UNIT 5- Fiscal & Monetary Combinations

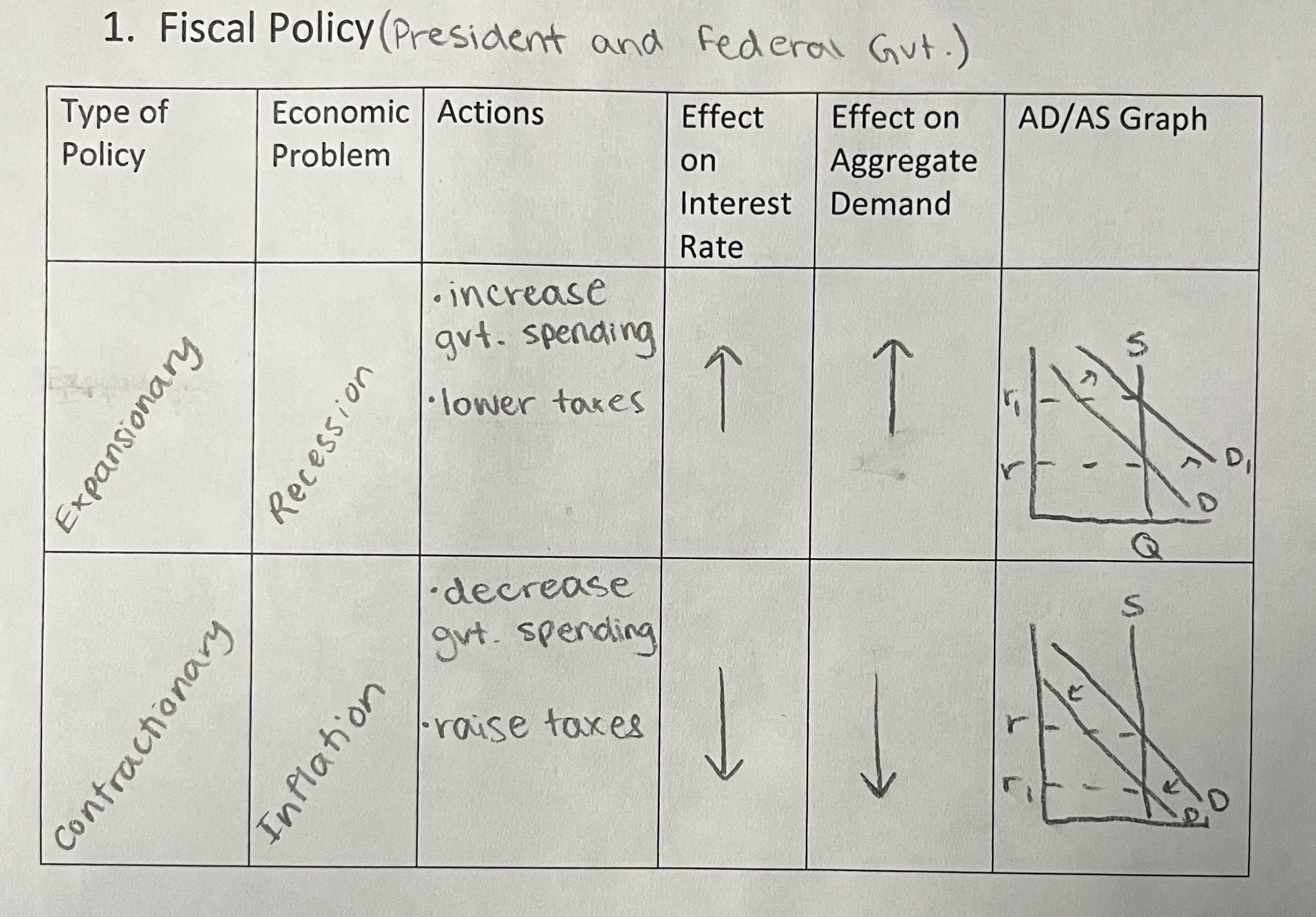

