[6: MODULE 5]

SELF-EMPLOYED, MIXED INCOME EARNERS, ALIENS

That legal text describes a simplified tax option for self-employed individuals and professionals in the Philippines whose income is below the VAT threshold.

In simple terms, it means you have two choices for paying your income tax and business tax if your total annual income (gross sales/receipts plus other income) is under the limit for Value-Added Tax (VAT):

1. The 8% Optional Tax

Rate: 8%

What it applies to: Your gross sales or gross receipts and other non-operating income in excess of P250,000.

What it replaces:

The regular graduated income tax rates (the standard tax table).

The 3% Percentage Tax (which is the usual business tax for non-VAT taxpayers).

💡 Analogy: Think of this as an "all-in-one" simplified tax rate that combines your income tax and your percentage tax. You get a P250,000 deduction before the 8% even starts.

2. The Standard Tax System

This is the alternative option you have if you choose not to use the 8% option:

Income Tax: You pay the graduated income tax rates (like everyone else, with a P250,000 tax-exempt threshold).

Business Tax: You also pay the 3% Percentage Tax on your gross sales/receipts (because your income is below the VAT threshold).

Key Takeaway

If you're a self-employed individual or professional whose gross income is below the VAT threshold, you can choose to simplify your tax calculation by paying a flat 8% on your income above P250,000, instead of calculating the graduated income tax and the 3% percentage tax separately.

Rate of Tax for Mixed Income Earners

All income from compensation

All income from business

Deductions from Gross Income

Nonresident Alien Engaged in Trade or Business Within the Philippines.

Tax on Nonresident Alien Not Engaged in Trade or Business the PH

Alien Individual Employed by Regional or Area Headquarters and Regional Operating

Headquarters of Multinational Companies - same tax treatment as filipinos employed in the same roles

Alien Individual Employed by Offshore Banking Units - same tax treatment as filipinos employed in the same roles

Alien Individual Employed by Petroleum Service Contractor and Subcontractor

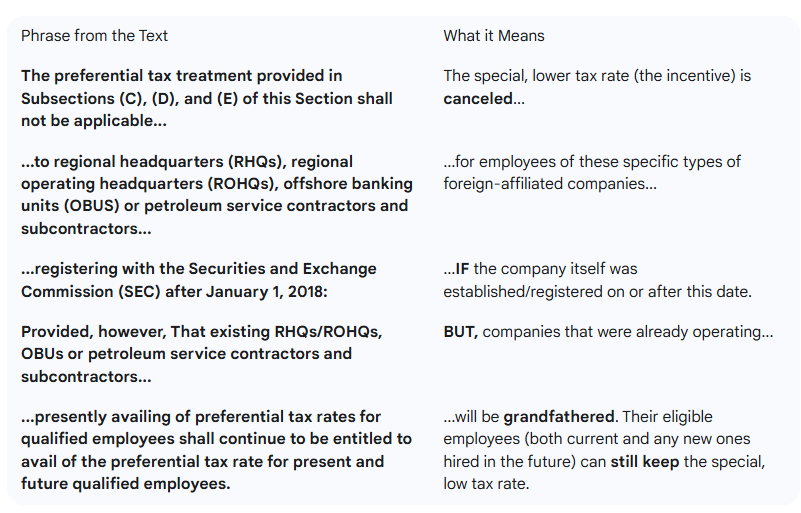

The government has removed a special, low tax rate (historically 15% on gross income) for the qualified employees of four specific types of entities, but only for those entities that were registered after a specific date.

The Simple Summary

Old Companies (Registered before Jan 1, 2018): Their qualified employees get to keep the special 15% tax rate, even for new hires.

New Companies (Registered on or after Jan 1, 2018): Their employees DO NOT get the special tax rate. They must pay the regular graduated income tax rates (the standard tax table for all individuals).

OVERALL

1. The Point of the First Section: Simplifying Tax for Small Businesses

Section 24(A)(2)(b) - Rate of Tax on Income of Purely Self-employed Individuals... (the first text you were confused by)

THE POINT: To give small, non-VAT businesses and independent professionals a super easy way to pay their taxes.

