Intro to accounting

in class notes

assets= liabilities + equaity three basic components

possessions are assets, stocks are also assets

liabilities and equity are claims

equity is your own net assets

this equation is also known as a balance sheet equation

four statements:

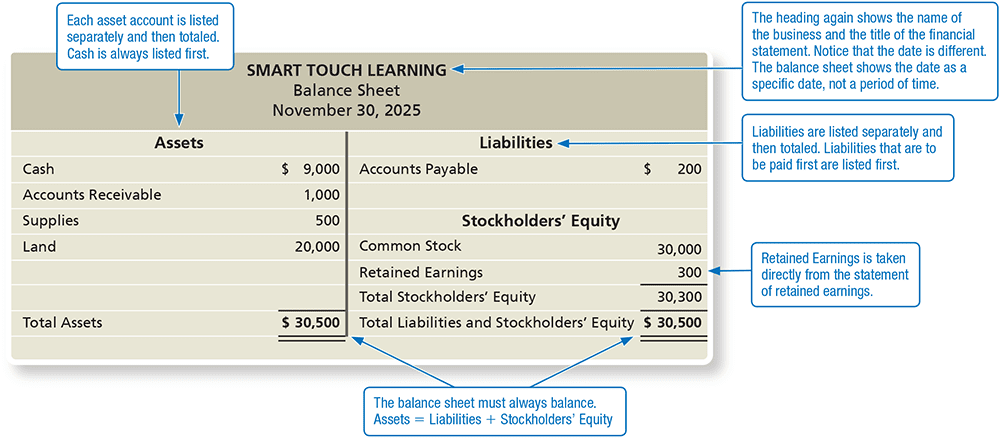

balance sheet: tells us what we have and how much we owe to others and what is left only do balance sheet at the end of a physical period

set up:

company name (end of physical period could be monthly, quarterly, and annually)

(us dollar)

textbook notes (chapter one)

1.1 notes

accounting is the information system that measures business activities, processes the information into reports, and communicates the results to decision makers

two major fields:

financial accounting provide information for external decision making, such as investors, lenders, customers, and the federal government

managerial accounting: focuses on information for internal decision makers, such as the company’s mangers and employees

any person or business to whom a business owes money is a creditor they evaluate the company’s ability to make the payments by reviewing its financial statements

Types of certifications:

CPA is a certified public accountant they are license professional accountants who serve the general public. CPAs work for public accounting firms, businesses, government entities, or educational institutions

CGMA is a chartered global management accountant, this distinguishes accountants who have advanced knowledge in finance, operations, strategy, and management

CMA is a certified management accountant who is a certified professional who specialize in accounting and financial management knowledge, generally CMAs work for a single company

CFP is a certified financial planner who work with individuals to help them budget, plan for retirement save for education, and manage their finances

data analytics is the process of examining data, identifying trends, and drawing conclusions, and is often used by companies to answer business questions

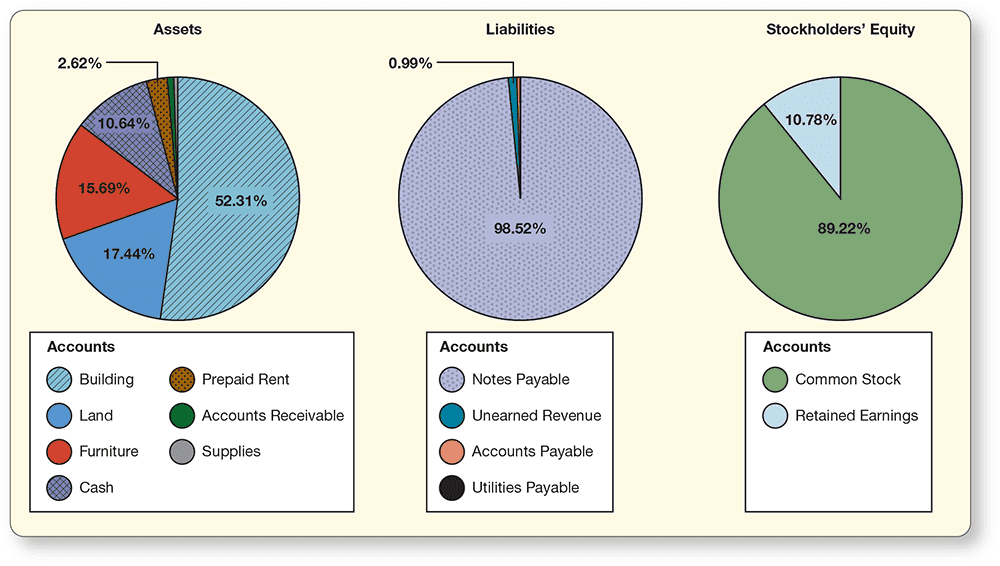

data visualizations are the presentations of data, trends, and conclusions ina graphical format

1.2 notes

in the United States, the Financial Accounting Standards Board (FASB) is a privately funded organization who oversee the creation and governance of accounting standards

Securities and Exchange Commissions (SEC) is the U.S. governmental agency that oversees the U.S. financial markets it also oversees those organizations that set standards (like the FASB)

the FASB also works with congressionally created groups like the Public Company Accounting Oversight Board (PCAOB) and private groups like the Association of International Certified Professional Accountants (AICPA), Institute of Management Accountants (IMA), and International Accounting Standards Board (IASB)

Generally Accepted Accounting Principles (GAAP) are the guidelines for accounting information it is the main U.S. accounting rule book.

companies whose stock is publicly traded (companies whose stock can be purchased and sold on a public stock exchange, such as the New York Stock Exchange or NASDAQ) are required to follow the rules of the SEC

one of those rules required the publicly traded company to file financial statements using GAAP

companies that are not publicly traded still follow GAAP as financial lenders oftern require them

the AICPA issued a financial reporting framework for small-and medium-sized entities to guide these types of businesses in the development of financial statements

companies that are not incorporated in or do significant business in another country might be required to publish financial statements using International Financial Reporting Standards (IFRS) which are published by International Accounting Standards Board (IASB)

the IFRS is a set global accounting standards that is required by 144 countries/jurisdictions

in the U.S. foreign companies that are listed on the U.S. stock exchange are able to report their financial information using either U.S. GAAP or IFRS standards

IFRS are generally less specific and based more on principle than the U.S. GAAP, IFRS leaves more room for professional judgement, IFRS allows periodic revaluation of certain assets and liabilities to restate them to market value rather than keeping them at historical cost

GAAP rests on conceptual framework that identifies the objectives, characteristics, elements, and implementation of financial statements and created the acceptable accounting practices

the objective of financial reporting is to provide information useful for making investment and lending decisions, to be useful the information must be relevant and have faithful representation for this to happen the faithful representation is complete, neutral, and free from material error

Economic Entity Assumption and economic (business) entity is an organization that stands apart as a separate economic unit boundaries are drawn around each entity to keep its affairs distant from those of other entities

an entity refers to one business, separate from its owners

a corporation is a business entity formed under state law the state grants them a charter which is a document that gives the state’s permission to form a corporation also known as authorization

separate legal entity:

a corporation is a distinct entity from a legal perspective, it is an entity that exists apart from its owners, who are called the stockholders ( a person who owns stock in a corporation) it share holders. the corporation has man of the rights that a person has.

