Chapter 11: Stockholders' Equity

Objective 11.1: Explain the role of stock in financing a corporation.

Corporate Ownership

- The major advantage of the corporate form of business is the ease of raising capital as both large and small investors can participate in corporate ownership.

- Advantages include:

- It is simple to become an owner of a corporation:

- You just have to buy a share of the company’s stock.

- You can easily transfer ownership:

- Sell the stock to someone else.

- A corporation provides limited liability.

- A shareholder is not responsible for a company’s debt.

- It the company goes bankrupt, you lose the amount you paid for the initial stock, but you are not liable for company’s liabilities.

- Because a corporation is a separate legal entity, it can:

- Own assets

- Incur liabilities

- Sue and can be sued

- Enter into contracts

- Corporations are regulated by law.

- You must submit an application to the state government to create a corporation. When a corporation is approved, the state issues the articles of incorporation which holds information about the corporation.

- Stockholder benefits include:

- Voting rights - being able to vote on important issues at annual meetings.

- Dividends - Stockholders have the right to receive dividends when declared by the board of directors.

- Residual claims (liquidation rights) - If the corporation goes bankrupt, stockholders share in any remaining assets after creditors are paid.

- Preemptive rights - Existing stockholders have the first chance to purchase newly issued stock before it is issued to the public.

Equity vs Debt Financing

- Equity financing is issuing new stock to investors.

- Advantages:

- Equity does not have to be repaid, but debt does.

- Dividends are optional, but there is interest on debt.

- Debt financing is borrowing money from lenders.

- Advantages:

- Interest on debt is tax deductible.

- Debt does not change shareholder control.

Objective 11.2: Explain and analyze common stock transaction.

Stockholders’ Equity

- The four elements of stockholders’ equity:

- Contributed Capital

- Retained Earnings

- Treasury Stock

- Accumulated Other Comprehensive Income or Loss

- Contributed Capital (Common Stock and APIC)

- The company receives capital from investors when they sell stock to them.

- APIC is Additional Paid in Capital, which is the amount collected over par.

- Retained Earnings

- It is earned capital.

- Cumulative net income means less cumulative dividends.

- Treasury Stock

- Shares that were issued, but the company decided they wanted to buy them back.

- This is a contra accounts that has a normal DEBIT balance and reduces Stockholders’ Equity.

- It is a permanent account.

- A contra account that is “stuck like glue” to Common Stock and APIC.

- Accumulated Other Comprehensive Income or Loss

- Recorded unrealized gains and losses that cause temporary changes in the value of assets and liabilities of the company.

- The may involve pensions, foreign currencies, and financial investments.

- It holds everything else (what we can’t squeeze into Common Stock because it can only hold par value).

Authorization, Issuance, and Repurchase of Stock

- A corporation can only issue a certain number of shares, which are known as authorized shares.

- Issued shares are permanently for the stockholder unless:

- They sell them to another company

- The corporation buys them back (treasury stock)

- Unissued shares are shares that haven’t been traded.

- Outstanding shares are owned by stockholders. They are the only shares that can’t get dividends.

Stock Authorization

- Par value is assigned to each share of stock that is authorized.

- It is not the same at market price, which is the value of what shares can sell for to the public.

- It is always a small number, like $0.01 per share.

- Some states require par value.

- No-Par value stock does not have a determined price.

- No PAR = No APIC

Stock Issuance

- The first time a corporation’s stock is available to the public is called an initial public offering (IPO).

- When new stock is issued to the public, this is called seasoned new issue.

- Issuing stock at par value, always the same journal entry:

- Debit cash

- Credit Common Stock (shares x par value amount)

- Credit Additional Paid In Capital (cash - common stock)

- Example: A company issued 100,000 shares of $0.01 par value common stock for $30 per share.

- Step 1: Calculate cash received.

- Shares x Price per share

- 100,000 x $30

- Cash = 3,000,000

- Step 2: Calculate Common Stock.

- Shares x Par value

- 100,000 x $0.01

- Common Stock = $1,000

- Step 3: Calculate Additional Paid-In Capital (APIC).

