ECONS QUESTIONS EOY YEAR 3

Economics Y3 EOY

COLOR CODING

RED - explanation

BLUE - textbook definition

YELLOW - points

GREEN - less important point

PURPLE - Adv, Disadv

Market Economic System

QK. What is a market economic system?

The market economic system is an economic system where supply and demand direct the production of goods and services, there is no government intervention in a market economic system, all resources are privately owned, prices are determined by the demand of goods and services, and everyone is motivated by self-interest

QK. What is self interest?

Where producers tries to maximize profit and consumers tries to maximize satisfaction from the consumption of goods and services

Q1. State 3 limited roles of the government in a market system. [4]

Regulator. As a regulator the government enforces laws and regulations so there’s no cheating happening in trade ensuring the market is working properly

Consumer. Buy goods and services from private firms for government needs/government operations

Producer. employ factors of production (immigration services, policing services)

A government may or may not exist in a market economic system, and if its exists it probably have very little power

Q2. State the overall aim of the market system. [2]

Bring a more efficient allocation of resources and use of scarce resources to improve social and economic welfare to society

Advantages of the Market Economic System

Q3. Explain 3 advantages of a market economic system. [6]

More variety of goods and services will be produced, this is due to consumer sovereignty, where consumers influence the types of goods and services produced, so firms compete to maximize profit by making a more variety of G&S that appeals to the consumers, giving them more choices

Firms respond quickly to changes to consumer wants and spending patterns (trends) bc, are profit-motivated motivated will quickly allocate their resources to areas where there are more profits, bc more follow trend → more demand → more profits, thus scarce resources are not wasted

Firms will develop new and better products, bc profit is motivated, they develop new and better products to gain the upper hand over competitors so that they can earn and sell more than their competitors

Market Failure

Q4. Define ‘market failure’. [2]

Market failure is a situation where the free market is unable to achieve an efficient allocation of resources from society’s point of view.

QK. What causes market failure

Merit and demerit goods

Positive and negative externalities

Public goods

Externalities

Q5. Define ‘externality’. [2]

Spillover effects arising from the production or consumption of a good on other people

Q6. Define ‘positive externality’. [2]

This is a spillover benefit to third parties due to the actions of an individual or firm, creating an external benefit.

Q7. Define ‘negative externality’. [2]

This is a harmful spillover effect on third parties due to the actions of an individual or firm, creating an external cost.

Q8. Definition ‘private benefit’ and ‘private cost’. [2]

The benefits enjoyed by the person or firm when consuming or producing the product. The costs incurred by the person or firm when consuming or producing the product.

Q9. Define ‘external benefit’ and ‘external cost’. [2]

The benefit enjoyed by a third party without having to pay for it.The costs incurred by a third party, and not by those responsible for the harmful activity

Q10. Define ‘social benefit’ and ‘social cost’. [2]

The total benefits of an activity to society, the total costs of an activity to society

Q11. State the effects of a negative and positive externality. [2]

Negative - There will be high social costs and harmful spillover effects. (pollution, smoking)

Positive - There will be high social benefits and spillover benefits. (education)

Q12. Explain how negative externalities cause market failure. [4]

The social cost will be high if a product creates a lot of negative externalities and high external costs during consumption or production. The social costs will be more than social benefits, meaning that this is an uneconomic use of resources, and the good is over-produced and over-consumed. It reduces the economic welfare of society, and hence market failure since resources are not used efficiently.

Q13. Explain how positive externalities cause market failure. [4]

Positive externalities bring high social benefits (external benefits) and private benefits upon consumption. If this is done on a large scale, the social benefits will be more than social costs, meaning that this is an economic use of resources. However, the good is under-produced and under-consumed. Hence, there is market failure since resources are not used efficiently.

so, too much consumption and production of positive externalities means resources are not being used efficiently, and resources are being strained, resources can be used in other areas in need

Merit & demerit Goods

Q14. Define ‘merit goods’ and ‘demerit’ goods. [2]

Merit goods - Socially desirable goods, with high external benefits when consumed, but are under-consumed (education, healthcare)

Demerit goods - Socially undesirable goods, with high external costs when consumed, but are over-consumed (alcohol, sugar, cigarettes)

