Macroeconomics Final

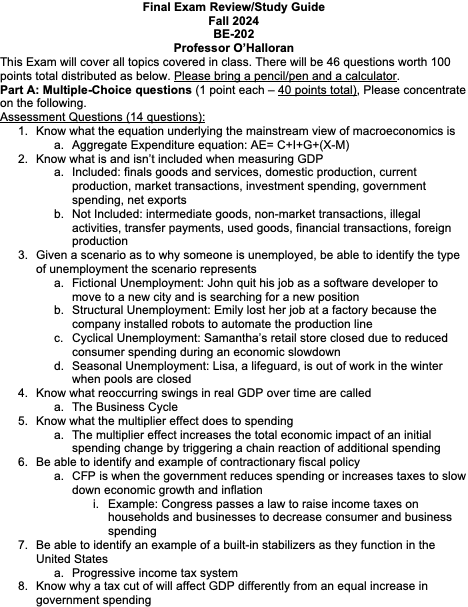

Final Exam Review/Study Guide

Fall 2024

BE-202

Professor O’Halloran

This Exam will cover all topics covered in class. There will be 46 questions worth 100 points total distributed as below. Please bring a pencil/pen and a calculator.

Part A: Multiple-Choice questions (1 point each – 40 points total), Please concentrate on the following.

Assessment Questions (14 questions):

1. Know what the equation underlying the mainstream view of macroeconomics is

a. Aggregate Expenditure equation: AE= C+I+G+(X-M)

2. Know what is and isn’t included when measuring GDP

a. Included: finals goods and services, domestic production, current production, market transactions, investment spending, government spending, net exports

b. Not Included: intermediate goods, non-market transactions, illegal activities, transfer payments, used goods, financial transactions, foreign production

3. Given a scenario as to why someone is unemployed, be able to identify the type of unemployment the scenario represents

a. Fictional Unemployment: John quit his job as a software developer to move to a new city and is searching for a new position

b. Structural Unemployment: Emily lost her job at a factory because the company installed robots to automate the production line

c. Cyclical Unemployment: Samantha’s retail store closed due to reduced consumer spending during an economic slowdown

d. Seasonal Unemployment: Lisa, a lifeguard, is out of work in the winter when pools are closed

4. Know what reoccurring swings in real GDP over time are called

a. The Business Cycle

5. Know what the multiplier effect does to spending

a. The multiplier effect increases the total economic impact of an initial spending change by triggering a chain reaction of additional spending

6. Be able to identify and example of contractionary fiscal policy

a. CFP is when the government reduces spending or increases taxes to slow down economic growth and inflation

i. Example: Congress passes a law to raise income taxes on households and businesses to decrease consumer and business spending

7. Be able to identify an example of a built-in stabilizers as they function in the United States

a. Progressive income tax system

8. Know why a tax cut of will affect GDP differently from an equal increase in government spending

a. A tax cut affects GDP less than an equal increase in government spending because not all of the tax cut is spent (due to saving), while government spending directly increases aggregate demand in full

9. Given the nominal interest rate and the rate of inflation, be able to calculate the real interest rate

a. Real Interest Rate = Nominal Interest Rate - Inflation Rate

10. Be able to identify the appropriate monetary policy the Fed should use to control inflation

a. Restrictive (contractionary) monetary policy

11. Know what the Fed group that decides monetary policy is called

a. Federal Open Market Committee (FOMC)

12. Be able to identify some of the normal functions of the Federal Reserve

a. Monetary policy, regulation of banks, maintaining financial stability, providing payment services, supporting financial system

13. Recall that specialization is based on minimizing opportunity cost

14. Given a change in the exchange rate, be able to determine which currency appreciated and which currency depreciated

a. Appreciated: a currency appreciates if it can buy more of another currency

b. Depreciation: a currency depreciates if it can buy less of another currency

Three questions from each chapter on the following topics.(24 questions):

Chapter 6

1. Be able to identify reasons why prices tend to be inflexible even when demand changes

o Menu costs, wage contracts, price stickiness, government price controls, expectations of future prices

2. Given two diagrams showing demand changes, one with a horizontal supply curve and the other with a vertical supply curve, be able to identify would is associated with short run and which is associated with the long run

o Horizontal supply curve= short run

o Vertical supply curve= long run

3. Know why prices tend to be sticky in the short run

o Prices tend to be sticky in the short run due to factors like menu costs, wage contracts, and firms' reluctance to change prices frequently.

