Cleaner version ECO test week

what i need to know

What is economics

the evolution of economic thinking

demand supply and market equilibrium

government intervention (price controls, subsidies, taxes, and the impacts)

elasticities (PED, PES, YED,)

Market failure (Externalities (negative & positive), public goods)

Rational producer behaviour (HL) (Profit maximization (MC=MR) Fixed vs variable costs, short run vs long run costs)

Market power (Perfect competition, Monopoly, Monopolistic competition, Oligolopoly)

Demand, supply and market equilibrium

Demand

Law of Demand: when price goes up, quantity demanded goes down (same goes for the other way) . Therefore, a negative relationship exists between price and quantity demanded

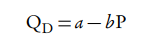

formula of law of demand

in this formula QD= Quantity demanded

P = price

a = intersect; if the a in the formula changes, the demand curve will shift to the left (if a decreases) or to the right (if a increases)

b = slope; the higher the b, the higher the slope of the demand curve; in the case of the demand curve, b will be negative because of the negative relationship between price and quantity demanded.

Demand curve

shifts to right means quantity demanded increases if shifts to less means quantity demanded decreases. the factors that can have an affect on the demand curve is

the income of consumers (when income increases they will have more money to spend same with the other way around.)

The price of a complementary good - a price of a complementary good is a good that is consumed along another good. if one of the good increases the other will too

Price of substitute good - a substitute is good that is consumed instead of another good ex (matchsticks vs lighters) if one of the goods price increases the demand for the other good increases

Population - if it increases there will be more people to demand that good (also can be the other way around)

Market equilibrium

Free market: any place where buyers meet suppliers to exchange goods and services. could be physical or digital. A free market is free from government intervention.

Equilibrium

equilibrium is when demand = supply

an equilibrium is allocative efficiency this is since the quantity produced matches the quantity demanded

if there is no outside interference the market will always move towards the equilibrium

disequilibrium

disequilibrium is when demand ≠ supply

What prices do in the market

Allocate scarce resources efficiently

Ration scarce resources by encouraging / discouraging consumption

signal excess demand/ supply and need for resources

incentivize producers to output to profit

Excess demand causes prices to rise to reach equilibrium

excess supply causes prices to drop to reach equilibrium

Negative externalities of production and consumption

Negative externalities of production

Negative externalities of production costs to 3rd parties as a result of the actions of the producers. examples of this can be:

Air pollution

Resource depletion

Resource degredation

Deforestation

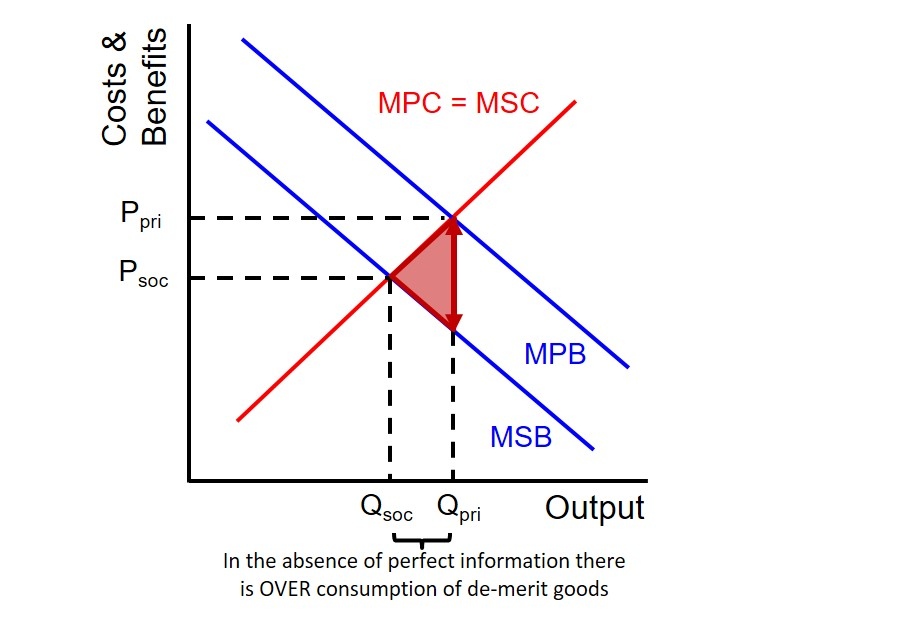

Negative externality of production on a diagram

Negative externalities of consumption

The cost’s 3rd parties as a result of the actions of consumers, example if a consumer is smoking a cigarette bystanders can be more likely to face respiratory issues.

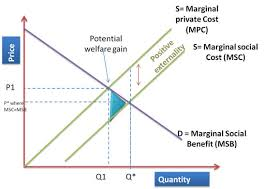

Positive externalities of production and consumption

Positive externalities of consumption

the benefits of 3rd parties due to actions of consumers. examples of this can be healthcare, if someone is well educated it can benefit the rest of the society.

