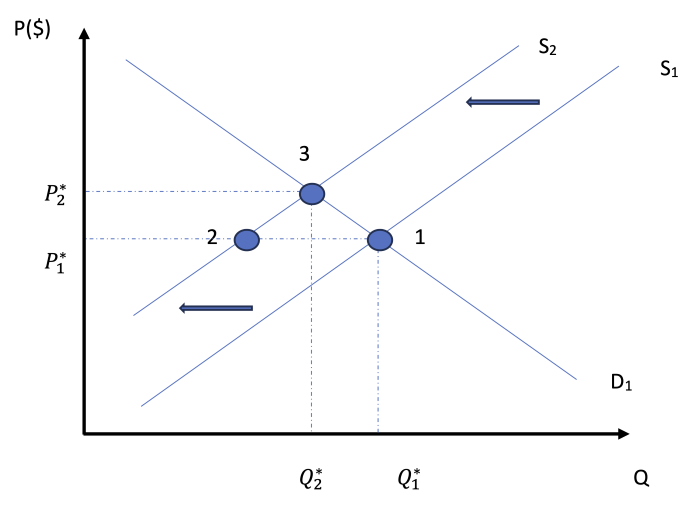

Market Equilibrium Graphs (supply + demand)

Consumer Surplus (C.S.) - willingness to pay and what they did pay

Producer Surplus (P.S.) - difference between market price and lowest price a producer uses to produce

Assumptions of perfectly competitive markets

all actions (consumers/producers) have access and fully process all relevant information

there are many small buyers and producers - all with equally negligible market power

all actors are rationally self-interested

Welfare - theoretical surplus value left with different economic agents (consumers, firms, governments)

Production - market clearings

Optimal Allocation

MR = MB (marginal benefit)

Social surplus = consumer + producer surplus

In a perfectly competitive market, social surplus is at its largest

Analysis of surpluses are called “welfare analysis”

Price Mechanism Functions

A - allocation (resources are allocated to those who need it most)

R - rationing (not everyone in the market gets what they want, only those who have the same valuation of the product as the firms)

S - signaling (communication of information that drives other factors)

I - incentive (capitalist system is driven by incentives)

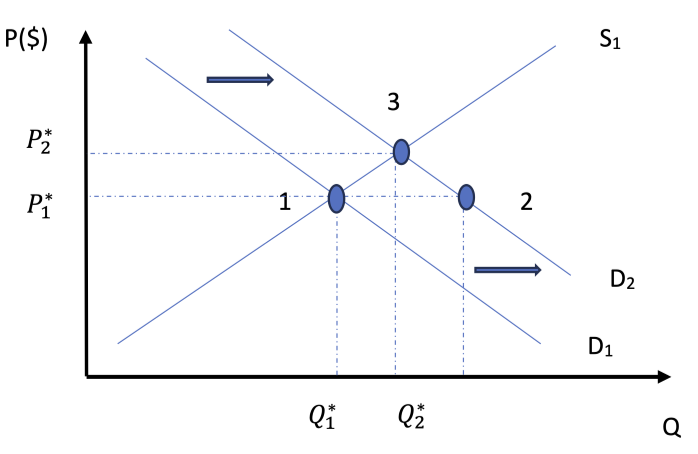

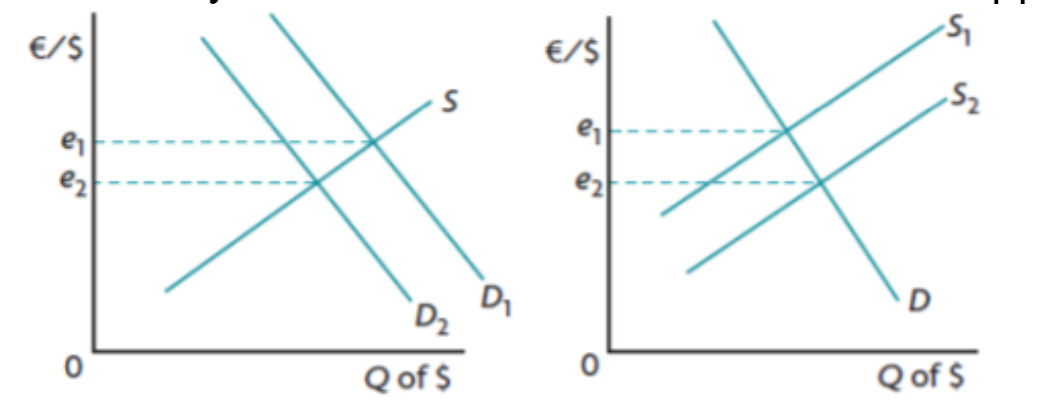

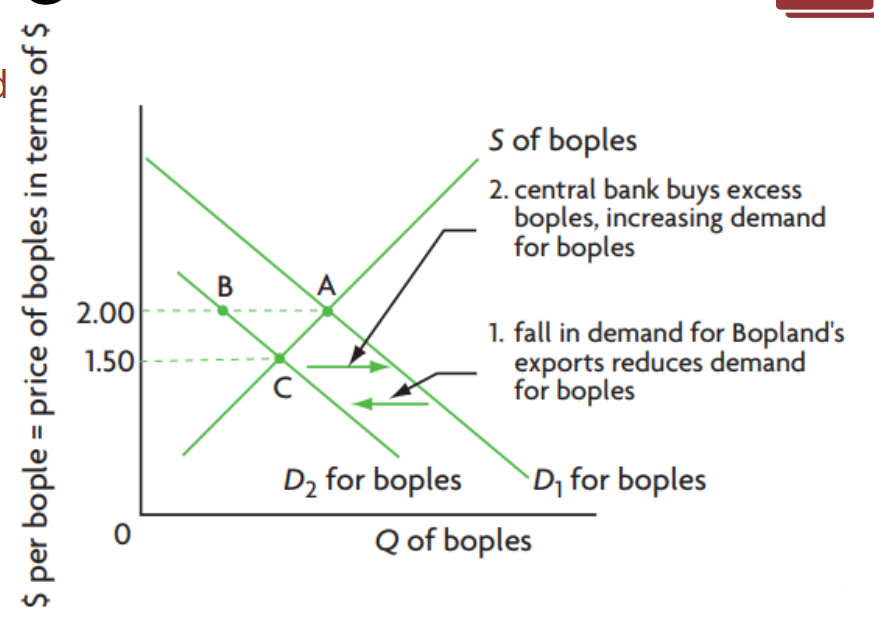

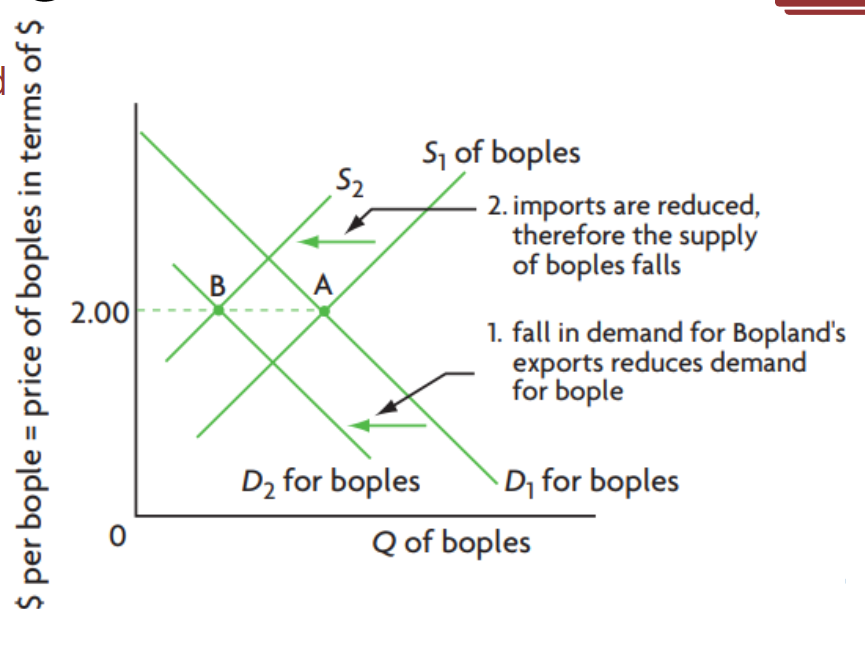

2 Demand Curves

2 Supply Curves

Moving from point 1 to point 3 on both graphs

Point 2 has excess supply/demand

ARSI to move to the new equilibrium point

At both equilibriums, there is optimal allocation

Structure of Microeconomics

How do consumers and producers make choices in trying to meet their economic objectives?

Demand

Supply

Competitive market equilibrium

Elasticities of Demand

Elasticities of Supply

Critique of the maximizing behavior of consumers and producers

interaction between consumers and producers determine where resources are directed

welfare is maximized if allocative efficiency is achieved

constant change produces dynamic markets

consumer and producer choices are the outcome of complex decision making

When are markets unable to satisfy important economic objectives - and does government interaction help?