ex: a corporation may buy, own, and sell property; enter into contracts; sued and be sued

items that the business owns(its assets) and those items that the business has to pay later (its liabilities) belong to the corporation and not to the individual stockholders

the ownership interest of a corporation is divided into shares of stock to become a stockholder you must purchase the stock of the corporation

the corporate charter specifies how much stock the corporation is authorized to issue (sell) to the public due to this it is usually easier for corporations to raise capital

continuous life and transferability:

stockholders may transfer stock as they wish either by selling or trading the stock to another person, giving the stock away, or deposing of the stock in any other way since corporations have continuous lives regardless of changes in ownership of their stock, the transfer of the stock has no effect on the continuity of the corporation

for sole proprietorships and partnerships, in contrast, end when their ownership changes for any reason

a corporation’s life is not dependent on a specific individuals ownership

no mutual agency:

no mutual agency means that the stockholder of a corporation cannot commit the corporation to a contract unless the stockholder is acting in a different role, such as an officer in the business

mutual agency of the owners is not present in a corporation as it is in a partnership

limited liability of stockholders:

a stockholder has limited liability for the corporation’s debts, the most that stockholders can lose is the amount the originally paid for the stock

sole proprietors and partners are personally liable for the debts of their businesses

The combination of limited liability and no mutual agency means that persons can invest unlimited amounts in a corporation with only the fear of losing whatever amount the individual has invested if the business fails. This attractive feature enables a corporation to raise more money than proprietorships and partnership

separation of ownership and management:

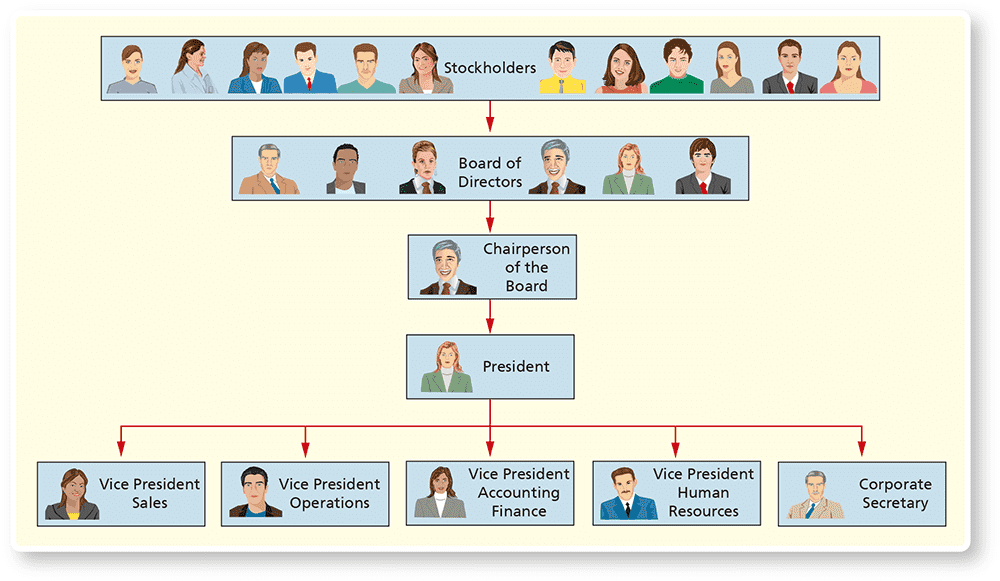

stockholders own the business, but a board of directors elected by the stockholders appoints corporate officers to manage the business

corporate taxation:

corporations are separate taxable entities, they pay a variety of taxes not paid by sole proprietorships or partnerships

federal and state income taxes- corporate earnings are subject to double taxation, first corporations pay their own income tax on corporate income then the stockholders pay personal income tax on the dividends that they receive from corporations. this is different from sole proprietorships and partnerships, which pay no business income tax instead the tax falls solely on the individual owners

annual franchise tax levied by the state- the franchise tax is paid to keep the corporation charter in force and enables the corporation to continue in business

structure of a corporation:

business assets of a person are separate from their home or cars or personal assets because of the economic entity assumption

the cost principal:

this states that acquired assets and services should be recorded at their annual cost(also called historical costs is the costs average over time) and not fair value

this means that we record transactions at the amount shown on the receipt the actual amount paid

For example, assume our fictitious company Smart Touch Learning purchased land for $20,000. The business might believe the land is instead worth $25,000. The cost principle requires that Smart Touch Learning record the land at $20,000, not $25,000.

this principal also holds that accounting records should continue reporting the historical cost of an asset over its useful life instead of adjusting the cost annually to fair value

fair value (also called market value)is also the current costs because of a change in the market or inflation represents the price that would be received if the assets was sold

cost is a reliable measure

example: Suppose Smart Touch Learning holds the land for six months. During that time land prices rise, and the land could be sold for $30,000. Should its accounting value—the figure on the books—be the actual cost of $20,000 or the current market value of $30,000(costs because of a change in trend or inflation)? According to the cost principle, the accounting value of the land would remain at the actual cost of $20,000 (average value throughout time)

the going concern assumption:

this is another reason for measuring assets at historical cost

this assumes that the entity will remain in operation for the foreseeable future under this assumption accountant assume that the business will remain in operation long enough to use existing resources for their intended purpose

the monetary unit assumption:

the value of a dollar changes over time, and a raise in the price level is called inflation, during period of inflation a dollar will purchase less

accountants will assume that the dollar’s purchasing power is stable and this is the basis of the monetary unit assumption which requires that the items on the financial statements be measured in terms of monetary unit (a standard unit of value of a country’s coinage)

ethic in accounting and business:

the SEC requires publicly held companies to have their financial statements audited by independent accountants

an audit is an examination of a company’s financial statement and records

the independent accountants then issue an opinion that states weather the financial statements gives a fair picture of the company’s financial situation this assures that investors are getting accurate information before purchasing stock

Sarbanes-Oxley Act (SOX) is intended to curb financial scandals sox requires management to review internal control and take responsibility for the accuracy and completeness of their financial reports. they also made it a criminal offense to falsify financial statements

Public Company Accounting Oversight Board (PCAOB) was created by sox to monitor the work of independent accountants who audit public companies

1.3 notes

accounting equation:

measures the resources of business (what the business owns or has control of) and the claims to those resources (what the business owes to creditors and to the owners)

three parts: assets, liabilities, and equity

assets= liabilities+equity the left side of the equation always equals the right side of the equation

example: If a business has assets of $230,000 and liabilities of $120,000, its equity must be 230,000-120,000 = 110,000 equity

assets are an economic resources that is expected to benefit the business in the future, assets are something of value that the business owns or has control of

example: cash, merchandise, inventory, furniture, and land

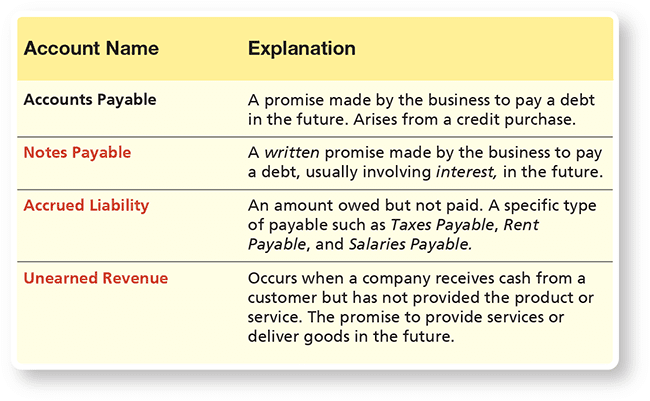

liabilities are debts that are owed to creditors, liabilities are something the business owes and represents the creditors’ claims on the business’ assets

example: a creditor who has loaned money to a business has a claim to some of the assets until the business pays the debt

many liabilities have payable in their titles such as accounts payable, notes payable, and salaries payable

equity:

represents the amount of assets that are left over after the company has paid its liabilities, its the company’s net worth

equity two main components

contributed capital (paid-in capital) is the amount contributed (such as cash or other assets) to the corporation by its owners (the stockholders) the basic element of contributed capital is stock, which is the corporation issues to the stockholders as evidence of their ownership

common stock represents the basic ownership of every corporation

retained earnings is the equity earned by profitable operations that is not distributed to stockholders