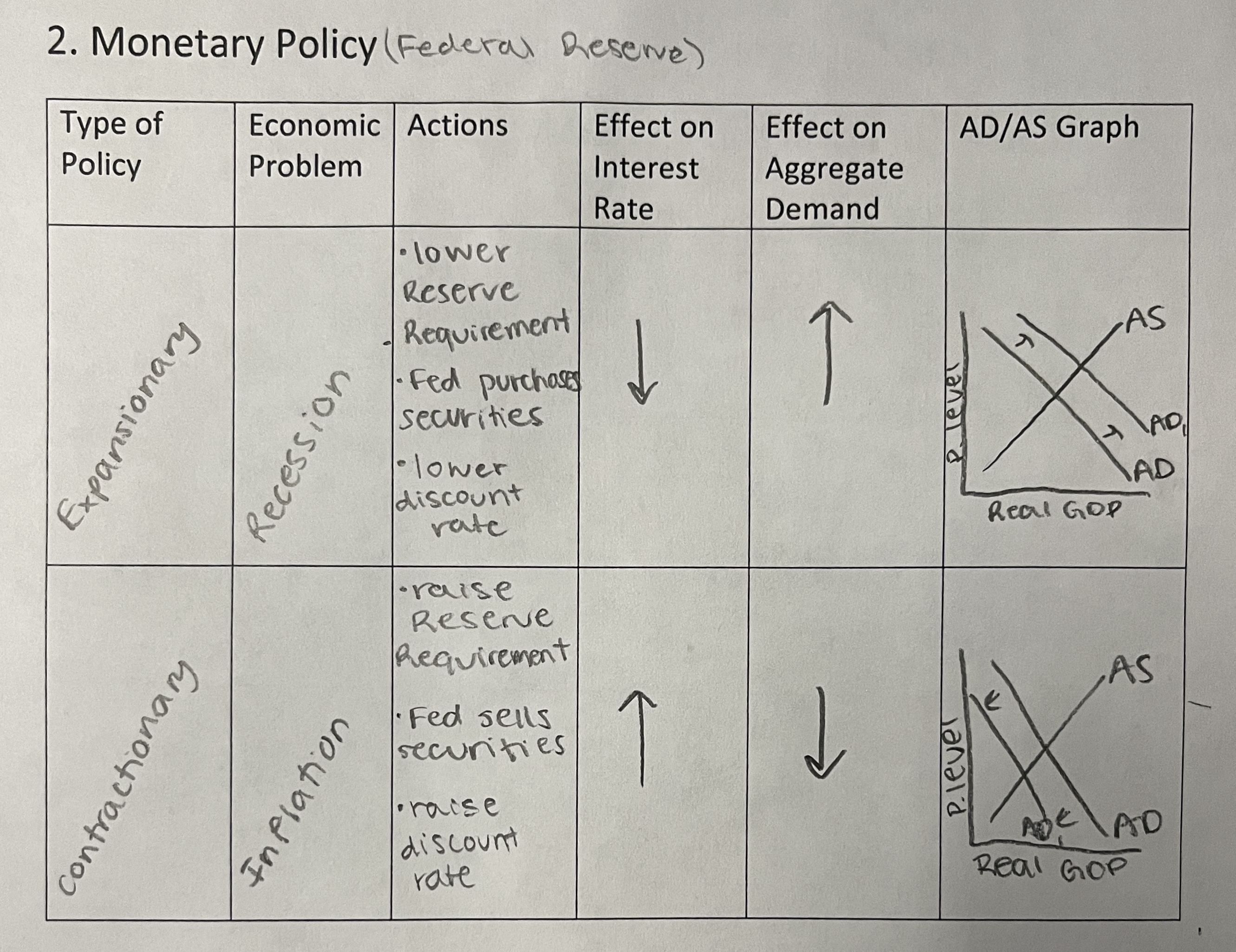

Review of Fiscal & Monetary Policy

Long Run Effects of Policies:

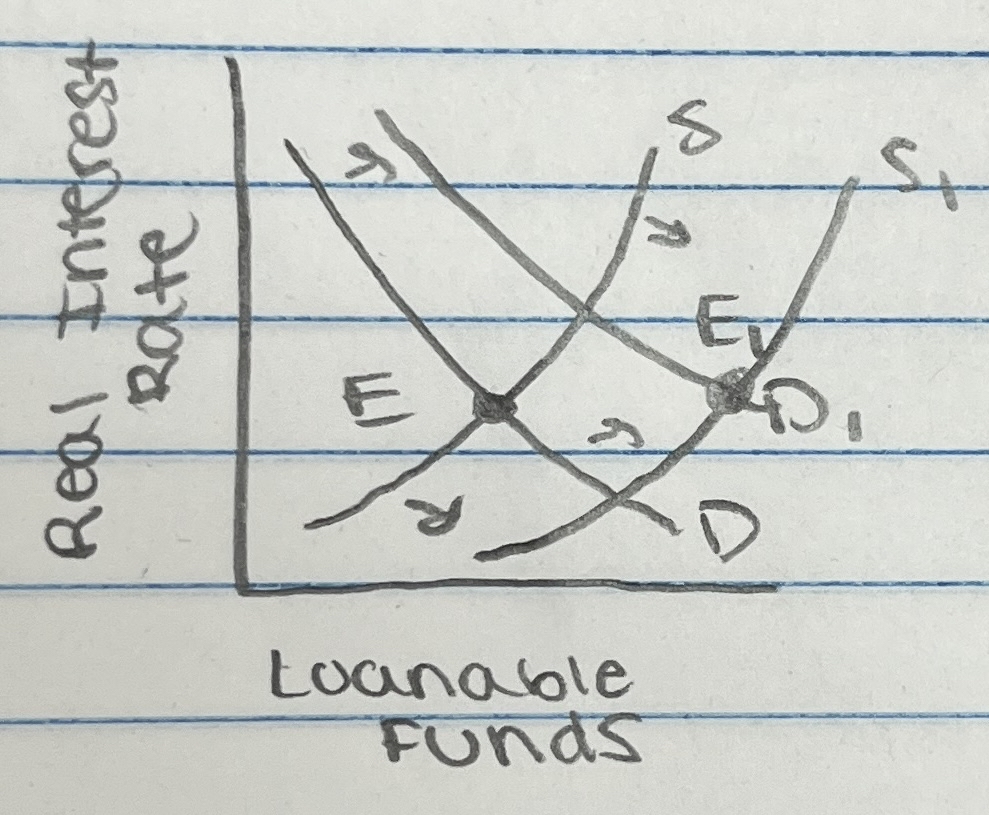

have to take a look at interest rates

high interest rates aren’t good for investment

low interest rates promote investment

Effects of Expansionary Fiscal Policy

Deficit Spending

government spending is greater than tax revenue

government must borrow money to finance the deficit

government issues bonds → supply of bonds increases which decreases the price of bonds and increases interest rates

Crowding Out

the budget deficit causes interest rates to rise, which hurts private investment

private investment gets crowded out by government borrowing

hurts the economy in the long run

reduces effectiveness of an expansionary fiscal policy

aggregate demand will increase, but not by as much as you would want it due to high interest rates

Monetizing the Deficit

Fed will increase money supply to keep interest rates from rising

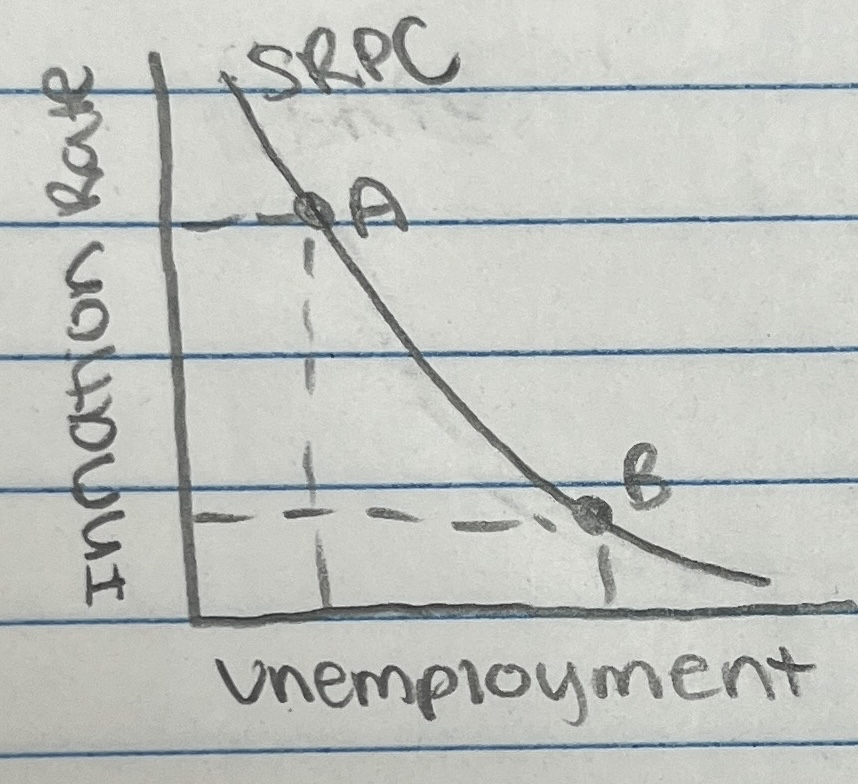

Trade Off Between Inflation and Unemployment

Philips Curve - a graph relating to the rate of inflation to the unemployment rate

Short Run

A = high inflation, low unemployment

B = high unemployment, low inflation

short run Philips Curve works mostly when changes come from the demand side

demand-pull inflation

when changes come from the demand side you move along an existing short-run Philips Curve