Role of government in microeconomics

Market failure

externalities and common pool or common access resources

public good

asymmetric information (imbalanced information held by consumers and/or consumers)

market power (single/small number of suppliers)

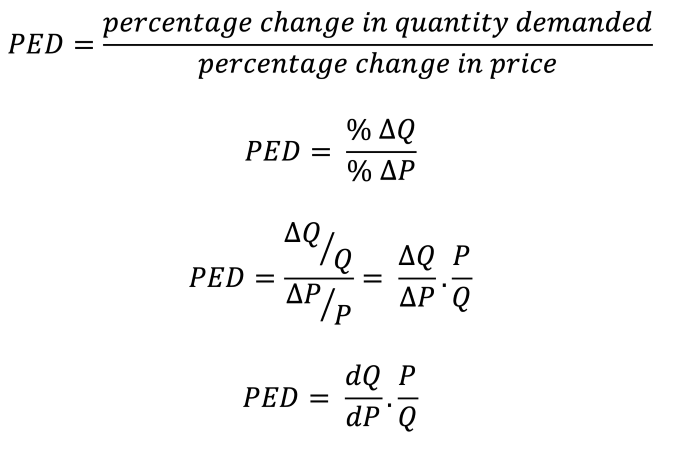

Price Elasticity of Demand (PED)

measure of the responsiveness of the quantity demanded of a good subject to the change in price

Percentage change and differentiation to calculate

the greater the PED, the more sensitive the quantity demanded is to changes in price

PED = percentage change in quantity demanded / percentage change in price

|PED| > 1 demand is relatively elastic

|PED| < 1 demand is relatively inelastic

|PED| = 0 demand is unitary

PED = ∞ perfectly elastic (horizontal demand curve)

quantity demanded responds infinitely to changes price

PED = 0 perfectly inelastic (vertical demand curve)

fixed price: quantity demanded does not change at all when price changes

How can PED change along a straight line?

as you move along the x-axis, it gets less elastic

as quantity increases, elasticity decreases

Determinants of Price Elasticity of Demand (PED)

number of close substitutes

more subtitutes = increased price sensitivity

substitution effect

luxuries VS staples

higher proportion of income spent on the good = increased price sensitivity

expensive good alerts the consumer more when price changes

necessity

if consumers really need the product (ex: food), then they will not change their quantity demanded when price changes therefore inelastic

time

purchases made with longer time periods are generally more elastic

short-run → less elastic, long-run → more elastic

How does PED change across income levels?

more elastic for lower income groups

increased necessity and proportion of income for each good

elasticity depends on the good (price-quantity relationship)

quantity demanded changes, but not the demand curve

“staples” are essential, less elastic

necessity, not many close substitutes, cheap

Applications of PED

pricing decisions by firms regarding price changes and effects of a change of price on total revenue (TR) → price * quantity

inelastic → % change in Q < % change in P

when TR rises, P rises and vice versa

government decisions regarding indirect taxes

elastic → % Q > % P

if an indirect tax is applied, unemployment could increase due to the decreased revenue for firms when they change the price with the tax

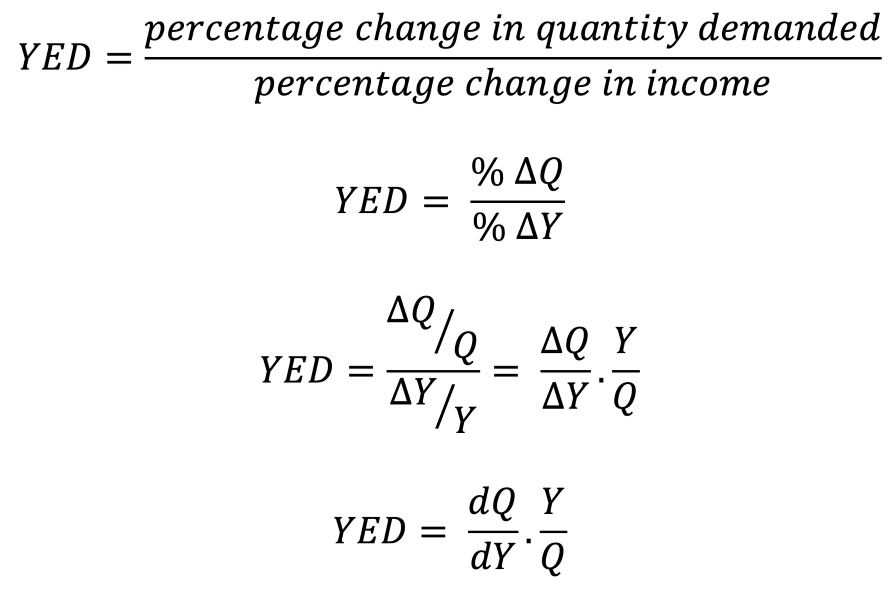

Income Elasticity of Demand (YED)

measure of how much demand for a product changes when there is a change in the consumer’s income

YED = percentage change in quantity demanded / percentage change in income

|YED| > 1

income-elastic

luxury goods

% change in D > % change in income

|YED| < 1

income-inelastic

necessity goods

% change in D < % change in income

YED to categorize inferior and normal goods

normal good → when income increases, demand increases

positive YED value

inferior goods → when income increases, demand decreases

negative YED value

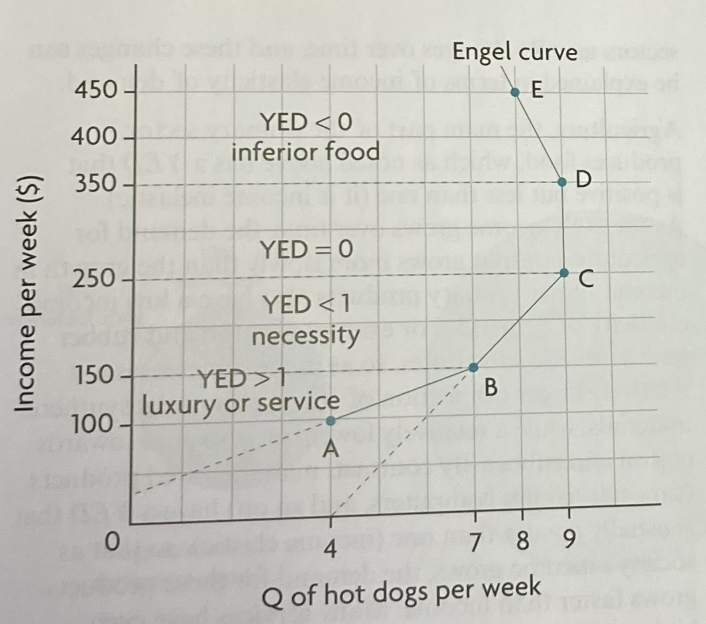

Engel Curve

axes → income and quantity

|YED| > 1 luxury/service, |YED| < 1 necessity

YED > 0 normal good

YED < 0 inferior good

quantity demanded when income increases also increases then diminishes and goes backwards

if you continue a segment AB with the same slope and that line cuts the y-axis, then it is a luxury

if it cuts the x-axis, it is a necessity

only works on income = y and quantity = x

Primary Commodities

raw materials (cotton, coffee)

inelastic demand (they are necessities)

consumers are not everyday households, but manufacturers

Manufactured Goods

made from primary commodities

more elastic, as there are more substitutes

Why is YED important?

For firms:

products with a high YED will see a demand increase when income increases (used to see maximum profit based off changes in income)

allocation of resources to fit income groups in products

if income falls, production of inferior goods increase because of YED rules

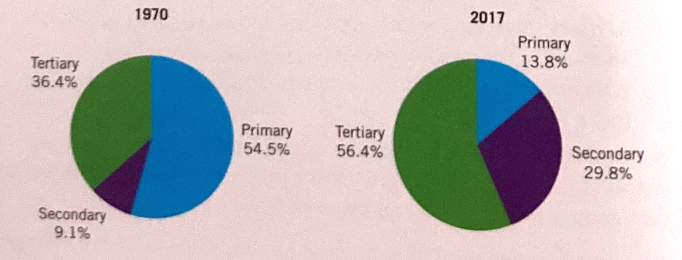

Sectoral changes

primary sector: agriculture, fishing, extraction (forestry, mining)

secondary sector: manufacturing, takes primary products and uses them to manufacture producer goods (machinery, consumer goods) also includes construction

tertiary sector: service, produces services or intangible products (financial, education, information, technology)

shifts in the relative share of national output and employment

as countries grow and living standards improve, there is a change in proportion of the economy that is produced

extra income is spent on manufactured goods as the demand is more elastic than the primary products (using YED to measure/verify) ← same goes for the service sector

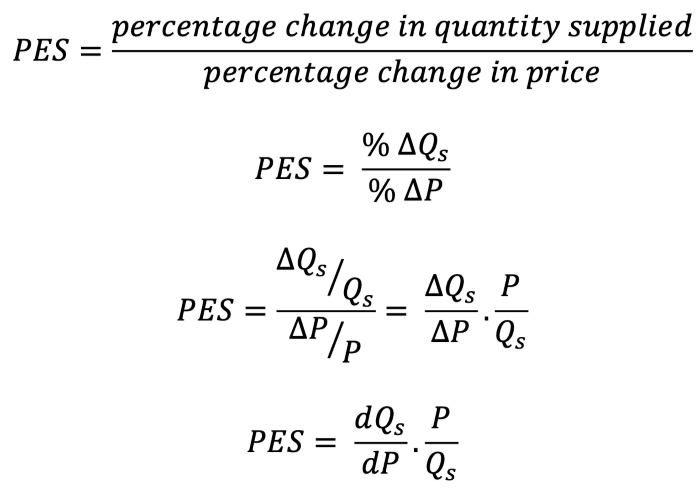

Price Elasticity of Supply (PES)

sensitivity/responsiveness of quantity supplied to changes in price

PES = percentage change in quantity supplied / percentage change in price

PES > 1 relatively elastic

PES < 1 relatively inelastic

same rules as per PED except no absolute value because of positive relationship between price and quantity supplied

Determinants of F

time

producers cannot adjust quantity supplied quickly

short-run → inelastic, long-run → elastic

mobility of factors of production

easy to swich between production → more elastic and vice versa

unused capacity

if there is a sudden increase in quantity demanded, then firms can use unused capacity to increase production

more unused capacity → more elastic

inventory/ability to store stocks

the more there is in stock, the easier it is to distribute a product if demand increases

more inventory → more elastic

Primary commodities → relatively inelastic

takes time to grow/extract which makes it more difficult to increase production

not always easy to store → time

Manufacture products → relatively elastic

easier to increase production and/or keep inventory

2.4 - Behavioural Economics

Assumptions of Rational Consumer Choice

free markets are built on the assumptions of rational decision making

in classical economic theory, rational means economics agents are able to consider the outcome of their choices and recognise the net benefits of each one

rational agents - will select the choice that reaps highest benefit/utility

Rational choice theory - individuals use logic and sensible reasons to determine the correct choice (connected to an individual’s self-interest)

Consumer Rationality

assumption that individuals use rational calculations to make choices which are within their own best interest (using all information available to them)

Utility Maximization

economic agents select choices that maximize their utility to the highest level

Perfect Information

information is easily accessible about all goods/services on the market

individuals have access to all information available at all times in order to make the best possible decision

Limitations of Assumptions of Rational Consumer Choice

behavioural economics recognizes that human decision-making is influenced by cognitive biases, emotions, social, and other psychological factors that can lead to deviations from rational behaviour

individuals are unlikely to always make rational decisions

5 limitations are shown below:

Biases

biases influence how we process information when making decisions = influence the process of rational decision making

example: common sense, intuition, emotions, personal/social norms

Types of Bias

Rule of Thumb - individuals make choices based on their default choice gained from experience (ex: same product from same company, but not the best possible choice)

Anchoring and Framing - individuals rely too heavily on an initial piece of information (anchor) when making subsequent judgements or decisions (ex: car dealer says car is worth $10,000 and you know it’s worth less, but this anchor of information causes you to purchase the car for a higher price)

