Capital Budgeting

Capital Budgeting

• We have spent the past four weeks using TVM relationships to evaluate the NPV from cashflows over time.

• We will now use these methods to evaluate capital budgeting alternatives, the projects a firm chooses to pursue.

• The firm’s decision to pursue a project should be based on whether or not the project meets the objective of maximizing the value of the firm to the owners or shareholders

How would we evaluate this

Project?

• Initial Investment = $150,000

• 1st Year Cash flow = $50,000

• 2nd Year Cash flow = $70,000

• 3rd Year Cash Flow = $90,000

• Required Return = 12%

Capital Budgeting - Basics

Four steps in the Capital Budgeting Process:

First - Estimate cash flows in the project. Essential and most difficult step.

Second - Select an appropriate opportunity cost of capital.

Third - Apply an evaluation technique.

Fourth - Determine the selected alternative and implement.

• For now we will focus on the third step and evaluate various techniques.

Investment Evaluation Techniques

• Common Methods to Evaluate Capital Budgeting (Investment) Alternatives

• Best Evaluation Method

– Net Present Value (NPV)

• Similar yet Potentially Inferior Evaluation Method

– Internal Rate of Return (IRR)

– Modified IRR

• Commonly Used Clearly Inferior Evaluation Methods

– Payback & Discounted Payback

– Book Accounting Return (ROA )

Net Present Value

net present value = PV of benefits - PV of the costs

• Net Present Value (NPV) - Is the present value of all the cashflows of a project discounted at the appropriate opportunity cost of capital.

• NPV Method

• Once cashflows are estimated, discount the cashflows at the appropriate opportunity cost of capital.

• Subtract the required investment from the PV calculated above.

• Select the project if the NPV is positive.

Net Present Value: Applying NPV to Long-Lived Projects

• NPV works for any length project.

• Identify the pattern of cash flows and use the appropriate TVM tools.

– Lump Sums

– Annuities

– Perpetuities

– Growing Perpetuities

• You can have positive or negative cashflows over any period of time

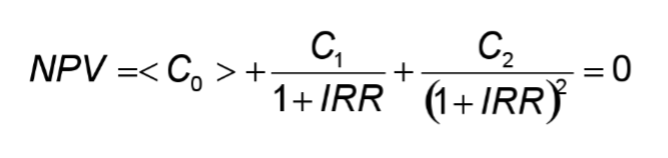

Internal Rate of Return

• For multiple cashflows there is no easy solution.

• Set up the cashflows and guess for different IRRs.

• Calculation is simple using a spreadsheet.

• IRR can also be calculated using your calculator’s financial functions.

• If IRR exceeds required OCC, then accept project.

Internal Rate Of Return (IRR)

Find cost of capital at which project would be fair value (NPV = 0)

Accept project if actual cost of capital is less than calculated value.

.

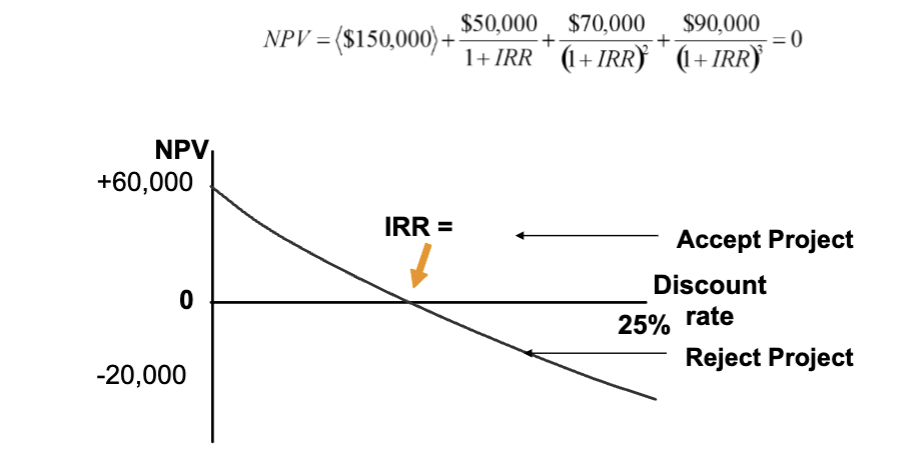

Internal Rate Of Return (IRR)

To obtain return on long-lived project find discount rate at which NPV = 0

Example:

Invest $150,000 today, project returns $50,000 in Yr1, $70,000 in Yr 2 and $90,000 in Yr3.

