2.1.1 Macroeconomics objectives

Economic growth

Economic growth is the increase in real and/or potential GDP (output) in an economy in a given period of time

GDP (Gross Domestic Product) is a measure of economic growth.

GDP is the value of production of goods and services in an economy in a given period of time (normally a year).

Real – takes into account inflation

Nominal –Not adjusted to take into account inflation

GDP per capita means GDP per person

Limitations of GDP as a measure of economic growth

GDP overestimates well-being – it does not take into account the environmental damage of production, consuming unhealthy products (demerit goods), un-reporting of loss of natural resources

GDP underestimates well-being - natural resources are not included, social factors are not included (e.g. people are living longer), quality of output is not taken into consideration, national happiness is not considered

GDP lacks information – numbers do not indicate the type of production, GDP does not provide info about income distribution and it does not measure many aspects of quality of life.

GDP does not take into account the quality of production (in particular technological goods)

GDP does not include unofficial or unpaid work. The value of goods and services that are consumed by the producers, rather than traded, is also not included. This is a particular issue in developing countries with higher levels of subsistence agriculture.

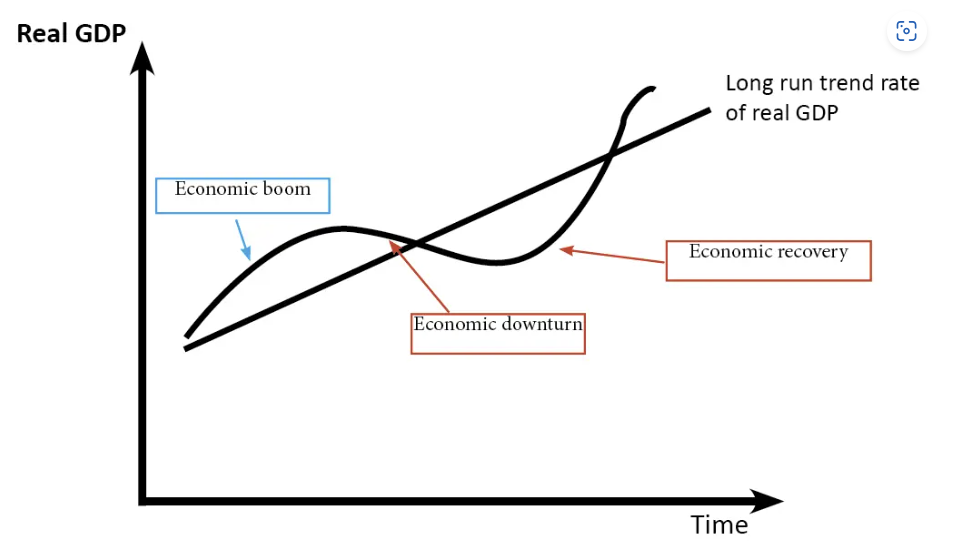

The economic cycle (also known as the trade and business cycle)

The trade/business/economic cycle describes how the economy tends to exhibit recurring trends in economic growth rates. It shows the fluctuations in GDP over time. Booms tend to be followed by economic slumps or slowdowns, which tend to be followed by recession, before the economy moves into the recovery phase, and then back into a boom.

In a boom period there tends to be:

High rates of growth, low rates of unemployment, inflationary pressures, high consumer and business confidence, improving government budget balance (as tax revenue rises, and government expenditure on benefits falls.)

In the UK, a recession is defined as a period of two or more consecutive quarters of negative economic growth. In a recession there tends to be: Negative rates of economic growth, high rates of unemployment, low levels of inflation, low business and consumer confidence, a worsening government budget balance.

(The opposite occurs in a slump)

The impact of economic growth

The benefits of economic growth:

Higher standards of living as average incomes rise and more goods and services are available for consumption

Increased revenues and profits for firms.

Increased employment opportunities.

An improvement in the government budget balance (less government spending and more tax revenue)

A decrease in absolute poverty rates

Increased consumer and business confidence, leading to more investment

Improvement in the environment as more efficient, cleaner technology is developed

Life expectancy tends to increase with income

Education standards increase

Health improves

The costs of economic growth include factors such as:

A negative impact on the environment as non-renewable resources are used up and negative production externalities are created

Increased inflationary pressure due to increase in demand for goods and services

An increase in relative poverty/income inequality – the rich tend to benefit more than the poor

A worsening of the trade balance as consumers purchase more imports with their increased average incomes and inflation means competitiveness of exports fall.

The social effects of increased production – more stress, less leisure time.

