Economics HL Unit 2

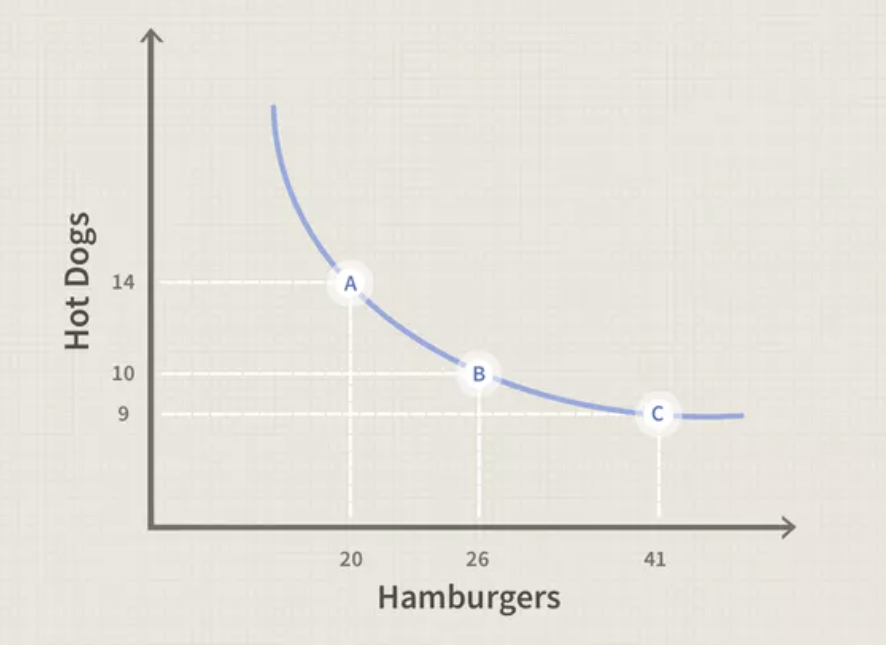

Marginal rate and substitution

MRSxy = oppurtunity cost, slope of indifference curve

A series of optimal consumer choices provides the theoretical basis for an individual demand curve

Diminishing marginal utility

as we consume more of a good, the satisfaction we derive from 1 additional unit decreases

rate of satisfaction diminishes with every 1 unit

examples: food, cars

Indifference curves

IC always has a negative slope if consumer likes both goods

IC cannot intersect

Every good can lie on one IC

ICs are not thick

Demand Theory

Substitute effect

Measures of consumer MRSxy, before and after the price change

Amount of additional food the consumer would buy to achieve the same level of utility (assuming a price decrease in one good)

Moving from one optimal curve to another

Steps:

Identify initial optimum basket of goods

Identify final optimum basket of goods, after the price change

Identify the decomposition optimum basket (DOB), attributed to the substitution effect

DOB must be on a BL that is parallel to BL2 following the price change

Assume that consumer retains same level of utility after the price change

Income effect

Accounts for price change by holding the consumer’s purchasing power (following price change) constant and finding an optimum bundle on a new (higher/lower) utility function

Purchasing power - number of goods/services that can be purchased with a unit of currency (falls when price increases)

Measured from the DOB (B and Xb) to the final optimum bundle, following price change (C and Xc)

Both effects move in the same direction

Law of Demand

At a higher price, consumers will demand a lower quantity of a good (vice versa)

Relates to diminishing marginal utility by compensating (off-set) DMU must be negatively related to quantity

Inverse relationship of price and quantity

Given the presence of diminishing marginal utility, in order to promote increased consumption, prices must fall

For a “normal good,” the increase in consumption results from a fall in price - this is driven by:

a lower MRSxy, while remaining on the same IC generates increased consumption of good X (substitute effect)

the theoretical increase in income necessary to lift the consumer to the higher IC, while keeping the ratio of prices at the new level (income effect)

Economic theory of demand always starts at the individual level. A horizontal summation of many individual demand curves provides a market demand curve. Market demand curves are always less steep than individual demand curves

Determinants of Demand

Income

Price of substitutes/complements

Number of consumers

Preference or tastes

These factors cause a market demand curve to shift (change in demand)

Individual Demand Curve

a series of optimal choice bundles across different price levels (shown on price-quantity graphs)

Inferior Good

whether the substitution effect or income effect dominates in an empirical not theoretical question

Opposite of a normal good, demand falls when income rises

Non-price determinants of demand

income (normal good)

income (inferior good)

preferences/tastes

price of substitute/complement goods

number of consumers

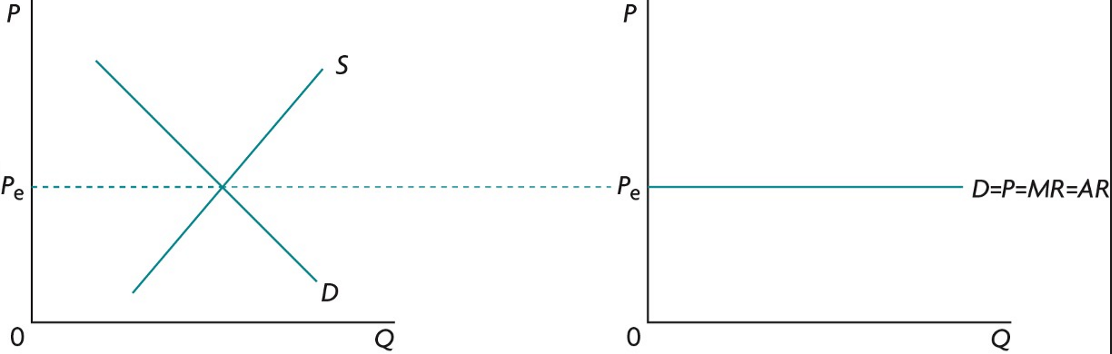

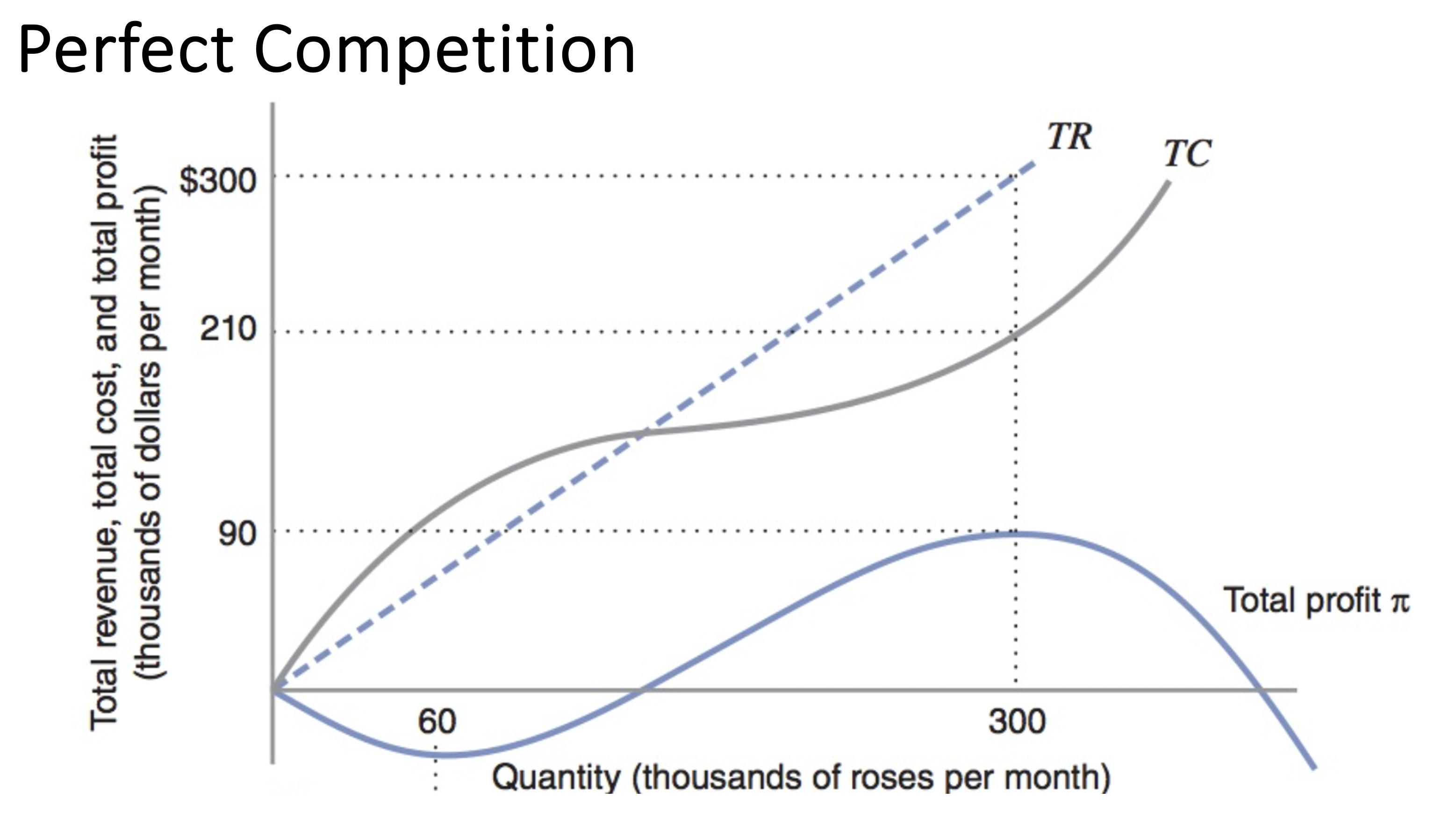

Perfect Competition

Economic profit maximization is the assumed goal of private firms

Total cost represents the most efficient combination of inputs for a given level of output

