Chapter 6

Authors and Copyright

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

Copyright © 2014 by The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 6: Reporting and Interpreting Sales Revenue, Receivables, and Cash.

Learning Objectives (Page 2)

After studying this chapter, you should be able to:

6-1 Analyze the impact of credit card sales, sales discounts, sales returns, and sales of bundled items on net sales.

6-2 Estimate, report, and evaluate the effects of uncollectible accounts receivable (bad debts) on financial statements.

6-3 Analyze and interpret the receivables turnover ratio and the effects of accounts receivable on cash flows.

6-4 Report, control, and safeguard cash.

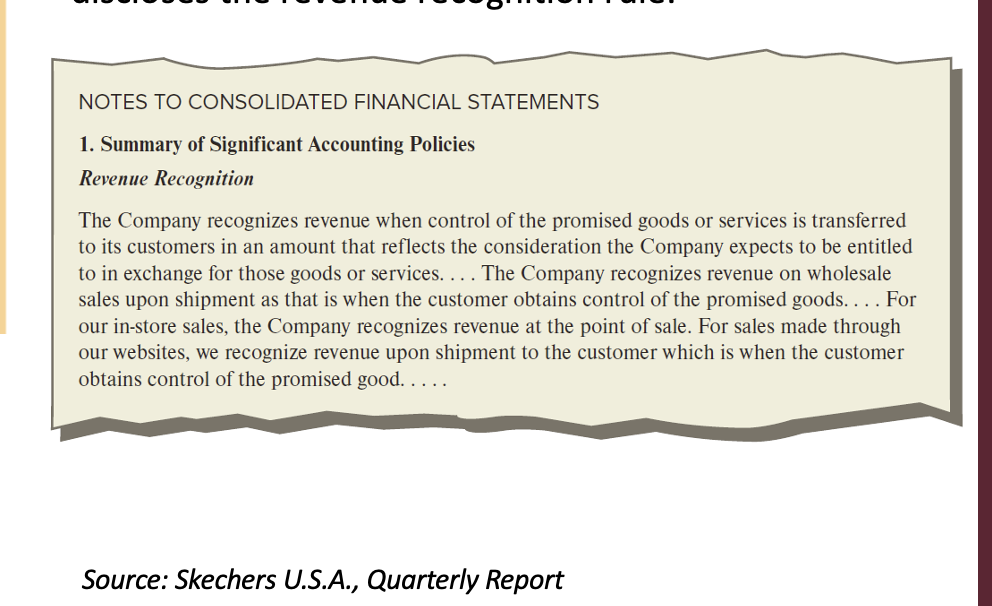

Accounting for Net Sales Revenue (Page 4-5)

Revenue Recognition Principle defines when to record revenues:

When goods and services are transferred to customers.

In the expected amount the company will receive.

Net sale Revenue

For sellers of goods, sales revenue is recorded when title and risks of ownership transfer to the buyer. The point at which title (ownership) changes hands is determined by the shipping terms in the sales contract.

Shipping Terms:

FOB Destination: Title changes hands on delivery.

FOB Shipping Point: Title changes hands at shipping date.

FOB = Free on Board

Sales revenue is recorded when the title and risks of ownership transfer to the buyer.

Service revenue is typically recorded once services are provided.