Inflation

Low and stable inflation

Definitions

Inflation: A sustained increase in the average price level in an economy in a given period of time.

Deflation: A fall in the average price level in an economy in a given period of time.

Disinflation: A fall in the rate of inflation (prices increasing but at a slower rate)

Measuring inflation - CPI

CPI is the Consumer Price Index. It measures the change in prices over a year. The measure uses a ‘shopping basket’ of approximately 750 goods and services. The prices of most of these items are collected from around 150 different locations each month. The indices are weighted to reflect the importance of the various items. (E.g. a household spends more on fuel each month then bread; this is reflected in the CPI). Both the contents of the baskets and the weights are updated annually.

Types of inflation

Demand-pull inflation

An increase in demand with no increase in supply will increase the price level. This is because there is less spare capacity in the economy.

Cost-push inflation

An increase in costs of production can increase the price level in an economy. E.g. an increase in wages, import prices or taxes. Firms will pass increased costs onto consumers.

The relationship between inflation and interest rates

Most countries have an inflation target. E.g. the UK target is 2%. The main way a country controls inflation is by using monetary policy.

Monetary policy is manipulation of interest rates and the money supply to achieve the inflation target.

Normally the central bank is in charge of monetary policy. The central bank is an organisation that is independent from the government. Their main role is to control inflation.

When inflation is high (above the target), the central bank will INCREASE interest rates. (see 2.1.2 for a detailed explanation why). The main reason is because high interest rates increase the cost of borrowing and reduces the reward for saving. This means consumers and firms consume and borrow less, resulting in lower inflation. The opposite happens when there is a decrease in interest rates.

The costs of high inflation

Lack of purchasing power – consumers have to spend a higher proportion of their income on necessities and therefore have less money to spend on luxuries.

Growth and unemployment - inflation makes it difficult for firms and consumers to plan for the future. This may mean firms invest less as they don’t want to take risks. Consumers may bring forward or reduce their purchases depending on what they think is in their best interests. These disruptions are likely to reduce output and spending in the economy as a whole.

International Competitiveness – Inflation can lead to exports being less competitive and imports being relatively cheaper affecting the current account balance.

Wages increase – an increase in the average price level pressures employers to put up wages.

Redistribution costs – People of fixed incomes will suffer (purchasing power will fall)

Psychological costs – price rises are very unpopular, even if wages have increased more than inflation.

Shoe-leather costs – when prices rise, ‘shopping’ around increases. This represents an opportunity cost – time taken by consumers to find the lowest prices. Also, there is an opportunity cost of holding money. Consumers will spend time finding a bank who offers the best interest rate.

Uncertainty – This will increase costs for businesses as planning needs to be thorough. It also reduces investment

There could be a wage-price spiral

Menu costs – firms have to spend time changing their menus when prices change.

The benefits of low inflation

The real value of borrowing is decreased over time

An inflation target can help policy makers make decisions

Stable and low inflation boosts business and consumer confidence

Low unemployment

Definitions

Employment – those in paid word

Unemployment – when individuals are without a job but actively seeking work

Unemployment rate – number unemployed divided by the population of working age.

Measure of unemployment

Unemployment is generally measured by the Labour Force Survey (LFS) which is conducted by the International Labour Organisation (ILO)

Labour force survey method

This is compiled using the ILO. People who are counted as unemployed:

Are people without a job, want a job, have actively sought work in the last four weeks, and are able to start work within the next two weeks; or

Are out of work, have found a job and are waiting to start it in the next two weeks

The Labour Force survey asks 60,000 people whether they are unemployed and whether they are looking for a job.

It is good for international comparisons.

However, some problems of labour force survey:

It could be subject to sampling errors and may not be truly representative

Difficult to decide whether somebody is sick or actively seeking work.

Causes or types of unemployment

Frictional unemployment – short-term unemployment. People who are in-between jobs or those who have just finished studying.

Seasonal unemployment – occurs when people are unemployed at certain times of the year, because they work in industries where they are not needed all year round. E.g. tourism.

Structural unemployment – unemployment resulting from industrial reorganization, typically due to technological change, rather than fluctuations in supply or demand. This often happens because there is occupational and geographical immobility of labour. Structural unemployment is likely to have a more long-term detrimental effect than others such as frictional and seasonal.

Cyclical or demand-deficient unemployment – unemployment resulting from there being insufficient demand in an economy. This tends to vary with an economic cycle.

Voluntary unemployment – when a person chooses not to work

Consequences of Unemployment

1. Loss of income: The majority of the unemployed experience a decline in their living standards and are worse off out of work. This leads to a decline in spending power and the rise of debt problems.

