3.4 Final accounts

Stakeholders and accounting information

- Business managers

- Workforce

- Banks

- Creditors such as suppliers

- Customers

- Government and tax authorities

- Investors and potential investors in a business

Limitations of accounting information to stakeholders

- One set of accounts is of limited use

- Accounts do not measure items which cannot be expressed in monetary terms

- The accounts of one business do not allow for comparisons

- Business accounts will only publish the minimum information required by law

- Accounts are historic

- Window dressing: presenting the accounts of a business in the best possible, or most flattering, way which could potentially mislead users of accounts.

The principles and ethics of accounting practice

Integrity: accountants should act honestly in all dealings with clients and also with tax authorities and all other stakeholder groups. It means being straightforward, honest and truthful in all professional and business relationships.

Objectivity: accountants shouldn’t allow bias, conflict of interest or the influence of other people to override their professional judgement.

Professional competence and due care: accountants are required to carry out their work with proper regard for relevant technical and professional standards. This means that nobody should undertake professional work which they are not competent to perform.

Confidentiality: accountants shouldn’t disclose professional information unless they have specific permission or a legal or professional duty to do so.

Professional behavior: when breached, it leads to most complaints to the professional accounting bodies. Clearly, accountants should comply with all relevant legal obligations when dealing with a client's affairs and assist clients to do the same.

The main business accounts

Profit and loss account = Income statement = Statement of comprehensive income records the revenue, costs and profit (or loss) of a business over a given period of time. It’s composed of 3 sections:

- Trading account

- Gross profit: equal to sales revenue less cost of sales.

- Sales revenue (or sales turnover): total value of sales made during the trading period = selling price x quantity sold.

- Cost of sales (or cost of goods sold): direct cost of purchasing the goods that were sold during the financial year.

- Profit and loss section

- Operating profit (net profit or profit before interest and taxation): gross profit minus overhead expenses.

- Profit after tax: operating profit minus interest costs and corporation tax.

- Dividends: share of the profits paid to shareholders as a return for investing in the company.

- Appropriation account

- Retained profit: profit left after all deductions, including dividends, have been made; this is “ploughed back” into the company as a source of finance.

Balance sheet = Statement of financial position: accounting statement that records the values of a business’s assets, liabilities and shareholders’ equity at one point in time.

- Shareholders’ equity: total value of assets less total value of liabilities.

- Share capital: total value of capital raised from shareholders by the issue of shares.

Cash flow statement = Statement of cash flows

- It shows where cash was received from and it what it was spent on.

Different types of intangible assets

- Intangible assets: assets that have no physical substance and are not financial instruments.

- Marketing-related intangible assets

- Customer-related intangible assets

- Artistic-related intangible assets

- Contract-related intangible assets

- Technology-related intangible assets

- Goodwill arises when a business is valued at or sold for more than the balance sheet values of its assets.

- Intellectual property: asset that has been developed from human ideas and knowledge.

Depreciation of assets

Nearly all fixed/non-current assets will depreciate or decline in value over time.

- Annual depreciation attempts to record capital expenditure over the useful life of an asset and avoids recording this expenditure as a one-off cost when the asset is purchased.

- The assets will retain some value on the balance sheet each year until fully depreciated or sold off.

- The profits will be reduced by the amount of that year’s depreciation and will not be under-recorded or over-recorded.

- Assets decline in value due to wear and tear or technological change.

Calculating depreciation

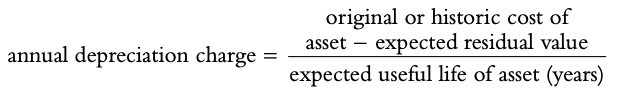

Straight-line depreciation: constant amount of depreciation is subtracted from the value of the asset each year.

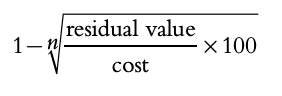

Reducing (diminishing) balance method