Accounting Policies

Motivating sale and collections

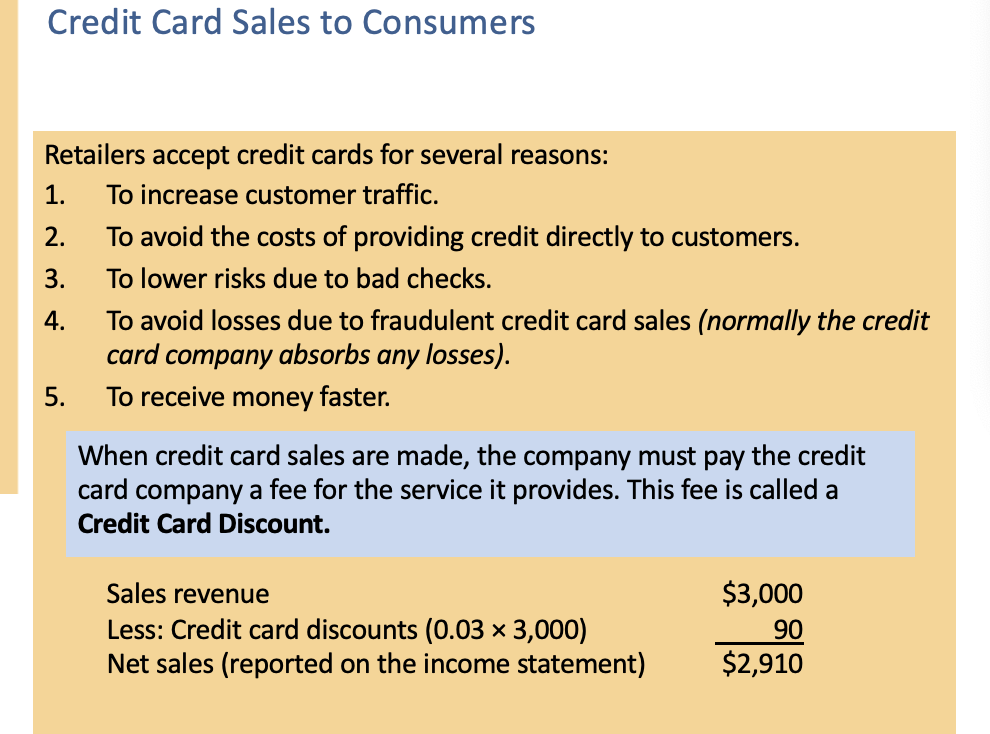

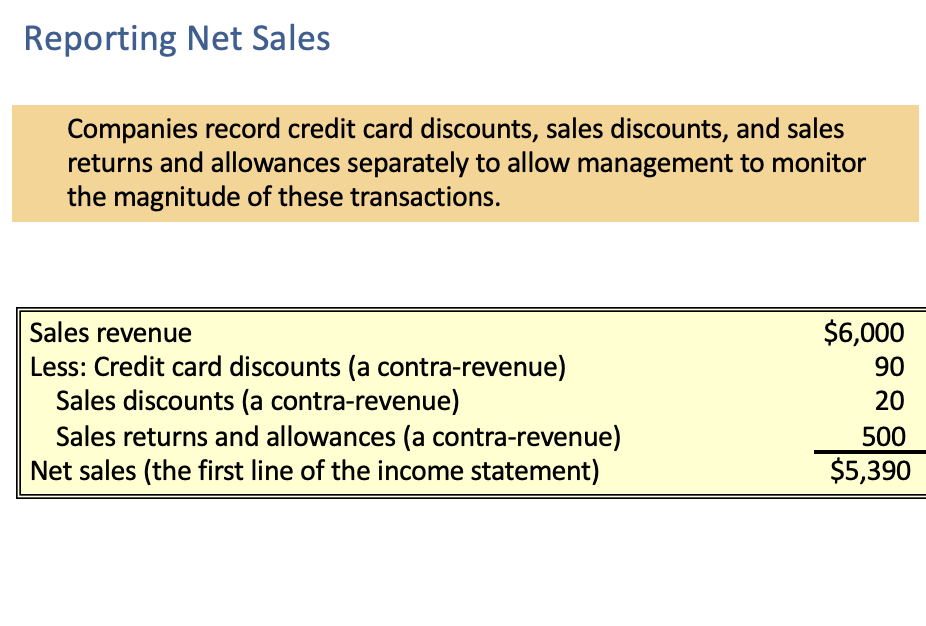

Credit Card Sale to Consumers

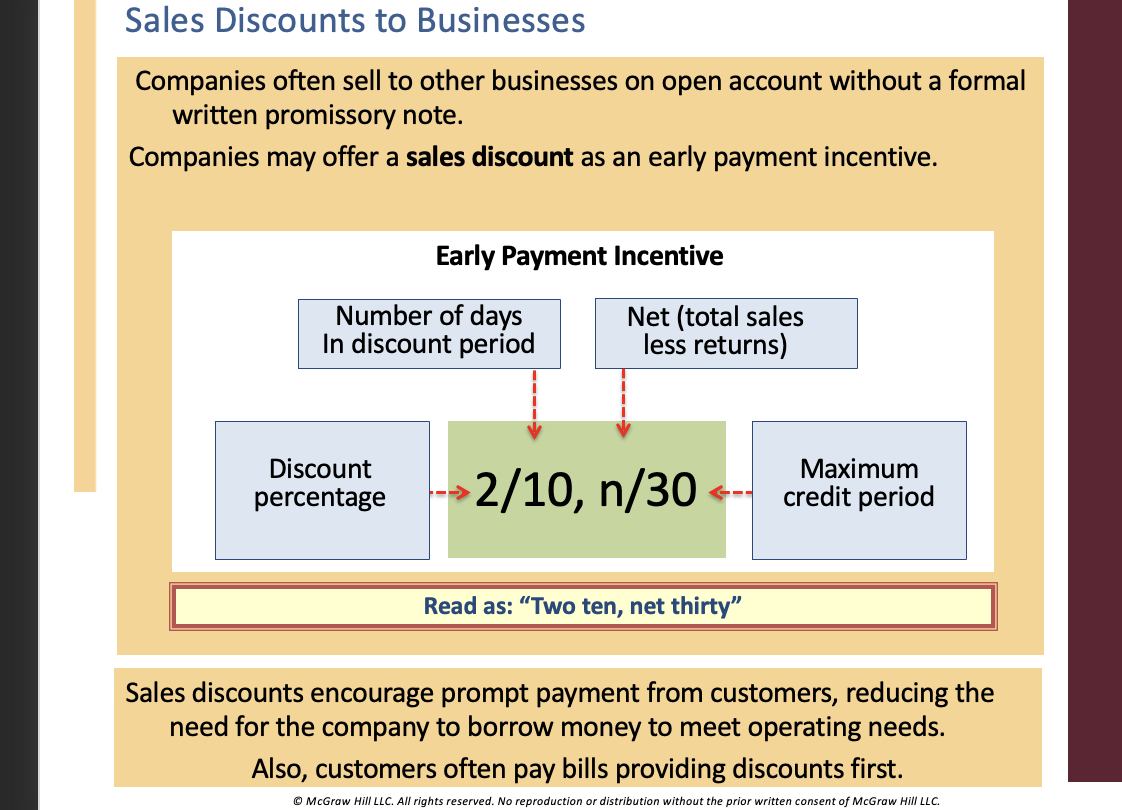