2. Use of scarce resources: People who are out of work do not make any contribution to production. This is a waste of resources and results in lower levels of national income. In some countries, youth unemployment is very high. Many consider that this is particularly wasteful.

3. Poverty: Even in developed countries, most people who find themselves without a job have to suffer hardship. Their incomes fall because state benefits are generally lower than wages. In extreme cases, unemployed people lose their homes because they cannot afford mortgage payments.

4. Government spending on benefits: In most developed countries, when people are unemployed they are entitled to receive some financial benefit from the state. If unemployment levels rise, the government has to allocate more money to unemployment benefit. This extra expenditure will incur an opportunity cost. For example, the money could be better spent on education or health care.

5. Loss of national output: Unemployment involves a loss of potential national output (i.e. GDP levels fall) and is a waste of scarce resources. If some people choose to leave the labour market permanently because they have lost the motivation to search for work, this can have a negative effect and damage the economy’s growth potential.

6. Loss of tax revenue: When unemployment rises, tax revenues will fall because most taxes are linked to income and spending. This means the government has less to spend and may have to cut public sector services. Alternatively, it may borrow more, which will increase national debt or it may have to increase tax rates. For example, taxes on incomes, corporate profits and spending may have to rise.

7. Social costs: Rising unemployment is linked to social deprivation. For example, there is a relationship with crime and social dislocation including increased divorce rates, worsening health and lower life expectancy. Regions that suffer from persistently high long-term unemployment see falling real incomes and a widening of inequality of income and wealth.

8. Consumer confidence: During periods of high unemployment, consumer confidence is likely to fall. Most people who find themselves without a job have to suffer hardship. Their incomes fall because state benefits are generally lower than wages. As a result, these people lose confidence and play a less significant role in the economy. Also, people who remain employed may start to worry about their own job security. Their confidence is also negatively affected.

9. Business confidence: During periods of high unemployment, business confidence is low as incomes fall/

10. Social costs: Losing a job can be psychologically hard on workers. Individuals may doubt their value as a person. This can lead to stress within relationships. Unemployed people are less likely to get married and more likely to get divorced as their lack of work raises stress levels. Stress can also lead to poorer health. Finally, unemployment can potentially lead to crime. The unemployed still need the necessities of life.

Surplus or balance on the current account of balance of payments

The balance of payments is a document outlining all transactions between one country and all other countries. It comprises of the current account and capital and financial accounts. You only need to be aware of the current account for the IGCSE.

Current account

The current account (or current balance) is the value of exports – value of imports.

Exports and imports include trade in goods (known as visibles) and trade in services (invisibles)

Exports inject money into the economy and imports results in a withdrawal of money from an economy.

Current account deficits and surpluses

A current account deficit occurs when the value of imports is greater than the value of exports. This means money is flowing out of the country. The current balance will be negative.

A current account surplus occurs when the value of exports is greater than the value of imports. This means money is flowing into the country. The current balance is positive.

Relationship between the current account and exchange rates

If a country’s exchange rate gets stronger (which means that one unit of a currency can buy more units of another currency), exports become more expensive and imports become cheaper. This might result in fewer exports being sold and more imports being bought. This will have a negative impact on the current account. For example, if a country already has a current account deficit, the size of the deficit is likely to increase.

The balance on the current account may also have an impact on the exchange rate. For example, if a country has a surplus on the current account resulting from rising sales of goods abroad, demand for that country’s currency will rise (foreigners will need to buy that country’s currency to pay for the goods). This increase in demand for currency could drive up the exchange rate. Therefore that country’s exchange rate gets stronger. Exchange rates, and the impact of changing exchange rates on the current account, are discussed in more detail later.

Remember: SPICED. Strong pound, imports cheap, exports dear

Reasons for current account deficits and surpluses

Quality of domestic goods – If domestic goods are good quality, there would be an increase in demand for these goods from foreign customers (exports increase) and there would be less demand for imports.

Quality of foreign goods – If foreign goods are good quality, there would be an increase in demand for these goods from domestic customers (imports increase) and a there would be less demand for exports.

Price of domestic goods – If domestic goods are expensive, there would be a decrease in demand for exports and an increase in demand for cheap imports

Price of foreign goods – If foreign goods are expensive, there would be a decrease in demand for imports and potentially an increase in demand for exports.

Exchange rates between countries: An increase in the exchange rate causes imports to become cheaper and exports to become more expensive. This causes a deterioration in the current account as there is an increase in demand for imports and a decrease in demand for exports.