Shifts in short-run Philips Curve:

cost-push inflation → shifts SRPC to the right

inflationary expectations → if we expect higher prices, we increase our demand today, which shifts SRPC to right

when AS decreases → SRPC shifts right

when AS increases → SRPC shifts left

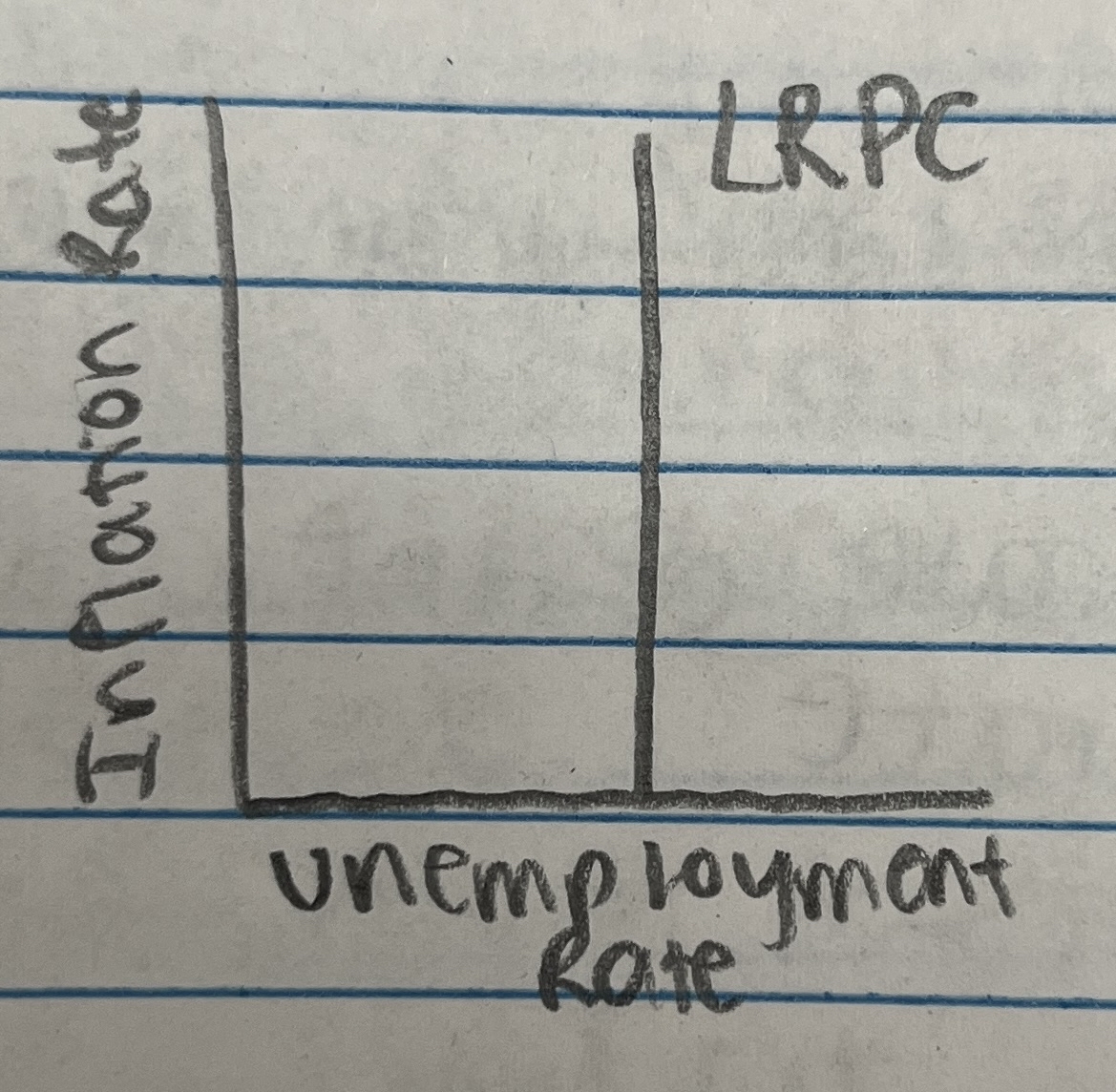

Long Run Philips Curve

vertical at full employment level

Economic Growth

An increase in the productive capacity of the economy

Measured as a percentage change in Real GDP or per capita Real GDP

per capita = per person

Growth is important to improving our state of living

Evolving technology is part of growth

Rule of 70/72 = divide the rate of growth into 70 or 72 → gives you the number of years it will take the economy to double its capacity

shifts to right → economic growth

Factors to Economic Growth:

Productivity - key to economic growth

amount of output per unit of input

Increase in real capital

interest rates go up → less real capital

interest rates go down → more real capital

Improvement in worker skills (human capital)

education, training, etc.

Improvement in technology

Natural resources

abundance of natural resources increases growth

Economic system to provide incentives to work, save, and invest

Differences between Potential GDP and Actual GDP

Potential GDP is real GDP that the economy would produce if all of its resources were fully employed

Actual GDP is real GDP, that doesn’t necessarily mean you’re at full employment