Chapter 7

1. Know what would occur if intermediate goods were included in the calculation of Gross Domestic Product (GDP)

a. It would result in double counting and an inflated measure of economic output

2. Know how consumer durables are defined

a. Goods that are used by consumers over a long period of time and do not quickly wear out or get consumed

3. Know which component of total expenditure in GDP is largest

a. Consumer spending (consumption)

4. Know what is and isn’t included in government expenditure

a. Included: government spending on goods and services

b. Not Included: transfer payments and interest on debt

5. Know how US exports and imports are added or subtracted into total expenditure

a. Exports are added to total expenditure, while imports are subtracted

6. Given a table with various national accounting identities, be able to calculate GDP using the expenditure approach

7. Know what real GDP measures

a. Measures the value of all goods and services produced in an economy, adjusted for inflation or deflation

8. Know what a price index is

a. Statistical measure that tracks the average change in prices of basket of goods and services over time

9. Given a table showing output, price and the price index for various periods, be able to calculate nominal GDP and real GDP in a specific period

10. Given nominal GDP and real GDP, be able to calculate the GDP price index

11. Given real GDP and the price index, be able to calculate nominal GDP

12. Given nominal GDP and the corresponding price index in two periods, be able to calculate real GDP in the second period

13. Be able to identify what may cause GDP to be overstated or understated

a. Overstated GDP: can occur due to double counting, asset overvaluation, or government spending misrepresentation

b. Understated GDP: can happen when non-market activities, environment degradation, or the information economy are not adequately measured

14. Know why GDP may not be a good measure of people’s standard of living

a. It excluded non-market activities, doesn’t account for income distribution, ignores environmental and social factors, no consideration of leisure time, ignores changes in quality of goods and services

Chapter 8

1. Given a nation’s real GDP and population in two periods, be able to calculate the percentage change in real GDP per capita

a. Percentage change in real GDP per capita= (real GDP per Capita in period 2- real GDP per Capita in period 1 / real GDP per Capita in period 1) * 100

2. Be able to use the rule of 70 to determine how long it would take for a nation’s economy to double in size

a. Years to double= 70 / annual growth rate (%)

3. Given two countries' growth rates, be able to determine the difference in doubling times for the two countries

a. Use rule of 70

4. Know when the process of modern economic growth began

a. During the Industrial Revolution in the late 18th century

5. Know which economic regions of the planet have experienced the fastest and slowest economic growth in real GDP per capita since 1820

a. Fastest growth: East Asia (China, Japan, South Korea), Western Europe, North America (especially U.S.)

b. Slowest growth: Sub-Saharan Africa, South Asia, parts of Latin America

Chapter 9

1. Given a table showing the size of the population, employed, unemployed and discouraged workers, be able to calculate the size of the labor force and the unemployment rate

o Labor force = employed + unemployed

o Unemployment rate= (unemployed / labor force) * 100

2. Recall that the difference between the natural rate of unemployment and the actual rate of unemployment will be the amount of cyclical unemployment

3. Know what is meant when we say that the US Macroeconomy is at full employment

o It means the economy is operating at a level where all available labor resources are being utilized efficiently, and the unemployment rate is at a natural rate

4. Given the natural rate of unemployment and the actual rate of unemployment, be able to apply Okun’s Law to calculate the negative GDP gap as a percentage of potential GDP

o Negative GDP Gap % = 2 * (actual unemployment rate – natural unemployment rate)

5. Be able to identify a cause of cost push inflation

o Higher wages, rising raw material costs, supply chain disruptions, currency devaluation, or increased taxes and regulations

