AP Micro Unit 2

2.1 Demand

Demand is the different quantities of goods that consumers are willing and able to buy at different prices.

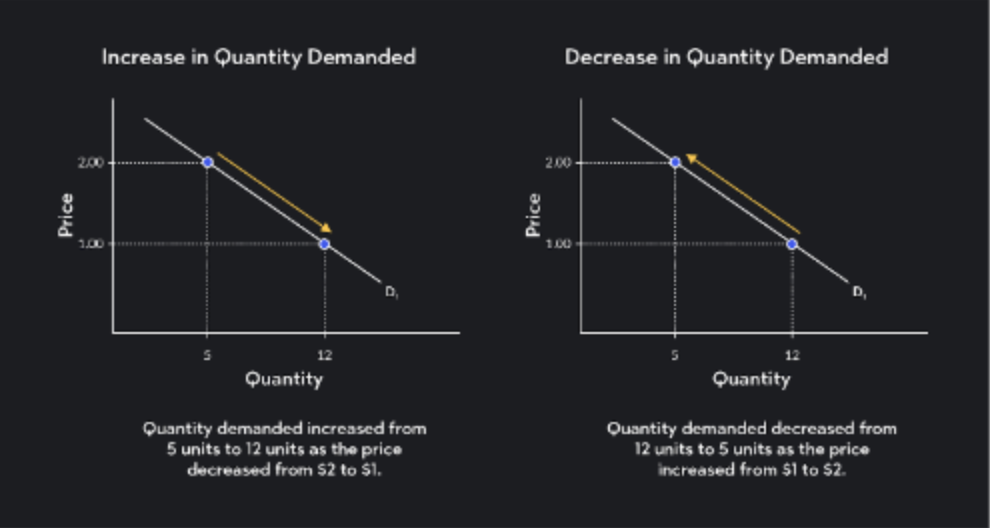

Law of Demand

There is an inverse relationship between price and quantity demanded; as the price of a good decreases, the quantity demanded typically increases, and vice versa.

Why does demand change?

The substitution effect

if the price goes up for one product, a consumer will buy more of a substitute product

The Income Effect

If the price goes down, the purchasing power increases for customers, allowing them to purchase more.

The Demand Curve

Downward sloping concave curve

Goes from high to low, inverse relationship to price

Each time price gets cheaper, more people want the product

Shifts in Demand

Ceteris paribus - “all other things held constant”

Price does not change demand, it changes quantity demanded.

5 Shifters of Demand

Tastes and preferences

Number of consumers

Price of related goods

Income

Future expectations

Price of Related Goods

Substitutes

goods used in place of another

Complements

two goods that are bought and used together

Income

Normal goods

ex: new cars

As income increases, demand increases

As income falls, demand falls

Inferior Goods

ex: ramen

As income increases, demand falls

As income falls, demand increases

2.2 Supply

Supply

the different quantities of good that sellers are willing and able to sell (produce) at different prices

Higher the price is, the more you’ll want to supply!

Law of Supply

There is a direct (positive) relationship between price and quantity supplied.

As the price goes up, the quantity supplied by producers will go up.

If supply increases, the original supply curve will be replaced by a supply curve located to the right of the original (the original curve experienced a rightward shift). If supply decreases, the original supply curve will be replaced by a supply curve located to the left of the original (the original curve experienced a leftward shift). It is appropriate to use "right" and "left" to categorize these shifts because supply is measured on the x-axis and numbers get larger as you head to the right on the x-axis and smaller as you head to the left on the x-axis.