Instead of keeping detailed records, calculating net income, paying the graduated income tax rate, and paying a separate 3% percentage tax, they can choose the 8% Flat Tax Option.

Before: Complicated, high compliance burden.

After (8% Option): Simple, low compliance burden. You just pay 8% on your gross income above P250,000 and you're done with both income tax and business tax.

2. The Point of the Second Section: Eliminating a Special Perk

Section 25(F) - The preferential tax treatment provided in Subsections (C), (D), and (E) of this Section shall not be applicable... (the second text you were confused by)

THE POINT: To ensure fairness and uniformity in the tax system by making high-earning employees in special foreign companies pay the same tax rate as everyone else.

The tax law previously gave a major tax break—a special 15% tax rate on gross income—to the employees (often highly-paid expatriates) of:

Regional Headquarters (RHQs)

Regional Operating Headquarters (ROHQs)

Offshore Banking Units (OBUs)

Petroleum Service Contractors

The government decided this was unfair because an employee doing the same job at a non-special Philippine company would pay a much higher tax under the regular graduated rates (which can go up to 35%).

Old Policy: Special low rate for a select few.

New Policy: All employees (except those in the "grandfathered" older companies) must now pay the regular graduated income tax rates (the same table as all other employees). This removes a privilege that was seen as violating the principle of "equal protection" under the law.

PASSIVE INCOME

INCOME TAX RATE

Rate of Tax on certain passive income

interest income received by individual taxpayer (except nonresident individuals) shall be subject to final income tax at 15% of interest income

from a depository bank under expanded foreign currency deposit system

long-term deposit or investment evidenced by certificates prescribed by BSP shall be exempt from the tax imposed under this subsection

long-term deposit or investment in the form of savings, common or individual trust funds, deposit substitutes, investment management accounts and other investments

Cash and/or Property Dividends from all types of companies except general professional partnerships shall be subject to an income tax of 20% on the total amount

exceptions:

prizes amounting to Ten thousand pesos (P10,000.00) or less which shall be subject to tax under Subsection (B)(l) of Section 24

winnings amounting to Ten thousand pesos (P10,000.00) or less from Philippine Charity Sweepstakes Office (PCSO) games which shall be exempt

That royalties on books as well as other literary works, and royalties on musical compositions shall be subject to a final tax of ten percent (10%) on the total amount

Exemption: interest income from long-term deposit or investment evidenced by certificates shall be exempt from this tax

in the form of savings, common or individual trust funds, deposit substitutes, investment management accounts and other investments

BUT, should the holder of the certificate pre-terminate the deposit or investment before the fifth year, a final tax should be imposed on entire income and withheld by the depositary bank from the proceeds of the long-term deposit or investment certificate

based on remaining maturity:

"Four (4) years to less than five (5) years - 5%; "Three (3) years to less than four (4) years - 12%; "Less than three (3) years - 20%

C. On Capital Gains from Sales of Shares of Stock not Traded in the Stock Exchange - final tax at the rate of 15% upon net capital gains during taxable year

except shares sold or disposed of through the stock exchange

Sale of shares of stock through stock exchange will be taxed

Tax on Sale, Barter or Exchange of Shares of Stock Listed and Traded through the Local Stock Exchange

D. Capital Gains from Sale of Real Property

6% final tax based on gross selling price or current fair market value, but whichever is higher, is imposed upon capital gains

tax liability, if any, on gains from sales shall be determined under section 24 A or here, depending on what taxpayer wants

Capital Gains Tax Exemption

The whole point is to let you sell your old house and buy or build a new one without having to pay tax on the profit, as long as you meet certain strict conditions.

Principal Residence Capital Gains Tax Exemption

This rule allows a natural person (an individual) to be exempt from the 6% Capital Gains Tax (CGT) when they sell their primary home, provided they follow four strict conditions.

The Main Condition (The Reason for the Exemption)

You must fully use the proceeds from the sale to acquire or construct a new principal residence within eighteen (18) calendar months from the date of the sale.

The Four Key Requirements

Reinvestment Period: You must buy or build the new home within 1.5 years (18 months) of selling the old one.

Frequency Limit: You can only avail of this exemption once every ten (10) years.