Availability - individuals rely on immediate examples of information that come to mind easily when making judgements/decisions (causes individuals to overestimate the likelihood/importance of events/situations based on how readily available they are in their memory)

Bounded Rationality

people make decisions without gathering all necessary information to make a rational decision within a given time period

rational decision making is limited because of

thinking capacity

availability of information

lack of time available to gather information

too many choices also cause people to make irrational decisions

example: in a supermarket, there are too many choices of products of the same good, making it difficult to reach a decision

Bounded Self-Control

individuals have a limited capcity to regulate their behaviour and make decisions in the face of conflicting desires or impulses

self-control is not an unlimited resource

because humans are influenced by family, friends, or social settings, it causes social norms to interfere in decision making (does not result in the maximization of consumer utility)

decision making based on emotions → does not yield the best outcome

businesses capitalize on the lack of bounded self-control of individuals when appealing to their target audience to maximize sales

Bounded Selfishness

economics agents do not always act within their own self interest

individuals do things for others without a direct reward

ex: altruism - selflessness without expecting anything in return

Imperfect Information

information is not perfectly accessible due to:

intelluctual property rights

cost of accessing information

amount of information and options available

people make decisions based on limited information

asymmetric information may also lead to decisions based on limited information

when one party has more information than another

Choice Architecture

intentional design of how choices are presented so as to influence decision making

simplifies the decision making process

3 types, as shown below:

Default Choice

individual is automatically signed up to a particular choice

decision is already made even when no action has been taken

individuals rarely change from the default change

Restricted Choice

choices available to individuals are limited which helps individuals make more rational decisions

Mandated Choices

requires individuals to make a specific decision or take a particular action by imposing a requirement or obligation

mandated choices can be used to ensure compliance with regulations or societal norms, making it necessary for individuals to make certain decisions

Nudge Theory

practice of influencing choices that economic agents make, using small prompts to influence their behaviour

firms should use nudges in a responsible way to guide and influence decision making

designed to guide people toward certain decisions or actions while still allowing them to have freedom of choice

consumer nudges should be designed with transparancy, respect for individual autonomy, and clear societal benefits in mind

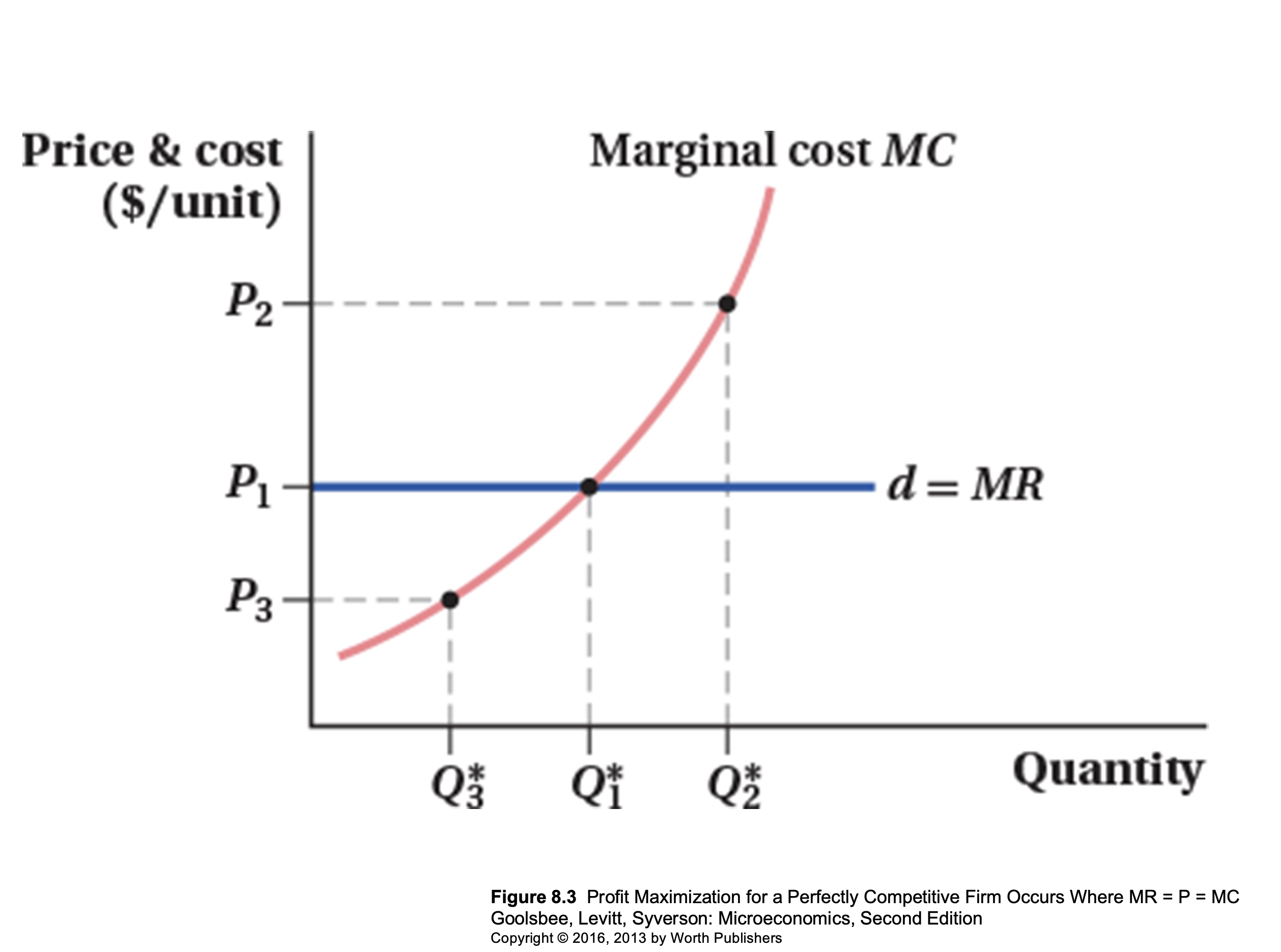

Profit Maximization

most firms have the rational business objectiveof profit maximization

profits benefit shareholders as they receive dividends and also increase the underlying share price

an increase in the underlying share price increases the wealth of the shareholder

profit maximization rule

when MC=MR, then no additional profit can be extracted from producing another unit of output

when MC<MR, additional profit can still be extracted by producing another unit of output

when MC>MR, the firm has gone beyond the profit maximization level of output and starts making a marginal loss on each unit produced (beyond MR=MC)

in reality, firms find it difficult to produce at the profit maximization level of output

the level may be unknown

in the short term, they may not adjust their prices if the marginal cost changes

MC changes regularly and regular price changes would be disruptive

in the long-term, firms will seek to adjust prices to the profit maximization level of output

firms may be forced to change prices by the competition regulators in their country

profit maximization level of output often results in high prices for consumers

changing prices changes the marginal revenue

Growth

increasing sales revenue/market share

maximize revenue to increase output and benefit from economies of scale

a growing firms is less likely to fail

Revenue Maximization as a Sign of Growth

in the short-term, firms may use this strategy to eliminate the competition as the price is lower than when focusing on profit maximization

firms produce up to the level of output where MR=0

when MR>0, producing another unit of output will increase total revenue

Market Share as a Sign of Growth

sales maximzation which further lowers prices and has the potential to increase market share

occurs at the level of output where AC=AR (normal profit/breakeven)

firms may use this strategy to clear stock during a sale to increase market share

firms sell remaining stock without making a loss per unit

Satisficing

pursuit of satisfactory/acceptable outcomes rather than profit maximization

decision-making approaach where businesses aim to meet a minimum threshold or standard of performance rather than striving for the absolute best outcome

small firms may satisfice around the desires of the business owner

many large firms often end up satisficing as a result of the principal agent problem

when one group (the agent) makes decisions on behalf of another group (the Principal), often placing their priorities above the Principal’s

Corporate Social Responsibility (CSR)

conducting business activity in an ethical way and balancing the interests of shareholders with those of the wider community

extra costs are involved in operating in a socially responsible way and these costs must be passed on to consumers

2.7 - Government Intervention

Why do governments intervene in markets?

Influence (increase/decrease) household consumption

decrease consumption of demerit goods

provide support to firms

earn revenue

influence the level of production of firms

provide support to low-income households

correct market failure

promote equity

Microeconomic forms of government intervention

price controls

indirect taxes

subsidies

direct provision of services

command and control regulation and legislation

consumer nudges

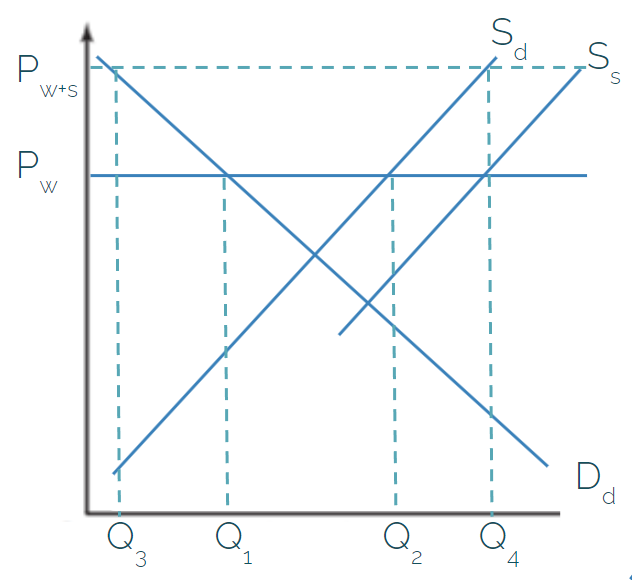

Price controls

price ceiling + price floor

Price Ceiling

maximum price

below equilibrium point

the point where the price ceiling is set is Pmax

at Pmax, firms are willing to supply Qmax but the consumers demand a quantity above Q*

shaded area - 2 triangles, a and b

a = amount by which consumer surplus is reduced

b = amount by which produer surplus is reduced

excess demand shown by the values Qmax - Q1

managed through subsidies and tax breaks → costs

Price Floor

minimum price

above equilibrium point (Pmin)

common in agriculture

areas c, e, f, g, h are government expenditure → excess supply

producer surplus is increased (d+e → b, c, d, e, f)

f = directly from the government to the producers

a price floor creates welfare loss, indicating allocative inefficiency due to an overallocation of resources to the production of goods