Positive externality of production

Benefits to 3rd parties as a result of the actions of producers, example if a firm is innovative and creates new technology another firm could copy their idea

Government intervention

There are many different methods that governments may implement for example

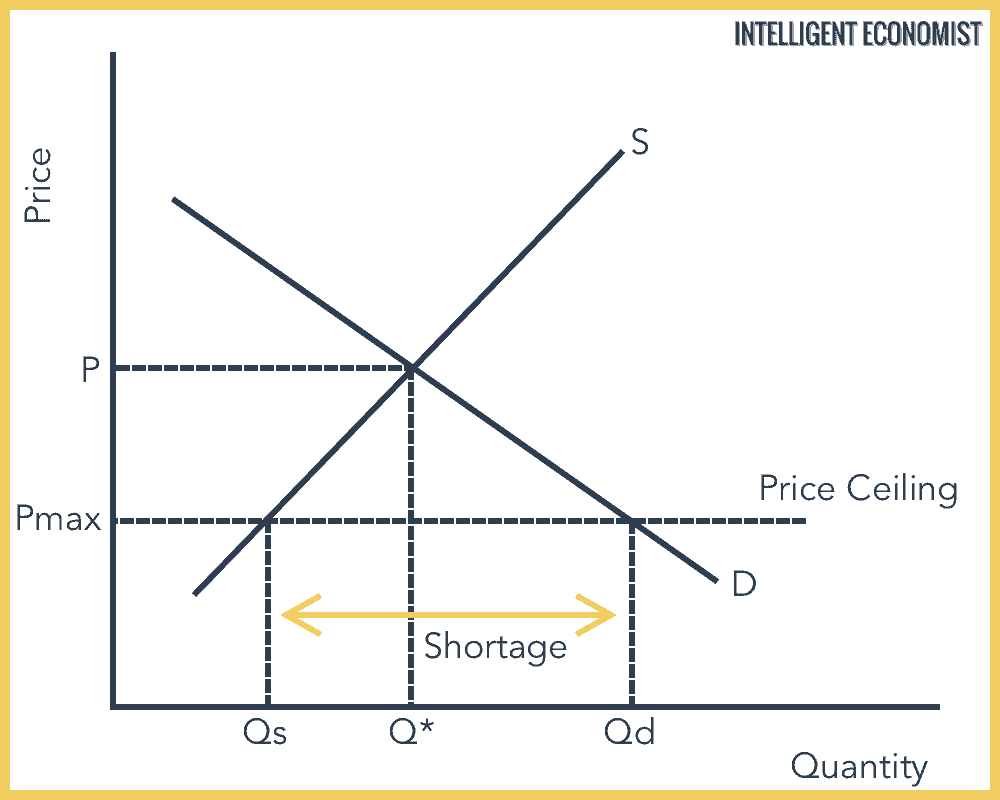

Price controls

price ceiling: maximum legal for goods/services ex (rent controls)

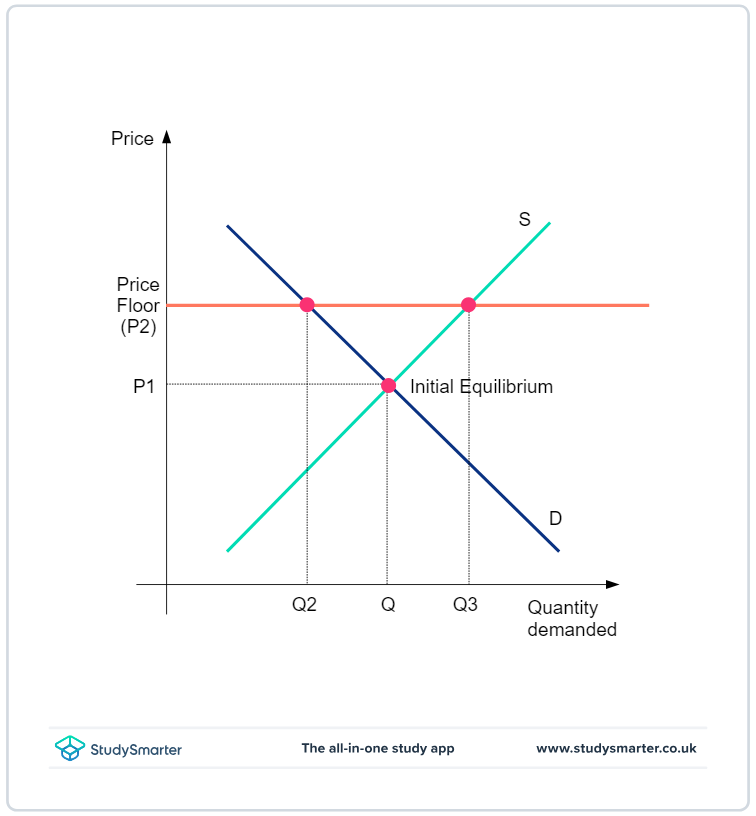

price floor: minimum legal prices (eg. minimum wage)