Chapter 20

1. Given a table containing hypothetical data for the U.S. balance of payments, be able to determine the U.S. balance on current account

a. Balance of current account = export of goods and services – imports of goods and services + net income + net transfers

2. Know what net investment income represents in the balance of payments

a. The difference between income earned by a country from its foreign investments and income paid to foreign investors

3. Know what a deficit on the current account implies about the capital and financial account

a. Means the country is importing more than it is exporting

4. Given an exchange rate in terms of one country’s currency, be able to state the exchange rate in the other country’s currency

5. Know what impact the depreciation or appreciation of the U.S. dollar will have on prices of our exports to foreigners and the price of U.S. imports

6. Know what impact an appreciation of a foreign country’s currency will have on the price of their imports and exports

7. Given a diagram showing the demand and supply of Euros in the foreign exchange market, be able to predict what will happen to the value of the dollar (appreciate or depreciate) if there is an increase or decrease in the supply of Euros

8. Know what happens the value of the dollar when foreign interest rates rise relative to U.S. rates

a. The value of the U.S. dollar typically falls

9. Know what will happen to currency values if currency traders expect the inflation rate to be much higher in one country than the other

a. The currency of the country with the higher expected inflation will depreciate relative to the currency of the country with the lower expected inflation

Chapter 10

1. Given an individual’s income in two periods and the corresponding levels of saving, be able to calculate their Marginal Propensity to Save (MPS)

o MPS = change in saving / change in income

2. Know what dissaving means

o The act of spending more than one’s current income, leading to a decrease in savings

3. Know what will happen to the consumption function if consumers expect a recession in the future

o Consumption function will likely shift downward

4. Given the cost of an investment and the net revenue it is expected to generate, be able to calculate the expected rate of return

o Expected rate of return (ERR) = (net revenue / cost of investment) * 100

5. Given the expected rate of return and the interest rate, be able to determine whether an investment will be made

o If the expected rate of return is greater than or equal to the interest rate

6. Know what will happen to investment demand when the real interest rate declines

o Investment demand generally increases

7. Know what will happen to investment demand if a non-interest rate determinant changes

o It can shift the investment demand curve

8. Given the Marginal Propensity to Consume (MPC), be able to calculate the size of the multiplier

o Multiplier = 1 / 1 - MPC

9. Given the MPC and the amount of the change in investment, be able to calculate the total change in GDP from the initial change in investment

o Use multiplier formula

10. Know what the multiplier effect indicates

o Refers to the concept that an initial change in spending leads to a larger total increase in economic activity

11. Given a table showing the impact of a change in investment spending in the first, second and subsequent rounds, be able to determine the MPC and MPS as well as the total change in income resulting from the initial change in investment

Chapter 11 (skipped)

Chapter 12

1. Be able to identify examples of the real balances effect, the interest rate effect, and the foreign trade effect

2. Know why the short-run aggregate supply (AS) curve becomes steeper as it approaches potential output

a. Due to the constraints and pressures that arise when the economy is near its capacity

3. Know what happened to the aggregate demand (AD) curve as foreign incomes change

a. Increase in foreign incomes: causes a rightward shift of the AD surve due to higher exports

b. Decrease in foreign incomes: causes a leftward shift of the AD curve due to lower exports

4. Be able to identify causes of an increase or decrease in AD

a. Increase in AD: higher consumer spending, investment spending, government spending, net exports

b. Decrease in AD: lower consumer spending, investment spending, government spending, net exports

5. Know which AS curve we should use to understand business cycles and macroeconomic policy correctly

a. Short-Run Aggregate Supply Curve

6. Know what may cause the AS curve to shift right (increase) or left (decrease)

a. Rightward shirt (increase): lower input costs, technological improvements, increased availability of labor and capital, decreased taxes and regulations, currency depreciation

b. Leftward shift (decrease): higher input costs, technological setbacks, decreased availability of labor and capital, increased taxes and regulations, currency appreciation

7. Know what the foreign purchases effect suggests about the relationship between the price level and GDP

a. Suggests that there is an inverse relationship between the price level in a country and the net exports