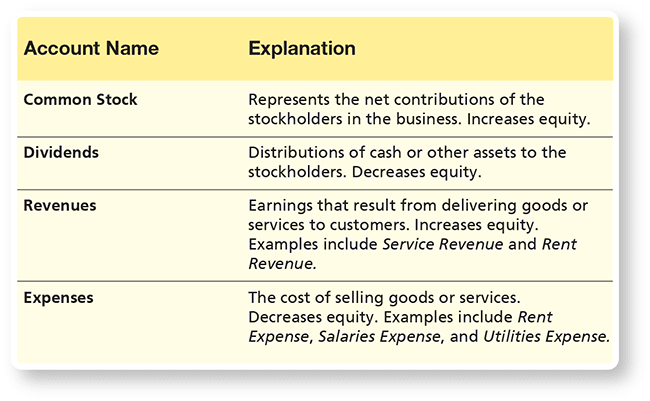

three types of events that affect retained earnings: dividends, revenues, and expenses

dividends are a distribution of a corporations earnings to stockholders can be paid in the form of cash, stock, or other property. dividends represent decreases in retained earnings and therefore decrees stockholders equity

revenues are earnings that result from delivering goods or services to customers

example: sale revenues, service revenue and rent revenue

revenues increase a corporation’s retained earnings and therefore increase stockholders equity

expenses are costs of selling goods or services

expenses are the opposite of revenues and therefore decreases retained earnings and stockholders equity

example: rent expenses, salaries expenses, advertising expenses, and utilities expenses

the difference between revenue and expense is net income and net loss

net income occurs when total revenues are greater than total expenses

net loss occurs when total expenses are greater than total revenues

The accounting equation can now be expanded to show the components of equity:

a cooperation can determine the change in equity from the beginning of the year to the end of the year by using the expanded components of equity

issuances of commons stock and revenues earned during the year will always increase equity and dividends distributed and expenses incurred during the year will always decrease equity

ending equity can be calculated with the following equation:

beginning equity+ issuance cost of common stock- dividends distributed+ revenues- expenses= ending equity

1.4 notes

transaction is any event that affects the financial position of the business and be be measured with faithful representation

transactions affect what the company has (assets), owes (liabilities), and/or its net worth (equity)

an accountant records only those events that have dollar amounts that can be measured reliably,

example: buying a building, a sale of merchandise, and the payment of rent

1.5 notes

financial statements are business documents that are used to communicate information needed to make business decisions

four types of financial statements:

income statement (statement of earnings) presents a summary of a business entity’s revenues and expenses for a period of time, such as a month, quarter, or year this incomes tells us weather the business enjoyed net income suffered a net loss. the only two accounts shown on the statement are revenues and expenses

revenues-expenses= net income or net loss

statement of retained earnings show the changes in retained earnings for a business entity during a time period, such as a month, quarter, or year. income statement is prepared before the statement of retained earnings the net income or loss must be first calculated on the income statement and then carried to the statement of retained earnings

retained earnings, beginning+ net income or -net loss for the period- dividends for the period= retained earnings, ending

balance sheet( statement of financial position) lists a business entity’s assets, liabilities, and stockholders’ equity as of specific date, usually the end of a month, quarter, or year. The balance sheet is a snapshot of the entity. An investor or creditor can quickly assess the overall health of a business by viewing the balance sheet.

assets= liabilities+ stockholders equity

money owed to a vendor is reported on the balance sheet as accountable payable

balance sheet:

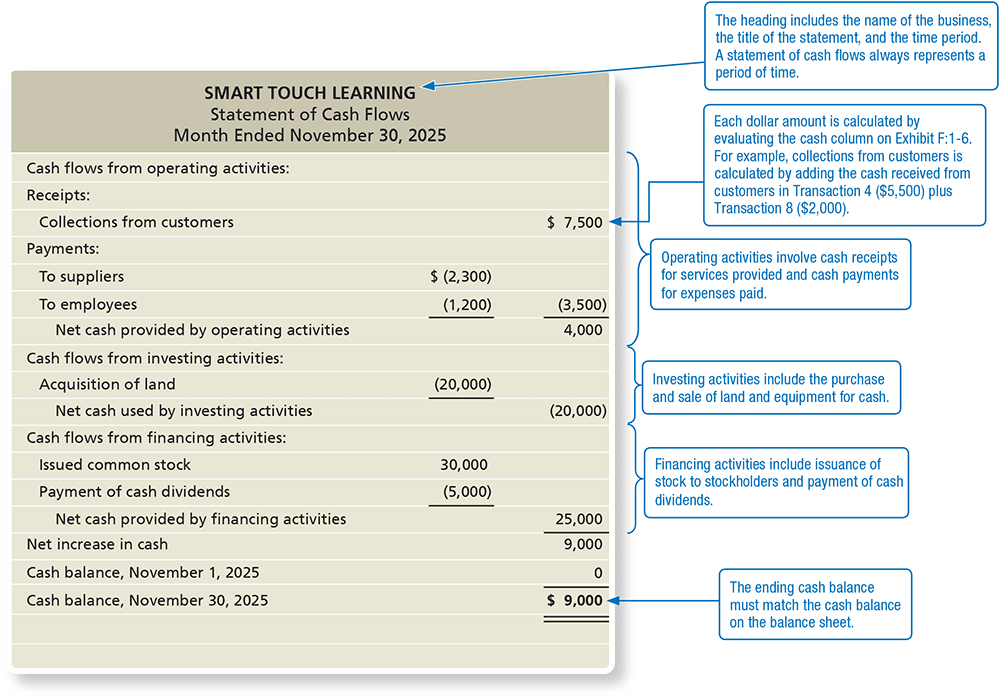

statement of cash flows reports the cash coming in (positive amounts) and the cash going out (negative amounts) during a period it only reports transactions that involve cash because it reports the net increase or decrease in cash during the period and the ending cash balance * If a transaction does not involve cash, such as the purchase of supplies on account, it will not be reported on the statement of cash flows.

divided into three sections:

operating activities involve cash receipts for services provided to customers and cash payments for expenses

investing activities include the purchase and sale of land and equipment for cash

financing activities include cash contributions by stockholders, cash dividends paid to the stockholders, cash received from borrowing, and cash paid when loans are repaid

cash flows from operating activities, cash flows from investing activities, cash flows from financing activities

statement of stockholders

return of assets (ROA) how well a company is performing

beginning total assets+ ending total assets/2 to find average total assets

net income/ average total assets for finding ROA

chapter two notes

2.1 notes

account is the detailed record of all increases and decreases that have occurred in an individual asset, liability, or equity during a specified period

assets are economic resources that are expected to benefit the business in the future

liability is a debt that is something there business owes a business generally has fewer liability accounts than asset accounts

types of liabilities:

equity is the stockholders claim to the assets of the business also known as stockholders equity

stock holders equity is made up of contributed capital and capital earned. contributed capital is consists of of common stock and earned capital results from the earnings of delivering goods or services

chart of accounts is a list of all company accounts along with the account numbers

account numbers are just shorthand versions of the account names, one account number equals one account name just like a social security number is unique to one individual

account numbers usually have two or more digits. assets are often numbered with 1, liabilities with 2, stockholders equity with 3, revenues with 4, and expenses with 5

the second or third digit in an account number indicate where the account fits within the category

each company chooses its own account numbering system

ledger is a collection of all the accounts, the changes in those accounts, and their balances

an chart of accounts and a ledger are similar in that they both list the account names and numbers but a ledger is more detailed and includes the increases and decreases of each account for a specific point in time