Price ceiling diagram

price floor diagram

Tax and subsidies

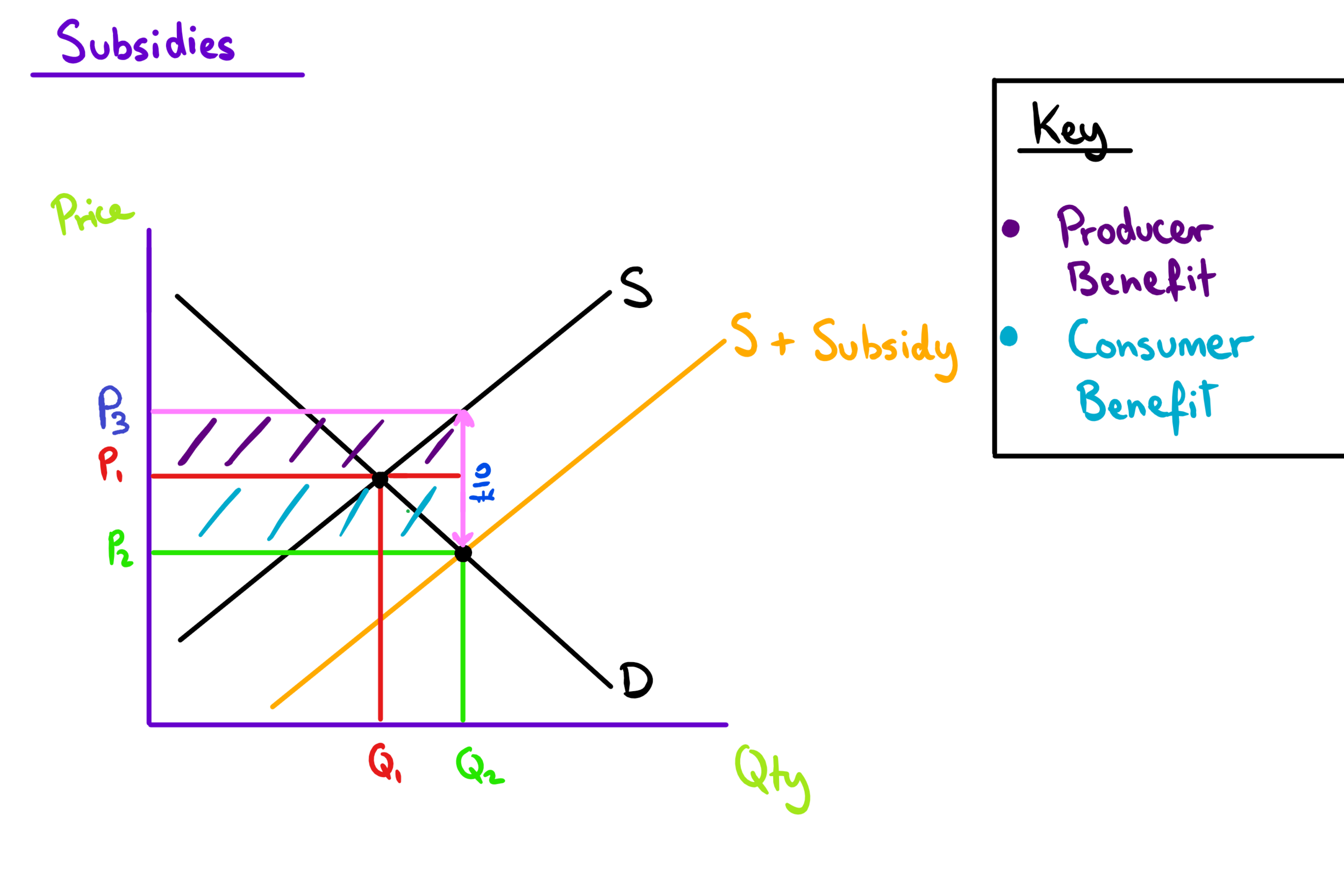

another method could be Tax and subsidies

taxes: imposed to discourage negative externalities (eg. taxes on cigarettes)

Subsidies: financial support to encourage production/consumption of goods with positive externalities (eg renewable energy subsides)

taxes diagram

Subsidy diagram

Market failure

Market failure in microeconomics occurs when a market fails to allocate its own resources efficiently or equitably.

There are multiple causes for market failures and these can be

Externalities

(when a third party is affected by an economic transaction without being apart of it.)