The rate at which total revenue (TR) changes with respect to change in output (Q) is marginal revenue (MR)

MR = TR/Q = (Q*P)/Q = P

Profits are maximized when marginal revenue = marginal cost

After the point where MR=MC, your profits will be negative

Supply = MC, total cost optimized

Market Equilibrium

the intersection of the demand and supply curves

total cost is important as it is the basis of an individual firm’s supply curve

upward sloping section of the marginal cost curve is the supply curve

Efficiency of demand/supply curves

Supply curves

Optimal combination of cost-minimizing inputs for each level of output

Demand curves

Optimal combination of utility-maximizing goods for a given level of income

Market supply curve

Horizontal summation of a series of individual supply curves

Supply Theory

Supply - total amount of goods and services that producers are willing and able to purchase at a given price in a given time period

Law of Supply

as the price of a product rises, the quantity supplied of the product will usually increase (ceteris paribus)

firms attempt to maximize product by increasing quantity supplied when the price is higher (and vice versa)

Non-price determinants of supply

Changes in costs of factors of production

Prices of related goods

Indirect taxes and subsidies

Future price expectations (producer)

Changes in technology

Number of firms

Shocks

Markets only work when there is strong competition

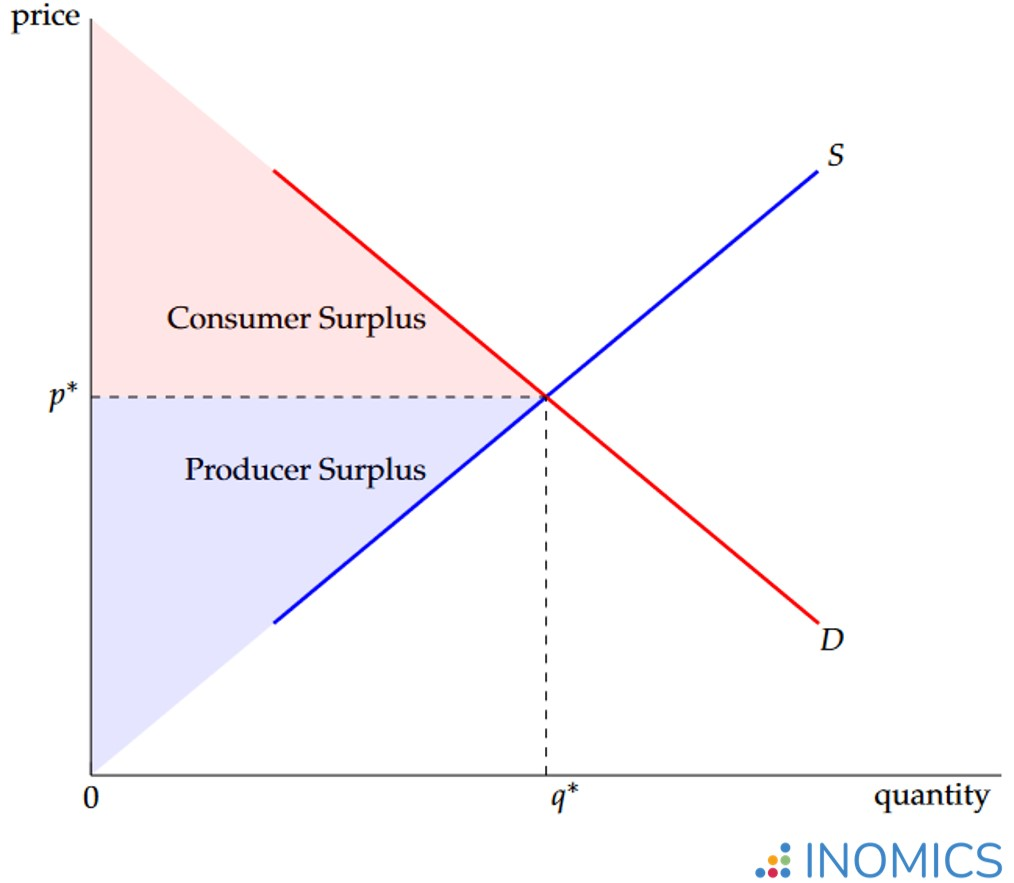

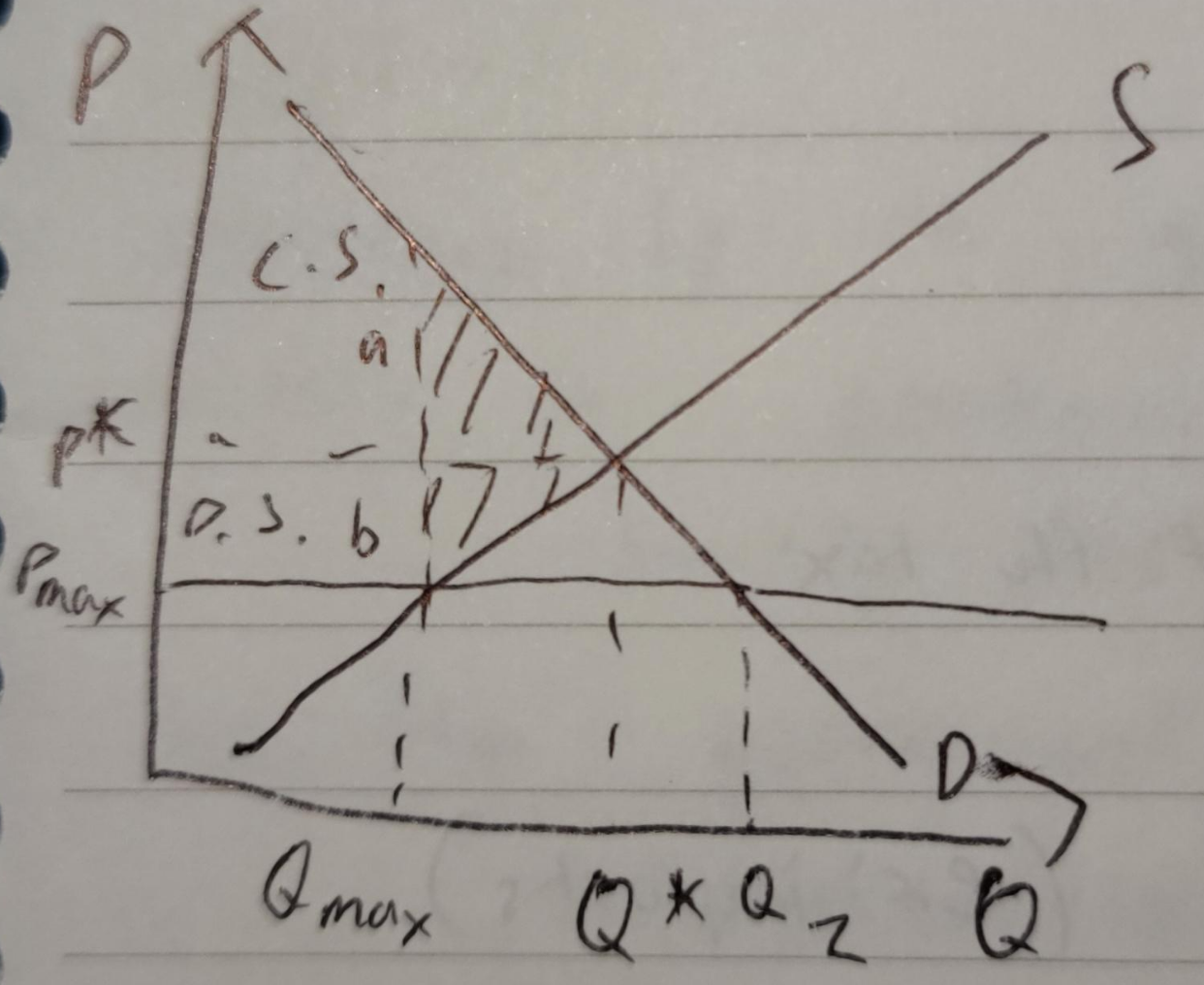

Market Equilibrium Graphs (supply + demand)

Consumer Surplus (C.S.) - willingness to pay and what they did pay

Producer Surplus (P.S.) - difference between market price and lowest price a producer uses to produce

Assumptions of perfectly competitive markets

Assumptions of perfectly competitive markets

all actions (consumers/producers) have access and fully process all relevant information

there are many small buyers and producers - all with equally negligible market power

all actors are rationally self-interested

Welfare - theoretical surplus value left with different economic agents (consumers, firms, governments)

Production - market clearings

Optimal Allocation

MR = MB (marginal benefit)

Social surplus = consumer + producer surplus

In a perfectly competitive market, social surplus is at its largest

Analysis of surpluses are called “welfare analysis”

Price Mechanism Functions

A - allocation (resources are allocated to those who need it most)

R - rationing (not everyone in the market gets what they want, only those who have the same valuation of the product as the firms)

S - signaling (communication of information that drives other factors)

I - incentive (capitalist system is driven by incentives)