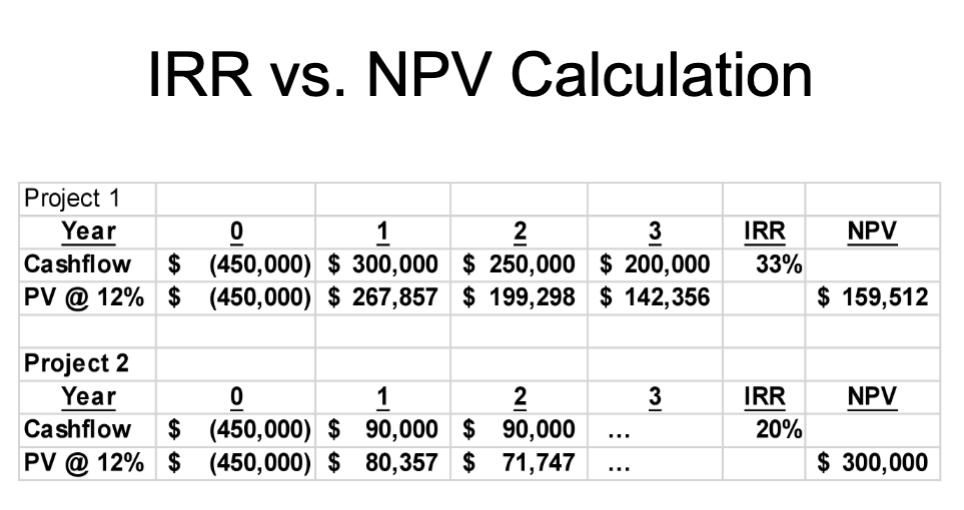

IRR Examples

• Dell Computer is considering two different projects

• Project One will generate the following cashflows:

– Yr 0 Cost $450,000

– Yr 1 Proceeds $300,000

– Yr 2 Proceeds $250,000

– Yr 3 Proceeds $200,000

• Project Two will generate the following cashflows:

– Yr 0 Cost $450,000

– Yr 1 Proceeds $90,000 a year forever

• Calculate IRR of the two projects

• Calculate the NPV at an Opportunity Cost of Capital = 12%.