2.2 notes

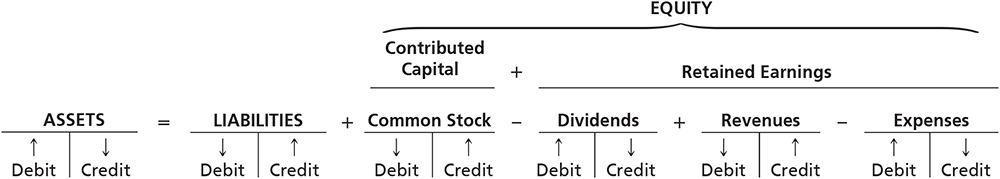

double-entry system is a system of accounting in which every transaction affects at least two accounts *accounting uses this system to record the dual effect of each transaction the transaction would be incomplete if only one side were recorded

examples: purchase of supplies what is the dual effect: increase the account for supplies (the business received supplies) but a decreases in cash (the business paid cash)

t-account: a summary account that is shaped like a capital T with debit posted on the left side of the vertical line and credits on the right side of the vertical line

debit goes on the left side and credit go on the right. debit is abbreviated as DR and credit as CR

debit is gaining money credit is loosing money

recorded increases or decreases to an account is determined by the account type (asset, liability or equity), for any given account increases are recorded on one side and decreases are recorded on the other

new accounting equation which includes debit and credit

in the expanded accounting equation that Dividends and Expenses record increases and decreases opposite of Common Stock and Revenues. This is because increases in Dividends and Expenses decrease equity

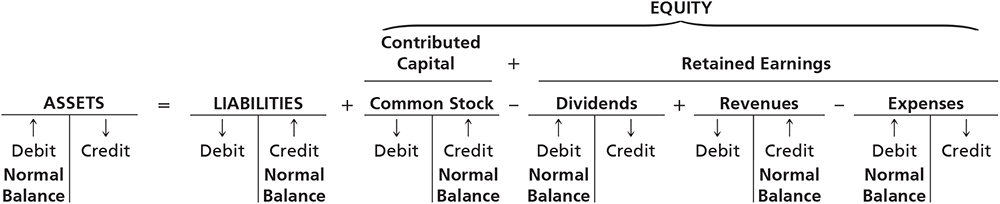

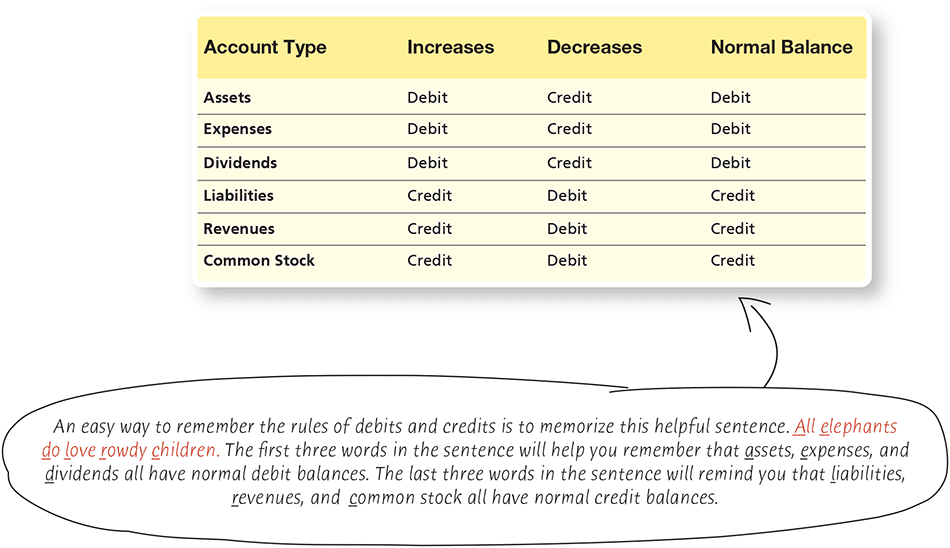

normal balance is that balance that appears on the increase side of an account *all accounts have a normal balance*

accounting equation with normal balance marked

rules of debit and credits and normal balances for each account type:

2.3 notes

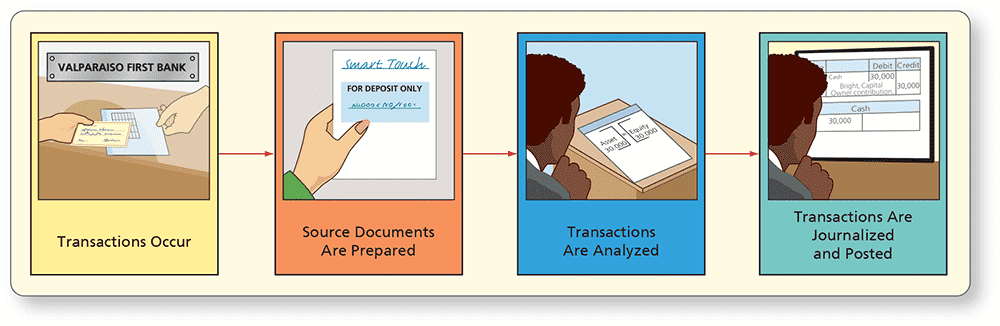

source documents provide the evidence and data for recording transactions

other source documents that businesses use include:

purchase invoice documents that tell the business how much and when to pay a vendor for the purchases on account, such as supplies

bank checks documents that illustrate the amount and date of cash payments

sales invoice documents provided to clients when a business sells service goods; or tells the business how much revenue to record

an accountant should not do anything without seeing source documents first

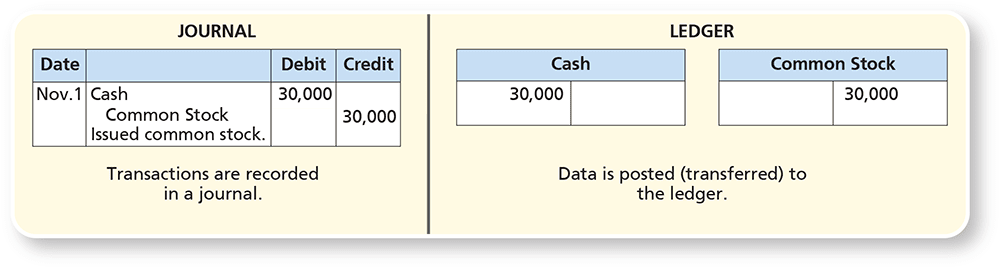

transactions are then recored in a journal which is the record of transactions in date order

posting is the process of transferring data from the journal to the ledger

*debits in the journal are posted as debits and credits as credits NO exceptions*

process:

journalizing and posting process:

identify the accounts and the account type (asset, liability, or equity)

decide whether each account increases or decreases, then apply the rules of debits and credits

record the transactions in the journal

post the journal entry to the ledger

determine whether the accounting equation is in balance

the four column account still has debit and credit columns, but is also adds two additional columns that are used to determine a running balance