Negative externalities (harmful effects like pollution)

Positive externalities (beneficial effect like vaccines)

Market failure occurs due to a mismatch between private and social costs, which results in inefficient resource allocation. In this case, markets either overproduce or underproduce goods.

Public goods

Public goods are non-excludable and nonrivalrous, meaning individuals cannot be excluded from using them. and one persons consumption doesnt reduce the availability of others (ex. Street lights)

The free rider problem prevents private markets from providing these goods efficiently.

The free rider problem is when individuals benefit from a good or service without paying for it because it is non-excludable. This leads to underprovision of the good or service as private producers have little incentive to supply it.

Example: people enjoying public goods like streetlights or national defence without contributing to their costs.

Elasticities

Elasticities

Elasticity refers to the responsiveness of one variable to change in another variable, an example of elasticity can be of the outbreak of coronavirus, during the outbreak consumers scrambled for face masks, some producers saw this as an opportunity and decided to raise prices

elasticity of demand - a measure of the responsiveness of the quantity demanded of a good or service to changes in one of the factors that determines it.

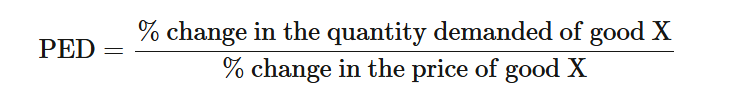

Price elasticity of demand

price elasticity of demand is a measure of how much the quantity demanded for a good changes when there is a change in its own price.

according to the law of demand when the price increases the quantity demanded decreases, the extent to which the quantity demanded decreases is determined by how ‘elastic’ it is.

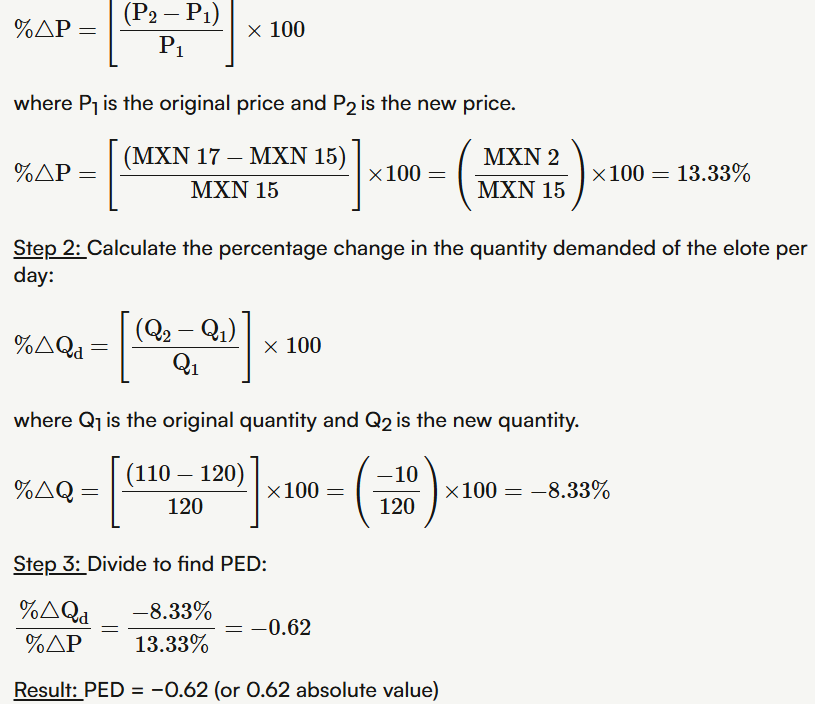

price elasticity of demand can be calculated in the following formula:

because of the negative relationship between price and quantity demanded mathematically speaking PED< 0 This is since when the price of a good increases the quantity demanded will decrease, however, economists always considered PED as a positive number.