8. Know how a change in investment will affect the Aggregate Demand (AD) curve

a. Increase in investment shifts the AD curve to the right, indicating an increase in aggregate demand

b. Decrease in investment shifts the AD curve to the left, indicating a decrease in aggregate demand

9. Know what shape the Aggregate Supply (AS) curves will take in the immediate short-run

a. Horizontal

10. Know what effect dollar depreciation will have on the AS curve

a. The curve will shift to the left

Chapter 13

1. Know what the appropriate fiscal policies are to fight a severe recession or demand-pull inflation

o To fight a severe recession: Use expansionary fiscal policies such as increased government spending and tax cuts to boost aggregate demand and stimulate economic activity.

o To fight demand-pull inflation: Use contractionary fiscal policies such as decreasing government spending and raising taxes to reduce aggregate demand and control inflation.

2. Note that a change in government spending will have a larger effect on GDP than an equal amount of change in taxes

3. Recall that the built-in stabilizers only partially offset the change in GDP resulting from the business cycle

4. Recall that the more progressive tax systems have the most stabilizing effect on the economy and would be represented by a steeper tax schedule curve

5. Know what the cyclically adjusted budget refers to

o Refers to a version of the government's budget that has been adjusted for the effects of the business cycle

6. Know how to find the federal budget deficit

o Federal Budget Deficit = government expenditures – government revenues

Chapter 14 (skipped)

Chapter 15

1. Be able to identify a cause-and-effect chain of expansionary and restrictive monetary policy

o Restrictive (Contractionary) Monetary Policy:

Cause: Central bank raises interest rates or reduces money supply.

Effect: Higher borrowing costs → reduced spending and investment → lower aggregate demand → slower economic growth and lower inflation.

o Expansionary Monetary Policy:

§ Cause: Central bank reduces interest rates or increases money supply.

§ Effect: Lower borrowing costs → increased spending and investment → higher aggregate demand → increased output and employment (but possible inflation)

2. Be able to identify the proper policies the FED should use to reduce inflation

o Increase the federal funds rate, sell government securities, increase the reserve requirements, increase the discount rate

3. Know what the FED should do to decrease the money supply

o Sell government securities, increase the federal funds rate, increase the discount rate, increase reserve requirements

4. Know what expansionary or restrictive monetary policy will do to interest rates and investment spending

Monetary Policy | Interest Rates | Investment Spending |

Expansionary | decrease | increase |

Restrictive (contractionary) | increase | decrease |

5. Know what impact monetary policy has on the aggregate demand (AD) curve

Monetary Policy | Effect on interest rates | Effect on AD | Shift on AD curve |

Expansionary | decrease | Increase in spending | Shift AD curve to the right |

Restrictive | increase | Decrease in spending | Shift AD curve to the left |

6. Given diagrams for the money market, Investment demand, and the AD-AS model, be able to identify what must occur to the money supply in order to achieve potential GDP

Part B: Problem-Solving Questions

Pact C: Short Essay Questions

Chapter 6

1. What are the three primary measures used in macroeconomics to assess the performance of an economy?

a. GDP, unemployment rate, and inflation rate

2. Evaluate the statement that "unexpected declines in demand, with inflexible prices, generate a rise in unemployment and a fall in output."

a. The statement is correct in describing the effects of an unexpected decline in demand in an economy with sticky prices. In the short run, when demand decreases unexpectedly and prices cannot adjust quickly, businesses reduce production, leading to higher unemployment and a decline in output.

Chapter 7

1. Define the four categories of expenditures that comprise GDP.

a. Consumption (c), Investment (i), government spending (g), net exports (nx)

2. Discuss the shortcomings of using GDP as a measure of the economy's output performance and as a measure of its standard of living.

a. Excludes non-market activities, ignores income inequality, excludes environmental costs, no measurement of quality of life, ignores informal economy, population size and distributions

Chapter 9

1. Just as a household's income does not measure its total happiness, a nation's GDP does not measure its total well-being. Explain.

a. While GDP measures economic activity, it does not capture the holistic aspects of well-being, such as happiness, equality, environmental health, or social stability, much like household income does not capture a family's overall happiness.

