GEOB Exam 3 Notes

Ch 7: International Trade and Globalization

International Trade

Trade: Involves the exchange of something of value for a price

Exports: Goods produced domestically and sold abroad

Imports: Goods produced abroad and sold domestically

Two Waves of Globalization

First Wave:

In the 19th century, technological advances led to increases growth in world trade. Much of this trade was between European countries. World War 1 and the subsequent rise of nationalism

Second Wave:

Trade expanded significantly following World War II. Driven by declining trade and investment barriers, transportation improvements, and technological change

What’s Being Traded

Primary Goods: Goods that are available from cultivating raw materials without a manufacturing process (agriculture, fishing, mining, forestry, etc)

Intermediate Goods: Components and parts which cross national borders before being made into final products (auto parts, semiconductors, etc)

Final Goods: Consumer goods (food, beverages, phones, etc)

Trade helps countries obtain items they cannot produce, and helps countries gain even if it can produce the good/service itself. Countries can specialize in certain goods they produce most efficiently and import products that can be made more efficiently elsewhere.

Trade Theories

Mercantilism: Economic philosophy advocating that countries should simultaneously encourage exports and discourage imports

Argued that the benefit of foreign trade was the importation of gold and silver (to support militaries)

Aims to achieve a favorable balance of trade. More exports than imports. Government should intervene to achieve a surplus in the balance of trade

Mercantilism views trade as a zero-sum game

Economic gain by one country results in an economic loss by another

Argues that exporting countries gain at the expense of importing countries

Specialization and Trade: Productive capacity relies on the division of labor

Production should be broken down into many small tasks. Each task is undertaken by a specialist. Producers then have a surplus that they can exchange with others and use to invest in efficiency-creating machinery

Absolute Advantage: A country that has an absolute advantage when it can produce a good using fewer inputs than another country

Comparative Advantage: A country has comparative advantage when it can produce a good at a lower opportunity cost than another producer

Forms the basis of international trade economics

Potential world production is greater with unrestricted free trade

Trade is a positive-sum game in which all countries that participate realize economic gains. Occurs even in countries that lack an absolute advantage.

First-Mover Advantage: is the precept that countries or firms which are first to produce a new product gain an advantage in markets which makes it virtually impossible for others to catch up.

Tariffs

Tariffs: A tax on imports

Encourage domestic production

Discourage imports from foreign producers

Protectionism: Government trade policy of favoring home producers and discouraging imports, in a general sense

Local Content Requirement: Refers to a trade policy that requires foreign investors to use local component suppliers

Import Quota: Barrier to trade which consists of limiting the quantity of an imported product that can legally enter a country

Dumping: Sale of goods abroad at below the price charge for comparable goods in the producing country

Import Substitution: An approach to economic development which favors producing goods for domestic consumption that otherwise would have been imported

Consequences of tariffs:

Higher prices for consumers

Less competition

Decreased Output

Arguments for Restricting Trade

The Jobs Argument: Argues that free trade destroys domestic jobs

Less domestic production = less domestic employment

The Unfair Competition Argument: Argues that free trade is only desirable if all countries play by the same rules

Other countries may subsidize industries (gov payments to lower domestic producers costs)

Encourage dumping (selling goods below their cost of production)

The National Security Argument: Argues that certain industries are vital for national security

Free trade might mean that a country is dependent on foreign producers. If war breaks out, supply chains may be disrupted.

The Protection-as-a Bargaining Chip Argument: Argues that trade restrictions can be useful when bargaining with trading partners on trade and other issues

Retaliatory tariffs might convince a foreign gov to remove its tariffs

The Infant Industry Argument: Argues that new industries should be protected from trade to help them become established

Trade restrictions prevent foreign firms from putting new domestic firms out of business

Ch 8: Global Finance

The Foreign Exchange Market

Foreign Exchange Market: Market for converting the currency of one country into that of another country

Exchange Rate: Rate at which one currency is converted into another

Allows us to compare the relative prices of goods and services in different countries

The Foreign Exchange market serves two primary functions:

Currency Conversion

Used in international trade and investment

Insuring against foreign exchange risk

Currency Speculation: Short-term movement of funds from one currency to another in hopes of profiting from shifts in exchange rates

Foreign Exchange Risk: Risk that changes in exchange rates will hurt the profitability of a business’ international operations

Companies protect themselves against foreign exchange risk by using fx markets to hedge (insure) themselves against adverse changes in foreign exchange rates.

Two basic instruments for hedging:

Spot Exchange Rates: The exchange rates at which a foreign exchange dealer will convert one currency into another that particular day

Forward Contracts: When two parties agree to exchange currency and execute a deal at some specific date in the future

Foreign Exchange Rate: Exchange rate governing forward exchange transactions. Often quoted for 30, 90, and 180 days into the future

What determines exchange rates?

Supply and demand of one currency relative to the supply and demand of another currency

Law of One Price: Identical products sold in different countries must sell for the same price when their price is expressed in the same currency

Assumes markets are competitive, transportation costs are nil, and there are no barriers to trade

Arbitrage Opportunity: Purchase of securities in one market for immediate resale in another to profit from a price discrepancy. Will eventually bring prices to parity.

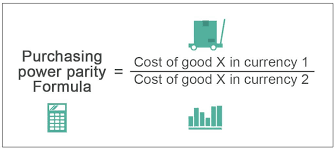

Purchasing Power Parity (PPP)

Purchasing Power: Ability to buy products and services

(PPP) Purchasing Power Parity: The exchange rate that equalizes the purchasing power of different currencies, by eliminating the differences in price levels between countries\

Other determinates of exchange rates:

Long-run Factors

Interest Rates

Monetary Policy

Political and Economic Stability

Short-run Factors

Investor Psychology

Bandwagon Effects

International Monetary System

Floating Exchange Rate: System under which the exchange rate for converting one currency into another is continuously adjusted depending on the laws of supply and demand

International Monetary Systems: The institutional arrangements countries adopt to govern exchange rates

Pegged Exchange Rate: Currency value is fixed relative to a reference currency

Dirty Float: A country’s currency is nominally allowed to float freely against other currencies. The gov will intervene if it believes that the currency has deviated too far from its fair value

Fixed Exchange Rate: System under which the exchange rate for converting one currency into another is fixed

Evolution of the International Monetary System

The Gold Standard: System based on pegging currencies to gold and guaranteeing convertibility

Balance of Trade Equilibrium: When the income a country’s residents earn from exports equals the money residents pay for imports

Balance of trade = exports - imports