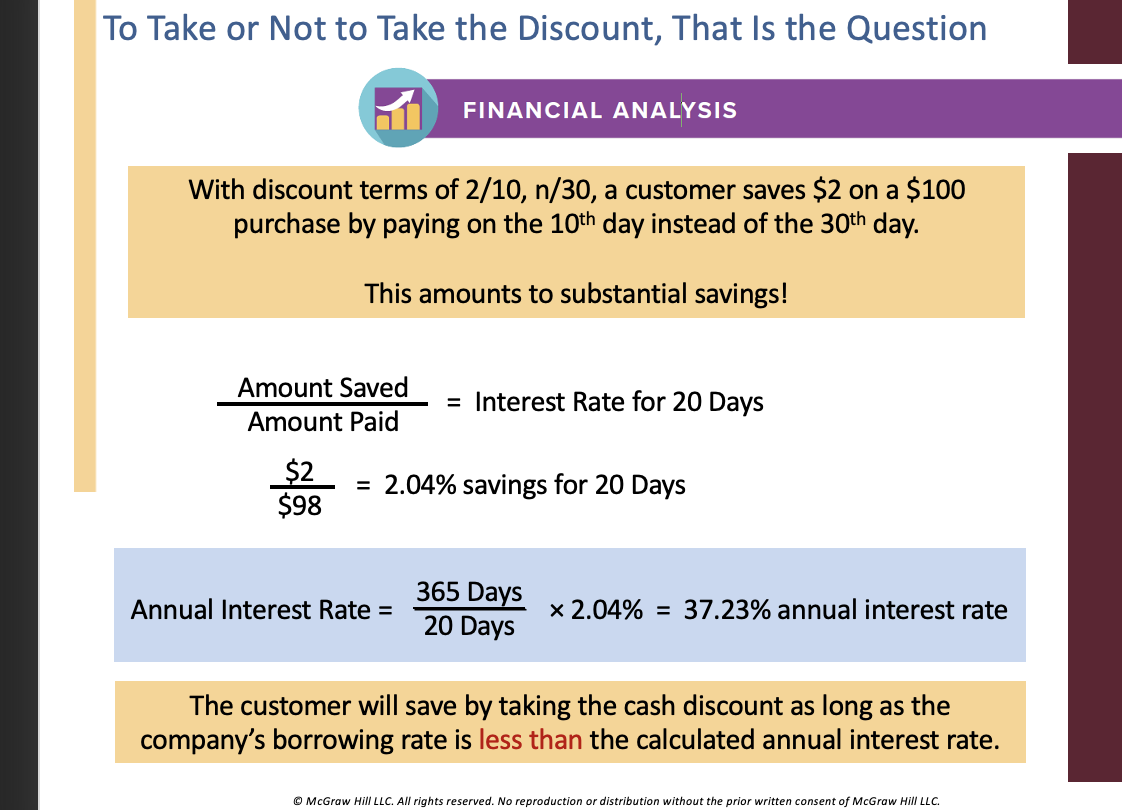

Sales Discounts & Terms (Page 9-10)

Sales discounts incentivize early payment:

Example: "2/10, n/30" means 2% discount if paid within 10 days, net amount due in 30 days.

Discounts encourage prompt payments, reducing the need for borrowing.

Impact of taking discounts:

A $100 purchase saves a customer $2 if paid within discount terms, yielding an annual interest rate of 37.23% on short-term savings.

