Ch 27 - Balance of Payments

Balance of payments: record financial transcripts made between consumers, businesses and the government in one country with others

Tells us how much is being spent by consumers and firms on imported goods and services

Debit: payments

Credits: receipts

Components of BOP: total current account must balance with total of capital and financial accounts

Capital account:

Capital transfers

Non-financial asset transfers

Financial account:

Direct investments

Portfolio investment

Reserve assets

Formula: → Capital account + Financial account = current assets

Current transfers: transfers of money where nothing is received in return

Non-financial asset transfers: purchase or use of natural resources that have no been produced

Capital transfers: debt forgiveness, non-life insurance claims and investment grants

Reserve assets: foreign currencies purchased to be used by the central bank in its monetary policy

Portfolio investment: purchase of shares and bonds

Direct investment: investment in physical capital usually undertaken by multinational corporations

Current account:

Current account balance: sum of capital account and financial account balances

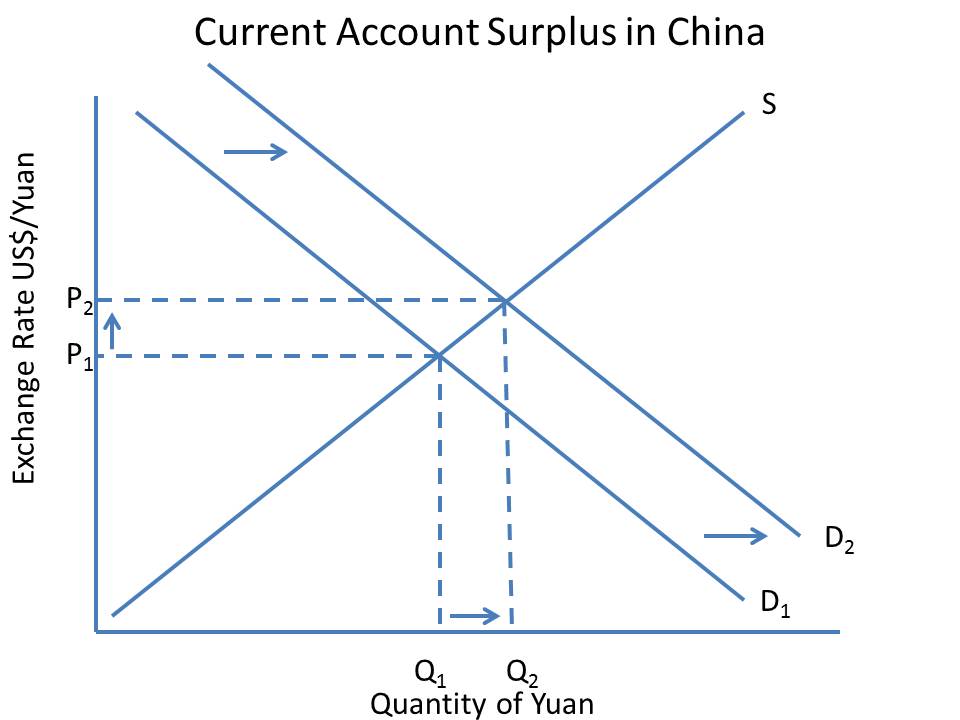

Current account surplus: indicates that the country is a net leader to the rest of the world.

if Current account is large, then the country is a major exporter

Current account deficit: the country is a net borrower to the rest of the world

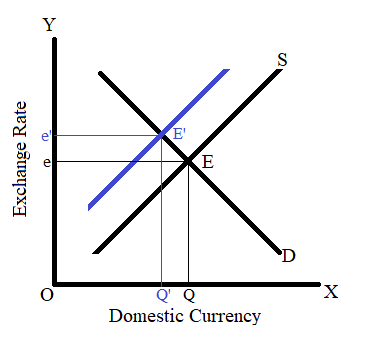

a. causes a downward pressure on the exchange rate and the relative value of the currency will decrease

b. currency should depreciate, will rectify the deficit as exports become cheaper relative to imports.

c. interest rates increase and encourage foreign direct investment, many reduce domestic investments

d. demand management: to rebalance the account deficit, which resolves account deficit

Effects:

Appreciation: as exports increase, demand for the currency increases and the value of the currency increases

Reduced export competitiveness: currency appreciates, in a floating exchange rate, exports become comparatively more expensive as demand for exports fall

Lower domestic consumption and investment: currency appreciates, imports will become more affordable compared to domestic products so consumption of domestic products falls

The appreciation can also deter foreign investment from abroad as it becomes more expensive

To reduce account deficit:

Expenditure switching policies: devaluing exchange rate, tariffs and policies to reduce inflation

Expenditure reducing policies: policies aim to reduce the real spending of consumers

Supply-side policies: to improve the country’s productivity in order to improve its exports competitiveness

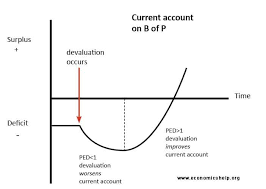

Marshall Lerner condition: states that currency devaluation will only lead to an improvement in the balance of payments if the sum of demand elasticity for imports and exports is greater than one

Point in PED < 1: demand for imports and exports will remain fairly elastic

Point in PED > 1: demand for imports and exports becomes more elastic

Knowt

Knowt