Notification: You must inform the Commissioner of Internal Revenue (BIR) of your intention to avail of this tax exemption by filing a prescribed return within thirty (30) days from the date of sale.

Cost Carry-Over (Tax Basis Rule): The original cost of the old residence (its "historical cost or adjusted basis") must be carried over to become the cost of the new residence. This is important because it means if you sell the new home later, the tax on the eventual profit will be calculated based on the much lower original cost.

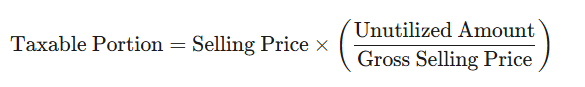

What Happens If You Don't Use All the Money?

If you do not fully use the proceeds to buy or build the new home, the exemption is only partial.

The portion of the profit that corresponds to the unutilized amount of the proceeds will be subject to the 6% Capital Gains Tax.

To calculate the taxable part, the formula is:

The tax will then be 6% of this calculated Taxable Portion.

E. Registration with the Register of Deeds (National Internal Revenue Code)

basically certified dapat that transfer of real property has already been reported, with capital gains or creditable witholding tax

"No registration of any document transferring real property shall be effected by the Register of Deeds..." | The sale/transfer is invalid in the eyes of the government and the title cannot be moved to the new owner... |

"...unless the Commissioner or his duly authorized representative has certified that such transfer has been reported, and the capital gains or creditable withholding tax, if any, has been paid..." | ...UNLESS the seller/taxpayer presents a Certificate Authorizing Registration (CAR) from the BIR, proving the taxes (like Capital Gains Tax or Withholding Tax) have been settled. |

"...the information as may be required... shall be annotated by the Register of Deeds in the Transfer Certificate of Title..." | The RD must write a note on the back of the title reflecting any relevant information required by the BIR (this is a control measure for future tax compliance). |

"...in cases of transfer of property to a corporation, pursuant to a merger, consolidation or reorganization... the information... shall be annotated..." | Even in special tax-free transfers (like a tax-deferred corporate merger), the RD still has to annotate the title with the required information to track the property's tax history. |

"...any violation of this provision by the Register of Deeds shall be subject to the penalties imposed under Section 269..." | The Register of Deeds faces criminal penalties if they register a property transfer without the proper BIR certification. This ensures compliance from the RD. |

RATES OF TAX ON CERTAIN PASSIVE INCOMES

Interest from Deposits and Yield or any other Monetary Benefit from Deposit Substitutes and from Trust Funds and Similar Arrangements, and Royaltie

: Most interest and royalty income earned by a local company is subject to a flat 20% Final Tax, but interest from a specific type of foreign currency deposit gets a lower 15% Final Tax to encourage foreign currency savings

Income Type | Tax Rate | What It Applies To |

General Rule: Final Tax | 20% | Interest from regular currency bank deposits, monetary benefits/yield from deposit substitutes, trust funds, and royalties. |

The Exception (Proviso): Final Tax | 15% | Interest income derived from a depository bank under the Expanded Foreign Currency Deposit System (EFCDS). |

CAPITAL GAINS TAX

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the Philippines, including pacto de retro sales and other forms of conditional sale.

WITHHOLDING TAXES

The main point of the Withholding Tax System (Sections 57 to 83) is to make tax collection efficient and mandatory by requiring the payer of income to deduct and remit the tax directly to the government on behalf of the recipient (payee).

Instead of the government waiting for millions of taxpayers to file their returns and pay their taxes, the payment is collected at the source of the income.

Types of Withholding Tax (Section 57)

Section 57 establishes the two major types of income tax withheld at the source, which determines how the tax affects the recipient's final tax liability.

(A) Withholding of Final Tax on Certain Incomes

What it is: The tax withheld by the payor is the full and final payment of the income tax due on that specific income.

Effect on Payee: The recipient (payee) does not include this income in their annual income tax return. Their tax obligation on that income is settled completely.

Applies to: Primarily passive income like interest from bank deposits, dividends, and certain royalties (the many Section references you see are to these specific income types).

(B) Withholding of Creditable Tax at Source

What it is: The tax withheld is only an advance payment on the recipient's total annual income tax liability.