Q15. Explain how merit goods cause market failure. [4]

Underconsumption and underproduction of merit goods in a free market, bc consumers don’t take into account the high external benefits when consuming (consumers don’t buy it), bc they only look at short term, and cost of production is expensive. people do not realize the full extent of private benefit to themselves

Q16. Explain how demerit goods cause market failure. [4]

Overconsumption and Overproduction of demerit goods in a free market, bc consumers don’t take into account the high external costs when consuming them (consumers consumes too much), bc, they only look at short term, addicting sometimes, people do not realize the full extent of private costs to themselves

Public Goods

Q17 Define ‘public goods’. [2]

They are goods that are non-rivalrous and non-excludable.

Q18. Explain how public goods cause market failure. [4]

Since they are non-rivalrous and non-excludable, it is impossible to charge a price to the consumers based on how much they have used and benefitted. Thus the free-rider problem arises, where they can enjoy the good without paying, and overconsumption of this leads to it being unprofitable, but such goods are socially and economically desirable, so its a welfare loss if public goods are not produced

Consequences of Market Failure

Q19. Explain the consequences of market failure. [4]

Zero production of public goods. Under-consumption and under-production of merit goods and goods with high external benefits, Over-consumption and over-production of demerit goods and goods with high external costs.

This all leads to welfare loss because society’s social and economic welfare is not maximized.

Mixed Economic System

Q20. Define ‘mixed economic system’. [2]

An economic system that combines the use of free market economic system with some government planning and control to determine the allocation of resources in the economy. (public and private sector)

Government Intervention

Q21. Define ‘direct provision’ and state 2 market failures it is used to correct. [4]

Government producing and supplying goods and services DIRECTLY to people.

it corrects market failure being lack of public goods, under-production of merit goods and goods with high external benefits.

Q22. State 2 advantages of direct government provision. [4]

It can directly increase the supply of public goods and merit goods that are under or not provided in a free market.

More people can consume the good at lower prices or “free-of-charge”

Q23. State 2 disadvantages of direct government provision. [4]

Opportunity cost may be high, the money used on government provision can be used somewhere else.

Government may increase taxes to provide the goods at a subsidised price, hence a greater tax burden for people.

Regulations

Q24. Define ‘regulations’ and state 2 market failures it is used to correct. [4]

Legal rules made by a government to control the behavior of the people and firms, or control the way something is done.

the market failures it is used to correct are over-consumption of demerit goods and activities with high external costs under-production of merit goods and goods with high external benefits.

Q25. State 2 advantages of regulations. [4]

Regulations, such as a total ban or restrictions, are usually quite

effective in correcting market failure directly

It is simpler to implement than other policies.

Q26. State 2 disadvantages of regulations. [4]

Regulations that restrict or ban production

may force companies to shut down, increasing unemployment

If the penalty is too low, people and firms may not comply with the regulations.

Q27. Define ‘price ceiling’ and reasons for setting one. [2]

A legal MAXimum price on a good set by the government that is below the market equilibrium price.

To make certain essential goods affordable to the poor

To prevent monopoly firms from overcharging consumers

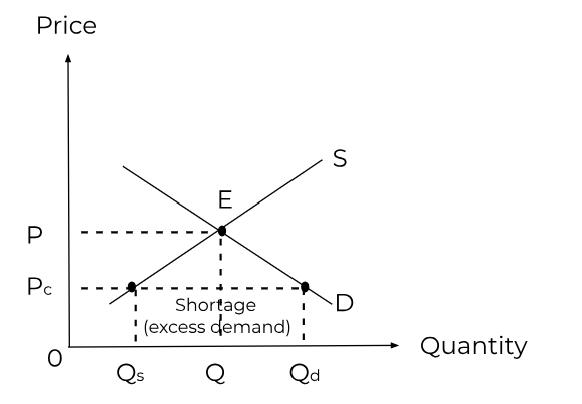

Q28. Draw a demand and supply diagram to illustrate price ceiling. [6]

Original market equilibrium price (P) is too high. So, the government sets a maximum price (price ceiling) of Pc, making it illegal to charge a price above Pc. At Pc, quantity supplied decreases to Qs but quantity demanded increases to Qd. Since Qd is more than Qs, there is excess demand for Qd-Qs

Q29. Define ‘price floor’ and reasons for setting one. [2]

A legal MINimum price on a good set by the government that is above the market equilibrium price.

