Chapter 16: Public Goods, Externalities, and Information Asymmetries

Private goods - Produced through competitive market system; offered for sale

Rivalry - When one person buys and consumes a product, it is not available for another person to buy and consume

Excludability - Sellers can keep people who do not pay for a product from obtaining its benefits

Market demand - Horizontal summation of the individual demand schedules

Consumers demand private goods, and profit-seeking suppliers produce goods that satisfy the demand

Public goods

Non-rivalry - One person’s consumption of a good does not preclude consumption of the good by others

Non-excludability - No effective way of excluding individuals from the benefit of the good once it comes into existence

Free-rider problem - Once a producer has provided a public good, everyone including nonpayers can obtain the benefit

Example: Public streetlights, which can be used by everyone even if they didn’t pay for it

Provided by gov’t through taxation

Optimal quantity is defined as MB = MC

Demand for public goods

Demand schedules show the price someone is willing to pay for the extra unit of each possible quantity

Find collective willingness to pay for each additional unit → Construct willingness-to-pay schedule for public good

Adding the prices that people are willing to pay for the last unit of the public good at each possible quantity demanded

Downward-sloping

Comparing MB and MC

Supply curve = Marginal cost curve

Law of diminishing returns

MB = MC → Cost efficiently allocates resources

Cost-benefit analysis - Used to decide whether to provide a particular public good and how much of it to provide

Total benefit > Total cost → Project is economically justifiable

Increase output as long as MB > MC

Marginal-cost-marginal-benefit rule - Tells us which plan provides the maximum excess of total benefits over total costs or, in other words, the plan that provides society with the maximum net benefit

Externalities - Cost or a benefit accruing to an individual or group—a third party—that is external to a market transaction

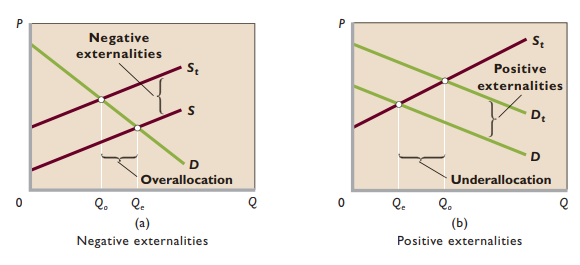

Negative externalities

Overproduction + resource overallocation

Firm’s supply curve lies to the right of (or below) the full-cost supply curve S, which would include the spillover cost

Transfers costs to society

Positive externalities

Underproduction + resource underallocation

Market demand curve D lies to the left of (or below) the full-benefits demand curve

Coase theorem - Government is not needed to remedy external costs or benefits where (1) property ownership is clearly defined, (2) the number of people involved is small, and (3) bargaining costs are negligible

Limitations

Many externalities involve many people affected + high bargaining costs

Must rely on gov’t to represent millions of affected parties

Example: If a business that produces machines in a factory is subject to a noise complaint initiated by neighboring households who can hear the loud noises of machines being made, the business may choose to offer financial compensation to the affected parties in order to be allowed to continue producing the noise or the business might refrain from producing the noise if the neighbors can be induced to pay the business to do so

Liability rules + lawsuits

Laws that define private property + protect from damage done by other parties

Remedy some externality problems

Private lawsuits to solve externalities also have limitations

Gov’t intervention

Direct controls - Legislation limiting activities causing negative externalities; raise marginal cost of production

Specific taxes - Taxes/charges specifically on related good; shifts private supply curve left

Subsidies + gov’t provision

Subsidies to buyers

Subsidies to producers

Gov’t provision (providing as public good)

Market-based approach to negative externalities

Tragedy of the commons - As long as “rights” to air, water, and certain land resources are commonly held and are freely available, there is no incentive to maintain them or use them carefully. As a result, these natural resources are overused and thereby degraded or polluted

Market for externality rights - Market-based approach to correcting negative externalities

Cap-and-trade program - An appropriate pollution-control agency determines the amount of pollutants that firms can discharge into the water or air of a specific region annually while maintaining the water or air quality at some acceptable level

Reduces society’s costs

Monetary incentive not to pollute

Example: Environmental Protection Agency (EPA)

Society’s optimal amount of externality reduction

Upward sloping MC, downward sloping MB

Optimal reduction of an externality - Occurs when society’s marginal cost and marginal benefit of reducing that externality are equal (MC = MB)

MB and MC curves can shift over time

Climate change

Climate-change problem - The earth’s surface has warmed over the last century by about 1 degree Fahrenheit, with an acceleration of warming during the past two decades

Kyoto Protocol

Climate change policies will create costs as well as benefits

Market mechanism will adjust based on climatic realities (ex. AC sales rising)

Transition costs - Costs of making economic adjustments

General policies to reduce carbon admissions

Carbon tax

Cap-and-trade program

Information failures

When either buyers or sellers have incomplete or inaccurate information and their cost of obtaining better information is prohibitive

Asymmetric information - Unequal knowledge possessed by the parties to a market transaction

Gov’t should increase info available to market participants

Inadequate buyer info about sellers

Can cause underallocation of resources

Examples: Gasoline market + licensing of surgeons

Inadequate seller info about buyers

Moral hazard problem - Tendency of one party to a contract or agreement to alter her or his behavior, after the contract is signed, in ways that could be costly to the other party

Adverse selection problem - Arises when information known by the first party to a contract or agreement is not known by the second and, as a result, the second party incurs major costs

Qualification - Ways to overcome information difficulties (Finding ways to overcome information difficulties without government intervention)

Many firms offer product warranties to overcome the lack of information about themselves and their products

Franchising

Example: When you visit a Wendy’s or a Marriott, you know what you are going to get, as the service offered is the same at every location

Knowt

Knowt