Effect on Payee: The recipient must include this income in their annual tax return, but they can credit (deduct) the amount already withheld from their total tax due.

If the credit is higher than the tax due, the taxpayer can claim a refund or carry it over as a credit.

Applies to: Active income like professional fees, rentals, commissions, and most importantly, compensation income (salaries and wages), which is covered in detail in the succeeding Sections (78-83).

Rate Adjustment: The TRAIN Law (RA 10963) amended the maximum creditable withholding tax rate from 32% to 15% starting January 1, 2019.

SEC. 58. Returns and Payment of Taxes Withheld at Source.

The main purpose is to establish the rules for reporting, paying, and documenting the taxes withheld, ensuring the funds are treated as a trust for the government and properly credited to the taxpayer.

Section 58: Rules for Withholding Agents

(A) Returns and Payments of Taxes Withheld (When and Where to Pay)

Requirement | Simplified Meaning |

Filing Location | The tax return and payment must be made to an authorized City or Municipal Treasurer where the withholding agent resides or has its principal office. |

Trust Fund | The tax deducted is considered a special fund in trust for the government. This means the withholding agent cannot use the money for its own expenses; it belongs to the government immediately upon deduction. |

Filing Deadline (Final Tax) | Returns must be filed and payment made within twenty-five (25) days after the close of the calendar quarter. |

Filing Deadline (Creditable Tax) | Returns must be filed and payment made not later than the last day of the month following the close of the quarter. |

(B) Statement of Income Payments Made and Taxes Withheld (Issuing Certificates)

This section mandates that the withholding agent must provide the taxpayer (recipient) with a certificate showing the income paid and the tax withheld. This certificate is crucial for the payee to claim their tax credit.

For Creditable Withholding Taxes (e.g., professional fees):

Corporate Payee: The statement (BIR Form 2307) must be issued simultaneously upon payment, but no later than the 20th day after the close of the quarter.

Individual Payee: The statement must be issued no later than March 1 of the following year.

For Final Withholding Taxes (e.g., bank interest): The statement (BIR Form 2306) must be given to the payee on or before January 31 of the succeeding year.

(C) Annual Information Return (Reporting to the BIR)

The withholding agent must file an annual summary report with the BIR listing all payees, the income paid to them, and the total taxes withheld.

Final Withholding Tax Return: Due on or before January 31 of the succeeding year.

Creditable Withholding Tax Return: Due no later than March 1 of the following year.

Compliance: Filing this annual return satisfies the general reporting requirements for income payments under Section 68.

(D) Income of Recipient (The Payee's Side)

This clarifies what the recipient (payee) must do with the tax withheld:

Creditable Tax: The payee must include the full income amount in their annual tax return, but the tax withheld is credited against their total tax due.

If the credit is more than the tax due, they get a refund (Section 204).

If the credit is less than the tax due, they must pay the difference.

Trust Funds: Reiterates that all withheld taxes are trust funds and must be kept separate from the agent's other money.

(E) Registration with Register of Deeds (Tax Enforcement for Real Property)

This subsection links the tax system to the legal transfer of real property, making tax payment mandatory for title registration. (This was detailed in your previous query, but is included here for completeness.)

No Registration Without CAR: The Register of Deeds (RD) cannot legally register any document transferring real property unless the taxpayer presents a Certificate Authorizing Registration (CAR) from the BIR.

Purpose: The CAR certifies that the required taxes (Capital Gains Tax or Creditable Withholding Tax) have been paid.

Penalty: The RD is subject to penalties if they violate this rule, ensuring they act as a tax gatekeeper.

WITHHOLDING ON WAGES

Wages - all remuneration (other than fees paid to a public official) for services performed by an employee for his employer

renumeration does NOT include:

remuneration paid: (1) For agricultural labor paid entirely in products of the farm where the labor is performed, or

(2) For domestic service in a private home, or

(3) For casual labor not in the course of the employer's trade or business

(4) For services by a citizen or resident of the Philippines for a foreign government or an international organization.