To support producers by increasing their income received

To reduce consumption of demerit goods by increasing the price paid

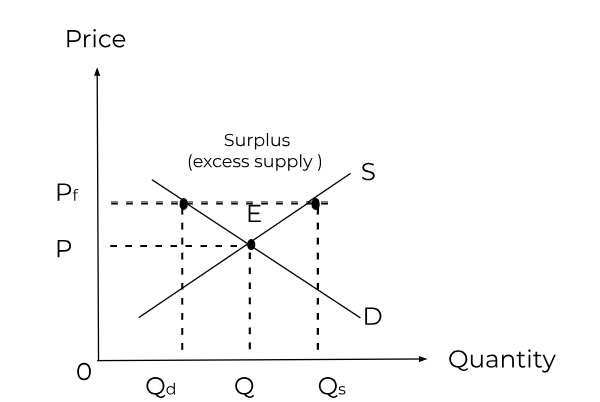

Q30. Draw a demand and supply diagram to illustrate price floor. [6]

Original market equilibrium price (P) is too low. So, the government sets a minimum price (price floor) of Pf, making it illegal to charge a price below Pf. At Pf, quantity supplied increases to Qs but quantity demanded decreases to Qd. Since Qs is more than Qd, there is excess supply of Qs-Qd.

Q31. State 2 advantages of price ceiling/price floor. [4]

Maximum price directly prevents monopoly firms from over-charging consumers

Minimum price directly ensures that the price of demerit goods is kept high

Q32. State 2 disadvantages of price ceiling/price floor. [4]

Minimum price may be ineffective if demand for the demerit good is price inelastic.

Price controls may encourage smuggling and black markets.

Indirect Taxes

Q33. Define ‘indirect taxes’ and state the market failure it is used to correct. [2]

Taxes imposed on goods and services, taxes but secretly

Its used to correct the over-consumption of demerit goods and activities with high external costs

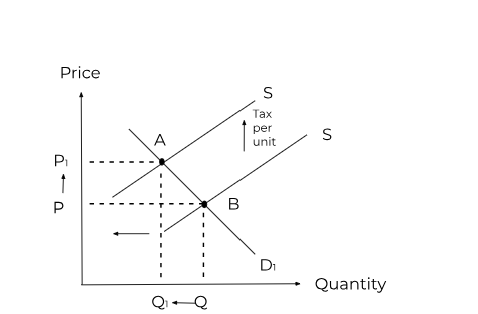

Q34. Draw a demand and supply diagram to illustrate indirect taxes. [6]

Original market price and quantity = P and Q. However, price is too low and there is currently over-consumption and over-production. The government imposes indirect tax, which increases the cost of production, making profitability decrease. Supply decreases, where the vertical distance between the 2 supply curves is the tax per unit. Market price increases from P to P1, and quantity demanded decreases from Q to Q1.

Q35. State 2 advantages of indirect taxes. [4]

Indirect tax can help internalize the externality, by making the producers pay for the damages caused by the externality in indirect taxes

Government collects tax revenue, which can be used to finance government spending

Q36. State 2 disadvantages of indirect taxes. [4]

Demand may be price inelastic for some goods, so increasing tax may be ineffective because the percentage fall in quantity demanded is less than that of the price rise.

Domestic firms may suffer losses and some workers may become unemployed as firms cut production due to higher costs.

Subsidies

Q37. Define ‘subsidies’ and state the market failure it is used to correct. [2]

A payment made by the government to producers to help reduce the cost of production.

It is used to correct the under-consumption of merit goods and goods with high external benefits

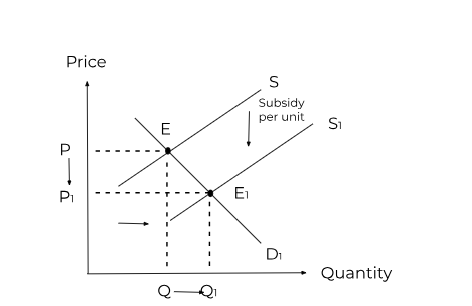

Q38. Draw a demand and supply diagram to illustrate subsidies. [2]

Original market price and quantity = P and Q. However, price is too high and there is currently under-consumption and under-production. The government provides subsidies to firms, which decreases the cost of production, making profitability increase. Supply increase, where the vertical distance between the 2 supply curves is the subsidy per unit. Market price decrease from P to P1, and quantity demanded increased from Q to Q1.

