Bureaucracy - Notes

Bureaucracy

What is Bureaucracy?

- Bureaucracy is the physical enforcement of a law. It is a complex system made up of administrative structure.

- the Bureaucracy has 4 million U.S. employees.

Principles of Bureaucracy \n

^^Hierarchical Authority: pyramid-like structure. Usually, the top has the leader with all of the power, and the workers are on the bottom.^^

\n

Job Specialization: each member has a responsibility of their own; repeat the same tasks on the daily basis. Their job is their specialization.

\n

Formalized Rules: specific rules and procedures followed by all members. Ensures jobs are equal and doable.

- a Bureaucracy does not need Bureaucratic Authority.

History and Growth

\n

Beginnings: provided standards for offices; qualifications

\n \n

^^Spoils System: practice of giving offices and favors to political supporters and friends.^^

\n \n

Reform Movement: competitive exams put in place but lacked funding.

\n \n

Pendleton Act: after Garfield’s assassination, merit system is put into place for hiring/promotion.

\n \n

Hatch Act: prohibits government employees from engaging in political duties while on duty.

\n \n

Civil Service Reform Act: created the Office of Personal Management to recruit, train, and create classification for employees.

Reform

Red Tape: too many complex rules, making it difficult to be productive.

\n

Conflict: agencies working at cross-purposes against one another.

\n

Duplication: two agencies doing the same thing.

\n

Waste: spending more than is necessary.

\n

Imperialism: agencies growing and becoming too powerful.

Organization

Who is part of the bureaucracy?

- ^^15 Cabinet departments^^

- Attorney General heads the Department of Justice

- Independent agencies have no cabinet status

- Independent Regulatory agency are there to regulate

Influences on the Bureaucracy

- ^^The Iron Triangle creates a bidirectional relationship^^between these three groups in which each member helps the other pass and execute laws. \n

Executive: appoints staff, issues budgets, pass executive orders.

\n

Congressional: influence on appointments, approves budgets, holds hearings, rewrite legislation.

\n

Iron Triangle: alliance between interest groups, congressional committees and bureaucratic agencies.

\n

Issue Networks: located within interest groups, temporary groups to argue for public policy, Congressional staff, think tanks, universities, the media.

Executive Office of the President

\n

What are some examples?

- White House Office

- National Security Council

- Office of Management and Budget

Executive Departments

- State

- Treasury

- Defense

What were the 3 original departments?

- State

- Treasury

- Defense

Independent Agencies

- Consumer Product Safety Commission (CPSC)

- Environmental Protection Agency (EPA)

- Equal Employment Opportunity Commission (EEOC) \n

Policy Making Process

\n

Agenda Setting: recognize the problem.

\n

Policy Formation: find ways to solve the problem.

\n

Policy Adoption: adopting a plan to solve the problem; legislation may be required. Selecting from all the possible solutions to solve the problem. \n

Policy Implementation: executing the plan of action using appropriate agency or agencies.

\n

Policy Evaluation: analyze of policy and its impact; make adjustments if necessary.

How do we Raise Revenue?

raise revenue. \n

Taxes: personal and corporate income tax, social insurance taxes, excise taxes, customs, duties, and estate and gift taxes.

- the largest form of revenue for the U.S. Government comes from income tax.

Other Methods: sale of government securities by the Federal Reserve and collection of fees for services provided such as patients.

Government Spending

Discretionary - Choice: defense spending, education, student loans, scientific research, environmental clean up, law enforcement, disaster and foreign aid. (We can freely choose on what we want to invest on).

\n \n

Nondiscretionary - No Choice: National debt, social welfare programs, social security, medicare, medicaid, veteran’s pensions, unemployment. (We don’t have a choice into investing; money that must be spent by the U.S. government).

Steps to the Federal Budget

Proposals: federal agencies submits estimates of their needs for the coming year to the Office and Management and Budget (OMB).

\n

Executive Branch: OMB works with the president’s office to create one single budget package to submit to Congress in January or February.

\n

Congress: Congress debates and modifies the President’s plans using the Congressional Budget Office (CBO). They hold hearings and analyze the budget to pass in both houses by September 15th. Puts together the budget package for major review and approval.

Players in the Budget Process

\n

Council of Economic Advisors: Professional economist on the President’s side. Sends report to Congress.

\n

Secretary of the Treasury: Member of the Cabinet is there to argue for business and finance world.

\n

Federal Reserve: appointed by President; serves 14 year terms, regulates reserve rates and interest rates.

Fiscal Policy: controlled by the Feds; how the government taxes and spends.

- When changing the way or the amount we tax citizens and the way we spend that money, this is considered as Fiscal Policy. \n

Monetary Policy: managing inflation by controlling how much money is in circulation, how much money costs; interest rates, and the buying power of money.

- Monetary policy refers to the actions taken by a central bank, such as the Federal Reserve in the US, to manage the supply and demand of money and credit in an economy. It is used to influence economic growth, inflation, and employment levels.

Economic Theories

Monetarism: people have a lot of money, but not enough stuff to be spent on.

\n

Keynesianism: government should create demand. Demand low put money in by spending, when it is too high; take money out by taxing. (John Maynard Keynes)

\n

Economic Planning: government should plan parts of the country’s economic activity. Wage and price controls (John Kenneth Galbraith)

\n

Supply-side Tax Cuts: less government interference and lower taxes. More investments and great economic productivity. (trickle-down economy)

Reaganomics: combines monetarism, supply-side tax cuts, and domestic budget cutting. Not always consistent goals.

\n

Effects of Reaganomics: stimulated economy. More government spending money, supply controlled by increase inflation. National debt increased.

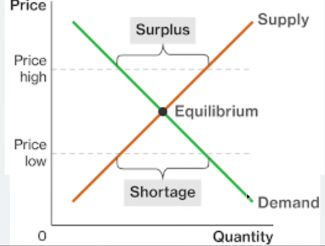

Surplus: happens when the country is spending less than it’s revenue from taxes.

\n

^^Shortage: occurs when the spending is greater than tax revenue, resulting in deficit spending to pay our bills. When current supply cannot keep up with current demand.^^

- deficit spending: When the country does not have enough money to pay its bills; people may use credit cards to pay their bills.

Draw the Graph