worked example

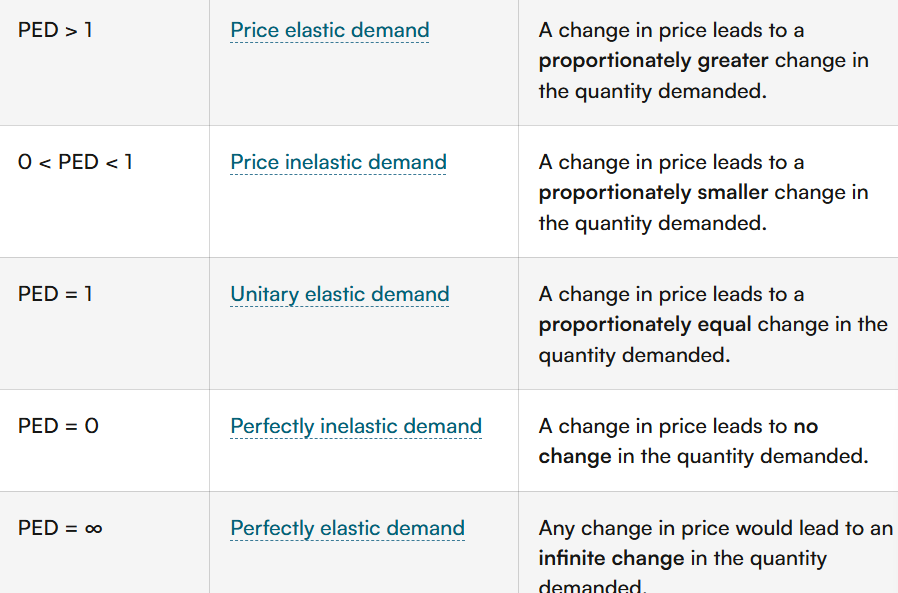

Range of values of price elasticity of demand

when price elasticity demand is greater than 1 (PED>1) we say that the demand is price elastic, this means that consumers demand is relatively responsive or sensitive to price changes.

Price inelastic demand

when the price elasticity value is between 0 and 1 (0<PED<1) demand is price inelastic.

The PED calculation will result in a number greater than 0 but less than 1.

Unitary elastic demand

When the price elasticity of demand is equal to 1 (PED=1) we say that demand is unitary elastic. in this case, a percentage change in the price of a good results in an equal percentage change in the quantity demanded

perfectly inelastic demand

when the value of the price elasticity of demand is zero (PED=0) we say that demand is perfectly inelastic. Customers demand is completely unresponsive to price changes

Perfectly elastic demand

when the value of price elasticity of demand is infinite (PED=infinity) demand is perfectly elastic. however if the price is raised, even by a minimal amount quantity demanded will be 0

Substitute goods

A product that can be used as a replacement for another product, for example, if a price of one vegetable increases it is more likely for consumers to decide to consume a different substitute vegetable, products with a lot of substitutes will be more responsive to price changes and therefore the demand will be more elastic. on the other hand other products withfew substitutes like crude oil will have inelastic demand.

Necessity goods

When a good is a necessity good consumers will be less responsive to price changes, this is because they have to consume it regardless, this can be for basic necessities like food and water, it can also be for addictive goods like drugs and cigarettes, and also for medical goods like services or products, like insulin.

Small note

time period can also be implemented in elasticity, this is since it can take time to find substitutes for example if the product is a necessity like an Epipen it may take a few weeks to find an alternative product that is cheaper. another small note is that if people spend a very small portion of their income on a product a price increase would see inelastic response in demand. this is since the price change is insignificant for the consumers.

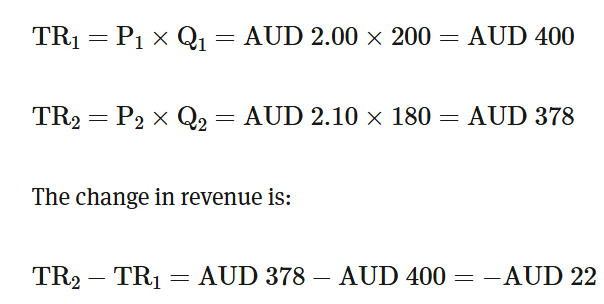

how to calculate change in revenue

Commodities

primary commodities, are goods that come from the land, extracted from it, or extracted from under the sea. they include agricultural, fishing, oil, coal, mineral and forestry products. the demand for most primary commodities is inelastic. primary commodities are usually necessities to those who eat it and they have few or no substitutes.

on the other hand the demand for manufactured goods are usually more elastic

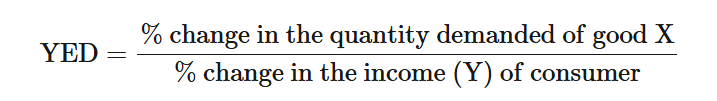

Income elasticity of demand (YED)

Income elasticity of demand (YED) is a measure of how much the quantity demanded of a good will change in response to a change in consumers income. For example if an income of a country rises by 5% we will likely see a increase in demand for many goods, some goods will experience a greater percentage increase in demand, others will see a smaller increase.