Q39. State the advantages and disadvantages of subsidies. [4]

Makes the good more affordable, allowing more people to consume the good.

Opportunity costs may be high.

Government may have to increase taxes to pay for the subsidy, raising tax burden for taxpayers. Hence, they have less income to satisfy other wants, and there is also opportunity cost for taxpayers.

Government Intervention in a Mixed Economy

Q40. Explain 2 problems created by government intervention. [4]

Public sector organizations may be inefficient and produce poor-quality goods and services. Some government interventions may be based on political and personal choices and not in the best interests of society and economy.

Q41. State 2 ways to reduce government intervention and increase the role of markets in a mixed economic system. [2]

Privatization and de-regulations

Q42. Explain 2 advantages of increasing the role of markets in mixed economic systems. [4]

Reduces the problems created by government intervention, increasing efficiency, reducing costs, lowering prices, and improving the quality of products produced.

There should be a more efficient allocation of resources, hence economic welfare increases.

Globalization

Q43. Define ‘globalization’. [2]

The process by which people, firms, and countries become increasingly interconnected and interdependent due to economic, social, technological, cultural, and political changes.

Q44. Explain 2 reasons for globalization. [4]

Advances in technology. Improvements in the speed of international communication enable people to order online goods. Better, cheaper transport makes it easier and cheaper to transport goods.

Removal of trade restrictions as economies are becoming more open

Q45. Explain 2 advantages of globalization. [2]

Raises competition as there is access to cheaper and greater variety of goods from different countries.

Expansion in the global economy leads to a rise in output, employment, incomes, and consumer spending in many economies.

Q46. State 2 disadvantages of globalization. [2]

Countries may be prone to external shocks as external events like a recession in one country may impact its trading partners.

It may raise unemployment as shifting to low-wage economies may affect job opportunities.

Free Trade & Protection

Free Trade

Q47 . Define ‘free trade’ and the reasons for it. [4]

International trade without any kind of trade barriers, such as tariffs or quotas. It involves the free movement and exchange of physical goods such as materials, components parts, equipment and finished products as well as services and money across international borders.

No country is self-sufficient to produce all goods and services it needs and wants, due to limited resources.

Q48. Define ‘open economy’. [2]

It is a national economy that engages freely in international trade with other economies.

Benefits of Free Trade

Q49. Explain 3 benefits of free trade. [6]

Lower price for consumers - Consumers can buy cheaper products and producers can acquire more affordable raw materials and semi-manufactured goods. Prices are often lower in some countries due to access to natural resources, variations in capital quality, and differing levels of technology.

Increases consumer choice - International trade allows consumers to enjoy a wider variety of products. They can access not only goods produced domestically but also those imported from various countries around the world.

Increased competition and greater production efficiency - International trade can increase competition, as domestic firms compete with foreign firms. This competition drives greater efficiency. International competition typically enhances the quality and variety of products available to consumers.

Disadvantages of Free Trade

Q50. Explain 3 disadvantages of free trade. [6]

International trade can increase worker and environmental exploitation. Multinational firms often relocate production to less-developed countries with lower costs, resulting in job losses in developed nations. In these countries, weaker regulations may lead to worker exploitation and environmental harm.

International trade accelerates resource depletion and climate change. Increased consumption of natural resources, driven by international trade, gives access to more products but also raises greenhouse gas emissions from transportation. This accelerates global climate change, with potentially severe and irreversible effects.

International trade may widen the gap between rich and poor countries. Developed economies dominate the demand for natural resources, lowering prices and reducing revenues for less-developed nations. This has led to economic conflicts, prompting some countries to impose trade restrictions to protect their domestic industries from foreign competition.

Methods of Production

Q51. Define ‘tariff’. [2]

Trade Barrier - Tariffs are indirect taxes on the prices of imported goods intended to reduce competition and increase prices to discourage domestic consumers from buying them.