2.4 notes

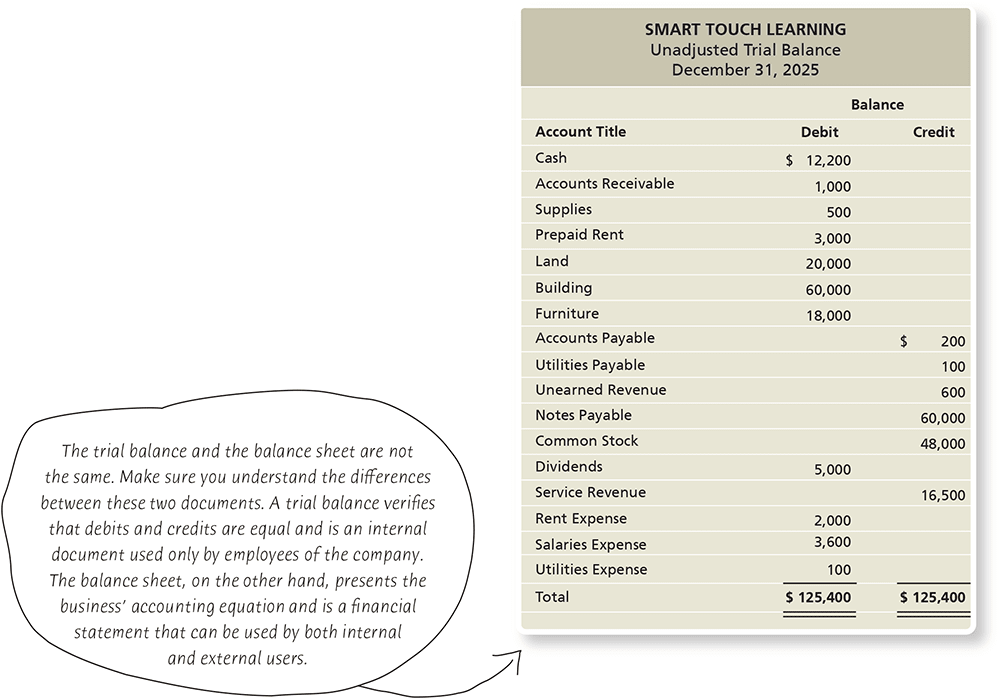

trial balance summarizes the ledger by listing all the accounts with their balances, assets first, followed by liabilities, and then equity

shows the balance on a specific date for all accounts in a company’s accounting system

throughout the accounting process, total debits ALWAYS equals total credits. If they do not, there is an error

balancing errors can be detected by computing the difference between total debits and total credits on the trial balance the perform one or more of the following actions:

search the trial balance for missing account: for example suppose the accountant omitted the dividers account from the trial balance (in graph above) total debits would be 120,400 (125,400-5,000). trace account from the ledger to the trial balance, and you will locate the missing account

divide the difference between total debits and total credits by 2 a debit treated as a credit, or vice versa, doubles the amount of error. suppose the accountant posted a 500 credit as debit. total debits contain the 500 so the credit balance is understated by 500. the out of balance amount the difference between the two columns is 1,000. dividing the difference by 2 identifies the 500 amount of the transaction then search the journal or ledger for a 500 transaction and trace it to the account affected

divide the out of balance amount by 9 if the results is evenly divisible by 9 the error may be a slide error(ex writing 1,000 as 100 or vice versa) or a transportation (ex listing 1,200 as 2,100). suppose for the example the accountant entered the 5,000 dividends as 50,000 on the trial balance. this a slide error, meaning the decimal point slid to the right when an extra zero was recorded. total debit would differ from total credit 45,000 (50,000-5,000=45,000). dividing 45,000 by 9 yields 5,000 the correct amount of the dividends. look for an account in the ledger with a 5,00 balance until you reach the dividends account. you have found the error

financial statements are prepared in the following order:

income statement - net income or loss= revenues-expenses

statement of retained earnings- beginning retained earnings+ net income (or -net loss)- dividends= ending retained earnings

balance sheet- assets=liabilities+ stockholders equity

dashboard is a visual display of data that can be used to answer a variety of different questions

dashboard example

2.5 notes

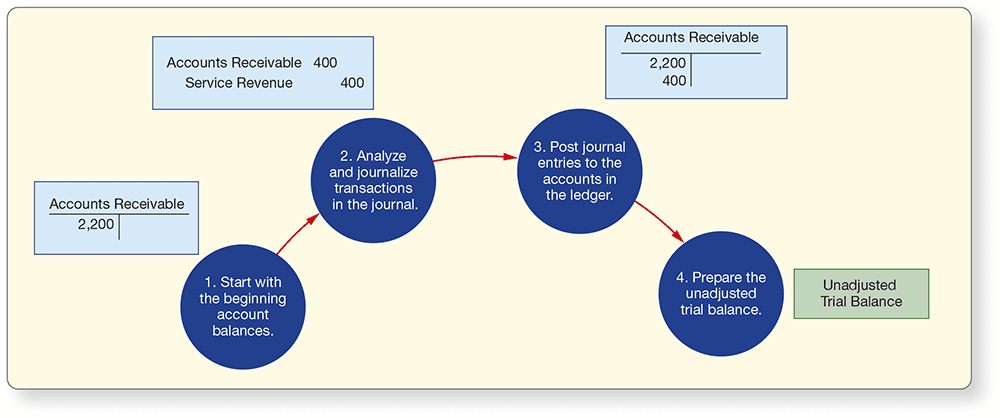

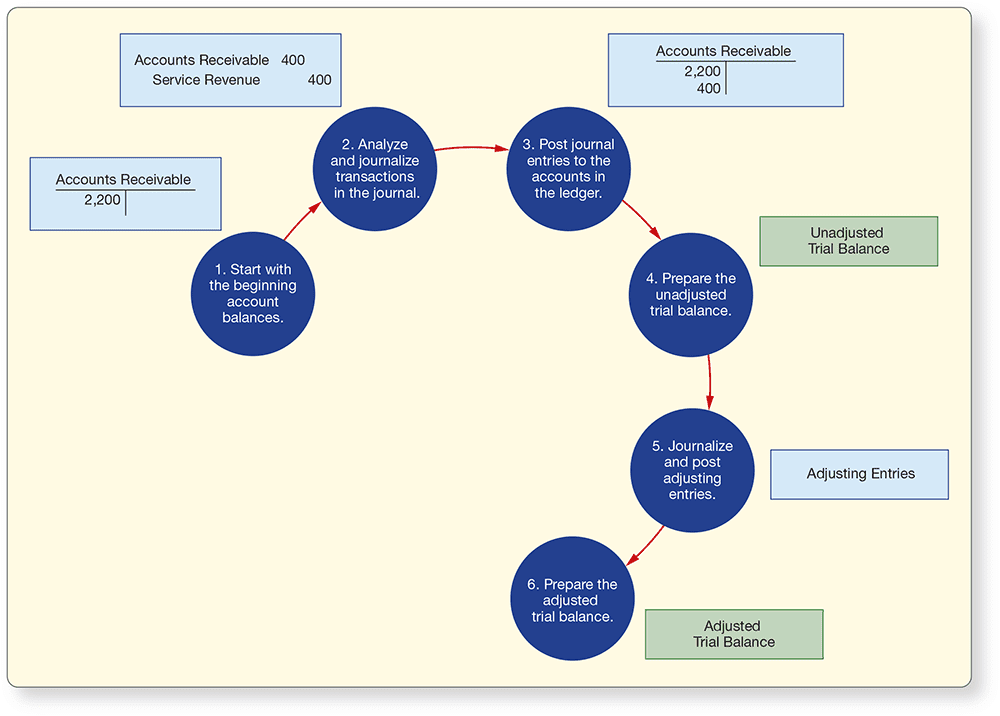

accounting cycle is the process by which companies produce their financial statements for a specific period of time