Formula for YED

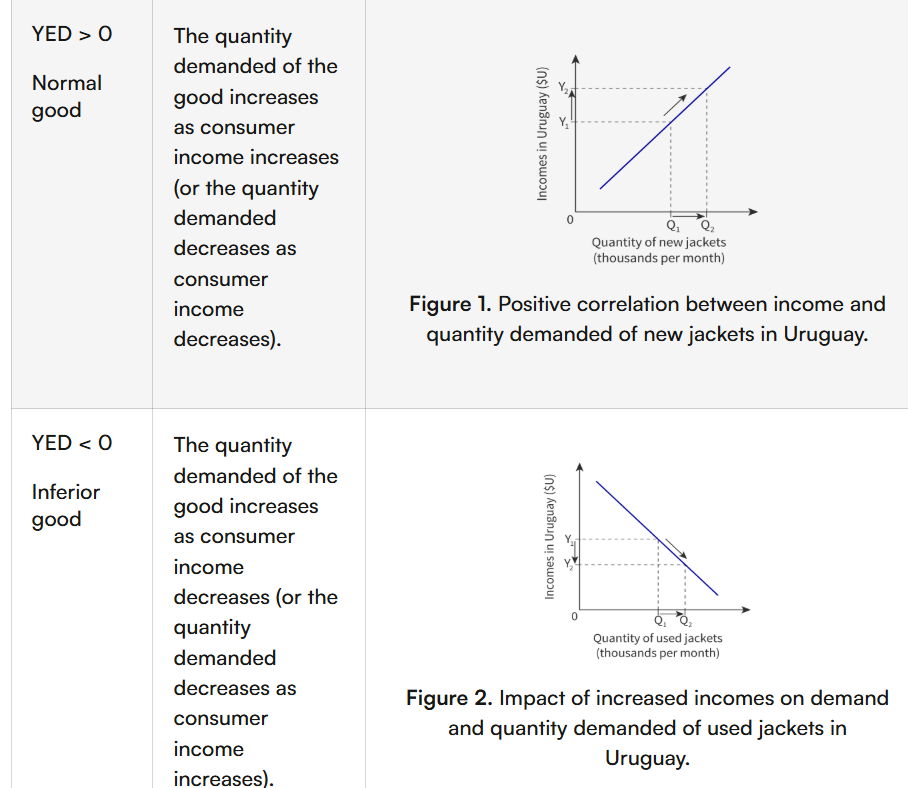

Normal goods and inferior goods

the sign of the value of income elasticity of demand tells us something about the good in question.

a positive sign means that as income increases, quantity demanded of a good increases, and as income decreases quantity demanded decreases. when their is a postitve relationship between incomes and the demand for a product it is considered a normal good.

a negative sign is that as income increase, quantity demanded of a good decreases, and as income decreases the quantity demanded of a good increases. when there is an inverse relationship between income and the quantity demanded for a product it is considered an inferior good.

if the YED is zero or very close to zero it is likely to be a necessity good

Price elasticity of supply

a measure of how much the quantity supplied of a good changes when there is a change in its own price. PES can be calculated when there is movement along the supply curve.