- Cash - Common stock

- 3,000,000 - $1,000

- APIC = 2,999,000

- Step 4: Make the journal entry.

| Cash | $3,000,000 | ||

|---|---|---|---|

| Common Stock | $1,000 | ||

| APIC | $2,999,000 |

Stock Exchanged Between Investors

- A transaction between two investors does not involve the corporation, so the corporation does not need to record anything.

- The corporation still has the same amount of shares issued to shareholders.

Stock Used to Compensate Employees

- Employees pay packages may include exclusive stock options for a “discount” price compared to what the market price is.

- Employees are later able to buy stock and the value will be higher.

- They can also sell their stock at a higher price.

Repurchase of Stock

- Treasury stock is the repurchase of issued stock.

- The purpose of repurchases can be:

- Making a company believe the stock is worth getting.

- Buy back the shares just to reissue them at a higher price to other companies.

- Buy back shares to reissue them to employees.

- Reduce the number of outstanding shares to increase per-share measures of earnings.

- When it is bought back, it is recorded at cost.

- It has no voting or dividend rights.

- Cash dividends paid is reduced when Treasury Stock is purchased.

- Stock transactions are only on the balance sheet.

- Journal entry for reacquiring stock:

- Debit Treasury Stock

- Credit Cash

- Example for reacquiring stock: A company reacquires 20,000 shares of its common stock at $20 per share.

- Step 1: Calculate cash paid.

- 20,000 x $20

- $400,000 is paid.

- Step 2: Make the journal entry.

| Treasury Stock | $400,000 | ||

|---|---|---|---|

| Cash | $400,000 |

- Journal entry for reissued stock:

- Debit Cash (shares x new price of share)

- Credit Treasury Stock (shares x initial price of stock)

- Credit Additional Paid-In Capital (shares x (new price - old price))

- Example for reissuing stock: A company reissues 10,000 shares of Treasury Stock at $35 per share.

- Step 1: Calculate cash received.

- Shares x New cost per share

- 10,000 x $25

- Cash = $250,000

- Step 2: Calculate Treasury Stock that will be issued.

- Shares x Initial price of stock (from reacquiring example)

- 10,000 x $20

- Treasury Stock = $200,000

- Step 3: Calculate APIC.

- (Shares x (new price - old price))

- (10,000 x ($25 - $20))

- 10,000 x $5

- APIC = $50,000

- Step 4: Make the journal entry.

| Cash | $250,000 | ||

|---|---|---|---|

| Treasury Stock | $200,000 | ||

| APIC | $50,000 |

- Stock transactions NEVER generates gains or losses.

Objective 11.3: Explain and analyze cash dividends, stock dividends, and stock split transactions.

Cash Dividends on Common Stock

- If investors get common stock then they will get a return on their investment.

- Returns on Common Stock investments can come in two forms:

- Dividends

- Increases in stock price

- Growth investment is buying stock that pay a small amount of dividends or no dividends at all.

- Income investments are from common stock that do pay dividends.

- Before a dividend is declared, a company must have:

- Enough retained earnings

- Enough cash

- Dividends are…..

- Declared by a board of directors.

- Not legally required.

- Liabilities once declared

- Dividends are not an expense.

Dividend Dates

- The declaration date is the day when the Board of Directors decide to issue a cash dividend. This is the day the liability is established. Journal entry:

- Debit Dividends

- Credit Dividends Payable

- The date of record is an administrative responsibility.

- No journal entry

- The date of payment reduces the liability and cash. Journal entry:

- Debit Dividends Payable

- Credit Cash

- The year end is when the temporary accounts are closed to Retained Earnings. Journal entry:

- Debit Retained Earnings

- Credit Dividends

- Example:

- Declaration Date: A company declares a cash dividends of $115,000,000 during its 2021 fiscal year.

| Dividend | $115,000,000 | ||

|---|---|---|---|

| Dividend Payable | $115,000,000 |

- Date of record: NO JOURNAL ENTRY

- Date of payment: The previously declared dividend is paid off by the company.

| Dividend Payable | $115,000,000 | ||

|---|---|---|---|

| Cash | $115,000,000 |

- Year end: The company’s temporary accounts are closed into Retained Earnings at the end of their accounting period.