Payroll Period - period when payment of wages is made

miscellanous payroll period - a payroll period other than, a daily, weekly, biweekly, semi-monthly, monthly, quarterly, semi-annual, or annual period

employer - basta who pay

In the case of a person paying wages on behalf of a nonresident alien individuaL or anyth foreign like nonresident alien individual, employer is the one paid for in behalf

SUPPLEMENTARY INFO:

This provision is known as the "Payroll Period Rule" for determining what counts as taxable "wages" for the purpose of withholding tax on compensation.

The main point is: When an employee performs both wage (taxable) and non-wage (non-taxable) work during a single pay period, you must classify all of the pay for that period based on the majority of the work performed.

Here is a simpler breakdown:

The Payroll Period Rule for Defining Wages

This rule applies when an employee's services in one pay period are mixed—some services are considered taxable "wages" and some are not.

Condition (Majority of Work) | Tax Consequence (All Pay for the Period) |

If the services constituting "wages" are performed during one-half (21) or more of the total payroll period (e.g., 8 out of 15 days). | All the remuneration (salary, commissions, etc.) paid to the employee for that entire period shall be deemed "wages" (and is subject to withholding tax). |

If the services constituting "wages" are performed during less than one-half (21) or less of the total payroll period (e.g., 7 out of 15 days). | None of the remuneration paid to the employee for that entire period shall be deemed "wages" (and is exempt from withholding tax). |

Example Scenario

Imagine a company pays its employees bi-weekly (a 14-day payroll period) and some of the employee's time is spent on non-taxable research work.

Scenario 1: Taxable Majority

The employee performs 7 days of taxable services and 7 days of non-taxable services (exactly half).

Result: All pay for the 14 days is treated as taxable wages.

Scenario 2: Non-Taxable Majority

The employee performs 6 days of taxable services and 8 days of non-taxable services (less than half is taxable).

Result: None of the pay for the 14 days is treated as taxable wages (it is entirely excluded).

Purpose of the Rule

This rule exists to simplify the accounting and tax withholding process for employers. Instead of requiring the employer to meticulously track and allocate pay based on the percentage of time spent on taxable vs. non-taxable duties, the rule provides a clear all-or-nothing threshold based on the majority of the work performed within that specific pay cycle.

INCOME TAX COLLECTED AT SOURCE

No withholding of tax required when total compensation income does not exceed minimum wage at 5K

If employer fails to deduct, tax won’t be deducted from them, but they will face liabiliy for any penalty or addition to the tax

In cases of overpayments, refund or credit shall be made to the employer to the extend of overpayment

For employees, amount deducted and whithheld will be allowed as a credit

EXCESS OF TAXES RETURNED

Returned and credited within three months from the fifteenth day of April

Refunds or credits made after such time will earn interest at the rate of 6% per annum, starting after the lapse

WITHHOLDING ON BASIS OF AVERAGE WAGES

The rule allows the Commissioner to authorize employers to use the following streamlined process:

Estimate Quarterly Wages: The employer can estimate the total amount of taxable wages an employee is expected to receive over a specific quarter (three months).

Determine Average Tax: The employer calculates the average tax amount that should be deducted for each paycheck during that quarter, based on the estimated total wages.

Deduct the Average Amount: The employer then deducts and withholds this average amount upon each payment of wages during the quarter, as if that average amount was the actual wage paid each period.

The effect of this rule is to ensure that while the total tax withheld over the quarter is generally correct, the actual amount withheld on any single paycheck remains stable, simplifying payroll for both the employer and the employee.

This is a form of tax estimation and averaging designed for administrative convenience.

It is subject to specific rules and regulations established by the Secretary of Finance, upon recommendation of the Commissioner of Internal Revenue.

Non resident aliens engaged in trade or business in the PH is subject to the same provisions

YEAR-END ADJUSTMENT

before calendar year end and before final payment, employer determines tax due from employee on taxable compensation income for the entire year. The difference (tax due - tax withheld from january to november) is either withheld on december or refunded

LIABILITY FOR TAX

if employer screws up tax is collected from them with penalties or additions to the tax

FILING OF RETURN AND PAYMENT OF TAXES WITHHELD

taxes deducted and withheld by the employer on wages of employees shall be covered by a return and paid to an authorized agent bank (Collection Agent)

The return shall be filed and the payment made within twenty-five (25) days from the close of each calendar quarter

The taxes deducted and withheld by employers shall be held in a special fund in trust for the Government until the same are paid to the said collecting officers.