2. What are two criticisms of the unemployment rate data? How do these criticisms relate to overstating or understating the unemployment rate?

a. Two criticisms of the unemployment rate data are exclusion of discouraged workers and underemployment. Discouraged workers can understate the true level of unemployment as it doesn’t account for those who are no longer actively searching for work but still face difficulty finding employment. Underemployment can lead to an overstatement of employment situation, as people may be counted as employed even if they are not.

Chapter 8

1. Which is more important, labor quantity or labor productivity, as a source of economic growth in the United States?

a. Labor productivity is considered more important because it drives sustainable improvements in efficiency, innovation, and living standards.

2. How does investment in capital goods and infrastructure contribute to economic growth?

a. By enhancing productivity, reducing production costs, improving efficiency, and creating jobs

Chapter 20

1. Explain how differences in relative price levels influence a nation’s relative exchange rate in a floating exchange rate system. What is the Big Mac Index and how can it predict movements in a floating exchange rate system?

a. In a floating exchange rate system, differences in relative price levels between two countries influence the exchange rate because higher price levels (inflation) in one country make its goods more expensive relative to another country’s goods. The Big Mac Index is an informal tool that compares the price of a Big Mac hamburger in different countries. It uses the theory of purchasing power parity (PPP), which suggests that in the long run, exchange rates should adjust so that a basket of goods (like a Big Mac) costs the same in different countries, once exchange rates are considered.

2. What are the economic effects of an appreciation of the dollar relative to foreign currencies?

a. An appreciation of the dollar makes imports cheaper and exports more expensive for foreign buyers. This can reduce demand for U.S. exports and increase demand for imports, potentially slowing economic growth. However, it also helps control inflation by lowering the cost of imported goods.

Chapter 10

1. How does a major tax change affect both the consumption schedule and saving schedule?

o A major tax change affects both the consumption and saving schedules by altering disposable income. A tax cut increases disposable income, shifting the consumption schedule upward (more spending) and the saving schedule downward (less saving). A tax increase reduces disposable income, shifting the consumption schedule downward (less spending) and the saving schedule upward (more saving).

2. What are two key facts that serve as the rationale for the multiplier effect?

o Increased spending and re-spending

Chapter 12

1. Explain how changes in the dollar's exchange rate can affect net exports and thus aggregate demand.

a. Dollar depreciation reduces imports which boosts net exports and leads to an increase in aggregate demand. Dollar appreciation reduces exports which increases imports and reduces net exports which leads to a decrease in aggregate demand.

2. The determinants of aggregate demand determine the location of the aggregate demand curve. What are the four basic determinants of aggregate demand?

a. Consumption (C), investment (I), government spending (G), and net exports (NX)

Chapter 13

1. Define expansionary fiscal policy. During which phase of the business cycle would it be appropriate to use?

o Expansionary fiscal policy involves increasing government spending or cutting taxes to stimulate the economy. It is appropriate to use during a recession or when the economy is in a downturn to boost demand and reduce unemployment.

2. Define contractionary fiscal policy. When should it be used?

o Contractionary fiscal policy involves decreasing government spending or increasing taxes to slow down the economy. It should be used during periods of high inflation or when the economy is overheating to control price increases.

Chapter 15

1. Trace the cause-effect chain that results from an expansionary monetary policy.

o In an expansionary monetary policy, the central bank lowers interest rates or increases the money supply. This makes borrowing cheaper, which encourages spending and investment. As a result, demand for goods and services rises, leading to higher output and employment, which can boost economic growth.

2. Differentiate between expansionary and contractionary/restrictive monetary policies.

o Expansionary monetary policy involves lowering interest rates or increasing the money supply to stimulate economic activity during a downturn.

o Contractionary (restrictive) monetary policy involves raising interest rates or reducing the money supply to control inflation and slow down an overheating economy.