econ chapter 9

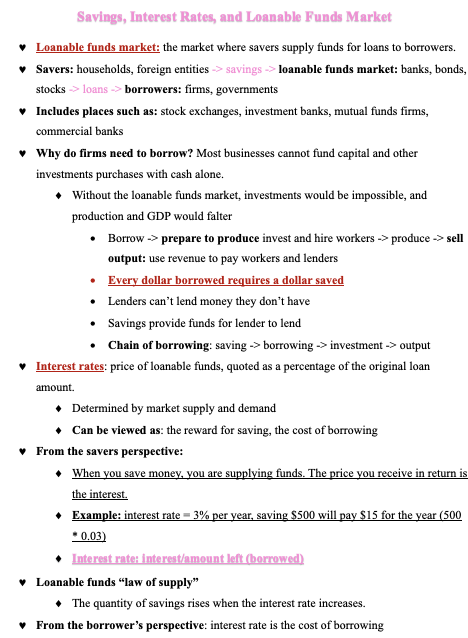

Savings, Interest Rates, and Loanable Funds Market

© Loanable funds market: the market where savers supply funds for loans to borrowers.

© Savers: households, foreign entities -> savings -> loanable funds market: banks, bonds, stocks -> loans -> borrowers: firms, governments

© Includes places such as: stock exchanges, investment banks, mutual funds firms, commercial banks

© Why do firms need to borrow? Most businesses cannot fund capital and other investments purchases with cash alone.

¨ Without the loanable funds market, investments would be impossible, and production and GDP would falter

· Borrow -> prepare to produce invest and hire workers -> produce -> sell output: use revenue to pay workers and lenders

· Every dollar borrowed requires a dollar saved

· Lenders can’t lend money they don’t have

· Savings provide funds for lender to lend

· Chain of borrowing: saving -> borrowing -> investment -> output

© Interest rates: price of loanable funds, quoted as a percentage of the original loan amount.

¨ Determined by market supply and demand

¨ Can be viewed as: the reward for saving, the cost of borrowing

© From the savers perspective:

¨ When you save money, you are supplying funds. The price you receive in return is the interest.

¨ Example: interest rate = 3% per year, saving $500 will pay $15 for the year (500 * 0.03)

¨ Interest rate: interest/amount left (borrowed)

© Loanable funds “law of supply”

¨ The quantity of savings rises when the interest rate increases.

© From the borrower’s perspective: interest rate is the cost of borrowing

© When should a firm borrow? Borrow funds if expected to return on investment is greater than the interest rate on the loan.

© Profit-maximizing firms borrow to fund an investment if and only if the expected return on the investment is greater than the interest rate on the loan.

© Higher the interest rate, less likely the firms are to borrow- law of demand

© Real interest rate: the interest rate corrected for inflation

© Nominal interest rate: the interest rate before inflation

© Fisher equation: real interest rate = the nominal (or annual) rate – the inflation rate

© Nominal rate = real interest rate + inflation rate

© Supply of loanable funds: households, comes from people saving money, interest rate is a reward for saving

¨ Shift in the supply of loanable funds is caused by: changes in income and wealth, changes in time preferences, consumption smoothing

© Demand of loanable funds: firms and government, comes from people wanting to borrow money

© Changes in income and wealth: increases in either income or wealth generally produce increase in savings.

¨ as the world gets richer, funds make their way into the U.S loanable funds market, making borrowing easier for U.S firms.

© Time preferences: people prefer to get goods sooner than later

¨ Weak time preferences means that someone is willing to wait for a higher consumption in the future

¨ Strong time preferences means that someone is not willing to wait long, values current consumption a lot more

© Consumption smoothing: occurs when people borrow and save to smooth consumption over their lifetime

© Demanders of lonabe funds are borrowers

¨ Demand is driven by firms that need to borrow for large capital projects

¨ Governments borrow to meet their high-level spending when tax revenue isn’t enough

© Shift in the demand of loanable funds is caused by:

¨ Changes in productivity of capital

¨ Changes in investors’ confidence

¨ Gov borrowing

© If capital is more productive, the demand for loanable funds will increase

¨ The returns on investment will be greater

¨ Ex: internet and computers

© Investors’ confidence: measure of what firms expect for future economic activity

¨ If a firm is more optimistic, it will borrow more today

¨ Investment demand may not even be based on rational decisions or real factors in the economy

¨ John Maynard referred investors drive to action as “animal spirits”

© Government budget deficit and borrowing: they need to borrow money to finance their debt (from us)