Microeconomics Chap 13 Monopolisitc competition + Oligopoly

Chapter 13

The main reason for giving out patents is that it stimulates inventive activity. Because the costs of research are very high, the ability to obtain a patent makes the research more attractive

.

`

Oligopoly:a small group of firms in a market with substantial barriers to entry. Because relatively few firms compete in such a market, each can influence the price, and hence each affect rival firms.

In an oligopolistic market, each firm faces a downward sloping demand curve. Because of this slope, the firm can charge a price above its marginal cost, creating a market failure: inefficient consumption.

Monopolistic competition : a market structure in which firms have market power but no additional firm can enter and earn positive profits.

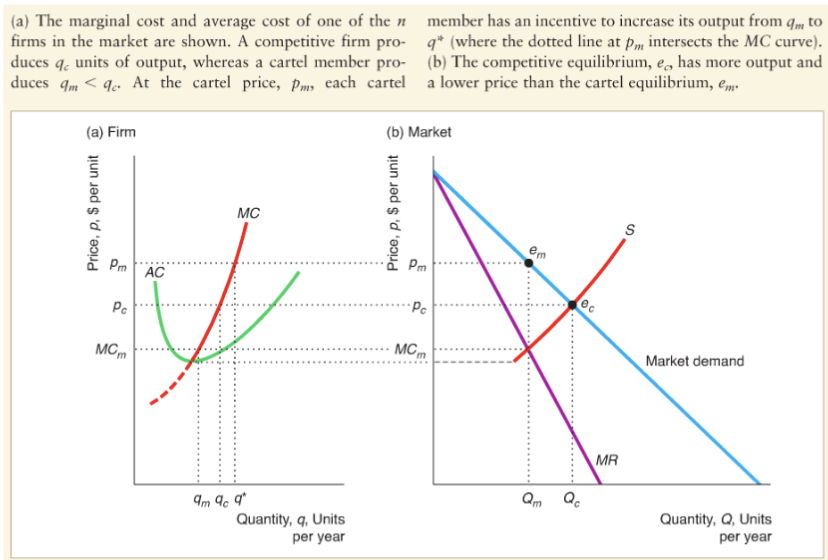

Cartel: a group of firms that explicitly agree to coordinate their activities.

🡪 By cooperating and behaving like a monopoly, the members of a cartel collectively earn the monopoly profit - the maximum possible profit.

13.2 Cartels

If firms successfully coordinate their actions, they can collectively behave like a monopoly.

Why cartels form ?

Firms have an incentive to form a cartel in which each firm reduces its output which leads to higher.

Firms have an incentive to form a cartel in which each firm reduces its output which leads to higher.prices and higher profits for individual firms and the firms collectively.

Cartels usually involve oligopolies, but they may form in a market that would otherwise be competitive.

A cartel chooses to produce a smaller market output than is produced by a competitive market.

The less elastic the market demand the potential cartel faces the higher the price the cartel sets and the greater the benefit from cartelizing.

LAWS AGAINST CARTELS

Antitrust laws and competition policies limit or forbid some or all cartels.

Cartels persist despite these laws for three reasons:

International cartels and cartels within certain countries operate legally. Ex: the Organisation of Petroleum Exporting Countries (OPEC).

Some illegal cartels operate believing that they can avoid detection or if caught that the punishment will be insignificant.

Some firms are able to coordinate their activity without explicitly colluding and thereby running afoul of competition laws.

WHY CARTELS FAIL

Cartels fail when:

Non-cartel members can supply consumers with large quantities of goods.

Each member of a cartel has an incentive to cheat on the cartel agreement.

🡪Once in the cartel, one firm can decide to again higher its output to maximise its profit be with only one firm cheating, the market price is not much modified and this might go unnotie

--> Prisoner's Dilemma game (Chapter 14: Game Theory)

MAINTAINING CARTELS

To keep firms from violating the cartel agreement, the cartel must be able to detect cheating and punish violators. Further, the members of the cartel must keep their illegal behavior hidden from customers and government agencies.

Cartels may use many techniques to detect cheating:

Some cartels give members the right to inspect each other's books.

Cartels may divide the market by region or by customers, so that a firm that tries to steal another firm's customer is more likely to be detected.

Other cartels use industry organizations to detect cheating. These organizations collect date on market share by firm and circulate their results.

Many methods are used to enforce cartel agreements, like contracts.

Sometimes government help creates and enforce cartels, e.g. lobbying.

`

Barriers to entry that limit the number of firms help the cartel detect and punish cheating.

--> The fewer the firms in a market, the more likely it is that other firms can detect that a firm cheats and the easier it is to impose costs on that firm.

`

MERGERS

If antitrust or competition laws prevent firms from colluding, they may try to merge instead.

--> That's why authorities restrict or forbid mergers in the cause they could be anti-competitive.

Also, the EC has been active in reviewing and blocking mergers.

It's a good idea to ban all mergers. No because some result in a more efficient production.

13.3. Cournot Oligopoly

Economists have many models of noncooperative oligopolistic behavior.

--> Which model is appropriate to use depends on the type of actions firms take, such as setting quantity or price, and whether firms act simultaneously or sequentially

Duopoly: an oligopoly with two firms.

THE DUOPOLY NASH-COURNOT EQUILIBRIUM

In the Cournot model, firms simultaneously choose quantities without colluding.

Firms have imperfect information about their rivals, each firm must choose its output before knowing what the other firms will choose.

In choosing its strategy to maximize its profit, each firm considers its belief about the output its rivals will sell.