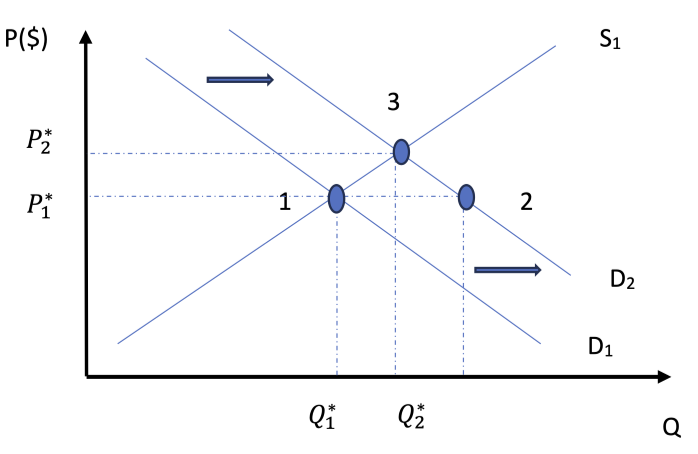

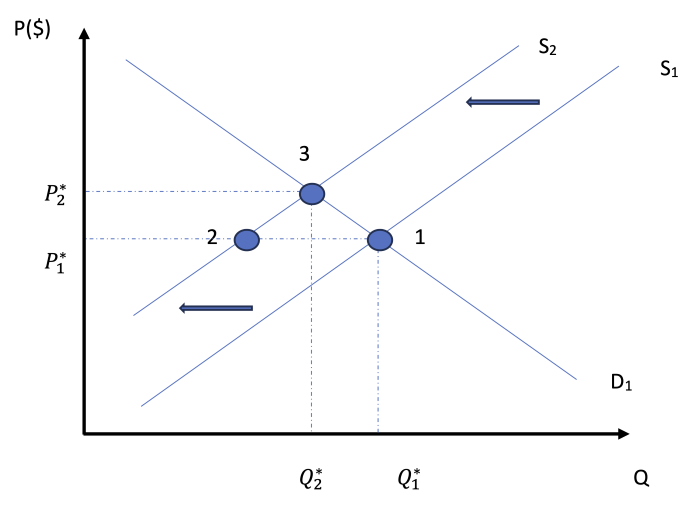

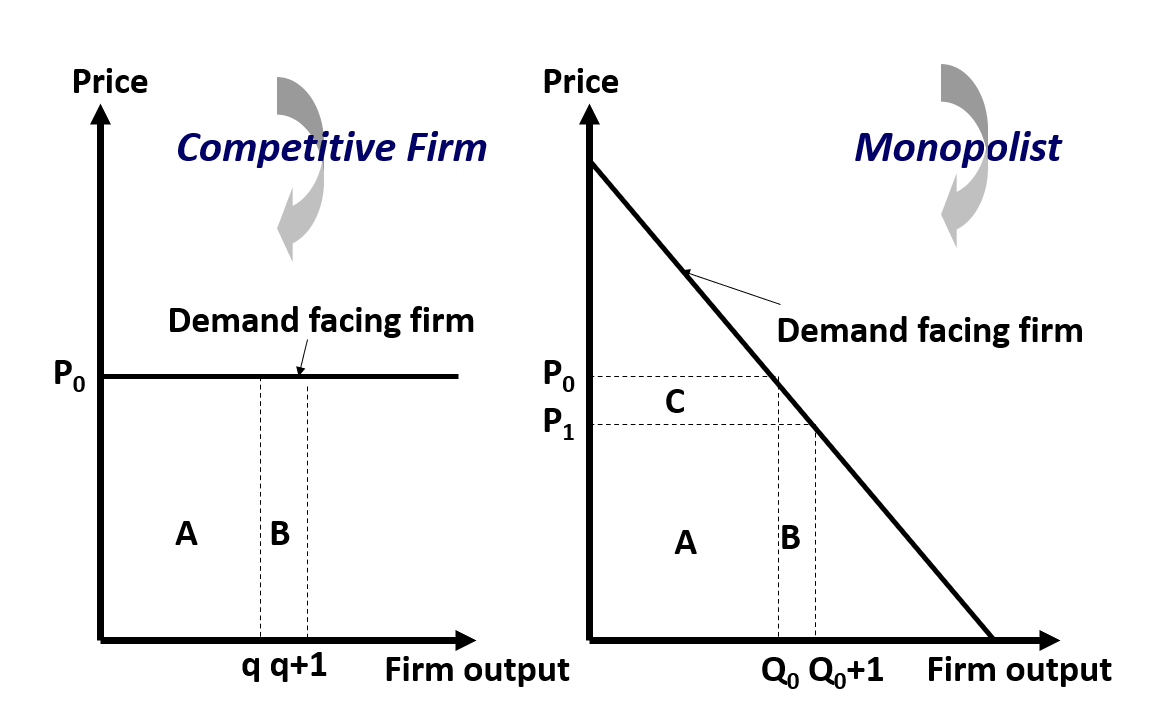

2 Demand Curves

2 Supply Curves

Moving from point 1 to point 3 on both graphs

Point 2 has excess supply/demand

ARSI to move to the new equilibrium point

At both equilibriums, there is optimal allocation

Structure of Microeconomics

How do consumers and producers make choices in trying to meet their economic objectives?

Demand

Supply

Competitive market equilibrium

Elasticities of Demand

Elasticities of Supply

Critique of the maximizing behavior of consumers and producers

interaction between consumers and producers determine where resources are directed

welfare is maximized if allocative efficiency is achieved

constant change produces dynamic markets

consumer and producer choices are the outcome of complex decision making

When are markets unable to satisfy important economic objectives - and does government interaction help?

Role of government in microeconomics

Market failure

externalities and common pool or common acess resources

public good

asymmetric information (imbalanced information held by consumers and/or consumers)

market power (single/small number of suppliers)

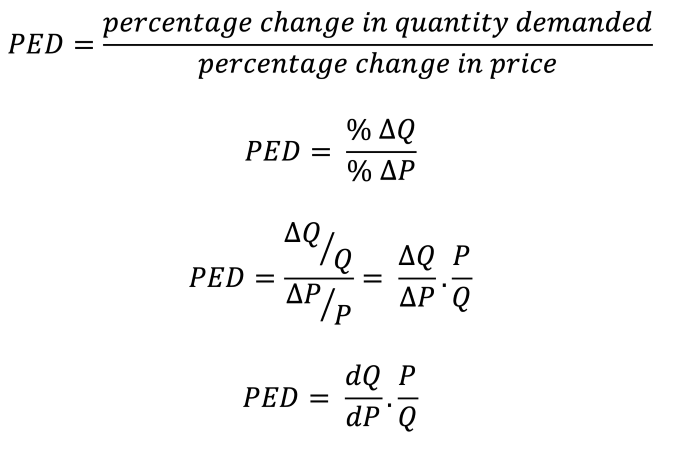

Price Elasticity of Demand (PED)

measure of the responsiveness of the quantity demanded of a good subject to the change in price

Percentage change and differentiation to calculate

PED = percentage change in quantity demanded / percentage change in price

|PED| > 1 demand is relatively elastic

|PED| < 1 demand is relatively inelastic

|PED| = 0 demand is unitary

PED = ∞ perfectly elastic

PED = 0 perfectly inelastic

How can PED change along a straight line?

as you move along the x-axis, it gets less elastic

as quantity increases, elasticity decreases

How does PED change across income levels?

more elastic for lower income groups

elasticity depends on the good (price-quantity relationship)

quantity demanded changes, but not the demand curve

“staples” are essential, less elastic

Determinants of Price Elasticity of Demand (PED)

number of close substitutes; more subs = increased price sensitivity

luxuries VS staples

time - purchases made with longer time periods are generally more elastic

proportion of income spent on the good

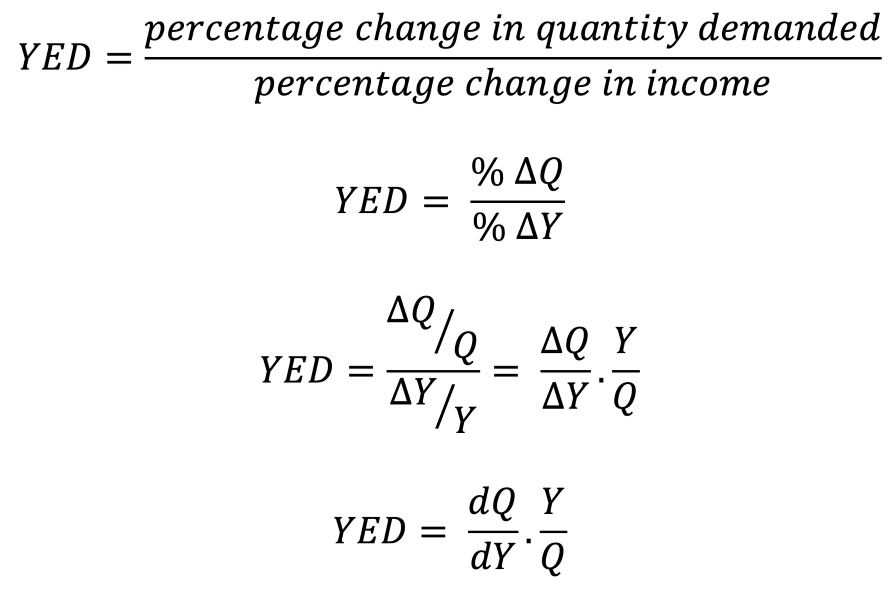

Income Elasticity of Demand (YED)

measure of how much demand for a product changes when there is a change in the consumer’s income

YED = percentage change in quantity demanded / percentage change in income

YED to categorize inferior and normal goods

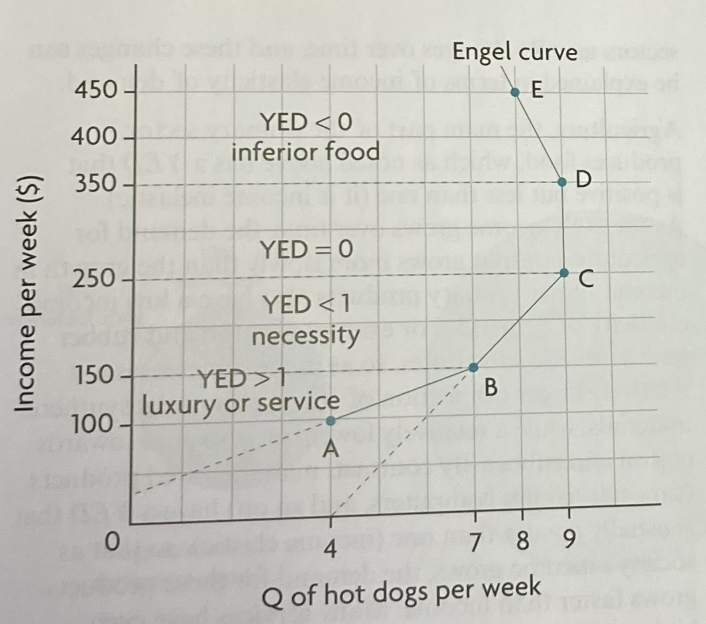

Engel Curve

axes → income and quantity

YED > 1 luxury/service

YED < 1 necessity

YED > 0 normal good

YED < 0 inferior good

quantity demanded when income increases also increases then diminishes and goes backwards

if you continue a segment AB with the same slope and that line cuts the y-axis, then it is a luxury

if it cuts the x-axis, it is a necessity

only works on income = y and quantity = x

Primary Commodities

raw materials (cotton, coffee)

inelastic demand (they are necessities)

consumers are not everyday households, but manufacturers

Manufactured Goods

made from primary commodities

more elastic, as there are more substitutes

Why is YED important?