Q52. What are quotas and how quota can be used as a trade protection. [4]

Quotas are limits on imports. They are administered through licenses or permits, where imports must obtain authorization to bring goods up to the quota limit. Restricting the supply of imports is likely to drive up their price.

Reasons for Trade Protection

Q53. Explain 3 reasons why a country should use protectionism measures. [6]

It helps to protect infant industries. This gives new firms the chance to develop, grow and become globally competitive. New, small businesses in newly developing industries with the potential to provide many more jobs and incomes in the future, may not get the chance to develop and grow if they are quickly eliminated by competition from lower-cost economies overseas. Providing them with protection from overseas competition may allow them to grow to take advantage of economies of scale and become internationally competitive.

It protects sunset industries that still provide significant employment in an economy. The shutdown of firms in these sectors can lead to high regional unemployment. To mitigate the speed of decline in these sectors, trade barriers can be implemented. These barriers protect against lower-cost imports, allowing workers to retrain or move to different employment opportunities.

It helps to correct trade imbalance. A country that spends more on imports than it earns from the sale of its exports will have a significant trade imbalance. Cutting spending on imports using tariff and non-tariff barriers can help to reduce a trade deficit.

Arguments against Trade Barriers

Q54. Explain 2 arguments against trade barriers. [4]

It restricts consumer choice. Less international trade means consumers will have fewer goods and services to choose from and producers to purchase them from.

It protects inefficient domestic firms. If domestic firms are protected from overseas competition there is a lack of competition and less pressure on them to improve their productivity and efficiency. Production costs and consumer prices will be higher than they might otherwise be and product quality could also be lower.

Foreign Exchange Rates (FOREX)

Q55. Define ‘foreign exchange rate and market’. [2]

Refers to the price of one currency in terms of another currency

The market where foreign currencies are bought and sold

Determination of FOREX in the FOREX Market

Q56. Explain how the floating exchange rate system works. [2]

The exchange rate of a currency is determined by market forces. The market equilibrium price of one national currency in terms of another currency forms the exchange rate

Q57. Explain 2 reasons why demand and supply for a currency (e.g. USD) increases. [4]

Consumers in foreign countries import goods and services produced in the USA. US-owned MNCs send their profits back to US headquarters.

US residents save money with banks abroad due to more attractive interest rates. Currency speculators sell their USD as they believe the USD will fall in value against other currencies.

Causes of Forex Fluctuations

Q58. Define ‘appreciation’ and give 2 reasons why. [2]

A rise in the value of a currency, against another currency, caused by market forces of demand and supply.