IN CASES OF RETURN AND PAYMENT FROM GOVERNMENT EMPLOYEES

the return of the amount deducted and withheld upon any wage shall be made by the officer or employee having control of the payment of such wage

STATEMENTS AND RETURNS

Section 83 of the National Internal Revenue Code (NIRC) deals with the mandatory reporting and documentation requirements for employers related to the Withholding Tax on Compensation (salaries and wages).

The main point is: The employer must provide a certificate to the employee detailing their pay and the tax withheld, and must also provide an annual summary of all employees to the Bureau of Internal Revenue (BIR).

Here is an easier breakdown of the requirements:

Section 83: Documentation and Reporting for Withholding on Wages

(A) Requirements: Statement for the Employee (The Employee's Copy)

This subsection mandates the issuance of the Certificate of Compensation Payment/Tax Withheld (commonly known as BIR Form 2316).

Requirement | Simplified Meaning |

What is Furnished | A written statement (Form 2316) confirming the total wages paid and the total amount of tax deducted and withheld during the calendar year. |

Standard Deadline | On or before January 31st of the year following the employment year. |

Termination Deadline | If the employee's job ends before the end of the year, the statement must be given on the same day the last payment of wages is made. |

Purpose | This certificate is the employee's proof that their tax has been withheld. It is essential for the employee's own annual tax filing (or for Substituted Filing, where this form serves as the return). |

(B) Annual Information Returns (The Government's Copy)

This mandates the employer's annual reporting to the tax authority.

Requirement | Simplified Meaning |

What is Submitted | An Annual Information Return (a summary) listing all employees, their total compensation income, and the total taxes withheld from each employee. |

Submission Deadline | On or before January 31st of the succeeding year. |

Attachment | The return must be accompanied by copies of the employee statements (Form 2316) referenced in paragraph (A). |

Compliance | Filing this annual return (often through a summary alphalist) satisfies the general requirement under Section 68 for reporting all payments made to others. |

(C) Extension of Time

This simply states that the Commissioner of Internal Revenue has the authority to grant employers a reasonable extension of time to provide these statements and returns, provided it is done under appropriate rules and regulations.

BARANGAY MICROENTERPRISE ACT

AN ACT TO PROMOTE THE ESTABLISHMENT OF BARANGAY MICRO BUSINESS ENTERPRISES (BMBEs), PROVIDING INCENTIVES AND BENEFITS THEREFOR, AND FOR OTHER PURPOSES.

"Barangay Micro Business Enterprise," -any business entity or enterprise engaged in the production, processing or manufacturing of products or commodities, including agro-processing, trading and services, whose total assets including those arising from loans but exclusive of the land on which the particular business entity's office, plant and equipment are situated, shall not be more than Three Million Pesos (P3,000,000.00).

HOW BMBE IS REGISTERED AND OPERATED

The Office of the Treasurer of each city or municipality shall register the BMBEs and issue a Certificate of Authority to enable the BMBE

processed within 15 working days

LGU may charge not exceeding 1K

INCENTIVES AND BENEFITS

All BMBEs are exempt from income tax for income arising from operations of the enterprise

exemption from coverage of minimum wage law

Key Provisions of Section 9

1. Mandatory Special Credit Windows

The law requires major government financial institutions (GFIs) to dedicate a specific financing channel for BMBEs:

Lending Institutions: The Land Bank of the Philippines (LBP), the Development Bank of the Philippines (DBP), the Small Business Guarantee and Finance Corporation (SBGFC), and the People's Credit and Finance Corporation (PCFC) must set up a special credit window for registered BMBEs.

Social Institutions: The Government Service Insurance System (GSIS) and the Social Security System (SSS) must also set up special credit windows, specifically for their members who wish to establish a BMBE.

Wholesale Lending: These GFIs are encouraged to wholesale (on-lend) these funds to accredited private financial institutions and community-based organizations (like credit cooperatives and NGOs) for direct credit support to BMBEs.