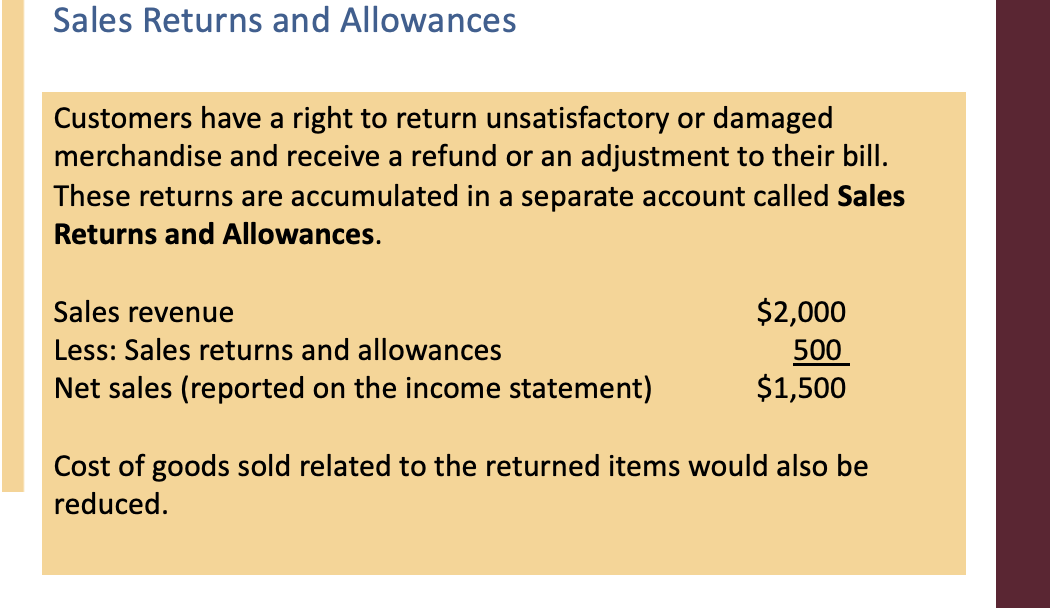

Sales Returns and Allowances (Page 11-12)

Customers may return unsatisfactory merchandise resulting in reductions recorded as:

Sales Returns and Allowances.

Example Calculation:

Sales Revenue: $2,000

Less: Returns: $500

Net Sales: $1,500

Similar treatment is applied in financial statements.