An increase in demand or a fall in supply of the currency

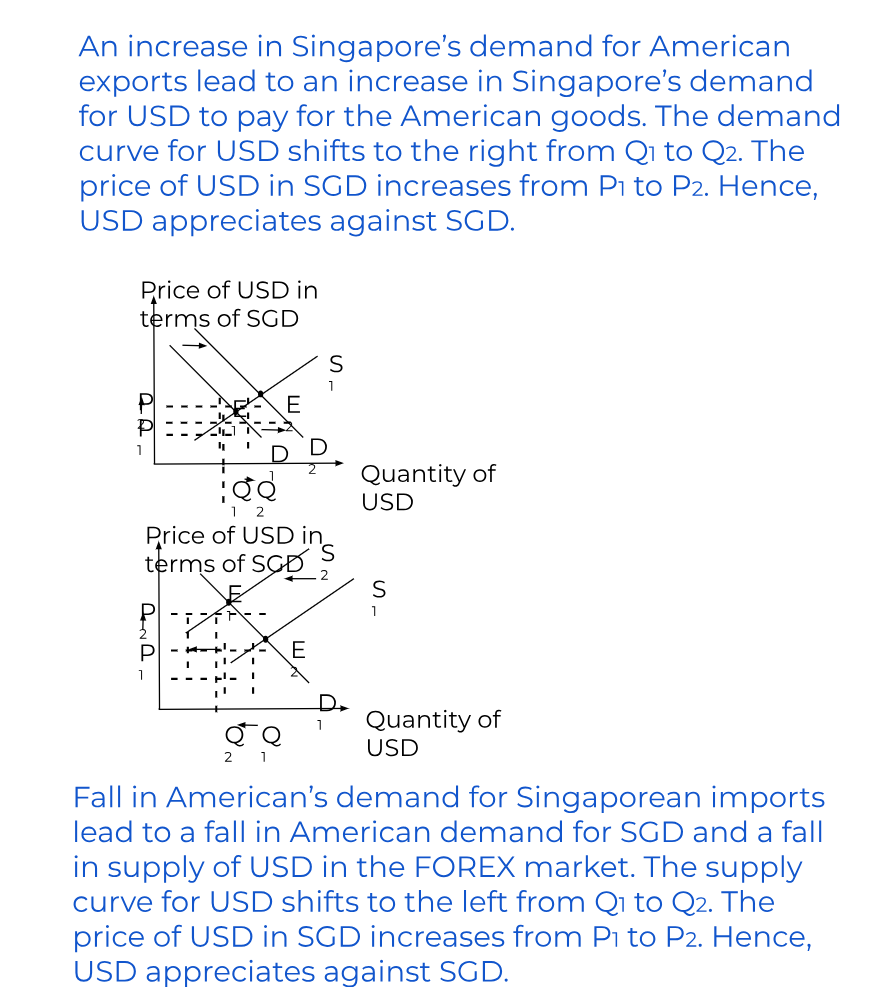

Q60. Draw 2 separate supply and demand diagrams for an appreciation of USD against SGD. [6]

Q61. Define ‘depreciation’ and give 2 reasons why. [2]

A fall in the value of a currency, against another currency, caused by market forces of demand and supply

A fall in demand or an increase in supply of the currency

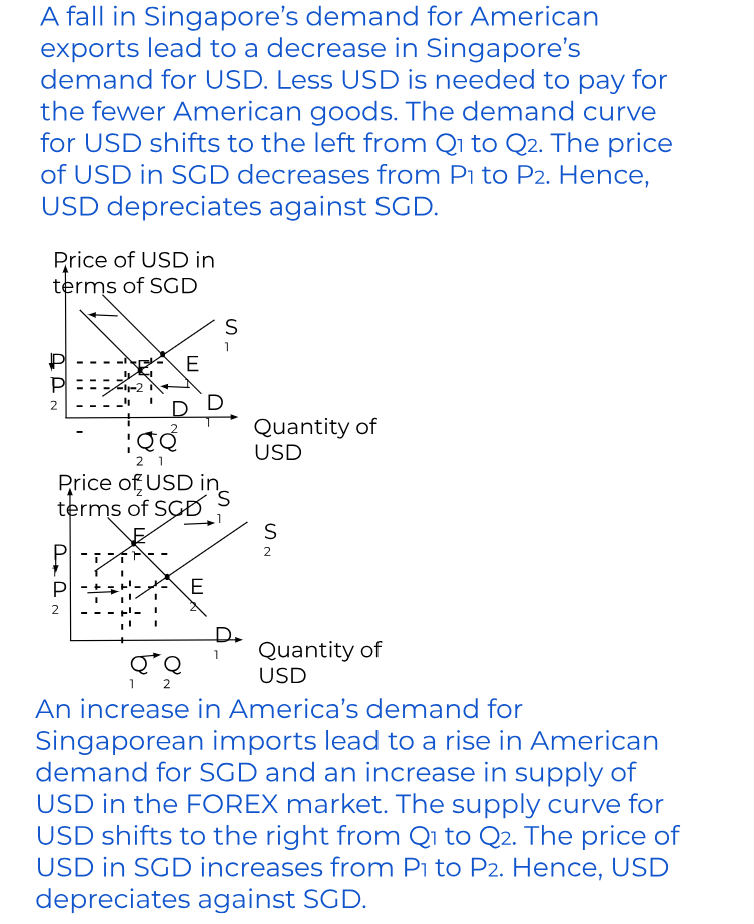

Q62. Draw 2 separate supply and demand diagrams for a depreciation of USD against SGD. [6]

Factors causing fluctuations in a floating exchange rate

Q63. State the impact on the forex market, the value of USD against EURO, and EURO against SGD for the following scenarios. [4]