society is getting too much of the good

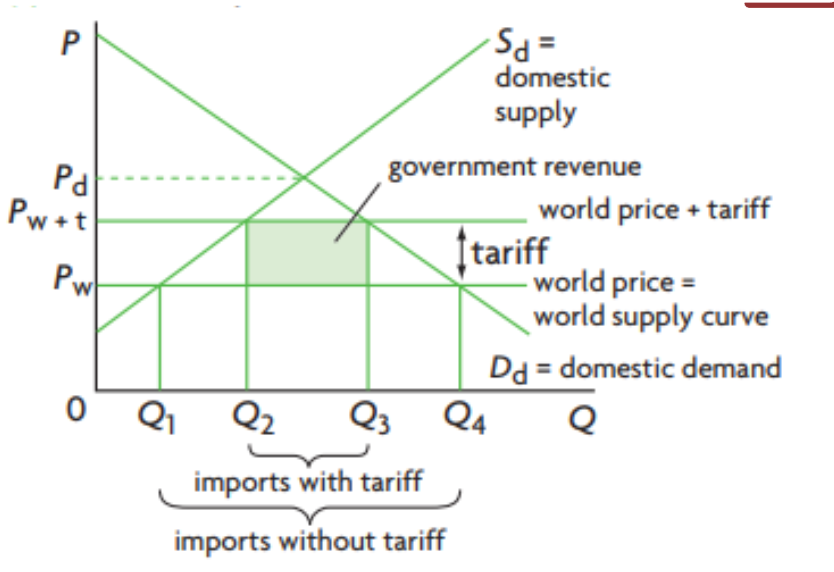

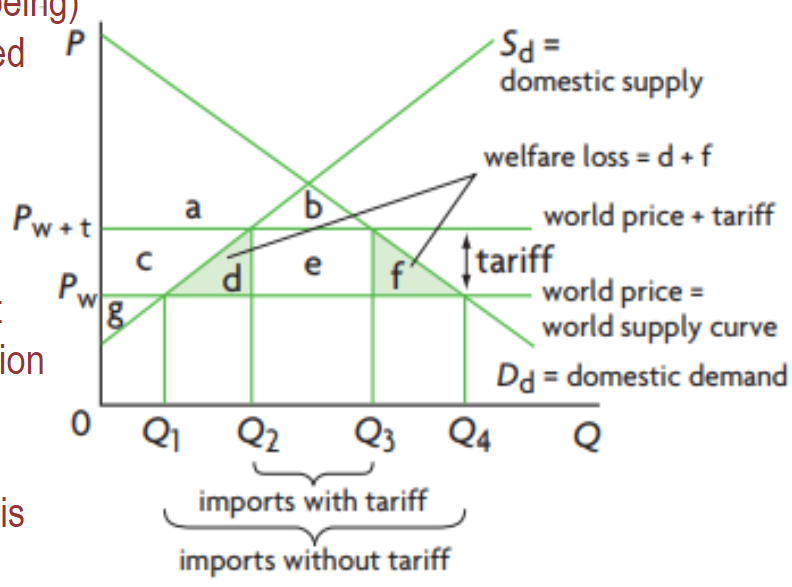

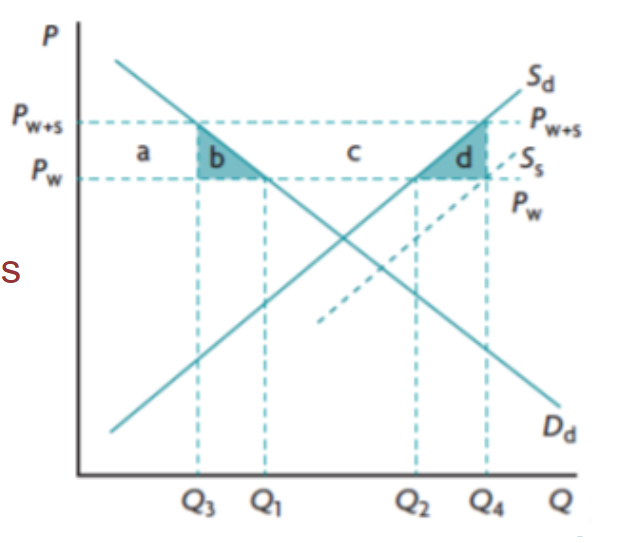

Indirect taxes

imposed on spending to buy goods and services

both consumers and producers pay a share of the tax

firms practically pay the tax

excise taxes - imposed on particular goods/services (ex: imports)

taxes on spending - value added tax (VAT) or goods/services tax (GST)

direct taxes are those directly paid to the government by taxpayers

an indirect tax creates a tax wedge

consumers face a higher price, while producers receive a lower price

Qt - Q* → lost sales (potential sales but they are lost/didn’t happen because of the tax)

Pp - price for producers, marginal cost

area of rectangle = government revenue

Pc - price for consumers

Pc>Pp, so demand decreases

shifts from S → S1

new equilibrium point formed at (Qt, Pc)

2 triangles, a and b

a + b - welfare loss, Dead Weight Loss (DWL)

both disappear, allocative inefficiency

a - consumer surplus loss

b - producer surplus loss

2 prices, C.S. and P.S. at different equilibriums

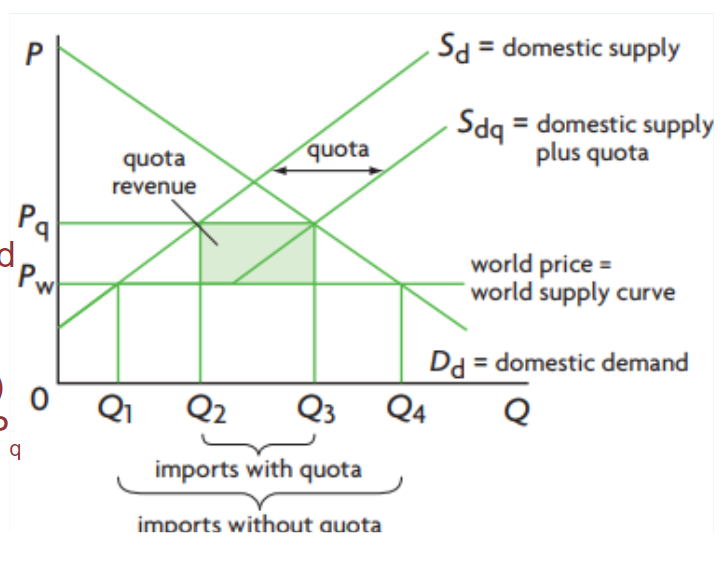

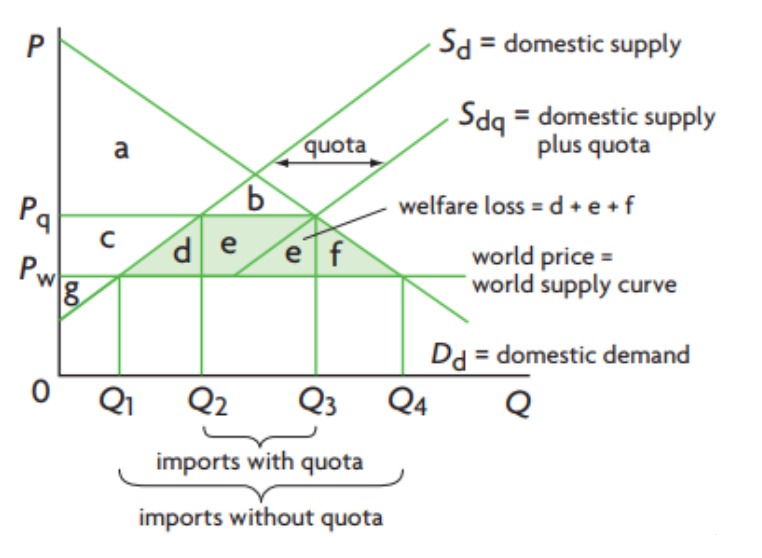

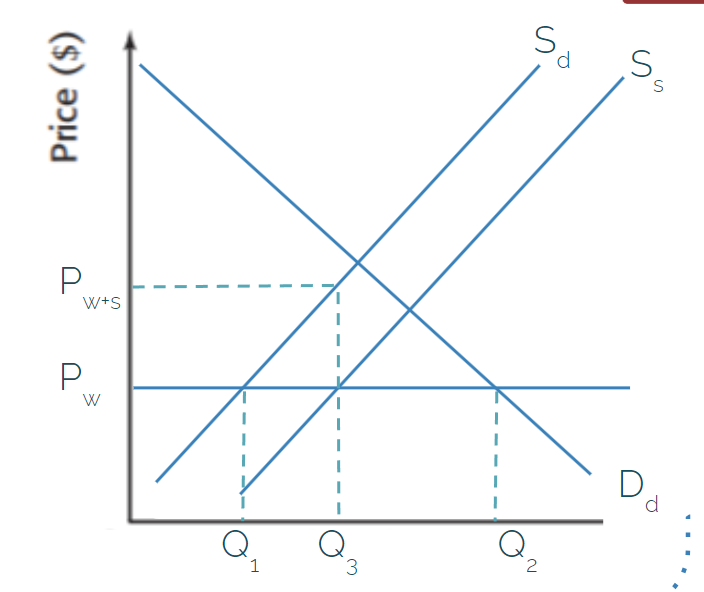

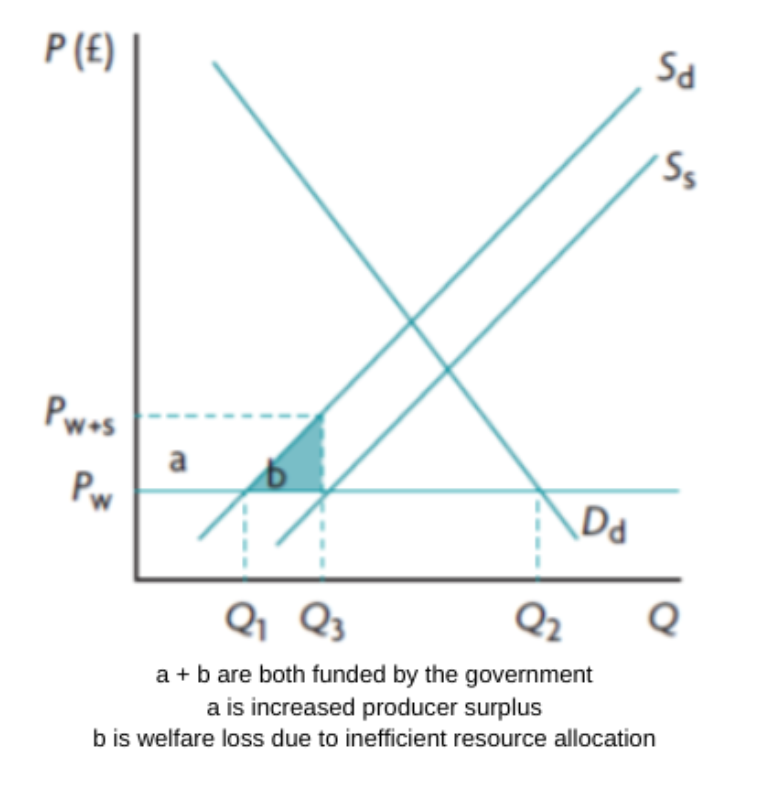

Subsidies

assistance by the government to individuals (firms, consumers, industries)

results in greater consumer and producer surplus

society loss as government spending on subsidy

loss from government spending is greater than the gain in surplus

welfare loss (allocative inefficiency) due to overallocation of resources to the production of goods (overproduction)