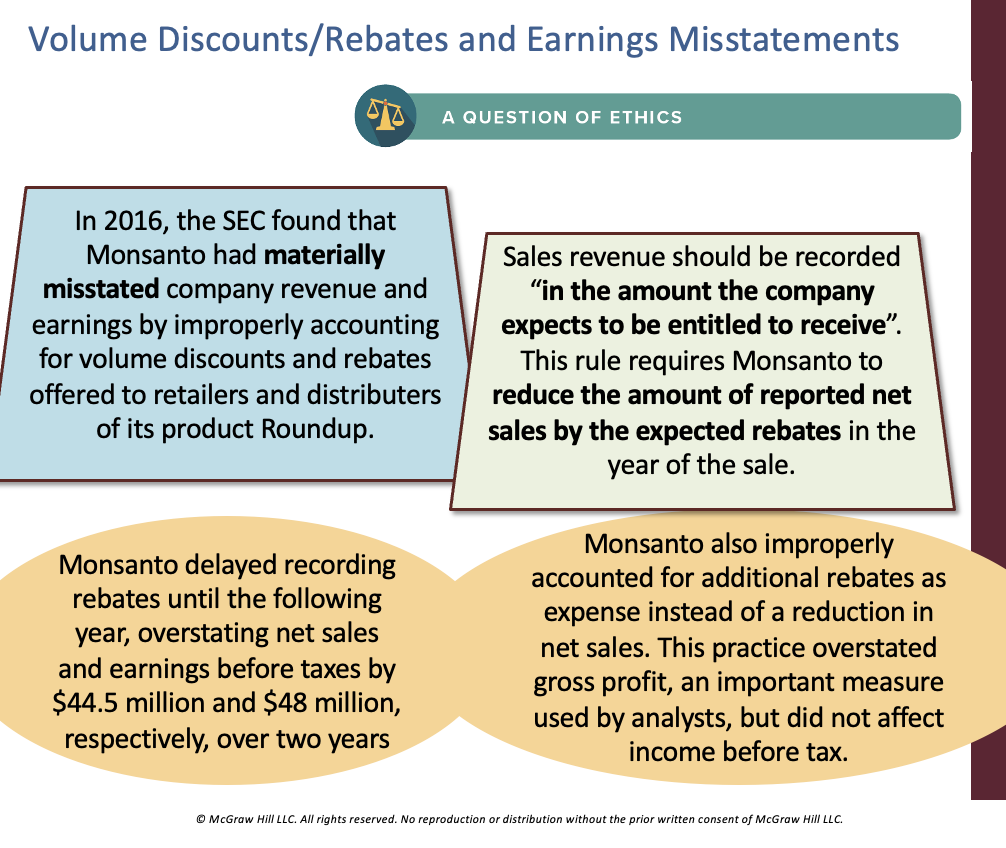

Volume Discount/ Rebates and Earning Misstatements

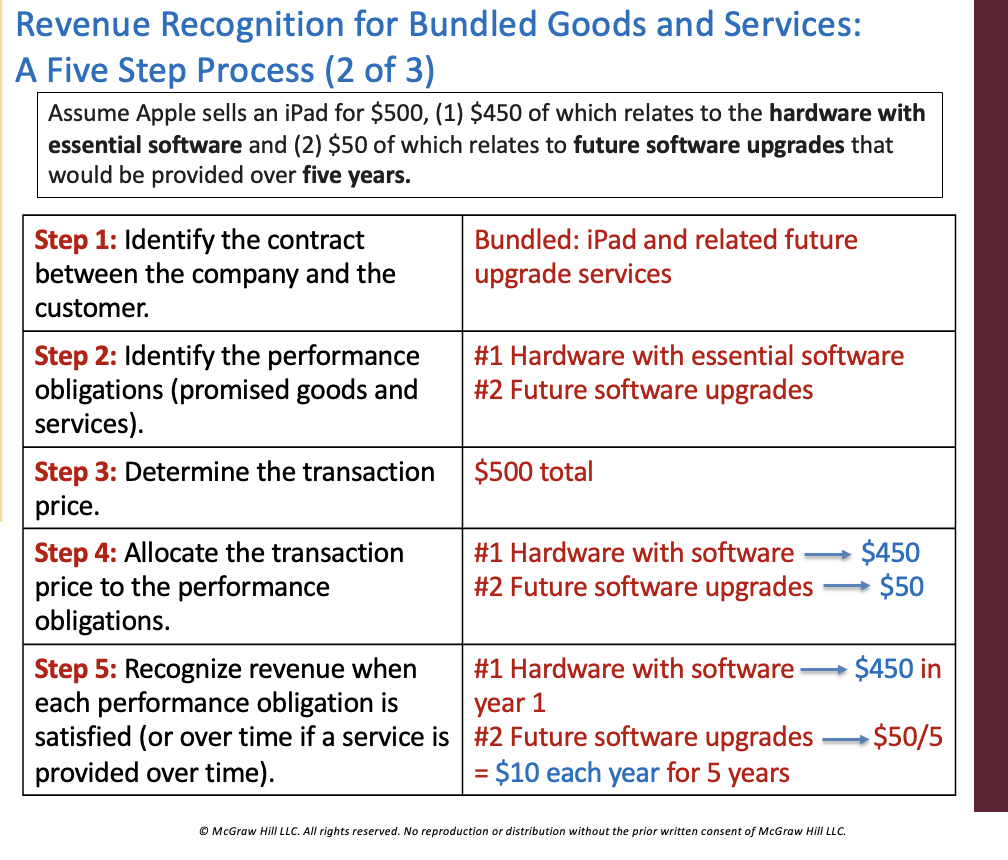

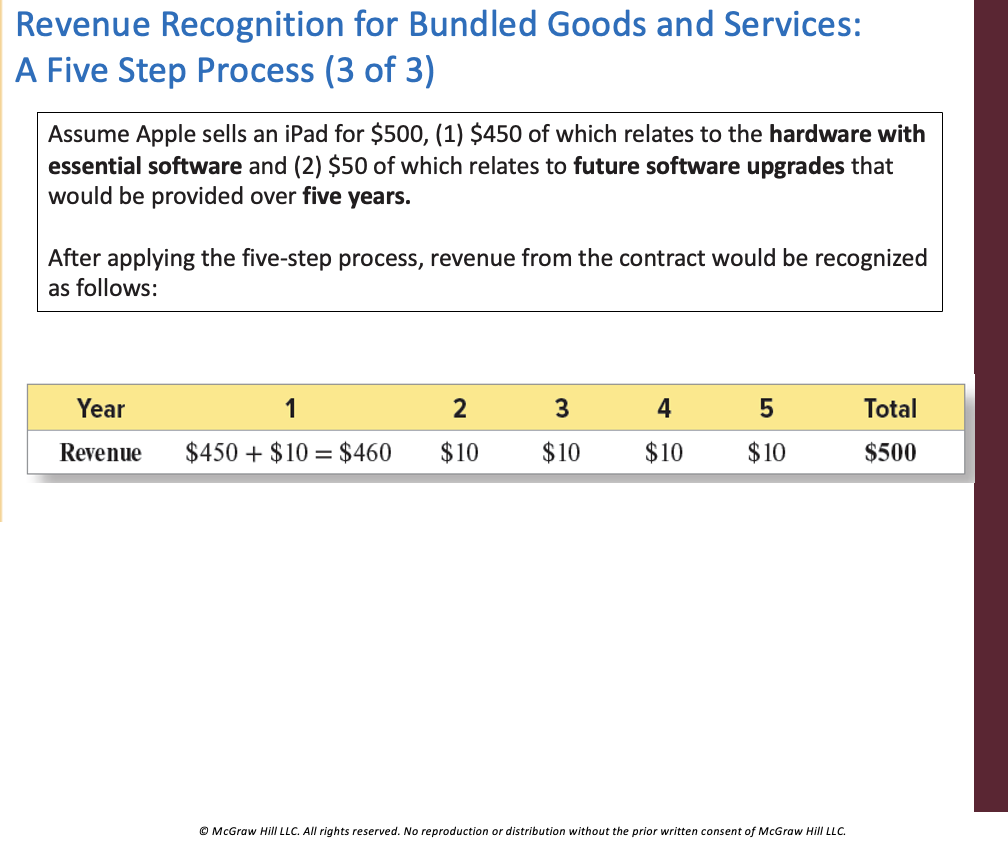

Revenue Recognition for Bundled Sales (Page 15-17)

Five-Step Process:

Step 1: Identify the contract the company and customer.

Step 2: Identify performance obligations (goods/services).

Step 3: Determine the transaction price.

Step 4: Allocate price to obligations.

Step 5: Recognize revenue as obligations are satisfied.

Example using Apple iPad sales shows allocation and timing of revenue recognition.

Measuring and Reporting Receivables (Page 18-19)

Classifications of receivables include:

Accounts Receivable: Credit sale on an open account.

or

Notes Receivable: Written promise to pay.

Trade Receivables: Normal course sales, nontrade for other transactions.

or

Non-trade receivables- (arise from the transactions other than the normal sale of merchandise or services)

Current (short-term)

or

Noncurrent (Long-term)

Need for currency conversion in foreign sales.