For firms:

products with a high YED will see a demand increase when income increases (used to see maximum profit based off changes in income)

allocation of resources to fit income groups in products

if income falls, production of inferior goods increase because of YED rules

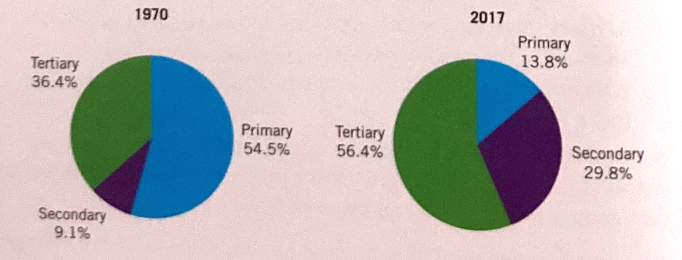

Sectoral changes

primary sector: agriculture, fishing, extraction (forestry, mining)

secondary sector: manufacturing, takes primary products and uses them to manufacture producer goods (machinery, consumer goods) also includes construction

tertiary sector: service, produces services or intangible products (financial, education, information, technology)

shifts in the relative share of national output and employment

as countries grow and living standards improve, there is a change in proportion of the economy that is produced

extra income is spent on manufactured goods as the demand is more elastic than the primary products (using YED to measure/verify) ← same goes for the service sector

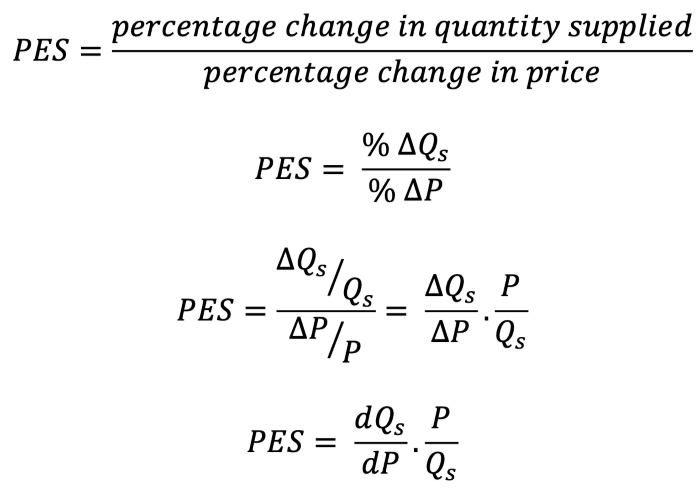

Price Elasticity of Supply (PES)

PES = percentage change in quantity supplied / percentage change in price

2.4 - Behavioural Economics

2.4 - Behavioural Economics

Assumptions of Rational Consumer Choice

free markets are built on the assumptions of rational decision making

in classical economic theory, rational means economics agents are able to consider the outcome of their choices and recognise the net benefits of each one

rational agents - will select the choice that reaps highest benefit/utility

Rational choice theory - individuals use logic and sensible reasons to determine the correct choice (connected to an individual’s self-interest)

Consumer Rationality

assumption that individuals use rational calculations to make choices which are within their own best interest (using all information available to them)

Utility Maximization

economic agents select choices that maximize their utility to the highest level

Perfect Information

information is easily accessible about all goods/services on the market

individuals have access to all information available at all times in order to make the best possible decision

Limitations of Assumptions of Rational Consumer Choice

behavioural economics recognizes that human decision-making is influenced by cognitive biases, emotions, social, and other psychological factors that can lead to deviations from rational behaviour

individuals are unlikely to always make rational decisions

5 limitations are shown below:

Biases

biases influence how we process information when making decisions = influence the process of rational decision making

example: common sense, intuition, emotions, personal/social norms

Types of Bias

Rule of Thumb - individuals make choices based on their default choice gained from experience (ex: same product from same company, but not the best possible choice)

Anchoring and Framing - individuals rely too heavily on an initial piece of information (anchor) when making subsequent judgements or decisions (ex: car dealer says car is worth $10,000 and you know it’s worth less, but this anchor of information causes you to purchase the car for a higher price)

Availability - individuals rely on immediate examples of information that come to mind easily when making judgements/decisions (causes individuals to overestimate the likelihood/importance of events/situations based on how readily available they are in their memory)

Bounded Rationality

people make decisions without gathering all necessary information to make a rational decision within a given time period

rational decision making is limited because of

thinking capacity

availability of information

lack of time available to gather information

too many choices also cause people to make irrational decisions

example: in a supermarket, there are too many choices of products of the same good, making it difficult to reach a decision

Bounded Self-Control

individuals have a limited capcity to regulate their behaviour and make decisions in the face of conflicting desires or impulses

self-control is not an unlimited resource

because humans are influenced by family, friends, or social settings, it causes social norms to interfere in decision making (does not result in the maximization of consumer utility)

decision making based on emotions → does not yield the best outcome

businesses capitalize on the lack of bounded self-control of individuals when appealing to their target audience to maximize sales

Bounded Selfishness

economics agents do not always act within their own self interest

individuals do things for others without a direct reward

ex: altruism - selflessness without expecting anything in return

Imperfect Information

information is not perfectly accessible due to:

intelluctual property rights

cost of accessing information

amount of information and options available

people make decisions based on limited information

asymmetric information may also lead to decisions based on limited information

when one party has more information than another

Choice Architecture

intentional design of how choices are presented so as to influence decision making

simplifies the decision making process

3 types, as shown below:

Default Choice

individual is automatically signed up to a particular choice

decision is already made even when no action has been taken

individuals rarely change from the default change

Restricted Choice

choices available to individuals are limited which helps individuals make more rational decisions

Mandated Choices

requires individuals to make a specific decision or take a particular action by imposing a requirement or obligation

mandated choices can be used to ensure compliance with regulations or societal norms, making it necessary for individuals to make certain decisions

Nudge Theory

practice of influencing choices that economic agents make, using small prompts to influence their behaviour

firms should use nudges in a responsible way to guide and influence decision making

designed to guide people toward certain decisions or actions while still allowing them to have freedom of choice

consumer nudges should be designed with transparancy, respect for individual autonomy, and clear societal benefits in mind