Pp and Pc switched (from indirect taxes), as consumers pay less and producers receive more

a = dead weight loss (DWL) due to overproduction

supply curve shifts (S → S1) because of one of the non-price determinants of supply (subsidies)

S1 = S + subsidy

2.8 - Market Failures

externalities are market failures, both positive and negative

also known as spillover effects

positive externalities: MS > MP at all levels of output up to the socially optimal level

negative externalities: MS < MP at al levels of output up to the socially optimal level

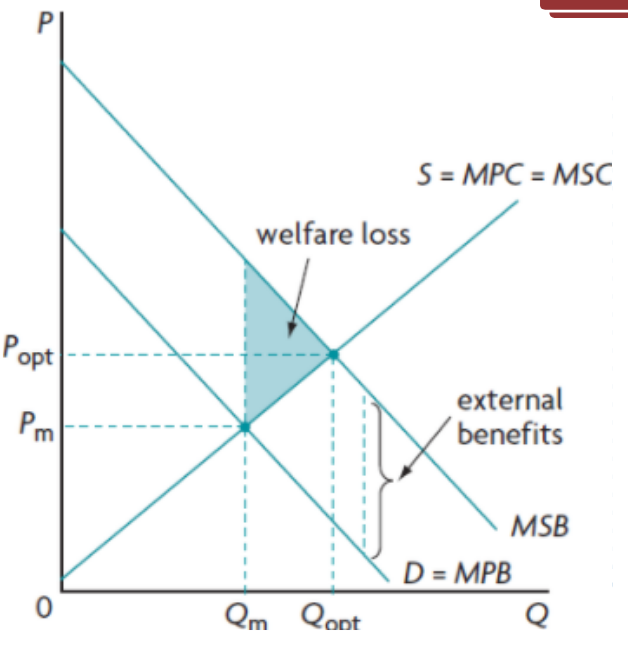

Merit Goods

goods that are beneficial to consumers but people do not consume enough

people underestimate/ignore potential benefits, caused by imperfect access to information

causes the demand to be lower than it should be

rivalrous and excludable

rivalrous → consumption of a merit good reduces amount available to others

excludable → possible for suppliers to prevent non-payers from benefitting from them

examples: healthcare, education

Positive externality of consumption

goods that when consumed, both the consumer and third parties benefit from it (external benefits)

ex: healthcare

MSC - marginal social cost

MPB - marginal private benefit

MSB - marginal social benefit

in a free market, people would consume where MPB=MSC (Q1, P1)

(Q*, P*) where MSB=MSC is the socially optimal level (potential welfare gain) because from Q1-Q*, MSB>MSC

if MPB shifts from Q1-Q* (toward MSB), then the welfare loss is gained (potential welfare gain = welfare loss)

MPB<MSB because there is an underconsumption of the merit good, and therrefore the shaded area above (potential welfare gain) is not gained by the society indicating a market failure

can be regarded as a welfare loss

underallocation of resources to this market (underproduction)

Government “fix”to positive externality of consumption

increasing consumption of merit goods

subsidies/direct provision

shifts the MSC curve rightwards

new socially efficient level at Q* but at a lower price (P2)

P2 < P1 < P*

improving information (merit goods)

legislation: government passing laws that force citizens to consume the good

Positive externality of production

production of a good creates external benefits for third parties

ex: human capital: training employees

MPC - marginal private cost

produces where MPC=MSB, where Q1 is located (Q1 < Q*)

if production increases to Q*, there is a welfare gain (welfare loss turned into welfare gain)

since MSC>MPC, there is an underconsumption of the merit good

underallocation of resources → market failure, allocative inefficiency

Government “fix” to positive externality of production

subsidies

causes MPC to be shifted downwards

full subsidy causes MPC=MSC when shifted

direct provision

high cost

offering training through the state for firms causes MPC=MSC

Demerit Goods

goods that are harmful to the consumer but people still consume either because they are unaware of or ignore the potential harm

caused by imperfect information

demand is higher than it should be

creates negative externalities when consumed

example: cigarettes, alcohol, gambling, junk food, drugs, prostitution

Negative externality of consumption

consumption of a demerit good causes adverse effects to third parties

ex: second hand smoking

in a free market, people maximize their private utility so they consume at MPB=MSC

there is a welfare loss as MSC>MSB from Q*-Q1

overconsumption of demerit goods

too many resources allocated to this market (demerit)

Government “fix” to negative externality of consumption

indirect taxes

taxes reduce consumption (DIAGRAM INCORRECT, CHECK TEXTBOOK)

legislation/regulation

making laws against the overconsumption of demerit goods

education/raising awareness

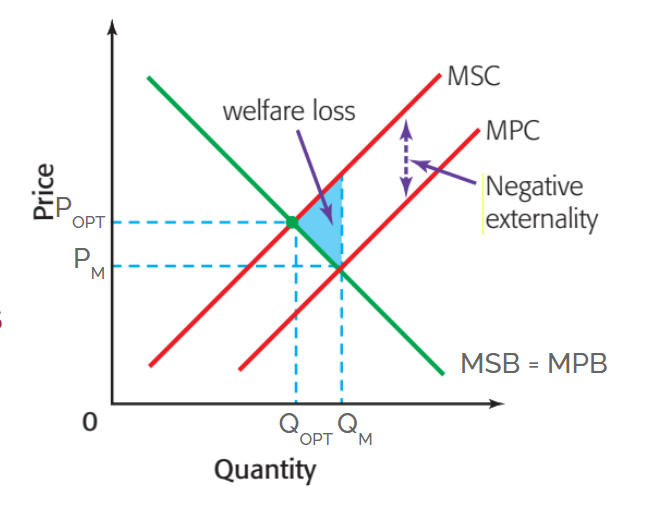

Negative externality of production

production of a good negatively impacts third parties

example: fumes from a factory

MSC<MPC so MPC=MSC+costs

MPC is below MSC, because there is an external cost added to society

producers produce at Q1

from Q1-Q*, MSC>MSB

welfare loss → market failure

Government “fix” to negative externality of production

indirect taxes

closes gap between MSC and MPC (MPC shifts leftward toward MSC to reduce level of consumption of demerit good)

Common Pool Resources

rivalrous and non-excludable (linked to negative externalities)

rivalrous: if one person uses, others cannot at the same level of utility

non-excluable: very difficult to exclude people/groups of people from using

typically natural resources

examples: fishing grounds, forests, atmosphere, etc.

Government “fix” to negative externality of production

international agreements

tradable permits

carbon taxes

legislations/regulations

subsidies

Consequences for Stakeholders

Ronald Coase → transaction costs are a way of attempting to measure the impossible, to measure the charges for externalities

externality = transaction cost; there is a threshold where the transaction cost is too high so it is considered an externality

sometimes when transaction cost is low, government intervention is not needed

Collective self-governance

a solution to the over-use of common pool resources

users take control of the resource and use them in a sustainable way

applies at a local level (small communities)

pressure in small communities to operate within social norms

Ostom’s theories → no authority needed

Carbon Tax VS Tradable Permits

carbon taxes are easier than tradable permits (design + implementation)

carbon taxes are more difficult to manipulate for/against certain groups

carbon taxes do not require as much monitoring

carbon taxes are regressive

affects low-income groups more than high-income groups

tradable permits more easily control the level of carbon reduction

carbon taxes are easier to predict

businesses need certainty to plan for the future

rivalrous → one person consuming the good prevents another from consuming it

excludable → able to stop other people from consuming it once it has been provided

Common Pool Resource - rivalrous and non-excludable

no price signals

Tragedy of the Commons

overuse/over-consumption of the resource which may lead to depletion

Private Good - rivalrous and excludable

Public Good - non-rivalrous and non-excludable

free-rider problem → other people benefit from the good without paying for it

Quasi-public Good - non-rivalrous and excludable

Asymmetric information

when one party has more information than the other

buyers and sellers do not have equal access to information

either the buyer or seller has more information

Adverse Selection

when one party in a transaction has more information on the quality of the good than the other party

Moral Hazard

one party takes risks but does not face the full costs of these risks because the full costs of the risks are borne by another party

Perfect Competition / Rational Producer Behaviour

Suppliers and consumers are made up of equally small individuals

No barriers to market entry or exit

Firms are profit maximizing

Consumers are fully rational and consistent

Products sold are homogenous

Full information throughout the market

cannot set the price:

Imperfect competition - monopolies

monopoly market - where only one supply operates

the assumption of many small suppliers does not hold

1 supplier with absolute control over the market price

monopolist sets price at maximum total revenue

as quantity increases, total cost increases, total revenue increases then decreases

Monopoly

single seller facing many buyers

profit maximization condition: ΔTR(Q)/ΔQ = ΔTC(Q)/ΔQ

MR(Q) = MC(Q)

MR>MC → firm increases Q

MR<MC → firm decreases Q

MR=MC → maximizes profit, cannot increase

to sell more units, a monopolist lowers price

increase in profit = III while revenue sacrificed = I

change in TR = III-I

Area III = P * ΔQ

Area I = -Q * ΔP

change in monopolist profit: P(ΔQ) + Q(ΔP)

MR = ΔTR/ΔQ = (PΔQ + QΔP)/ΔQ = P+Q(ΔP/ΔQ)

MR → P=increase in revenue due to higher volume - marginal units = Q(ΔP/ΔQ): decrease in revenue due to reduced price

AR = TR/Q = PQ/Q = P

price a monopolist can change to sell quantity Q is determined by the market demand curve (the AR curve = market demand curve)