5 Shifters of Demand

Price/availability

Number of sellers

Technology

Government action: taxes and subsidies

Expectations of future profit

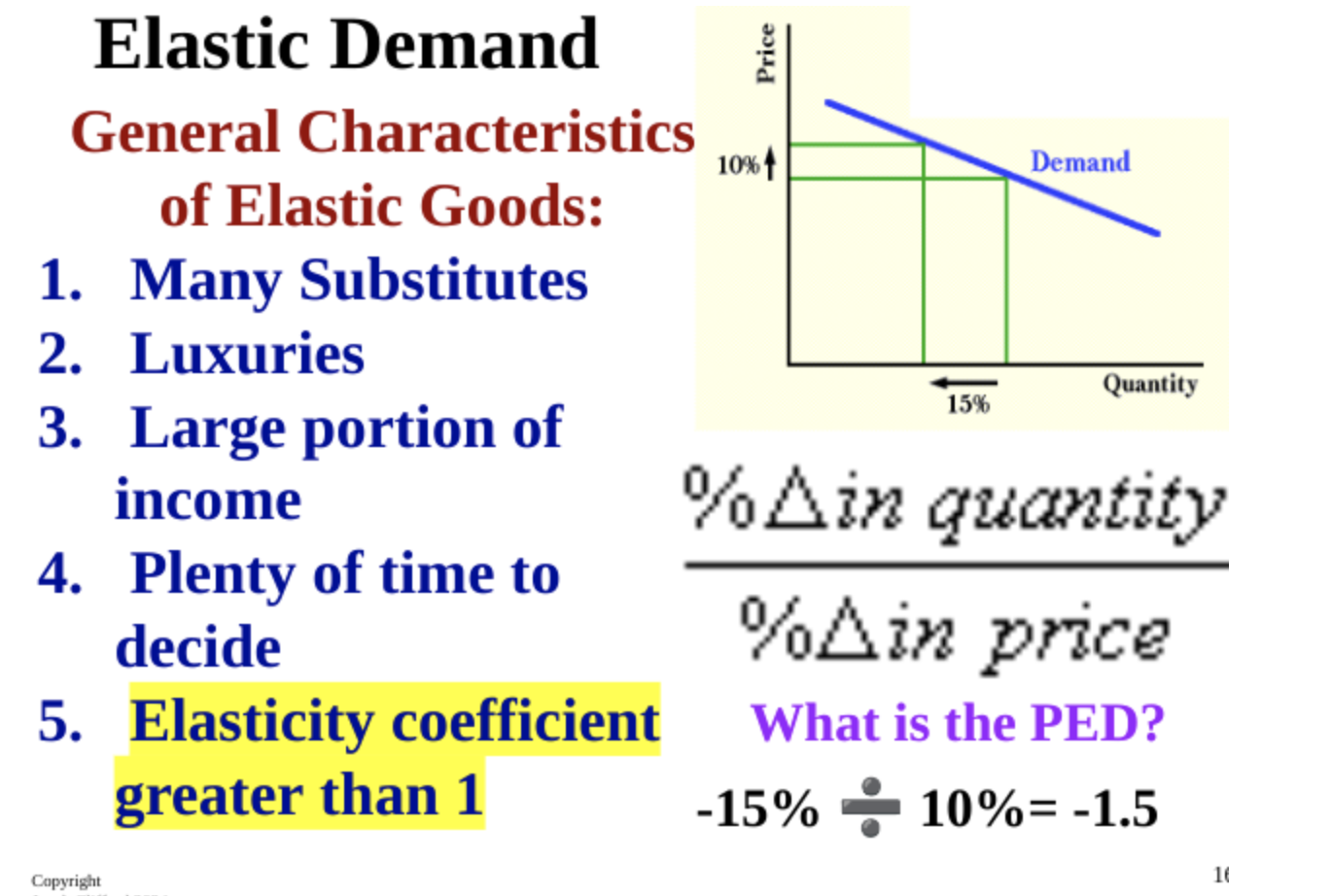

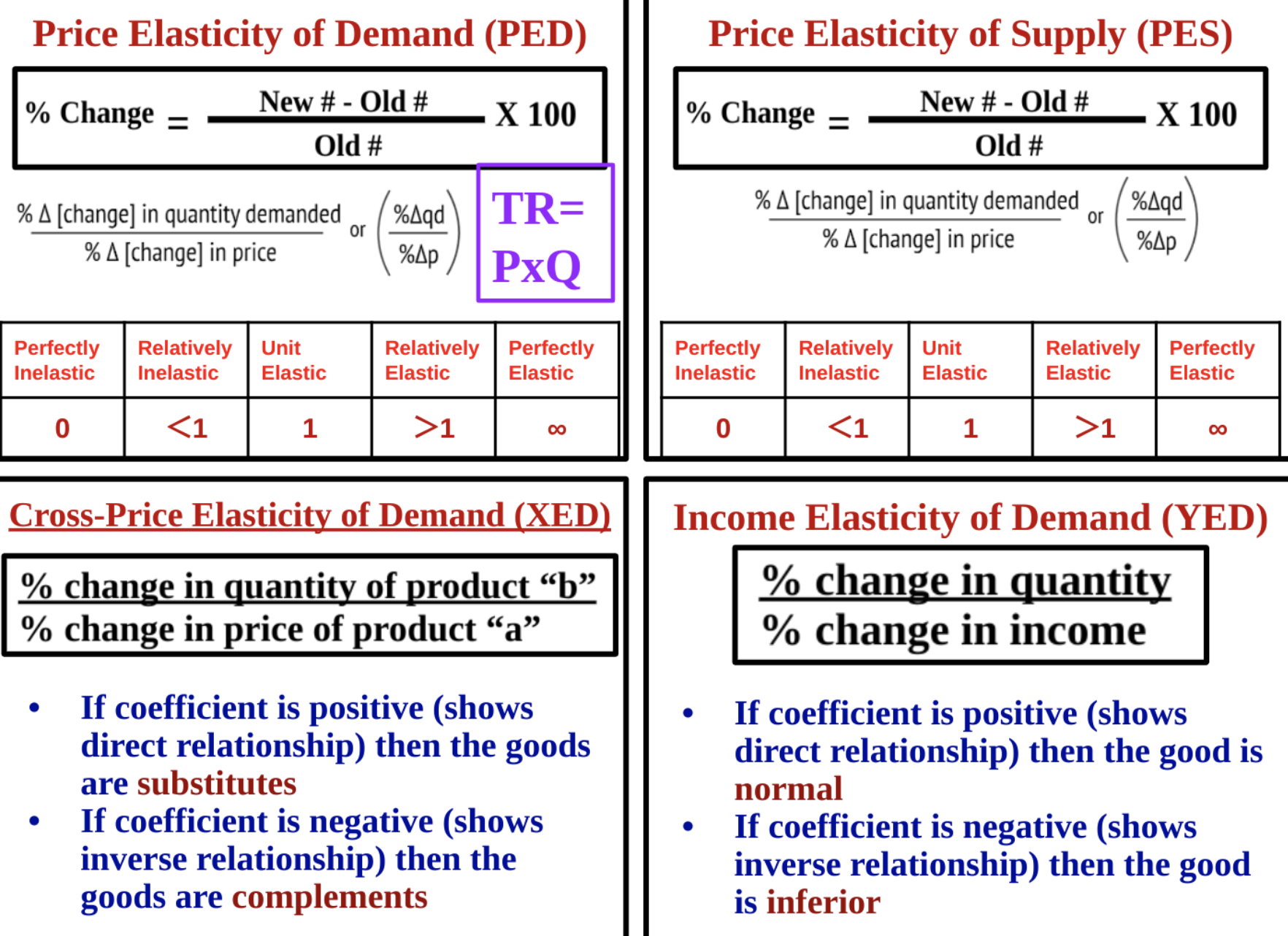

2.3-2.5 Price Elasticity of Demand

Elasticity

Determines how much more or how much less

Consumers will buy more when prices go down and less when prices go up

Price Elasticity of Demand

Knowing how much consumers will respond to a change in price is useful to firms

Why it matters:

Helps them decide what to charge and when, if ever, to have sales

Helps them determine substitutes in the market

Can be used by the government to decide when and how much to tax

(Absent Friday)