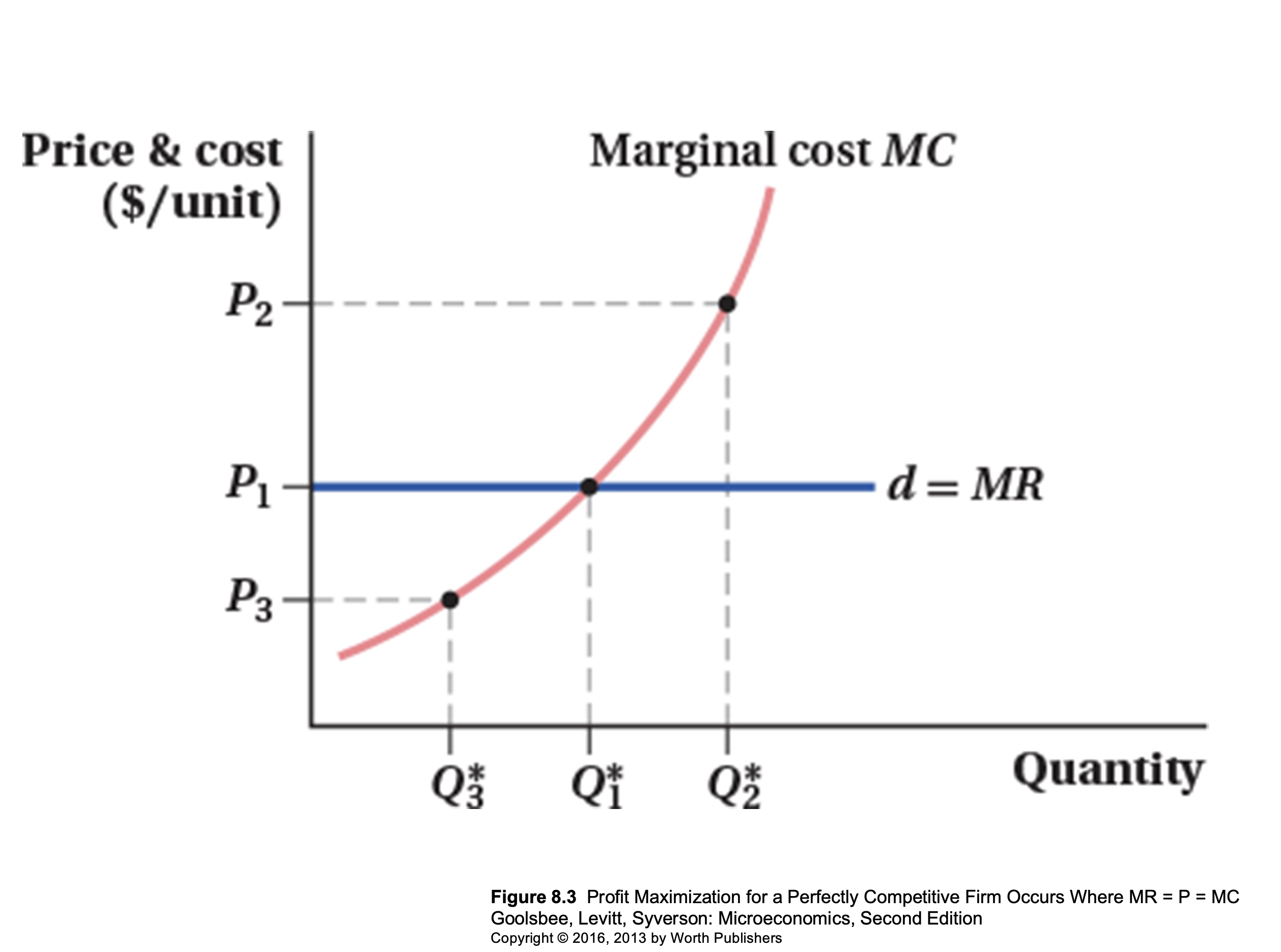

Profit Maximization

most firms have the rational business objectiveof profit maximization

profits benefit shareholders as they receive dividends and also increase the underlying share price

an increase in the underlying share price increases the wealth of the shareholder

profit maximization rule

when MC=MR, then no additional profit can be extracted from producing another unit of output

when MC<MR, additional profit can still be extracted by producing another unit of output

when MC>MR, the firm has gone beyond the profit maximization level of output and starts making a marginal loss on each unit produced (beyond MR=MC)

in reality, firms find it difficult to produce at the profit maximization level of output

the level may be unknown

in the short term, they may not adjust their prices if the marginal cost changes

MC changes regularly and regular price changes would be disruptive

in the long-term, firms will seek to adjust prices to the profit maximization level of output

firms may be forced to change prices by the competition regulators in their country

profit maximization level of output often results in high prices for consumers

changing prices changes the marginal revenue

Growth

increasing sales revenue/market share

maximize revenue to increase output and benefit from economies of scale

a growing firms is less likely to fail

Revenue Maximization as a Sign of Growth

in the short-term, firms may use this strategy to eliminate the competition as the price is lower than when focusing on profit maximization

firms produce up to the level of output where MR=0

when MR>0, producing another unit of output will increase total revenue

Market Share as a Sign of Growth

sales maximzation which further lowers prices and has the potential to increase market share

occurs at the level of output where AC=AR (normal profit/breakeven)

firms may use this strategy to clear stock during a sale to increase market share

firms sell remaining stock without making a loss per unit

Satisficing

pursuit of satisfactory/acceptable outcomes rather than profit maximization

decision-making approaach where businesses aim to meet a minimum threshold or standard of performance rather than striving for the absolute best outcome

small firms may satisfice around the desires of the business owner

many large firms often end up satisficing as a result of the principal agent problem

when one group (the agent) makes decisions on behalf of another group (the Principal), often placing their priorities above the Principal’s

Corporate Social Responsibility (CSR)

conducting business activity in an ethical way and balancing the interests of shareholders with those of the wider community

extra costs are involved in operating in a socially responsible way and these costs must be passed on to consumers

2.7 - Government Intervention

Why do governments intervene in markets?

Influence (increase/decrease) household consumption

provide support to firms

earn revenue

influence the level of production of firms

provide support to low-income households

correct market failure

promote equity

Microeconomic forms of government intervention

price controls

indirect taxes

subsidies

direct provision of services

command and control regulation and legislation

consumer nudges

Price controls

price ceiling + price floor

Price Ceiling

maximum price

below equilibrium point

the point where the price ceiling is set is Pmax

at Pmax, firms are willing to supply Qmax but the consumers demand a quantity above Q*

shaded area - 2 triangles, a and b

a = amount by which consumer surplus is reduced

b = amount by which produer surplus is reduced

excess demand shown by the values Qmax - Q1

managed through subsidies and tax breaks → costs

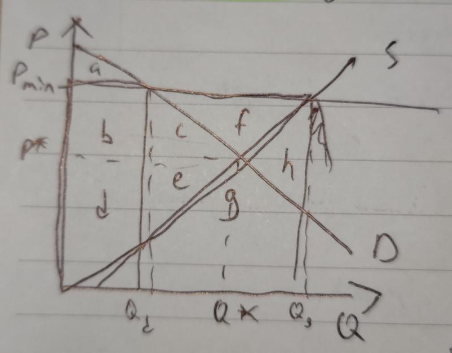

Price Floor

minimum price

above equilibrium point (Pmin)

common in agriculture

areas c, e, f, g, h are government expenditure → excess supply

producer surplus is increased (d+e → b, c, d, e, f)

f = directly from the government to the producers

a price floor creates welfare loss, indicating allocative inefficiency due to an overallocation of resources to the production of goods

society is getting too much of the good

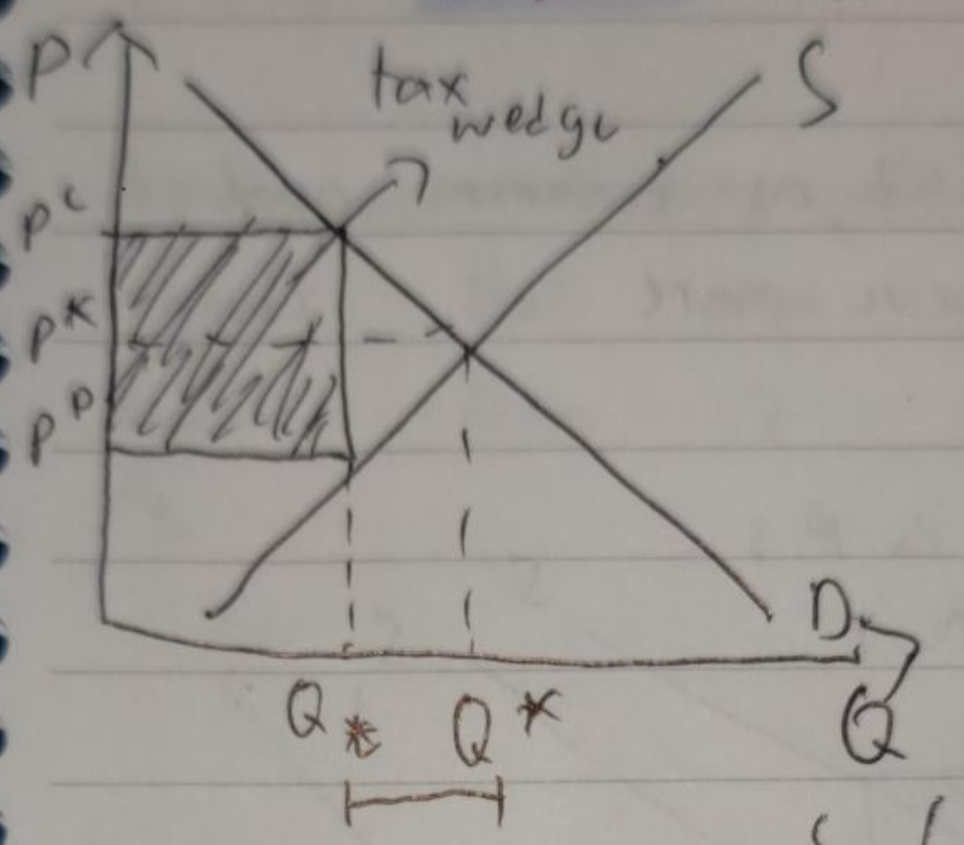

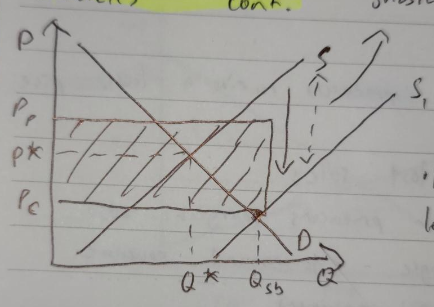

Indirect taxes

imposed on spending to buy goods and services

both consumers and producers pay a share of the tax

firms practically pay the tax

excise taxes - imposed on particular goods/services (ex: imports)

taxes on spending - value added tax (VAT) or goods/services tax (GST)

direct taxes are those directly paid to the government by taxpayers

an indirect tax creates a tax wedge

consumers face a higher price, while producers receive a lower price

Qt - Q* → lost sales (potential sales but they are lost/didn’t happen because of the tax)

Pp - price for producers, marginal cost

area of rectangle = government revenue

Pc - price for consumers

Pc>Pp, so demand decreases

shifts from S → S1

new equilibrium point formed at (Qt, Pc)