it is the steps that companies follow throughout the time period

steps in accounting cycle:

start with the beginning account balances if it is a new company such as smart touch learning, the beginning balances are $0 otherwise companies use the balances determined at the end of the pervious accounting period

analyze and journalize transactions in the journal companies will analyze the source documents and record transactions as journal entries in the journal using the rules of debits and credits

post journal entries to the accounts in the ledger journal entries are posted, or transferred, from the journal to the ledger. in most accounting systems this process is automatically completed by the accounting software

prepare the unadjusted trial balance periodically throughout the time period, the company will prepare an unadjusted trial balance which summarizes the account balances as reported in the ledger. the unadjusted trial balance is useful in verifying the equality of debits and credits

2.6 notes

debt ratio shows the proportion of assets financed with debt and is calculated by dividing total liabilities by total assets. it can be used to evaluate a business ability to pay its debts

debt ratio= total liabilities/ total assets

the liabilities represent the claims of the creditors and the equity represents the claims of the stockholders

the higher the debt ratio the higher the risk

All liabilities must eventually be paid, and the debt ratio is one indication of the ability of the company to fulfill these obligations.

chapter 3 notes

3.1 notes

cash basis accounting records only transactions with cash: cash receipts and cash payments

when cash is paid expenses are recorded, when cash is received revenues are recorded as a result revenues are recorded only when cash is received and expense are recorded only when cash is paid

the cash basis of accounting is not allowed under GAAP; however small businesses will sometimes use this method

the cash method is an easier accounting method to follow because it generally requires less knowledge of accounting concepts and principles. the cash basis accounting method also does a good job of tracking a business cash flow

accrual basis accounting follows GAAP and records the effect of each transaction as it occurs that is, revenue are recorded when earned and expense are recorded when incurred

revenues are considered to be earned when the services or goods are provided to the customers

under accrual basis accounting it is irrelevant when ash is received or paid

3.2

time period concept assumes that a business’ activities can be sliced into small segments and that financial statements can be prepared for specific periods, such as a month, quarter, or year

the 12-month accounting period used for the annual financial statements is called a fiscal year

revenue recognition principle tells accountants when to record revenue and requires companies follow a five step process:

identify the contract with the customer, a contract is an agreement between two or more parties that created enforceable rights and obligations

identify the performance obligations in the contract, a performance obligation is a contractual promise with a customer to transfer a distinct good or service. a contract might have multiple performances obligations

example: For example, AT&T Inc. (NYSE: T) often provides a new phone to customers who sign a two-year cellular service agreement. This represents two distinct performance obligations: the cellular service agreement and the new phone

determine the transaction price the transaction price is the amount that the entity expects to be entitled (given) to as a result of transferring goods or services to the customer

allocate the transaction price to the performance obligations in the contract if the transaction has multiple performances obligations, the transaction price will beed to be allocated among the different performance obligations

recognize revenue when (or as) the entity satisfies each performance obligation the business will recognize revenue when (or as) it satisfies each performance obligation by transferring a good or service to a customer. a good or service is considered transferred when the customer obtains control of the good or service. the amount of revenue recognized is the amount allocated to the satisfied performance obligation

matching price principle(sometimes called the expense recognition principle) guides accounting for expenses and ensures the following:

all expenses are recored when they are incurred during the period

expenses are matched against the revenues of the period

to match expenses against revenue means to subtract expenses incurred during one month from revenues earned during that same month

3.3 notes

accrual basis accounting requires the business to review the unadjusted trial balance and determine whether any additional revenues and expenses need to be recorded

adjusting entry is completed at the end of the accounting period and records revenues to the period in which they are earned and expenses to the period in which they occur

adjusting entries also update the asset and liability accounts adjustments are needed to properly measure several items such as:

net income (or loss) on the income statement

assets and liabilities on the balance sheet

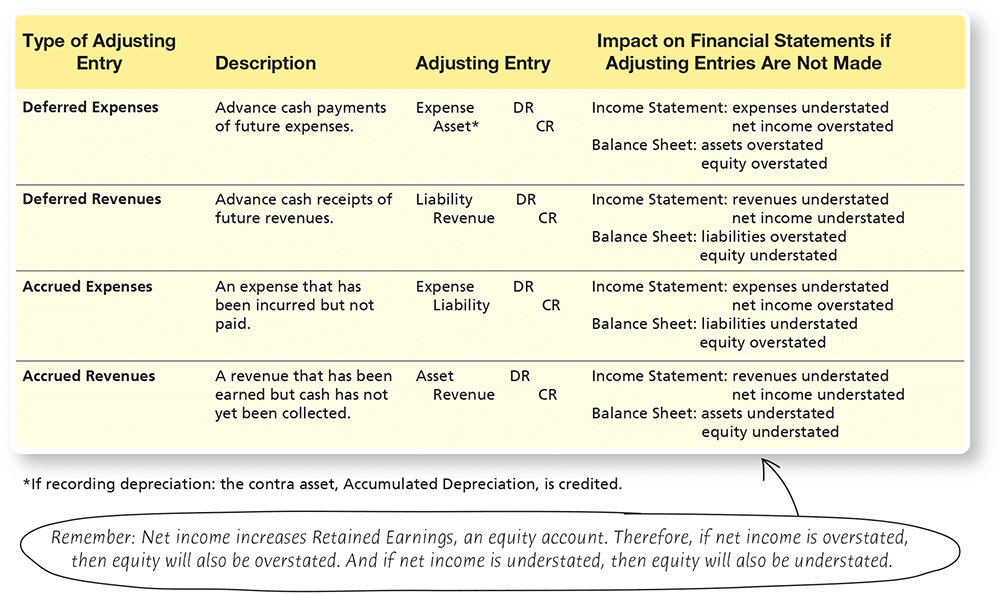

two basic categories of adjusting entries:

deferral adjustment the cash payment occurs before an expense is incurred or the cash receipt occurs before the revenue is earned. A deferral delays (or defers) the recognition of revenue or expense to a date after the cash is received or paid

accrual adjustments are the opposite. an accrual records an expense before the cash is paid, or it records the revenue before the cash is received

the two basic categories of adjusting entries can be further separated into four types:

deferred expenses (deferral)

deferred revenues (deferral)

accrued expenses (accrual)

accrued revenues (accrual)

deferred expenses (prepaid expenses) are advanced payments of future expenses they are deferrals because the expenses is not recognized at the time of payment but deferred until they are used up as the payment is used up, the used portion of the asset becomes an expense via an adjusting entry

supplies are also accounted for as deferred expenses

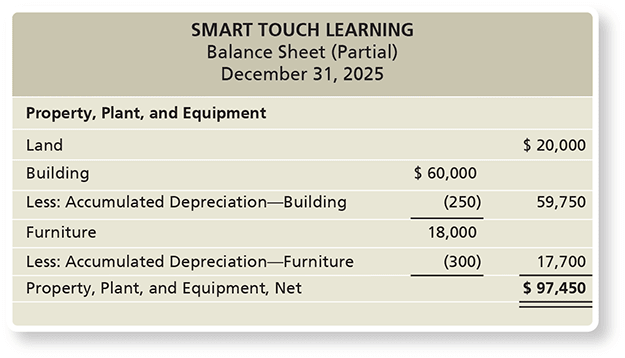

property, plant, and equipment (plant assets) are long-lived tangible assets used in the operation of a business

examples: land, buildings, equipments, furniture, automobiles

as a business uses these assets, their value and usefulness decline. the decline in usefulness of a plant asset is an expense, and accountant systematically spread the asset’s cost over its useful life

the allocation of a plants asset’s cover over its useful life is called depreciation

example: a business might pay cash for an automobile when purchased, but the automobile will last for years, so depreciation allocates the cost spent on the car over the time the business uses the car.

