2.1 - intro to tax policy, practice, and administration

Lecture Overview

This lecture provides an introduction to UK tax policy, focusing on:

The relationship between tax policy, tax practice, and tax administration.

Key contemporary issues shaping global tax policy.

Macroeconomic, political, and sociological influences on taxation.

The impact of digital transformation, global crises, and environmental taxation.

The topic is divided into two main parts:

Understanding the relationship between tax policy, practice, and administration.

Exploring factors that shape tax policy, including globalization, political priorities, technological advancements, and tax avoidance.

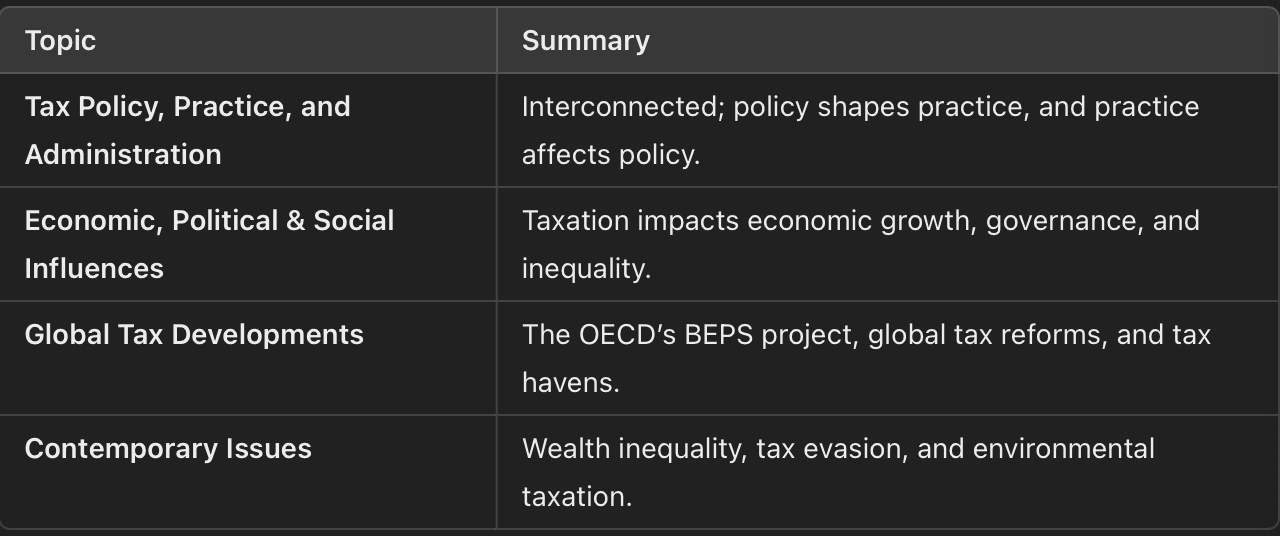

PART 1: The Connection Between Tax Policy, Practice, and Administration

What is Tax Policy?

Tax policy involves the government's strategic decisions about:

What taxes to levy – e.g., income tax, VAT, corporation tax.

On what base – determining taxable activities.

In what amounts – setting tax rates.

On whom – individuals, businesses, multinational corporations.

By what methods – direct/indirect taxation, progressive/regressive tax structures.

Key Considerations in Tax Policy

Macroeconomic factors – managing public finances, economic growth, and inflation.

Microeconomic impacts – how taxation affects business and consumer behavior.

Social and political dimensions – ensuring tax fairness, redistributing wealth.

What is Tax Practice?

Tax practice refers to the application of tax laws in preparing tax returns and ensuring compliance.

Practitioners include:

Tax advisors/accountants – advising clients on legal tax strategies.

Corporate tax departments – managing business tax obligations.

Government tax authorities – ensuring compliance and preventing tax evasion.

Role of Tax Practitioners

Advise on tax-efficient financial strategies.

Interpret tax law to minimize liability.

Ensure compliance with legal requirements.

Engage in tax planning to reduce tax burdens (legally).

What is Tax Administration?

Tax administration refers to the implementation and enforcement of tax laws by government agencies.