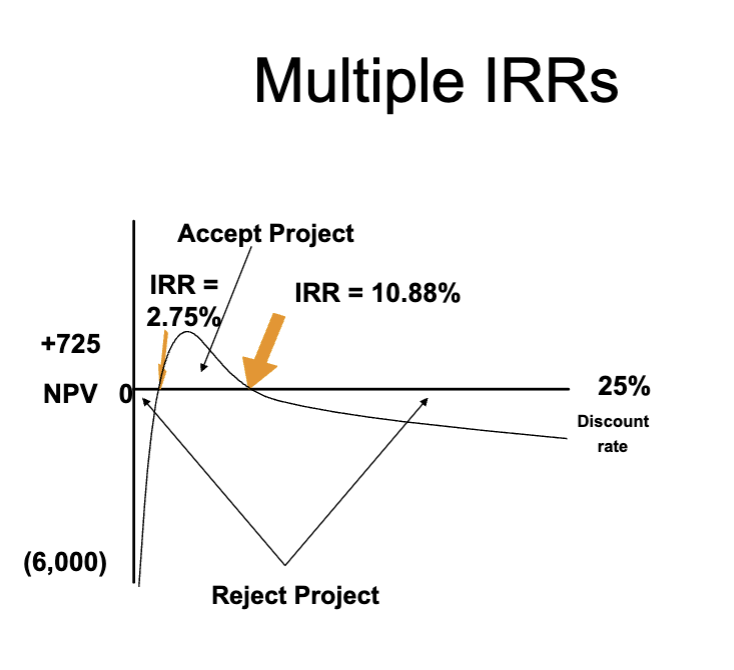

Pitfalls of the IRR Rule

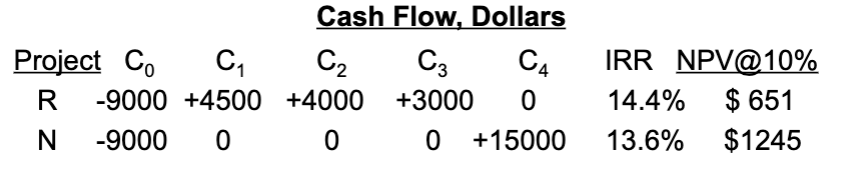

• Mutually Exclusive Projects:

– Occurs when either or:

(a) Projects have different scales.

(b) Projects have different time horizons.

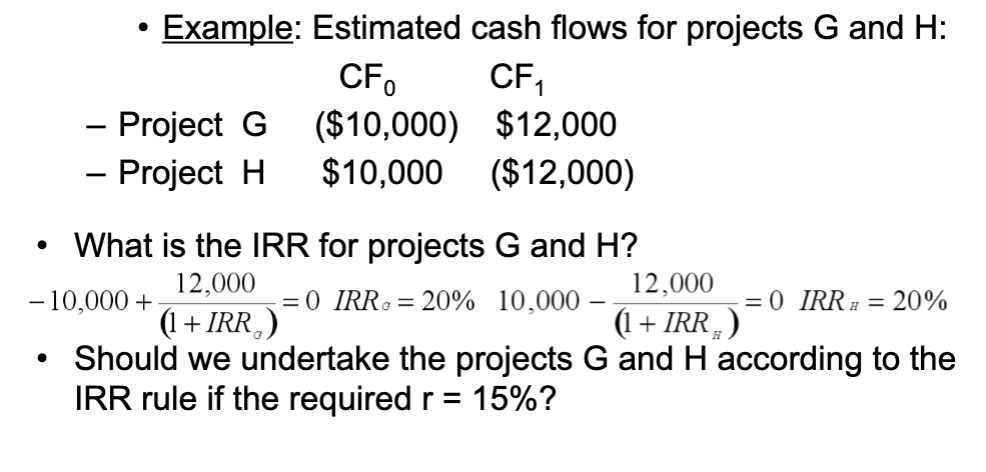

• Mixing Lending and Borrowing

Let’s illustrate with some examples:

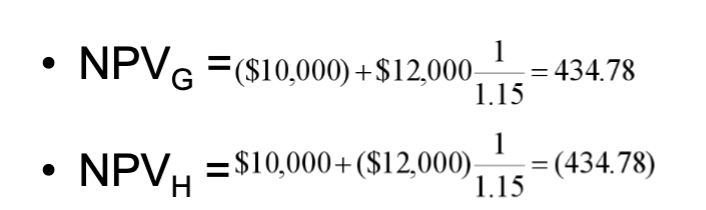

Borrowing/Lending Problem

• (1) Borrowing/Lending Problem: IRR rule does not differentiate between whether you are getting the rate or paying the rate.

Borrowing/Lending Problem

• Yet when reviewing the NPV for projects G and H the obvious problem is revealed

• Should we undertake the projects G and H according to the NPV rule?

• This example is pretty straightforward, now let’s look at another project.