all plant assets are depreciated with the EXCEPTION of land

the expected value of a depreciable asset at the end of its useful life is called residual value

straight-line method allocated an equal amount of depreciation each year and is calculated as:

straight line depreciation= (cost-residual value)/useful life

example: (18,000-0)/5 years —> 3,600 per year/12 months = 300 per month

accumulated depreciation account is the sum of all depreciation expense recorded for the depreciable asset to date

accumulated depreciation will increase (accumulate) over time

accumulated depreciation is a contra asset which means that it is an asset account with a normal credit balance. contra means opposite

contra account is an account that is paired with, and is listed immediately after, its related account in the chart of accounts and associated financial statement and whose normal balance is the opposite of the normal balance of the related account

a contra account has two main characteristics:

a contra account is paired with and is listed immediately after its related account in the chart of accounts and associated financial statement

a contra account’s normal balance (debit or credit) is the opposite of the normal balance of the related account

a business my have a separate accumulated depreciation account for each depreciable asset

book value represents the cost invested in the asset that the business has not yet expensed

unearned revenue is a liability

deferred revenue is a liability created when a business collects cash from customers in advance of completing a service or delivering a product

the revenue associated with the work or product is not recognized when the cash is received but is instead deferred until it is earned

3.4 notes

accrued expense an expense a business has incurred but has not yet paid

example: employee salaries since expenses. grow as the employee works, so the expense is said to be accrue. another example is interest expense on a note payable, interest accrues as time passes on the note.

an accrued expense always creates an accrued liability

corporations do not make daily or weekly entries to accrue expense instead they wait until the end of the accounting period and make an adjusting entry to bring each expense (and the related liability) up; to date for the financial statements

when an expense is paid over time the amount recorded is split in half for example:

Smart Touch Learning pays its employee a monthly salary of $2,400—half on the 15th and half on the first day of the next month. Notice on the calendar that the pay days are on December 15 and January 1.The December 15 entry records only the first half of December’s salaries expense. The second payment of $1,200 will occur on January 1; however, the expense was incurred in December, so the expense must be recorded in December in order to follow the matching principle that states that all expenses are recorded in the period when they are incurred. On December 31, Smart Touch Learning makes the following adjusting entry

formula for computing interest is

amount of interest= principal x interest rate x time

accrued revenue is a revenue that has been earned but for which the cash has not yet been collected

3.5 notes

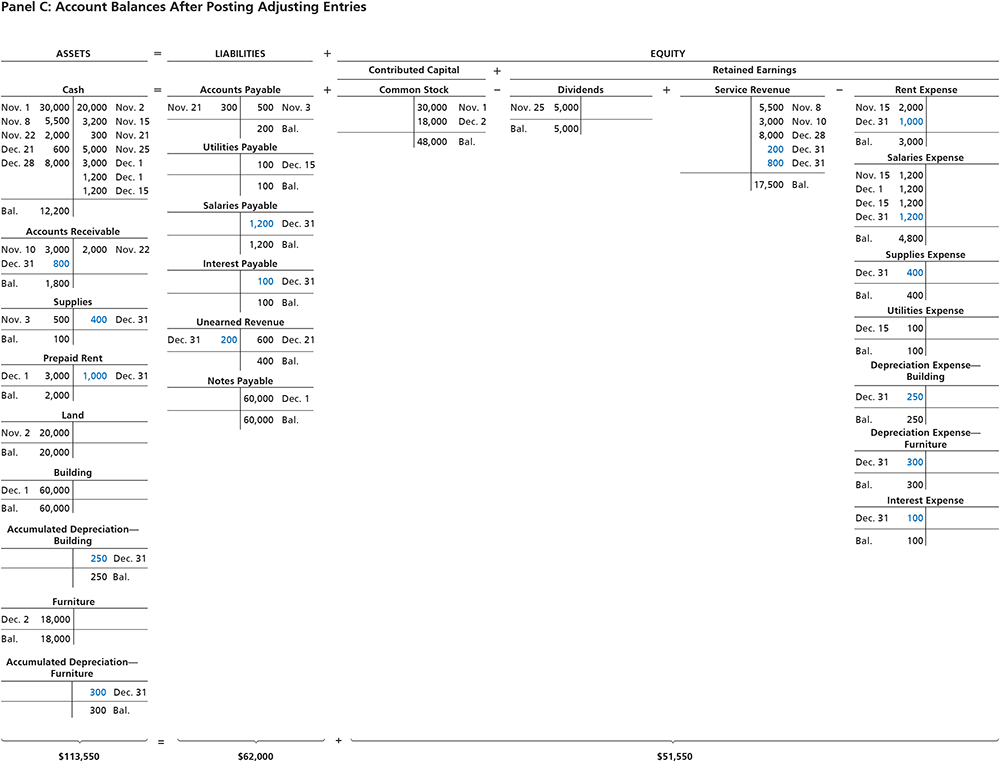

adjusted trial balance a list of all the accounts with their adjusted balances

Panel A gives the data for each adjustment. Panel B shows the adjusting entries.

Panel C shows the T-accounts and balances after posting.

trial balance summarizes the account balances from the ledger and its purpose is to ensure that total debits equal total credits

3.6 notes

the adjusted trial balance is used to prepare the financial statements

if the adjusting entries are not recorded, the ledger accounts will not reflect the correct balances, and the adjusted trial balance will be incorrect

3.7 notes

accounting cycle

chapter 4 notes

4.1 notes

order of financial statements:

income statement- which reports revenue and expenses and calculates net income or loss for the time period

statement of retained earnings- which shows how retained earnings changed during the time period due to the net income or loss and dividends

balance sheet- which reports assets, liabilities, and stockholders equity as of the last day of the time period

in a classified balance sheet each asset and each liability are placed into a specific category or classification

assets are shown in order of liquidity and liabilities are classified by the order in which they must be paid, either current within one year or long term more than a year

liquidity measures how quickly and easily an account can be converted to cash (because cash is the most liquid asset)

example: account receivable are relatively liquid because receivables are collected quickly within 30 days. supplies are less liquid and buildings and furnitures are even less so because they take longer to convert to cash or to be used up

Assets

the balance sheet lists assets in the order of liquidity. a classified balance sheet reports two asset categories:

current assets will be converted to cash, sold, or used up during the next 12 months or within the business’ operating cycle if the cycle is longer than a year

operating cycle is the time span when: cash is used to acquire goods and services, these goods and services are sold to customers, the business collects cash from customers