AR(Q) = P(Q)

if Q>0, MR<P and MR<AC (MR lies below demand curve)

firms produce at MR=MC to maximize profits

TR = B+E+F

Profit = B + E

L.S. = A

PED impacts the revenue

inelastic = more revenue

margin drives the average

P=a-bQ TR=P*Q

TR=(a-bQ)Q=aQ-bQ²

dTR/dQ = a-2bQCharacteristics of a monopoly market

single firm in the market

no close substitutes - monopolist’s good or service is unique

high barriers to entry

Long Run - factors of production are constant

Short Run - only labour can change (not land or capital)

Economies of Scale

LRAC = Long Run Average Cost

considered a barrier to entry

as the monopolist increases production, their costs go down as output goes up

if new firms try to compete, they are unable to keep up with the costs of the large firm

Profits

normal (π=0) → 0 profit

entrepreneurship is factored into the costs, so the wages are added into TC

abnormal (π>0)

loss (π<0)

π = TR-TC = (PQ) - (CQ)

π/Q = AR-AC = PQ/Q - CQ/Q = P-C

AR = P, AC = Cnormal profits are defined by the minimum revenue a firm must make to keep the business from shutting down (covers implicit and explicit costs)

in a perfectly competitive market:

there are no profits in the long run

due to free entry + full information

there are economic profits in the short run

P*=AR=MR, all horizontal lines

in a monopoly market:

can change the price but are still bounded by the demand, so AR and MR are no longer horizontal lines as they are in perfectly competitive markets

Perfectly Competitive Profits

for a single firm

normal profits (P*=AC)

MC cuts AC at its minimum

P* = AR = AC (when AR=AC, π=0)

abnormal profits (P*>AC)

AR>AC, so profits are positive (π>0)

sells at Q*

shaded area = profit

loss (P*<AC)

AR<AC, so profits are negative (π<0), so there is a loss

shaded area = loss

Rules for a single firm in a perfectly competitive market

cannot determine price, so they determine the quantity at MR=MC due to the profit maximizing rule

they also determine profit when AR=AC (AR=AC=π=0)

Monopolist Profits

normal profit (π=0)

higher price, lower quantity

profit = difference between AR and AC

Q*=P*=AR=AC, so there is no profits

abnormal profit (π>0)

AR>AC

shaded area = profit

Q* determined where MR=MC, then find AR/D when it is equal to Q*

AC1 determined where AC is when it is at Q*

loss (π<0)

same as abnormal profit, Q*, MR=MC, but AC>AR

shaded area = negative profit = loss because cost > revenue

Unit 3: Macroeconomics

Equality and Equity

Equity → income inequalities are needed to create incentive

Equality → equal distribution of income (minimizing income gap)

Market is unable to achieve equity

Equity → concept/idea of fairness; normative, means different things to different people

inequity is not inequality → distribution of wealth, income, or human opportunity

National Income Accounting

used to measure amount of economic activity in a country

money value of all goods and services produced in a year

can be measured through things like GDP

output method

actual value of all finished goods and services produced each year

prevents double counting

measures level of economic activity

income method

calculates the value of all factor incomes earned in the economy

sum of wages and salaries (labour), rent (land), interest (capital), profits (enterprise) → factors of production

national income (Y) → households receive factor incomes for output produced

expenditure method

total value of all spending

total spending on all newly produced goods and services

comprising C, I, G, and (X-M)

C → spending by individuals and households (largest component)

I → spending by all firms (gross fixed capital formation)

G → spending of the public sector

(X-M) → import expenditure

Circular flow of income

injections → add money to increase size (inc. in G, I, X)

leakages → remove money to reduce size (inc. in savings, tax, import)

Gross National Income (GNI)

GNI = GDP + (income earned abroad) - (income sent abroad)

Aggregate Demand (AD)

AD is the total demand for all goods and services in an economy at any given average price level

value often calculated using expenditure approach

AD = C+I+G+(X-M)

if AD has increased, economic growth has occured (and vice versa)

a 1% increase in C or G is much more significant than a 1% increase in (X-M)

AD curve is downward sloping

whenever there is a change in average price level, there is movement along the AD curve

if there is a change in any non-price determinants of AD, the AD curve shifts

increase in the non-price determinants results in a rightward shift

at every price level, real GDP has increased

Factors of Aggregate Demand

consumption (C)

consumer confidence →

interest rates ←

wealth →

income taxes ←

level of household debt ←

expectations of future price levels →

investment (I)

interest rates ←

business confidence →

technology →

business taxes ←

level of corporate debt ←

government spending (G)

political priorities

economic priorities

net exports (X-M)

income of trading partners →

exchange rates ←

trade policies

Real GDP and GNI

adjusted for inflation

calculated using a price deflator (GDP deflator)

converts current prices to constant prices

Real GDP = (nominal GDP / GDP deflator) * 100

Real GNI = Real GDP + net income earned abroad

Real GDP per capita = Real GDP / population

Real GNI per capita = Real GNI / population

purchasing power parity (ppp)

used to calculate relative purchasing power of different currencies

shows number of units of a country’s currency that are required to buy a product in the local economy, as $1 would buy the same product in the USA

Business Cycle

Recession

two or more consecutive quarters (6 months) of negative economic growth

increasing/high unemployment

increasing negative output gap and spare production capacity

low confidence for firms and households

low inflation

increase in government expenditure (great budget deficit)

Boom

increasing/high rates of economic growth

decreasing unemployment, increasing job vacancies

reduction of negative output gap or creation of positive output gap

spare capacity reduced/eliminated

high confidence = riskier decisions

increasing rates of inflation → usually demand-pull

Alternative Measures of Well-being

OECD Better Life Index → 11 factors

Housing

Jobs

Income

community

education

environment

civil engagement

health

life satisfaction

safety

work-life balance

The Happiness Index → 14 factors (scale from 0-10)

business and economic

citizen engagement

communications and technology

diversity (social issues)

education and families

emotional well-being

environment and energy

food and shelter

government and politics

law and order (safety)

health

religion and ethics

transportation

work (employment)

The Happy Planet Index → 4 factors

well-being → how citizens feel about their life overall (0-10)

life-expectancy → number of years a person is expected to live

inequality of outcomes → inequalities of people in a country (well-being, etc.)

ecological footprint → impact a person has on an environment

Aggregate Demand (AD) Curve

negative relationship between price levels and real GDP

wealth effect

when price levels increase, real value of wealth decreases, decreasing consumer confidence thus reducing demand/output

interest rate effect

increase in price levels leads to a fall in output demanded due to interest rates increasing because of an increased need for money

international trade effect

rising price level causes a fall in exports and a rise in imports due to domestic price increasing but others stay the same

Short Run (SR) and Long Run (LR)

SR in macroeconomics in the period of time when prices of resources are rougly constant/inflexible, in spite of changes in the price level

LR in macroeconomics is the period of time where prices of all resources (labour/wages) are flexible and change with changes in the price level

wages account for the largest part of the firm’s costs of production

SRAS - short run aggregate supply

profitability causes positive relationship between price levels and real GDP (increase in price = increase in output) and with unchanging resource prices, profits increase

Determinants of SRAS:

costs of factors of production

indirect taxes/potential subsidies/supply shocks

LRAS - long run aggregate supply

Monetarist/Neoclassical model

price mechanism

competitive market equilibrium

economy as a harmonious system (automatically tends to full employment)

LRAS is vertical due to changing resource prices

located at Yp (potential GDP) at the full employment level of real GDP

in the LR, economy produces potential GDP, which is independant of the price level

inflationary/deflationary gap - difference between SR and LR equilibrium

inflationary → SR>LR

deflationary → SR<LR

market corrections → either SRAS or AD curve shifts (different price levels, same GDP)

inflationary gap:

deflationary gap:

Keynesian model

equilibrium at different sections means different things (where AD=AS)

Ymax is where there is full employment

economy can be below full employment level, even in the long run

section 1 → AS is perfectly elastic as there is spare capacity (any increase in demand has no direct impact on general price levels)

section 2 → AS is relatively price elastic (upward sloping) as there is pressure of scarce resources as the economy grows

section 3 → AS is perfectly inelastic as there is no longer any spare capacity (all factor resources are fully employed)

any increase in AD beyond full employment level is inflationary

Shifts of the AS curve

Short run

costs of factors of production / indirect taxes

labour costs - wages/salaries account for a significant portion

raw material costs - increase means increase in costs of production

exchange rate - rise means domestic firms can buy imports at a lower price

interest rates - borrowing

bureaucracy and administration - legal procedures and policies

Long run

changes in economy’s quantity of factors of production

improvements in technology

increases in efficiency

changes in institutions

reductions in natural rate of employment

Long Run Equilibria

full employment is not zero unemployment (unemployment always exists)

frictional → certain number of people are in between jobs

seasonal → redundancies are caused by cyclical factors in the year

structural → skills mismatch in certain industries

Monetarist/Neoclassical model

occurs at full employment level of output (potential output)

Keynesian model

increase in AD increases national output without changing the general price level

increased demand for scarce resources and labour shortages cause general price levels to rise as national output increases

full employment level of output

firms compete for highly limited resources

general price increases but GDP is at its max

Macroeconomic objectives

economic growth

low unemployment

inflation

Economic Growth

maximization of the factors of production → quality + quantity

long-term economic growth

above potential level → something is wrong

short-term economic growth

actual output → current level fo real GDP

represented by any point on PPF diagram

actual growth → rate at which actual moves towards potential

short-term → below full level of unemployment

annual percentage change of a country’s output

short-run economic growth

increase in AD (rightrward shift) → Keynesian + Monetarist

increase in SRAS (rightward shift) → Monetarist

long-run economic growth

increase in potential output

achieves both economic growth and full employment

shift of the AS → monetarist + Keynesian

measurements of economic growth

nominal: rate of change in monetary value of GDP

real: accounts for inflation

Consequences of economic growth

living standards

generally leads to higher living standards

higher real income per capita

reduction/elimination of absolute poverty (not able to purchase essential goods)

raises consumption → encourages investment in capital → sustains growth

increased tax revenues (for taxes on expenditure/income) enable government to fund more merit goods

increased consumer spending → higher sales revenue (firms) → greater profits

spending on demerit goods increase → in long run, causes social welfare loss

risk of inflation increases → excessive aggregate demand → negative consequences

environment

creates negative externalities that cause problems to the environment

creates market failures caused by resource depletion

damages social and economic well-being in the long run

resource depletion not always sustainable → intergenerational equities

green GDP → adjustment of a country’s GDP to take into account environment degradation

income distribution

often generates greater disparities in distribution of income/wealth

not everyone benefits from economic growth

example: rich get richer, poor get relatively poorer

greater tax revenues = government redistribution of income/wealth in the economy

Low Unemployment

employment - use of factors of production in the production process

use of labour resources

governments want all available and willing to be employed

formal sector employment → officially recorded employment → workers paying income taxes and contributing to the country’s official GDP

unemployment → exists when forces of demand and supply are in disequilibrium

people are available and willing, seeking work but cannot find a job

inefficiency, non-use of scarce resources in the production process

ADL → aggregate demand for labour

ASL → aggregate supply for labour

those who are able and willing to work at the prevailing market equilibrium wage rate (Wc)