2 triangles, a and b

a + b - welfare loss, Dead Weight Loss (DWL)

both disappear, allocative inefficiency

a - consumer surplus loss

b - producer surplus loss

2 prices, C.S. and P.S. at different equilibriums

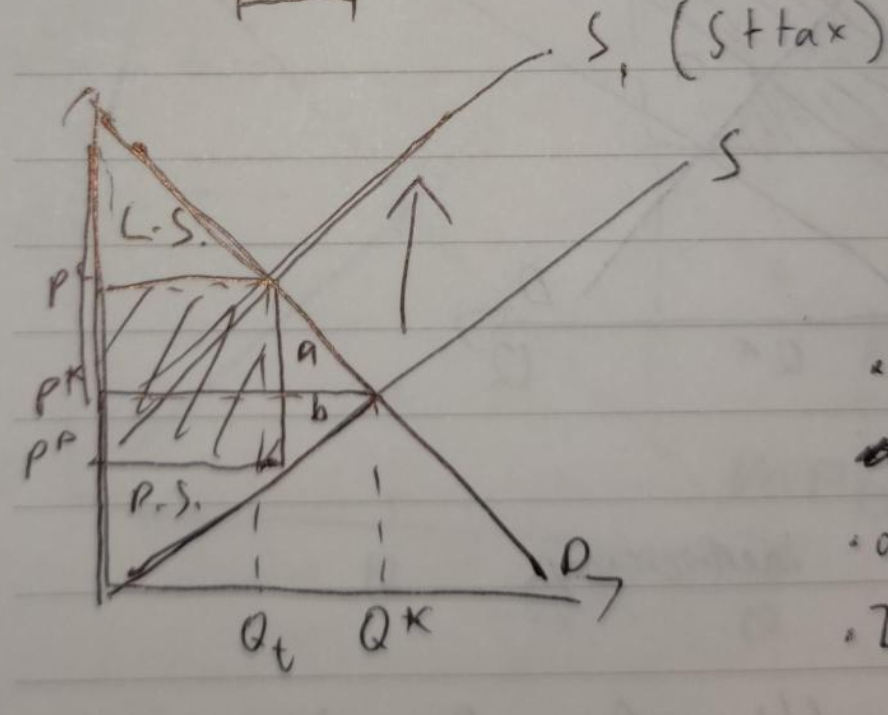

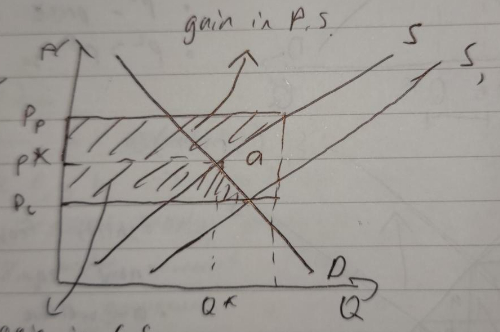

Subsidies

assistance by the government to individuals (firms, consumers, industries)

results in greater consumer and producer surplus

society loss as government spending on subsidy

loss from government spending is greater than the gain in surplus

welfare loss (allocative inefficiency) due to overallocation of resources to the production of goods (overproduction)

Pp and Pc switched (from indirect taxes), as consumers pay less and producers receive more

a = dead weight loss (DWL) due to overproduction

supply curve shifts (S → S1) because of one of the non-price determinants of supply (subsidies)

S1 = S + subsidy

2.8 - Market Failures

externalities are market failures, both positive and negative

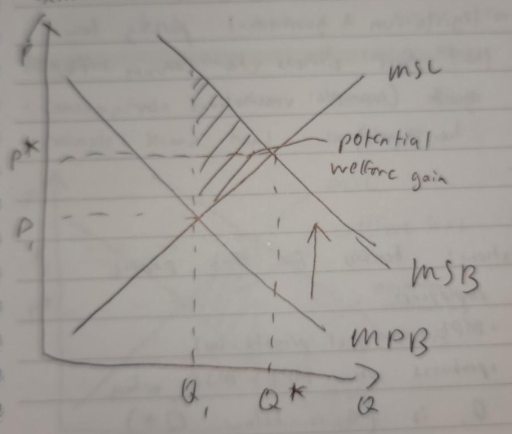

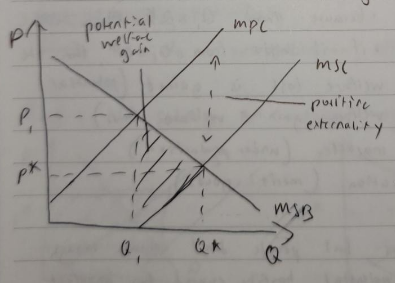

Positive externality of consumption

goods that when consumed, both the consumer and third parties benefit from it (ex: healthcare)

MSC - marginal social cost

MPB - marginal private benefit

MSB - marginal social benefit

in a free market, people would consume where MPB=MSC (Q1, P1)

(Q*, P*) where MSB=MSC is the socially optimal level (potential welfare gain) because from Q1-Q*, MSB>MSC

if MPB shifts from Q1-Q* (toward MSB), then the welfare loss is gained (potential welfare gain = welfare loss)

underallocation of resources to this market (underproduction)

Merit Goods

goods that are beneficial to consumers but people do not consume enough

people underestimate/ignore potential benefits, caused by imperfect access to information

causes the demand to be lower than it should be

examples: healthcare, education

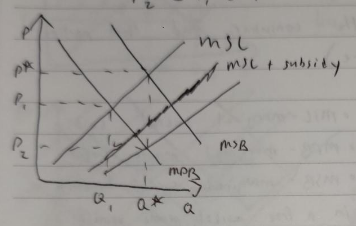

Government “fix”to positive externality of consumption

subsidies/direct provision

shifts the MSC curve downwards

new socially efficient level at Q* but at a lower price (P2)

P2 < P1 < P*

improving information (merit goods)

legislation: government passing laws that force citizens to consume the good

Positive externality of production

production of a good creates external benefits for third parties

ex: human capital: training employees

MPC - marginal private cost

produces where MPC=MSB, where Q1 is located (Q1 < Q*)

if production increases to Q*, there is a welfare gain (welfare loss turned into welfare gain)

underallocation of resources → market failure, allocative inefficiency

Government “fix” to positive externality of production

subsidies

causes MPC to be shifted downwards

full subsidy causes MPC=MSC when shifted

direct provision

high cost

offering training through the state for firms causes MPC=MSC

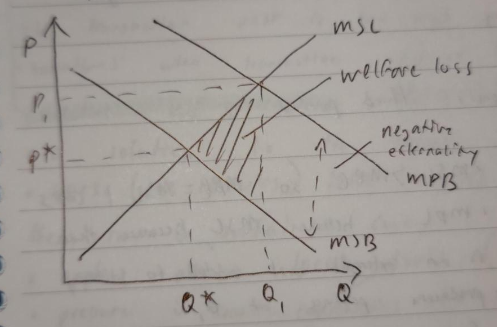

Negative externality of consumption

consumption causes adverse effects to third parties

ex: second hand smoking

in a free market, people maximize their private utility so they consume at MPB=MSC

in a free market, people maximize their private utility so they consume at MPB=MSCthere is a welfare loss as MSC>MSB from Q*-Q1

overconsumption of goods

too many resources allocated

Demerit Goods

goods that are harmful to the consumer but people still consume either because they are unaware of or ignore the potential harm

caused by imperfect information

demand is higher than it should be

creates negative externalities when consumed

example: cigarettes

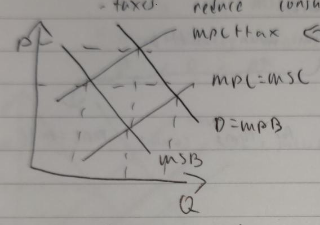

Government “fix” to negative externality of consumption

indirect taxes

taxes reduce consumption

legislation/regulation

making laws against the overconsumption of demerit goods

education/raising awareness

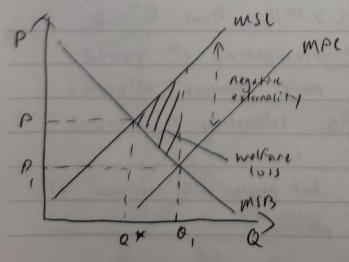

Negative externality of production

production of a good negatively impacts third parties

example: fumes from a factory

MSC<MPC so MPC=MSC+costs

MPC is below MSC, because there is an external cost added to society

producers produce at Q1

from Q1-Q*, MSC>MSB

welfare loss → market failure

Common Pool Resources

rivalrous and non-excludable (linked to negative externalities)

rivalrous: if one person uses, others cannot at the same level of utility

non-excluable: very difficult to exclude people/groups of people from using

typically natural resources

examples: fishing grounds, forests, atmosphere, etc.

Government “fix” to negative externality of production

international agreements

tradable permits

carbon taxes

legislations/regulations

subsidies

Consequences for Stakeholders

Ronald Coase → transaction costs are a way of attempting to measure the impossible, to measure the charges for externalities

externality = transaction cost; there is a threshold where the transaction cost is too high so it is considered an externality

sometimes when transaction cost is low, government intervention is not needed

Collective self-governance

a solution to the over-use of common pool resources

users take control of the resource and use them in a sustainable way

applies at a local level (small communities)

pressure in small communities to operate within social norms

Ostom’s theories → no authority needed

Carbon Tax VS Tradable Permits

carbon taxes are easier than tradable permits (design + implementation)

carbon taxes are more difficult to manipulate for/against certain groups

carbon taxes do not require as much monitoring

carbon taxes are regressive

affects low-income groups more than high-income groups

tradable permits more easily control the level of carbon reduction

carbon taxes are easier to predict

businesses need certainty to plan for the future

Common Pool Resource - rivalrous and non-excludable

Private Good - rivalrous and excludable

Public Good - non-rivalrous and non-excludable (free-rider problem)

Quasi-public Good - non-rivalrous and excludable

Asymmetric information

when one party has more information than the other

buyers and sellers do not have equal access to information

either the buyer or seller has more information

Adverse Selection

when one party in a transaction has more information on the quality of the good than the other party

Moral Hazard

one party takes risks but does not face the full costs of these risks because the full costs of the risks are borne by another party

Perfect Competition / Rational Producer Behaviour

Suppliers and consumers are made up of equally small individuals

No barriers to market entry or exit

Firms are profit maximizing

Consumers are fully rational and consistent

Products sold are homogenous

Full information throughout the market

cannot set the price:

Imperfect competition - monopolies

monopoly market - where only one supply operates

the assumption of many small suppliers does not hold

1 supplier with absolute control over the market price

monopolist sets price at maximum total revenue

as quantity increases, total cost increases, total revenue increases then decreases