Cash, accounts receivable, supplies, and prepaid expenses are examples of current assets

long term assets are all the assets that will not be converted to cash or used up within the business’ operating cycle or one year, whichever is greater

long term assets are typically made up of three categories:

long term investments an investment in debt and equity securities that the investor intends to hold for longer than a year. these investments include bonds or socks in which the company intends to hold longer than one year

property, plant, and equipment (also called fixed assets or plant assets). Land buildings, furniture, and equipment used in operations are plant assets. property, plant, and equipment are presented in order of the category name which land (property) being presented first and then buildings (plant) and equipment, furniture, and other accounts presented last

intangible assets are assets with no physical form that is valuable because of the special right it carries. examples are patents, copyrights, and trademarks. intangible assets are long term assets that convey special rights, such as the exclusive right to produce or sell inventions (patent) or book (copyright), or the symbol or image of a distinctive brand (trademark)

Labilities

the balance sheet lists liabilities in the order in which they must be paid. the two liability categories reported on the balance sheet are current liabilities and long-term liabilities

current liabilities must be paid with cash, or with goods and services, within one year or within the entity’s operating cycle if the cycle is longer than a year. Account payable, notes payable, due within one year, salaries payable, interest payable, and unearned revenue are all current liabilities. any portion of a long-term liability that is due within the next year is also reported as a current liability. current liabilities are listed in the order that they are due

long term liabilities are all liabilities that do not need to be paid within one year or within the entity’s operating cycle whichever is longer. Many notes payable are long-term

stockholder’s equity represents the stockholder’s claim to the assets of the business. the stockholders equity section reported on the balance sheet is in part transferred from the ending retained earnings balance on the statement oof retained earnings The equity balance also reflects the stockholders’ contributions through common stock. It represents the amount of assets that is left over after the corporation has paid its liabilities.

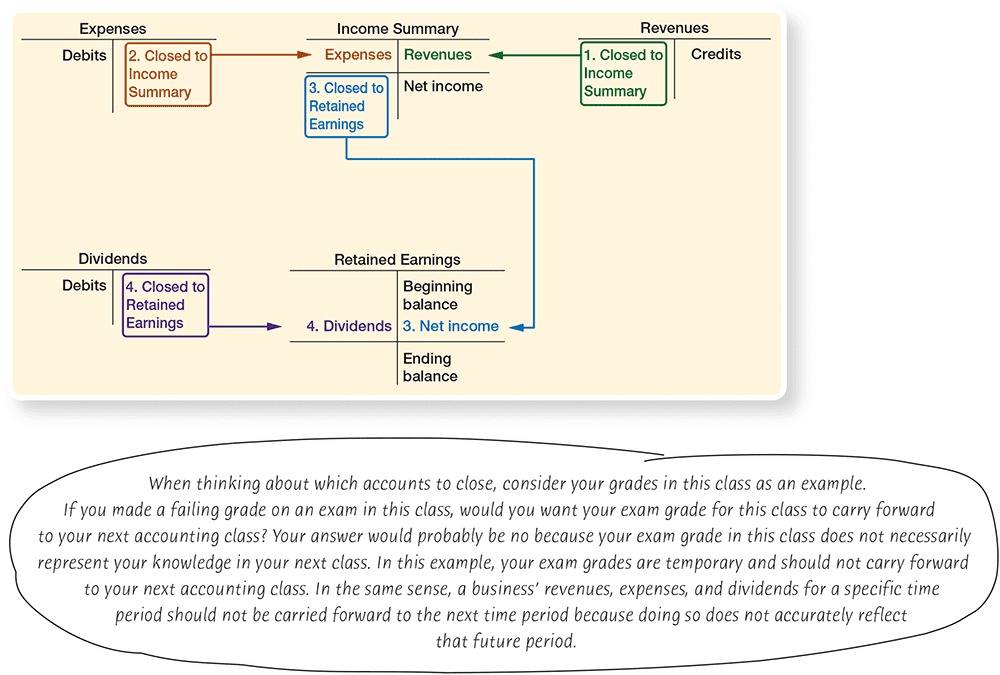

4.2 notesclosing process zeroes out all revenue accounts and all expense accounts in order to measure each period's net income separately from all other period

temporary accounts is an account that relates to a particular accounting period and is closed at the end of that period—the revenues, expenses, income summary, and dividends accounts

permanent accounts an account that is not closed at the end of a period—the assets, liabilities, common stock, and retained earnings— are not closed at the end of the period. permanent account balances are carried forward into the next time period. All accounts on the balance sheer are permanent accounts

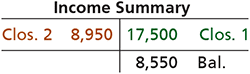

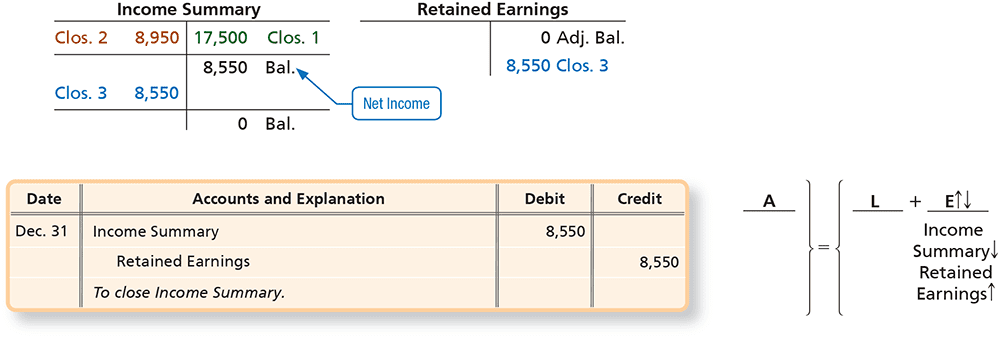

income summary account summarizes the net income or loss for the period by collecting the sum of all the expenses (a debit) and the sum of all the revenues (a credit). The income summary account is like a temporary “holding tank” that shows the amount of net incomes or loss of the current period. its ending balance—net income or loss is transferred (closed) to the retained earnings account (the final account in the closing process)

the closing process

the four steps in closing the books

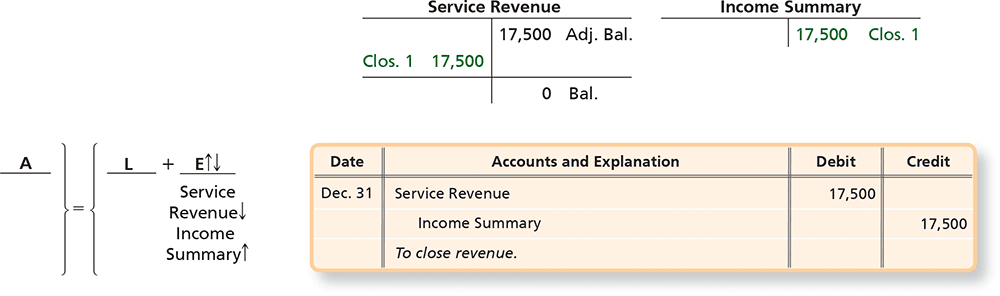

make the revenues accounts equal zero via the income summary account. this closing entry transfers total revenues to the credi side of the income summary account

make expense accounts equal zero via the income summary account. this closing entry transfers total expenses to the debit side of the income summary account

make the income summary account equal to zero via the retained earnings account. this closing entry transfers net income or loss to the retained earnings account

Knowt

Knowt