A = employer surplus, B+C = employee surplus, D+E = welfare loss, F = welfare supply

complements economic growth → higher employment = greater national expenditure

raises economic well-being and living standards

increases tax revenues for government expenditure on education/healthcare/infrastructure

prevents workers from leaving the country to find better opportunities (brain drain)

Measuring unemployment and unemployment rate

using number of people officialy unemployed as a percentage of the workforce per time period

unemployment rate = (number of employed / labour force) * 100

labour force - employed + self-employed + unemployed

difficulties of measuring unemployment

hidden unemployment / disguised unemployment → not included in the calculation

discouraged workers → unwilling to work but able to

voluntarily unemployed → not actively searching for work

Underemployment

people are inadequately employed → underutilization of labour force

although technically employed, the underemployed are not at their most efficient

cannot fully use their skills/abilities

Disparities

measure of unemployment ignores disparities such as:

regional → different regions have different rates of unemployment

ethnic → ethnic minority groups struggle more to find a job (higher unemployment)

age → unemployment rates are higher for the young/old

gender → females face a higher rate of unemployment

Cyclical Unemployment

unemployment derived from a downturn in the business cycle (recession)

lack of aggregate demand → fall in national real output → job losses

also referred to as demand deficient unemployment

most severe type of unemployment

results in mass job losses

firms try to control costs, protect profitability, and prevent business failure

represented through a deflationary gap / recessionary gap / negative output gap

difference between full employment and actual level of output (short-run)

closing the gap reduces cyclical unemployment

Natural Rate of Unemployment

equilibrium rate of unemployment

calculating level of unemployment when labour market is in equilibrium

NRU: no involuntary unemployment

some voluntary → some poeple remain out of a job

NRU = structural + seasonal + frictional

Costs of unemployment

personal costs

stress (depression, suicide)

low self-esteem

poverty

family breakdowns

social costs

crime / anti-social behaviour

indebtedness

social deprivation

economic costs

loss of GDP → negative economic growth

loss of tax revenues

increased cost of unemployment benefits

loss of income for individuals

greater disparities in distribution of income and wealth

Low and Stable rate of Inflation

inflation → sustained rise in general price level over time

people spend more to get the same amount

reduces purchasing power and country’s international competitiveness

price stability → general price levels remain broadly constant

net zero inflation, but a low and stable rate

Measuring rate of inflation

consumer price index (CPI) - change in average consumer prices over time

measured on a monthly basis but reported for a twelve month period

collects price data from a range of retail locations

assigns statistical weights (volume + value of quantities purchased)

(total cost of year T / total cost of base year) * 100

Limitations of the CPI

atypical households → CPI measures the ‘average’ household

regional/international disparities → prices vary between countries + average household

different income earners → CPI measures average; high income less affected by inflation

changes in product quality → CPI ignores quality

different patterns of consumption → difficult to apply statistical weights in historical data

time lags → due to huge amount of data needed to construct the CPI

volume / value of quantities purchased → uses quantities purchased instead of percentage of income

Causes of inflation

Keynesian - increase in aggregate demand

Monetarist - money supply

demand-pull → AD must be controlled

example: deflationary fiscal policy → prevents rise in consumption and investment

higher levels of AD

drives up general price levels

excessive aggregate demand (AD increases faster than AS)

might be due to higher GDP per capita, lower unemployment, increase in exports, lower interest rates, cuts in income tax

shown by AD1 → AD2

cost-push → rise in general price level

higher costs of production

shift from SRAS1 → SRAS2

increase in general price levels

reduces national output

higher production costs = raised prices

Costs of a high inflation rate

diminishes ability of money to function as a medium of exchange

uncertainty → reducing consumer and business confidence levels (lowers long run economic growth)

redistributive effects → costs are not equally distributed (ex: people with fixed income)

savings → real value of savings decrease over time (borrowers, lenders)

export competitiveness → exports become more expensive

economic growth → lowers expected real rates of return on capital investments

inefficient resource allocation → higher costs of production

shoe leather costs → customers spend more time looking for the best deals

REUSER → redistributive effects, export competitiveness, uncertainty, savings, economic growth, resource allocation

Causes of deflation

deflation → persistent fall in general price levels over time (inflation rate is negative)

either continual decline in AD or increase in SRAS

Benign deflation → positive effect as economy can produce more (rightwards shift of the SRAS curve) → boosts rational output + employment without raising general price level

deflation can be caused by lower production costs, higher productivity, or higher efficiency

Benign deflation - SRAS1 → SRAS2

also called non-threatening deflation

greater number and variety of goods and services

malign deflation → negative effect (leftwards shift of AD)

AD1 → AD2

associated with recessions and unemployment

harmful to the economy as there is a fall in real GDP

Disinflation

fall in the rate of inflation but prices are still rising

occurs when inflation rate is negative

leads to deflation if not controlled

shown by smaller proportional increase in average prices

Costs of deflation (malign)

uncertainty → increase in value of debts reduces confidence levels

redistributive effects → fall in value of assets and wealth

deferred consumption → postpones consumption (deflationary spiral)

cyclical unemployment / bankruptedness → falling prices/wages = falling AD/confidence

increase in real value of debt

inefficient resource allocation

policy ineffectiveness

Sustainable level of government (national) debt

budget deficit → value of government spending exceeds its revenue (G>T) per time period

government debt = accumulated budget deficits over the years

sustainable level - debt is affordable → paid in the long term

Measurement of government debt

uses percentage of GDP (debt to GDP ratio)

different from nominal/absolute value of debt

Costs of government debt

debt servicing costs - loan repayment plus interest rates incurred in the debt

credit ratings - measure of borrower’s ability to repay a loan

future taxation / government spending - austerity measures

budget deficits are not sustainable in the long run, there must be budget surpluses (G<T) to balance it out

Potential conflict between macroeconomic objectives

low unemployment and low inflatioon

high economic growth and low inflation

high economic growth and environmental sustainability

high economic growth and equity in income distribution

Low unemployment and low inflation

more employment = inflationary pressures

low unemployment creates demand-pull inflation due to increase in AD

full employment creates cost-push inflation due to wage inflation

short run Philips curve (SRPC) shows relationship between inflation and unemployment

demonstrates opportunity cost, either low unemployment or low inflation

trade-off only exists in the short run

stagflation → employment / GDP falls as there is inflation

stagflation and short run Philips curve

increased natural rate of unemployment

stagflation creates a worse trade-off between low unemployment and low inflation

long-run Philips curve (LRPC) is vertical at the natural rate of unemployment (NRU) → no trade-off

attempts to reduce NRU will be inflationary in the long run ((A→B) will cause (B→C))

the increase in costs of production shifts SRPC reverting the unemployment rate back to NRU

High economic growth and low inflation

economic growth → increase in AD in a country

if AD rises faster than AS, there is demand-pull inflation

increase in price levels caused by increase in AD

graph also represents trade-off between low unemployment and low inflation

cost-push inflation can also occur due to the full employment level being reached

firms try to attract the more scarce skilled labour, leading to wage inflation

monetary policy → reduces inflation by raising interest rates or increasing economic growth by cutting interest rates

conflict in use of interest rates, therefore conflict in objectives

sustainable economic growth can exist with low/stable rate of inflation

AS increases with AD

when inflation rises too quickly, it harms consumption and investment

controlled inflation can be helpful for economic growth (increases certainty)

high economic growth leads to an inflationary gap

High economic growth and environmental sustainability

as an economy grows, increased levels of production and consumption can create negative externalities that harm the environment

increased consumption of demerit goods (ex: cigarettes)

increased carbon footprint from increased income because of economic growth

environmentally sustainable economic growth is possible

use of green technologies and renewable energy sources

High economic growth and equity in income distribution

rapid economic growth leads to greater disparities in the distribution of the wealth/income in a country

widening the gap between the rich and the poor

although everyone in the country benefits from economic growth, not everyone benefits in the same way

minimum wage builds less wealth than billionaires

economic growth increases tax revenues, allowing the government to use the revenues to re-distribute income

so long as the tax system is progressive and equitable, there is not necessarily a conflict between economic growth and distribution of wealth

Unequal distribution of income/wealth

income

imbalances of income distributions → very few members of the society enjoying a high concentration of the nation’s income

to compare nations → GDP per capita or GDP in terms of purchasing power parity

wealth

imbalances in the spread of a country’s wealth → very few members account for a disproportionately large proportion of the wealth in a society

wealth → accumulation of assets with a monetary value

Factors that influence difference in wealth

economic factors → high national debt

natural resources → increases GDP per capita

environment → reduces wealth (ex: floods, droughts, etc.)

physical factors → reduces wealth (ex: hot/dry climates)

social factors → limits ability to produce wealth (ex: education)

political factors → determines economic prosperity (ex: war)

Measuring economic inequality

income inequality → relative share of national income earned by given percentages of a population (deciles / quintiles)

uses Lorenz curve and Gini coefficient

Lorenz curve

graphical representation of income/wealth distribution in a country

shows proportion of overall income/wealth accounted by each quintile or decile

this example shows that the bottom 60% of the population holds 20% of the wealth (B)

means the top 40% holds 80% of the wealth

data is cumulative → adds up to 1/100%

Gini coefficient

measures income/wealth inequality by calculating a numerical value of the Lorenz curve

G is between 0 and 1

the higher the value, the greater inequality

A = shaded area, B = area under Lorenz curve

Gini coefficient = A/(A+B)

line of equality has a 45° angle

Poverty

condition of an individual, household, or community/country being extremely poor

not having money to meet basic human needs

food, clothing, shelter, healthcare, education

absolute poverty → unable to afford basic needs for survival

relative poverty → income/consumption level below social norm within a country

differs from country to country

Measuring poverty

international poverty lines (poverty threshold) → minimum level of income to afford basic needs for human survival (below $1.90 a day)

does not take into account access to sanitation/water/electricity

a more accurate measure would be a national poverty line

line value depends on the country (higher national income = higher poverty line)

multidimensional poverty index (MPI)

uses health, education, adn standards of living

considers multiple factors that reduce quality of life

ex: sanitation, child mortality rate, average years of school

Minimum Income Standards (MIS)

lowest amount of income needed for an acceptable standard of living

varies by a country’s people’s standards and economic state

helps people live in a socially acceptable way

in the UK, MIS is used for:

calculating the living wage (minimum wage)

quantitative benchmark for NGO/charities to determine who is in need

calculating costs of bearing/raising a child

helps governments determine level of social security and transfer payments

Difficulties in measuring poverty

how would the national poverty line of very poor countries translate to the IPL?