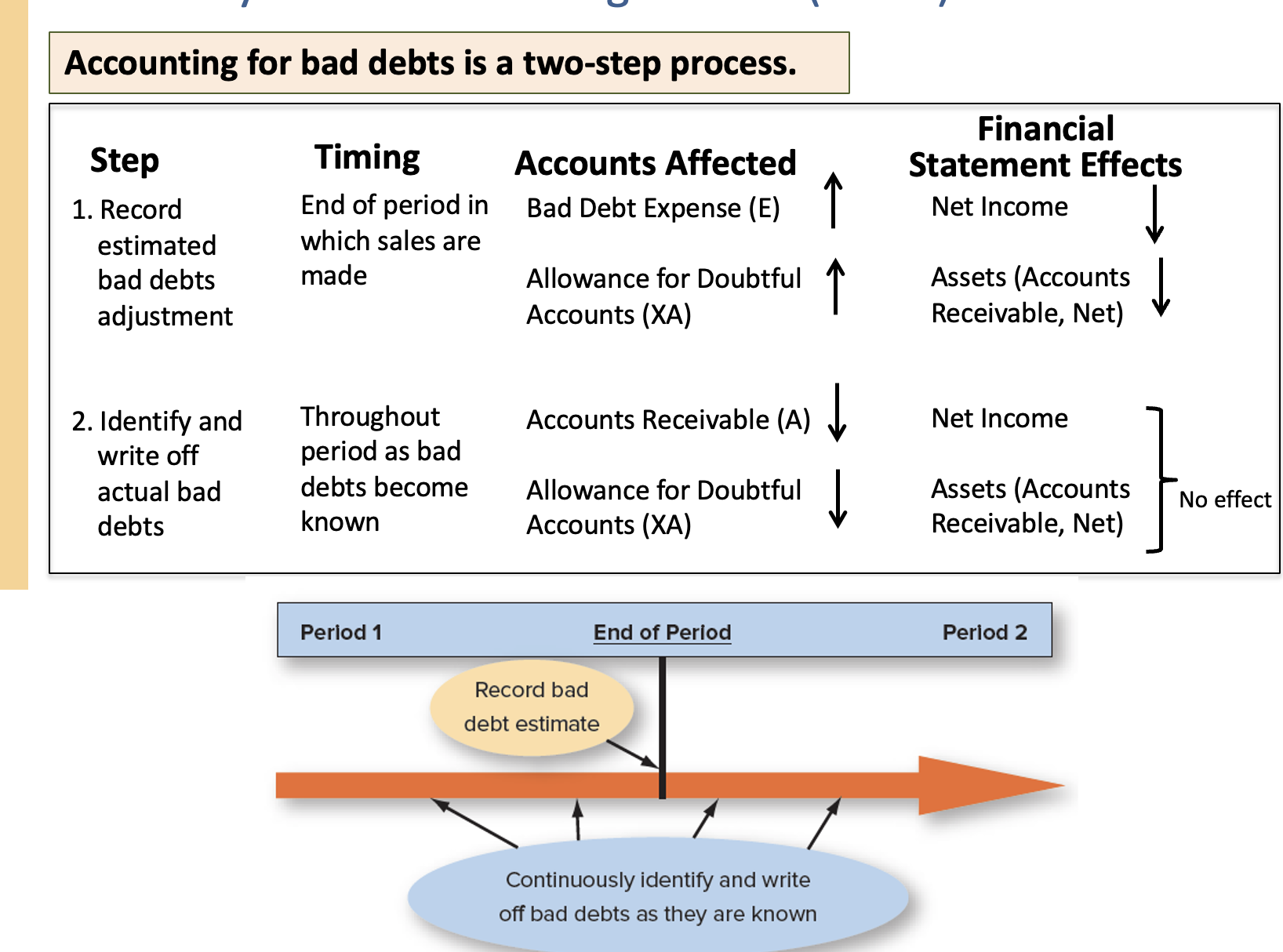

Accounting for Bad Debts (Page 21-24)

Bad Debts refer to uncollectible accounts owed by credit customers.

Allowance Method:

Requires estimates at the end of the accounting period.

Two-step process:

1) Record estimated bad debts,

2) Write off known uncollectibles.

Journal entries for write-offs and recoveries do not affect total accounts receivable or income.

Estimating Bad Debt Expense (Page 29-32)

Methods for estimating include:

Percentage of Credit Sales: Simple application tied to sales history.

Aging of Accounts Receivable: More accurate, assesses collectibility by age.

Approach differences in recording bad debts.

Receivables Turnover Ratio (Page 36-37)

Measures frequency of collection of receivables over a year.

Indicates the relationship between sales on account and collections.

Cash Reporting and Management (Page 39-46)

Cash and Cash Equivalents: Include checks, money orders, CDs, and T-Bills.

Cash Management Principles:

Ensure liquidity for operating needs and manage excess cash.

Strong Internal Controls:

Separate duties, daily deposits, reconciliation, and formal approval procedures are essential.

Bank Reconciliation (Page 44-46)

Identifies discrepancies between bank statement and company's records.

Necessary for accurate cash reporting and resolving unreconciled transactions.