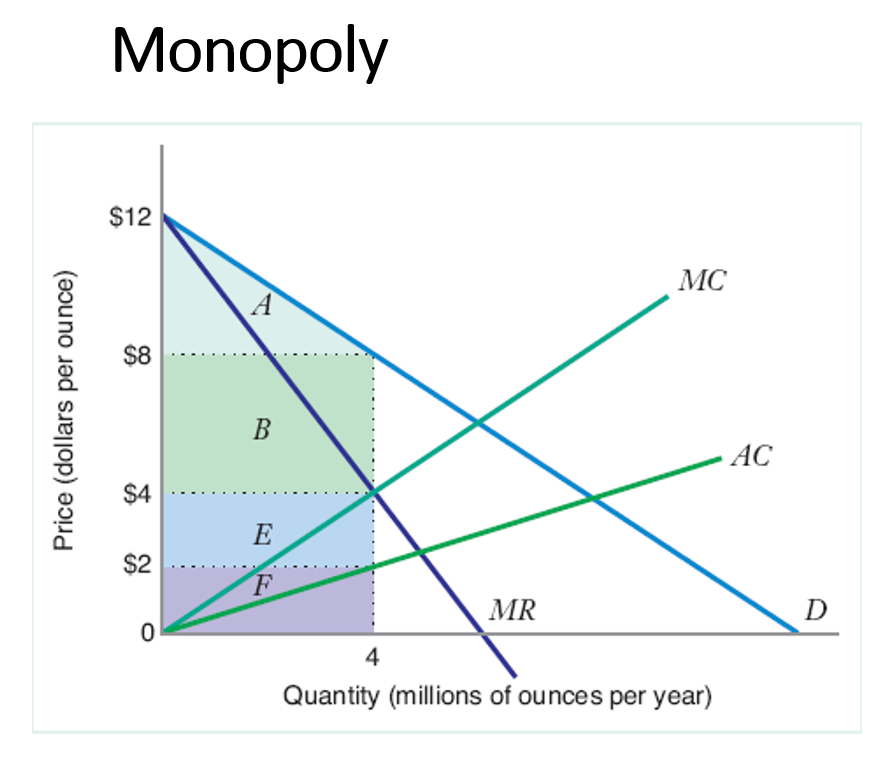

Monopoly

single seller facing many buyers

profit maximization condition: ΔTR(Q)/ΔQ= ΔTC(Q)/ΔQ

MR(Q) = MC(Q)

MR>MC → firm increases Q

MC<MC → firm decreases Q

MR=MC → maximizes profit, cannot increase

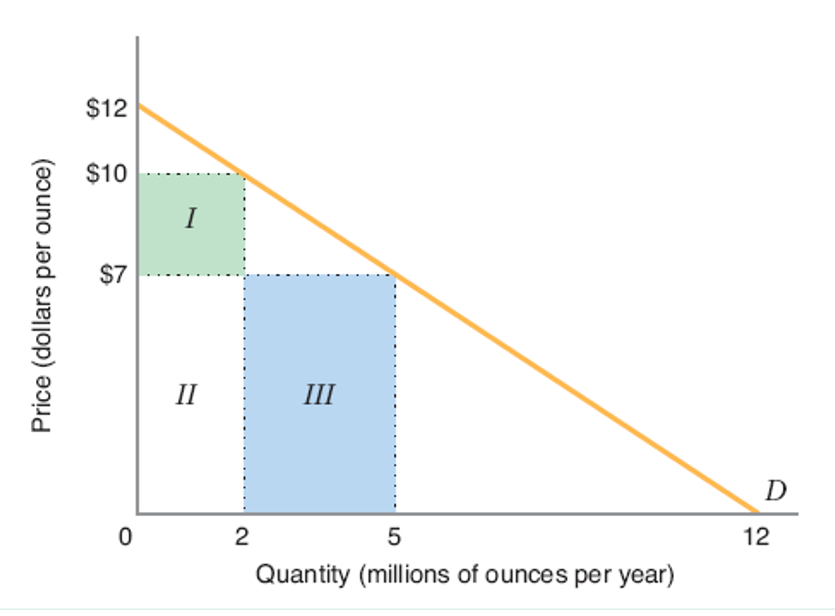

to sell more units, a monopolist lowers price

increase in profit = III while revenue sacrificed = I

change in TR = III-I

Area III = P * ΔQ

Area I = -Q * Δ

change in monopolist profit: P(ΔQ) + Q(ΔP)

MR = ΔTR/ΔQ = (PΔQ + QΔP)/ΔQ = P+Q(ΔP/ΔQ)

MR → P=increase in revenue due to higher volume - marginal units = Q(ΔP/ΔQ): decrease in revenue due to reduced price

AR = TR/Q = PQ/Q = P

price a monopolist can change to sell quantity Q is determined by the market demand curve (the AR curve = market demand curve)

AR(Q) = P(Q)

if Q>0, MR<P and MR<AC (MR lies below demand curve)

firms produce at MR=MC to maximize profits

TR = B+E+F

Profit = B + E

L.S. = A

PED impacts the revenue

inelastic = more revenue

margin drives the average

P=a-bQ TR=P*Q

TR=(a-bQ)Q=aQ-bQ²

dTR/dQ = a-2bQCharacteristics of a monopoly market

single firm in the market

no close substitutes - monopolist’s good or service is unique

high barriers to entry

Long Run - factors of production are constant

Short Run - only labour can change (not land or capital)

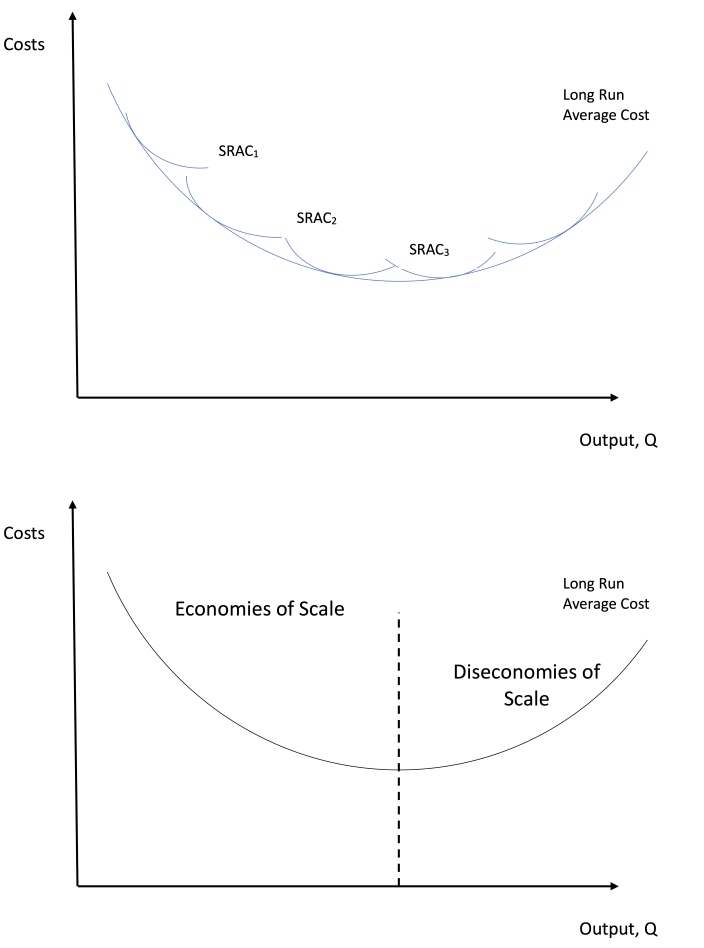

Economies of Scale

LRAC = Long Run Average Cost

considered a barrier to entry

as the monopolist increases production, their costs go down as output goes up

if new firms try to compete, they are unable to keep up with the costs of the large firm

Profits

normal (π=0) → 0 profit

entrepreneurship is factored into the costs, so the wages are added into TC

abnormal (π>0)

loss (π<0)

π = TR-TC = (PQ) - (CQ)

π/Q = AR-AC = PQ/Q - CQ/Q = P-C

AR = P, AC = Cnormal profits are defined by the minimum revenue a firm must make to keep the business from shutting down (covers implicit and explicit costs)

in a perfectly competitive market:

there are no profits in the long run

due to free entry + full information

there are economic profits in the short run

P*=AR=MR, all horizontal lines

in a monopoly market:

can change the price but are still bounded by the demand, so AR and MR are no longer horizontal lines as they are in perfectly competitive markets

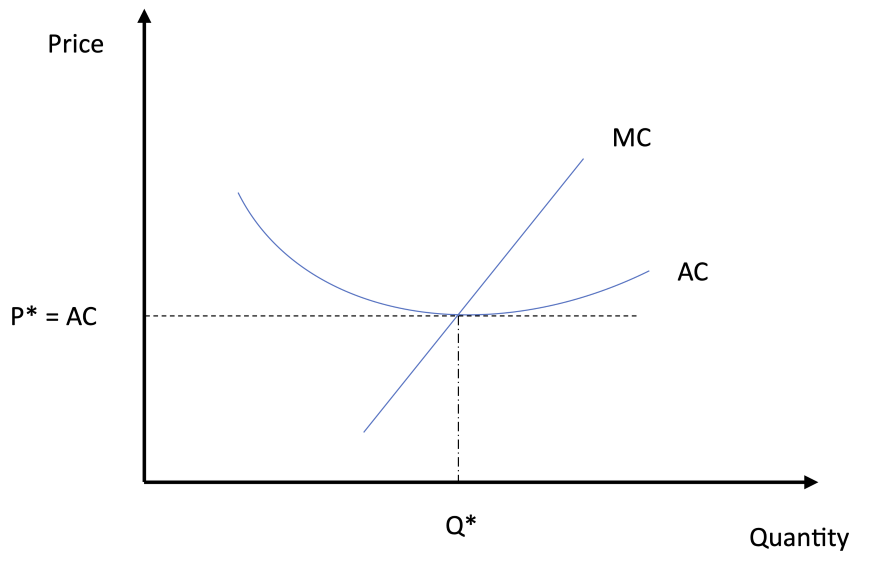

Perfectly Competitive Profits

for a single firm

normal profits (P*=AC)