Total Revenue Test

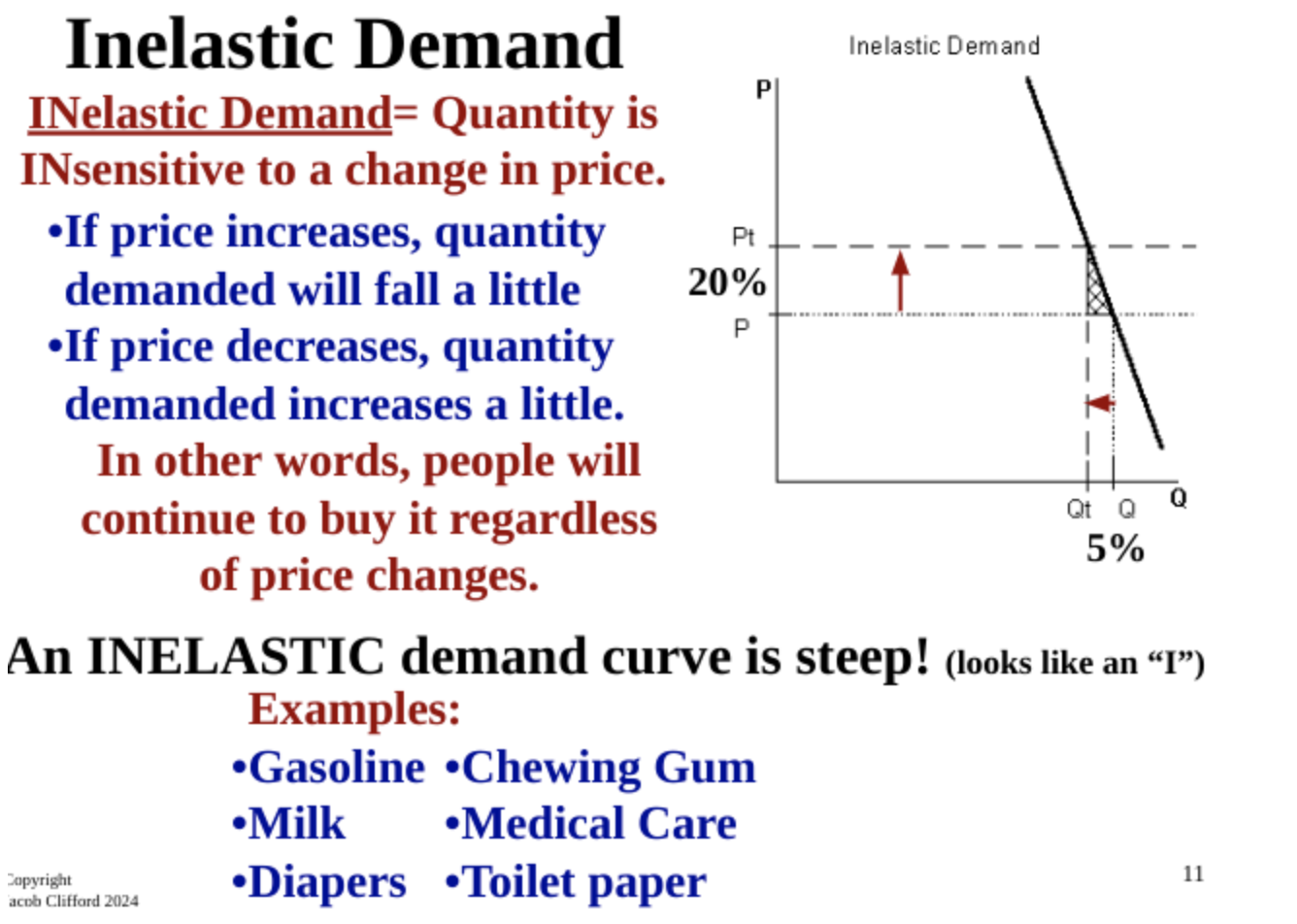

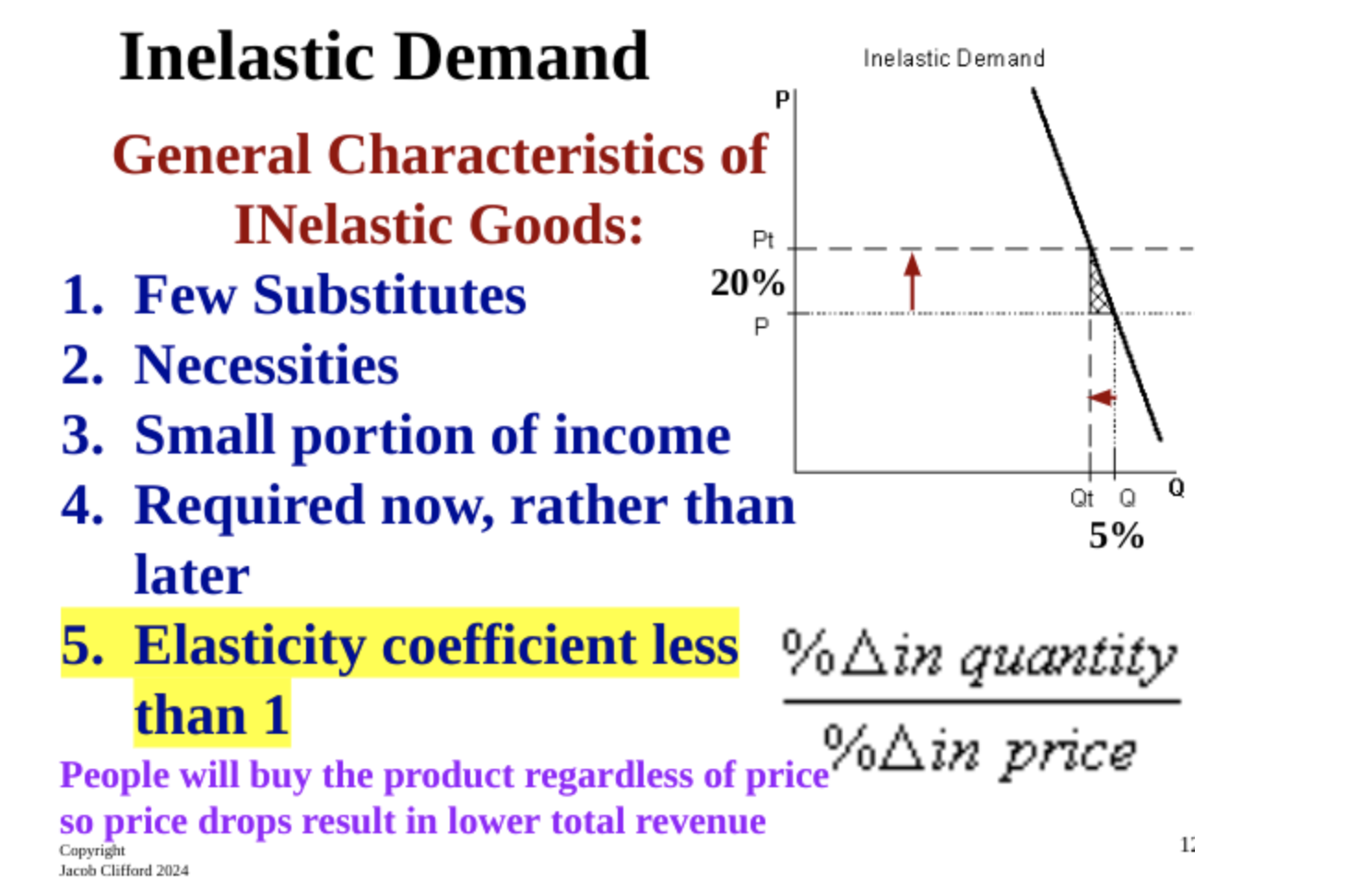

Inelastic

Price increase, causes total revenue to increase

Price decrease, causes total revenue to decrease

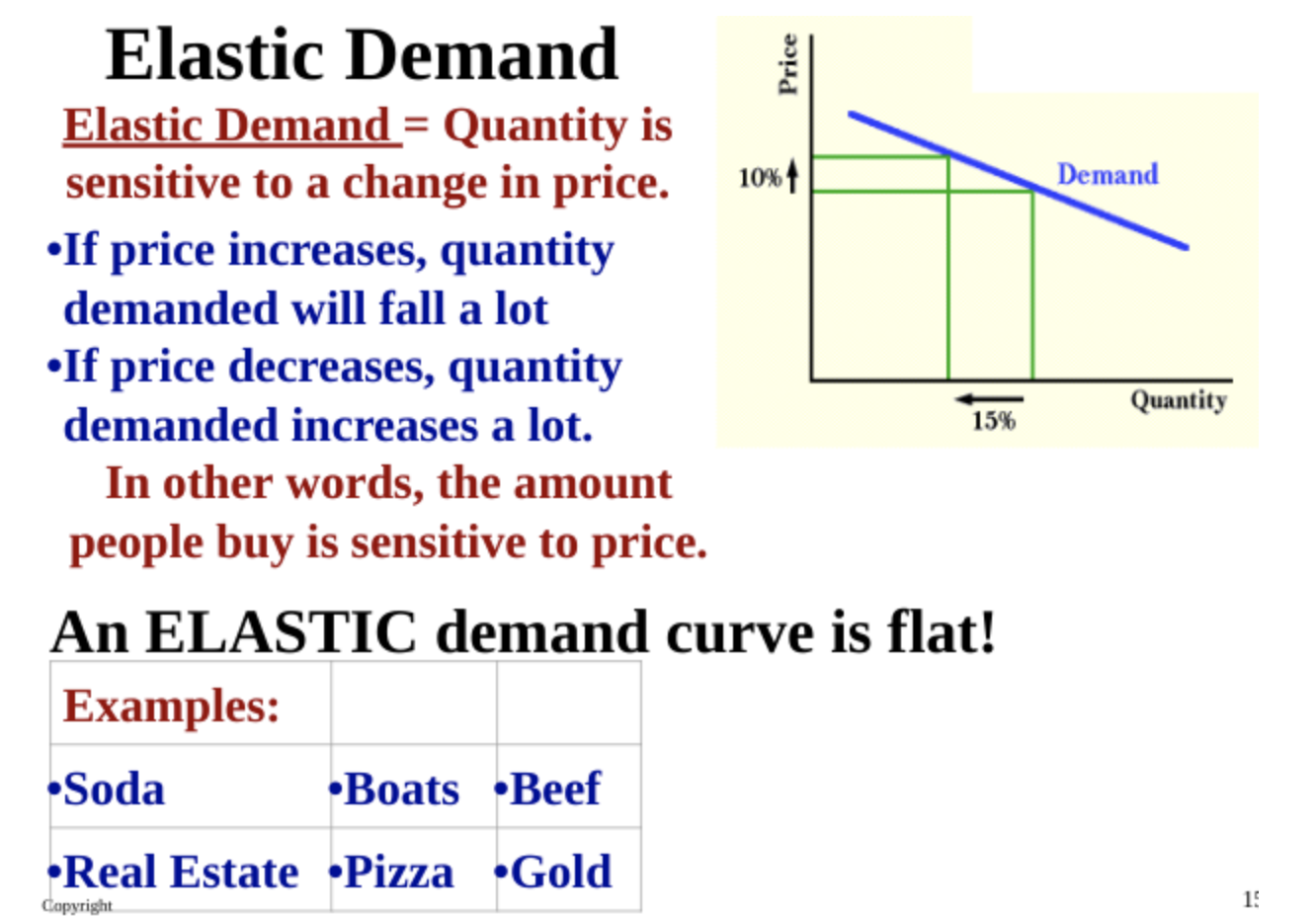

Elastic

Price increase, TR decrease

Price decrease, TR increase

Greater than 1 = elastic

Less than 1 = inelastic

Equal to 1 = unitary elastic

Price Elasticity of Supply

Elasticity of supply shows how sensitive producers are to change in price.

In elastic - insensitive to a change in price

Elastic - sensitive to a change in price

2.6-2.7

Double Shifts

If two curves shift at the same time, either price or quantity will be indeterminate.