Key Responsibilities of Tax Administrators

Efficient tax collection – ensuring revenue is raised fairly.

Minimizing costs – both for the government and taxpayers.

Monitoring compliance – detecting and preventing tax evasion.

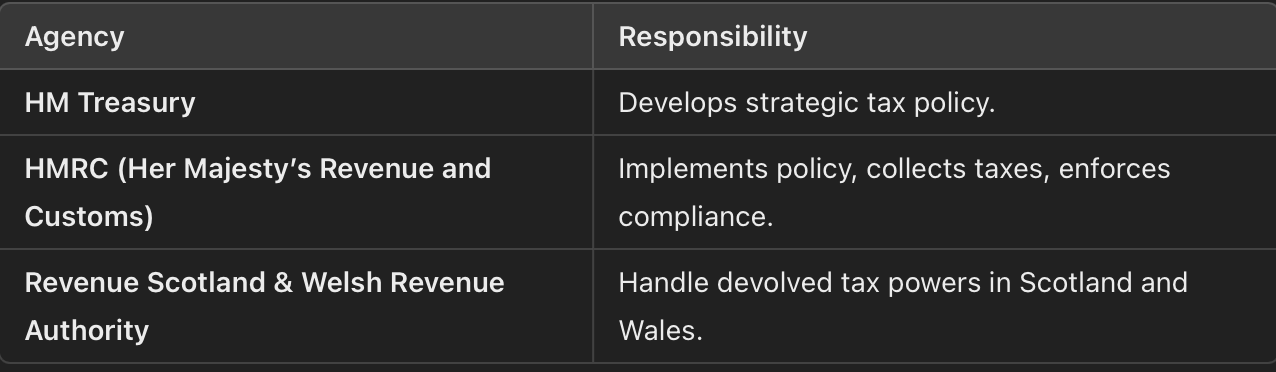

Tax Administrators in the UK

Interconnection Between Policy, Practice, and Administration

Policy shapes practice – new tax laws define what is legal or illegal.

Practice affects policy – loopholes and avoidance strategies lead to reforms.

Administration enforces policy – tax authorities monitor and enforce compliance.

Quote: "Policy change without administrative change is nothing." (Casanegra de Jantscher, 1990)

PART 2: Factors That Shape Tax Policy

1. Economic Factors

Tax is a key fiscal tool in economic policy. Governments use taxation to:

Raise revenue for public services.

Control inflation by influencing consumer spending.

Regulate business behavior through tax incentives or penalties.

International Economic Considerations

Globalization: Increasing international trade affects tax regulations (e.g., VAT on imports/exports).

Tax competition: Countries compete by lowering corporate tax rates to attract foreign investment.

Trade agreements: Free trade zones may have special tax rules.

Macroeconomic Issues

Governments must balance tax revenue with public expenditure and debt levels.

Progressive vs. regressive tax structures influence income distribution.

Tax policy can either stimulate or slow economic growth.

Microeconomic Issues

Behavioral taxation: Higher taxes on cigarettes or alcohol aim to discourage consumption.

Industry-specific taxation: Different industries may have different tax incentives or burdens.

2. Political and Governance Influences

Political priorities determine tax policy (e.g., wealth redistribution vs. low tax, pro-business policies).

Regulatory environment: A country’s ability to enforce tax laws affects compliance.

International cooperation: Organizations like the OECD set global tax norms.

