Inflation and unemployment measurement

INFLATION :

Inflation is defined as the general and continuous increase in average price levels in the economy, which erodes purchasing power and can affect economic stability. Hyperinflation , on the other hand , is very high levels of inflation

The opposite of inflation is deflation , it is the period of time where there is a continuous fall in the general price levels across the economy. Whereas, disinflation is a fall in the level of inflation , meaning that there is still inflation but at a lower rate

Consumer price index ( CPI ) is a measure of the price levels , used to measure inflation. It is produced to international standards so that comparisons can be made across different countries and time periods, allowing economists to analyse trends and make informed policy decisions. This index helps to measure the money a household needs to buy the same basket of goods at the same time in the previous year

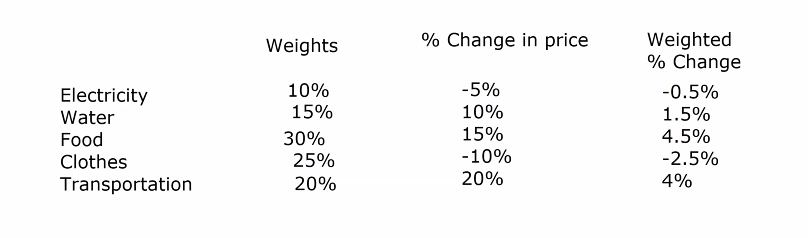

Showing the solving process using electricity:

The weighted change is calculated by multiplying -5 × 10% = -0.5%. Cpi weights are assigned based on their significance in consumers spending patterns

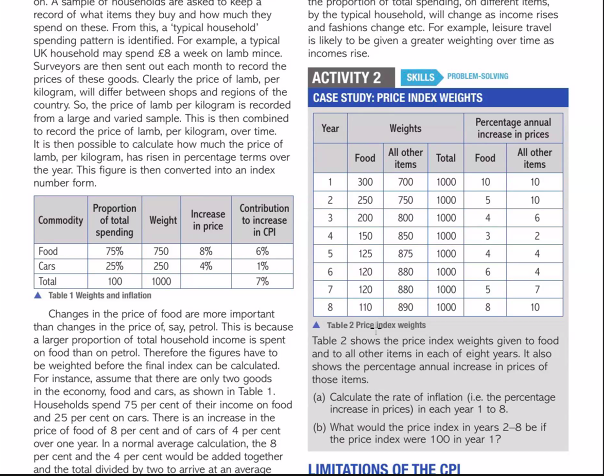

For activity 2 question b , in the second year , the RPI is 108.75 , so for the third years calculation , multiply 108.75 with the value or the third years inflation rate , which is 5.60%. The answer is 6.09 , then it will be added with 108.75.

The formulas for GDP :

real - nominal

gdp x index price of current year / index price of base yearnominal - real

gdp x index price of base year / index price of current year

The drawbacks of CPI:

CPI only provides information regarding how much it would cost to buy the same basket of good during the next year , however for some households the basket may change substantially

In theory , each household will have their own inflation rate

The index cannot indicate changes in the quality of goods, for example prices might rise because improvement rather than inflation

CPI excludes a number of items relating to housing such as interest repayments

Its difficult how to include new goods since their price level didnt exist in the previous year

The producer price index ( PPI ) is used to measure the change in price of a typical basket of good bought and sold by manufacturers of an economy. The PPI includes price indices of materials and fuels used by the manufacturers ( the input prices ) This helps understand the impact of inflation on producers rather than consumers

The PPI is used to indicate future trends of inflation , this is because higher prices paid by producers means their cost of production is increasing , as a result there might be cost push inflation as retailers will try to pass the costs onto consumers. However, there may be a time lag so the effect may take months to show on CPI

UNEMPLOYMENT:

The ILO defines unemployment as the those who are without a job , want a job and have actively looked for a job for the last four weeks and can start working within the next two weeks

The population of the working age : 16-65

According to the ILO, anyone who works even one hour of paid work during a week is employed. The labour force is made up of those in employment ( full time and part time ) and those who are unemployed , they are also known as the economically active population. Those who are out of work but dont meet the ILO’s criteria of unemployment are economically inactive. Examples include :

students

stay at home parents

people who are retired early

those unable to work due to sickness

The term hidden unemployment is used for those who wish to work but arent actively seeking work , they are not officially counted as unemployed , usually they dont get government benefits.

The underemployed are those who work but wish to work more hours or do a more skilled job , such as part timers who wish to work full time and make full use of their skill and abilities.

In short,

the population of the working age ( 16 - 65 ) = economically active population + economically inactive population

the labour force ( economically active population ) = those in employment + ILO unemployed

The ILO unemployment rate is calculated using the “Labour Force Survey” ( LFS ). The survey asks questions about individuals personal circumstances and their activity in the labour market.

ILO unemployed rate =( ILO unemployed / economically active population ) x 100

Four important statistics :

The employment rate is the number of those in work divided by the population of those in working rate , expressed as a %

ILO unemployment rate is unemployed divided by the economically active population , as a %

The activity rate or participation rate is the number of those in work or unemployed divided by the working population age

The inactivity rate is the number of those in the inactive population divided by the population of the working age

Different types of unemployment:

structural employment : this is when the demand for labour is less than its supply in an individual labour market in the economy. This can be broken down into different parts : 1. regional unemployment , where unemployment differs between regions because factors of production are geographically immobile. 2. sectoral unemployment , where unemployment occurs because people are laid off as the industry they are in is in a decline. 3. technological unemployment is when groups of workers lose their jobs as its taken over by new technology.

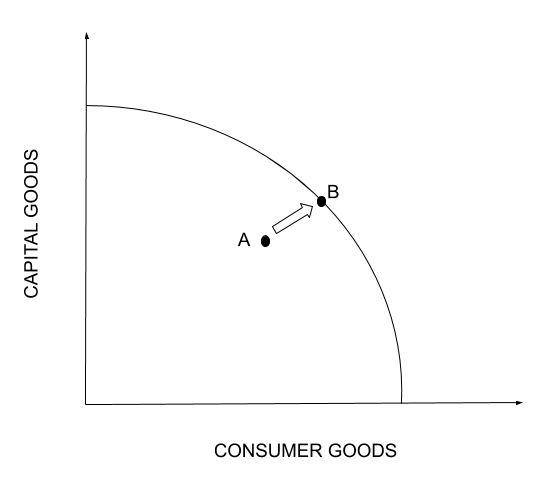

cyclic or demand deficit unemployment : this occurs when there is insufficient aggregate demand in the economy for enough workers to get a job. Cyclical unemployment will be higher when the economy is in a recession. Capital is also underutilised

at point A there is unemployment

Frictional unemployment : Frictional unemployment refers to the short-term unemployment that occurs when people are between jobs or are entering the workforce for the first time. It is a natural part of the job search process, as individuals may leave a job voluntarily to seek better opportunities. There is always a level of frictional unemployment when people switch jobs.

Real wage unemployment or classical unemployment : Real wage is wage that is adjusted for inflation. This is when real wage rates are at a level above the equilibrium. Or if its too low , some workers may simply prefer to not take low paying jobs as the welfare benefit payments are higher.

Seasonal unemployment : this is when workers become unemployed during certain times of the year depending on seasons , such as higher unemployment during winters when workers are laid off and in summer unemployment falls as they are taken in again.