Impact of current account deficit

Leakage from the economy: A persistent current account deficit suggests that a country is becoming increasingly dependent on imports. This means that consumers are buying goods produced outside the domestic economy. As a result, money flows out of the economy to overseas businesses. This represents a leakage from the economy. It means that output and employment levels in the domestic economy are under threat

Can be inflationary if prices rise abroad: A country running a high current account deficit might be exposed to inflationary pressures. If the prices of imports go up, this will be reflected in the general price level since many imported goods will be counted when the CPI is calculated. Consequently, rising import prices will result in higher domestic inflation levels.

Low demand for our exports: A country with a high current account deficit might be struggling to sell goods and services abroad. If demand for exports is low, it might mean that the quality of goods and services is poor or the price is too high.

Problems finding foreign reserves to fund the deficit: If a country has a continuing current account deficit, it will need foreign currency to pay for the rising quantity of imports that are being purchased. If the foreign currency reserves of a country run low, it may be necessary to borrow. However, persistent borrowing may cause long-term problems. Sometimes, a current account deficit can be financed by a capital account surplus. For example, flows of foreign currency can be attracted by a country if its interest rates are high

Protection of the environment

Business activity that damages the environment includes:

Mining: Open-cast mining, where materials are extracted from a giant hole in the ground, is one of the most damaging mining activities of all. This often involves crushing rocks, which may release harmful materials, such as radioactive elements, asbestos-like minerals and metallic dust This can leak slowly through the ground into water systems if not managed effectively. In addition to this, huge open-cast mines scar the countryside and destroy wildlife habitats. The mining of coal, iron ore, gold, diamonds, copper and many other minerals can have this effect. Another problem is that most modern mining techniques use large quantities of water. Wastewater from these activities may find its way into waterways and threaten the supply of fresh drinking water

Power generation: The generation of electricity can be very damaging to the environment. This is particularly the case when it is produced by burning fossil fuels, such as coal and oil. A wide range of harmful environmental impacts can result from fossil fuel power plants, such as emissions, the release of hot water, climatic and visual impacts from cooling towers, solid waste disposal, ash disposal (for coal), and noise. The burning of fossil fuels produces potentially dangerous ‘greenhouse gases’, Other forms of power generation may also be harmful. For example, nuclear power stations pose two very serious threats. A leak of radioactive material from a nuclear power station could have a disastrous effect on people and the environment. Too much exposure to radioactive material can kill people and very large areas of land surrounding a plant could become unusable following a leak. There is also the problem of waste disposal. Radioactive waste has to be stored underground for thousands of years before it is safe

Agriculture: Farming can have a variety of negative environmental effects. One of the main problems results from the use of pesticides and fertilisers. Although fertilisers can increase crop yields, after heavy rainfall some always ends up in rivers, lakes and the sea where it can kill aquatic life. It is possible that pesticides can cause ill health. The long-term effects of exposure to pesticides on humans is still very much unknown. However, farmers who face regular exposure to pesticides have been found to suffer symptoms, such as headaches and hand tremors.

Construction: The construction industry produces more waste material than any other industry. Construction activities such as land clearing, operation of diesel engines, demolition, burning and working with toxic materials contribute to air pollution. Also, construction sites generate high levels of dust from materials such as concrete, cement, wood, stone and silica. Diesel and oil, paint, solvents, cleaners and other harmful chemicals and construction waste and dirt can be washed into water systems. Also, when land is cleared it causes soil erosion. As a result, silt and soil runs into natural waterways, restricts sunlight and can destroy aquatic life.

Ways businesses damage the environment:

Visual pollution, including litter: Business activity may cause some visual pollution. This is where business activity results in something physical that looks very unattractive. For many people, the sight of smoke flowing from power stations might be regarded as visual pollution. Finally, most people would also regard litter as visual pollution. Litter is a more serious problem in countries where there is no orderly collection system.

Noise pollution:. If noise causes disturbance to everyday life, then it can be a problem for people and reduce their quality of life. Some common examples of business-related noise pollution may be caused by: jet engines, as aircraft fly over residential areas, music and loud conversations in pubs, bars, night clubs and discos if located too near residential areas, machinery, vehicles and power tools on construction sites ,the constant sound of commercial traffic on a road or motorway. Constant exposure to loud noise can have a negative impact on people and wildlife. For example, noise can damage eardrums and lead to loss of hearing. Loud noise can also disrupt sleeping patterns and raise stress levels.