| Retained Earnings | $115,000,000 | ||

|---|---|---|---|

| Dividends | $115,000,000 |

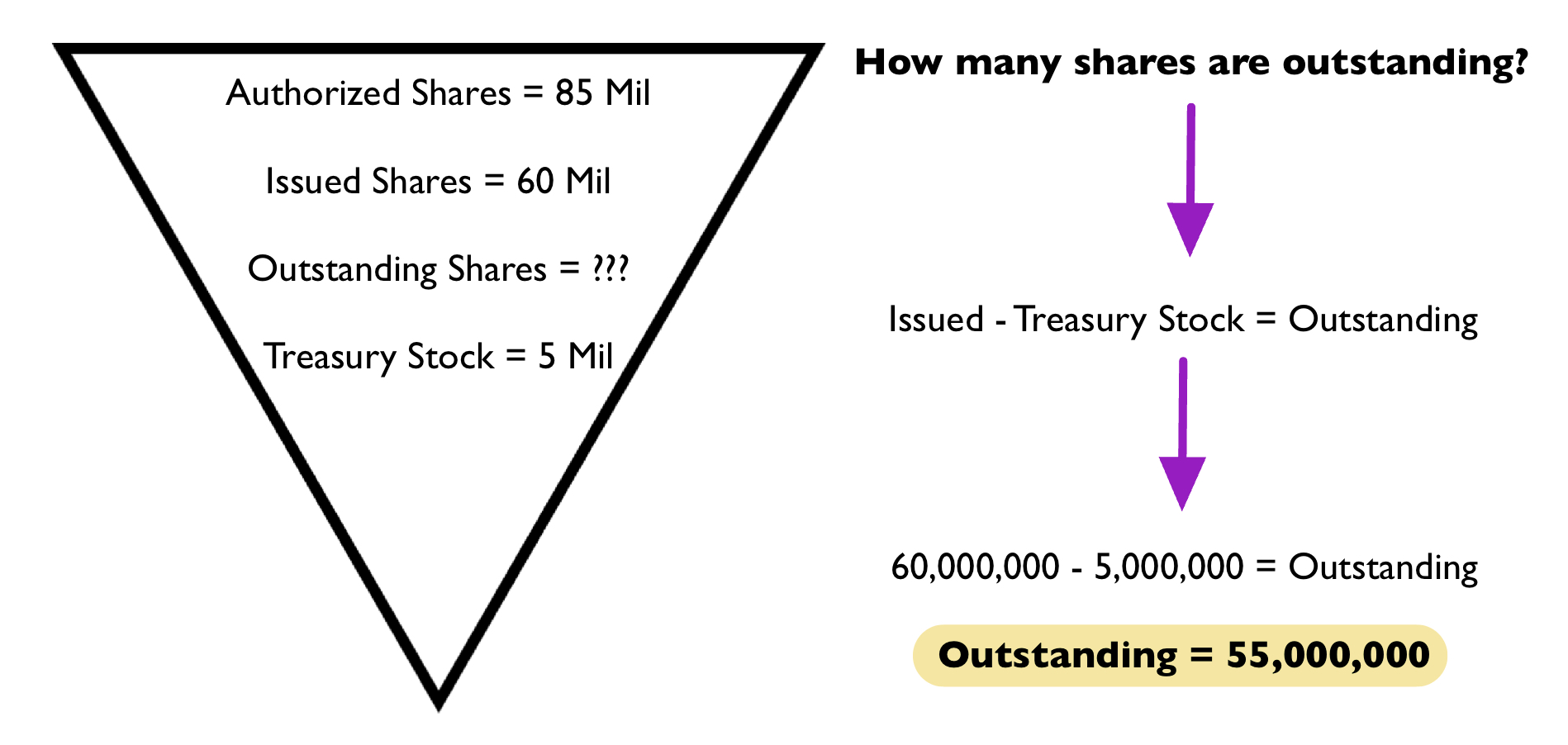

The Common Stock Triangle 🔽

Authorized shares are the max amount of shares that can be issued.

Issued shares are given to shareholders.

Outstanding shares are what has not been issued.

==Equation to calculate outstanding shares:==

- Issued - Treasury shares = Outstanding Shares

Example:

Objective 11.4: Describe the characteristics of preferred stock and analyze transactions affecting preferred stock.