the formula for PES is

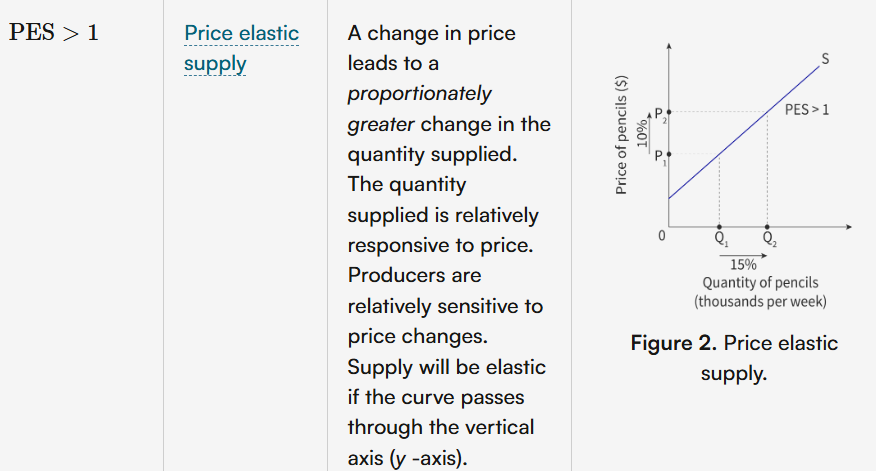

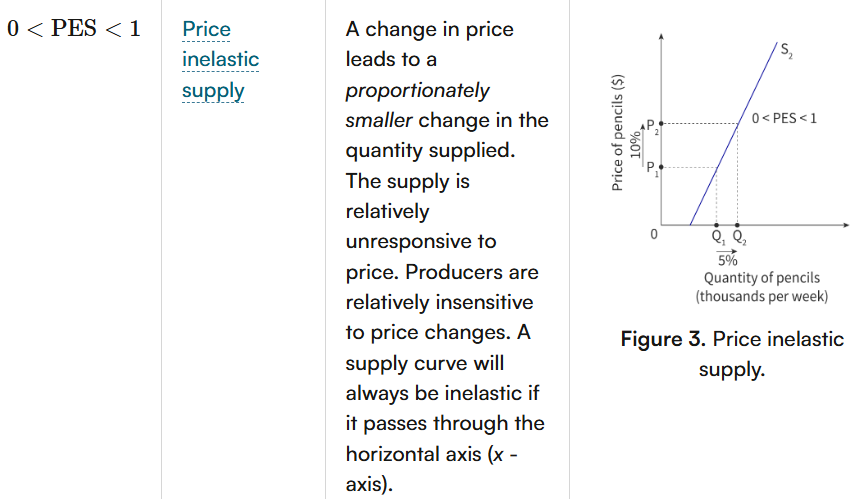

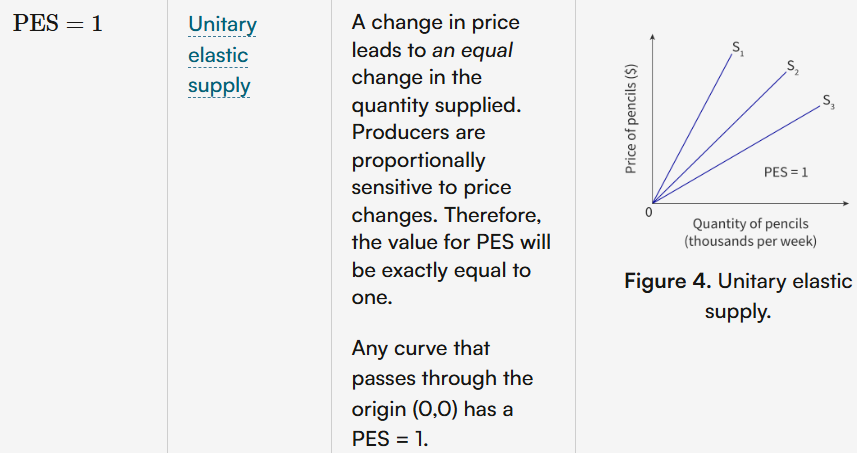

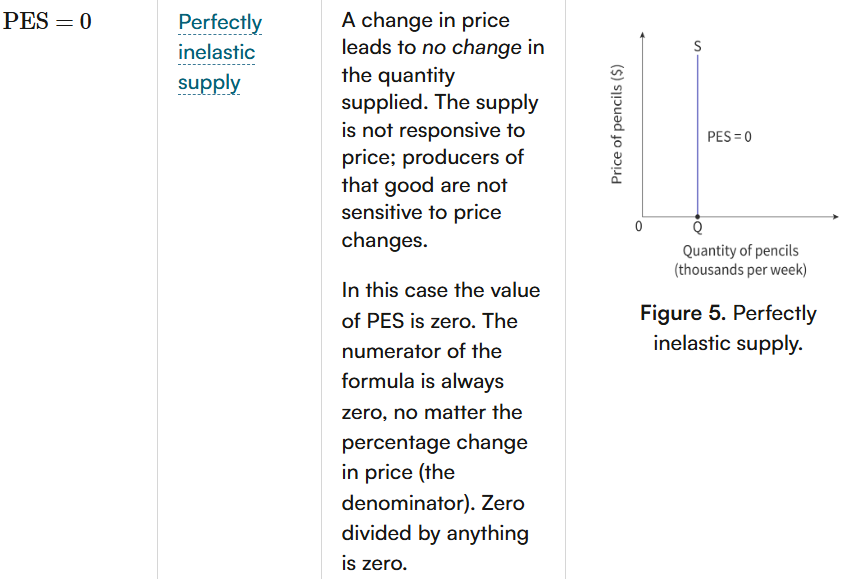

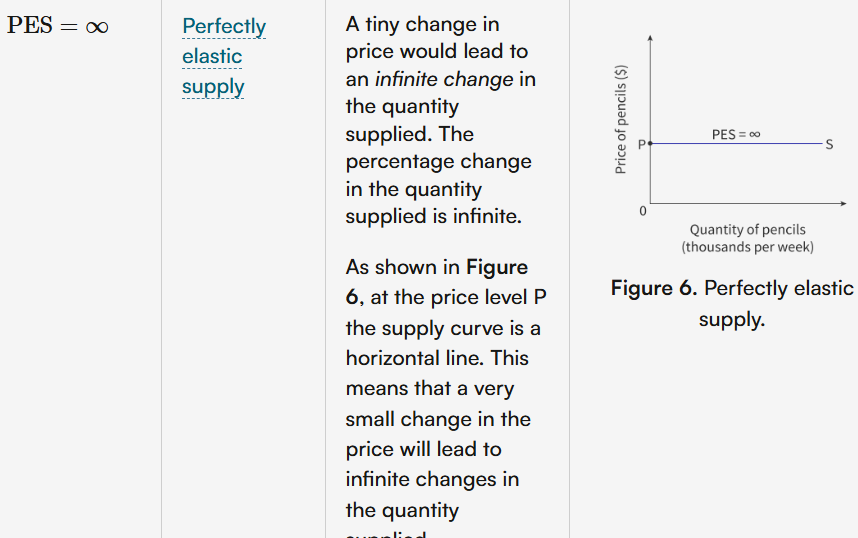

range of values

Determinants of price elasticity of supply

time period considered - The time lag between the moment the price of a good. changes and the producer's ability to adjust resources and production to respond to the price change is an important factor.