Cournot introduced an equilibrium concept like Nash equilibrium (Chapter 14: Game Theory

Cournot equilibrium: A set of quantities chosen by firms such that, if, holding the quantities of all other firms constant, no firm can obtain a higher profit by choosing a different quantity.

🡪We look at equilibrium in a market that lasts only for one period, i.e. each firm chooses its quantity only once.

We make four assumptions:

The market has a small number of firms, and no other firms can enter.

The firms set their quantities independently and simultaneously.

The firms have identical costs.

The firms sell identical products.

EX: To determine the Cournot equilibrium, we need to establish how each firm chooses its quantity.

We determine its residual demand curve first, the market demand that is not met by other sellers at

![]() any given price.

any given price.

Graphical approach

The strategy that each firm uses depends on the demand curve it faces and its marginal cost.

In general, the residual demand function is the market demand function minus the supply of other firms.

D' (p) = D(p) -S°(p)

A firm wants to change its behavior if it is selling a quantity that is not on its best response curve.

In a Cournot equilibrium, neither firm wants to change its behavior.

Thus, in a Cournot equilibrium, each firm is on its best-response curve: each firm is maximizing its p given its correct belief about its rival's output.

The Cournot equilibrium is the intersection of the firms' best-response curves.

A firm's best-response curve gives the quantity it will supply given the quantity supplied by its rival.

Math approach (from Lecture)

To find the Cournot equilibrium:

Point where both firms play their best response

At the intersection of the 2 curves

qA=qB

To find the profit they make:

A= (P-AC) x qA

P = 100 – qA – qB

AC= MC =10

What is firm A's best response to any aB?

Inverse demand: P = 100 -Q --> P = 100 - qA-qB

Residual demand: P = (100 - qB) – qA

Total revenue: RA = (100 - qB) qAA

Marginal revenue: MR. = 100 - Qa--2QA

Profit maximisation: MRA = MCA

100 – qB--2qA =10

Best response curve: qA = 45 - 0.5qB

NB: Same approach to find qB

EQUILIBRIUM, ELASTICITY & THE NUMBER OF FIRMS

The price to consumers is lower if two firms set output independently than if they collude.

The price to consumers is even lower it there are more than (wo lirms acuing independently in the market.

Each Cournot firm maximizes its profit by operating where its marginal revenue equals its marginal cost

The Lerner Index: (p - MC) / p, is a measure or market power, the firm's ability to raise prise above marginal cost

🡪We find that a Cournot firm's Lerner Index depends on the elasticity the firm faces:

As the number of firms grows larger --> the residual demand elasticity a firm faces approaches -

--> So the Lerner index approaches zero, which is the same as with price-taking, competitive firms.

NB: If the number of firms is 1 then n = 1 and the Lerner Index is the same as for a monopoly.

NONIDENTICAL FIRMS

We initially assumed that the firms were identical in the sense that they faced the same cost functions and produced identical products.

However, costs often vary across firms, and firms often differentiate the products they produce from

those of their rivals.

Unequal costs

In the Cournot model, the firm sets its output to equate its marginal revenue to its marginal cost, which determines its best-response function.

If the firms' marginal costs vary, then the firms' best-response functions will as well.

In the resulting Cournot equilibrium, the relatively low-cost firm produces more.

🡪 So long as the products are not differentiated, they both charge the same price.

We can illustrate the effect of unequal costs using our earlier duopoly airlines example. Suppose that American Airlines' marginal cost remains at $147, but United's marginal cost drops to $99.

The firms continue to play Cournot, but the playing field is no longer level. United's output increases.

Differentiated products

By differentiation oligopolistic firm can shift its demand curve to the right and make it less elastic

🡪 The less elastic, the more the firm can charge.

Because differentiation makes demand curves less elastic,

🡪Price markups over marginal costs are usually higher when products are differentiated than when they're identical.

13.4. Monopolistic Competition

Monopolistically competitive markets do not have barriers to entry, so firms can enter the market until one new firm can enter profitably.

Monopolistically competitive firms face downward-sloping residual demand curves,

🡪So they charge prices above marginal cost

Monopolistically competitive firms face downward-sloping residual demand curves because the market.

In a monopolistically competitive market, each firm tries to maximize its profit however each makes zero economic profit due to entry.

Two conditions in a monopolistically competitive equilibrium

Marginal Revenue equals marginal cost > MR=MC

Price Equals Average Cost > P= MC

NB: Profit = 0

Minimum efficient scale (full capacity): The smallest quantity at which the average cost curve reaches its minimum.

🡪The firm's minimum efficient scale is the quantity at which the firm no longer benefits from economies of scale curve because its demand curve is downward sloping.

Thus, to be tangent, the AVC curve must be downward sloping.

Therefore, a monopolistically competitive firm operates at less than full capacity in (ne long run

NB: --> If the average cost were less than price at that quantity, firms would make positive profits and entrants Would be attracted.

> If average cost were above the price, firms would lose money, so firms would exit until the

marginal firm was breaking even,

The fewer monopolistically competitive firms

The less elastic the residual demand curve each firm laces

The higher the price.

The elasticity of demand for an individual Cournot firm is n

Where n = number of firms & = market elasticity

Similarly, the more differentiated are firms' products > the less elastic the residual demand curve and the higher the price.

The number of firms in equilibrium is smaller.

The greater the economies of scale and

The farther to the left the market demand curve

FIXED COSTS AND THE NUMBER OF FIRMS

The number of firms in a monopolistically competitive equilibrium depends on firms’ costs.

The larger each firm’s fixed cost, the smaller the number of monopolistically competitive firms in the market equilibrium

The lower the fixed costs, the more firms there are in the monopolistically competitive equilibrium

![]()

Knowt

Knowt