Air pollution: Factories, machines and vehicles that discharge emissions into the atmosphere are responsible for most of the world’s air pollution. E.g. Sulphur dioxide, which comes from burning fossil fuels, such as coal and petroleum, is one the major causes of air pollution. Emissions from vehicles, such as lorries, buses, cars, trains, auto rickshaws and aeroplanes, are responsible for a huge amount of pollution. Manufacturing and processing businesses discharge carbon monoxide, hydrocarbons, organic compounds and chemicals into the air, which contribute to pollution. Agricultural activities: Ammonia is one of the most dangerous gases in the atmosphere. It is often a by-product from a range of agriculture activities.

Water pollution: Water pollution is the contamination of oceans, rivers, lakes, groundwater and other bodies of water by harmful substances. E.g. sewage being dumped or industrial waste leaked into rivers and seas.

Government intervention to protect the environment

A number of measures are used to help reduce environmental damage resulting from business activity

Taxation

Many governments impose taxes on those that damage the environment. E.g. firms can be taxed. This increases costs for firms, reducing production. The advantages of this tax are that emissions would be reduced, new jobs will be created in the production of clean energy and tax revenues will be boosted.

Subsidy

The government can offer grants, tax allowances and other subsidies to firms as an incentive to reduce activities that damage the environment. For example, a firm might receive a subsidy if it builds a plastics recycling plant. This might encourage households and firms to recycle their plastic waste instead of dumping it. The government can also give subsidies to firms or activities that generate positive externalities. For example, one reason why rail companies are subsidised in many countries might be because they take traffic off the road and therefore help to reduce congestion and carbon emissions

Regulation

A range of legislation, regulations, guidelines and codes of practice exist in many countries, which is designed to help protect the environment. E.g. ban some business projects than will damage the environment. Other duties include giving advice to firms about protecting the environment, helping firms reduce waste, working with farmers, looking after wildlife and helping people get the most out of enjoying the environment

Fines

Many firms are responsive to financial penalties when imposed. This is because fines will reduce their profits. Fines should therefore act as an incentive to comply with environmental laws.

Pollution permits

Governments can issue pollution permits. These documents give businesses the right to discharge a certain amount of polluting material – say 1 tonne per year. These permits are ‘tradable’. This means that a business can sell its pollution permit to another business if it has found a way of reducing its own level of pollution. Therefore, a business that is struggling to control levels of pollution can buy them and discharge more polluting material legally.

Government provision of parks

In many countries the government establishes national parks. The parks, often very large areas of land, aim to preserve and protect areas of outstanding natural beauty. They may contain wildlife, historic sites, beautiful scenery and areas of special interest. They welcome visitors but there may be restrictions on their activities. For example, the lighting of fires may be prohibited and selected areas will be provided for camping and other accommodation.

Redistribution of income

Income inequality: differences in income that exist between the different groups of earners in society, that is, the gap between the rich and the poor

Absolute poverty: where people do not have enough resources to meet all of their basic human needs. the World Bank defined absolute poverty as those people who are required to survive on less than US$1.90 per day.

Relative poverty: poverty that is defined relative to existing living standards for the average individual. There is no precise measurement of relative poverty. However, one approach is to measure the number of households whose total income is at a certain level below the median income for that country. This certain level will vary according to different definitions. In the EU, the level is 60 per cent. Therefore, if the median income in an EU country was €21 500, a household living on an income of €11 400 would be living in relative poverty.

Reasons to reduce poverty and inequality

Meet basic needs

Raise standards of living

Ethical reasons – some people feel the need to act morally correct and give to charity to help end poverty.

Government intervention to reduce inequality and poverty

Progressive taxation - A progressive tax system is one that places the burden of taxation more heavily on the rich – that is, those who can afford to pay. A progressive tax is a tax where the proportion of income paid in tax rises as the income of the taxpayer rises. For example, if a person earning US$10 000 paid US$600 in tax, the proportion of their income paid in tax is 6 per cent. In the same country, if a person earning US$100 000 pays US$30 000, the proportion paid in tax is 30 per cent.

Redistribution through benefit payments - In most developed countries, governments have a welfare system, which is used to redistribute income in favour of the poor. Most systems involve using tax revenues to make direct payments to those on low incomes and those who cannot work at all. For example, in many European countries payments are made to the unemployed, the disabled, the sick, single-parent families, the elderly and those on very low incomes

Investment in education and healthcare - One route to reducing poverty is through education. Clearly, if people are educated and are able to develop a range of skills, such as reading and writing, numeracy, communication, analysis, problem solving, evaluation, critical thinking and language, they are more employable. Investment in health care will also help to reduce poverty. Health programmes can reduce child mortality rates, increase life expectancy and reduce suffering.

Knowt

Knowt