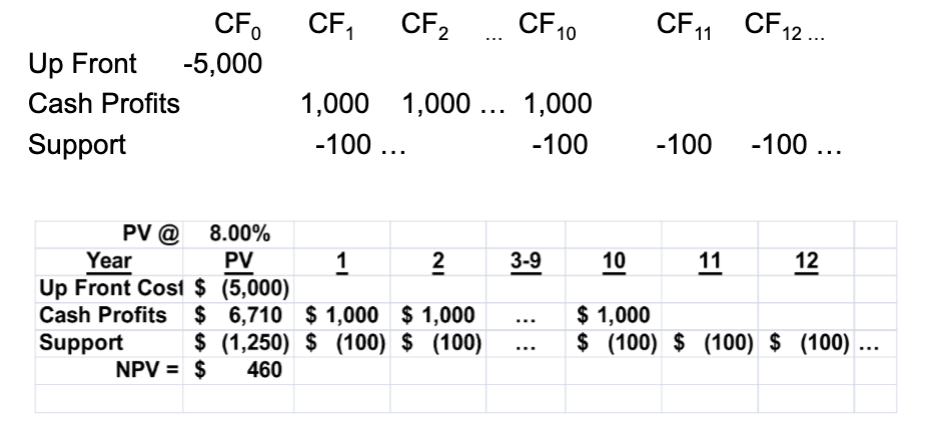

Non-conventional CFs

Consider a new Software Development Project N with the following cashflows and a 8% cost of capital.

Modified IRR – An Incomplete Adjustment

• If the projects are mutually exclusive, which project should be accepted according to IRR and NPV?

• In Modified IRR we assume positive CF is reinvested at the Cost of Capital to the horizon date of the longer project and calculate the resulting IRR which we call MIRR.

NPV - Always the Preferred Choice

• IRR Potential Pitfalls

– Can be misleading when scale or timing of cashflows differ

– Sometimes there are multiple solutions for an IRR problem

– Sometimes these is no solution to an IRR problem

• Modified IRR

– Adjusts for timing differences by reinvesting cash flow at the Opportunity Cost of Capital.

– Does not adjust for other pitfalls.

• NPV is Always the Best Method

– Since NPV gives us a measure of value created it is superior to IRR alone.

– IRR or MIRR can sometimes give you insight into a project’s risks so you can calculate both if comparing projects with similar NPVs.

Constraints in Capital Budgeting

• Theoretically firms should purse all positive NPV projects available to them.

• In practice many firms constrain the capital projects they pursue.

• A recent study of Fortune 500 firms found that 64% of responding firms used some form of capital rationing.

• Rationing can be motivated by:

– External Constraints

– Internal Constraints

• If capital must be rationed, the Profitability Index is a useful decision rule

Profitability Index

• Definition: The profitability index is the net present value of future cash flows generated by a project divided by the required investment.

• The higher the profitability index the larger the “bang for the buck” shareholders receive from the investment.

Steps:

(1) Forecast cash flows (amount and timing of each).

(2) Estimate the opportunity cost of capital.

(3) Calculate the profitability index for each project.

(4) Rank projects by the profitability index (NPV/Investment) and go down the list until you run out of money.

Profitability Index (PI)

• Only use the profitability index when there is some kind of constraint.

• This is what is known as a constrained optimization problem. In this case the constraint is cash. The constraint could be any limited resource.

• Modifications of the profitability index can be useful when any resource is limited. For example:

- floor space in a manufacturing plant

- gates at an airport

- the hours available from an employee that performs some task.

Equivalent Annual Costs (EAC)

• Often firms are faced with comparing to similar yet not identical expenditures.

• Equivalent Annual Costs (EAC) provides a framework to compare costs over different time horizons. This is also referred to as Equivalent Annual Annuity (EAA).

• Method

– Identify the yearly costs for both alternatives.

– Calculate the PV of the costs using the OCC.

– Convert the costs into an annuity to equally spread costs over time horizon resulting in a measure of EAC.

– Compare Equivalent Annual Costs and select lowest alternative

Summary

Initial Problem: How do we consistently evaluate various investment opportunities?

Net Present Value allows us to evaluate projects in multiple dimensions:

Timing & Amount of Investment Requirement

Profitability (Economic Profit)

Rate of Return

Contribution to the Value of the Firm

If resources are constrained, use the profitability index and calculate both IRR and NPV to make sure all issues are addressed.