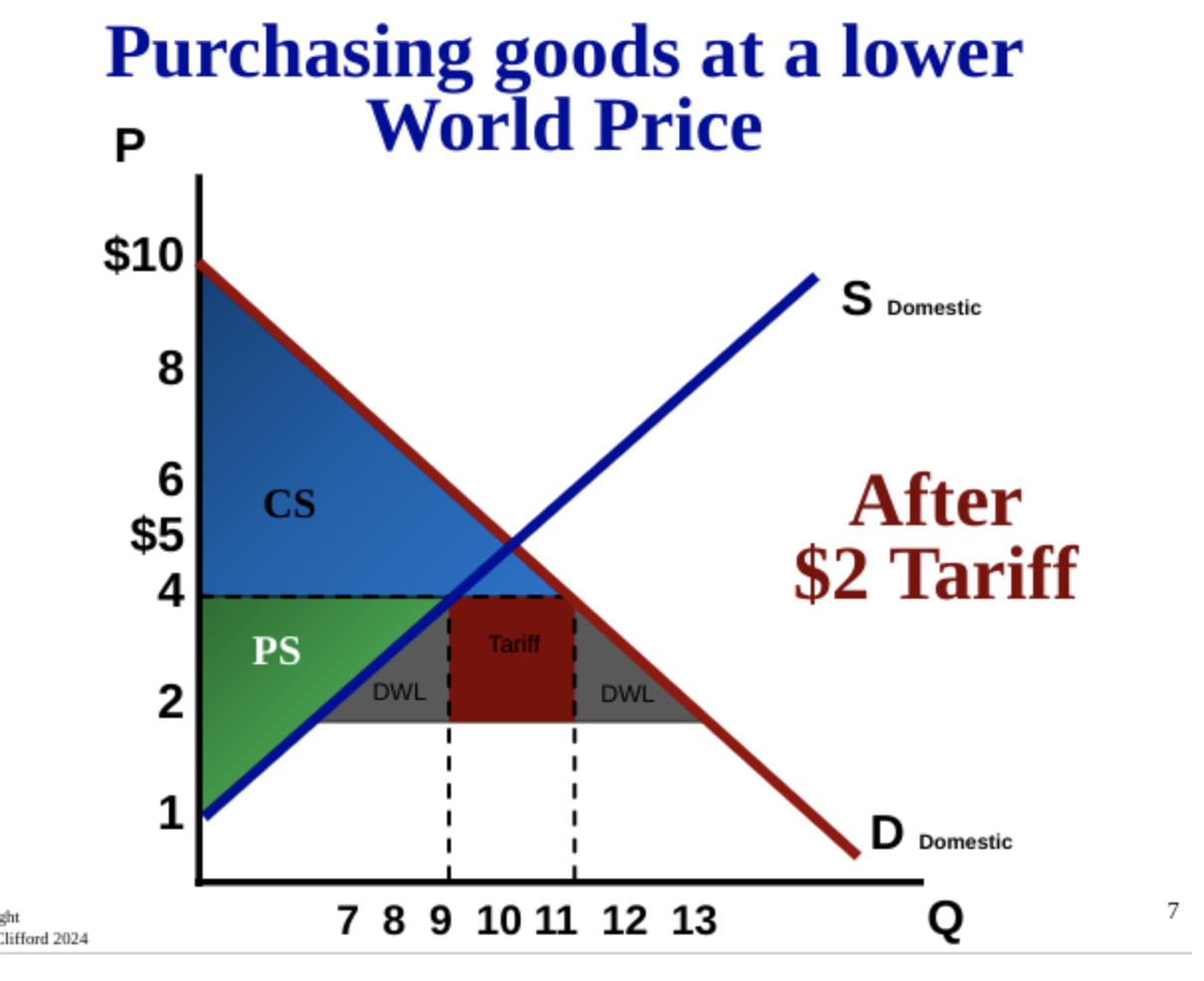

Deadweight loss

This refers to the loss of economic efficiency resulting from a market distortion, such as taxes, subsidies, or price controls, which prevent the market from reaching equilibrium. When these interventions are in place, the quantity of goods traded decreases, leading to a reduction in total welfare for both consumers and producers. In essence, deadweight loss represents the lost economic benefit that occurs when the optimal price and quantity are not achieved.

Consumer surplus

the difference between what you’re willingly to pay and what you pay

CS = buyer’s maximum - price

Producer Surplus

difference between the price the seller received and how much they’re willingly to sell it for

PS = Price - Seller’s minimum

2.8 The Effects of Government Intervention in Markets

Price floor - lowest price a product is allowed to be

Price ceiling - highest price a product is allowed to be

Excise Taxes

A per unit tax on producers

For every unit made, the producer must pay money, not a lump sum (one time only) tax.

The goal is form them to make less of the goods the government deems dangerous or unwanted

2.9 Tariffs

World Price - countries can buy products at their own domestic price or they can buy the products at a cheaper world price

Tariff - tax on imports that increases the world price

made to protect domestic producers from a cheaper world price

to prevent domestic producers from a cheaper world price

Quota - a limit on number of imports