2. Double Credit Incentive for Compliance

This is the most powerful incentive for private banks to lend to BMBEs:

Alternative Compliance: Loans granted to BMBEs are considered alternative compliance toward two mandatory lending laws:

Presidential Decree No. 717 (The Agri-Agra Law, related to agriculture and agrarian reform credit).

Republic Act No. 6977 (The Magna Carta for Small and Medium Enterprises, related to SME credit).

Double Computation: For the purpose of meeting the mandatory lending quotas under the two laws above, every loan granted to a BMBE is computed at twice (2x) the amount of its face value. This makes BMBE lending highly attractive for banks seeking to meet their legal obligations efficiently.

3. Tax Exemption on Interest Income

To further incentivize government lending, the interest income derived from BMBE loans granted by the major GFIs (LBP, DBP, PCFC, SBGFC, GSIS, and SSS) is exempt from the Gross Receipts Tax (GRT).

4. Credit Guarantee Mechanism

To minimize risk for the lending institutions:

The SBGFC and the Quedan and Rural Credit Guarantee Corporation (QUEDANCOR) are required to set up a special guarantee window to provide necessary credit guarantees for BMBE loans.

5. Reporting and Regulation

The concerned financial institutions must annually report to both Houses of Congress on the status of the credit delivery program. The Bangko Sentral ng Pilipinas (BSP) is tasked with formulating the implementing rules and establishing incentive programs to improve credit flow to BMBEs.

SEC. 10. Technology Transfer, Production, and Management Training

This section establishes the funding mechanism and the key government agencies responsible for providing technical and training support to BMBEs.

1. The BMBE Development Fund

Funding Source: An endowment of Three Hundred Million Pesos (P300,000,000) from the Philippine Amusement and Gaming Corporation (PAGCOR).

Administrator: The fund is administered by the Small and Medium Enterprise Development (SMED) Council.

Purpose: The fund is dedicated to supporting initiatives for technology transfer, production and management training, and marketing assistance for BMBEs.

2. Implementing Agencies

The following government agencies are authorized to avail of the Fund to implement programs for BMBEs:

Department of Trade and Industry (DTI)

Department of Science and Technology (DOST)

University of the Philippines Institute for Small Scale Industries (UP ISSI)

Cooperative Development Authority (CDA)

Technical Education and Skills Development Authority (TESDA)

Technology and Livelihood Resource Center (TLRC)

3. Market Linkage and Reporting

Market Matching: The DTI is mandated to coordinate with the private sector and NGOs to link or match-up BMBEs with small, medium, and large enterprises (SMEs and LSEs), and to establish incentives for this linkage.

Annual Reporting: The DTI, on behalf of the other partner agencies, must furnish the appropriate Committees of both Houses of Congress with a yearly report detailing the development and accomplishments of their BMBE projects.

SEC. 11. Trade and Investment Promotion

This short but important section ensures that the data collected during the BMBE registration process is utilized for business growth:

Data Utilization: Data gathered from BMBE registration (which the government collects) must be made accessible to and utilized by private sector organizations and NGOs.

Purpose: The goal is to facilitate business matching, trade, and investment promotion efforts, turning registration data into an active tool for economic development.

PENALTY

Any violator of the provision of this act be punished by a fine of not less tahn 25K but not more than 50K and suffer imprisonment of not less than 6 months but not more than 200 years

CLASS NOTES

If you set up a corpo, and ikaw lang nandun, you’re taxed as a corp

To be taxed as a sole prop, you have to register. Reserve under DTI

personal expenses cannot be deducted in the case of an employee

corpos 2 taxes

itemized

Optional Standard Deduction

40%of gross income

If sole proprietor, sole proprietor lang

Sole proprietor can deduct expenses like a corporation

MCIT is actually 2% now pero 1% siya sa papers

4th taxable year

Normal Income = Gross - Expenses

if sole proprietor, u can pay 8% tax rate anytime

VAT Threshold = more than 3 M

OSD is pwede sole prop and mixed income earner

EXAMPLE

Man earns 50,000 a month

30,000 a month = 360,000

TI = 600,000

next, know the tax bracket

20% na yung long-term tax js months ago

EXAMPLE

if thru the lens of a corporation

600,000 - 360,000

tax rate is 20%

below 250K, no tax

NEED:

Tax table

calculator