relative poverty is highly subjective

a permanently low income creates a poverty trap

PPP highly differs with location

Causes of economic inequality and poverty

inequality of opportunity

different levels of resource ownership

different levels of human capital

discrimination (gender, race, etc.)

unequal status and power

government tax and benefit policies

globalization and technological change

market-based supply-side policies

Impact of high income/wealth inequality

brings possibility of higher income for those who work hard which creates incentives for people to work harder → improving labour effort

prospect of earning higher incomes encourages people to invest in education and skill development → imporves labour productivity

entrepreneurial instincts are encouraged as a result of potential to earn higher profits

greater incentives and wealth creation can lead to a higher savings ratio

can be used to fund investments which creates an increase in the economy’s long-term growth and development

creates more social tensions in the form of demonstrations, protests, political unrest, and crime which leads to less investment and labour participation rates

more government spending on transfer payments to sustain the economy

adds to government debt, not directly to the national income

discourages workers from joining labour foce and entrepreneurs from investing

increases voluntary unemployment

affects standard of living

affects social stability

Taxation

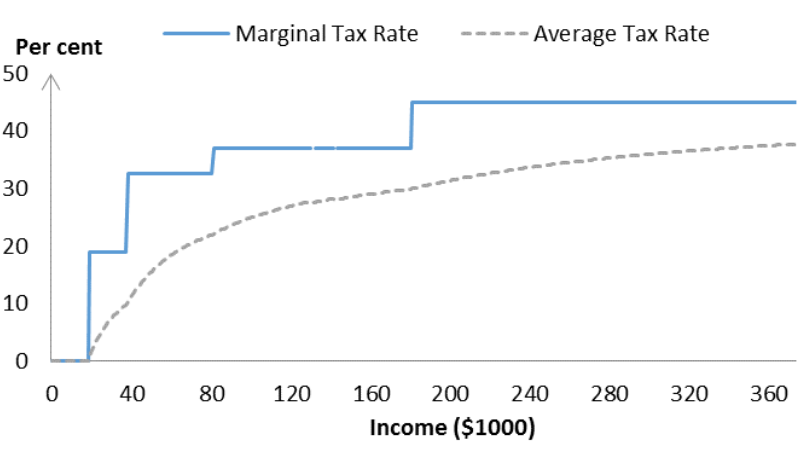

progressive tax → higher incomes = higher percentage of tax paid

tax threshold → workers earn a certain amount of income per year before they can be taxed

proportional taxes → percentage of tax paid stays the same irrespective of taxpayer’s income

also called flat rate taxes

regressive taxes → those with a higher ability to pay are charged a lower rate of tax

used to combat inequality in wealth and income

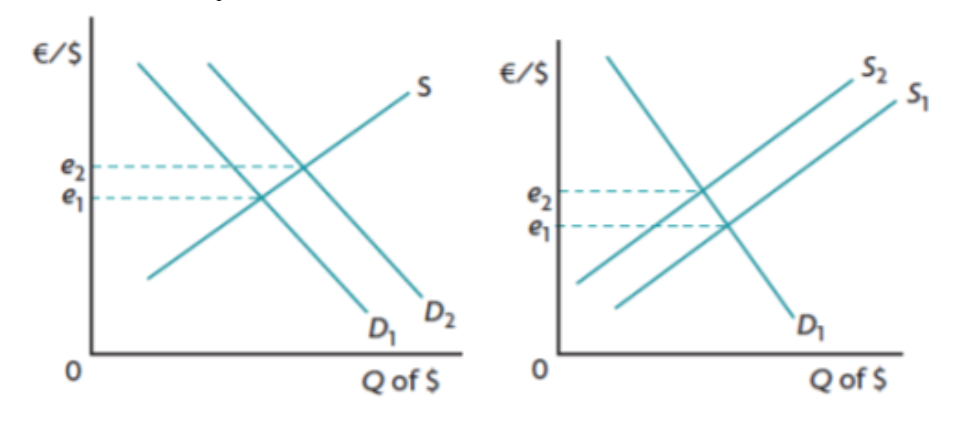

Monetary policy

control and use of interest rates and money supply to influence level of AD and economic activity

overseen by the central bank or designated money authority

interest rates → price of money

Functions of a central bank

executor of monetary policy

government’s bank

banker’s bank

sole issue of legal tender (bank notes or coins)

lender of last resort

credit control

Goals of monetary policy

low and stable rate of inflation (inflation targeting)

inflation target rate → transparent goal to help control inflation

low unemployment

lower interest rates = economic activity increases = increase in AD

reduces borrowing costs so consumer confidence increases

reduce business cycle fluctuations

lower interest rates in a downturn and higher interest rates in booms

promote a stable economic environment for long-term growth

greater degree of certainty and confidence

external balance (imports = exports)

influence the exchange rate

lower interest rates = reducing exchange rate

Money creation

credit creation → banks create money from deposits of savers and borrowers

minimum reserve ratio → limit on amount commercial banks can lend

to limit growth in money supply

money multiplier = 1/reserve ratio (how much deposit increases money supply)

if the central bank wants to limit economic activity and suppress inflationary pressures, the minimum reserve ratio is increased to limit growth in money supply

Tools of monetary policy

Open Market Operations (OMO)

buying/selling of government securities by a country’s central bank

government securities - type of public sector debt to finance government

sale of bonds with promise to repay borrowed money with fixed rate of interest

government securities sold when money supply needs to fall

increased interest (return) rate attracts buyers/investors

contractionary monetary policy → withdraws money from economy

opposite is true (not sold but purchased by central banks)

Minimum Reserve Requirements (MRR)

commerical banks generally want to lend more to profit more, but the central banks require them to keep a certain percentage of their deposits at the central bank

called the minimum reserve ratio or minimum reserve requirement (MRR)

ensures the commercial banks have enough cash for their daily transactions

bank run → most customers withdraw all their cash deposits on any given day

raising MRR limits growth → 1/MRR = money multiplier

Changes in central bank Minimum Lending Rate (MLR)

official rate of interest charged by central bank or loans to commercial banks

also known as base rate, discount rate, and refinancing rate

influences interest rates from commerical banks for lending

if MLR increases, the lending rates increase too → contractionary

Quantitative Easing (QE)

central banks purchase corporate bonds to directly inject money into the economy

the institutions have “new” money and see an increase in liquidity

boosts money supply and promotes lending (increase in AD)

central bank creates money

central bank buys bonds from financial institutions

interest rates reduced

businesses/people borrow more money

businesses/people spend more and create jobs

boosts the eocnomy

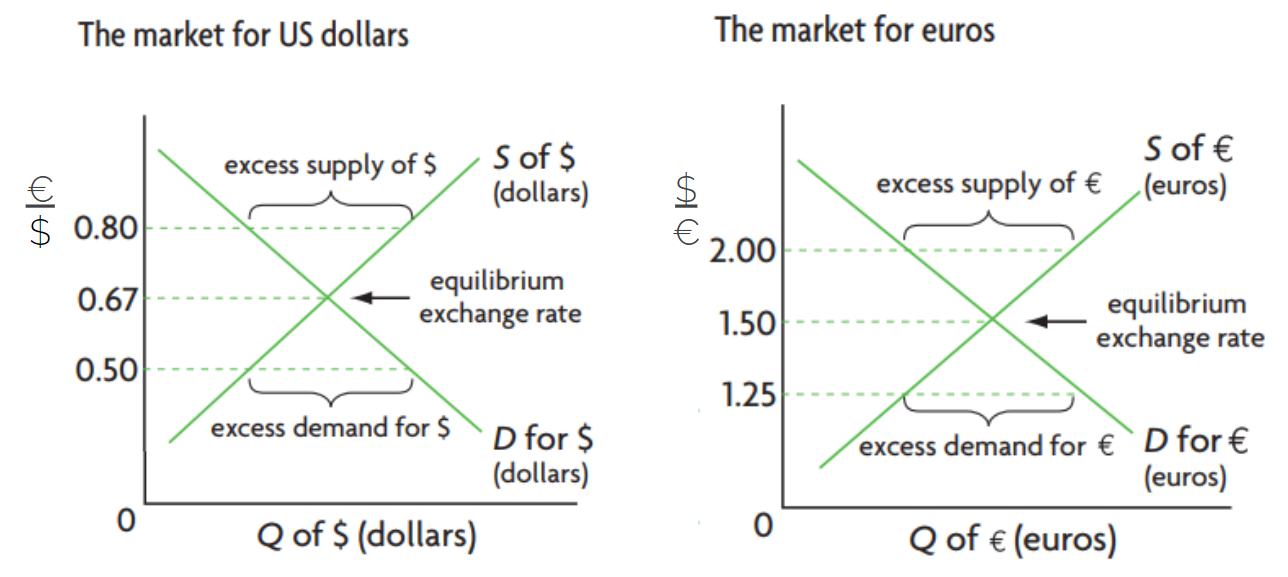

Demand and Supply of money

interest rate → return for lenders or price for borrowing (price of money)

Dm → desire to hold money rather than saving it

Sm → total amount of money in the economy

supply is vertical because supply of money is fixed at any given time by central banks

opportunity cost of holding money varies directly with interest rate → fall in interest rates = reduction in opportunity cost of holding money

central banks consider these when deciding supply of money:

state of economy (ex: deflationary gap = reduction in interest rates)

rate of growth of nominal wages (ex: higher labour cost = higher prices = inflation)

business confidence levels (lower interest rates = more incentive for investment)

house prices (most valuable asset)

exchange rate

Real VS Nominal interest rates

interest rate → price of money (cost of credit or return on savings)

nominal interest rate → actual rate agreed on between bank and customer

real interest rate → accounts for inflation

real IR = nominal IR - inflation rate

IR = interest rate

Expansionary monetary policy (loose/easy)

lower interest rates → shifts AD rightwards to close a deflationary gap

AD = C+I+G+(X-M)

C, I, G rise due to cheaper borrowing cost