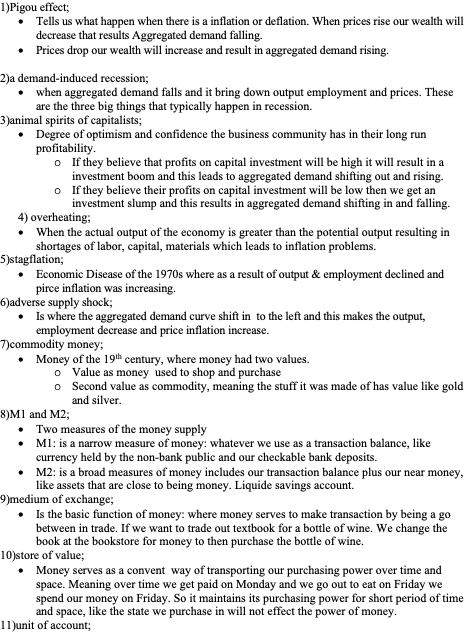

I. Define and Explain

1)Pigou effect;

· Tells us what happen when there is a inflation or deflation. When prices rise our wealth will decrease that results Aggregated demand falling.

· Prices drop our wealth will increase and result in aggregated demand rising.

2)a demand-induced recession;

· when aggregated demand falls and it bring down output employment and prices. These are the three big things that typically happen in recession.

3)animal spirits of capitalists;

· Degree of optimism and confidence the business community has in their long run profitability.

o If they believe that profits on capital investment will be high it will result in a investment boom and this leads to aggregated demand shifting out and rising.

o If they believe their profits on capital investment will be low then we get an investment slump and this results in aggregated demand shifting in and falling.

4) overheating;

· When the actual output of the economy is greater than the potential output resulting in shortages of labor, capital, materials which leads to inflation problems.

5)stagflation;

· Economic Disease of the 1970s where as a result of output & employment declined and pirce inflation was increasing.

6)adverse supply shock;

· Is where the aggregated demand curve shift in to the left and this makes the output, employment decrease and price inflation increase.

7)commodity money;

· Money of the 19th century, where money had two values.

o Value as money used to shop and purchase

o Second value as commodity, meaning the stuff it was made of has value like gold and silver.

8)M1 and M2;

· Two measures of the money supply

· M1: is a narrow measure of money: whatever we use as a transaction balance, like currency held by the non-bank public and our checkable bank deposits.

· M2: is a broad measures of money includes our transaction balance plus our near money, like assets that are close to being money. Liquide savings account.

9)medium of exchange;

· Is the basic function of money: where money serves to make transaction by being a go between in trade. If we want to trade out textbook for a bottle of wine. We change the book at the bookstore for money to then purchase the bottle of wine.

10)store of value;

· Money serves as a convent way of transporting our purchasing power over time and space. Meaning over time we get paid on Monday and we go out to eat on Friday we spend our money on Friday. So it maintains its purchasing power for short period of time and space, like the state we purchase in will not effect the power of money.

11)unit of account;

· Where money serves to denominate prices in dollarand write contracts for sophisticated trades.

12)required reserves and excess reserves;

· Assume that you put a 10000 deposit at the bank 10% of the deposit the bank has to hold in reserves which is called a required reserve. The remaining 90000 is a excess reserve which the bank use a loaning money for other clients.

13)liquidity problem in banking;

· When there is a large outflow of funds by either the depositors or creditors and the outflow excessed a banks reserves, leading the bank to fails as they do not have enough funds to fulfill the outflow transaction.

14)insolvency problem in banking;

· A bank suffers a large loss due to making bad loans, or bad trades. This loss exceeds a banks capital. The banks capital is the owners own contribution to the bank,

15)lender of last resort;

· When the federal reserve makes emergency loans to a failing financial nstitution to prevent a panic. Because they believe if they let the bank fail it will create a panic.

16)the Fed’s Dual Mandate;

· Dual mandate from the congress

· 1. Price stability: low and stable inflation rate 2% rate

· 2. High employment economy 95%-96% of employment rate.

17)open market operations;

· Is the federal reserves buying and selling of bonds on the open bond market( free market) to conduct monetary policies.

18)open market purchase/open market sale;

· Open market purchase: fed purchase bonds from a bond dealer, which then they use to pump money into the banking systems so the deposits increase and the reserves increase. They buy bonds to expand money and credit supply

· Open market Sales: the fed sells the bond to the bond dealer, so the fed then gets paid from the banks meaning the deposits will decrease and the reserves will decrease. They sell bonds to shrink money and credit supply

19)Federal Open Market Committee;

· The committee is made up of 7 board of government and the 12 presidents of the regional federal reserve banks. These individuals meet and form a committee called the FOMC. They meet every 6 weeks, for 2 days. On day 1 they discuss monetary policies amongst themselves. Day 2 they vote on the policy where only 12 individuals vote, who are the 7 BOD and 5 presidents.

20)Federal funds rate.

· Is the interest rate the fed reserve sets when it conducts monetary policies. When they engage in an open market purchase they increase the money and credit supply and the federal funds rate decrease. While for the sales in open market they raise the federal funds rates.