Preferred Stock

- Preferred stock is given to a special group of investors.

- Preferred stock has different features such as:

- It has different voting rights (none or a lot).

- Dividends may be paid at a fixed rate.

- It has priority over normal common stock.

- Preferred Stock Issuance increases cash and stockholders’ equity.

Preferred Stock Redemption

- Preferred stock that was issued can be bought back.

- This redemption means the preferred stock is retired, which results in the issuance being reversed.

Preferred Stock Dividends

- Preferred stock gives two dividends preferences:

- Current dividend preference

- Cumulative dividend preference

- A current dividend preference states that preferred dividends must be paid before paying dividends to stockholders.

- A cumulative dividend preference states if a current dividends is not paid, the unpaid amount has to be paid before other common dividends.

- Dividends in arrears regard cumulative preferred stock that has not been paid yet. They are not on the balance sheet.

Retained Earnings

- Retained Earnings are the collective earnings of a company.

- Net income increases Retained Earnings.

- Net loss decreases Retained Earnings.

- Giving cash or dividends to stockholders also decreases Retained Earnings.

- The negative balance of Retained Earnings is called accumulated deficit.

Statement of Stockholders’ Equity

- The statement of stockholders’ equity shows each stockholders’ equity account so we can track increases and decreases for each account.

- Examples of what may be included:

- Issued shares

- Treasury stock

- Net income

- Cash dividends

- Stock dividends

- Common stock

- APIC

- Retained Earnings

Objective 11.5: Analyze the earnings per share (EPS), return on equity (ROE), and price/earnings (P/E) ratios.

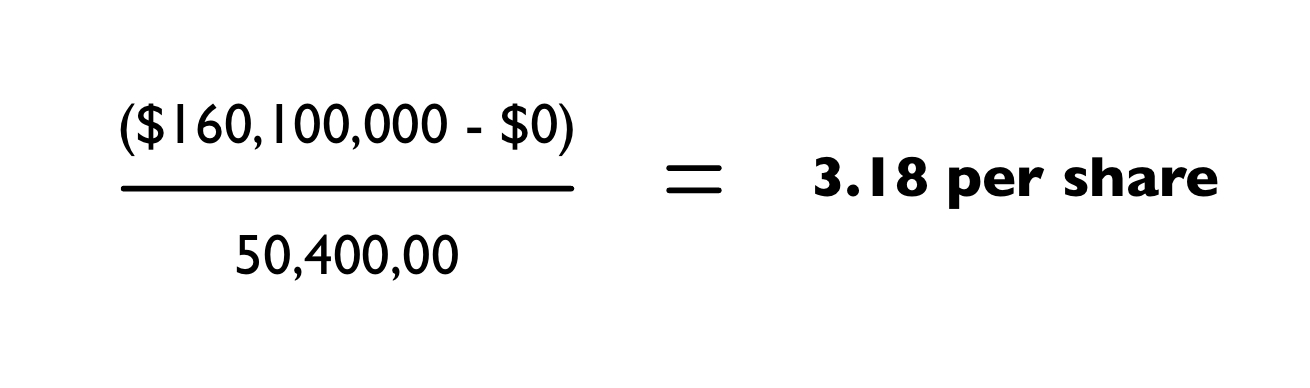

Earnings Per Share (EPS)

Earnings per share provides information on the profit earned from common stock that is outstanding.

Recent earning ratios can look into how dividends and stock prices may be in the future.

Using EPS, you can compare the financial ratio to other years.

You can not compare companies using this ratio.

The higher that ratio, the better.

==Equation to calculate earnings per share:==

- (Net Income - Preferred Dividends)/ Average number of Common Shares Outstanding

Example: A company’s income for 2022 was $160,100,000. It has $0 of preferred dividends. The average number of its outstanding shares was 50,400,000.

Return on Equity (ROE)

Return on Equity reports a company’s return to stockholders.

The ratio can be compared across companies.

The higher the ratio, the better.