flexibility and cost of factors of production - when a firm is producing a certain product, it uses a specific combination of factors of production.

unused capacity - when firms are not using their production resources at their maximum capacity.

ability to store stock - if a firm has the capacity to store stock, which means keeping inventories of a good in a warehouse, the supply can be more responsive to a change in price.

Rational producer behavior

rational producer behavior refers to the way’s firms make decisions maximize their profits. producers are assumed to act rationally. meaning they aim to:

maximize profits - they try to produce at the lowest cost while selling at the highest possible price

minimize cost’s - they seek the most efficient combinations of resources (land, labor, capital) to reduce productions

respond to incentives - they adjust production based on changes in demand, prices and government policies.

optimize output levels - they produce where marginal cost (MC) = marginal revenue (MR), as this is the profit maximizing point.

Consider market conditions - their behavior depends on the level of competition (perfect competition, monopoly, oligopoly etc)

Types of competitive markets (Market power)

Monopoly

A monopoly is when a single firm is operating in the entire market, it is the result of strong barriers to exit’s and entry’s. the barriers can be the firm enjoying economies of scale, with new firms struggling to compete due to large start up costs, consumers may also be brand loyal which can create problems for new entrants.

Oligopoly

an oligopoly is a market structure in which only a few firms operate. These markets can be supermarkets, energy suppliers, mobile phone companies, telecommunications and internet providers. this can result in fierce competition among them.

Monopolistic competition

The most competitive and most common market, there are many firms in this market structure each relatively small in size compared to the market. they sell similar goods but the goods are not identical. branding is what commonly sets the firms apart.

Perfect competition

A perfect competition market is a hypothetical market structure in which there are many firms, each with small market structure that sell an identical product.

Government intervention in response to market power abuse

firms with monopoly power can also take advantage of their position by setting higher prices and restricting choice to consumers. Allowing monopoly’s to operate unchecked is a risk governments may want to manage. they can use

legislation - Governments may legislate to prevent monopoly powers from forming, they may also pass laws that restrict the market share that the largest firms of an oligopoly can have

regulation - governments can investigate markets and ensure that the monopoly is not being used against public interest. regulations can involve a process of licensing, setting standards, inspections, the issuing of fines.

Nationalisation - A government may take control of a private sector industry in order to run it as part of the public sector for the best interests of the public.

Public and private goods

Private goods are

Excludable - people can be prevented from them if they dont pay

Rivalrous - one person’s use reduces availability for others

Examples

food

cars

clothes

smartphones

Public goods are

non excludable - no one can be prevented from using them even if they dont pay

non rivalrous - one persons use doesnt reduce availability for others

Examples

Streetlights

national defense

public parks (in some cases)

lighthouses

Asymmetric information

when buyers and sellers do not have the same information, leading to inefficent market outcomes. types of asymmetric information can be

adverse selection - when one party hides information leading to a bad deal for the other side

moral hazard - this happens after a transaction, where one party takes more risks because they dont bear the full consequences

Extra notes

demerit good - a good or service whose consumption is considered unhealthy.

terms for understanding externalities and market efficiency

marginal private benefit (MPB)

the additional benefit an individual consumer receives from consuming one more unit of a good

it reflects the willingness to pay for the product

in a free market, demand is based on MPB, but it ignores external benefits or cost’s

Marginal social benefit (MSB)

the total benefit to society from consuming one more unit of a good

MSB = MPB +external benefits (if positive externalities exist)

for demerit goods (eg. cigarettes) MSB is less than MPB

Marginal private cost (MPC)

The addition cost producers bear to produce one more unit of a good

this includes wages, raw materials, and other production costs

in a free market supply is based on MPC, ignoring external costs.

how these relate to market failure

for goods with negative externalities (demirit goods) MPB > MSB and MSC > MPC leading to an overconsumption and market failure

For goods with positive externalities (merit goods): MSB > MPB and MPC = MSC → leading to underconsumption and inefficiency.

overconsumption happens when a good is consumed beyond the socially optimal level because the market ignores it’s external costs, this leads to market failure since more resources are allocated to producing the good than is beneficial for society.

Underconsumption occurs when a good is consumed less than the socially optimal level because the market ignores its external benefits. This leads to market failure since fewer resources are allocated to the good than would maximize societal welfare.