Week 2

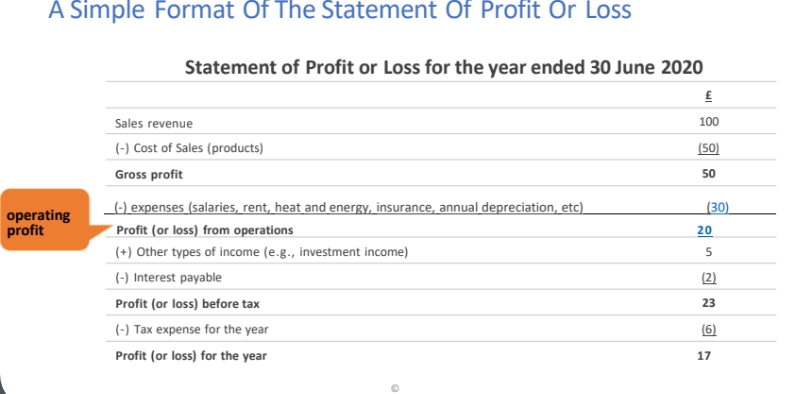

Statement of profit or loss

. measures and reports how much profit the company has generated over a period

. Total revenue for the period − Total expenses incurred in generating that revenue

Revenue

. inflow of economic benefits

. increase in asset or a decrease in liability

. for example, sales of goods, fees for service or subscriptions

Expenses

. Outflow of economic benefits

. Decrease in asset or an increase in liability

. For example, wages and salaries, rent or the cost of buying/making the goods.

Statement of profit or loss with the accounting equation

. Assets = equity + revenue - expenses + liabilities

. revenue - expenses = statement of profit or loss

Accrual- basis accounting

. Accounting transactions should be recorded in the periods in which they occur ( rather than when the cash flows related to them occur)

. Companies should recognise revenues when they perform services (rather than when they receive cash)

. Expenses should be recognised when incurred (rather than when paid)

Recognition of revenue

. Under IFRS 15, Revenue will be recognised when control is passed to the customer. Factors that may indicate the point in time at which control passes include, but are not limited to:

. It is the entity has a present right to payment for the asset

. The customer has legal title to the asset; the entity has transferred physical possession of the asset

. The customer has the significant risks and rewards related to the ownership of the asset

. The customer has accepted the asset

cash receipts

. Total sales revenue will often be different from the total cash received from sales

. during the period as sales on credit are usually recognized before the cash is received.

. For cash sales, there will be no difference in timing between reporting sales revenue and cash received.

. Some businesses require payment before providing the service, for example:

Rent received from letting premises

Subscription fees

Unearned revenue is cash received and recorded as a liability before the revenue is earned

Recognition of expenses

. According to the matching convention, the expenses related to the cost of sale is just the cost of inventories that are sold during the period, not the whole cost of inventories that are available for sale (i.e. each sales revenue is matched with the associated cost of that particular sale). Expenses should be matched to the revenue that they helped to generate.

. The expenses associated with a specific item of revenue must be taken into account in the same reporting period as that in which the item of revenue is included

. When the amount paid during the year is less than the full expense for the period => Accrued expense

. When the amount paid during the year is more than the full expense for the period => Prepaid ( or deferred ) expense

Accrued expenses

. They refer to expenses which have occurred by the business for goods or services that have been delivered (provided) by the suppliers but which have not been billed and paid yet.

. should be recognised as a liability

. Total taxation for the year should be deducted from profit after interest in the statement of profit or loss regardless of whether it has been paid or not

. Accrued expense brings about a liability so will also affect statement of financial position:

. If the total taxation for the year has not been paid:

The total amount should be included as an accrued expense undercurrent liabilities in the statement of financial position

. If part of the taxation has been paid during the year:

Only the unpaid amount is included as an accrued expense undercurrent liabilities in the statement of financial position

Prepaid expenses

. Occurs when the expenses paid before they are used; in other words, when the paid amount is more than the full expense for the reporting period.

. Companies must only recognise the expenses that are used up/consumed

. The amount that has been prepaid should be recognised as an asset. The supplier owes to the company services/goods paid but not yet delivered

Depreciation

. Depreciation is used to estimate the cost of non current assets (e.g. property, plant and equipment, fixtures and fittings etc. ) that have been consumed/used up in generating the revenues recognized during a particular period.

. This includes:

Wear and tear from using the asset

The asset becoming obsolete

Passage of time

Annual depreciation

. is an expense and appears in the statement of profit or loss

Accumulated depreciation

. (the aggregate amount of annual depreciation from previous years plus this year’s annual depreciation) is deducted from the assets in the statement of financial position

Depreciation methods

. Straight line method: Equal amounts of depreciation expense for each year that the asset is held

. Reducing balance methods: Fixed percentage rate of depreciation to the carrying amount of the assets each year

Trade receivables problems

. A debt is described as a bad debt when there is no further hope of the customer paying the amount owed.

. For example, the debtor declared bankruptcy with

no asset available to pay their creditors.

. If the customer is known to be in difficulties but the company still hopes to recover the cash owed, the debt is described as a doubtful debt

Bad debt

. When a trade debtor fails to settle the outstanding amounts, the debt is said to be irrecoverable

. Reduce the amount of trade receivables in the statement of financial position

. Increase expenses by creating an expense known as bad debts in the statement of profit or loss

Doubtful debts

. When a trade debtor is known to be in difficulty, but the company still hopes to recover the amount owed

. Reduce the amount of trade receivables in the statement of financial position

. Increase expenses by creating an expense known as allowance for trade receivables (i.e., provision for doubtful debts) in the statement of profit or loss