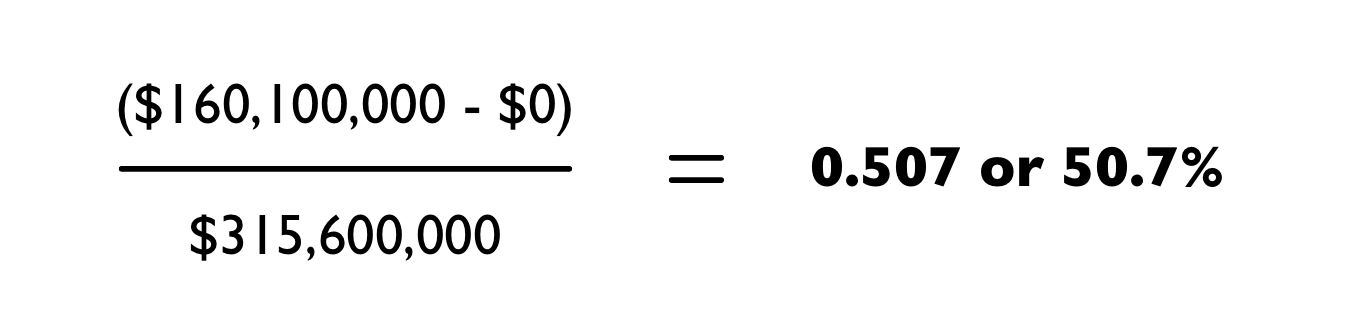

==Equation to calculate return on equity:==

- (Net Income - Preferred Dividends)/ Average Common Stockholders’ Equity

Example: A company’s income for 2022 was $160,100,000. It has $0 of preferred dividends. The average common stockholders equity was $315,600,000.

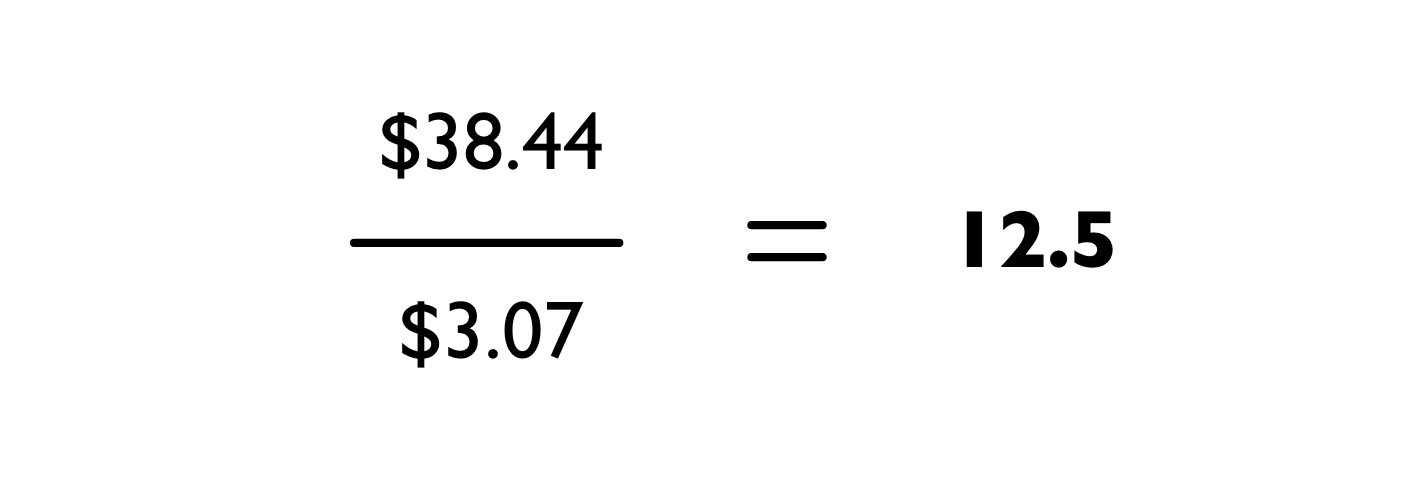

Price/Earnings (P/E) Ratio

The Price/Earnings ratio is a measure of the value that investors place on a company’s common stock.

The current stock price comes from the stock exchange.

With this ratio, you need to calculate EPS before calculating P/E.

==Equation to calculate the price/earning ratio:==

- Current Stock Price (per share)/ Earning Per Share (annual)

Example: A company’s stock price was $38.44 when the company reported its 2022 EPS of $3.07.