MC cuts AC at its minimum

P* = AR = AC (when AR=AC, π=0)

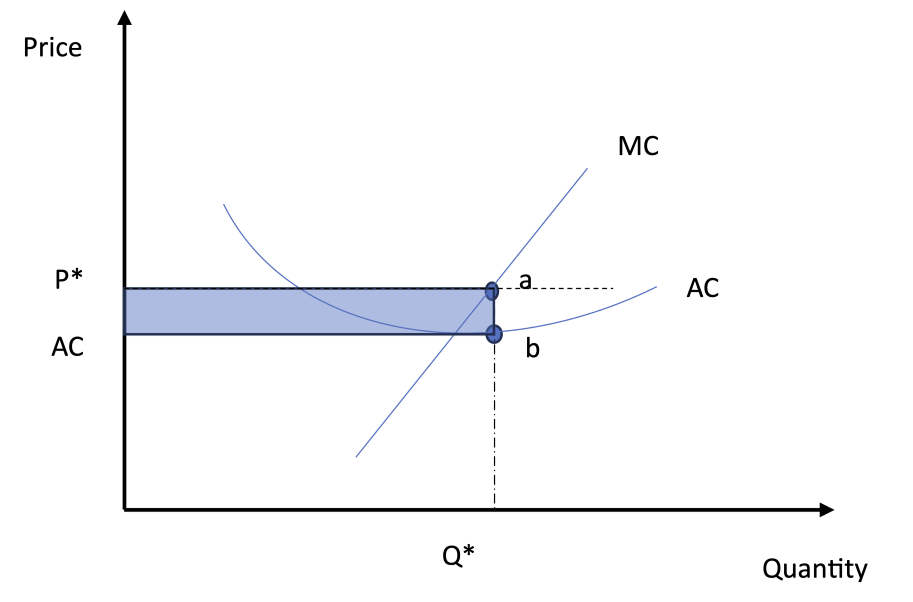

abnormal profits (P*>AC)

AR>AC, so profits are positive (π>0)

sells at Q*

shaded area = profit

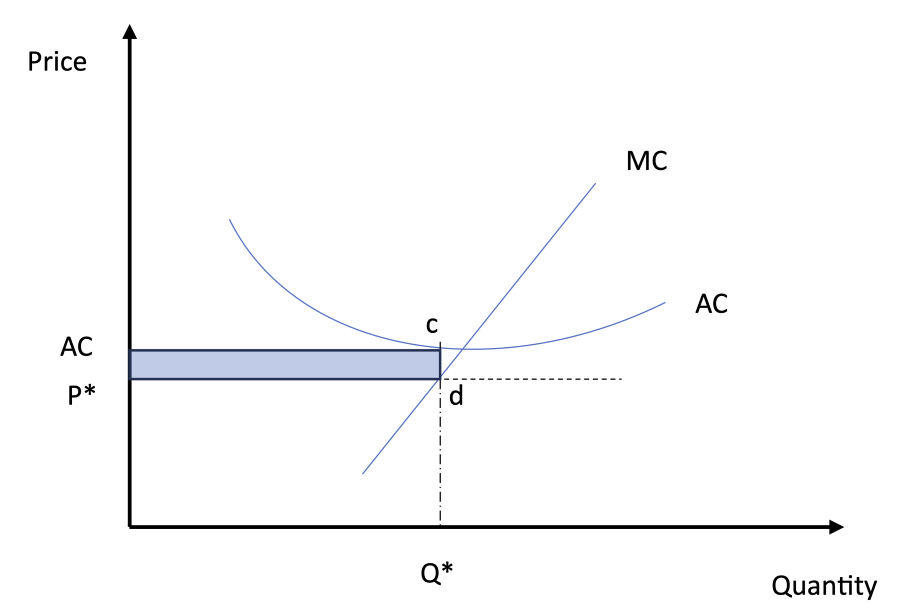

loss (P*<AC)

AR<AC, so profits are negative (π<0), so there is a loss

shaded area = loss

Rules for a single firm in a perfectly competitive market

cannot determine price, so they determine the quantity at MR=MC due to the profit maximizing rule

they also determine profit when AR=AC (AR=AC=π=0)

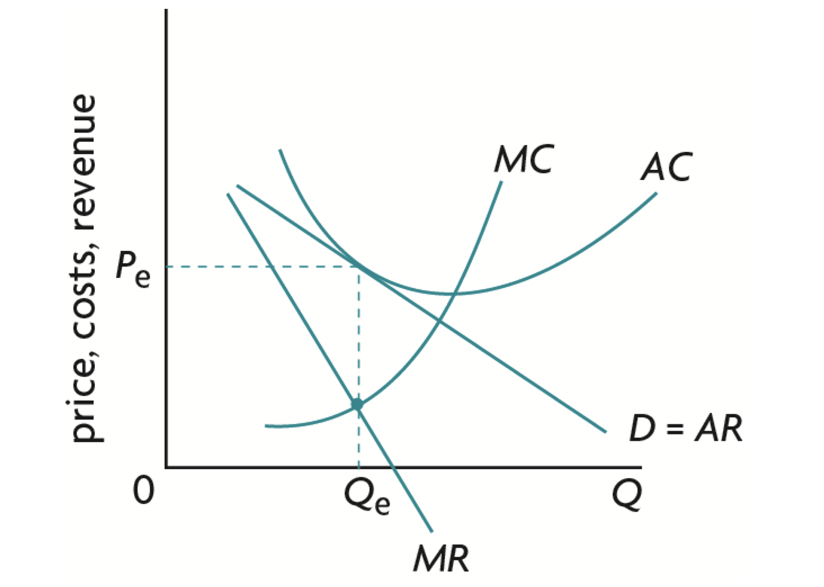

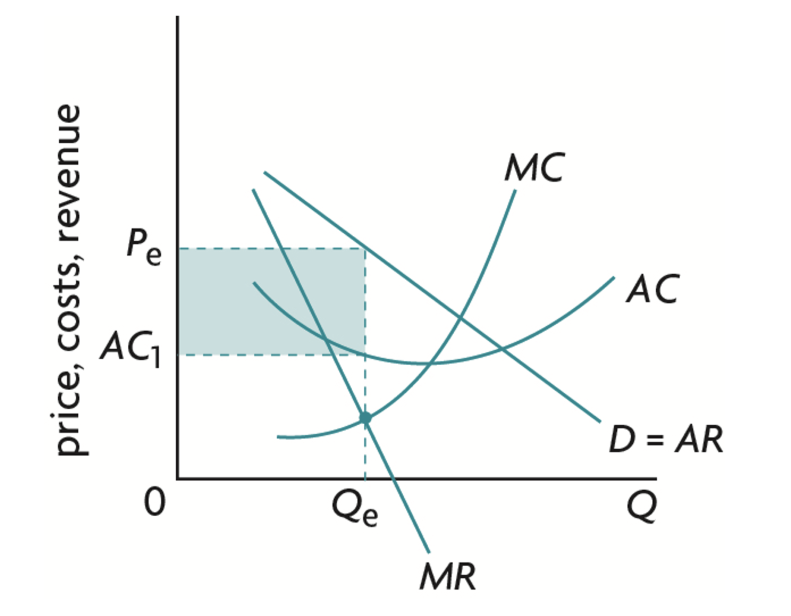

Monopolist Profits

normal profit (π=0)

higher price, lower quantity

profit = difference between AR and AC

Q*=P*=AR=AC, so there is no

Am

abnormal profit (π>0)

AR>AC

shaded area = profit

Q* determined where MR=MC, then find AR/D when it is equal to Q*

AC1 determined where AC is when it is at Q*

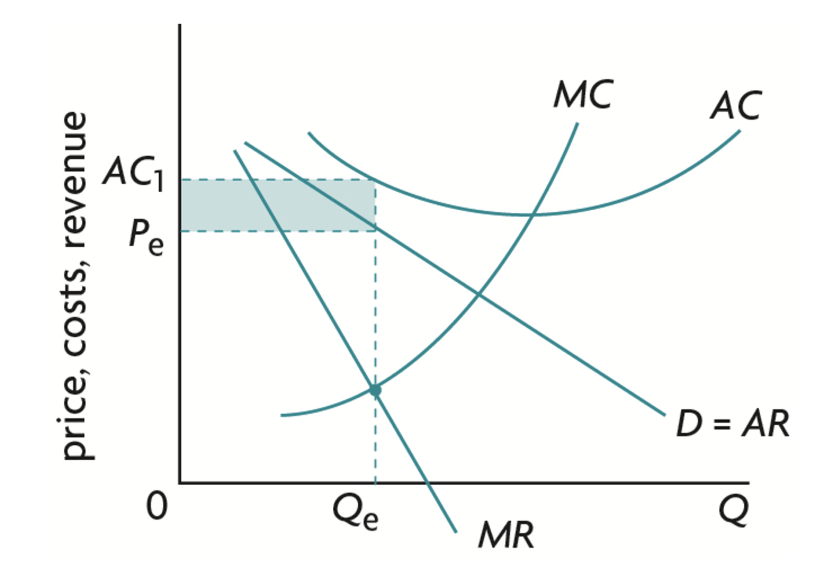

loss (π<0)

same as abnormal profit, Q*, MR=MC, but AC>AR

shaded area = negative profit = loss because cost > revenue