US raise demand for imports from France

US supplies more USD to buy EURO. USD depreciates, EURO appreciates

US decrease demand for imports from France

US reduces its supply of USD to buy EUROS. USD appreciates, EURO depreciates

French raise demand for US exports

France raises its demand for USD. USD appreciates, EURO depreciates

French reduce demand for US imports

France reduces its demand for USD. USD depreciates, EURO appreciates

Q64. Explain 4 factors causing fluctuation in a floating exchange rate (use USD as domestic currency). [8]

Inflation. Countries with lower inflation rates than their trading partners will have exports that are more internationally competitive, raising demand for its national currency and causing an appreciation in the value of its currency relative to the currencies of its trading partner.

Changes in Interest Rates. Higher interest rates offer residents a higher return on their savings and investment, thereby attracting more foreign capital, which causes the currency to appreciate.

Speculation. Foreign currency speculators notice if the value of USD is expected to rise or fall, deciding whether to buy or sell now to make a profit. The higher demand or supply for USD will cause the value of USD to appreciate or depreciate respectively.

Entry or Departure of multinational companies. An economy that attracts foreign investment will see an increase in demand for its currency and an appreciation in the value of its currency.

Q65. A clothing manufacturer exports winter coats to the European market from Thailand. Each coat is priced at 4000 THB for sale in Europe. For an exchange rate of 1 THB = 0.025 EUR, each coat will therefore cost 100 euros.

Find the price of each coat if EUR depreciated against THB to 1 EUR = 32 THB. [2]

1 EUR = 32 THB

1 THB = 0.03125 EUR

4000 THB = 125 EUR

Find the price of each coat if EUR appreciated against THB to 1 EUR = 50 THB. [2]

1 EUR = 50 THB

1 THB = 0.02 EUR

4000 THB = 80 EUR

Consequences of FOREX Fluctuations

Q66. Explain 2 consequences of a depreciation in the value of the currency of a country. [4]

Raise international competitiveness and improve balance of trade. There will be cheaper and more competitive exports that will increase the demand for exports, raising export revenue, economic growth, jobs, and income. It also makes imports to that country more expensive to buy, raising the cost of imported goods and raw materials, and increasing the cost of production. This raises the price of goods, leading to import inflation.

Raise inflation. Depreciation may create inflationary pressure which harms consumers, especially those on low income. It reduces the purchasing power of the currency, causing imported raw materials or finished goods to become more expensive, raising the firm’s cost of production and prices, leading to imported inflation.

Floating vs Fixed Exchange Rate System

Q67. Define ‘Managed Floating Exchange Rate’. [2]

An exchange rate system where a nation’s central bank may intervene in the FOREX markets to help maintain a steady exchange rate to prevent volatile fluctuation in the currency.

Q68. Explain what are foreign currency reserves and how the government uses them to intervene in the FOREX market. [4]

Reserves of gold or foreign currencies held by a country’s Central Bank. The Central Banks buy and sell foreign currency reserves to change the demand and supply of their domestic currency in the FOREX market so that the domestic currency can rise or fall in value and remain at the targeted rate.

Q72. Explain how the Central Bank prevents its currency value from rising and falling too much. [4]

The government may buy foreign currency reserves, by selling its reserves of the domestic currency to raise its supply in the FOREX market. The Central Bank may lower interest rates to reduce the incentive for overseas residents to save and invest in their country. This lowers overseas demand for its domestic currency. These cause the currency to depreciate.

The government may sell foreign currency reserves, by buying up its domestic currency to raise its demand in the FOREX market. The Central Bank may raise interest rates to raise the incentive for overseas residents to save and invest in their country. This raises overseas demand for its domestic currency. These cause the currency to appreciate.

Q73. Define ‘Fixed Exchange Rate System’. [2]

A system where the value of the currency is set and maintained by the government at a fixed value, against another currency

Q74. Explain how the Central Bank intervenes in the FOREX market. [4]

When the value of its domestic currency is too low, it sells foreign currency reserves to buy up its domestic currency on the FOREX market or raise interest rates

When the value of its domestic currency is too high, it buys foreign currency reserves by selling off its reserves of the domestic currency in the FOREX market, or lower interest rates.