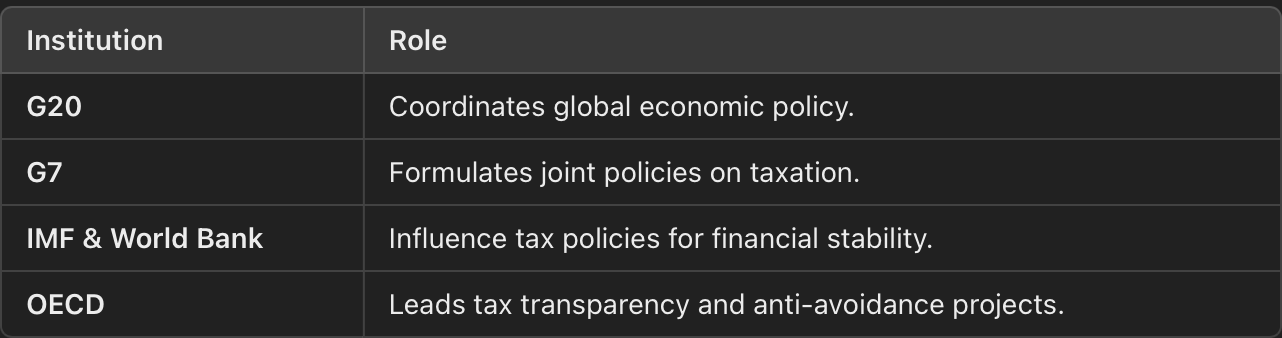

Key Political Players in Global Tax Policy

Example: OECD’s Role

The OECD’s BEPS (Base Erosion and Profit Shifting) project aims to:

Prevent tax avoidance by multinational companies.

Ensure transparency in tax reporting.

Introduce a global minimum corporate tax of 15%.

3. Technological and Digital Transformation

E-commerce & digital economy: Harder to tax due to cross-border transactions.

Cryptocurrency: Creates challenges in tracking taxable transactions.

AI & Big Data: Enhances tax authorities’ ability to track and analyze economic activity.

4. Crises and External Shocks

Events such as COVID-19, climate change, and geopolitical conflicts influence tax policy:

Increased spending on public services leads to new taxation strategies.

Economic downturns may result in tax relief measures or stimulus packages.

Climate-related events necessitate funding for disaster recovery.

5. Sociological, Environmental, and Ethical Issues

Fairness in taxation: Who should bear the highest tax burden?

Tax as a behavioral tool: Can taxation encourage environmentally friendly practices?

Demographic shifts: Ageing populations may require changes in tax policy.

Green Taxes

Used to curb environmental damage (e.g., carbon tax).

The UK is ranked low in green tax implementation compared to OECD peers.

Challenges:

Higher energy taxes may push businesses to relocate.

Green taxes can disproportionately affect low-income households.

Contemporary Issues in Taxation

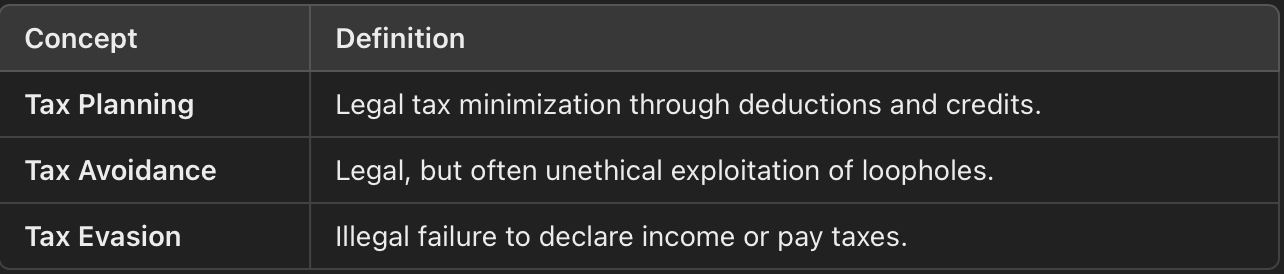

1. Tax Avoidance vs. Tax Evasion

Case Study: The Panama and Paradise Papers

Exposed large-scale use of offshore tax havens by wealthy individuals and corporations.

Revealed industrial-scale tax dodging through shell companies.

2. Global Wealth Inequality

The top 1% own 38% of global wealth, while 50% of the population own just 2%.

Tax systems can either reduce or widen income inequality.

Challenges:

Many high-net-worth individuals shelter wealth in tax havens.

Falling corporate tax rates contribute to wealth concentration.

Solutions to Wealth Inequality

Increase inheritance and property taxes.

Reduce corporate tax loopholes.

Strengthen global cooperation on tax transparency.

Key Takeaways

Knowt

Knowt