International Trade and Public Policy

Changing Equilibria from Trade

Trade leads to reallocation of resources based on comparative advantage

While total surplus increases, indicating overall economic gains, there are winners and losers

Consumers benefit from imports (lower prices)

Producers benefit from exports (higher prices)

Impact of Imports

If the world price is lower than the domestic price:

The country will import the good

Domestic price decreases to match the world price

Consumer surplus increases due to lower prices

Producer surplus decreases as domestic producers receive less for their goods

Total surplus increases, indicating a net gain from trade

Impact of Exports

If the world price is higher than the domestic price:

The country will export the good

Domestic price increases to match the world price

Producer surplus increases due to higher prices

Consumer surplus decreases as consumers pay more

Total surplus increases, reflecting gains from trade

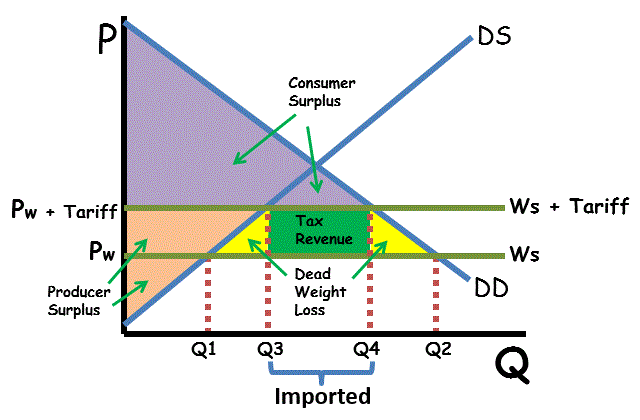

Trade and Tariffs

Quota rent: difference between demand price and supply price

Tariffs: tax placed on a good that is imported or exported

Import quota: restriction on the quantity of a good that can be imported

The purpose of a tariff is to make imported goods more expensive, thereby encouraging consumers to purchase domestically produced items.

Tariffs raise the price of imported goods

Higher prices lead to a decrease in the quantity of imports

Domestic producers may benefit from reduced competition and higher prices

Consumers face higher prices and fewer choices

Tariffs can lead to a deadweight loss, which represents the loss of economic efficiency when the equilibrium outcome is not achievable or not achieved

This loss occurs because some mutually beneficial trades between buyers and sellers do not happen due to the tariff-induced price increase

Tariffs generate revenue for the government, calculated as the tariff amount multiplied by the quantity of imports

While tariffs can protect domestic industries, they often lead to higher prices for consumers and a net loss in total surplus due to deadweight loss