Unit 3 P1

M16

Aggregate Demand

all good and services (real GDP) that buyers are willing and able to purchase at different price levels

Consumer spending has a large effect on the economy b/c it usually accounts for 2/3 of GDP

biggest impact on consumer spending is disposable income (income after taxes)

Consumption functions show how a household consumer’s spending varies with the household’s current disposable income

Marginal propensity to consume or MPC is the increase in consumer spending when disposable income rises by $1

Consumption Function graph

y intercept, A, is the amount the household would spend if its current disposable income was 0

slope of the consumption function is the MPC

Effects of Government Spending

If the government spends x amount of money, aggregate demand (AD) will not increase by the same amount

Government spending becomes income for consumers → AD increases

Consumers take that money and spend, further increasing AD

The amount by which AD increases depends on how much new income consumers save

if they save a lot, spending and AD will increase less and vice versa

The Multiplier Effect

An initial change in spending will set off a spending chain that is magnified in the economy

Total change in GDP = Multiplier * Initial change in spending

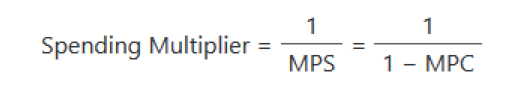

Calculating the Spending Multiplier

Marginal Propensity to Save (MPS)

How much people save rather than consume when there is a change in income

MPS = 1 - MPC (b/c people can either save or consume)

Planned Investment Spending

decreases during economic downturns or periods of uncertainty

rising interest, lower consumer confidence, anticipated declines in demand

M17

Inverse relationship between price level and Real GDP output

if price level increases (inflation) → real GDP demanded falls

if price level decreases (deflation), real GDP demanded increases

Aggregate Demand (AD) Curve

Changes in price level don’t shift the curve, instead they cause a move along the curve

Why is AD curve downward sloping

Wealth Effect

Interest Rate Effect

Foreign Trade Effect

Wealth effect

higher price levels reduce purchasing power of money → decreases quantity of expenditure

lower price levels increasing purchasing power → increase expenditures

Decrease in income taxes → increased expenditures

Expected increase in future income leads to increase in spending

Interest Rate Effect

Price levels increase → lenders charge higher interest rates to get a return on their loans

Higher interest rates discourage consumer spending and business investment

As price level goes up, output goes down

Foreign Trade Effect

U.S. price levels rise → foreign buyers purchase fewer U.S. goods and Americans buy more foreign goods

Exports fall + imports rise → real GDP demanded falls

Price level goes up → output goes down

Shifters of Aggregate Demand

Increase in spending shifts AD right and vice versa

1. Change in Consumer Spending

Higher incomes

consumer expectations

household in debt

taxes

2. Change in Investment Spending

interest rates

future business expectations

productivity and technology

business taxes

3. Change in Government Spending

Government expenditures (defense + public works)

4. Change in Net Exports

exchange rates (currencies)

national income vs. abroad

M18 Aggregate Supply

Aggregate Supply (AS)

amount of goods and services (real GDP) that firms will produce in an economy at different price levels

differentiates btwn short run and long-run and has two different curves

Short Run AS

wage and resource prices will NOT increase as price levels increase

Long Run AS

wages and resources prices will increase as price levels increase

In the short run, if total revenue increases, real profits will increase; however, in long-run AS workers will demand higher wages to match prices → nominal profits increase, but since all prices and costs have increased, REAL profits are unchnaged

If real profit doesn’t change the firm has no incentive to increase output

Long Run (LR) Aggregate Supply (AS) graph

quantity in the long run is a fixed quantity, vertical line

assumption: in the long run, economy will be producing at full employment

3 Shifters of Aggregate Supply

Change in Resource Prices

prices of domestic and imported resources

supply shocks

inflationary expectations

i.e. if producers expect higher prices in the future ,workers will demand higher wages and costs will increase → decrease AS

Change in Actions of government (NOT GOV SPENDING)

taxes on producers

subsidies for domestic producers

change in productivity

change in productivity

Increase in national production → curve shifts right and vice versa

M19

Combination of AD and AS shows economy at full employment output

inflationary and recessionary gaps

economy can either be at full employment, recessionary gap, inflationary gap

inflationary gap

output is high and unemployment is less than NRU

actual GDP is above potential GDP (quantity is greater than LRAS)

correct by shifting SRAS to the left

Recessionary gap

output is low and unemployment is greater than NRU

actual GDP is below potential GDP

can be corrected by shifting SRAS to the right

Economic growth can only happen with an INCREASE in Ivestment Spending on Capital goods or capital spending

Capital Goods (CG) are things that companies purchase to increase their output in the future

Capital Spending (CS) includes things like machines, warehouses, new technologies etc.

Investment Spending actually causes a shift in both AD and AS

shift in AD caused by company’s increase in spending

shift in AS is caused by company’s new output as a result of the spending

Knowt

Knowt